Ship Autopilot System Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435017 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Ship Autopilot System Market Size

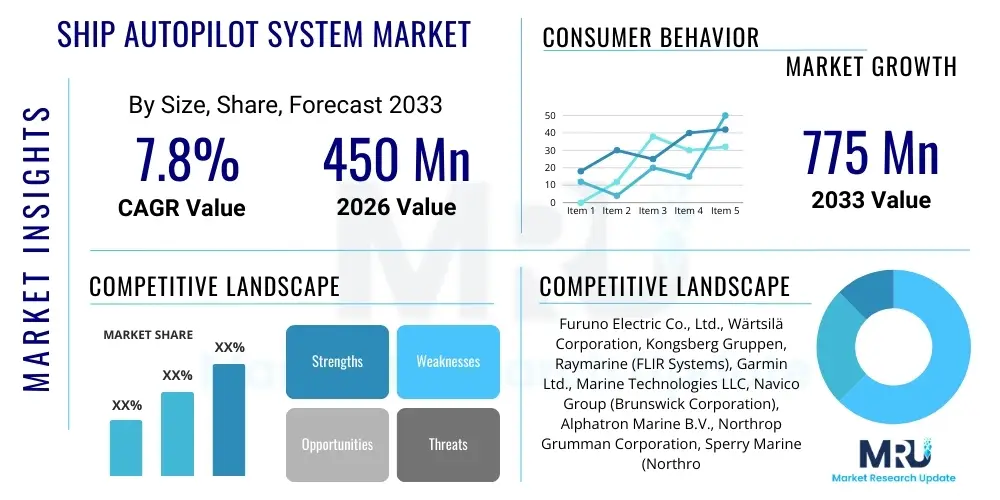

The Ship Autopilot System Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at USD 450 Million in 2026 and is projected to reach USD 775 Million by the end of the forecast period in 2033.

Ship Autopilot System Market introduction

The Ship Autopilot System Market encompasses sophisticated electronic and mechanical assemblies designed to automatically steer a vessel without continuous manual input from the crew. These systems utilize advanced navigation inputs, including data from GPS/GNSS receivers, magnetic compasses, and inertial navigation systems (INS), processed by control units to manage the rudder or steering gear actuators. The primary objective is maintaining a preset course (heading control) or following a defined track (track control) with high precision, optimizing fuel consumption, and reducing navigational fatigue for maritime personnel. The increasing global trade volumes, coupled with stringent requirements for operational efficiency and safety mandated by international organizations like the IMO (International Maritime Organization), serve as fundamental drivers for the adoption of these technologies across the global fleet.

Product sophistication ranges from standard hydraulic or electrical systems found on recreational boats and smaller commercial vessels to complex, fully integrated bridge systems utilized on large tankers, container ships, and naval vessels. Modern autopilot systems are often integrated components of a vessel's overall bridge management system (BMS), communicating seamlessly with Electronic Chart Display and Information Systems (ECDIS), radars, and Dynamic Positioning (DP) systems. Key applications span the entire maritime sector, including long-haul commercial shipping, specialized offshore operations, passenger ferries, and high-speed defense craft, where precise course keeping is paramount for safety and schedule adherence.

The benefits derived from implementing ship autopilot systems are multifaceted, primarily revolving around enhanced operational performance and cost reduction. These systems significantly improve navigational accuracy, ensuring the vessel adheres precisely to optimized routes, which directly contributes to substantial fuel savings—a critical factor in mitigating the high operating costs associated with international shipping. Furthermore, the automation provided by these systems allows bridge officers to dedicate more attention to critical tasks such as collision avoidance, threat assessment, and monitoring other essential vessel parameters, thereby enhancing overall situational awareness and maritime safety compliance, a crucial element in the highly regulated shipping industry environment.

Ship Autopilot System Market Executive Summary

The Ship Autopilot System market is experiencing robust growth driven by the pervasive trend toward maritime digitalization, operational cost optimization, and the nascent but accelerating transition towards autonomous shipping. Business trends indicate a shift from standalone autopilot units to integrated, AI-enhanced navigation suites, where system providers are offering comprehensive bridge solutions that merge autopilot functionalities with sensor fusion, predictive maintenance capabilities, and advanced route planning software. Key industry players are focusing heavily on developing robust cyber-secure systems capable of handling the increasing complexities of real-time data processing required for high-accuracy track control in congested waterways. Strategic collaborations between technology firms and ship builders are accelerating the deployment of these advanced systems in new vessel constructions and major retrofit projects across established shipping lanes.

Regionally, Asia Pacific (APAC) dominates the market, primarily due to the massive shipbuilding capacity concentrated in countries like China, South Korea, and Japan, which mandates the installation of standardized navigation equipment. However, North America and Europe are pivotal in driving technological innovation, particularly concerning the deployment of sophisticated autonomous navigation pilot projects and compliance with stringent environmental regulations (which demand optimized, fuel-efficient routing). Regulatory harmonization across different maritime zones remains a key regional challenge, influencing how quickly advanced autonomous features can be adopted globally, although the IMO is consistently working toward establishing clear guidelines for Maritime Autonomous Surface Ships (MASS).

Segmentation trends highlight the increasing demand for advanced autopilot systems that utilize inertial navigation (INS) and GNSS correction services for centimeter-level accuracy, especially in the defense and offshore support vessel segments where dynamic positioning is essential. By component, the sensor and control unit segments are witnessing significant investment, focusing on developing ruggedized, highly reliable components resistant to harsh marine environments. Furthermore, commercial vessels, particularly large container ships and oil tankers, remain the largest application segment, emphasizing reliability, redundancy, and ease of integration with existing legacy bridge electronics. The aftermarket segment, driven by the need to upgrade older vessels to meet current efficiency standards, also represents a substantial growth opportunity.

AI Impact Analysis on Ship Autopilot System Market

Common user inquiries regarding AI’s impact on ship autopilot systems frequently center on concerns about reliability, cyber resilience, and regulatory acceptance for autonomous operation. Users often question how AI algorithms can handle complex, unpredictable scenarios such as severe weather, dense traffic in restricted areas, or equipment failure, asking specifically about the transition protocols between AI control and human override. There is also significant interest in the competitive advantage provided by AI in route optimization, predicting environmental variables (like currents and waves), and reducing human error. The overarching theme is the balancing act between achieving the promised efficiency gains of AI-driven navigation and ensuring the absolute safety and regulatory compliance required for ocean travel, leading to expectations that AI will initially function as a decision support layer before taking over full control.

- AI facilitates predictive course correction, reducing energy waste by anticipating environmental changes (waves, currents).

- Machine learning algorithms enhance collision avoidance capabilities far beyond traditional radar plotting by analyzing complex, multi-vessel scenarios.

- AI enables sophisticated sensor fusion, integrating data from LIDAR, radar, cameras, and sonar for comprehensive situational awareness.

- Integration of AI supports advanced health monitoring and predictive maintenance for steering gears and control units.

- It is foundational for achieving higher levels of autonomy (MASS), progressing toward fully unmanned vessel operations.

- AI tools improve human-machine interface (HMI) design, providing prioritized, actionable data to bridge officers during automated navigation.

DRO & Impact Forces Of Ship Autopilot System Market

The market dynamics are defined by a confluence of accelerating factors that mandate sophisticated navigation solutions, tempered by operational complexities and the need for significant infrastructure investment. Drivers include the global mandate for operational efficiency, especially reducing fuel consumption through optimized routing, and the push towards autonomous vessel technology to combat the shortage of skilled maritime labor. Restraints largely center on the prohibitively high initial capital expenditure for installing advanced, integrated bridge systems and the associated technical training requirements for crew. Cybersecurity vulnerability is also a major restraint, as these connected systems become increasingly susceptible to remote malicious attacks, demanding robust security protocols. Opportunities lie primarily in the development and commercialization of MASS technologies and the modernization of older fleets to comply with increasingly strict environmental regulations, such as the IMO’s Carbon Intensity Indicator (CII).

Impact forces shape the trajectory of market adoption. Technological advancement, particularly the maturity of sensor technology and computational power (Moore’s Law applied to marine electronics), rapidly lowers the cost-to-performance ratio, making advanced systems more accessible. Simultaneously, regulatory shifts, spearheaded by the IMO and regional bodies like the EU, dictate the pace and requirements for technology implementation, especially regarding safety standards and cybersecurity. Economic factors, such as volatile bunker fuel prices, heavily influence the return on investment calculation for shipowners, thereby driving demand for efficient autopilot systems that minimize route deviations and time at sea. The market is also heavily influenced by competitive dynamics, where integrated solution providers leverage their expansive portfolios to offer end-to-end navigational ecosystems.

Crucially, standardization across different vendor platforms remains a significant impact force. A lack of universal protocols for data exchange between autopilot systems, ECDIS, and other navigational aids can hinder seamless integration and system interoperability, particularly during vessel retrofitting. The industry is currently witnessing a push toward open architectures to facilitate easier integration and maintenance. Furthermore, the geopolitical environment, affecting global trade routes and the security needs of naval forces, dictates continuous innovation in high-precision, redundant navigation systems, ensuring market resilience even during periods of trade volatility.

Segmentation Analysis

The Ship Autopilot System market is comprehensively segmented across several key dimensions, providing a granular view of specific technological preferences, application requirements, and geographical demand patterns. The primary segmentation revolves around the core technology used for navigational input, the components making up the system, the types of vessels that utilize these systems, and the system complexity. Analyzing these segments is critical for manufacturers to tailor their R&D investments, ensuring compliance with diverse vessel class needs, ranging from the reliability-focused requirements of commercial tankers to the high-redundancy needs of naval platforms. The trend is moving toward convergence, where technology segments like GPS and INS are increasingly used in tandem to provide highly resilient and accurate positioning data, enabling advanced track control functionalities necessary for autonomous readiness.

In terms of application, the commercial vessel segment, dominated by cargo and logistics ships, accounts for the largest market share due to the sheer volume of the global mercantile fleet and the intensive focus on voyage optimization for maximizing profitability. Conversely, the defense segment, while smaller in volume, drives innovation, demanding systems with enhanced stealth capabilities, high-speed accuracy, and hardened security against jamming and spoofing attacks. Component-wise, the demand for sophisticated sensors, particularly those that enable 3D mapping of the surrounding environment, is outpacing growth in traditional actuator units, reflecting the shift toward proactive environmental awareness rather than reactive course correction. The forecast suggests sustained growth in the advanced autopilot system segment, driven by new regulations promoting efficient vessel operation.

- By Technology:

- Magnetic Compass Autopilot Systems

- GPS/GNSS Autopilot Systems

- Inertial Navigation Systems (INS) based Autopilot

- Hybrid/Sensor Fusion Systems

- By Component:

- Control Units/Processors (The Brain)

- Actuators (Steering Gear Interface)

- Sensors (Rudder Feedback, Fluxgate, Gyro Compass)

- Display Units and Human-Machine Interface (HMI)

- By Application:

- Commercial Vessels (Tankers, Cargo Ships, Bulk Carriers)

- Defense Vessels (Frigates, Submarines, Patrol Vessels)

- Recreational Boats and Yachts

- Specialized Vessels (Offshore Support, Fishing, Research)

- By Type:

- Standard Autopilot Systems (Heading Control)

- Advanced Autopilot Systems (Track Control, Weather Routing Integration)

Value Chain Analysis For Ship Autopilot System Market

The value chain for Ship Autopilot Systems begins with upstream activities, primarily involving the design and manufacturing of high-precision electronic components, including microprocessors, GNSS chipsets, gyroscopes, and specialized marine sensors. Key upstream suppliers include technology companies specializing in ruggedized electronics and software developers focused on robust navigation algorithms and AI processing cores. The quality and reliability of these upstream components directly dictate the performance and longevity of the final product, necessitating rigorous testing and certification processes to meet stringent maritime standards (e.g., IMO, Class Societies). Supply chain resilience, particularly for crucial semiconductor components, has become a key focus area following global supply disruptions.

Midstream, the value chain is dominated by system integrators and Original Equipment Manufacturers (OEMs) who assemble these components, develop proprietary control software, and integrate the autopilot unit into a cohesive bridge system. Major maritime electronics providers like Kongsberg, Wärtsilä, and Garmin utilize extensive R&D capabilities to ensure seamless interoperability between the autopilot, ECDIS, radar, and propulsion control. This stage involves significant value addition through software development, system redundancy design, and customization based on vessel type (e.g., dynamic positioning systems for offshore vessels). Certification by classification societies (e.g., Lloyd's Register, DNV) is mandatory before deployment, representing a crucial gate in the value chain.

Downstream activities involve distribution channels, installation, commissioning, and post-sales maintenance. Distribution is executed both directly, particularly for large naval or new-build commercial contracts handled by major integrators, and indirectly through a global network of specialized marine electronics distributors, dealers, and installation workshops. The aftermarket support, including software updates, calibration, and repair services, is critical and constitutes a substantial revenue stream, ensuring the continuous operational accuracy and security of the installed systems throughout the vessel’s lifecycle. The shift toward remote diagnostics and software-as-a-service (SaaS) models for autopilot performance monitoring further optimizes the downstream service delivery.

Ship Autopilot System Market Potential Customers

The primary customers and end-users of ship autopilot systems span the global maritime ecosystem, reflecting the diverse applications of these navigational aids. The largest customer segment comprises commercial ship operators and owners, including major container shipping lines (like Maersk, CMA CGM), bulk carrier fleets, and oil and gas tanker companies. These customers prioritize systems that offer superior fuel efficiency through precise track keeping and rapid return on investment (ROI) derived from optimized voyage planning. Shipyards, acting as procurement intermediaries during new construction, are also crucial customers, often specifying particular OEM systems based on integration capabilities and pricing agreements, favoring robust and globally supported systems.

Another significant customer base includes governmental and defense organizations. Naval forces require highly specialized, redundant autopilot systems capable of operating under extreme conditions and integrating advanced covert navigation features, often procured through high-value, long-term defense contracts. Similarly, coast guards and maritime enforcement agencies utilize these systems for efficient patrol and search-and-rescue operations. Finally, the recreational boating and yachting community forms a substantial segment, demanding user-friendly, reliable, and often aesthetically integrated systems, typically sourced through marine equipment retail channels and specialized yacht outfitters.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450 Million |

| Market Forecast in 2033 | USD 775 Million |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Furuno Electric Co., Ltd., Wärtsilä Corporation, Kongsberg Gruppen, Raymarine (FLIR Systems), Garmin Ltd., Marine Technologies LLC, Navico Group (Brunswick Corporation), Alphatron Marine B.V., Northrop Grumman Corporation, Sperry Marine (Northrop Grumman), Tokimec Inc., Yokogawa Electric Corporation, Siemens AG, Damen Shipyards Group, Rolls-Royce Holdings plc (Power Systems), Rh Marine, C-Map (Navico), OSI Maritime Systems, Consilium AB, Hyundai Heavy Industries Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Ship Autopilot System Market Key Technology Landscape

The technological landscape of the Ship Autopilot System market is rapidly evolving, moving beyond traditional magnetic and gyro compass inputs toward sophisticated sensor fusion and digital control. The foundational shift involves integrating high-accuracy positioning technologies such as Real-Time Kinematic (RTK) GNSS and sophisticated Inertial Navigation Systems (INS). INS provides highly reliable positioning and attitude data, crucial when external GNSS signals are degraded or unavailable (e.g., due to spoofing or jamming). The utilization of advanced micro-electromechanical systems (MEMS) within INS has driven down costs while increasing performance, making hybrid INS/GNSS solutions the de facto standard for high-end commercial and defense applications, ensuring system redundancy and accuracy, especially critical for tight maneuvering.

A central technological focus is the advancement of the control algorithms themselves. Modern autopilots employ adaptive control systems that utilize machine learning (ML) to dynamically adjust steering parameters based on sea state, vessel speed, and load condition, moving away from static PID (Proportional-Integral-Derivative) controllers. This adaptive capability maximizes efficiency, minimizes wear and tear on steering components, and significantly improves fuel economy by reducing unnecessary rudder movements. Furthermore, the incorporation of hydrodynamics modeling into the control loop allows the autopilot to anticipate the vessel’s response to external forces, resulting in smoother, more stable navigation, a key performance indicator for both passenger comfort and structural longevity.

The future of the technology landscape is inherently tied to Generative AI and the development of digital twins. Manufacturers are increasingly using digital twin technology to simulate complex marine environments and test autopilot performance under various fault scenarios and extreme weather conditions before physical deployment. Connectivity is paramount; thus, the proliferation of high-speed satellite communication (VSAT, LEO satellite constellations) enables real-time data streaming between the vessel and shore-based operational centers. This facilitates remote monitoring, over-the-air software updates, and the implementation of shore-based remote control capabilities, laying the necessary infrastructure groundwork for fully autonomous, regulated vessel operations (MASS Level 4).

Regional Highlights

Regional dynamics heavily influence the demand and technological penetration of ship autopilot systems, reflecting varying shipbuilding rates, regulatory regimes, and maritime commerce volumes across the globe. Asia Pacific (APAC) stands as the undisputed market leader, primarily driven by China, South Korea, and Japan, which together constitute the world’s largest shipbuilding hubs. The demand here is massive, driven by high volumes of new vessel construction, where sophisticated navigation systems are mandatory installations. Furthermore, expanding naval modernization programs in countries like India and Australia contribute significantly to the advanced autopilot segment, focusing on indigenous technology development and robust supply chains to support their fleets.

Europe represents a mature yet highly innovative market. Key drivers include stringent environmental regulations enforced by the European Union, which incentivize ship owners to adopt the most fuel-efficient, advanced track-control autopilots. Countries such as Norway, Germany, and the Netherlands are at the forefront of autonomous shipping trials and technology development, hosting leading integrators and classification societies. The European market focuses heavily on integrating autopilot systems with environmental sensors and weather optimization software to ensure compliance with the IMO’s Carbon Intensity Indicator (CII) framework, thereby promoting the premium segment of the market.

North America is characterized by robust defense spending and a strong market for specialized vessels (e.g., offshore support, research, and cruise liners). The US Navy and Coast Guard are major consumers of advanced, highly redundant systems capable of operating in diverse and contested environments. Commercial demand is concentrated around optimizing efficiency in high-traffic areas like the Panama Canal and the Great Lakes, driving adoption of precise track-keeping systems. Meanwhile, the Middle East and Africa (MEA) and Latin America regions are projected to exhibit high growth rates. MEA growth is linked to significant investment in port expansion, the modernization of regional tanker fleets, and naval defense upgrades, while Latin America's market expansion is driven by increasing commodity trade volumes necessitating better fleet management and navigational safety upgrades.

- Asia Pacific (APAC): Dominates due to world-leading shipbuilding output and large naval modernization budgets in China, South Korea, and India, emphasizing volume and integration.

- Europe: Focuses on premium, advanced systems driven by environmental mandates (CII, EEXI) and leadership in autonomous shipping trials (MASS Level 3/4).

- North America: Strong demand from the defense sector and specialized commercial vessels; early adopter of high-end sensor fusion and cyber-hardened systems.

- Middle East & Africa (MEA): Emerging high-growth area propelled by critical maritime trade routes, fleet modernization, and oil/gas industry vessel expansion.

- Latin America: Growth tied to increasing import/export trade volumes and necessary investments in modernizing aging coastal and regional commercial fleets for efficiency.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Ship Autopilot System Market.- Furuno Electric Co., Ltd.

- Wärtsilä Corporation

- Kongsberg Gruppen

- Raymarine (FLIR Systems)

- Garmin Ltd.

- Marine Technologies LLC

- Navico Group (Brunswick Corporation)

- Alphatron Marine B.V.

- Northrop Grumman Corporation

- Sperry Marine (Northrop Grumman)

- Tokimec Inc.

- Yokogawa Electric Corporation

- Siemens AG

- Damen Shipyards Group

- Rolls-Royce Holdings plc (Power Systems)

- Rh Marine

- C-Map (Navico)

- OSI Maritime Systems

- Consilium AB

- Hyundai Heavy Industries Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Ship Autopilot System market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary benefit of using an advanced ship autopilot system?

The primary benefit is optimized fuel consumption and improved operational efficiency. Advanced systems utilize adaptive algorithms and precise track control (rather than just heading control) to maintain the shortest, most efficient route, significantly reducing voyage time and bunker fuel costs.

How is AI changing ship autopilot technology?

AI integrates machine learning into autopilot systems to enable predictive navigation and enhanced collision avoidance. AI processes complex sensor data to anticipate vessel dynamics and environmental factors, facilitating smoother, safer, and more autonomous course adjustments than traditional systems.

Which technology provides the highest navigational accuracy for large commercial vessels?

Hybrid systems combining Inertial Navigation Systems (INS) with high-precision GNSS (like RTK GPS) offer the highest navigational accuracy. This sensor fusion ensures robust, continuous positioning, even if external satellite signals are temporarily compromised or unavailable.

What major regulatory factors influence the Ship Autopilot System market?

Major regulatory factors include mandates from the International Maritime Organization (IMO) regarding bridge systems and the Carbon Intensity Indicator (CII). These regulations drive demand for advanced systems that can prove precise, fuel-saving navigation necessary for compliance and emissions reduction goals.

Are ship autopilot systems vulnerable to cybersecurity threats?

Yes, modern, connected ship autopilot systems, especially those relying on external data feeds and remote monitoring, are susceptible to cyber threats such as spoofing or jamming of GNSS signals and remote network intrusion. Manufacturers prioritize secure, segregated network architectures to mitigate these risks.

What is the expected Compound Annual Growth Rate (CAGR) for this market?

The Ship Autopilot System Market is projected to exhibit a CAGR of 7.8% between 2026 and 2033, driven by increasing marine automation and demand for fuel-efficient navigation technologies across the global fleet.

How do autopilot systems contribute to reduced maritime accidents?

By automating precise course-keeping, autopilot systems free up bridge personnel to focus on high-level situational awareness, monitoring radar and AIS for potential collision threats, thereby reducing fatigue and the incidence of human error, especially during long transoceanic voyages.

What is the difference between heading control and track control in autopilot systems?

Heading control maintains a fixed compass direction (heading), regardless of drift caused by wind or current. Track control, available in advanced systems, continuously adjusts the heading to keep the vessel precisely on a pre-defined GPS track line, significantly improving routing accuracy and efficiency.

Which market segment drives the most revenue for autopilot manufacturers?

The Commercial Vessels segment, including large cargo ships, tankers, and bulk carriers, generates the largest revenue due to the sheer volume of the global merchant fleet and the continuous requirement for highly reliable, certified systems across new builds and retrofitting projects.

How does the integration of ECDIS affect autopilot operations?

Integration with ECDIS (Electronic Chart Display and Information System) is essential for advanced track control. The autopilot system receives the planned route directly from the ECDIS, allowing it to navigate the vessel precisely along digital waypoints and contours while respecting safety parameters and restricted areas.

What challenges are unique to installing autopilot systems in retrofit projects?

Retrofitting challenges include integrating modern digital systems with aging, often analog, steering gear and hydraulic interfaces, overcoming limited space in existing bridges, and ensuring electromagnetic compatibility (EMC) with legacy navigation electronics.

What role does the actuator play in the autopilot system?

The actuator is the mechanical interface that executes the commands from the control unit. It typically interfaces with the steering gear (e.g., the rudder pump) to physically move the rudder, determining the vessel’s rate of turn based on the computed course correction signal.

Which region is leading in technological innovation related to autonomous navigation?

Europe, particularly Scandinavia (Norway and Finland), is leading technological innovation in maritime autonomy (MASS), focusing on advanced sensor fusion, remote operations, and developing regulatory frameworks necessary for uncrewed vessel trials and implementation.

What are the key components included in a standard autopilot system?

A standard system typically includes a compass or heading sensor, a control unit (processor), a rudder feedback unit, and an actuator unit connected to the steering gear. The human-machine interface (HMI) for inputting settings and monitoring performance is also a crucial component.

How does the market address the issue of skilled personnel shortages?

The increasing sophistication of autopilot systems, especially through automation and AI integration, directly addresses the shortage of skilled personnel by simplifying complex navigation tasks and reducing the required human workload, paving the way for eventual remote supervision of fleet operations.

What is the difference between proprietary and open-architecture autopilot systems?

Proprietary systems are closed ecosystems, restricting component compatibility and upgrades to a single vendor's products. Open-architecture systems adhere to standards, allowing shipowners to integrate components from various manufacturers, offering greater flexibility and easier future upgrades.

How are adverse weather conditions managed by advanced autopilot systems?

Advanced autopilots integrate weather routing data and predictive hydrodynamics models. They proactively adjust steering and speed to minimize rolling and pitching, optimizing comfort and structural safety, rather than merely reacting to immediate wave and wind forces, thereby maintaining efficiency.

What is the significance of the gyroscope sensor in an autopilot system?

The gyroscope (often part of an INS or a dedicated gyrocompass) provides stable, accurate heading information regardless of the vessel’s motion (roll, pitch, yaw). This input is essential for the control unit to calculate precise steering corrections, especially in rough seas where magnetic compasses may be unreliable.

How do defense vessels’ requirements differ from commercial vessel autopilot needs?

Defense vessels require higher redundancy, immediate responsiveness for tactical maneuvers, stealth capabilities (minimal electromagnetic signature), and cyber-hardened systems resistant to signal jamming and spoofing, contrasting with the commercial focus on long-term fuel efficiency and stability.

What is the role of sensor fusion in modern autopilot technology?

Sensor fusion is the process of combining data from multiple input sources—such as GPS, INS, radar, and cameras—to create a single, highly reliable, and comprehensive picture of the vessel's position and environment. This robustness is mandatory for enabling autonomous decision-making and high-integrity navigation.

Which company holds a dominant position in the integrated bridge system market?

Companies like Wärtsilä and Kongsberg Gruppen hold dominant positions in the integrated bridge system market, offering comprehensive suites that seamlessly integrate autopilot functionalities with propulsion control, dynamic positioning, and total vessel management solutions.

Why is the maintenance and service segment crucial for this market?

The maintenance and service segment is crucial because ship autopilot systems require periodic calibration, software updates, and immediate technical support to maintain navigational accuracy and regulatory compliance throughout the vessel’s operational life, generating significant aftermarket revenue.

How does the price of bunker fuel affect autopilot adoption rates?

High and volatile bunker fuel prices significantly accelerate the adoption rate of advanced autopilot systems. The increased cost sensitivity pressures ship owners to invest in technology that guarantees immediate and substantial savings through highly optimized, fuel-efficient routing and precise course keeping.

What is the concept of a 'Digital Twin' in the context of marine autopilot systems?

A Digital Twin is a virtual replica of the physical vessel and its autopilot system, used for simulation. It allows engineers and operators to test software updates, evaluate system performance under adverse conditions, and predict maintenance needs without affecting the operational status of the actual ship.

What future development is expected to significantly impact the market by 2033?

The successful regulatory standardization and commercialization of Maritime Autonomous Surface Ships (MASS) will be the most significant impact factor, shifting the market focus entirely toward AI-driven, hyper-redundant, remote-operable navigational systems required for unmanned voyages.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager