Shallow and Deepwater Landing String Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436088 | Date : Dec, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Shallow and Deepwater Landing String Market Size

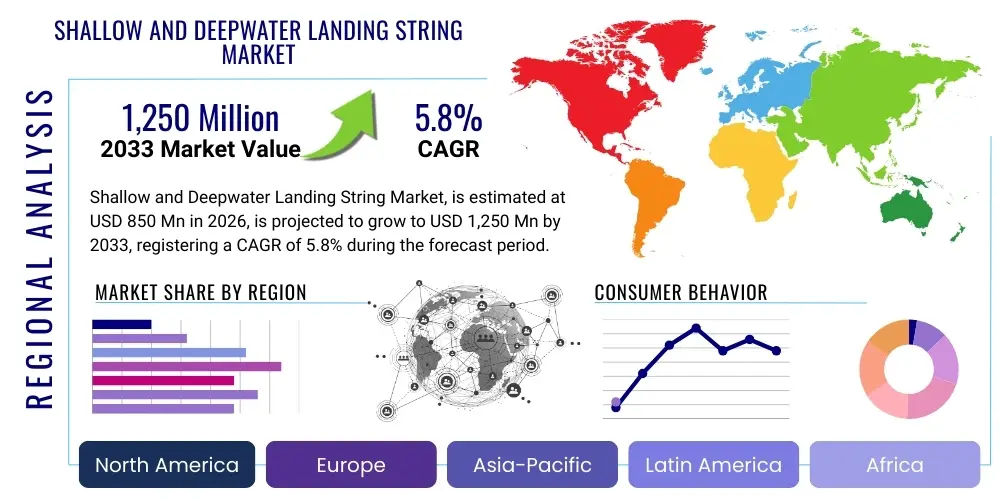

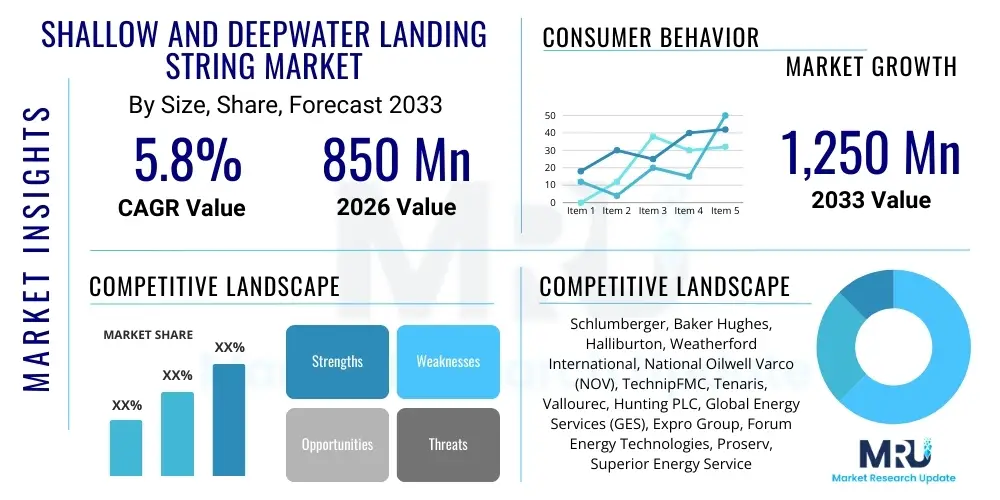

The Shallow and Deepwater Landing String Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at $850 Million USD in 2026 and is projected to reach $1,250 Million USD by the end of the forecast period in 2033.

Shallow and Deepwater Landing String Market introduction

The Shallow and Deepwater Landing String Market encompasses the specialized tubulars and high-pressure valve assemblies utilized primarily in offshore oil and gas operations to safely run, land, and set downhole completion or testing equipment. Landing strings are critical safety barriers, especially in deepwater environments where high pressure and extreme temperatures necessitate robust and reliable components for well control during sensitive operations like installing subsea trees or running production tubing. This specialized equipment ensures the integrity of the wellbore and provides a reliable means of communication and circulation to the downhole equipment, significantly mitigating operational risks associated with deep-sea drilling and completion.

Landing strings are defined by their integration of advanced components such as subsea test trees (SSTT), retainer valves, and disconnect tools, which are essential for emergency well isolation and safe disconnection from the wellhead in harsh offshore conditions. Major applications include horizontal and vertical deepwater well completions, reservoir testing, and subsea intervention activities. The inherent benefits of utilizing standardized, high-specification landing strings include enhanced safety protocols, reduced non-productive time (NPT) due to equipment failure, and optimized wellbore productivity through precise placement of completion tools. The market growth is fundamentally driven by the resurgence in deepwater exploration and production investments, particularly in challenging basins like the Gulf of Mexico, offshore Brazil, and West Africa, where conventional methods are insufficient to manage extreme hydrostatic pressures and formation loads.

Furthermore, stringent regulatory requirements governing offshore safety, particularly after major incidents, are compelling operators to adopt the latest generation of landing string technology featuring enhanced shear capabilities and redundant safety mechanisms. The ongoing focus on extending the productive life of existing deepwater assets also drives demand for specialized landing strings optimized for workover and intervention operations. The increasing complexity of well designs, incorporating multilateral and high-angle profiles, demands landing string systems that can handle increased torque, drag, and abrasive conditions, pushing manufacturers toward innovation in material science and joint technology, thereby fueling the sustained expansion of this niche but critical energy segment.

Shallow and Deepwater Landing String Market Executive Summary

The Shallow and Deepwater Landing String Market is poised for stable growth, fueled primarily by renewed capital expenditure in offshore exploration and production, driven by stabilized global oil prices and the pursuit of complex, high-yield deepwater reserves. Current business trends indicate a strong emphasis on standardization of subsea equipment interfaces and the integration of smart landing string technologies featuring real-time monitoring capabilities to enhance operational safety and efficiency. Companies are increasingly focused on leasing and service models rather than outright sales, allowing operators greater flexibility and access to the latest equipment revisions without massive upfront investment. Technological advancement centers around developing lighter, stronger materials capable of withstanding ultra-high pressures and hydrogen sulfide (H2S) environments typical of deepwater reservoirs, ensuring extended operational longevity and superior structural integrity under dynamic loads during deployment and retrieval.

Regionally, the market is heavily dominated by established deepwater hubs such as North America, particularly the U.S. Gulf of Mexico, and Latin America, driven by massive pre-salt projects in Brazil, which require ultra-deepwater capabilities and highly resilient landing string components. Asia Pacific is emerging as a critical growth region, spurred by aggressive offshore development initiatives in Malaysia, Indonesia, and Australia, although their activity is generally focused on deepwater rather than ultra-deepwater fields compared to the Atlantic basin. European activity, centered mainly around the North Sea, focuses primarily on maintenance, integrity management, and workover operations utilizing landing strings, reflecting a shift from pure exploration to asset optimization in mature fields, demanding specialized, smaller-diameter systems for interventions.

In terms of segmentation, the Deepwater and Ultra-Deepwater segment continues to exhibit the highest growth rate due to the increasing average depth of new discoveries, necessitating highly specialized equipment rated for pressures exceeding 15,000 psi. Component trends favor integrated safety valve assemblies and rapid-disconnect systems, which are viewed as non-negotiable safety elements. End-user demand remains highest among international oil companies (IOCs) and national oil companies (NOCs) that operate major deepwater assets, although specialized drilling contractors and oilfield service providers are gaining market share by offering packaged, integrated landing string services. This convergence of stringent safety regulations, sustained offshore investment, and technological necessity defines the current market landscape and dictates future growth trajectories.

AI Impact Analysis on Shallow and Deepwater Landing String Market

User queries regarding the impact of Artificial Intelligence (AI) on the Shallow and Deepwater Landing String Market frequently revolve around three core themes: predictive maintenance, optimization of deployment procedures, and enhancement of subsea safety protocols. Users are primarily concerned with how AI can minimize expensive operational downtime associated with equipment failure in high-risk deepwater environments. Key expectations center on leveraging machine learning (ML) algorithms to analyze massive datasets—including pressure logs, temperature profiles, vibration metrics, and historical failure rates—collected during landing string deployment. The goal is to move beyond reactive maintenance towards proactive replacement schedules, thus extending tool life and guaranteeing well integrity during critical operations.

A second major theme in user questions addresses the use of AI for real-time decision support during landing string operations. Deploying long, heavy landing strings in deep water involves complex physics, influenced by ocean currents, vessel heave, and wellbore geometry, making optimization challenging for human operators alone. Users anticipate AI-driven systems providing optimized running speeds, recommended torque settings, and dynamic load balancing adjustments in real-time. This application of AI aims to reduce the risk of stuck pipe situations or damage to sensitive downhole equipment, improving the efficiency of installation, which can often take several days in ultra-deepwater settings. Furthermore, AI is expected to standardize complex operational procedures, ensuring compliance with strict safety standards regardless of the experience level of the crew executing the operation.

The third area of interest focuses on AI’s role in material science and design optimization of landing string components. Machine learning models can simulate millions of operational scenarios and stress tests to identify optimal material compositions and geometric designs for high-pressure, high-temperature (HPHT) environments, accelerating the development cycle for next-generation equipment. While AI will not replace the physical landing string components, it will fundamentally change how they are designed, monitored, and utilized, transitioning the industry towards Condition-Based Monitoring (CBM) services. This integration promises a significant improvement in Mean Time Between Failures (MTBF) for critical landing string assemblies like the Subsea Test Tree (SSTT), which are vital for emergency disconnection and well isolation.

- AI-driven Predictive Maintenance: Utilizing sensor data (vibration, pressure, strain) to forecast potential component failure in landing strings, reducing non-productive time (NPT) and maintenance costs.

- Real-time Operational Optimization: Machine learning algorithms analyze dynamic environmental and wellbore conditions to recommend optimal running speeds and procedures for safer and faster deployment.

- Enhanced Well Control Simulation: AI models simulate complex well events and failure scenarios, improving the design and operational protocols for high-integrity pressure protection systems (HIPPS) within landing strings.

- Automated Data Interpretation: AI streamlines the analysis of downhole data transmitted via landing string components, enabling faster decision-making during critical completion or testing phases.

- Material Stress Analysis: ML optimizes material selection and component geometry to enhance the fatigue resistance and pressure rating of landing string tubulars for ultra-deepwater applications.

DRO & Impact Forces Of Shallow and Deepwater Landing String Market

The dynamics of the Shallow and Deepwater Landing String Market are shaped by a complex interplay of driving forces (D), critical restraints (R), compelling opportunities (O), and overarching impact forces. The primary driver is the sustained global demand for hydrocarbon resources, which necessitates the exploitation of increasingly difficult and high-yield offshore reserves, particularly those found in deep and ultra-deep waters. This exploration surge mandates the use of highly reliable and sophisticated landing string systems capable of managing extreme pressures and hazardous environments. Furthermore, continuous governmental and industry pressure to enhance offshore safety standards, evidenced by stringent regulations like those enforced by the Bureau of Ocean Energy Management (BOEM) and similar international bodies, requires mandatory adoption of advanced safety components, directly boosting demand for high-specification landing string assemblies featuring advanced shear rams and redundant sealing elements. This regulatory push elevates the quality requirement across the entire supply chain.

However, the market faces significant restraints. The exceptionally high capital expenditure (CAPEX) required for deepwater projects creates volatility, making them highly susceptible to short-term fluctuations in global crude oil prices; any significant downturn often leads to the immediate cancellation or deferral of offshore drilling campaigns, which directly impacts landing string utilization rates. Technological complexity also acts as a restraint; the design, manufacturing, and maintenance of deepwater landing string components require highly specialized materials, precise machining tolerances, and certified personnel, resulting in high operational costs that limit smaller operators. Furthermore, environmental concerns and the global energy transition agenda pose a long-term risk, potentially reducing the attractiveness of new fossil fuel investments, although the current consensus predicts offshore oil and gas remaining critical for decades.

Opportunities for growth are concentrated in the rapid adoption of digitalization and automation within landing string operations. Integrating sensors for continuous condition monitoring, paired with telemetry systems, offers significant operational cost reduction and safety improvement, creating new market avenues for service providers offering smart, integrated solutions. Additionally, the growing focus on unconventional offshore resources, such as high-pressure, high-temperature (HPHT) gas reservoirs, necessitates specialized landing strings manufactured from exotic, corrosion-resistant alloys, opening premium segments for specialized manufacturers. The potential for the landing string technology to be repurposed or adapted for emerging offshore carbon capture and storage (CCS) applications—specifically the high-integrity injection wells—presents a long-term diversification opportunity, leveraging existing deep-sea pressure management expertise. These drivers, restraints, and opportunities are profoundly impacted by global economic stability and geopolitical risks that influence oil supply and pricing dynamics.

- Drivers: Increased deepwater and ultra-deepwater exploration activities; stringent global offshore safety regulations; demand for high-integrity well completion systems; technological advancements enabling HPHT operations.

- Restraints: Volatility in global crude oil prices leading to CAPEX deferrals; high initial investment costs for specialized equipment; long lead times for highly customized components; operational complexity and high skilled labor requirements.

- Opportunities: Adoption of 'smart' landing string systems with integrated monitoring sensors; growth in workover and intervention markets for mature deepwater fields; expansion into frontier deepwater basins (e.g., Eastern Mediterranean, Arctic); potential adaptation for offshore CCS injection systems.

- Impact Forces: Geopolitical instability affecting global oil supply; technological obsolescence risks if new completion methods emerge; environmental activism impacting project approvals; standardization initiatives reducing proprietary hardware differentiation.

Segmentation Analysis

The Shallow and Deepwater Landing String Market is critically segmented based on operational parameters that define the technical specifications and utilization environment of the equipment. These segmentations allow for precise market sizing and strategic targeting by vendors, reflecting the diverse demands arising from varying well depths, pressure requirements, and operational objectives across the global offshore energy landscape. Key classification criteria include the depth of operation, which fundamentally dictates the hydrostatic and pressure requirements; the composition of the string, differentiating between the high-cost safety valve assemblies and the standard tubulars; the intended application, which separates drilling/testing uses from long-term completion installation; and the end-user profile, which distinguishes between asset owners and service providers.

The most lucrative segment remains the Ultra-Deepwater operation depth (1500 meters and deeper), driven by the exploration of frontier basins requiring strings capable of withstanding extreme tensions and pressures (up to 20,000 psi). Within the component segment, sophisticated valve assemblies, particularly the Subsea Test Tree (SSTT) and shearable disconnect tools, command the highest market value due to their critical safety function and complex engineering. The market is also strategically divided by application, where completion operations—the final and most critical phase of well construction—represent the largest revenue contributor, as landing strings are non-negotiable for running and setting subsea trees and permanent production packers. These detailed segmentations provide a granular view of market needs, essential for manufacturers to tailor their product offerings and service delivery models effectively.

- By Operation Depth:

- Shallow Water (Up to 500 meters)

- Deepwater (500 meters to 1500 meters)

- Ultra-Deepwater (Greater than 1500 meters)

- By Component:

- Landing String Tools (Subsea Test Trees, Emergency Disconnect Packages, Circulating Subs, Safety Valves)

- Tubing and Pipe (High-Strength Tubulars, Drill Pipe for Running String)

- Handling and Accessory Equipment (Running Tools, Stress Joints, Handling Subs)

- By Application:

- Completion Operations (Running and Setting Subsea Trees and Equipment)

- Testing and Evaluation (Drill Stem Testing, Reservoir Flow Measurement)

- Intervention and Workover (Wellbore Remediation, Downhole Equipment Replacement)

- By End-User:

- International Oil Companies (IOCs)

- National Oil Companies (NOCs)

- Drilling Contractors

- Independent Oilfield Service Providers

Value Chain Analysis For Shallow and Deepwater Landing String Market

The value chain of the Shallow and Deepwater Landing String Market begins with upstream analysis, focusing heavily on the specialized raw materials required. This phase involves the procurement of high-strength alloy steels (such as proprietary chrome and nickel alloys) necessary to manufacture tubulars and specialized tools capable of resisting sour gas (H2S and CO2) corrosion and high internal pressures. Suppliers must meet rigorous specifications and certification requirements, leading to high barriers to entry for steel manufacturers. Following material procurement is the complex manufacturing and precision machining phase, where specialist oilfield equipment companies design, forge, and machine the critical components—most notably the Subsea Test Trees (SSTT) and high-pressure valves—which are proprietary and require substantial intellectual property and capital investment. Quality control, non-destructive testing, and final hydrostatic testing are paramount at this stage to ensure regulatory compliance and operational safety.

The midstream elements focus on the distribution channel, which is typically characterized by a direct model for highly complex deepwater strings and an indirect model for standard rental equipment. Direct distribution involves the original equipment manufacturers (OEMs) or their specialized service divisions contracting directly with major IOCs and NOCs, often providing the equipment as part of a comprehensive service package that includes engineering support, deployment supervision, and retrieval services. This close relationship ensures that the specialized components are handled correctly and integrated seamlessly into the overall drilling or completion program. Rental fleets are managed either by the manufacturers or large, independent oilfield service companies, allowing operators to lease the expensive landing strings for the duration of a specific well operation, optimizing their capital utilization and ensuring access to the latest certified equipment without permanent ownership.

The downstream analysis centers on the utilization phase—the actual running, operating, and maintenance of the landing string system on the offshore rig or vessel. End-users (E&P companies) rely heavily on the technical expertise provided by the service companies for successful deployment. Post-use, the equipment undergoes rigorous inspection, repair, and recertification (IRR) processes, which form a significant segment of the aftermarket value chain. The complexity and high cost of these tools mandate meticulous maintenance schedules, often proprietary to the manufacturer, ensuring compliance with extremely strict recertification intervals required by regulatory bodies. The long-term profitability in this market is often derived more from the specialized, high-margin service, rental, and recertification segments than from the initial product sale, making the aftermarket service crucial for sustaining the value chain.

Shallow and Deepwater Landing String Market Potential Customers

Potential customers for Shallow and Deepwater Landing Strings are fundamentally the entities responsible for managing and executing offshore hydrocarbon extraction projects, with a distinct concentration among major global players who possess the technical capability and financial resources to operate in high-risk deepwater environments. The primary end-users are International Oil Companies (IOCs) like ExxonMobil, Chevron, Shell, and BP, and major National Oil Companies (NOCs) such as Petrobras, Saudi Aramco, and Equinor, which own the licenses and bear the ultimate risk for deepwater assets. These entities require landing strings for critical operations including initial well testing, installation of subsea completion systems, and ongoing intervention work. Due to the high criticality of the equipment, these companies often demand bespoke specifications and high-assurance supplier contracts, prioritizing safety and reliability over marginal cost savings, making them the most attractive client base.

A second major customer category includes specialized drilling contractors and large oilfield service providers who operate under contract for the IOCs and NOCs. Companies like Transocean, Ensco Rowan (now Valaris), and Noble Corporation often procure or lease landing strings as part of an integrated package for their deepwater drilling rigs. In this scenario, the service provider acts as the intermediary buyer, bundling the landing string equipment with the rig, personnel, and associated services, offering a turnkey solution to the asset owner. This trend towards integrated service delivery means that landing string manufacturers must maintain strong relationships not only with the asset owners but also with the major deepwater drilling and completion service integrators, who influence purchasing decisions regarding ancillary equipment.

Finally, smaller, independent exploration and production companies focusing on specific deepwater fields also constitute a growing customer base, particularly in regions where smaller, high-return discoveries are being developed. These smaller operators, however, typically rely almost entirely on rental models and third-party service providers to access landing string technology, given their lower internal capital reserves and desire to minimize fixed asset ownership. The common thread among all potential customers is the absolute necessity for certified, high-pressure equipment that meets stringent international safety and environmental standards, confirming that the market is heavily specification-driven rather than commodity-driven, focusing intensely on component integrity and reliable performance under severe operational stress.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $850 Million USD |

| Market Forecast in 2033 | $1,250 Million USD |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Schlumberger, Baker Hughes, Halliburton, Weatherford International, National Oilwell Varco (NOV), TechnipFMC, Tenaris, Vallourec, Hunting PLC, Global Energy Services (GES), Expro Group, Forum Energy Technologies, Proserv, Superior Energy Services, Odfjell Drilling, Aker Solutions, Dril-Quip, Subsea 7, Oceaneering, and other specialized tooling providers. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Shallow and Deepwater Landing String Market Key Technology Landscape

The technology landscape for the Shallow and Deepwater Landing String market is dominated by advancements aimed at enhancing safety, reliability, and pressure tolerance, particularly in ultra-deepwater and high-pressure, high-temperature (HPHT) environments. A primary technological focus is on the Subsea Test Tree (SSTT) system, which functions as the primary emergency barrier during completion or testing operations. Modern SSTTs incorporate dual-redundant sealing mechanisms and advanced mechanical shear systems capable of severing high-strength tubing and maintaining well integrity under catastrophic conditions. These systems utilize hydraulic or electro-hydraulic controls to ensure rapid response times, essential for preventing major deepwater incidents. Manufacturers are also developing modular SSTT designs that can be quickly adapted for various well sizes and pressure ratings, minimizing inventory requirements and increasing operational flexibility across diverse offshore projects.

Another pivotal technology involves the tubular connection systems. Standard API connections are often inadequate for the high fatigue loads, bending moments, and torsional stresses encountered when running long strings in dynamic deepwater conditions. Consequently, proprietary premium connections (e.g., specific wedge-thread or metal-to-metal seal systems) are extensively used to ensure gas-tight integrity and high tensile strength throughout the entire string length. These premium connections are essential for minimizing the risk of leaks or catastrophic string parting during high-load hoisting operations or severe storm conditions. Furthermore, the material science supporting these components is continually advancing, with increased usage of high-nickel alloys and duplex stainless steels to combat severe internal corrosion caused by high concentrations of CO2 and H2S, ensuring the equipment maintains integrity over its mandated service life and through multiple recertification cycles.

The integration of smart technology represents the frontier of landing string innovation. Modern landing strings are increasingly incorporating fiber optic sensing (FOS) and real-time pressure and temperature transducers directly into the tubular wall or connection areas. This allows operators to monitor key operational parameters, such as strain, vibration, and internal fluid characteristics, instantaneously during deployment. This real-time data acquisition is crucial for optimizing running speeds, detecting early signs of potential problems (like differential sticking), and providing validated data for AI-driven predictive maintenance models. The ability to transmit reliable, high-bandwidth data through the landing string enhances situational awareness for the rig crew, fundamentally improving risk management and operational efficiency, thereby cementing the transition towards fully digital offshore well execution systems.

Regional Highlights

The global Shallow and Deepwater Landing String Market exhibits significant regional variations driven by the concentration of active offshore exploration and production projects, local regulatory frameworks, and technological maturity. North America, particularly the U.S. Gulf of Mexico (GOM), stands as a dominant force, characterized by a high volume of ultra-deepwater drilling and stringent safety regulations enforced by the BOEM. The GOM basin consistently features some of the deepest wells globally, demanding landing string components rated for 20,000 psi and temperatures up to 350°F. The region's market is driven by large-scale, long-term deepwater projects and a highly mature service infrastructure, leading to consistent demand for the latest high-specification, high-redundancy landing string systems. Key market activity involves both new field development and extensive workover campaigns on established deepwater assets, fueling strong rental and service revenue for specialized equipment providers.

Latin America, dominated by Brazil and Mexico, represents the most significant growth trajectory in the market, especially due to Petrobras's large-scale development of the deepwater pre-salt reservoirs offshore Brazil. These multi-billion-barrel fields are characterized by complex sub-salt geology, demanding drilling and completion systems capable of handling extremely high reservoir pressures and complex fluid characteristics. The landing string segment here is characterized by high demand for robust, large-diameter systems designed for extremely long vertical depths and lateral reaches. Mexico, following recent energy reforms, is also seeing renewed deepwater exploration, though on a smaller scale than Brazil. The region's market structure often involves strong participation from NOCs and mandates for local content, influencing supply chain strategies and partnerships for international landing string manufacturers seeking market penetration.

The European market, centered on the North Sea (UK, Norway), is mature and stabilizing, with the focus shifting from pure exploration to optimizing production from existing assets and maximizing economic recovery (MER). While the depth requirements are generally less extreme than in the GOM or Brazil, the North Sea environment imposes unique challenges related to harsh weather, strict environmental discharge regulations, and the prevalence of mature wells requiring complex intervention and workover operations. This drives demand for smaller, more agile landing string systems suitable for light intervention vessels and specialized coiled tubing or wireline applications. Regulatory compliance in this region, particularly concerning well integrity and barrier management (often stricter than international standards), ensures a steady market for the highest quality, recertified landing string components, focusing on minimizing operational risk in densely populated areas.

Asia Pacific (APAC) is emerging rapidly, with key activity zones in Malaysia, Indonesia, Australia, and India. While Ultra-Deepwater activities are less frequent than in the Atlantic, the region is highly active in deepwater exploration and development, driven by growing energy demand and national efforts to secure domestic supply. Landing string requirements in APAC often vary significantly between countries; Australian projects, for instance, demand extreme environmental compliance, while Southeast Asian projects focus on handling high volumes and often involve challenging shallow-gas risks and high bottom-hole temperatures. The market here is characterized by rapid project lifecycles and increasing competition among service providers, driving demand for cost-effective, yet highly reliable, landing string rental and procurement options, often necessitating the establishment of localized service centers for inspection, repair, and maintenance (IRR) capabilities to meet demanding mobilization schedules.

The Middle East and Africa (MEA) region presents a dichotomy. The Middle Eastern component, historically focused on onshore and shallow offshore drilling, is now increasingly moving into deepwater developments, particularly in the Red Sea and Arabian Sea, driven by major NOC initiatives aiming to diversify production sources. Demand for landing strings in this area is nascent but growing, characterized by a preference for long-term supply contracts and joint ventures with major international vendors. The African component, particularly West Africa (Nigeria, Angola, Ghana), has long been a deepwater hub, paralleling the complexity and pressure requirements found in Brazil. Political stability and regulatory clarity heavily influence project schedules here, but the underlying need for high-specification landing strings for massive offshore developments remains consistently strong, making it a critical region for specialized equipment deployment and supporting infrastructure investment.

- North America (U.S. Gulf of Mexico): Dominant market share; driven by ultra-deepwater exploration and stringent safety mandates (BOEM); high demand for 20K psi rated systems and advanced Subsea Test Trees.

- Latin America (Brazil): Fastest growth segment; massive pre-salt reserves driving demand for high-strength, large-diameter landing strings for complex deep wells; market dominated by Petrobras CAPEX.

- Europe (North Sea): Mature market focused on asset integrity and workovers; high regulatory compliance requirements; demand for specialized, smaller systems for intervention operations.

- Asia Pacific (Malaysia, Indonesia, Australia): Rapidly emerging deepwater activity; diversified requirements across sub-basins; focus on cost-effective, reliable rental fleets and localization of service centers.

- Middle East and Africa (West Africa, Red Sea): Strong potential for deepwater growth in the long term; demand linked to large-scale, international deepwater field developments and local content requirements.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Shallow and Deepwater Landing String Market.- Schlumberger

- Baker Hughes

- Halliburton

- Weatherford International

- National Oilwell Varco (NOV)

- TechnipFMC

- Tenaris

- Vallourec

- Hunting PLC

- Global Energy Services (GES)

- Expro Group

- Forum Energy Technologies

- Proserv

- Superior Energy Services

- Odfjell Drilling

- Aker Solutions

- Dril-Quip

- Subsea 7

- Oceaneering

- Oil States International

Frequently Asked Questions

Analyze common user questions about the Shallow and Deepwater Landing String market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function of a landing string in deepwater oil operations?

The primary function of a landing string is to safely run and set specialized downhole equipment, such as subsea trees, production packers, or testing tools, in offshore wells. It serves as a high-integrity conduit for well control, circulation, and communication, integrating essential safety barriers like the Subsea Test Tree (SSTT) to ensure the well can be isolated immediately in an emergency.

How do 'smart' landing strings enhance operational safety and efficiency?

Smart landing strings incorporate integrated sensor technology, such as fiber optic sensors and pressure transducers, which provide real-time data on strain, temperature, and internal pressure during deployment. This real-time monitoring allows operators to optimize running procedures, detect anomalies immediately, and enable predictive maintenance, significantly reducing the risk of equipment failure and operational downtime (NPT).

Which geographical region leads the demand for high-specification landing strings?

North America, specifically the U.S. Gulf of Mexico, leads the demand for high-specification landing strings due to extensive ultra-deepwater activity and highly stringent regulatory requirements (BOEM). This region necessitates landing string components rated for the highest pressures (often 20,000 psi) and deep water depths.

What are the key technical differences between shallow water and ultra-deepwater landing strings?

Ultra-deepwater landing strings require significantly higher tensile strength and fatigue resistance to manage the sheer weight and dynamic loads of long strings (up to 10,000 feet or more). They must also incorporate proprietary, high-pressure, metal-to-metal sealing connections and complex Subsea Test Trees rated for pressures far exceeding those typically required for shallower environments.

What is the impact of oil price volatility on the Shallow and Deepwater Landing String Market?

Oil price volatility has a direct and significant impact, as deepwater projects are highly capital-intensive. When prices fall, E&P companies frequently defer or cancel new deepwater exploration and development campaigns, leading to reduced utilization rates and lower immediate demand for landing string procurement or rentals.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager