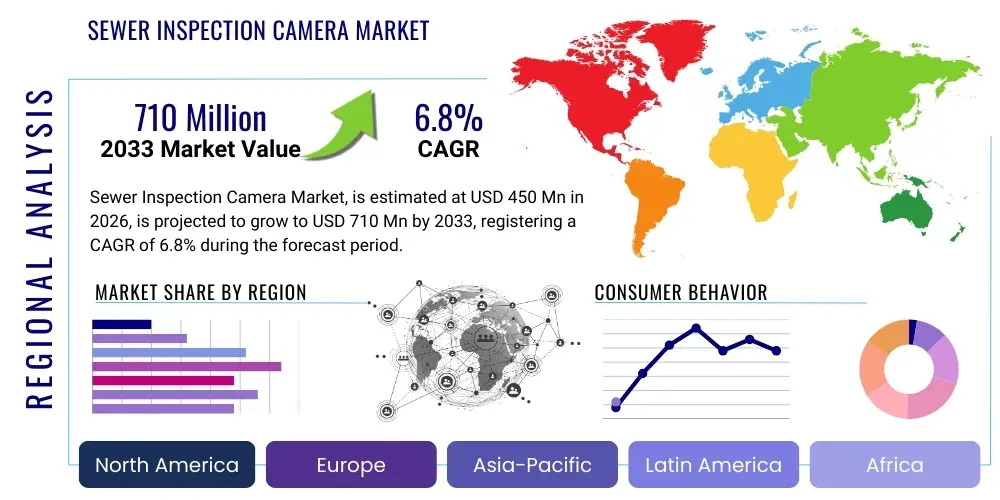

Sewer Inspection Camera Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436381 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Sewer Inspection Camera Market Size

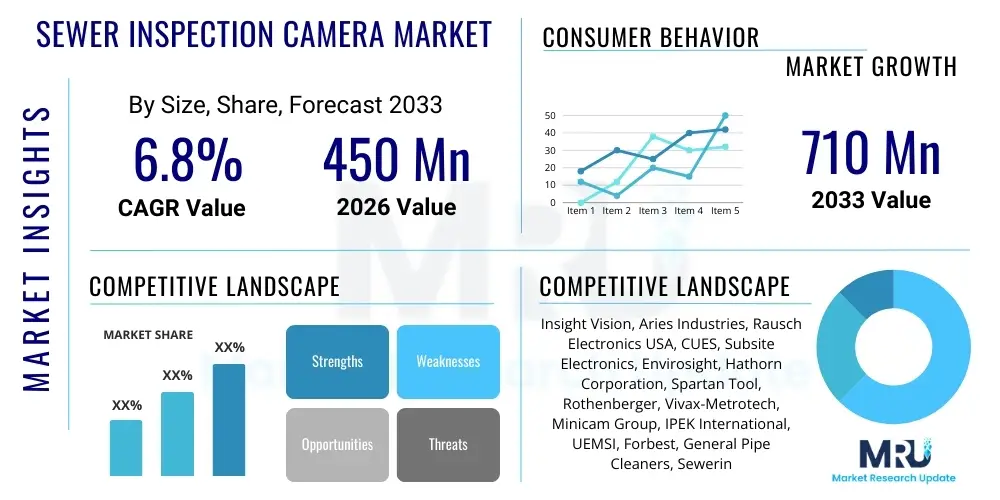

The Sewer Inspection Camera Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 450 Million in 2026 and is projected to reach USD 710 Million by the end of the forecast period in 2033. This consistent growth trajectory is primarily fueled by the accelerating deterioration of municipal water and wastewater infrastructure globally, necessitating proactive and non-destructive inspection methods. The increasing adoption of advanced robotic systems capable of navigating complex pipe networks further contributes significantly to this market expansion.

Sewer Inspection Camera Market introduction

The Sewer Inspection Camera Market encompasses devices designed for the visual examination and documentation of subsurface pipelines, conduits, and drains without requiring extensive excavation. These systems, ranging from portable push-rod cameras used for residential plumbing to advanced robotic mainline crawler units employed in large municipal infrastructure projects, provide critical diagnostic capabilities. Modern sewer inspection cameras utilize high-resolution optics, powerful illumination, and sophisticated data logging features, enabling operators to accurately identify defects such as cracks, blockages, root intrusion, joint displacements, and structural failures, which are vital for maintaining public health and environmental standards.

The primary applications of sewer inspection cameras span municipal utility management, where they are integral to preventative maintenance programs and regulatory compliance checks; residential and commercial plumbing services for fault diagnosis and repair verification; and specialized industrial applications, including the inspection of high-pressure or chemically-resistant piping systems. The inherent benefits of these cameras—including reduced downtime, lower labor costs compared to traditional excavation, and the generation of detailed, traceable digital reports—have solidified their position as indispensable tools in infrastructure management. Furthermore, the technology aids in condition assessment studies, providing valuable data inputs for capital planning and rehabilitation prioritization within utility organizations.

Market growth is predominantly driven by global trends involving aging infrastructure in developed nations, where pipes often exceed their intended lifespan, leading to frequent failures and leaks. Concurrently, rapid urbanization in developing regions necessitates the installation and continuous monitoring of new wastewater networks, demanding robust inspection solutions. Stricter environmental regulations aimed at reducing sewage overflow events and pollution, coupled with the rising focus on predictive maintenance strategies enabled by digital inspection data, further act as powerful market accelerators. Technological advancements, such as the integration of 3D mapping and AI-powered defect analysis, are enhancing the efficiency and accuracy of inspection procedures, stimulating demand across all end-user segments.

Sewer Inspection Camera Market Executive Summary

The Sewer Inspection Camera Market is witnessing a strategic pivot towards digitalization and automation, driven by the need for enhanced efficiency in infrastructure maintenance. Business trends indicate a strong focus on developing modular, versatile crawler systems that can adapt to varying pipe diameters and conditions, alongside a significant push for connectivity, allowing for real-time data streaming and cloud-based reporting platforms. Manufacturers are increasingly integrating software solutions that automate defect identification and reporting processes, reducing the reliance on manual interpretation and speeding up remedial actions. This shift underscores a broader industry movement towards preventative maintenance models supported by robust data analytics, moving beyond simple fault detection to proactive condition prediction.

Regional trends reveal that North America and Europe currently represent the largest revenue generators, primarily due to well-established regulatory frameworks mandating regular sewer inspections and substantial government investment in infrastructure rehabilitation projects. However, the Asia Pacific (APAC) region is projected to register the fastest growth rate, fueled by massive public investments in constructing new urban sanitation infrastructure and the rapid industrialization demanding complex pipe inspection in manufacturing hubs. The Middle East and Africa (MEA) are also emerging as high-potential markets, particularly with large-scale development projects necessitating rigorous quality control for newly installed utilities. The disparity in regional maturity drives tailored product offerings, with advanced features like self-navigating capabilities being prioritized in mature markets, while cost-effectiveness and durability are key considerations in emerging economies.

Segmentation trends highlight the increasing dominance of the Mainline Crawler camera segment, especially for large municipal applications, reflecting the growing need to inspect extensive sewer networks efficiently. Concurrently, the Software and Service segment is experiencing exponential growth, outpacing hardware sales, as utilities prioritize integrated data management, analytics, and AI-driven reporting tools over standalone camera purchases. Furthermore, there is a distinct market preference shift towards cameras offering superior image quality (4K resolution) and specialized features like laser measuring and sonar profiling, enabling comprehensive structural assessments beyond mere visual inspection. This points to the increasing sophistication required of inspection equipment to meet complex engineering demands.

AI Impact Analysis on Sewer Inspection Camera Market

Common user questions regarding AI's influence in the sewer inspection domain center on the feasibility of fully automated defect detection, the reliability and accuracy of machine learning algorithms in classifying varied pipe conditions (e.g., distinguishing a minor crack from a joint separation), and the practical implementation costs associated with integrating AI-powered software into existing inspection workflows. Users are keen to understand how AI can transform raw video footage into actionable, standardized reports instantly, thereby mitigating the laborious and subjective nature of current human-based video analysis. There is also significant interest in AI's potential for predictive modeling—using historical inspection data to forecast future failure points and optimize maintenance schedules.

The core themes emerging from this analysis confirm high user expectations for AI to serve as a critical force multiplier in infrastructure maintenance. Users anticipate that AI integration will significantly address the chronic labor shortages facing the industry, providing automated quantification of pipe defects (such as measuring the percentage of wall loss or the degree of offset). This capability standardizes assessment criteria across different operators and regions. Moreover, AI is expected to move beyond simple detection into complex classification and prioritization, enabling utilities to allocate scarce repair resources based on actual structural integrity data rather than general estimates.

Consequently, the market is rapidly adapting, with leading inspection software providers launching products featuring deep learning models trained on vast datasets of sewer defects. These systems drastically reduce the processing time from days to minutes, offering immediate, detailed analysis embedded directly into the inspection workflow. The impact of AI is transforming sewer inspection from a purely diagnostic process into a data science operation, elevating the strategic value of the inspection camera itself, which now serves primarily as a high-fidelity data acquisition platform for intelligent software systems. This convergence of optics, robotics, and artificial intelligence represents the future benchmark for market competitiveness.

- Automated Defect Recognition: AI algorithms minimize human error by instantly identifying and classifying common pipe anomalies like infiltration, corrosion, and root intrusion from video feed.

- Standardized Reporting: Ensures uniform reporting across different inspection teams by objectively quantifying defect severity and location, crucial for regulatory compliance.

- Predictive Maintenance: Machine learning models analyze historical inspection data and environmental factors to forecast potential failure points, enabling proactive repair scheduling.

- Increased Throughput: Automated processing accelerates the analysis of inspection footage, significantly reducing the time required between inspection and final repair planning.

- Enhanced Data Integrity: AI integration improves the overall quality and consistency of collected data, making it more valuable for long-term asset management planning and digital twin modeling.

DRO & Impact Forces Of Sewer Inspection Camera Market

The Sewer Inspection Camera Market is fundamentally shaped by powerful drivers, necessitating continuous investment in inspection technologies to maintain public infrastructure and adherence to escalating environmental standards. The primary driver is the accelerating decay of global piping infrastructure, much of which was installed post-WWII and is rapidly reaching or surpassing its design life, leading to structural failures, leaks, and service interruptions. This structural urgency mandates reliable, non-destructive inspection tools. Restraints, conversely, include the substantial initial capital investment required for advanced robotic crawler systems and the necessity for specialized training and technical expertise to operate, maintain, and accurately interpret the complex data generated by these high-end cameras. These cost barriers particularly challenge smaller municipal utilities and independent plumbing firms, limiting broad-scale adoption of the most technologically advanced equipment.

Opportunities for market expansion are strongly rooted in the rapid technological maturation of associated fields, specifically the integration of Internet of Things (IoT) sensors, drone technology for aerial assessment, and sophisticated AI-powered software analytics. The emergence of developing economies, particularly those undertaking large-scale urban development projects, presents vast greenfield opportunities for modern inspection solutions that can ensure the quality control of new installations. Furthermore, the global shift towards smart city initiatives places a high premium on interconnected, data-driven utility management systems, positioning sewer inspection data as a cornerstone for proactive city planning and resilience strategies, thereby generating significant new revenue streams for solution providers.

The impact forces exerted upon this market are technological advancement and stringent environmental policies. Technological advancements are continuously enhancing the capabilities of the cameras—improving resolution, extending battery life, and adding laser profiling for dimensional measurements—making inspections more precise and comprehensive. Simultaneously, increasingly strict regulatory frameworks, such as those governing sanitary sewer overflows (SSOs) and water quality protection, compel utilities to adopt preventative maintenance and continuous monitoring programs. These external forces ensure sustained demand for innovative, reliable inspection equipment, driving manufacturers towards miniaturization, modularity, and increased automation to meet escalating performance and compliance requirements.

Segmentation Analysis

The Sewer Inspection Camera Market is structurally segmented based on the type of camera technology used, the specific application environment, and the end-user profile, allowing manufacturers to tailor products to specific operational requirements and budget constraints. The Type segmentation primarily divides the market into three core categories: Push Rod Cameras, which are smaller, highly portable, and used for residential and commercial drain lines (typically 2 to 6 inches in diameter); Mainline Crawler Cameras, which are large, remotely operated robotic systems designed for inspecting large municipal pipes (6 inches and above); and Handheld/Reel Cameras, used for smaller, accessible pipes. This stratification reflects the varying degrees of pipeline accessibility and diameter present across the service landscape.

From an application standpoint, the market is largely compartmentalized into Municipal, Residential/Commercial, and Industrial sectors. Municipal applications represent the largest segment, driven by the massive scale of public infrastructure, mandatory inspection cycles, and large capital budgets allocated for water and wastewater management. Residential and commercial applications focus on localized problem diagnosis by plumbing contractors, demanding speed and portability. Industrial applications, often involving hazardous environments such as chemical plants or oil refineries, require specialized, explosion-proof or chemically resistant camera systems, commanding premium prices due to stringent safety and durability standards.

Analyzing these segments provides crucial insights into growth dynamics, revealing that while mainline crawlers dominate in terms of market value due to their high unit cost and complexity, the service and software segment associated with all camera types is demonstrating the fastest growth. This trend signifies a shift in value proposition from merely selling hardware to providing comprehensive, data-centric inspection solutions that leverage cloud technology and artificial intelligence for superior asset management outcomes. The ongoing refinement of camera features, such as self-leveling heads and superior illumination, across all segments aims to maximize data quality for automated analysis.

- Type

- Push Rod Cameras

- Mainline Crawler Cameras

- Handheld Inspection Cameras

- Application

- Municipal Water & Wastewater

- Residential & Commercial Plumbing

- Industrial Inspection (Oil & Gas, Chemical, Manufacturing)

- End User

- Utility Providers

- Independent Contractors & Plumbers

- Government Agencies

- Construction Companies

- Connectivity

- Wired Systems

- Wireless (Wi-Fi/5G Integrated) Systems

Value Chain Analysis For Sewer Inspection Camera Market

The value chain for the Sewer Inspection Camera Market begins with the upstream suppliers responsible for high-precision components. This includes manufacturers of highly durable optical sensors (often high-definition or 4K), specialized lighting systems (LED and Xenon), robust cable materials (fiber-optic and conductive cables), and complex robotic motors/actuators required for crawler units. Key challenges in the upstream phase involve sourcing highly resilient, corrosion-proof materials capable of withstanding harsh sewer environments. The midstream manufacturing phase involves system assembly, integration of proprietary software, calibration, and rigorous quality testing. Value is added here through specialized engineering design focused on modularity, battery performance, and software integration for data acquisition and mapping capabilities.

The downstream component of the value chain is dominated by distribution and service provision. Products are moved through direct sales channels, typically involving large, customized contracts with major municipal utilities or government entities requiring extensive after-sales support and training. Indirect channels involve a network of authorized distributors, resellers, and professional equipment rental companies, who cater mainly to independent plumbing contractors and smaller firms. These indirect channels provide geographical reach and localized customer support, which is critical for equipment requiring prompt technical maintenance.

A significant portion of the value is captured at the service provision stage, where specialized contractors utilize the cameras to deliver inspection services, structural assessment reports, and regulatory compliance data. This service-centric approach drives demand not only for the hardware but for continuous software updates, training, and data analytics tools. Therefore, market participants often focus on building strong relationships with both large utilities (direct buyers) and the network of independent service providers (indirect users) to maintain visibility and control over the lifecycle of the inspection data generated by their equipment.

Sewer Inspection Camera Market Potential Customers

The potential customers for sewer inspection camera systems are broadly categorized into entities responsible for infrastructure maintenance, public health, and construction quality assurance. The most significant customer segment consists of Municipal Water and Wastewater Departments, which are mandated to ensure the structural integrity and functional efficiency of vast public sewer networks. These entities require sophisticated, durable, and highly reliable mainline crawler systems for comprehensive, systematic inspection programs and significant capital investments in preventative maintenance and rehabilitation projects, making them the largest and most consistent buyers in the market.

A secondary, high-volume customer group comprises independent professional plumbing contractors and service firms. These buyers typically focus on push-rod and portable camera systems, using them for localized fault diagnosis in residential, commercial, and small-scale municipal pipe systems. Their purchasing decisions are often driven by portability, ease of use, rapid diagnostic capabilities, and favorable return on investment (ROI) derived from efficiency gains over traditional troubleshooting methods. They often rely on indirect distribution channels and rental services for access to the equipment.

Furthermore, specialized industrial facilities, including petrochemical plants, food processing facilities, and heavy manufacturing sites, represent a niche but high-value customer base. These environments frequently require specialized camera systems (e.g., explosion-proof ATEX certified, or small-diameter cameras for complex piping arrays). Finally, construction and civil engineering firms are potential customers, utilizing inspection cameras for quality control checks on newly laid pipes before project handover and acceptance by municipal authorities, ensuring compliance with strict governmental installation standards.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450 Million |

| Market Forecast in 2033 | USD 710 Million |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Insight Vision, Aries Industries, Rausch Electronics USA, CUES, Subsite Electronics, Envirosight, Hathorn Corporation, Spartan Tool, Rothenberger, Vivax-Metrotech, Minicam Group, IPEK International, UEMSI, Forbest, General Pipe Cleaners, Sewerin GmbH, Visioprobe, Wohler USA, Pearpoint, and IBAK Helmut Hunger. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Sewer Inspection Camera Market Key Technology Landscape

The technological landscape of the Sewer Inspection Camera Market is rapidly evolving, moving beyond simple visual documentation to sophisticated dimensional analysis and automated data processing. A key technological advancement involves the integration of high-definition (HD) and ultra-high-definition (4K) sensors, paired with advanced dynamic LED lighting systems. This combination ensures maximum clarity even in dark, turbid environments, providing the necessary image fidelity for AI algorithms to accurately classify minor structural defects. Furthermore, the development of intelligent, self-leveling camera heads ensures the captured imagery maintains a consistent orientation, critical for accurate spatial mapping and minimizing operator intervention in complex pipe geometries.

A second crucial area of innovation is the development of advanced robotic crawler platforms. Modern crawlers feature sophisticated multi-articulated steering systems, robust motors, and modular designs that allow rapid adaptation to pipe sizes ranging from 6 inches to over 60 inches. Integration of supplementary technologies such as Sonar (for flooded pipes), Lidar, and Laser Profiling is becoming standard. Laser profiling technology provides precise measurement of pipe deformation, ovality, and structural loss, transforming the inspection process from qualitative assessment to quantitative engineering analysis. This shift is essential for prioritizing rehabilitation projects based on objective structural data rather than subjective visual estimates.

Finally, connectivity and software are defining the next generation of inspection tools. The increasing adoption of wireless transmission protocols (including 5G capabilities in some enterprise solutions) allows for real-time video streaming from remote locations directly to data analysis centers or cloud platforms. The primary technological value now resides in the accompanying software packages, which utilize Artificial Intelligence and Machine Learning (AI/ML) to automatically code pipe conditions (using standards like NASSCO PACP). These software suites generate comprehensive digital reports, manage asset inventories, and interface with Geographical Information Systems (GIS) to provide spatial context for maintenance decisions, thus completing the digital transformation of the inspection workflow.

Regional Highlights

- North America: This region holds a dominant market share, characterized by mature infrastructure requiring continuous renewal and rehabilitation. Stricter regulatory mandates by entities like the EPA regarding overflow prevention and pipeline integrity drive consistent demand. The market here is highly technologically advanced, exhibiting rapid uptake of AI-enabled crawler systems and high-resolution imaging for comprehensive condition assessment. The presence of major vendors and high municipal budgets ensures sustained investment in premium equipment and advanced software solutions.

- Europe: The European market demonstrates robust growth, particularly in Western and Northern Europe, driven by long-established utility standards and a strong focus on environmental protection. Countries like Germany and the UK prioritize systematic preventative maintenance programs using sophisticated mainline cameras equipped with laser profiling features. The market sees a strong balance between purchasing and renting equipment, catering to diverse utility and contractor needs.

- Asia Pacific (APAC): APAC is the fastest-growing region, propelled by massive urbanization and corresponding large-scale construction of new wastewater and sanitation networks, particularly in China, India, and Southeast Asia. While cost sensitivity remains a factor, the need for quality assurance in new pipelines and the urgent retrofitting of existing networks in megacities create substantial opportunities. The market growth is largely fueled by significant government investment in smart city infrastructure and basic sanitation coverage expansion.

- Latin America: This region presents moderate growth, often focused on necessary upgrades to basic infrastructure and addressing water loss due to leakage. Market adoption is fragmented, with larger metropolitan areas investing in advanced crawler technology, while smaller jurisdictions rely more on entry-level push-rod systems. Economic stability and governmental prioritization of sanitation projects are key determinants of market expansion here.

- Middle East and Africa (MEA): Growth in MEA is highly concentrated in the Gulf Cooperation Council (GCC) states due to extensive, state-funded mega-projects in infrastructure development. These regions demand high-end, durable equipment capable of operating in extreme heat conditions. In parts of Africa, the market is emerging, driven by international aid and domestic initiatives focused on improving basic water and sanitation services, favoring robust, lower-maintenance inspection tools.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Sewer Inspection Camera Market.- CUES Inc.

- Insight Vision

- Envirosight LLC

- IBAK Helmut Hunger GmbH & Co. KG

- Rausch Electronics USA Inc.

- Aries Industries Inc.

- Subsite Electronics (Ditch Witch)

- Hathorn Corporation

- Vivax-Metrotech Corp.

- Minicam Group

- IPEK International GmbH

- Spartan Tool LLC

- General Pipe Cleaners

- Forbest International Trading LLC

- Rothenberger Group

- Wohler USA Inc.

- Sewerin GmbH

- Pearpoint (SPX Corporation)

- UEMSI Inc.

- Radiodetection (SPX Corporation)

Frequently Asked Questions

Analyze common user questions about the Sewer Inspection Camera market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary factors driving the demand for advanced sewer inspection camera systems?

The demand is primarily driven by the critical need to address aging municipal infrastructure, strict environmental regulations mandating overflow prevention and regular pipeline integrity checks, and the increasing adoption of preventative maintenance strategies enabled by precise, non-destructive inspection data. Technological advancements like AI integration further boost demand by improving inspection efficiency.

How does Artificial Intelligence (AI) enhance the functionality of sewer inspection cameras?

AI significantly enhances functionality by automating the analysis of video footage, enabling instant and objective defect classification (e.g., quantifying crack severity, detecting root intrusion), standardizing reporting across different projects, and facilitating predictive maintenance modeling by analyzing vast datasets of pipe conditions.

What is the difference between Push Rod Cameras and Mainline Crawler Cameras?

Push Rod Cameras are portable, manually propelled tools used for inspecting smaller, shorter lines (typically 2-6 inches) like residential drains. Mainline Crawler Cameras are larger, motorized robotic systems designed for remotely navigating extensive municipal pipelines (6 inches and above) and are equipped with advanced steering, lighting, and measurement capabilities like laser profiling.

Which geographical region exhibits the fastest growth rate in the Sewer Inspection Camera Market?

The Asia Pacific (APAC) region is projected to exhibit the fastest growth rate due to rapid urbanization, massive government investments in constructing new urban sanitation and wastewater infrastructure, and increasing industrial expansion requiring reliable inspection and quality control of new pipe installations.

What role does 3D mapping and laser profiling play in modern pipe inspection?

3D mapping and laser profiling convert visual inspection into a precise quantitative engineering assessment. They are used to accurately measure dimensional changes, such as pipe ovality, wall loss, and structural deformation, providing critical data needed for rehabilitation planning, prioritizing repairs, and ensuring regulatory compliance beyond simple visual assessment.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager