Shelled Shrimp Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432868 | Date : Dec, 2025 | Pages : 253 | Region : Global | Publisher : MRU

Shelled Shrimp Market Size

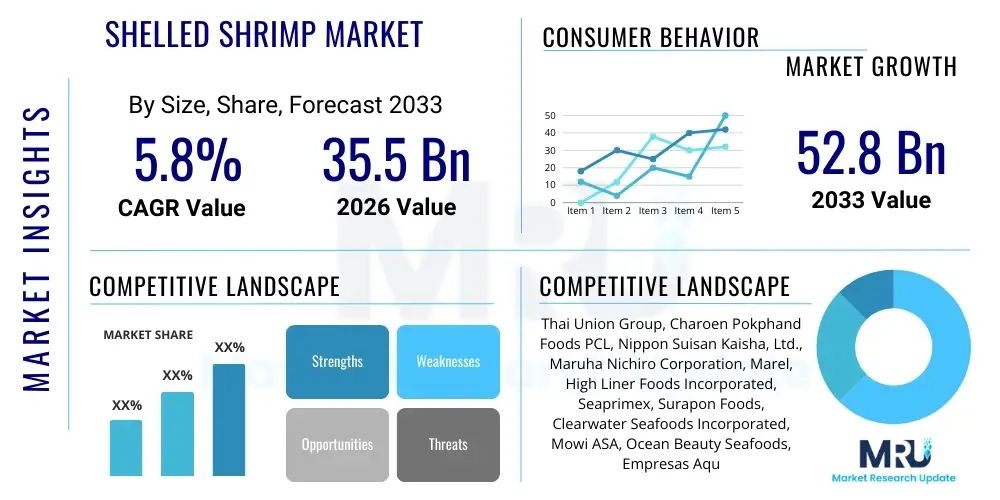

The Shelled Shrimp Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 35.5 Billion in 2026 and is projected to reach USD 52.8 Billion by the end of the forecast period in 2033.

Shelled Shrimp Market introduction

The Shelled Shrimp Market encompasses the global trade and consumption of shrimp products where the outer shell has been removed, making them ready-to-cook or ready-to-eat. These products range from headless, peeled, deveined, or entirely prepared shrimp, catering to both the foodservice industry and retail consumers seeking convenience and reduced preparation time. Shrimp, being one of the most widely consumed seafood products globally, sees significant demand across developed and emerging economies, driven by its nutritional profile, versatility in culinary applications, and relatively lower cost compared to other high-end seafood options. The market benefits substantially from advancements in processing technology, cold chain logistics, and aquaculture practices which ensure consistent supply and high product quality throughout the distribution network.

Major applications for shelled shrimp span household cooking, fine dining, quick service restaurants, and prepared meals manufacturing. The inherent benefits of shelled shrimp include extended shelf life due to freezing techniques, ease of portion control, and the elimination of labor-intensive tasks for the end consumer or commercial kitchen staff. Furthermore, increasing urbanization and the resulting time constraints on consumers have amplified the preference for value-added seafood forms. Key market drivers include rising disposable incomes, growing awareness of protein-rich diets, and the effective marketing strategies employed by major seafood processors focusing on sustainability and product traceability.

Shelled Shrimp Market Executive Summary

The global Shelled Shrimp Market is experiencing robust growth driven primarily by shifting consumer demographics favoring convenience and the continuous innovation in freezing and preservation technologies. Business trends indicate a strong move toward sustainable sourcing, with major processors investing heavily in certifications like ASC and BAP to meet increasing buyer demands for ethical and environmentally friendly products. The market structure is highly competitive, characterized by vertical integration among key aquaculture giants who control breeding, farming, processing, and distribution. Furthermore, e-commerce platforms and specialized online seafood retailers are emerging as critical distribution channels, especially following global shifts toward at-home consumption.

Regional trends highlight Asia Pacific (APAC) as the dominant force, serving as both the largest production hub, particularly for farmed Pacific white shrimp (Penaeus vannamei), and a rapidly expanding consumer market due to increasing middle-class populations in countries like China and India. North America and Europe remain key consumption markets, characterized by high demand for premium, value-added, and traceable products. Segment trends indicate that the peeled and deveined (P&D) category commands the largest market share due to its superior convenience. Additionally, the increasing demand for cooked, frozen shelled shrimp is notable, reflecting the desire for maximum ease of preparation in both retail and foodservice settings.

The overarching strategic imperative for market players involves supply chain resilience and quality control. With international trade remaining fundamental to this market, geopolitical stability and effective tariffs management play crucial roles in maintaining profitability. Future market expansion will be contingent upon successfully addressing challenges related to disease management in aquaculture farms, reducing the carbon footprint of production, and adapting to fluctuating raw material prices, often dictated by harvests in Southeast Asia and Latin America.

AI Impact Analysis on Shelled Shrimp Market

Common user questions regarding AI's impact on the Shelled Shrimp Market primarily revolve around four themes: Can AI improve aquaculture yields and disease prediction? How can AI ensure faster, more accurate sorting and quality control in processing plants? Will AI-driven logistics reduce spoilage and supply chain costs? And finally, how will predictive analytics influence global shrimp pricing and procurement strategies? Users are keenly interested in operational efficiencies and enhanced food safety resulting from technological integration. The analysis reveals that the primary expectation is that AI will revolutionize the upstream segment (farming) by optimizing feed conversion ratios (FCR) and detecting pathogens early, thereby securing a more stable and high-quality supply of raw shrimp for shelling.

The implementation of Artificial Intelligence and Machine Learning (ML) in the shelled shrimp processing segment focuses heavily on automation and precision. Traditional manual shelling and inspection processes are slow and prone to human error. AI-powered vision systems are being deployed to grade shrimp based on size, color, texture, and detect subtle imperfections or contamination with significantly higher speed and accuracy than conventional methods. This not only enhances product consistency—a key selling point for major retail chains and foodservice providers—but also drastically reduces labor costs and improves throughput in high-volume production facilities. Furthermore, ML algorithms are optimizing inventory management by forecasting demand with greater precision, minimizing the need for extensive freezing capacity and reducing risks associated with fluctuating inventory levels.

In the distribution and logistics phase, AI tools are utilized for dynamic route optimization and cold chain monitoring. By analyzing real-time sensor data, AI can predict potential temperature excursions or logistical delays, allowing preemptive measures to be taken, thus preserving the quality of the frozen shelled product. This level of oversight is crucial for maintaining the integrity of sensitive seafood products exported across long distances. Although the investment in AI infrastructure is substantial, the long-term benefits in terms of yield improvement, waste reduction, and enhanced regulatory compliance position AI integration as a major competitive advantage for large-scale shrimp producers and processors globally.

- AI optimizes feed management in aquaculture, reducing Feed Conversion Ratio (FCR) and operating expenses.

- Machine learning models predict disease outbreaks (e.g., White Spot Syndrome Virus) in ponds, enabling proactive intervention.

- AI-powered optical sorting systems automate quality control, grading shrimp by size, color, and defect presence with high precision.

- Predictive maintenance analytics minimize downtime in shelling and freezing equipment, ensuring continuous processing flows.

- AI enhances supply chain traceability and transparency using blockchain integration and smart logistics planning.

- Demand forecasting algorithms improve inventory management for frozen shelled products, minimizing waste and storage costs.

DRO & Impact Forces Of Shelled Shrimp Market

The market dynamics of the Shelled Shrimp sector are governed by a complex interplay of Drivers, Restraints, and Opportunities (DRO), which collectively form the impact forces shaping market growth trajectories. A primary Driver is the overwhelming consumer demand for convenience foods, particularly high-protein, easily prepared seafood items, fueled by accelerating global urbanization and dual-income households. This demand is further amplified by technological advances in flash freezing and cold chain management, allowing high-quality products to reach distant markets efficiently. Coupled with this is the continuous growth and refinement of aquaculture techniques, particularly in Asia, ensuring a stable and cost-effective supply of raw material.

However, the market faces significant Restraints, predominantly centered on biological risks and regulatory hurdles. Shrimp aquaculture is susceptible to severe disease outbreaks, which can instantaneously wipe out massive harvests, leading to supply instability and volatile pricing. Moreover, stringent regulations regarding antibiotics use, environmental discharge standards, and import quotas in major consuming regions (EU, US) increase operational complexity and compliance costs. The industry also grapples with negative perceptions and potential boycotts related to unsustainable harvesting practices or labor issues in certain production regions, requiring substantial investment in traceability and ethical sourcing verification.

The primary Opportunities lie in diversification and sustainability. Developing value-added products beyond basic peeled shrimp, such as marinated, breaded, or pre-cooked ready meals, offers higher profit margins and caters to specialized consumer niches. Furthermore, adopting advanced sustainable farming technologies, including closed recirculation aquaculture systems (RAS) or biofloc technology, reduces disease risk and environmental impact, unlocking premium market access. The overall impact force matrix suggests that while biological and environmental risks pose persistent challenges, the dominant forces of convenience-driven demand, coupled with technological solutions in processing and sustainability, will continue to exert a strong positive influence, propelling market expansion over the forecast period.

Segmentation Analysis

The Shelled Shrimp Market is segmented based on the level of processing, the origin species, the freezing technology employed, and the distribution channel used to reach the final consumer. This segmentation is crucial as it dictates pricing strategies, product differentiation, and target market focus for manufacturers. The primary differentiation factor remains the preparation level, categorizing products into raw, cooked, or marinated forms, where raw shelled shrimp dominate the volume, but cooked and value-added forms provide superior revenue growth due to higher per-unit pricing. Geographic segmentation highlights the disparity between high-volume production centers in Asia Pacific and high-value consumption markets in North America and Europe, influencing global trade flows and logistics requirements.

- By Product Type:

- Raw Shelled Shrimp (Peeled, Undeveined; Peeled, Deveined - P&D)

- Cooked Shelled Shrimp (Cooked, P&D; Cooked, Tail-on)

- Value-Added/Marinated Shelled Shrimp

- By Species:

- Penaeus vannamei (Pacific White Shrimp)

- Penaeus monodon (Black Tiger Shrimp)

- Macrobrachium rosenbergii (Giant River Prawn)

- Others (e.g., Pink Shrimp, Northern Shrimp)

- By Freezing Technology:

- Individual Quick Freezing (IQF)

- Block Freezing

- By Distribution Channel:

- Food Service (Horeca, Institutional Buyers)

- Retail (Supermarkets/Hypermarkets, Convenience Stores, Specialty Seafood Stores, Online Retail)

Value Chain Analysis For Shelled Shrimp Market

The value chain for the Shelled Shrimp Market is intricate and highly globalized, starting from the upstream sector encompassing hatcheries, feed manufacturing, and shrimp farming (aquaculture). The efficiency and health of the upstream supply significantly impact the final product quality and price volatility. Hatcheries provide post-larvae (PL) to farms, which rely on specialized feed, often enriched with specific proteins and additives. As farming transitions toward more sustainable and controlled environments (like biofloc or RAS), the upstream investment in high-quality PL and advanced nutrition becomes paramount, establishing the foundation of traceability and quality assurance required by demanding international buyers.

The midstream sector is defined by processing and distribution. Raw shrimp harvested from farms are transported to processing plants where the critical steps of de-heading, peeling, deveining, cooking (if required), and freezing take place. This stage is highly capital-intensive, requiring specialized, often automated, equipment for high-volume shelling and IQF freezing to maintain textural integrity. Quality testing, regulatory compliance checks (HACCP, ISO), and packaging for export or domestic sale are also concentrated here. Distribution channels are varied; direct routes involve large processors supplying major retail chains or foodservice giants, while indirect routes utilize international commodity traders, brokers, and third-party logistics (3PL) providers specializing in refrigerated cargo, ensuring the frozen product moves seamlessly from Asian processors to Western ports.

The downstream sector focuses on market penetration and end-user engagement, primarily divided between retail and foodservice segments. Retail distribution through supermarkets demands aesthetically pleasing, consumer-friendly packaging, and strong brand presence, often supported by targeted marketing campaigns emphasizing product origin and ease of use. The foodservice segment (restaurants, catering) demands bulk packaging, consistent sizing, and reliable year-round supply. The integration of e-commerce has shortened the distribution path for some specialty brands, allowing direct-to-consumer sales and enhanced transparency regarding the product journey from farm to table. Successfully navigating this value chain requires deep expertise in cold chain logistics and strong regulatory compliance across multiple jurisdictions.

Shelled Shrimp Market Potential Customers

The end-users and buyers of shelled shrimp products are highly diverse, encompassing a wide spectrum of commercial entities and individual consumers motivated by convenience, quality, and culinary versatility. One of the largest customer bases resides in the institutional food service segment, which includes major restaurant chains (especially seafood specialists, Asian cuisine concepts, and buffets), catering services for corporate or public events, and institutional buyers like schools, hospitals, and military facilities. These customers prioritize consistent volume, strict specifications regarding piece count and size grading, and competitive bulk pricing, requiring a reliable B2B supply relationship established through long-term contracts with major processors.

The retail sector represents the most visible segment of potential customers, catering directly to household consumers. This includes global supermarket chains and hypermarkets, which stock frozen packaged shelled shrimp in various formats (P&D, cooked, raw, tail-on). Consumer buying behavior in this segment is increasingly influenced by factors beyond price, such as product traceability, sustainability certifications (e.g., MSC, ASC), organic labeling, and convenience features like resealable packaging or microwavable options. Furthermore, specialty seafood shops and gourmet food retailers target customers willing to pay a premium for specific, high-quality species or regional specialties, requiring sophisticated supply chains focused on niche procurement.

A rapidly growing segment of potential customers is the Prepared Meals and Food Manufacturing Industry. Large-scale food companies utilize shelled shrimp as a key ingredient in frozen ready meals, pasta sauces, pre-made salads, and packaged appetizers. These manufacturers require industrial quantities that adhere to exceptionally strict food safety standards and ingredient specifications. Their demand is highly inelastic and often based on forward contracts, ensuring stable purchasing volumes for processors. The rise of meal kit delivery services also represents a new, dynamic customer segment seeking high-quality, pre-portioned shelled shrimp for inclusion in their rotating menu offerings, emphasizing high visual appeal and minimal preparation time for the final consumer.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 35.5 Billion |

| Market Forecast in 2033 | USD 52.8 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Thai Union Group, Charoen Pokphand Foods PCL, Nippon Suisan Kaisha, Ltd., Maruha Nichiro Corporation, Marel, High Liner Foods Incorporated, Seaprimex, Surapon Foods, Clearwater Seafoods Incorporated, Mowi ASA, Ocean Beauty Seafoods, Empresas AquaChile S.A., Sajo Industries Co., Ltd., Pacific Andes International Holdings, Rich Products Corporation, Mazzetta Company, Iberconsa, Cooke Aquaculture, Aqua Star, Vinh Hoan Corporation |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Shelled Shrimp Market Key Technology Landscape

The technological landscape in the Shelled Shrimp Market is characterized by innovations aimed at enhancing efficiency, ensuring safety, and maximizing product quality throughout the value chain, particularly concerning preservation and processing. Individual Quick Freezing (IQF) remains the foundational and most critical technology, ensuring that each piece of shrimp is rapidly frozen individually. This prevents clumping, preserves the texture, and allows for flexible portioning, making IQF-shelled shrimp the preferred format in both retail and foodservice sectors. Advancements in cryogenic freezing using liquid nitrogen or carbon dioxide are also gaining traction, particularly for premium products, as they achieve ultra-rapid freezing rates that minimize cellular damage and maintain superior sensory attributes.

In processing plants, automation technology is rapidly replacing manual labor for the shelling and deveining processes. Advanced robotic and semi-automated machinery utilizes high-pressure water jets, specialized blade systems, and sophisticated optical scanners to execute delicate shelling tasks quickly and with minimal product breakage. These systems are integrated with Machine Vision technology, which uses high-resolution cameras and pattern recognition algorithms to inspect shrimp on the conveyor belt, automatically sorting based on species, size, weight, and detecting foreign materials or defects. This level of automation significantly boosts throughput, improves hygiene standards, and addresses persistent labor shortages in many large-scale processing hubs.

Furthermore, technology focused on traceability and sustainability is becoming mandatory. The implementation of sensor-based monitoring systems tracks temperature and humidity throughout the cold chain from farm to fork, generating immutable data logs critical for regulatory compliance and quality assurance. Alongside physical tracking, blockchain technology is being explored to create decentralized, verifiable records of product origin, processing history, and certification status. This technological transparency is vital for satisfying the consumer demand for ethical sourcing and combating illegal, unreported, and unregulated (IUU) fishing, reinforcing the credibility of the shelled shrimp supply chain globally.

Regional Highlights

The global Shelled Shrimp Market exhibits distinct consumption and production profiles across major geographic regions, heavily influencing international trade patterns and market saturation levels. Asia Pacific (APAC) stands as the undisputed leader in both production and future growth potential. Countries such as Vietnam, Thailand, India, Indonesia, and Ecuador (though geographically outside APAC, Ecuador is a major Pacific rim producer) dominate global aquaculture output, especially for Penaeus vannamei. APAC’s competitive advantage lies in its suitable climate, lower labor costs, and developed processing infrastructure geared toward mass export. The regional consumer market is also rapidly expanding, driven by rising disposable incomes and changing dietary habits favoring protein-rich seafood.

North America, particularly the United States, represents the largest single consumption market globally for imported shelled shrimp. Demand here is characterized by a strong preference for large, P&D, and cooked shrimp, driven by the massive foodservice sector and high retail spending power. The market is highly sensitive to food safety standards and import regulations, requiring exporters to comply with strict FDA guidelines and often demanding sustainability certifications. The US market is highly dynamic, witnessing constant shifts in pricing due to trade policies and disease-related supply fluctuations from Asian and Latin American producers.

Europe constitutes another major import hub, defined by fragmented consumer preferences and rigorous sustainability mandates, particularly within the European Union. Western European nations like Spain, France, and the UK have historically high seafood consumption rates. However, European buyers prioritize certifications (e.g., GlobalG.A.P., ASC) and strict chemical residue limits, necessitating complex compliance procedures for third-country exporters. Latin America is significant primarily as a major exporting region (Ecuador, Mexico) focusing on cost-effective mass production to serve US and EU markets, while the Middle East and Africa (MEA) present burgeoning consumption growth, fueled by expatriate populations and growing tourism sectors, requiring increased imports of frozen, high-quality products.

- Asia Pacific (APAC): Dominates global production volume; strong domestic market growth driven by China and India; key exporter of raw and processed shrimp globally.

- North America: Largest consumption market by value; high demand for ready-to-eat and value-added frozen products; strict import standards and food safety regulations.

- Europe: High emphasis on sustainability and traceability certifications (ASC/MSC); fragmented market with significant demand concentrated in Western EU member states; stringent chemical residue and quality controls.

- Latin America: Major global supplier, particularly Ecuador and Mexico, focusing on efficient, large-scale Penaeus vannamei farming for export markets.

- Middle East and Africa (MEA): Emerging consumer market with rapidly growing demand driven by tourism, hospitality sector expansion, and increasing affluent populations requiring high-quality imports.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Shelled Shrimp Market.- Thai Union Group

- Charoen Pokphand Foods PCL

- Nippon Suisan Kaisha, Ltd.

- Maruha Nichiro Corporation

- Marel

- High Liner Foods Incorporated

- Seaprimex

- Surapon Foods

- Clearwater Seafoods Incorporated

- Mowi ASA

- Ocean Beauty Seafoods

- Empresas AquaChile S.A.

- Sajo Industries Co., Ltd.

- Pacific Andes International Holdings

- Rich Products Corporation

- Mazzetta Company

- Iberconsa

- Cooke Aquaculture

- Aqua Star

- Vinh Hoan Corporation

Frequently Asked Questions

Analyze common user questions about the Shelled Shrimp market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary factors driving the growth of the Shelled Shrimp Market?

The market growth is primarily driven by three key factors: the increasing consumer demand for convenient, ready-to-cook protein options due to busy lifestyles; advancements in IQF (Individual Quick Freezing) technology which preserve quality and extend shelf life; and the stable, cost-effective supply chain established by large-scale aquaculture operations, predominantly in Asia and Latin America.

Which species dominates the global supply of processed, shelled shrimp?

The Pacific White Shrimp (Penaeus vannamei) overwhelmingly dominates the global supply of processed, shelled shrimp. Its suitability for high-density farming, fast growth rate, and resilience to various environments make it the most economically viable species, accounting for the vast majority of globally traded farmed shrimp products used for shelling.

What are the main risks associated with shrimp aquaculture that impact the shelled product supply?

The main risks are biological, primarily centered on virulent disease outbreaks, such as White Spot Syndrome Virus (WSSV) and Early Mortality Syndrome (EMS). These diseases can cause rapid, catastrophic crop loss, leading to significant supply shortages and subsequent price volatility in the shelled shrimp market, necessitating high biosecurity standards in farms.

How does the distribution channel influence the pricing of shelled shrimp?

The distribution channel significantly influences pricing. Shelled shrimp sold through the Food Service segment (bulk B2B sales) typically command lower per-unit prices but require high-volume contracts. Conversely, products sold through the Retail segment, especially specialized or value-added, branded options in supermarkets, carry higher profit margins due to sophisticated packaging, marketing, and the inclusion of sustainability premiums.

How is technology being utilized to improve traceability in the shelled shrimp value chain?

Technology is enhancing traceability through the adoption of sensor-based cold chain monitoring (IoT) and blockchain ledger systems. These technologies provide verifiable, immutable records of the shrimp’s origin, processing date, temperature history, and certification status, ensuring full transparency for importers and consumers regarding ethical sourcing and food safety compliance.

What role do sustainability certifications play in the North American and European shelled shrimp markets?

Sustainability certifications, such as Aquaculture Stewardship Council (ASC) and Best Aquaculture Practices (BAP), are critical gatekeepers for premium access in North America and Europe. Major retailers and foodservice companies increasingly require these certifications to demonstrate commitment to environmental stewardship and social responsibility, making compliance a necessity for sustained market access rather than just a competitive advantage.

Explain the significance of Individual Quick Freezing (IQF) in maintaining shelled shrimp quality.

IQF is essential because it flash-freezes each shrimp individually very rapidly. This process locks in the natural moisture and texture, preventing large ice crystal formation that typically damages cell structure during slow freezing. By preventing clumping and preserving quality, IQF ensures the shelled shrimp retains its superior sensory attributes (texture and flavor) upon thawing and cooking.

How does the rise of e-commerce impact the traditional retail distribution of shelled shrimp?

The rise of e-commerce, particularly specialized frozen seafood delivery and meal kit services, challenges traditional brick-and-mortar retail by shortening the supply chain. It allows niche brands to reach consumers directly, offering enhanced traceability information and premium pricing, while placing pressure on traditional retailers to improve their frozen logistics capabilities and competitive pricing.

What are the primary differences in demand between raw and cooked shelled shrimp products?

Raw shelled shrimp (P&D) accounts for the largest volume and is favored by high-volume foodservice providers and home cooks who prefer maximum culinary versatility. Cooked shelled shrimp, however, commands a premium price and is driven by the ultra-convenience segment—consumers and manufacturers needing ready-to-eat ingredients for salads, cocktails, or pre-packaged meals, prioritizing speed and safety.

How does automation technology enhance food safety during the shelling process?

Automation technology enhances food safety by minimizing human contact with the product, thereby reducing the risk of microbial contamination. Automated shelling and inspection systems operate under strict hygienic conditions, and integrated optical scanners can detect foreign materials or product defects that are invisible or easily missed by human inspectors, ensuring higher product purity and regulatory compliance.

Which regional market is anticipated to show the fastest CAGR for shelled shrimp consumption?

While North America remains the largest market by value, the Asia Pacific (APAC) region is anticipated to demonstrate the fastest Compound Annual Growth Rate (CAGR) in consumption. This acceleration is fueled by the rapid expansion of the urban middle class, increased cold chain investment, and the internalization of high-quality processing standards, driving domestic demand across major producing countries.

What is the current trend regarding Penaeus monodon (Black Tiger Shrimp) consumption?

Penaeus monodon, or Black Tiger Shrimp, is typically associated with a premium segment. Although its volume is significantly lower than P. vannamei due to slower growth rates and higher farming complexity, it maintains stable demand in high-end foodservice and gourmet retail markets due to its larger size, distinct texture, and visually appealing coloration when cooked.

Define the concept of "value-added" products within the Shelled Shrimp Market.

Value-added products refer to shelled shrimp that have undergone secondary processing beyond basic peeling and freezing. This includes marinating with sauces or spices, breading, skewering, or incorporating the shrimp into multi-ingredient ready-to-eat meal components. These products offer superior consumer convenience and typically realize significantly higher retail prices.

Why is supply chain resilience a major strategic focus for large shrimp processors?

Supply chain resilience is vital because global shelled shrimp supply is vulnerable to unpredictable events, including disease outbreaks in farming regions, geopolitical tensions affecting trade routes, and climate-related disruptions. Major processors prioritize resilience by diversifying sourcing geographically and investing in vertical integration to mitigate volatility and ensure consistent, year-round product availability for global contracts.

How is the move toward closed-loop aquaculture systems affecting the cost structure?

Closed-loop systems like Recirculating Aquaculture Systems (RAS) require high initial capital investment in technology and infrastructure. While they initially increase production costs compared to traditional open pond farming, they offer predictable yields, significantly reduce water usage, minimize external disease risk, and often result in premium pricing due to superior quality and environmental benefits, leading to better long-term operational stability and reduced risks.

What impact does fluctuating commodity feed pricing have on the shelled shrimp retail price?

Feed constitutes a major operational expense in shrimp aquaculture. Fluctuations in key feed ingredients like fishmeal, soybeans, or wheat directly impact the farming cost base. Processors typically absorb short-term volatility, but sustained increases in feed prices are generally passed down the value chain, leading to increased wholesale and eventual retail prices for shelled shrimp products.

Describe the key operational challenge faced by processors regarding size grading and consistency.

The key operational challenge is ensuring consistent and accurate size grading, which is paramount for commercial buyers and retail packaging. Inaccurate grading leads to financial penalties and client dissatisfaction. Modern processors rely on high-speed, AI-enabled optical sorting machines to overcome the inconsistencies inherent in manual or less sophisticated mechanical grading, thereby maximizing the value of the raw material.

What role does the hospitality (Horeca) sector play in the total market consumption?

The hospitality sector (Hotels, Restaurants, Catering, or Horeca) is a cornerstone of shelled shrimp consumption, particularly in developed markets. It demands large quantities of consistently sized, high-quality, pre-shelled products to minimize kitchen labor and food preparation time. The sector’s demand patterns are highly sensitive to global tourism and economic conditions.

How are processors responding to consumer demands for antibiotic-free shrimp?

Processors are responding to the demand for antibiotic-free shrimp by implementing stringent farm-level monitoring, shifting toward preventative health management practices, and utilizing advanced farming techniques (e.g., biofloc systems) that minimize the need for prophylactic treatments. Mandatory third-party testing and certification programs further validate antibiotic-free claims for consumers in critical markets like the EU and the US.

What is the forecasted impact of climate change on shrimp supply and market dynamics?

Climate change poses a significant threat, primarily through increased frequency of severe weather events (hurricanes, floods) that damage coastal farms, and shifts in water temperature and salinity, which stress farmed shrimp populations and increase disease susceptibility. The forecasted impact is reduced supply stability, higher insurance costs, and geographic shifts in optimal farming regions, potentially increasing market volatility over the long term.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager