Server Virtualization Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434344 | Date : Dec, 2025 | Pages : 248 | Region : Global | Publisher : MRU

Server Virtualization Market Size

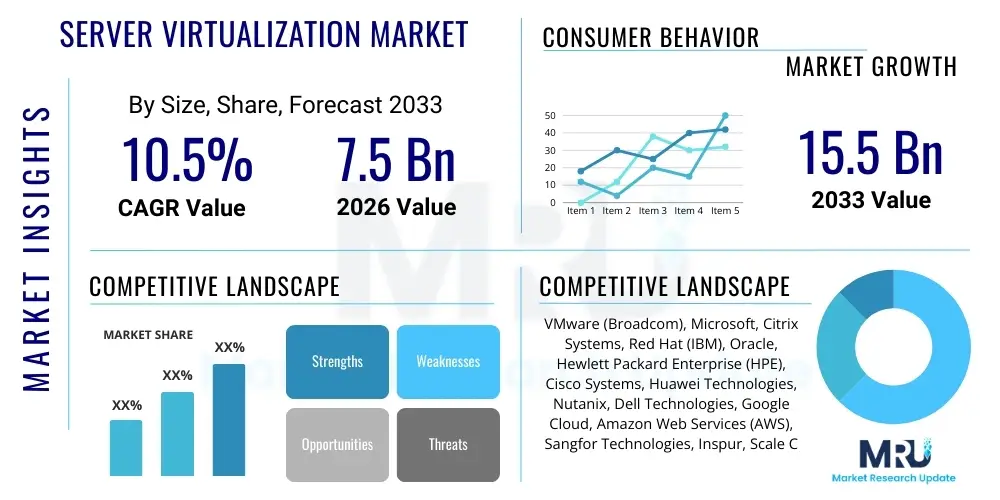

The Server Virtualization Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 10.5% between 2026 and 2033. The market is estimated at USD 7.5 Billion in 2026 and is projected to reach USD 15.5 Billion by the end of the forecast period in 2033. This substantial growth trajectory is primarily fueled by the accelerating enterprise migration towards cloud infrastructures, the necessity for optimized resource utilization in data centers, and the pervasive adoption of hybrid and multi-cloud environments which fundamentally rely on robust virtualization technologies.

Server Virtualization Market introduction

The Server Virtualization Market encompasses technologies that partition a physical server into multiple isolated virtual servers (Virtual Machines or VMs). This process abstracts hardware resources, allowing operating systems and applications to run independently, thus maximizing hardware utilization and reducing the overall operational footprint and capital expenditure associated with maintaining vast physical server farms. Key products within this domain include hypervisors (Type 1 and Type 2), virtualization management software, and integrated cloud stacks designed to manage these virtualized environments across private, public, and hybrid domains. The core objective of server virtualization is to enhance agility, improve disaster recovery capabilities, and optimize energy consumption within modern IT infrastructures.

Major applications span across large enterprises, Small and Medium-sized Enterprises (SMEs), and public sector organizations, primarily focusing on data center consolidation, testing and development environments, workload mobility, and facilitating streamlined cloud adoption strategies. By enabling organizations to run diverse operating systems and applications simultaneously on a single physical machine, server virtualization significantly reduces hardware purchasing cycles and simplifies complex infrastructure management tasks. The technology is critical for business continuity planning, ensuring rapid failover and simplified migration of workloads without incurring significant downtime, which is essential in sectors like BFSI and telecommunications where high availability is paramount.

The principal benefits driving market expansion include substantial cost savings through hardware rationalization, increased IT resilience, and the ability to scale resources dynamically based on fluctuating demand. Furthermore, server virtualization acts as a crucial foundational layer for modern DevOps practices and container orchestration platforms, enabling quicker deployment times and more efficient resource provisioning. Key driving factors involve the global shift towards software-defined data centers (SDDCs), the urgent need for enhanced security and compliance management across distributed environments, and the inherent scalability features offered by hypervisor technology to support burgeoning data loads and complex application architectures.

Server Virtualization Market Executive Summary

The Server Virtualization Market is experiencing robust acceleration driven by shifts in business trends, particularly the enterprise movement toward hybrid cloud models and the emergence of edge computing infrastructure which requires lightweight virtualization solutions. Business trends indicate a strong demand for advanced features such as enhanced security integration within hypervisors, automated workload balancing, and seamless interoperability between different virtualization platforms (such as VMware, Hyper-V, and open-source solutions). Furthermore, the consolidation of key market players, notably the acquisition of major virtualization providers by large technology conglomerates, is reshaping competitive dynamics and influencing long-term product development roadmaps, emphasizing integrated infrastructure stacks rather than standalone virtualization tools.

Regionally, North America maintains its dominance due to the high concentration of advanced technological infrastructure, early adoption of cloud computing, and significant spending on data center modernization across various sectors, including technology and healthcare. However, the Asia Pacific (APAC) region is demonstrating the highest growth velocity, fueled by rapid digitalization initiatives in emerging economies like India and China, increasing governmental investment in local data center capacity, and the necessity for scalable IT infrastructure to support a growing digital economy. European markets are characterized by strong regulatory compliance requirements (such as GDPR), driving demand for virtualization solutions that offer robust data governance and localization features, particularly in the financial services sector.

Segment trends highlight the increasing prominence of cloud-based server virtualization services (IaaS offerings) over traditional on-premise deployments, reflecting the preference for operational expenditure (OpEx) models and scalable resource management. Within components, the software segment remains the largest contributor, particularly the licensing and subscription models for enterprise-grade hypervisors and centralized management platforms. However, the services segment, including implementation, consulting, and managed services, is projected to register a higher CAGR, reflecting the complexity associated with integrating virtualization into multi-cloud environments and the demand for specialized expertise in optimizing virtualized resource pools and securing these environments effectively.

AI Impact Analysis on Server Virtualization Market

User queries regarding AI's impact on server virtualization frequently revolve around performance optimization, resource provisioning, and security automation. Common questions include how AI algorithms can predict resource needs to prevent VM sprawl, whether AI-driven management tools can dynamically adjust hypervisor settings for latency reduction, and the role of machine learning in identifying and neutralizing virtualized environment security threats. These questions summarize user expectations for virtualization management moving beyond static, rule-based systems to highly adaptive, intelligent platforms capable of autonomous optimization. The key theme is the shift toward AI-Ops, where artificial intelligence monitors, learns, and automatically implements changes within the virtualized server environment, thereby significantly reducing manual administration and enhancing overall system efficiency and reliability.

- AI-Driven Resource Provisioning: Machine learning algorithms analyze historical usage patterns to predict future workload demands, enabling proactive and highly accurate allocation of CPU, memory, and storage resources to individual VMs, minimizing waste and optimizing density.

- Intelligent Workload Balancing: AI dynamically adjusts the placement and migration of virtual machines across physical hosts to maintain optimal performance levels, significantly improving application responsiveness and energy efficiency within the data center.

- Automated Security Posture Management: AI models continuously monitor virtual network traffic and VM behavior, detecting anomalies and potential security breaches in real-time, facilitating automated response mechanisms, and securing lateral movement within the virtualized infrastructure.

- Predictive Maintenance and Failure Prevention: Utilizing machine learning to analyze hardware telemetry data and hypervisor logs, predicting potential hardware failures or capacity bottlenecks before they impact service availability, thereby enabling proactive migration or remediation.

- Enhancement of Hyper-Converged Infrastructure (HCI): AI optimizes storage policies and compute distribution within HCI environments, maximizing the integration and efficiency benefits derived from unified software-defined infrastructure stacks.

DRO & Impact Forces Of Server Virtualization Market

The Server Virtualization Market is characterized by powerful internal and external forces shaping its trajectory. The primary Driver is the imperative for organizations globally to reduce capital expenditure (CapEx) on hardware while simultaneously increasing IT flexibility and agility to respond to fast-changing market demands. The ability of virtualization to consolidate hundreds of server workloads onto a fraction of the physical hardware provides immediate and quantifiable cost benefits, serving as a continuous impetus for adoption, particularly in emerging economies and among cost-sensitive organizations seeking robust infrastructure modernization. Furthermore, the exponential growth in data volume necessitates scalable and easily manageable infrastructure, making virtualization an indispensable foundation for modern data centers and cloud deployments.

Conversely, significant Restraints challenge market expansion and full optimization. Key challenges include the initial complexity and high upfront costs associated with migrating legacy applications to virtualized environments, requiring specialized skill sets that can be costly to acquire and retain. Moreover, the inherent security risks associated with hypervisor compromise—known as "hyperjacking"—represent a critical concern, as a single point of failure can potentially expose numerous virtual machines. Performance overheads, particularly for highly intensive applications requiring direct hardware access (e.g., high-performance computing or complex graphical rendering), also act as a constraint, prompting organizations to selectively virtualize workloads.

Despite these restraints, substantial Opportunities are emerging, particularly in the realm of hybrid virtualization and the adoption of next-generation solutions. The growth of containerization (e.g., Docker and Kubernetes) presents both a competitive challenge and a synergistic opportunity, driving demand for solutions that offer robust integration between traditional VMs and microservices architectures. Furthermore, the expansion of the Internet of Things (IoT) and edge computing creates new demand for lightweight, purpose-built server virtualization solutions capable of running securely and efficiently in highly distributed, resource-constrained environments outside the centralized data center. These impact forces collectively dictate the strategic investment priorities for vendors and influence the adoption curves across different industry verticals globally.

Segmentation Analysis

The Server Virtualization Market is meticulously segmented across key dimensions, including Component, Deployment Model, Organization Size, and Industry Vertical, allowing for detailed analysis of consumption patterns and strategic market penetration. The Component segmentation—Software, Hardware, and Services—provides insights into where organizational budgets are allocated, with software (hypervisors and management suites) constituting the foundational layer, while the services segment (consulting, implementation, and managed services) represents the fastest-growing revenue stream, reflecting the need for outsourced expertise in managing complex, multi-vendor virtualized landscapes. Understanding these segments is critical for vendors to tailor their offerings, whether focusing on core product innovation or expanding their professional services portfolio.

Segmentation by Deployment Model—On-Premise, Cloud-Based, and Hybrid—is perhaps the most dynamic area, illustrating the industry's rapid pivot from proprietary on-premise infrastructure towards consumption-based cloud services and flexible hybrid architectures. While on-premise solutions remain vital for highly regulated industries requiring strict data sovereignty, the cloud-based model is dominating new deployments due to its inherent scalability and lower upfront capital requirements. The Hybrid model, which seamlessly integrates public and private cloud environments using virtualization tools, represents the future standard, offering enterprises the optimal blend of control, security, and elasticity to match diverse workload requirements.

- Component:

- Software (Hypervisors, Management Tools)

- Services (Implementation, Consulting, Managed Services, Support)

- Deployment Model:

- On-Premise

- Cloud-Based

- Hybrid

- Organization Size:

- Small and Medium-sized Enterprises (SMEs)

- Large Enterprises

- Industry Vertical:

- IT and Telecommunications

- Banking, Financial Services, and Insurance (BFSI)

- Healthcare and Life Sciences

- Manufacturing

- Government and Defense

- Retail and E-commerce

- Energy and Utilities

Value Chain Analysis For Server Virtualization Market

The Value Chain of the Server Virtualization Market begins with the upstream suppliers, primarily involving semiconductor manufacturers (providing processors and memory crucial for hypervisor performance) and foundational hardware vendors (producing the physical servers). This upstream analysis focuses on the innovation cycle of hardware, as advances in CPU architecture directly influence the efficiency and density achievable by Type 1 hypervisors. Strong relationships between virtualization software developers and hardware original equipment manufacturers (OEMs) are essential to ensure compatibility, driver optimization, and leveraging hardware-assisted virtualization features (like Intel VT-x and AMD-V), setting the initial cost and performance parameters for the end solution.

The mid-stream of the value chain involves the core activity of software development and solution integration, dominated by proprietary hypervisor vendors like VMware, Microsoft, and open-source contributors like Red Hat. These entities design, develop, and license the core virtualization platforms and management suites. Distribution channels play a vital role here, utilizing both Direct sales models, especially for large enterprise accounts requiring bespoke contracts and deep technical support, and Indirect channels, leveraging vast networks of Value-Added Resellers (VARs), system integrators (SIs), and managed service providers (MSPs) who package the virtualization software with implementation services and ongoing maintenance contracts, ensuring broad market reach across different organization sizes and geographies.

Downstream analysis focuses on the consumption and optimization phase, involving end-users across various industry verticals who deploy, manage, and scale their virtualized environments. The efficiency of the downstream operations heavily relies on post-sales services and support, including training, migration services, and ongoing professional consultation provided by the virtualization vendors or their channel partners. The quality of this support directly impacts customer satisfaction and retention. Furthermore, the transition to cloud-based and hybrid deployment models places cloud service providers (CSPs) like AWS, Azure, and Google Cloud at a critical juncture in the downstream value chain, as they utilize underlying virtualization technology to deliver Infrastructure-as-a-Service (IaaS) to millions of end-users.

Server Virtualization Market Potential Customers

Potential customers for server virtualization technologies span a vast spectrum of organizations prioritizing operational efficiency, scalable IT infrastructure, and robust disaster recovery capabilities. Large enterprises across all sectors—particularly Banking, Financial Services, and Insurance (BFSI), Telecommunications, and Global Manufacturing—represent the primary buyers. These organizations manage massive data centers and require virtualization to consolidate sprawling server farms, facilitate complex data migration projects, and ensure high availability for mission-critical applications such as trading platforms and ERP systems. The financial sector, for instance, heavily relies on virtualization for setting up secure, isolated testing environments before deploying regulatory-compliant systems.

Furthermore, Small and Medium-sized Enterprises (SMEs) constitute a rapidly growing customer base, driven by the need to access enterprise-grade infrastructure benefits without the prohibitive upfront cost of physical hardware. For SMEs, virtualization, especially when packaged as a cloud-based service, offers a pathway to increased IT agility and reduced operational expenses. They often seek simplified management interfaces and turnkey solutions that minimize the need for dedicated, highly specialized IT staff, focusing on Type 2 hypervisors or integrated HCI solutions that abstract hardware complexities, enabling faster time-to-value for their core business operations.

The public sector, including government agencies, defense organizations, and educational institutions, represents another significant segment of potential customers. These entities often operate under tight budgetary constraints and strict compliance mandates concerning data residency and security. Server virtualization provides them with the means to efficiently manage aging IT infrastructure, reduce energy consumption to meet sustainability goals, and create highly secure, segmented network environments for sensitive data processing. Their buying decisions are frequently influenced by vendor accreditation and compliance with industry-specific regulatory standards, such as FedRAMP in the US or similar regional governance frameworks.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 7.5 Billion |

| Market Forecast in 2033 | USD 15.5 Billion |

| Growth Rate | 10.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | VMware (Broadcom), Microsoft, Citrix Systems, Red Hat (IBM), Oracle, Hewlett Packard Enterprise (HPE), Cisco Systems, Huawei Technologies, Nutanix, Dell Technologies, Google Cloud, Amazon Web Services (AWS), Sangfor Technologies, Inspur, Scale Computing, Proxmox Server Solutions, E-Pao, Suse (Rancher Labs), Qemu (Open Source), Parallels International. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Server Virtualization Market Key Technology Landscape

The technological landscape of server virtualization is primarily defined by hypervisors, which are categorized into Type 1 (bare-metal) and Type 2 (hosted). Type 1 hypervisors, such as VMware ESXi, Microsoft Hyper-V, and Citrix XenServer, run directly on the host hardware, providing high efficiency and security, making them the standard choice for enterprise data center consolidation and high-performance cloud environments. The architectural complexity of these bare-metal solutions mandates robust kernel integration and dedicated hardware support. Continuous advancements in Type 1 hypervisors focus on improving hardware-assisted virtualization capabilities and enhancing management platforms to handle vast distributed virtual environments, often integrating features for software-defined networking and storage (SDN/SDS) capabilities.

A major evolution impacting the virtualization landscape is the rise of Hyper-Converged Infrastructure (HCI). HCI integrates compute, storage, and networking into a single, software-defined solution managed through a unified interface. Platforms offered by vendors like Nutanix and Dell EMC VxRail are fundamentally built on top of virtualization layers, streamlining infrastructure deployment and management while offering significant scalability benefits. HCI is rapidly replacing traditional three-tier architecture in many data centers, driving demand for virtualization software that is tightly integrated with distributed file systems and sophisticated data protection mechanisms, offering simpler deployment models suitable for both centralized and remote office/branch office (ROBO) environments.

Furthermore, the competitive dynamic between traditional server virtualization and operating system-level virtualization, specifically containerization using technologies like Docker and Kubernetes, is profoundly influencing technological roadmaps. While containers offer greater agility and lower overhead for cloud-native applications, they lack the isolation offered by full virtual machines. The current technology trend is moving toward integrated solutions, such as those supporting Kata Containers or leveraging specialized hypervisor capabilities to secure multi-tenant container deployments. Vendors are focusing on creating platforms that manage both VMs and containers seamlessly, recognizing that hybrid application architectures requiring both levels of isolation and density will dominate future enterprise IT infrastructure.

Regional Highlights

- North America: This region holds the largest market share, characterized by high IT maturity, substantial presence of key market vendors (VMware, Microsoft), and early adoption of advanced virtualization technologies, including comprehensive cloud and hybrid infrastructure deployments. Significant investment in large-scale data center construction, particularly in the US and Canada, driven by hyperscalers and stringent regulatory requirements in finance and healthcare, ensures sustained leadership in virtualization spending and innovation.

- Europe: The European market demonstrates steady growth, driven by digital transformation initiatives, particularly in Germany (Manufacturing) and the UK (Financial Services). Adoption is highly influenced by regulatory compliance (like GDPR), leading to demand for localized cloud and virtualization solutions that offer strong data residency controls and transparent security features. Western Europe is rapidly transitioning toward HCI solutions to modernize legacy infrastructure efficiently.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing region, fueled by massive industrialization and urbanization across emerging economies such as China, India, and Southeast Asian nations. Governments and private enterprises are making significant investments in domestic cloud infrastructure and modern data centers. The market is highly competitive, featuring strong local players alongside global leaders, with key demand areas being telecommunications (5G rollout) and high-tech manufacturing seeking efficient operational virtualization.

- Latin America (LATAM): Growth in LATAM is focused primarily on data center consolidation and utilizing virtualization to manage IT budgets effectively in countries like Brazil and Mexico. The market often leans towards open-source virtualization solutions to reduce licensing costs, although major proprietary vendors are increasingly focusing on managed service partnerships to penetrate the region's developing enterprise sector.

- Middle East and Africa (MEA): MEA presents specialized opportunities, particularly in the Gulf Cooperation Council (GCC) countries, driven by ambitious smart city projects and economic diversification initiatives moving away from oil reliance. Large-scale government investments in public and private clouds, coupled with rising demand from the BFSI sector, necessitate robust, highly secure server virtualization to support next-generation digital services.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Server Virtualization Market.- VMware (Broadcom)

- Microsoft Corporation

- Citrix Systems, Inc.

- Red Hat, Inc. (IBM)

- Oracle Corporation

- Hewlett Packard Enterprise (HPE)

- Dell Technologies Inc.

- Nutanix, Inc.

- Cisco Systems, Inc.

- Huawei Technologies Co., Ltd.

- Amazon Web Services (AWS)

- Google LLC (Google Cloud)

- Sangfor Technologies

- Inspur Group

- Scale Computing

- Proxmox Server Solutions GmbH

- Parallels International GmbH

- Suse SA

- E-Pao Corporation

- ZTE Corporation

Frequently Asked Questions

Analyze common user questions about the Server Virtualization market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between server virtualization and containerization?

Server virtualization creates full Virtual Machines (VMs), each including its own operating system kernel, offering strong isolation and compatibility for diverse operating systems. Containerization shares the host operating system kernel, making it significantly lighter and faster for deployment, but offering less isolation than a full VM. VMs are suited for heterogeneous workloads and security isolation, while containers are ideal for cloud-native microservices and rapid application deployment.

How does server virtualization contribute to cost reduction in enterprises?

Server virtualization enables massive physical server consolidation, drastically reducing the number of physical machines required in a data center. This leads to immediate and substantial cost savings in capital expenditure (less hardware purchasing), operational expenditure (lower power consumption, cooling costs), and reduced administrative overhead, as management shifts from physical units to software interfaces.

What are the key security concerns associated with hypervisors?

The primary security concern is 'hyperjacking,' where an attacker compromises the hypervisor layer (Type 1), gaining control over all hosted virtual machines. Other concerns include the security of management interfaces and potential vulnerabilities arising from shared resources. Mitigation strategies focus on hypervisor patching, strict access control, and leveraging micro-segmentation capabilities within the virtualized network fabric.

Which industry vertical is adopting server virtualization at the fastest rate?

The IT and Telecommunications vertical consistently leads in terms of volume and complexity of virtualization deployments, driven by the rollout of 5G infrastructure and the transition to software-defined network functions virtualization (NFV). However, the Healthcare and Life Sciences vertical is showing rapid accelerated adoption, particularly for research computing and secure patient data management, often leveraging highly resilient virtualized private cloud solutions.

What is the role of Hyper-Converged Infrastructure (HCI) in the modern virtualization market?

HCI plays a pivotal role by integrating the core components of IT infrastructure (compute, storage, networking) and placing the management layer directly on the hypervisor. This simplifies deployment, scales linearly, and reduces complexity, making it highly attractive for organizations implementing software-defined data centers and those seeking a streamlined path to hybrid cloud operations, effectively blurring the line between virtualization software and hardware solutions.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- X86 Server Virtualization Infrastructure Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Os Level Server Virtualization Market Size Report By Type (Hardware, Software and Services), By Application (BFSI, Telecommunications and IT, Healthcare, Transportation and Logistics, BFSI, Others), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Statistics, Trends, Outlook and Forecast 2025-2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager