Severe Duty Motors Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433456 | Date : Dec, 2025 | Pages : 251 | Region : Global | Publisher : MRU

Severe Duty Motors Market Size

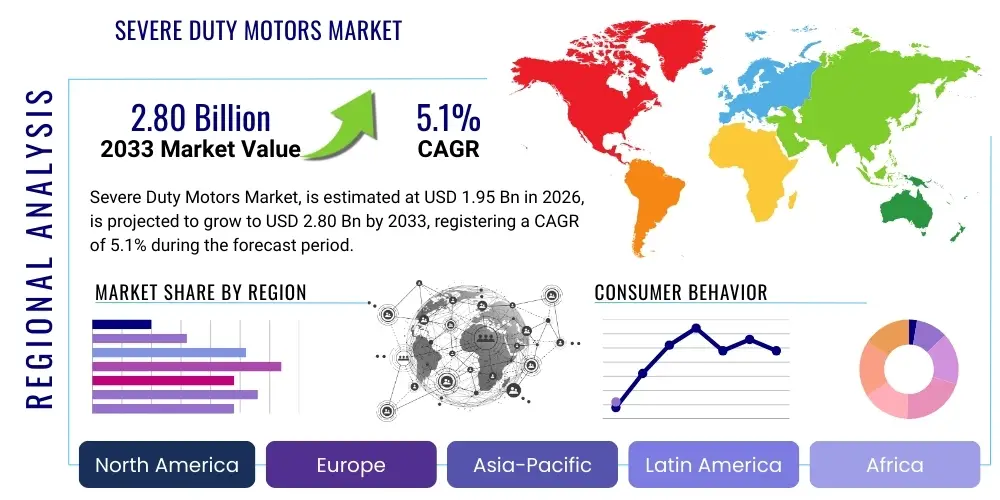

The Severe Duty Motors Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.1% between 2026 and 2033. The market is estimated at USD 1.95 Billion in 2026 and is projected to reach USD 2.80 Billion by the end of the forecast period in 2033. This growth trajectory is driven primarily by increasing industrial infrastructure investments in emerging economies, coupled with stringent regulatory standards mandating higher energy efficiency in demanding operating environments worldwide. Severe duty motors are critical components designed to withstand extreme conditions, including high humidity, corrosive chemicals, abrasive dust, and high ambient temperatures, thereby ensuring operational continuity and minimizing downtime in mission-critical applications.

Severe Duty Motors Market introduction

Severe duty motors are specialized electric motors engineered to operate reliably in the harshest industrial environments where standard general-purpose motors would fail prematurely. These environments often include chemical processing plants, oil and gas refineries, mining operations, pulp and paper mills, and power generation facilities, characterized by exposure to dust, moisture, corrosive agents, and extreme temperature variations. The robust construction of these motors typically involves features such as corrosion-resistant paint, specialized sealing systems (e.g., Inpro/Seal or labyrinth seals), robust cast iron frames, and advanced insulation systems designed to meet or exceed NEMA Premium or IEC IE3/IE4 efficiency standards, guaranteeing longevity and maximizing operational uptime under stress.

Major applications for severe duty motors span across driving pumps, fans, compressors, conveyors, and various material handling equipment essential for core industrial processes. Their primary benefit lies in their exceptional reliability, which significantly reduces maintenance costs and prevents catastrophic equipment failures in high-cost, continuous operations. Furthermore, the push for sustainable industrial practices and reduced carbon footprints drives the adoption of high-efficiency severe duty motors, aligning operational needs with global energy conservation mandates. Key driving factors include the rapid pace of global industrialization, particularly in the Asia Pacific region, the necessity for modernizing aging industrial infrastructure in developed economies, and increasing awareness regarding the total cost of ownership (TCO) where motor longevity offsets higher initial purchase costs.

Severe Duty Motors Market Executive Summary

The Severe Duty Motors Market is experiencing robust growth fueled by several converging business, regional, and segment trends. Business trends highlight a strong shift toward highly efficient IE4 and potentially IE5 compliant motor solutions, driven by tightening global energy regulations like those enforced by the Department of Energy (DOE) in North America and equivalent bodies internationally. Manufacturers are focusing heavily on integrating advanced condition monitoring capabilities, utilizing smart sensors and IoT platforms to enable predictive maintenance, which enhances the value proposition of these high-initial-cost assets. This emphasis on digitalization transforms severe duty motors from mere mechanical assets into intelligent components within industrial ecosystems, appealing greatly to large corporations prioritizing operational intelligence and asset utilization.

Regionally, the Asia Pacific (APAC) market, spearheaded by China and India, represents the highest growth potential due to massive ongoing investments in infrastructure, chemicals, refining, and metal processing sectors. North America and Europe, while mature, exhibit steady growth driven primarily by replacement cycles and mandatory upgrades to higher efficiency standards in established industries such as water treatment and petrochemicals. Segment trends indicate that the AC induction motor category dominates the market due to its proven reliability and cost-effectiveness across a broad power range, particularly in medium voltage applications. Furthermore, the oil and gas sector remains the largest end-user segment, demanding motors certified for hazardous areas (e.g., explosion-proof certifications), ensuring stringent safety and reliability standards are met under extreme pressure and corrosive conditions.

AI Impact Analysis on Severe Duty Motors Market

User queries regarding AI's influence on severe duty motors primarily center around how Artificial Intelligence can extend motor lifespan, optimize performance in dynamic environments, and prevent unscheduled downtime, which is exceptionally costly in severe duty applications. Users are concerned with the effectiveness and return on investment (ROI) of integrating AI-driven predictive maintenance platforms with existing industrial control systems (ICS). Key expectations involve AI algorithms analyzing sensor data (vibration, temperature, current signatures) to detect subtle anomalies indicative of failure long before traditional maintenance triggers. This shift promises a move from time-based or reactive maintenance to truly predictive maintenance, maximizing motor operational efficiency and ensuring compliance with strict safety protocols inherent in industries like petrochemicals and mining.

The implementation of AI significantly enhances the capabilities of severe duty motor systems. AI models can correlate operational variables, environmental conditions, and motor load profiles to generate highly accurate health assessments. This level of granularity is crucial because severe duty motor failures are often complex, resulting from the cumulative stress of multiple environmental factors. Beyond maintenance, AI is also influencing motor design, where generative design algorithms can optimize material selection and cooling mechanisms for specific, demanding applications, ensuring motors are perfectly tailored for maximum efficiency and resilience in their designated harsh environments, ultimately lowering operational risk for end-users.

- AI-driven Predictive Maintenance: Analyzing complex operational datasets to predict component degradation (bearings, insulation, windings) and schedule precise maintenance interventions.

- Operational Optimization: Using machine learning to adjust motor speed and torque based on real-time process demands and environmental factors, maximizing energy efficiency (IE4/IE5 performance).

- Fault Diagnosis Automation: Rapidly identifying the root cause of electrical or mechanical faults, reducing troubleshooting time in critical industrial settings.

- Enhanced Design and Simulation: Utilizing AI tools for generative design, optimizing motor geometry, ventilation, and material composition for extreme temperature and corrosion resistance.

- Asset Management Integration: Seamless integration of motor health data into enterprise asset management (EAM) systems for comprehensive fleet monitoring and lifecycle management.

DRO & Impact Forces Of Severe Duty Motors Market

The Severe Duty Motors Market is shaped by a critical interplay of drivers, restraints, and opportunities (DRO) that determine its growth trajectory and structure. The primary driver is the accelerating pace of global industrial infrastructure development, particularly in heavy process industries across developing nations, demanding robust and reliable machinery. Simultaneously, stringent governmental and international regulations enforcing higher efficiency standards (IE3, IE4, and forthcoming IE5) necessitate the replacement of older, less efficient general-purpose motors with advanced severe duty variants that offer superior operational performance and longevity, even if initial capital expenditure is higher. These factors create strong underlying demand, ensuring market resilience against short-term economic fluctuations.

However, the market faces significant restraints, most notably the high initial cost associated with severe duty motors. The specialized materials, robust construction, advanced insulation systems, and explosion-proof certifications required for harsh environments substantially inflate the purchasing price compared to standard industrial motors, presenting a barrier to entry for smaller enterprises. Furthermore, the complexity of compliance and certification, particularly navigating the varying global standards (NEMA vs. IEC) and hazardous area classifications (ATEX, IECEx, UL), adds lead time and administrative burden to manufacturers and end-users alike. This fragmentation of standards can slow down adoption and cross-regional market penetration.

Opportunities for growth are concentrated in the adoption of smart manufacturing and Industry 4.0 paradigms. The integration of IoT sensors and digital twins allows severe duty motors to participate actively in centralized monitoring systems, transforming routine maintenance practices. Moreover, the increasing global focus on renewable energy projects, particularly wind and geothermal power generation, presents new niche applications for severe duty motors tailored to handle extreme weather conditions and remote operation. The emerging retrofitting market, focused on upgrading installed motor bases with modern severe duty, high-efficiency models, also provides a significant revenue stream for manufacturers.

Segmentation Analysis

The Severe Duty Motors Market is segmented based on critical technical and application parameters, allowing for targeted market analysis and strategic planning. The core segmentation criteria involve motor type, output power, efficiency class, and the specific end-user industry. Analyzing these segments is essential for understanding regional demand patterns, technological preferences, and competitive landscape dynamics. For instance, the distinction between AC and DC severe duty motors highlights the shift toward AC induction motors due to their greater reliability and ease of maintenance, although DC motors retain relevance in specific high-torque, low-speed applications.

Power output segmentation, covering fractional horsepower, integral horsepower (up to 500 HP), and high horsepower (above 500 HP), dictates the primary end-user markets; high horsepower motors are crucial for large-scale operations in oil and gas and utilities, whereas integral horsepower motors are widely used in chemical processing and mining support equipment. Furthermore, the mandated efficiency classes (IE3 and IE4 being the current standards) are increasingly driving purchasing decisions, moving the market away from lower-efficiency legacy models. The dominance of the oil & gas and chemical sectors as end-users underscores the high demand for explosion-proof and corrosion-resistant characteristics unique to severe duty specifications.

- By Motor Type:

- AC Severe Duty Motors (Induction Motors, Synchronous Motors)

- DC Severe Duty Motors

- By Output Power:

- Up to 1 HP (Fractional)

- 1 HP to 500 HP (Integral)

- Above 500 HP (High Horsepower)

- By Efficiency Class:

- IE3 (Premium Efficiency)

- IE4 (Super Premium Efficiency)

- By End-User Industry:

- Oil and Gas (Upstream, Midstream, Downstream)

- Chemical and Petrochemical

- Mining and Metals

- Power Generation (Conventional and Renewable)

- Water and Wastewater Treatment

- Pulp and Paper

- Food and Beverage

Value Chain Analysis For Severe Duty Motors Market

The value chain for the Severe Duty Motors Market begins with the highly specialized procurement of raw materials, focusing on components designed for extreme longevity and environmental resistance. This includes high-grade electrical steel (laminations) for reduced core losses, corrosion-resistant cast iron or steel for motor frames, specialized high-temperature insulation materials (often Class F or H), and high-durability sealing materials. Upstream suppliers must meet rigorous quality controls, as the integrity of these materials directly impacts the motor's ability to withstand severe operational conditions. The manufacturing phase involves precision engineering, specialized winding techniques, and stringent quality assurance processes, including mandatory testing for performance under simulated harsh environments, often culminating in third-party safety and efficiency certifications.

The distribution channel is typically bifurcated into direct sales to large Original Equipment Manufacturers (OEMs) who integrate the motors into complex industrial machinery (e.g., large compressors or pumps), and indirect sales through authorized distributors and Maintenance, Repair, and Operations (MRO) service providers. Direct sales facilitate deep customization required for mission-critical projects in sectors like oil and gas. Indirect channels focus on supporting the installed base, providing spares, replacements, and quick-turnaround repairs, which are essential given the need for immediate restoration of service in severe duty applications. Strong relationships with certified service centers are crucial for market penetration and post-sales support.

Downstream, the severe duty motor reaches the end-user, often a large industrial facility. The crucial element at this stage is installation, commissioning, and continuous monitoring. As severe duty motors are high-value assets, end-users increasingly rely on sophisticated monitoring systems (often integrated by the motor manufacturer or a third-party IT provider) to track operational parameters, predict failures, and maximize asset life. The longevity and reliability achieved through the rigorous value chain processes provide a significant competitive edge to manufacturers capable of delivering comprehensive product and service packages.

Severe Duty Motors Market Potential Customers

Potential customers for severe duty motors are primarily large industrial entities operating in environments characterized by physical and chemical stressors that necessitate equipment built beyond standard industrial specifications. These end-users prioritize reliability, safety, and longevity over initial cost, understanding that motor failure in their operations can lead to catastrophic downtime, significant production losses, and potential environmental or safety hazards. The largest buyers are often global companies with continuous process operations where uptime is paramount, such as integrated oil and gas companies, multinational chemical producers, and global mining corporations.

Specific target customer segments include those involved in hydrocarbon processing, where motors must be certified explosion-proof (Division 1/Zone 1 environments) and highly resistant to corrosive gases and liquids. The mining sector, dealing with extreme dust loads, vibrations, and moisture, represents a key customer base for motors with superior ingress protection (IP ratings) and robust frame construction. Furthermore, the expanding global network of municipal and industrial water and wastewater treatment plants requires severe duty motors to withstand continuous exposure to moisture, harsh chemicals used for treatment, and sometimes submerged or semi-submerged operating conditions, making them essential buyers.

The modernization of utility infrastructure, including power generation (both coal-fired and nuclear), also constitutes a significant customer segment, requiring specialized motors for boiler feed pumps, cooling towers, and ventilation systems that must operate reliably under high ambient temperatures and aggressive environmental conditions. These customers are focused on long-term capital expenditure planning and often prefer suppliers who can provide motors compliant with the highest efficiency standards (IE4/IE5) to meet corporate sustainability goals and reduce long-term energy consumption.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.95 Billion |

| Market Forecast in 2033 | USD 2.80 Billion |

| Growth Rate | 5.1% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | ABB Ltd., Siemens AG, General Electric Company (GE), WEG S.A., Nidec Corporation, Regal Rexnord Corporation, TECO Electric & Machinery Co., Ltd., Brook Crompton, Marathon Electric, Toshiba Corporation, VEM Group, Mitsubishi Electric Corporation, Rockwell Automation, Hoyer Motors, Leeson Electric, Hyosung Heavy Industries, Kirloskar Electric Company, Lafert Group, Lenze SE, Baldor Electric Company (now part of ABB) |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Severe Duty Motors Market Key Technology Landscape

The technological evolution within the Severe Duty Motors Market is centered around three core areas: maximizing energy efficiency, enhancing durability through specialized materials, and implementing digitalization for predictive capabilities. The drive toward higher efficiency standards, specifically IE4 (Super Premium Efficiency) and the emerging IE5 standards, pushes manufacturers to utilize advanced motor topologies, such as Permanent Magnet Synchronous Motors (PMSM) and synchronous reluctance motors (SynRM), which offer significantly reduced energy losses compared to traditional induction motors, especially under partial load conditions. These advanced designs necessitate complex manufacturing processes and sophisticated magnetic material sourcing, positioning technological leaders at the forefront of market competition.

Durability enhancement is achieved through innovations in insulation systems, focusing on voltage spike resistance and thermal stability. Severe duty motors increasingly utilize advanced winding insulation materials (often meeting Class H standards) and specialized sealing systems (like non-contact labyrinth seals or bearing isolators) to prevent the ingress of abrasive particles and corrosive moisture, which are primary causes of premature motor failure in harsh environments. Furthermore, manufacturers are incorporating specialized coatings and anti-corrosion treatments on external frames and components, crucial for applications in coastal, marine, or chemical processing environments where chemical resistance is essential for long operational life.

The integration of Industry 4.0 technologies marks a pivotal shift in the severe duty motor landscape. Modern severe duty motors are equipped with integrated sensors that monitor vibration, temperature, current, and rotor position in real time. This data is processed locally or transmitted via secure IoT protocols to cloud platforms or edge computing devices, enabling advanced diagnostics, predictive maintenance scheduling, and remote monitoring. Technologies such as embedded digital twin models allow operators to simulate operational stress and predict remaining useful life (RUL), transforming the maintenance paradigm from reactive to highly proactive and intelligent, substantially improving the total cost of ownership for end-users.

Regional Highlights

- North America (NA):

North America holds a significant share of the Severe Duty Motors Market, driven primarily by stringent energy efficiency regulations implemented by the U.S. Department of Energy (DOE) and Canadian authorities, which mandate the use of high-efficiency motors (NEMA Premium equivalent) for most industrial applications. The region’s mature industrial base, especially in the petrochemical, oil and gas, and mining sectors, demands continuous replacement and upgrades of existing motor fleets with robust, certified severe duty models. Investment in digital transformation and the high adoption rate of IoT and predictive maintenance solutions further contribute to market growth, with a strong focus on motors certified for hazardous locations (Class I, Division 1 and 2).

The demand landscape in North America is characterized by large capital expenditure projects in the energy sector, particularly in processing facilities and pipeline infrastructure, requiring high-horsepower severe duty motors. Furthermore, the aging infrastructure across water and wastewater treatment facilities necessitates replacement programs focusing on corrosion-resistant and highly reliable pump motors. Key market players benefit from established distribution networks and the need for localized technical support and certification compliance, making market entry challenging for non-compliant international competitors.

- Europe:

Europe’s Severe Duty Motors Market growth is intrinsically linked to the European Union’s commitment to energy efficiency (IE standards) and decarbonization goals. Regulations promoting the minimum efficiency performance standards (MEPS), specifically enforcing IE3 and the transition to IE4 for most motor ranges, mandate the shift toward advanced severe duty technologies. The region boasts strong manufacturing capabilities, particularly in Germany and Italy, focusing on high-precision, customized severe duty motors for specialized applications in chemicals, pharmaceuticals, and heavy machinery manufacturing. The market is also heavily influenced by rigorous safety standards, including ATEX certification requirements for motors operating in potentially explosive atmospheres.

Market expansion in Europe is supported by continuous investments in modernizing industrial plants and the substantial demand generated by the water infrastructure sector. There is a notable trend towards adopting synchronous reluctance motors (SynRM) and permanent magnet technology in severe duty applications due to their exceptional efficiency, especially under variable speed operation, which aligns perfectly with regional sustainability targets and variable frequency drive (VFD) implementation. The demand is stable, driven mainly by mandated replacement cycles and technological upgrades rather than rapid greenfield expansion.

- Asia Pacific (APAC):

The Asia Pacific region is projected to be the fastest-growing market for severe duty motors globally, primarily due to unprecedented industrial expansion, rapid urbanization, and massive investments in infrastructure across countries like China, India, and Southeast Asian nations. The booming oil and gas exploration, expansion of chemical manufacturing capacity, and the high demand for raw materials driving the mining sector are creating significant opportunities for severe duty motor manufacturers. While energy efficiency standards are gradually strengthening across the region, the initial market driver remains capacity expansion in harsh environments.

China, being the world’s largest industrial producer, represents a colossal market for severe duty motors, both for domestic manufacturing consumption and as a global production hub. India’s continuous development of its process industries and regulatory push for energy conservation also fuel demand. Local and international manufacturers are heavily investing in establishing manufacturing and service centers within APAC to serve the large, diverse, and geographically challenging customer base, focusing on cost-effective yet reliable severe duty solutions tailored to regional environmental stressors like high humidity and dust.

- Latin America (LA):

Latin America’s market for severe duty motors is strongly influenced by the performance of its dominant sectors: mining (particularly in Chile and Peru), oil and gas (Brazil, Mexico), and basic materials processing. These industries often operate in remote, physically demanding, and highly corrosive environments, creating a constant demand for robust, reliable severe duty equipment. Economic stability and governmental support for industrial investment directly correlate with market growth in this region. The focus remains strongly on durability and performance under extreme load conditions.

The replacement market is growing as older installations require upgrades to meet newer operational safety and efficiency benchmarks. Brazil stands out as a significant market due to its large-scale energy and commodity processing industries. Challenges include economic volatility and logistics complexity, requiring manufacturers to maintain lean, responsive supply chains and localized service capabilities to support remote operational sites effectively.

- Middle East and Africa (MEA):

The MEA region, particularly the Gulf Cooperation Council (GCC) countries, represents a high-value market driven almost entirely by the large-scale oil, gas, and petrochemical sectors. Severe duty motors are indispensable for pipeline operations, refinery processing, and massive desalination plants, all of which operate under conditions of extreme heat, sand ingress, and highly corrosive elements. The region demands motors that comply strictly with hazardous area classifications (e.g., ATEX, IECEx) and are designed to manage exceptionally high ambient temperatures without derating.

Significant greenfield projects and continuous investment by national oil companies ensure sustained demand for high-horsepower, customized severe duty motors. While efficiency mandates are less uniformly stringent than in Europe or North America, reliability and compliance with safety certifications remain the paramount purchasing criteria. Infrastructure projects in South Africa and ongoing industrialization efforts in emerging African economies also contribute to the overall regional growth, particularly in mining and power generation applications.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Severe Duty Motors Market.- ABB Ltd.

- Siemens AG

- General Electric Company (GE)

- WEG S.A.

- Nidec Corporation

- Regal Rexnord Corporation

- TECO Electric & Machinery Co., Ltd.

- Brook Crompton

- Marathon Electric

- Toshiba Corporation

- VEM Group

- Mitsubishi Electric Corporation

- Rockwell Automation

- Hoyer Motors

- Leeson Electric

- Hyosung Heavy Industries

- Kirloskar Electric Company

- Lafert Group

- Lenze SE

- Baldor Electric Company (now part of ABB)

Frequently Asked Questions

Analyze common user questions about the Severe Duty Motors market and generate a concise list of summarized FAQs reflecting key topics and concerns.What defines a severe duty motor and how does it differ from a general-purpose motor?

A severe duty motor is defined by its robust construction, engineered specifically to withstand extreme operational stressors such as high moisture, caustic chemicals, abrasive dust, extreme temperature fluctuations, and high vibration. Key differences include specialized sealing systems, superior insulation (often Class F or H), corrosion-resistant cast iron frames, and sometimes specialized explosion-proof certifications (e.g., NEMA Premium or IEC Ex). General-purpose motors are not built to endure these harsh environmental conditions, leading to significantly reduced lifespan and reliability in severe duty applications.

Which industry segment generates the highest demand for severe duty motors?

The Oil and Gas (O&G) industry segment consistently generates the highest demand for severe duty motors. This is due to the inherent complexity and hazardous nature of drilling, refining, and pipeline operations, which require motors to be not only highly durable and reliable but often certified as explosion-proof (Hazardous Area certified) to operate safely with flammable gases and vapors. Chemical and Petrochemical processing plants follow closely, driven by the need for corrosion resistance against aggressive chemical substances.

What are the key efficiency standards driving the adoption of new severe duty motors?

The adoption of new severe duty motors is primarily driven by global governmental mandates focusing on minimum energy efficiency performance standards (MEPS). The current key standards include NEMA Premium in North America and the IEC efficiency classes IE3 (Premium Efficiency) and IE4 (Super Premium Efficiency). These regulations compel industrial users to replace older, less efficient motors, thereby pushing the market toward advanced topologies like SynRM and PMSM severe duty motors to meet the highest efficiency benchmarks and reduce energy consumption.

How does the integration of Industry 4.0 affect the severe duty motors market?

Industry 4.0 integration profoundly affects the market by enabling advanced predictive maintenance capabilities. Severe duty motors are increasingly equipped with integrated IoT sensors and smart monitoring systems that collect real-time data on vibration, temperature, and current signatures. AI algorithms analyze this data to predict potential failures long before they occur, maximizing operational uptime, reducing the high cost of unscheduled downtime in critical process industries, and allowing operators to manage the motor fleet lifecycle effectively through centralized digital platforms.

What are the main regional growth drivers for severe duty motor sales?

The main regional growth drivers differ significantly. In North America and Europe, growth is primarily fueled by regulatory mandates requiring high-efficiency replacements and the modernization of aging infrastructure. Conversely, in the Asia Pacific (APAC) region, the growth driver is rapid industrial expansion, massive greenfield investments in chemical processing and metals production, and increasing awareness of the total cost of ownership (TCO) where reliable severe duty motors reduce maintenance expenditures in high-stress operational environments.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager