Sewing and Embroidery Combination Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433005 | Date : Dec, 2025 | Pages : 242 | Region : Global | Publisher : MRU

Sewing and Embroidery Combination Market Size

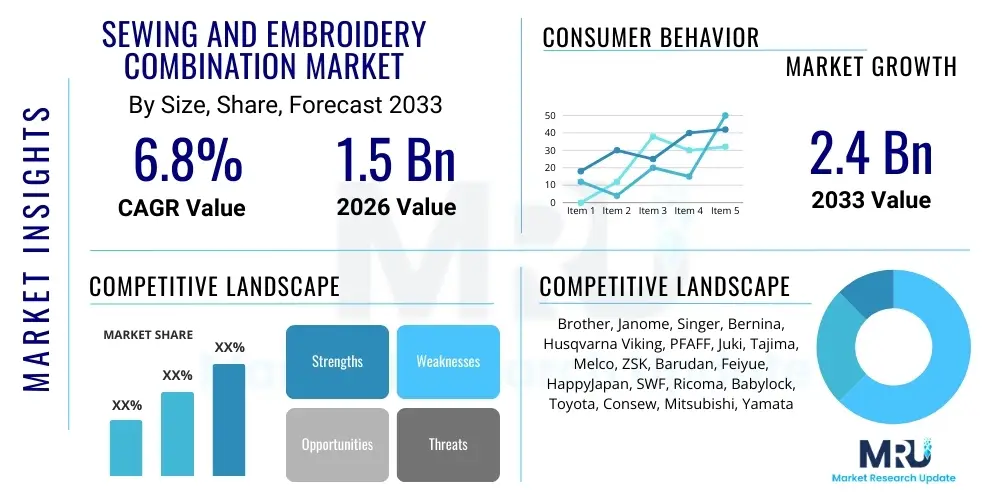

The Sewing and Embroidery Combination Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 1.5 Billion in 2026 and is projected to reach USD 2.4 Billion by the end of the forecast period in 2033.

Sewing and Embroidery Combination Market introduction

The Sewing and Embroidery Combination Market encompasses advanced computerized machines designed to perform both traditional sewing functions, such as garment construction and utility stitching, and intricate automated embroidery, including monogramming, appliqués, and decorative designs. These dual-function devices cater to a broad spectrum of users, ranging from dedicated hobbyists and small home-based businesses (SOHO) to educational institutions and specialized commercial customization services. The product description emphasizes seamless transition between sewing modes and embroidery capabilities, often facilitated by touchscreens, sophisticated software interfaces, and built-in design libraries. The machines are characterized by high stitch speed, precision indexing, and automated features such as needle threading and thread cutting, significantly enhancing efficiency and creative scope for complex textile projects. The convergence of these two disciplines into a single apparatus represents a major technological leap, streamlining the creative process and reducing the need for multiple specialized pieces of equipment, thereby optimizing workspace and investment for end-users.

Major applications for these combination machines are heavily skewed toward high-end garment customization, decorative home furnishings, and the creation of personalized gifts or branded apparel. In the household segment, users leverage the machines for crafting intricate quilts, enhancing apparel with personalized embroidery, and undertaking sophisticated DIY projects that require both structural sewing and decorative embellishment. Commercially, small custom shops, bridal boutiques, and uniform suppliers utilize the machines for on-demand customization, allowing them to offer a wide array of high-margin personalized products quickly. Educational applications involve teaching textile arts and engineering design principles, offering students hands-on experience with modern, digitally controlled fabrication tools. The versatility offered by these combination units is a primary draw, allowing businesses to pivot quickly between production tasks, such as repairing or assembling a textile item, and value-added decoration, ensuring maximum utilization of the machinery.

The primary benefits driving market adoption include enhanced creative flexibility, time efficiency due to automation, and exceptional precision unattainable through manual methods. Driving factors further include the global proliferation of the ‘maker’ movement, increasing consumer demand for personalized and unique products, and continuous technological advancements resulting in more user-friendly interfaces and expanded connectivity (such as Wi-Fi design transfer). Furthermore, manufacturers are integrating advanced software features that allow for easy design manipulation, simulated stitching previews, and efficient color management, lowering the entry barrier for complex embroidery work. The compact nature and dual functionality of these machines, coupled with improved reliability and reduced maintenance needs compared to dedicated industrial machines, solidify their position as essential tools for modern textile creation and customization across various sectors.

- Product Versatility: Seamless integration of high-precision sewing and complex automated embroidery functions in one unit.

- Key Applications: Home crafting, bespoke garment customization, quilting, small-scale commercial branding, and textile education.

- Driving Factors: Growth of DIY culture, increasing demand for personalization, and continuous hardware/software integration improvements.

- Core Benefits: Superior stitch quality, significant time savings through automation, and expanded creative possibilities for intricate designs.

Sewing and Embroidery Combination Market Executive Summary

The Sewing and Embroidery Combination Market is experiencing robust growth driven primarily by shifting consumer behaviors favoring personalization and the increasing accessibility of advanced consumer-grade technology. Business trends highlight a pronounced move towards digitalization in textile creation, with top manufacturers heavily investing in cloud-based design libraries and enhanced machine connectivity to appeal to a digitally native customer base. Key market players are differentiating themselves through proprietary software ecosystems, offering subscription models for design access and advanced tutorial support, thereby generating recurring revenue streams beyond the initial hardware sale. Furthermore, the rise of specialized e-commerce platforms focused on custom textile goods has amplified the need for efficient, high-quality combination machines capable of handling small-batch, diverse orders. This dynamic environment necessitates continuous R&D focus on faster processing units, larger embroidery fields, and enhanced material compatibility to maintain competitive edge in a rapidly evolving customization landscape, positioning software and connectivity as crucial competitive differentiators.

Regionally, the Asia Pacific (APAC) stands out as the fastest-growing market, propelled by expanding manufacturing bases in countries like China and Vietnam, coupled with rising disposable incomes in emerging economies fueling consumer interest in home decor and crafting. North America and Europe maintain leading market shares in terms of value, driven by high adoption rates among hobbyists, established small and medium-sized enterprises (SMEs) specializing in customization, and strong consumer spending on premium, technologically advanced models. European markets show a particular focus on sustainability and durability, influencing purchasing decisions towards machines with long warranties and modular components. Conversely, penetration in Latin America and the Middle East & Africa (MEA) is accelerating, supported by improving distribution networks and the growing presence of global brands initiating targeted marketing campaigns focused on artisanal and local crafting communities. Regional market expansion is highly correlated with accessible technical support infrastructure and localized language interfaces.

Segment trends reveal that the computerized/multi-head segment is witnessing the highest growth, particularly in commercial and semi-industrial applications where efficiency and volume capacity are paramount. In terms of application, the Household segment remains the largest volume consumer, benefiting from machines that offer a balance of performance and ease of use, often bundled with beginner-friendly software. The distribution channel analysis indicates a strong shift towards online retail and manufacturer-direct channels, providing customers with comprehensive product information, digital tutorials, and direct access to specialized customer service, which is vital for complex machinery. However, specialty retail stores remain essential for providing hands-on demonstrations and localized training, particularly for high-end, premium machines. Future segment growth is expected to be dominated by models integrating advanced AI features for design optimization and automated material handling, further blurring the line between consumer and industrial equipment.

- Business Trends: Emphasis on digital ecosystems, cloud-based design services, and subscription models for recurring revenue.

- Regional Trends: APAC is the fastest-growing market; North America and Europe lead in terms of technology adoption and value share.

- Segment Trends: Strongest growth observed in computerized multi-head machines and the expanding online distribution channel.

- Strategic Focus: Manufacturers prioritize user interface improvements, integration of smart features, and expanded design libraries.

AI Impact Analysis on Sewing and Embroidery Combination Market

User queries regarding AI's influence in the Sewing and Embroidery Combination Market primarily revolve around three key areas: automation of complex design creation, optimization of stitching parameters, and enhancing error detection/correction during operation. Users frequently ask if AI can generate novel embroidery patterns based on textual prompts or uploaded images, essentially functioning as a creative design assistant. There is significant concern about how AI-driven optimization might affect existing design workflows, specifically whether it will simplify the complex digitization process (converting artwork into machine-readable stitch files) or potentially limit the creative control of experienced digitizers. Additionally, users are keenly interested in predictive maintenance features, querying whether AI algorithms can analyze machine performance data (stitch velocity, motor temperature, vibration patterns) to forecast component failure before it occurs, ensuring continuous uptime for commercial users. These themes underscore a demand for intelligent features that enhance both the creative frontend and the operational efficiency backend of combination machines, mitigating manual effort and technical complexities.

The introduction of Artificial Intelligence is poised to revolutionize the design phase by implementing generative algorithms capable of transforming abstract concepts or low-resolution images into highly optimized, stitch-ready embroidery files. Current software often requires extensive manual adjustments by a digitizer to define stitch type, direction, density, and underlay, a time-consuming and expertise-dependent task. AI-driven digitization tools utilize deep learning models trained on vast datasets of high-quality designs, allowing the software to automatically interpret complex curves and colors, assigning optimal stitching strategies that minimize thread breaks, fabric puckering, and waste. This automation drastically reduces the learning curve for new users while boosting productivity for professionals, enabling faster turnaround times for personalized and bespoke orders, which is critical in fast-paced retail and small-scale manufacturing environments.

Operationally, AI enhances machine performance through real-time adaptive control and quality assurance. Modern combination machines equipped with integrated sensors and machine learning processors can dynamically adjust tension, speed, and even needle penetration depth based on the specific fabric characteristics detected (e.g., density, elasticity) and the complexity of the current stitch segment. Furthermore, AI systems are being developed to monitor the stitching process via high-speed cameras, immediately identifying anomalies such as skipped stitches, looping, or imperfect registration, stopping the machine instantaneously and prompting the user with precise corrective actions. This level of process control minimizes costly production errors and material waste, significantly improving overall output quality and reducing manual supervision requirements, particularly for multi-head commercial units operating continuously.

- Generative Design: AI assists in automatically converting raster images or sketches into optimized vector stitch paths, reducing digitization time.

- Stitch Optimization: Machine learning models dynamically adjust tension, density, and speed based on real-time fabric feedback and design complexity.

- Predictive Maintenance: AI analyzes operational data to predict component failure (e.g., timing belt wear, sensor drift), minimizing unplanned downtime.

- Quality Control: Computer vision algorithms detect stitching errors, misregistration, or thread breaks instantly, ensuring high output quality without constant human oversight.

- User Experience: AI facilitates smart tutorial systems and troubleshooting guides, customizing learning paths based on user skill level and common operational mistakes.

DRO & Impact Forces Of Sewing and Embroidery Combination Market

The Sewing and Embroidery Combination Market is shaped by powerful driving forces centered around innovation and changing consumer behavior, while simultaneously facing significant restraints related to cost and technological complexity. Opportunities are vast, particularly through digital distribution and integration with broader creative economies. The primary driver is the accelerating trend of personalization across textile and apparel industries, necessitating versatile equipment capable of handling unique, high-quality decorative elements on demand. This trend is amplified by the widespread adoption of social media and visual platforms, which showcase customized crafting and apparel, inspiring greater consumer engagement in DIY and bespoke creation. Furthermore, continuous advancements in hardware miniaturization and software usability have made formerly industrial-level capabilities accessible and manageable for the average consumer, driving volume growth in the household segment. These factors collectively push manufacturers toward producing machines with greater connectivity and integrated design services.

However, the market faces considerable restraints, notably the high initial capital investment required for these sophisticated combination units compared to basic sewing machines or entry-level embroidery-only devices. This cost factor creates a high barrier to entry for budget-conscious consumers and small startups, limiting market penetration in lower-income demographics. Additionally, the complexity associated with mastering the integrated software and calibration procedures—specifically the detailed process of embroidery digitization, material stabilization, and thread management—can be daunting for novice users, leading to frustration and potential underutilization of the machine's full capabilities. The steep learning curve necessitates substantial customer support and training resources, increasing operational costs for manufacturers and distributors, which can indirectly impact end-user pricing and adoption rates, requiring manufacturers to continuously simplify user interfaces.

Significant opportunities exist in expanding e-commerce penetration, utilizing subscription models for design access, and targeting niche customization segments. The growth of online platforms allows manufacturers to reach global audiences directly, providing personalized support and disseminating software updates seamlessly. The market is increasingly impacted by forces demanding eco-friendly operations; thus, developing machines optimized for minimal material waste and energy consumption presents a major opportunity for market differentiation. Furthermore, technological partnerships focusing on seamless integration with Computer-Aided Design (CAD) software and 3D printing technologies could open up new hybrid textile creation possibilities. The inherent impact forces, therefore, include high R&D expenditure to maintain feature parity, the need for robust intellectual property protection for proprietary software, and navigating global supply chain volatility affecting component availability and manufacturing costs, particularly for complex electronic controllers and precision mechanical parts.

- Drivers: Growing consumer demand for customized and unique textile products; technological advancements improving machine accessibility and ease of use; expansion of the global DIY and crafting communities.

- Restraints: High initial purchase price and steep learning curve associated with advanced features; reliance on specific proprietary software and connectivity requirements; market saturation in highly developed economies limiting new household penetration.

- Opportunities: Expansion into developing markets; strategic utilization of e-commerce and direct-to-consumer models; integrating advanced AI for design automation and error reduction; developing specialized, portable commercial units for mobile customization services.

- Impact Forces: Competitive pressure driving down hardware margins; increasing consumer expectation for seamless software integration and cloud services; global regulatory changes affecting electronic waste and energy efficiency standards; skilled labor scarcity for machine repair and maintenance.

Segmentation Analysis

The Sewing and Embroidery Combination Market is primarily segmented based on machine type (distinguishing between functionality and capacity), application (identifying key end-user environments), and distribution channel (analyzing how products reach the consumer). Analysis across these dimensions provides crucial insights into market dynamics, pricing strategies, and product development priorities tailored to specific user needs. Machine Type segmentation typically ranges from entry-level household models with smaller embroidery fields and limited speeds to advanced multi-needle, multi-head commercial machines designed for high-volume, continuous operation. Understanding this dichotomy is essential, as the technology stack and investment required vary dramatically between these types, directly influencing target marketing efforts and regional sales forecasting.

Application-based segmentation is vital for recognizing the value chain positioning of these machines. The household segment prioritizes user-friendliness, aesthetic design, and quiet operation, often integrating features like automatic design resizing and simple touchscreens. Conversely, the commercial/industrial segment demands robustness, networkability, high speed, and the ability to handle a wider variety of materials and larger frame sizes. The educational segment focuses on durability and standardized interfaces suitable for institutional teaching environments. The evolving needs within the commercial sector, particularly the rapid growth of micro-manufacturing and localized production, continue to push the demand for compact yet powerful semi-industrial models that bridge the gap between home-use affordability and industrial-level output capabilities.

Distribution Channel analysis tracks the effectiveness of traditional versus digital retail strategies. The shift towards online sales is significant, driven by the convenience of product comparison, access to extensive video tutorials, and direct purchasing from manufacturers which often includes bundled software perks. However, specialty stores remain critical as they offer personalized demonstrations, localized training sessions, and immediate technical troubleshooting, essential components for supporting complex, high-investment machinery. The success of market players increasingly depends on an omni-channel approach that leverages the informational reach of online platforms while maintaining the hands-on service capabilities provided by physical retail networks, optimizing the customer journey from inquiry to post-purchase support.

- By Type:

- Single Head Combination Machines

- Multi Head Combination Machines

- Computerized Combination Machines

- Mechanical/Electronic Combination Machines

- By Application:

- Household (Hobbyists, Home Decor)

- Commercial (Custom Apparel Shops, Monogramming Services, Small Boutiques)

- Industrial/Semi-Industrial (Small Batch Manufacturing, Uniform Production)

- Educational Institutions

- By Distribution Channel:

- Specialty Retail Stores

- Online Retail (E-commerce Platforms, Manufacturer Websites)

- Department Stores

- Direct Sales/Distributor Networks

Value Chain Analysis For Sewing and Embroidery Combination Market

The value chain for the Sewing and Embroidery Combination Market is characterized by a complex structure involving highly specialized upstream component manufacturing, sophisticated assembly and software integration by OEMs, and a diverse, multi-tiered downstream distribution network. Upstream analysis focuses on the procurement of high-precision mechanical components, including stepper motors, needle bars, tension regulators, and electronic control boards (PCBs). Key suppliers in this phase are often specialized manufacturers from Asia (Japan, South Korea, Taiwan, China) providing precision engineering necessary for high stitch quality and speed. Software development, which defines the machine's capability and user experience, is an increasingly crucial upstream activity, often managed in-house or through specialized software firms focusing on digitization algorithms and connectivity protocols. The quality and reliability of these upstream inputs directly influence the final machine's performance and durability, making supplier relationship management and quality control paramount.

The core of the value chain involves the Original Equipment Manufacturers (OEMs) who are responsible for machine assembly, rigorous quality testing, and proprietary software integration. This phase is characterized by significant investment in automation and clean-room assembly environments to ensure precision. Marketing and branding are integral to this stage, transforming generic hardware into recognizable, feature-rich consumer or commercial products. Downstream activities involve reaching the end-user through various channels. Direct distribution involves manufacturers selling directly via their websites or dedicated brand showrooms, offering maximum control over pricing and customer experience. Indirect channels rely on regional distributors, large department stores, and, most significantly, specialized sewing and crafting retail stores that provide necessary localized services like machine setup, technical workshops, and repair support, often critical for retaining high-value customers.

The choice between direct and indirect distribution channels impacts profitability, market reach, and customer service delivery. While direct sales offer higher margins and immediate customer feedback, indirect channels, particularly specialty stores, provide the essential technical expertise and community engagement that complex machinery requires. These stores act as crucial knowledge centers, demonstrating machine capabilities and mitigating the steep learning curve, thereby acting as effective sales multipliers. The efficiency of the distribution channel, including warehousing and logistical management for large equipment, is critical for maintaining competitive pricing and timely delivery. Furthermore, the provision of post-sale services—including software updates, technical repair, and access to design libraries—adds significant value downstream, fostering customer loyalty and influencing repeat purchases and upgrades.

Sewing and Embroidery Combination Market Potential Customers

The potential customer base for Sewing and Embroidery Combination Machines is exceptionally diverse, spanning professional entities that rely on the equipment for income generation and passionate individuals engaging in creative pursuits. The primary end-users fall into distinct categories, each prioritizing different features and price points. The largest segment is the Household Hobbyist, consisting of quilters, crafters, and DIY enthusiasts who value ease of use, extensive built-in design libraries, and connectivity features that simplify design transfer. These buyers are typically sensitive to user interface quality and expect reliable, comprehensive manufacturer support, often preferring mid-range, single-head computerized models suitable for sporadic but complex personal projects and gift creation.

A rapidly growing customer segment is the Small and Medium Enterprise (SME) specializing in custom goods, including promotional product suppliers, online boutiques selling personalized clothing, and local monogramming services. These commercial buyers require semi-industrial durability, multi-needle capabilities for faster color changes, larger hoop sizes, and robust software for efficient batch processing. For these professional end-users, uptime and speed are critical metrics, leading them to invest in higher-priced, more rugged machines, viewing the purchase as a crucial business asset. Their buying decisions are heavily influenced by the machine’s capacity for network integration and its ability to handle different material weights and thicknesses reliably.

Institutional buyers, such as vocational schools, fashion colleges, and technical training centers, represent another vital customer category. These entities purchase machines for educational purposes, focusing on ease of maintenance, standardized operational platforms, and durability under frequent student use. Government departments, particularly those involved in military or public service uniform management, also act as potential buyers, often requiring machines with specific technical compliance standards for repair and decoration of institutional apparel. Understanding these varied customer needs—from the simplicity desired by the home user to the industrial reliability demanded by the professional—is central to effective product line strategy and feature prioritization in the market.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.5 Billion |

| Market Forecast in 2033 | USD 2.4 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Brother, Janome, Singer, Bernina, Husqvarna Viking, PFAFF, Juki, Tajima, Melco, ZSK, Barudan, Feiyue, HappyJapan, SWF, Ricoma, Babylock, Toyota, Consew, Mitsubishi, Yamata |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Sewing and Embroidery Combination Market Key Technology Landscape

The technological landscape of the Sewing and Embroidery Combination Market is rapidly evolving, driven by the convergence of precision mechanical engineering, advanced computer vision, and sophisticated software connectivity. Core technologies center around computerized numerical control (CNC) systems that govern needle movement, thread tension, and frame indexing with micron-level accuracy, ensuring complex designs are executed flawlessly across varied materials. A primary technological focus is on enhancing machine connectivity, with Wi-Fi and cloud integration becoming standard features, enabling direct design transfer from smart devices and remote diagnostics. This shift supports the growing demand for immediate software updates and access to vast, continuously expanding digital design libraries, fundamentally changing how users manage their creative assets and interact with their machines. Furthermore, the integration of specialized microprocessors allows for faster on-board processing, facilitating real-time adjustments necessary for high-speed, intricate embroidery, moving away from reliance on external computers for basic operation.

Another crucial technological area involves advancements in automated material handling and specialized mechanisms that simplify the user experience. Features such as automatic needle threading, computerized thread trimming, and sensor-based tension control systems are becoming mandatory even in mid-range models. Multi-needle technology, once exclusive to large industrial machines, is now common in semi-commercial units, significantly boosting productivity by eliminating manual thread changes for multi-color designs. Furthermore, camera-based positioning systems are emerging, using integrated vision technology to precisely scan the material and automatically align embroidery designs with existing patterns or specific fabric points (e.g., matching a pocket seam or collar edge), drastically improving accuracy and reducing setup time, which is a major pain point for complex projects requiring perfect registration.

The future technology landscape is heavily invested in improving the interface and accessibility of design software. Key software technologies include advanced auto-digitizing algorithms that leverage AI (as previously discussed) to translate images into stitch files more intelligently, and 3D preview rendering, which simulates the final embroidered outcome before the first stitch is placed, helping users anticipate potential issues like puckering or density inconsistencies. Additionally, the development of proprietary file formats and operating systems ensures brand loyalty and compatibility across a manufacturer’s ecosystem of machines and design tools. Security protocols are also gaining prominence to protect licensed digital design content transferred via cloud services, ensuring robust digital rights management (DRM) for both manufacturers and independent designers selling patterns through official channels. This blend of mechanical robustness, intelligent automation, and secure digital integration defines the cutting-edge of the combination machine sector.

Regional Highlights

Regional dynamics play a crucial role in shaping the demand, distribution, and technological adoption patterns within the Sewing and Embroidery Combination Market. North America remains a stronghold for high-value sales, driven by a large, affluent consumer base dedicated to quilting, crafting, and small business customization. The market here is characterized by high demand for premium, feature-rich combination machines that incorporate the latest technology, such as large touchscreens, sophisticated software connectivity, and integrated AI features. The robust presence of specialized retail stores and well-established dealer networks contributes to higher sales conversion rates by providing necessary training and strong after-sales support. Key countries like the United States and Canada dictate global trends in home-based business equipment and high-end consumer electronics adoption, focusing heavily on brand reputation and customer service excellence.

Europe represents a mature market with specific emphasis on quality, durability, and energy efficiency, often influenced by stricter regulatory standards regarding electronic waste and safety. Western European countries, particularly Germany, the UK, and France, exhibit stable demand in both the household segment (driven by traditional textile arts and DIY fashion) and the commercial segment (catering to luxury customization and boutique apparel). The market in Eastern Europe is growing rapidly, benefiting from increasing disposable incomes and the establishment of local textile and apparel manufacturing hubs. European consumers tend to prioritize long-term investment, favoring brands known for mechanical precision and longevity, which translates into strong demand for high-quality, mid-to-high-tier machines.

Asia Pacific (APAC) is projected to be the fastest-growing market globally, propelled by two major factors: the immense population and rising middle-class disposable income, boosting the household segment in countries like India and Southeast Asia; and the region’s dominance in textile manufacturing (China, Vietnam, Bangladesh), driving commercial demand for efficient, multi-head industrial and semi-industrial combination machines. While price sensitivity is higher in many APAC countries, the sheer volume potential offsets lower margins. Furthermore, technological innovation is increasingly emerging from this region, with local manufacturers competing fiercely on features and price. Latin America (LATAM) and the Middle East & Africa (MEA) are emerging markets, where growth is currently concentrated in urban centers, fueled by small entrepreneurial ventures utilizing these machines for localized apparel customization, uniform production, and artistic textile ventures, relying heavily on improving e-commerce logistics for machine access.

- North America: Leading market for premium, technology-integrated machines; strong DIY culture and small business adoption. Key markets: USA, Canada.

- Europe: Mature market focused on durability, energy efficiency, and precision engineering; stable growth across hobbyist and luxury commercial segments. Key markets: Germany, UK, France.

- Asia Pacific (APAC): Fastest-growing region driven by rising middle-class income and massive textile manufacturing industry; high demand for both entry-level household units and industrial multi-head equipment. Key markets: China, India, Vietnam.

- Latin America (LATAM): Emerging market with growing adoption fueled by increasing disposable income and localized customization businesses. Key markets: Brazil, Mexico.

- Middle East & Africa (MEA): Growth concentrated in urban areas; demand supported by small entrepreneurial custom textile services. Key markets: UAE, South Africa.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Sewing and Embroidery Combination Market.- Brother Industries, Ltd.

- Janome Corporation

- Singer (SVP Worldwide)

- BERNINA International AG

- Husqvarna Viking (SVP Worldwide)

- PFAFF (SVP Worldwide)

- JUKI Corporation

- Tajima Industries Ltd.

- Melco International Inc.

- ZSK Stickmaschinen GmbH

- Barudan Co., Ltd.

- Feiyue Group Co., Ltd.

- HappyJapan Inc.

- SWF Embroidery Machine

- Ricoma International Corporation

- Babylock

- Toyota Sewing Machine Co., Ltd.

- Consew

- Mitsubishi Electric Corporation (Industrial Sewing Division)

- Yamata (YAMATA SEWING MACHINE CO., LTD)

Frequently Asked Questions

Analyze common user questions about the Sewing and Embroidery Combination market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected growth rate (CAGR) of the Sewing and Embroidery Combination Market through 2033?

The Sewing and Embroidery Combination Market is expected to exhibit a Compound Annual Growth Rate (CAGR) of 6.8% between the years 2026 and 2033, driven by technological integration and consumer demand for personalization.

How does Artificial Intelligence (AI) specifically influence the efficiency of combination machines?

AI improves efficiency by automating the complex process of design digitization, optimizing stitching parameters based on fabric type, and providing real-time quality control checks to minimize errors and waste during high-speed operation.

Which regional market is currently experiencing the fastest growth in the adoption of these machines?

The Asia Pacific (APAC) region is demonstrating the fastest growth rate, fueled by rising disposable incomes, expansion of the textile manufacturing sector, and increased consumer interest in creative and customized products.

What are the primary factors restraining the widespread adoption of sewing and embroidery combination units?

The main restraints include the significant high initial investment cost required for technologically advanced machines and the steep learning curve associated with mastering complex integrated software and specific embroidery techniques.

What segment of the market provides the most critical post-sale service and training support?

Specialty Retail Stores and authorized dealer networks remain the most critical distribution channel for providing in-depth product demonstrations, personalized technical training, and essential localized post-purchase maintenance and repair services.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager