Shark Fin Antenna Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435642 | Date : Dec, 2025 | Pages : 248 | Region : Global | Publisher : MRU

Shark Fin Antenna Market Size

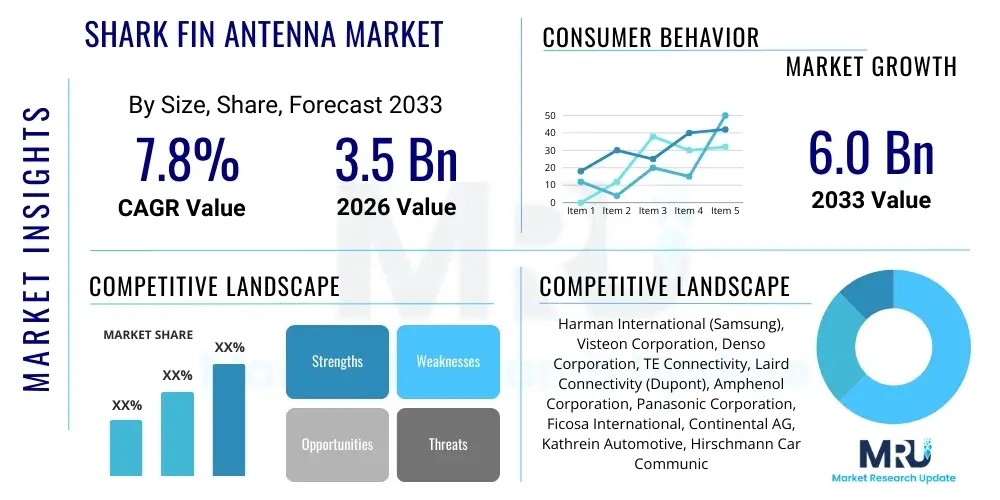

The Shark Fin Antenna Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at $3.5 Billion in 2026 and is projected to reach $6.0 Billion by the end of the forecast period in 2033. This substantial expansion is fundamentally driven by the escalating integration of sophisticated telematics, navigation, and entertainment systems within modern passenger and commercial vehicles, demanding high-performance, multi-functional external antennas.

Shark Fin Antenna Market introduction

The Shark Fin Antenna Market encompasses the design, manufacture, and distribution of external vehicle antennas characterized by their sleek, aerodynamic, and distinctive dorsal fin shape. Originally introduced as a design element complementing high-end luxury vehicles, these antennas have rapidly become standard components across various vehicle segments due to their superior performance characteristics and aesthetic appeal. Unlike traditional whip antennas, the shark fin design typically houses multiple antenna elements—often consolidating GPS, cellular 4G/5G connectivity, digital radio (DAB/SiriusXM), and Wi-Fi capabilities—into a single, compact, and robust unit. This integration capability is critical for supporting the rapidly evolving connected car ecosystem, which relies on seamless, high-bandwidth data transfer for operational safety and consumer services.

Major applications for shark fin antennas span the entire automotive sector, including Passenger Vehicles (Hatchbacks, Sedans, SUVs), Commercial Vehicles (Trucks, Buses), and specialized vehicles requiring advanced tracking and communication, such as emergency service fleets. The primary benefits driving market adoption include enhanced aerodynamic performance, reduced drag noise compared to conventional antennas, improved signal reception due to strategic mounting location, and significant aesthetic upgrades that contribute positively to the vehicle's overall design language. Moreover, their durable, low-profile casing offers superior protection against environmental factors and vandalism, ensuring long-term reliability essential for OEM specifications.

Driving factors underpinning this market growth include stringent governmental regulations mandating features like eCall systems in regions such as the European Union, which require reliable cellular connectivity, directly translating to demand for integrated antenna solutions. Furthermore, the proliferation of advanced driver-assistance systems (ADAS) and the development of vehicle-to-everything (V2X) communication technologies necessitate the high-frequency and multi-band capabilities inherent in advanced shark fin antenna designs. Consumer demand for uninterrupted streaming services, real-time traffic updates, and enhanced navigation is also a powerful catalyst, positioning the shark fin antenna as a crucial enabler of the digital cockpit experience.

Shark Fin Antenna Market Executive Summary

The Shark Fin Antenna Market is experiencing robust growth fueled by converging trends in automotive connectivity and aesthetic design modernization. Key business trends indicate a shift towards highly modular and multi-functional antennas capable of supporting emerging standards like 5G and V2X communication protocols. Original Equipment Manufacturers (OEMs) are increasingly sourcing integrated antenna modules from Tier 1 suppliers to simplify vehicle assembly lines and manage complexity associated with housing diverse communication technologies. Strategic alliances between antenna manufacturers and semiconductor firms are emerging to develop active antennas incorporating signal processing and amplification directly within the unit, maximizing performance efficiency and minimizing signal loss—a critical development influencing future pricing structures and competitive positioning.

Regionally, the Asia Pacific (APAC) market, spearheaded by China, Japan, and South Korea, is projected to maintain the highest growth trajectory, driven by massive domestic automotive production volumes and the rapid adoption of electric vehicles (EVs) and high-tech passenger cars. North America and Europe, however, remain central to innovation, particularly in the premium and luxury segments, where demand for sophisticated telematics (e.g., satellite navigation and emergency services integration) pushes the boundaries of antenna complexity and quality. Regulatory mandates in these regions, such as the EU's eCall, ensure a baseline demand for connectivity features, solidifying the market's stability and consistent growth.

Segmentation trends highlight the dominance of the Passenger Vehicle segment, particularly within the mid-range and SUV categories, where consumers expect high levels of built-in connectivity as standard. By Type, the Multi-Function Shark Fin Antennas segment is overwhelmingly favored over single-function units, reflecting the industry's drive towards consolidation and cost-efficiency. The aftermarket sector, while smaller than the OEM market, is seeing steady growth as vehicle owners upgrade older models to access modern connectivity features or improve aesthetic profiles, though the OEM channel retains the significant majority of revenue due to the complexity and necessity of factory integration.

AI Impact Analysis on Shark Fin Antenna Market

User queries regarding AI's influence on the Shark Fin Antenna Market frequently center on how machine learning algorithms can enhance signal processing, optimize antenna performance across varied environmental conditions, and contribute to the reliability required for autonomous driving. Users are concerned with whether AI can predict and compensate for signal interference in highly dense urban environments, thereby ensuring the uninterrupted data flow vital for V2X safety applications. Furthermore, there is significant interest in AI's role in the manufacturing and design phases, specifically regarding generative design techniques to create more aerodynamically efficient or covert antenna housings, and using predictive maintenance AI to diagnose potential antenna failures before they compromise critical vehicle functions.

The primary impact of Artificial Intelligence in this sector revolves around augmenting the capabilities of the antenna system beyond simple signal reception. AI algorithms are increasingly being integrated into the associated electronic control units (ECUs) and transceiver modules connected to the shark fin antenna. This integration allows the system to intelligently manage frequency band switching, dynamically adjust beamforming (especially important for satellite reception or future 5G New Radio applications), and apply noise cancellation techniques customized in real-time based on geographic location, vehicle speed, and weather conditions. This sophisticated signal management elevates the reliability of mission-critical functions like GPS localization and emergency communication, which are non-negotiable for modern vehicle safety ratings.

Beyond functional performance, AI is streamlining the development lifecycle. Machine learning models are analyzing vast datasets of field performance data—including factors like material degradation, temperature variation, and mounting placement effects—to optimize future antenna designs for maximum longevity and minimal signal distortion. This predictive design approach significantly reduces iteration time and improves the first-pass success rate for new product introductions by Tier 1 suppliers. Moreover, AI-driven quality control in manufacturing uses computer vision to inspect subtle defects in the antenna radome (the outer cover) or internal circuitry, ensuring that the components meet the rigorous durability and weather resistance standards demanded by automotive OEMs, thereby indirectly boosting market trust in the reliability of these integrated systems.

- AI-enabled dynamic frequency management optimizes signal strength and reduces packet loss across congested networks.

- Machine learning algorithms enhance beamforming for next-generation satellite and 5G connectivity components housed within the antenna.

- Predictive maintenance AI monitors antenna system health and anticipates component failure, ensuring reliability for V2X systems.

- Generative AI is used to optimize the aerodynamic shape of the shark fin housing for reduced drag and noise.

- AI-driven quality control improves manufacturing precision and durability standards for OEM components.

- Algorithms analyze environmental factors (e.g., weather, urban density) to perform real-time signal compensation and interference rejection.

DRO & Impact Forces Of Shark Fin Antenna Market

The market dynamics for shark fin antennas are shaped by a strong interplay of technological advancement, regulatory impetus, design preference, and cost pressures. Key drivers include the mandatory adoption of integrated telematics systems globally and the exponential increase in data consumption within vehicles, requiring multi-band, high-performance antennas. Restraints primarily involve the high complexity and cost associated with incorporating five or more separate antenna elements into a single, compact unit, posing manufacturing challenges and increasing the initial unit price compared to simpler solutions. Opportunities are concentrated in the rapidly expanding Electric Vehicle (EV) and autonomous vehicle sectors, which demand absolute reliability and superior bandwidth for communication and sensing. The primary impact forces are regulatory compliance requirements, OEM platform standardization, and competitive pricing strategies driven by APAC manufacturers seeking greater market share.

Drivers are primarily centered on the 'Connected Car' paradigm. The requirement for continuous connectivity to support over-the-air (OTA) software updates, streaming services, sophisticated navigation systems that use real-time data, and crucial safety features like eCall and bCall (breakdown call) solidifies the need for integrated, high-efficiency antenna systems. Furthermore, the push towards autonomous driving (Level 3 and above) necessitates robust V2X communication, often relying on dedicated short-range communication (DSRC) or cellular V2X (C-V2X) technologies, which must be seamlessly integrated and perfectly tuned within the vehicle exterior. The aesthetically pleasing nature of the shark fin, which integrates complex technology without compromising vehicle design, serves as a significant commercial driver, moving it from a luxury feature to a standard expectation across mass-market segments.

Restraints involve the technical challenges inherent in multi-band integration. Placing multiple radiating elements in close proximity within a small housing can lead to significant electromagnetic interference (EMI) and desensitization, potentially degrading performance across specific frequency bands. Overcoming these integration issues necessitates specialized materials, advanced shielding, and sophisticated design methodologies, which contribute to higher research and development costs. Another constraint is the material selection for the radome itself; it must be aesthetically pleasing, extremely durable, resistant to UV and extreme temperatures, yet still fully transparent to radio frequencies—a balance that often requires premium engineering plastics and specialized paint processes, thus increasing overall production complexity and limiting the potential for aggressive cost reduction compared to conventional exterior components.

Opportunities are vast, particularly within the burgeoning commercial telematics sector, where trucking and logistics companies require robust fleet management systems reliant on constant GPS and cellular tracking. The rollout of 5G networks presents a massive opportunity, requiring antenna redesigns capable of handling millimetre wave (mmWave) frequencies and enhanced bandwidth requirements. The ongoing transition to electric vehicles also presents a unique opportunity, as EVs generally incorporate more advanced digital features and require complex battery management systems that communicate via telemetry, driving demand for the most advanced, multi-functional antennas available. Impact forces, therefore, prioritize suppliers who can navigate strict OEM qualification processes while demonstrating scalability and the capability to integrate emerging wireless standards like Wi-Fi 6/7 into future-proof antenna modules.

Segmentation Analysis

The Shark Fin Antenna Market is segmented based on the type of function (Single-Function vs. Multi-Function), the connectivity technology deployed (GPS, Cellular, Satellite Radio, Wi-Fi), the channel of distribution (OEM vs. Aftermarket), and the type of vehicle (Passenger Vehicles vs. Commercial Vehicles). The core market growth is concentrated in the Multi-Function segment within the Passenger Vehicle category, driven by consumer expectations for comprehensive connectivity packages encompassing navigation, emergency services, and high-speed internet access. Technology segmentation is rapidly evolving, with a growing emphasis on 5G and C-V2X capabilities, indicating a strong trend toward future-proofing vehicle communication architectures. The OEM channel holds a commanding share due to the integral nature of these components to vehicle design and essential safety systems.

- By Type:

- Single-Function Shark Fin Antenna (e.g., dedicated GPS or dedicated AM/FM)

- Multi-Function Shark Fin Antenna (Integrating 2 or more communication technologies: GPS, GSM, Satellite Radio, Wi-Fi, DSRC/C-V2X)

- By Technology:

- Cellular Connectivity (2G/3G/4G/5G)

- Global Navigation Satellite Systems (GNSS/GPS/GLONASS)

- Satellite Radio (SiriusXM, etc.)

- Digital Audio Broadcast (DAB)

- Wi-Fi/Bluetooth

- V2X Communication (DSRC, C-V2X)

- By Vehicle Type:

- Passenger Vehicles (Sedans, SUVs, Hatchbacks)

- Commercial Vehicles (Trucks, Buses, Light Commercial Vehicles)

- By Sales Channel:

- Original Equipment Manufacturer (OEM)

- Aftermarket

Value Chain Analysis For Shark Fin Antenna Market

The value chain for the Shark Fin Antenna Market is structured around specialized engineering and deep integration between upstream component providers and downstream automotive assemblers. Upstream analysis focuses on raw material providers, including high-grade engineering plastics (ABS, polycarbonate) for the radome, specialized shielding materials (EMI/RFI), and semiconductor suppliers providing the critical active components such as low-noise amplifiers (LNAs), filters, and baseband chips essential for processing multiple radio signals simultaneously. These raw materials and electronic components are highly regulated, demanding rigorous certification for automotive use, which creates high barriers to entry for new suppliers and reinforces the dominance of established players.

Midstream activities are dominated by Tier 1 automotive suppliers who specialize in integrating these complex electronic components into a single, compact, and environmentally sealed antenna module. This stage involves sophisticated R&D in electromagnetic compatibility (EMC) testing and antenna pattern tuning to ensure optimal performance without interference. The key competitive advantage at this stage lies in proprietary design methodologies that minimize coupling between radiating elements and ensure aesthetic integration with vehicle body lines. Manufacturing processes must adhere to stringent Automotive Industry Action Group (AIAG) standards, emphasizing quality control (QC) and robust testing protocols for vibration, temperature cycling, and water resistance, translating into high operational complexity.

The downstream analysis primarily involves the distribution and integration of the finished antenna unit. The direct channel, the Original Equipment Manufacturer (OEM) pathway, accounts for the vast majority of market volume. Tier 1 suppliers deliver the antennas directly to vehicle assembly plants (JIT delivery), where they are integrated onto the roof panel early in the production cycle. The indirect channel, the aftermarket, utilizes traditional automotive parts distributors, specialized tuning shops, and online retailers to reach end consumers seeking replacements or upgrades. While the aftermarket provides higher margins, the OEM segment dictates technology trends, volumes, and standardization protocols across the industry.

Shark Fin Antenna Market Potential Customers

Potential customers and end-users of shark fin antennas are primarily classified based on their role in the automotive lifecycle and their technological requirements. Original Equipment Manufacturers (OEMs) of passenger vehicles constitute the largest customer base, dictating specifications, quality, and volume requirements. This customer group prioritizes seamless design integration, high-reliability standards (zero defects), and cost-effective multi-functional solutions capable of supporting five or more separate communication streams required for their global vehicle platforms. Their purchasing decisions are heavily influenced by long-term strategic partnerships and compliance with safety regulations like eCall.

The second major segment includes manufacturers of Commercial Vehicles (CVs), such as heavy-duty truck and bus manufacturers, who prioritize durability, robust communication for fleet management (telematics), and continuous tracking capabilities. For CVs, the antenna system is often viewed as a critical operational tool, necessary for optimizing logistics, monitoring driver behavior, and ensuring regulatory compliance (e.g., electronic logging devices, ELDs). These customers require industrial-grade reliability and often deploy specialized antennas supporting fleet-specific frequency bands, focusing less on aesthetics and more on ruggedized performance in harsh environments.

A growing customer segment is the automotive aftermarket, comprising independent repair garages, specialized electronics installers, and individual vehicle owners. These customers are driven by two main needs: replacement of damaged factory antennas or aesthetic/functional upgrades. Consumers in the aftermarket often seek solutions that are easy to install and offer features (like enhanced DAB reception or adding GPS functionality to older vehicles) not present in their original equipment. Furthermore, niche applications, such as emergency service vehicles (police, ambulance) and specialized municipal fleets, represent high-value customers who demand custom antenna arrays supporting proprietary or dedicated public safety communication networks, requiring highly customized and reliable shark fin configurations.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $3.5 Billion |

| Market Forecast in 2033 | $6.0 Billion |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Harman International (Samsung), Visteon Corporation, Denso Corporation, TE Connectivity, Laird Connectivity (Dupont), Amphenol Corporation, Panasonic Corporation, Ficosa International, Continental AG, Kathrein Automotive, Hirschmann Car Communication, Taoglas, Ace Technologies, Molex LLC, Luxshare Precision Industry Co., Ltd., Shenzhen Sunway Communication Co., Ltd., Pulse Electronics, Huawei Technologies Co., Ltd., TDK Corporation, Kenwood Corporation. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Shark Fin Antenna Market Key Technology Landscape

The technological evolution of the Shark Fin Antenna Market is defined by the migration from passive, single-band reception devices to complex, active, multi-band communication hubs. The core technology involves the integration of high-performance antennas for diverse frequency ranges—ranging from hundreds of megahertz (for FM/AM/DAB) up to multiple gigahertz (for 5G and GNSS)—all optimized for reception within a small form factor. A crucial technology is the use of Low-Noise Amplifiers (LNAs) and filtering circuitry placed immediately adjacent to the radiating elements. This active design amplifies weak signals and filters out noise and interference, drastically improving the signal-to-noise ratio (SNR), which is essential for maintaining robust connectivity, particularly in remote areas or high-speed environments.

Advanced material science plays a significant role in enabling these complex integrations. New polymer composites and specialized coatings are continuously developed for the radome to ensure RF transparency across a wide spectrum of frequencies while providing maximum resistance to UV degradation, chemical exposure (e.g., car washes, road salts), and impact. Furthermore, the integration of cellular V2X (C-V2X) technology is rapidly becoming a standard requirement, requiring the antenna system to support dedicated 5.9 GHz frequencies for direct communication between vehicles and infrastructure. This technology demands exceptional bandwidth consistency and low latency, pushing manufacturers to employ advanced patch antenna designs and phase-array techniques within the shark fin housing to maximize directional gain and system reliability for safety applications.

The industry is also witnessing the rise of integrated smart antenna solutions, where signal processing intelligence is embedded directly within the unit. This includes technology for multiplexing and demultiplexing signals, allowing a single coaxial cable connection to handle data streams from multiple internal antenna elements, simplifying wiring harness complexity for OEMs. The adoption of MIMO (Multiple-Input Multiple-Output) antenna configurations, particularly for 4G and 5G cellular communication, further defines the key technological landscape. MIMO utilizes multiple antennas (often 2x2 or 4x4) within the housing to improve data throughput and link reliability, capitalizing on spatial diversity and signal richness—a necessary capability for supporting high-definition video streaming and sophisticated real-time vehicle diagnostics required by the modern connected ecosystem.

Regional Highlights

- Asia Pacific (APAC): APAC is the largest and fastest-growing market globally, primarily fueled by the sheer volume of automotive manufacturing, particularly in China, which leads the world in vehicle production and EV adoption. Government initiatives in countries like China and India to promote smart transportation and mandatory telematics adoption in new vehicle platforms are creating a massive captive market for shark fin antennas. Japan and South Korea remain innovation hubs, focusing on integrating cutting-edge technologies such as 5G C-V2X and high-precision GNSS capabilities into their vehicles, driven by domestic manufacturers aiming for global technological leadership. The region's competitive landscape is intensely focused on cost optimization and high-volume scalability.

- North America: This region represents a highly mature market characterized by robust demand for premium infotainment systems, including satellite radio (SiriusXM) and advanced cellular telematics services (OnStar, etc.). Regulatory requirements, especially those relating to 911 emergency services connectivity, ensure a high baseline demand for reliable, multi-functional antennas. The market here is highly influenced by consumer desire for seamless integration of personal devices and services (e.g., Apple CarPlay, Android Auto), requiring antennas capable of supporting high data throughput and sophisticated Wi-Fi connectivity standards. Furthermore, North America is a key early adopter region for high-level autonomous vehicle testing, driving demand for V2X and high-accuracy GPS antennas.

- Europe: Europe exhibits stable growth, heavily underpinned by the mandatory implementation of the eCall system for all new type-approved vehicles, which fundamentally requires an integrated GNSS and cellular antenna solution, typically housed in the shark fin module. The European market focuses heavily on quality, design aesthetics, and adherence to stringent environmental and safety standards. Digital Audio Broadcast (DAB) requirements are also significant drivers, necessitating specific frequency reception capabilities within the antenna package. The shift towards electric vehicles (EVs) is accelerating the demand for highly reliable connectivity for battery management telemetry and charging station communication.

- Latin America (LATAM): The LATAM market is emerging, driven by increasing vehicle production and rising consumer incomes leading to higher technological expectations. While penetration of high-end features might lag North America and Europe, there is growing regulatory movement towards implementing mandatory tracking and emergency systems in several key countries (e.g., Brazil, Mexico) to combat high rates of vehicle theft and improve public safety. This necessitates reliable cellular and GPS integration, making the multi-functional shark fin antenna an increasingly essential component in mid-range and luxury vehicles sold in the region.

- Middle East and Africa (MEA): This region shows varied growth patterns, with the Gulf Cooperation Council (GCC) countries leading in the adoption of luxury and technology-packed vehicles, mirroring European and North American consumer trends. The deployment of smart city infrastructure and high investment in telecommunication networks (including 5G rollout) in countries like the UAE and Saudi Arabia are strong drivers. In parts of Africa, the demand is often concentrated on robust fleet management systems for commercial vehicles operating in challenging terrain, prioritizing durability and satellite communication capabilities alongside standard cellular services, necessitating ruggedized antenna solutions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Shark Fin Antenna Market.- Harman International (A Samsung Company)

- Visteon Corporation

- Denso Corporation

- TE Connectivity

- Laird Connectivity (A Dupont Business)

- Amphenol Corporation

- Panasonic Corporation

- Ficosa International

- Continental AG

- Kathrein Automotive GmbH

- Hirschmann Car Communication (A TE Connectivity Company)

- Taoglas

- Ace Technologies Corp.

- Molex LLC

- Luxshare Precision Industry Co., Ltd.

- Shenzhen Sunway Communication Co., Ltd.

- Pulse Electronics

- TDK Corporation

- Alps Alpine Co., Ltd.

- Huawei Technologies Co., Ltd. (Automotive Business Unit)

Frequently Asked Questions

Analyze common user questions about the Shark Fin Antenna market and generate a concise list of summarized FAQs reflecting key topics and concerns.What specific technologies are housed within a modern multi-function shark fin antenna?

Modern multi-function shark fin antennas integrate antennas for 4G/5G cellular connectivity, Global Navigation Satellite Systems (GNSS) like GPS and GLONASS, Satellite Radio (e.g., SiriusXM), Digital Audio Broadcast (DAB), and often V2X communication (DSRC or C-V2X) and Wi-Fi/Bluetooth capabilities. These components are typically active, utilizing integrated Low-Noise Amplifiers (LNAs) and sophisticated filters to ensure optimal signal integrity across all bands.

How does the shark fin design impact vehicle aerodynamics and fuel efficiency?

The sleek, low-profile design of the shark fin antenna is engineered to minimize aerodynamic drag compared to traditional whip antennas. While the impact on overall vehicle fuel efficiency is marginal, the reduced drag contributes to improved high-speed stability and significantly lowers wind noise, aligning with OEM requirements for NVH (Noise, Vibration, and Harshness) reduction and overall aesthetic modernization.

Which market segment currently drives the highest demand for shark fin antennas?

The Original Equipment Manufacturer (OEM) segment within the Passenger Vehicle category drives the highest demand. This dominance is due to the mandatory inclusion of integrated telematics and navigation systems in new vehicle models globally, particularly high-volume platforms like SUVs and mid-range sedans where connectivity is now considered a standard feature, rather than an option.

What regulatory factors are accelerating the adoption of these advanced antenna systems?

Key regulatory factors include the European Union's mandate for the eCall system, which requires reliable, continuous cellular and GNSS connectivity for automatic emergency reporting. Similar regulations globally, coupled with safety standards promoting advanced driver assistance systems (ADAS) and future autonomous functions relying on V2X communication, necessitate the high reliability and multi-band capabilities provided by shark fin designs.

What is the primary technological challenge in manufacturing multi-band shark fin antennas?

The primary challenge is managing Electromagnetic Interference (EMI) and maintaining high signal isolation between the numerous radiating elements (sometimes 5 or more) packed into a compact radome. This complexity requires advanced shielding techniques, specialized filtering circuitry, and rigorous electromagnetic compatibility (EMC) testing to prevent cross-talk and performance degradation across critical communication bands.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager