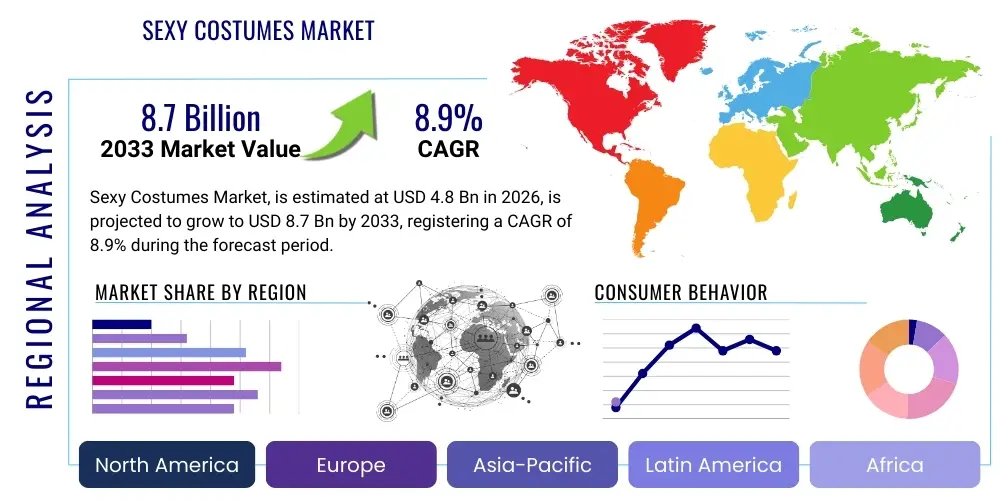

Sexy Costumes Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436891 | Date : Dec, 2025 | Pages : 253 | Region : Global | Publisher : MRU

Sexy Costumes Market Size

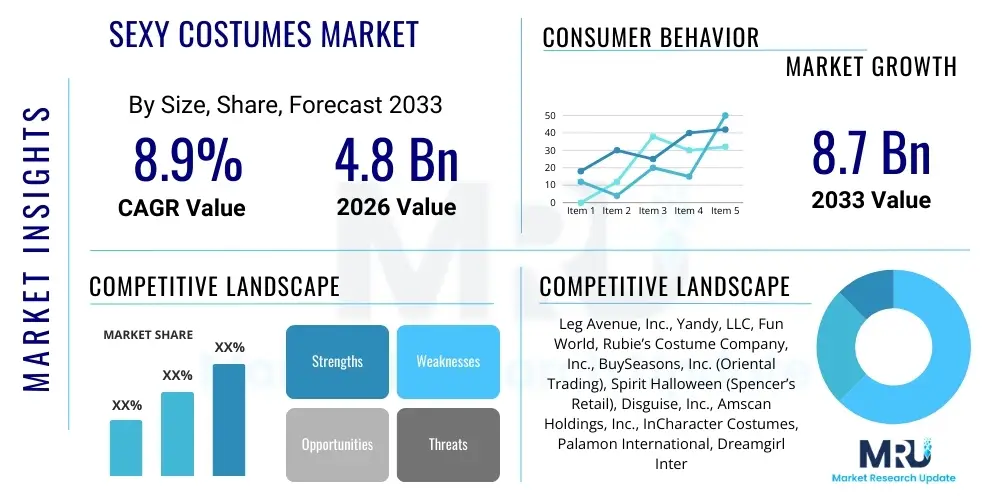

The Sexy Costumes Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.9% between 2026 and 2033. The market is estimated at USD 4.8 Billion in 2026 and is projected to reach USD 8.7 Billion by the end of the forecast period in 2033. This substantial growth is driven primarily by the rising global acceptance of theme parties, festive celebrations beyond traditional holidays, and the exponential expansion of e-commerce platforms which facilitate discrete and convenient purchases. Furthermore, increasing social media influence and the normalization of self-expression through elaborate and thematic attire contribute significantly to market expansion, especially among younger demographics in North America and Europe. The shift towards experiential spending, where consumers prioritize unique events and customized apparel, further solidifies the upward trajectory of the market size over the forecast horizon. Investments in innovative materials and rapid fashion cycle adaptation by leading manufacturers are critical elements supporting this robust valuation increase.

Sexy Costumes Market introduction

The Sexy Costumes Market encompasses the design, manufacturing, distribution, and sale of apparel intended for thematic events, role-playing, intimate occasions, and major holidays such as Halloween, Carnival, and Mardi Gras. This market is characterized by diverse product offerings, ranging from sophisticated, high-end designer pieces utilizing luxurious materials to mass-market, affordable items focusing on trend-driven aesthetics. Key products include character-based outfits, fantasy attire, specialized uniforms, and historically inspired garments, all tailored to emphasize specific aesthetic appeal. The intrinsic nature of these products positions them uniquely at the intersection of fashion, entertainment, and personal expression, making demand highly susceptible to seasonal fluctuations and cultural trends.

Major applications of these costumes extend beyond traditional Halloween celebrations, increasingly permeating niche markets such as cosplay events, adult theme parties, specialized entertainment venues, and bedroom role-playing. The primary benefits driving consumer adoption include the facilitation of self-expression, enhanced emotional connection in intimate relationships, participation in social rituals, and the pursuit of novelty and temporary identity transformation. The market’s dynamism is constantly fueled by pop culture references, streaming media content, and rapid viral trends, demanding agility and rapid design adaptation from manufacturers.

Driving factors propelling this market include the globalization of Western holidays, particularly the commercialization of Halloween outside the U.S.; the continuous growth of specialized e-commerce platforms offering vast, discreet inventories; and the rising disposable income in emerging economies enabling expenditure on novelty and entertainment items. Furthermore, societal shifts towards greater body positivity and acceptance of diverse self-presentation styles lower the barriers to entry for consumers experimenting with expressive attire. The convergence of fashion retail models with costume manufacturing ensures a year-round demand for various thematic garments, moving the market away from purely seasonal reliance.

Sexy Costumes Market Executive Summary

The Sexy Costumes Market is undergoing significant evolution, marked by strong business trends centered on digitization and customization. Retail landscapes are rapidly shifting, with specialized online retailers and direct-to-consumer (D2C) channels claiming increasing market share due to their ability to offer unparalleled inventory depth, competitive pricing, and privacy in transactions. Key industry players are focusing on advanced supply chain management, utilizing predictive analytics to forecast rapidly changing consumer preferences related to specific pop culture phenomena. Sustainability and ethical sourcing are emerging, albeit slowly, as important differentiators, driven by environmentally conscious consumers seeking higher-quality, reusable costume pieces over disposable fast-fashion options. Strategic partnerships between costume manufacturers and entertainment IP holders are crucial for timely product launches corresponding to blockbuster media events, ensuring high revenue streams during peak seasons.

Regionally, North America maintains its dominance due to the deep cultural integration and commercial magnitude of Halloween, coupled with high consumer willingness to spend on elaborate attire. Europe follows, with significant contribution from festive occasions like Carnival and localized themed events, showing robust growth in countries like Germany and the UK. Asia Pacific (APAC) represents the fastest-growing region, fueled by rising disposable incomes, urbanization, and the immense popularity of anime, manga, and gaming culture, driving demand for high-fidelity cosplay and theme-based party wear. The Middle East and Africa (MEA) and Latin America (LATAM) are nascent markets showing potential, largely influenced by global trends and the increasing popularity of Western-style celebrations among younger populations, though cultural constraints sometimes limit penetration.

Segment trends highlight the growing importance of the ‘Plus Size’ category, addressing historical underservice in inclusive sizing and reflecting broader market demands for demographic representation. The ‘Licensed Character’ segment shows consistent performance, benefiting from strong intellectual property protection and recognized brands, while the ‘Fantasy and Role-Play’ category sees accelerated growth, propelled by the expanding BDSM and intimate apparel markets. Distributionally, the rise of specialized online marketplaces (e.g., Etsy, dedicated costume sites) continues to erode the reliance on traditional brick-and-mortar specialty stores, though large seasonal retailers remain critical for last-minute purchases. Material innovation focuses on comfort, durability, and better fabric breathability, shifting production towards sustainable and high-end synthetic blends.

AI Impact Analysis on Sexy Costumes Market

Common user questions regarding AI's influence in the Sexy Costumes Market typically revolve around personalized recommendations, design innovation, and supply chain efficiency. Users frequently ask how AI can generate novel costume concepts that predict viral trends, ensuring designs are launched before maximum demand peaks. A core concern is whether AI-driven sizing and fitting tools, such as virtual try-on features and body scanning applications, can reduce the high return rates associated with online costume purchases, which often involve non-standard sizing. Furthermore, stakeholders inquire about AI's role in optimizing inventory management—determining precise quantities of specific costume components (e.g., wigs, accessories, specific fabric colors) needed for rapid, seasonal manufacturing runs. The consensus suggests high expectation for AI to transform the market from a reactive, trend-following industry to a proactive, trend-setting environment focused on hyper-personalization and streamlined logistics.

- AI-driven Trend Forecasting: Utilizing machine learning algorithms to analyze social media engagement, streaming content popularity, and search queries to predict the next viral costume concepts, enabling rapid prototyping and market deployment.

- Hyper-Personalization in Retail: Implementing AI recommendation engines that suggest costume pieces, sizes, and styling accessories based on individual browsing history, previous purchases, body type data, and expressed interests, thereby enhancing customer experience and conversion rates.

- Virtual Try-On (VTO) Technology: Deployment of augmented reality (AR) and AI-enhanced visualization tools allowing customers to virtually try on costumes before purchase, drastically reducing product return rates stemming from fit issues.

- Optimized Supply Chain and Inventory: Using AI for precise inventory management, predicting material needs based on segmented sales forecasts, and optimizing logistics routes for swift, time-critical seasonal delivery.

- Automated Design Prototyping: Employing Generative AI tools to create initial design sketches and 3D models of accessories, accelerating the design cycle from concept to final sample, particularly beneficial in fast-fashion segments.

- Enhanced Customer Service: Utilizing AI-powered chatbots for instant, 24/7 customer support regarding sizing charts, material composition, and return policies, especially crucial during high-traffic holiday periods.

- Intellectual Property Monitoring: AI algorithms monitoring global e-commerce sites to detect and report counterfeit or unauthorized reproductions of licensed character costumes, protecting brand value and revenue streams for official manufacturers.

DRO & Impact Forces Of Sexy Costumes Market

The Sexy Costumes Market is driven by strong cultural and commercial forces, but simultaneously constrained by societal norms and logistical challenges, presenting varied opportunities for expansion. Key drivers include the overwhelming commercialization and increasing secularization of traditional holidays like Halloween globally, making costume expenditure a normalized annual event. Furthermore, the pervasive influence of social media platforms (e.g., TikTok, Instagram) encourages users to showcase elaborate, attention-grabbing thematic attire, thereby amplifying demand and competitive consumption. Opportunities are abundant in penetrating high-growth emerging economies with younger populations, developing year-round usage concepts such as themed corporate events and specialized festivals, and leveraging technological integration like AR/VR for enhanced online shopping experiences. The combined weight of these factors—cultural celebration, digital promotion, and consumer willingness to invest in experiences—creates a robust positive impact force on market valuation, sustaining high growth rates despite economic volatility.

However, significant restraints temper this growth trajectory. These include high seasonality, which necessitates manufacturers managing severe peak production cycles followed by long troughs, leading to inefficient resource utilization and high inventory risk. Societal and cultural sensitivities, particularly in conservative regions, impose significant market penetration limitations, restricting both product scope and promotional activities. Furthermore, the market suffers from high intellectual property infringement rates, where cheap, low-quality counterfeit costumes erode the profitability of legitimate manufacturers, demanding constant legal vigilance and resource allocation to combat piracy. Logistical restraints, such as high shipping costs for bulky items and complex international customs regulations for apparel, also pose consistent operational challenges.

The strategic opportunities available are compelling and often involve technological leverage. The development of high-quality, sustainable, and ethically produced 'investment' costumes targets an upscale demographic tired of disposable fast fashion, opening premium pricing segments. Expanding the product scope to include specialized accessories, makeup kits, and high-fidelity props allows companies to capture a larger share of the total expenditure per event. Crucially, optimizing the e-commerce experience through personalized fitting technology and secure, discreet packaging caters directly to consumer demand for convenience and privacy, providing a competitive edge. The ability to navigate these dynamics—capitalizing on digital demand while mitigating seasonal risks and counterfeit pressures—determines successful market performance and sustained profitability.

Segmentation Analysis

The Sexy Costumes Market is segmented based on numerous critical factors, primarily categorized by Product Type, End-User, Distribution Channel, and Material Type. Analyzing these segments provides a nuanced understanding of consumer behavior and growth pockets within the overall market structure. The Product Type segmentation reveals consumer preferences for licensed versus original designs, with licensed characters often driving massive revenue spikes following major media releases. End-user segmentation, distinguishing between adults and adolescents, highlights the specific design requirements and quality expectations for each demographic, with the adult segment typically demanding higher quality fabrics and detailing.

Distribution Channel analysis is crucial, showing the rapid dominance of online platforms over traditional retail outlets. E-commerce platforms excel in offering vast selections, discreet shipping, and comparative pricing, appealing strongly to the target demographic. Conversely, specialty retail stores maintain importance for immediate, in-person purchases and for accessing specialized, high-end costume components or requiring personalized fitting advice. Material type segmentation, covering synthetic materials (polyester, nylon) and natural fibers, impacts both pricing tiers and sustainability credentials, influencing procurement decisions for mass-market versus premium product lines. This comprehensive segmentation framework allows manufacturers to tailor marketing strategies, optimize inventory placement, and allocate design resources effectively across the diverse market landscape.

- By Product Type:

- Licensed Characters

- Fantasy and Role-Play (e.g., Mythical creatures, historical figures)

- Uniforms and Occupations (e.g., Medical, tactical)

- Pop Culture and Media Inspired

- Generic Themed Costumes

- By End-User:

- Adults (18-35 Age Group)

- Adults (36+ Age Group)

- Adolescents (13-17 Age Group)

- By Distribution Channel:

- E-commerce Platforms (Specialized Online Retailers, Marketplaces)

- Specialty and Seasonal Retail Stores (Pop-up shops, dedicated costume stores)

- Departmental Stores and Mass Merchandisers

- Direct-to-Consumer (D2C) Websites

- By Material Type:

- Synthetic Fabrics (Polyester, Acrylic, Nylon)

- Natural and Blended Fabrics (Cotton, Silk blends)

- Specialty Materials (Latex, Vinyl, Faux Leather)

Value Chain Analysis For Sexy Costumes Market

The value chain for the Sexy Costumes Market is intensive and highly globalized, starting with the upstream sourcing of raw materials, primarily synthetic fabrics like polyester and specialized trims, often sourced from textile hubs in Asia Pacific countries. Upstream analysis involves assessing the procurement stability of specialized inputs, including zippers, dyes, glitter, and intricate components like molded plastic or lightweight metals for props. Manufacturers heavily rely on efficient raw material supply contracts to manage costs, which fluctuate based on global petrochemical prices (for synthetics) and seasonal demand spikes. The design phase, which leverages cultural trends and intellectual property licenses, is a critical value-added step, translating market insight into viable, marketable apparel designs.

The transformation phase, involving manufacturing and assembly, is characterized by low-cost labor utilization, often concentrated in Southeast Asia, China, and parts of Latin America, focused on rapid production to meet seasonal deadlines. Midstream activities involve stringent quality control checks, ensuring designs comply with aesthetic expectations and regulatory standards (e.g., flammability regulations). Distribution is the most complex segment, particularly given the seasonal nature of the product. Companies must select between specialized logistics providers capable of handling large volumes quickly during peak season or utilizing their own D2C fulfillment centers. The distribution channel choice—direct online sale, wholesale to specialty retailers, or consignment to mass merchants—significantly influences the final consumer price and overall margin.

Downstream analysis focuses on the final sales points and consumer engagement. Direct sales channels (D2C websites and specialty online retailers) offer higher margins and greater control over branding and customer data, allowing for precise marketing campaigns. Indirect channels, such as third-party marketplaces (e.g., Amazon, eBay), provide unparalleled reach but dilute brand identity and increase competition based solely on price. The success of the downstream operation hinges on effective marketing, utilizing highly visual digital platforms, and ensuring seamless last-mile delivery. The post-purchase value includes customer feedback mechanisms, crucial for informing future design cycles, and managing the reverse logistics of returns, which are inherently high in this market due to sizing complexities and temporary usage patterns.

Sexy Costumes Market Potential Customers

Potential customers for the Sexy Costumes Market are predominantly defined by demographic factors such as age, disposable income, and psychographic characteristics including willingness to engage in expressive consumption and participation in themed social events. The primary end-user segment is young to middle-aged adults (18–45) residing in North America and Western Europe, who possess significant discretionary income and are major participants in seasonal celebrations like Halloween and New Year's Eve parties. This group values novelty, high visual impact for social media sharing, and convenience in purchasing, favoring online channels for rapid, discreet access to a wide variety of themed apparel. They are often early adopters of pop culture trends and are motivated by social validation and experiential consumption rather than necessity.

A rapidly growing customer segment comprises individuals involved in niche communities such as cosplay, comic conventions, and fan culture. These buyers exhibit extremely high demands for costume fidelity, material quality, and detail accuracy, often investing substantial amounts in high-end, custom-made or premium licensed outfits. While representing a smaller volume than the mass-market Halloween segment, this group offers higher average transaction values and contributes to year-round demand, mitigating some of the market’s inherent seasonality. Manufacturers targeting this segment focus on high craftsmanship, specialized accessories, and direct engagement with community influencers.

Another significant, often underestimated, customer base includes buyers utilizing these costumes for intimate occasions and adult role-playing. This segment highly prioritizes privacy, discreet packaging, and durable, comfortable materials suitable for specialized use. Marketing efforts targeting this group emphasize quality, thematic diversity, and confidentiality, driving substantial sales through dedicated intimate apparel e-commerce sites. Finally, commercial buyers, such as event organizers, theater groups, and specialized entertainment venues (e.g., resorts, cruise lines), represent institutional customers requiring bulk orders of durable, high-quality, professional-grade costumes for performance and staffing purposes, often demanding customized design solutions.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.8 Billion |

| Market Forecast in 2033 | USD 8.7 Billion |

| Growth Rate | 8.9% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Leg Avenue, Inc., Yandy, LLC, Fun World, Rubie’s Costume Company, Inc., BuySeasons, Inc. (Oriental Trading), Spirit Halloween (Spencer’s Retail), Disguise, Inc., Amscan Holdings, Inc., InCharacter Costumes, Palamon International, Dreamgirl International, Roma Costume, Forplay Catalog, Elope Inc., Escante, Inc., Coquette International Inc., Smiffy's, and Ann Summers. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Sexy Costumes Market Key Technology Landscape

The technological landscape driving the Sexy Costumes Market is fundamentally rooted in e-commerce optimization, personalization, and supply chain digitization, moving beyond simple retail transactional platforms. Key advancements center on enhancing the virtual shopping experience to overcome the physical limitations of trying on costumes. Augmented Reality (AR) try-on applications are becoming crucial, allowing users to overlay costume components onto their live camera feeds, providing a dynamic sense of fit and appearance without needing physical inventory. Furthermore, advanced AI-driven recommendation engines analyze style preferences, social media data, and body measurements uploaded by the user to suggest highly tailored products, significantly reducing the browsing time and improving conversion rates, especially during high-traffic seasonal periods. The effective deployment of high-resolution product photography and 3D modeling further supports customer confidence in online purchases, mitigating perceived risks related to quality inconsistency and poor fit.

In manufacturing and logistics, technologies focus on accelerating the production cycle and enhancing responsiveness to transient trends. 3D printing technology is increasingly used for intricate and specialized costume accessories and props, allowing for rapid, customized prototyping and small-batch production that traditional molding techniques cannot match. On the backend, advanced Enterprise Resource Planning (ERP) systems integrated with predictive analytics software allow companies to manage highly volatile inventory demands, accurately forecasting material needs and optimizing production schedules to minimize waste and storage costs during off-peak seasons. Furthermore, the use of blockchain technology is being explored by larger entities to ensure transparency and ethical sourcing of materials, providing verifiable claims regarding labor standards and environmental impact, appealing to the growing demographic of conscious consumers.

Digital marketing and consumer engagement are also heavily reliant on technology. Influencer marketing platforms utilize big data analytics to identify key social media personalities whose aesthetic aligns with specific costume categories, ensuring maximum reach and authenticity. Furthermore, interactive digital tools, such as quizzes and personalized mood board generators, guide customers through the extensive product catalogs, transforming the buying process from a search function into an engaging, personalized journey. Cybersecurity remains paramount, especially for platforms handling sensitive personal and financial data related to intimate apparel or discreet purchases, requiring robust encryption and data protection protocols to maintain consumer trust and comply with global privacy regulations (e.g., GDPR, CCPA).

Regional Highlights

- North America: Dominant Market Share and Innovation Hub

North America, particularly the United States, holds the largest market share in the Sexy Costumes Market, largely driven by the monumental scale and commercialization of Halloween. Annual consumer spending on costumes, decorations, and related party items is exceptionally high, making the last quarter of the year critical for regional manufacturers and retailers. The region acts as an innovation hub for marketing, utilizing celebrity endorsements and social media trends to dictate global fashion cycles for themed apparel. Demand is characterized by a strong preference for licensed products, high-quality materials, and early adoption of e-commerce and AR fitting technologies. However, the market is intensely competitive, forcing players to differentiate through faster shipping, broader size inclusivity (e.g., plus-size lines), and unique design aesthetics. The robust retail infrastructure and high disposable income ensure that the region will maintain its leadership position throughout the forecast period, driving trend development and setting pricing benchmarks for the global industry.

- Europe: Cultural Diversity and Festival Demand

The European market demonstrates stable growth, primarily anchored by regional festivals like Carnival (in Germany, Italy, and Spain) and localized cultural events, providing a more dispersed revenue stream compared to the concentrated seasonal focus of North America. The market is highly fragmented, reflecting varied national tastes and regulatory standards, particularly concerning textile safety and flammability. Western European countries, including the UK, Germany, and France, are major consumers, valuing both novelty and material quality. There is a discernible trend toward premium and customized costumes, reflecting a cultural emphasis on sustainability and reusability over disposable fashion. E-commerce penetration is strong, facilitated by reliable postal systems and high digital literacy, but physical specialty costume stores remain relevant in major urban centers, especially for high-end or bespoke items required for specific regional traditions. Central and Eastern Europe are rapidly expanding segments, influenced by increased exposure to global pop culture and rising consumer spending on leisure activities.

- Asia Pacific (APAC): Fastest Growing Region Driven by Cosplay and Youth Culture

The APAC region is projected to register the highest Compound Annual Growth Rate (CAGR) during the forecast period. This accelerated growth is primarily attributed to the massive influence of local entertainment industries, including anime, manga, and video games, which fuel an expansive and highly dedicated cosplay culture. Countries like Japan, South Korea, and China are both major producers and consumers of specialized, high-fidelity costume apparel. Increasing urbanization and the rising disposable income of the youth population in emerging markets like India and Southeast Asia are normalizing the celebration of Western-style holidays and thematic parties, opening vast new consumer bases. The distribution channel in APAC is heavily reliant on localized e-commerce platforms (e.g., Taobao, Rakuten), often supported by complex, personalized logistics networks catering to specific community needs. Investment in supply chain optimization is crucial here, as APAC is simultaneously a dominant manufacturing base and a rapidly expanding consumer market, necessitating efficient internal distribution.

- Latin America (LATAM): Emerging Opportunities and Festival Integration

The LATAM market is characterized by emerging opportunities, driven largely by traditional, large-scale public festivals like Carnival in Brazil and other localized celebrations that require elaborate, often customized attire. While volume consumption remains lower than in North America, there is strong growth potential as regional economies stabilize and connectivity improves. Brazil and Mexico are the primary revenue generators, demonstrating a rising appetite for internationally sourced costume designs alongside strong local manufacturing capabilities. E-commerce adoption is increasing, yet local specialty stores and informal markets play a significant role in distribution. Challenges include complex import tariffs and currency volatility, which impact the pricing of international products, driving demand for locally manufactured, cost-effective alternatives.

- Middle East and Africa (MEA): Niche Penetration and Cultural Sensitivity

The MEA market is the most restrictive due to pronounced cultural and religious sensitivities regarding self-expression and apparel. However, niche markets exist within expatriate communities, private functions, and in increasingly liberalized urban centers. Growth is slow but steady, focusing mainly on high-end, discreet purchases facilitated through specialized online platforms offering private delivery options. The demand here tends to be focused on high-quality, luxury role-play costumes and generalized theme party wear, often sourced from European or US manufacturers. Success in MEA requires meticulous marketing, careful adherence to local customs, and robust privacy policies to address consumer concerns regarding discretion.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Sexy Costumes Market.- Leg Avenue, Inc.

- Yandy, LLC

- Fun World

- Rubie’s Costume Company, Inc.

- BuySeasons, Inc. (Oriental Trading)

- Spirit Halloween (Spencer’s Retail)

- Disguise, Inc. (A subsidiary of JAKKS Pacific)

- Amscan Holdings, Inc. (Part of Party City Holdco Inc.)

- InCharacter Costumes

- Palamon International

- Dreamgirl International

- Roma Costume

- Forplay Catalog

- Elope Inc.

- Escante, Inc.

- Coquette International Inc.

- Smiffy's

- Ann Summers

- California Costume Collections

- Fever (Part of Leg Avenue EU)

Frequently Asked Questions

Analyze common user questions about the Sexy Costumes market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary growth driver for the Sexy Costumes Market?

The primary growth driver is the expansion and commercialization of global themed events, particularly the massive increase in spending and participation during Halloween in North America, coupled with the rising influence of digital media platforms encouraging expressive consumption and trend adoption.

How is e-commerce influencing the distribution of sexy costumes?

E-commerce is dominating the distribution channel by offering consumers unparalleled inventory selection, competitive pricing, and crucial discretion through private shipping options, effectively shifting purchases away from traditional brick-and-mortar seasonal retailers.

Which regional market shows the highest growth potential?

The Asia Pacific (APAC) region is forecasted to exhibit the highest Compound Annual Growth Rate (CAGR), driven by the flourishing cosplay culture, increased youth disposable income, and the rapid adoption of international entertainment trends across countries like South Korea, China, and Japan.

What technological advancements are impacting costume fit and sizing?

Technological advancements, including Augmented Reality (AR) virtual try-on features and AI-powered personalized sizing recommendations, are critical for improving customer satisfaction and significantly reducing the high return rates historically associated with online costume purchases due to inconsistent fit.

What is the most significant restraint facing costume manufacturers?

The most significant restraint is the extreme seasonality of demand, which complicates production planning and inventory management, leading to high operational costs during peak periods and requiring sophisticated predictive analytics to mitigate overstocking risks during off-seasons.

The comprehensive market analysis confirms the robust expansion of the Sexy Costumes sector, driven by digital commerce and cultural shifts favoring experiential consumption. Manufacturers must continually innovate designs, leverage AI for trend forecasting, and address sustainability concerns to maintain competitive advantage. The market trajectory indicates a significant move towards quality, personalization, and year-round relevance, particularly supported by niche segments like cosplay and intimate apparel. Strategic focus on efficient, globalized supply chains and effective use of visual marketing technologies will be paramount for securing market leadership through 2033. The convergence of fashion and entertainment ensures that this market remains vibrant, requiring constant adaptation to transient pop culture demands.

Further analysis of the competitive landscape suggests that market dominance is increasingly tied to intellectual property acquisition and robust licensing agreements. Companies that successfully secure rights to popular media franchises gain significant temporary advantages, often resulting in peak seasonal revenue surges that are difficult for generic costume producers to match. This focus on IP has intensified merger and acquisition activity, as larger entities seek to consolidate licensing portfolios and gain control over specialized manufacturing capabilities. The barrier to entry for small, independent designers remains relatively low on platforms like Etsy, fostering innovation, but scaling requires substantial capital investment in large-scale production facilities, quality control, and sophisticated international distribution networks capable of handling rapid fulfillment cycles.

Sustainability, while currently a secondary concern, is poised to become a major market influencer, especially in affluent Western markets. Consumers are increasingly critical of the ‘fast fashion’ model inherent in cheap, disposable Halloween costumes. This shift presents a strategic opportunity for manufacturers to launch premium lines marketed on the basis of durability, ethical material sourcing, and fair labor practices. Such high-quality, reusable costumes appeal to environmentally conscious buyers and those seeking investment pieces for recurring events or high-end theatrical purposes. Over the forecast period, expect regulatory bodies, particularly in Europe, to impose stricter environmental standards on textile waste and chemical usage, further accelerating the transition toward more sustainable production methods within the costume industry.

The adult role-play segment, often discreetly categorized within this market, demonstrates consistent, non-seasonal growth. This segment values comfort, sensual fabric feel, and high durability for repeated use. E-commerce platforms specializing in intimate apparel are key distribution channels, emphasizing privacy and descriptive product content over visual spectacle. Technological improvements in textiles, such as antimicrobial and moisture-wicking properties, are being incorporated into specialized costume lines to enhance comfort and longevity. As societal attitudes toward intimate expression continue to liberalize globally, this sub-segment is expected to provide stable, recession-resistant revenue streams that help balance the volatility inherent in the highly seasonal, large-scale event segments of the market.

Finally, the challenge of sizing standardization continues to plague the market, directly contributing to high return rates and customer frustration. Unlike standard apparel retail, costume sizing often lacks consistent global standards, relying on vague "one-size-fits-most" or proprietary size charts. The proliferation of AI and 3D body scanning technologies is seen as the definitive solution. By integrating consumer-uploaded body metrics with AI-predicted fit models, retailers can dramatically improve sizing accuracy, thereby enhancing the overall customer experience, reducing logistical costs associated with returns, and boosting profitability. Companies investing heavily in developing and deploying these fit technologies are positioned to gain a decisive competitive advantage in the digital marketplace over the next five to seven years.

The ongoing geopolitical and macroeconomic volatility presents a nuanced challenge. While consumers might reduce spending on luxury goods during economic downturns, expenditure on experiential items and low-cost entertainment, such as costumes for social gatherings, often remains resilient or even increases as a form of affordable escapism. However, manufacturers face cost pressures from fluctuating raw material prices (especially petrochemicals for synthetics) and increased global shipping costs. Hedging against currency risks and securing diversified manufacturing bases outside of traditional hubs are becoming essential strategies for maintaining cost competitiveness and supply chain reliability. The ability of manufacturers to absorb or efficiently pass along these rising operational costs will directly influence consumer pricing and market accessibility across different income brackets, particularly in price-sensitive emerging markets.

Furthermore, the segmentation analysis based on material type is becoming increasingly relevant for consumer targeting. The synthetic fabrics segment, primarily polyester, dominates due to its low cost, versatility, and ease of mass production, catering to the transient, fast-fashion demand characteristic of Halloween. However, the premium segment relies on specialized blends, high-end vinyl, or natural fibers to create a distinctive feel and superior drape, justifying higher price points. Innovation in sustainable synthetics—recycled polyester (rPET) derived from plastic bottles—is a growing trend, offering manufacturers a pathway to satisfy environmental demands without drastically escalating costs. Successful market players are expected to maintain a bifurcated strategy: optimizing synthetic mass production for volume and developing premium, ethically-sourced lines for margin capture and brand reputation enhancement.

The competitive strategy among key players is highly focused on speed-to-market and IP protection. The concept-to-shelf cycle for a trendy costume can be as short as six weeks, requiring highly adaptable design and manufacturing processes. Companies like Rubie’s and Leg Avenue leverage deep distribution networks and established relationships with mass retailers to ensure maximum shelf space during the critical autumn sales window. Simultaneously, they invest heavily in legal defense against widespread copyright infringement, which poses an annual threat to the profitability of licensed products. The transition to digital-first operations means that marketing spend is heavily skewed towards dynamic online advertising, influencer campaigns, and search engine optimization (SEO/AEO) to ensure their products appear prominently in rapidly evolving search queries related to viral costume concepts.

In terms of distribution channel evolution, the role of seasonal pop-up stores, exemplified by Spirit Halloween, remains crucial, offering a high-touch, immersive retail experience that generates excitement and caters to last-minute impulse purchases. While online sales drive convenience, the physical store environment effectively serves as an experiential marketing touchpoint, particularly for families and group shoppers. Integrating the online and physical experience—offering click-and-collect services or in-store returns for online orders—is a growing omni-channel strategy adopted by leading retailers to maximize convenience and capture sales across all consumer touchpoints. The operational complexity of managing these temporary, high-volume seasonal stores represents a unique logistical challenge and opportunity within the downstream value chain.

Looking ahead, the market is ripe for further consolidation, particularly as technology integration becomes more capital-intensive. Smaller, technology-agnostic costume companies may struggle to compete with the personalization and logistical efficiencies offered by larger, digitally integrated market leaders. Acquisition targets often include niche accessory manufacturers, specialized fabric suppliers, or technology startups focused on virtual sizing or trend forecasting. This continuous strategic M&A activity is aimed at creating vertically integrated companies capable of controlling the entire value chain, from raw material sourcing and proprietary design creation to optimized direct-to-consumer fulfillment, ensuring robust margin protection and minimizing reliance on volatile third-party suppliers.

The utilization of data analytics extends beyond trend prediction into predictive customer lifetime value (CLV) models. By analyzing purchasing patterns, repeat usage, and accessory expenditures, companies can segment their customer base to target high-value buyers year-round, rather than focusing solely on the seasonal transactional buyer. This shift towards fostering loyal, year-round engagement through specialized niche products (e.g., themed lingerie, props, specialty event wear) mitigates the risk of single-season revenue dependency. Effective communication strategies, often implemented via targeted email marketing and social media engagement, focus on educating the consumer about the quality, reusability, and potential versatility of the costume purchase, promoting a longer product lifecycle and encouraging repeat investment.

Furthermore, the diversification of end-user categories is driving innovation in product design. The growing number of corporate themed parties, team-building events, and specialized adult conventions necessitates costumes that are professional-grade, comfortable for long wear periods, and often require bulk customizations. Catering to this B2B segment demands specialized sales teams and manufacturing flexibility to accommodate large, often complex orders outside the standard retail cycle. This represents a significant, low-volatility revenue stream that major players are actively developing through corporate outreach programs and dedicated institutional sales divisions. The distinction between consumer-grade and professional-grade costumes is blurring, creating a demand for 'premium mass-market' products that offer enhanced durability and visual quality without the bespoke price tag.

The influence of global media streaming services cannot be overstated. Unlike traditional film or television, streaming platforms generate content with global simultaneous release, creating immediate, unified global demand for character-specific costumes. This instantaneous global trend-setting capability puts immense pressure on manufacturers to react instantly, sometimes requiring production to begin based on early leaks or promotional materials, posing both a massive logistical challenge and a high-reward opportunity. This phenomenon necessitates a flexible 'on-demand' manufacturing model supported by cloud-based inventory visibility across global warehouses to fulfill rapid international orders efficiently, mitigating the risk of obsolescence often associated with rapid content cycles.

In summary, the Sexy Costumes Market operates under high-stakes, rapid-cycle dynamics. Success is defined by an ability to master complex global logistics, leverage AI for hyper-personalization, manage significant seasonal fluctuations, and navigate the intricate landscape of intellectual property rights. The market is increasingly sophisticated, moving away from simple apparel sales toward offering integrated entertainment and experiential products, cementing its position as a dynamic, high-growth sector within the broader specialty retail industry through the forecast period.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager