Ship Liferafts Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433526 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Ship Liferafts Market Size

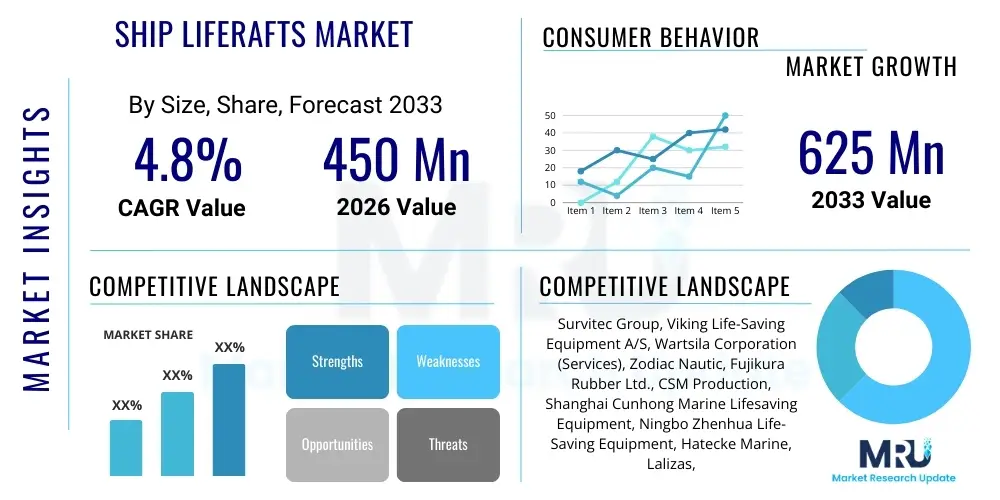

The Ship Liferafts Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at $450 Million USD in 2026 and is projected to reach $625 Million USD by the end of the forecast period in 2033.

Ship Liferafts Market introduction

The Ship Liferafts Market encompasses the manufacturing, distribution, and maintenance of specialized inflatable or rigid survival equipment designed for emergency evacuation from maritime vessels. These life-saving appliances are fundamental components of maritime safety, mandated globally by stringent international conventions, primarily the Safety of Life at Sea (SOLAS) established by the International Maritime Organization (IMO). The product category includes various types, such as davit-launched liferafts, throw-overboard liferafts, and specialized coastal or deep-sea variants, each designed to ensure the survival of crew and passengers following a catastrophic event at sea, such as sinking, fire, or collision.

Major applications of ship liferafts span across the entire maritime industry, including commercial shipping (cargo and container ships), passenger vessels (cruise ships and ferries), specialized vessels (tankers and LNG carriers), and the burgeoning offshore sector (oil rigs and wind farm support vessels). The primary benefit of these systems is the provision of a secure, buoyant, and sheltered refuge capable of sustaining occupants for an extended period until rescue services arrive, thereby directly minimizing loss of life in maritime incidents. Strict regulatory frameworks, particularly those dictating inspection frequency, capacity requirements, and material quality, act as continuous driving factors for market stability and growth.

Driving factors for sustained market expansion include the significant growth in global seaborne trade, necessitating an expansion of commercial fleets, especially in Asia Pacific. Furthermore, the increasing global scrutiny on passenger safety, particularly after high-profile maritime accidents, compels operators of cruise ships and ferries to invest in higher capacity and technologically advanced liferaft systems. Technological advancements focused on enhanced materials, improved hydrostatic release mechanisms, and simplified deployment systems are also contributing significantly to maintaining high demand for replacement and new installations.

Ship Liferafts Market Executive Summary

The Ship Liferafts Market is characterized by robust regulatory influence and consistent demand driven by fleet renewal and expansion across global shipping lanes. Key business trends indicate a strong shift towards high-durability materials and integrated monitoring systems that ensure compliance and readiness. Manufacturers are increasingly focused on developing lightweight yet robust liferafts that offer easier servicing and longer operational lifespans, addressing the high maintenance costs associated with traditional systems. Mergers and acquisitions focused on securing distribution networks and specialized expertise in hydrostatic release technology are also shaping the competitive landscape, pushing smaller regional players to specialize or consolidate.

Regionally, Asia Pacific (APAC) stands out as the primary growth engine, fueled by massive shipbuilding activity, particularly in South Korea, China, and Japan, which necessitates large volumes of new installations compliant with international standards. Europe maintains a mature market driven by replacement cycles in established commercial fleets and rigorous enforcement of EU maritime safety directives, positioning it as a leader in demanding high-specification, technologically advanced products. North America’s market is characterized by significant demand from naval applications and the burgeoning offshore oil and gas decommissioning and exploration sectors, requiring specialized, heavy-duty liferaft solutions designed for extreme environments.

Segment trends reveal that the Inflatable Liferafts segment, particularly those designed for davit-launching, holds the largest market share due to their widespread application across large passenger and cargo vessels, offering higher capacity and enhanced stability. The application segment growth is dominated by Commercial Cargo Vessels, reflecting the sheer volume of global trade, followed closely by the Passenger Ships segment, where safety redundancies and high capacity are paramount considerations. Sustainability considerations are beginning to influence material choices, though regulatory compliance remains the single most dominant factor influencing procurement decisions across all segments.

AI Impact Analysis on Ship Liferafts Market

Users frequently inquire about how AI and predictive analytics can improve the reliability and reduce the operational costs associated with mandatory liferaft maintenance and deployment. Common concerns revolve around automating the complex inspection process, integrating liferaft status data into vessel management systems (VMS), and using machine learning to predict potential failure points in materials or release mechanisms. The key themes summarized across user inquiries focus on shifting from fixed, scheduled maintenance to condition-based monitoring, leveraging AI for instant anomaly detection during high-risk weather conditions, and optimizing liferaft positioning and deployment protocols on autonomous or minimally crewed vessels. Expectations center on AI enhancing regulatory compliance verification without intensive human intervention and creating truly "smart" safety ecosystems.

- AI-Powered Predictive Maintenance: Utilizing sensor data (pressure, humidity, UV exposure) embedded in liferaft components to predict failure probability, optimizing servicing schedules beyond mandated timelines, reducing unnecessary inspections, and increasing operational readiness.

- Automated Compliance Monitoring: Machine learning algorithms analyze regulatory changes (e.g., SOLAS updates) and automatically cross-reference vessel inventory and inspection logs to ensure instantaneous, auditable compliance verification.

- Smart Deployment Systems: AI integration with ship navigation and weather systems to dynamically calculate the optimal deployment location and timing during an incident, accounting for drift, vessel list, and sea state, improving evacuation success rates.

- Quality Control in Manufacturing: AI-driven visual inspection and defect detection during the fabrication of liferaft materials and assembly processes, ensuring higher product quality and structural integrity before installation.

- Training and Simulation: Development of sophisticated virtual reality (VR) and AI-guided training simulators for crew deployment procedures, enhancing response efficacy under stress and varied conditions.

DRO & Impact Forces Of Ship Liferafts Market

The dynamics of the Ship Liferafts Market are heavily influenced by a combination of stringent international regulatory requirements (Drivers) that enforce baseline safety standards, significant upfront capital expenditure and complexity in logistics (Restraints), and emerging technological advancements paired with market expansion into niche sectors (Opportunities). These elements collectively define the competitive intensity and operational landscape. The inherent risk associated with maritime operations ensures that compliance and reliable performance are the paramount impact forces shaping procurement decisions, often outweighing pure cost considerations.

Key drivers include the non-negotiable adherence to the International Maritime Organization’s (IMO) SOLAS convention, which mandates specific liferaft types, capacities, and maintenance schedules for virtually all international shipping vessels. The continuous growth in the global commercial fleet, particularly the construction of larger mega-container ships and cruise vessels, necessitates proportionate investment in larger and more numerous liferaft systems. Furthermore, high-profile maritime disasters periodically heighten public and governmental focus on safety, leading to accelerated implementation of enhanced safety protocols and driving demand for advanced replacement units. These regulatory and fleet growth factors ensure consistent, inelastic demand for certified safety equipment.

However, the market faces significant restraints, notably the high initial procurement cost of certified, large-capacity liferafts, coupled with substantial ongoing service and maintenance expenses required to retain certification. The complexity of the global supply chain, involving specialized raw materials (rubberized fabric, CO2 cylinders) and certified service stations scattered worldwide, adds layers of logistical challenges. Opportunities are emerging through the adoption of new composite materials that offer lighter weight and longer service intervals, potentially lowering lifetime ownership costs. The rapid development of the offshore renewable energy sector (wind farms) and increased naval modernization efforts present specialized, high-margin niches requiring bespoke liferaft solutions resistant to extreme operational stresses. These opportunities allow manufacturers to differentiate beyond mere regulatory compliance.

Segmentation Analysis

The Ship Liferafts Market segmentation provides a critical view of product types, materials, deployment methods, and end-user applications, allowing stakeholders to precisely target specific maritime sectors with tailored safety solutions. The market is primarily analyzed based on product type—defining how the liferaft is launched—and the end-user application, determining the required capacity, durability, and certification level. Understanding these distinct segments is essential because the safety requirements for a large cruise ship (focusing on high capacity and automatic deployment) differ dramatically from those of a small fishing vessel (focusing on robustness and low maintenance).

Technological differentiation within the product type segment, particularly between traditional rigid liferafts and modern, high-capacity inflatable variants, dictates manufacturing processes and material science investment. Meanwhile, the application segmentation reflects global maritime economic trends; for instance, growth in LNG carrier fleets directly boosts demand for liferafts certified for hazardous environments. The stringent compliance requirements dictated by the IMO ensure that segmentation is not just based on consumer preference but also on mandatory classification based on the vessel's route, size, and function, thereby creating clearly defined market niches that manufacturers must cater to precisely.

- By Product Type:

- Inflatable Liferafts (Dominant Segment)

- Rigid Liferafts (Niche applications, older vessels)

- By Launch Mechanism:

- Throw-overboard Liferafts (Standard compliance)

- Davit-launched Liferafts (Passenger vessels, large capacity)

- Self-Righting Liferafts (High-risk waters)

- By End-User Application:

- Commercial Cargo Vessels (Container ships, Tankers, Bulk Carriers)

- Passenger Ships (Ferries, Cruise Liners)

- Naval and Defense Vessels

- Offshore Oil & Gas Rigs and Support Vessels

- Fishing Vessels

- By Material:

- Natural Rubber

- Synthetic Rubber (Neoprene, Hypalon)

- PVC and Polyurethane (Lower cost/coastal applications)

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America

- Middle East & Africa (MEA)

Value Chain Analysis For Ship Liferafts Market

The value chain for the Ship Liferafts Market is highly specialized, beginning with the manufacturing of advanced technical textiles and pressurized gas systems (upstream) and culminating in mandatory installation and global servicing networks (downstream). Upstream analysis involves raw material suppliers providing highly durable, certified materials such as specialized polymer-coated fabrics (Hypalon, Neoprene) and components for hydrostatic release units (HRUs) and CO2 inflation systems. Due to the high safety standards, material sourcing requires strict quality control and traceability, often involving specialized chemical and textile manufacturers certified to produce marine-grade components. This specialized material requirement creates high barriers to entry for new component suppliers.

The core manufacturing stage involves specialized assembly, vulcanization, and high-precision testing procedures mandated by classification societies (e.g., Lloyd’s Register, DNV). Manufacturers maintain direct links with these regulatory bodies to ensure that every finished product meets the latest SOLAS and regional standards. Distribution channels are complex; direct sales are often reserved for large naval or new shipbuilding contracts, while replacement markets primarily utilize indirect channels through a global network of specialized distributors and certified safety equipment service stations. These service stations are crucial, as they handle the mandatory annual and five-yearly inspections, servicing, and re-packing, representing a significant recurring revenue stream for the industry.

Downstream activities are dominated by shipyards and ship owners (the end-users). Shipyards procure liferafts for new vessel construction directly from manufacturers or major distributors, integrating them into the vessel structure. For existing fleets, procurement and servicing are managed by fleet management companies who rely heavily on certified service centers for compliance maintenance. The critical role of the indirect distribution channel—the service centers—means that logistical excellence and maintenance capacity are key differentiators, often determining long-term contracts based on global footprint and service quality rather than solely on the initial product price.

Ship Liferafts Market Potential Customers

Potential customers for the Ship Liferafts Market are defined by the global population of maritime vessels that are legally required to carry certified life-saving equipment, spanning commercial, governmental, and specialized marine operations. The primary buyers are large shipping corporations operating global fleets, including container lines, oil and gas tankers, and bulk carrier owners, which prioritize cost-efficiency, global serviceability, and strict adherence to class requirements. These customers typically engage in large-volume, long-term contracts for supply and mandatory servicing, viewing liferafts as non-negotiable compliance assets rather than optional investments.

A second major customer segment consists of operators of Passenger Ships, specifically cruise lines and ferry companies. These buyers have the highest demands regarding liferaft capacity, ease of deployment (often requiring davit-launched systems), and aesthetic integration, driven by intense scrutiny regarding passenger safety and the need to evacuate thousands of people quickly. The high volume of life-saving appliances required per vessel in this segment makes them highly lucrative targets. Furthermore, global navies and coast guards represent a specialized segment, requiring highly robust, military-specification liferafts designed for rapid deployment, often featuring specialized camouflage or reinforcement for harsh operational environments, with procurement driven by defense budgets and strategic necessity.

The shipbuilding industry itself acts as a crucial initial buyer, integrating new liferafts into vessels during construction, particularly in major shipbuilding hubs in Asia. Finally, the growing offshore energy sector, including both traditional oil and gas platforms and the expanding offshore wind farm maintenance sector, represents a customer base needing specialized, often smaller, highly durable liferafts and rescue systems certified for fixed installations or service operation vessels (SOVs). This diverse end-user base ensures stable demand across different economic cycles of the maritime industry.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $450 Million USD |

| Market Forecast in 2033 | $625 Million USD |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Survitec Group, Viking Life-Saving Equipment A/S, Wartsila Corporation (Services), Zodiac Nautic, Fujikura Rubber Ltd., CSM Production, Shanghai Cunhong Marine Lifesaving Equipment, Ningbo Zhenhua Life-Saving Equipment, Hatecke Marine, Lalizas, RFD Beaufort, Revere Survival Products, DSB (Deutsche Schlauchboot), Shanghai Youlong Rubber Products, Jiangyin Wolong Life-Saving Equipment |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Ship Liferafts Market Key Technology Landscape

The technological landscape of the Ship Liferafts Market is evolving, moving beyond simple buoyancy devices toward integrated, high-performance survival platforms. Key technological advancements focus heavily on optimizing material science to achieve greater durability, reduced weight, and extended service intervals, thereby addressing the high operational expenditure faced by ship owners. The shift from traditional rubber formulations to advanced synthetic materials like high-tenacity polyurethane and Hypalon composite fabrics enhances resistance to UV degradation, ozone exposure, and extreme temperature variations, crucial for liferafts stored continuously on open decks in harsh marine environments. These materials also allow for easier folding and packing, reducing the required storage space on board.

A second major area of innovation lies in the inflation and deployment mechanisms. Modern liferafts incorporate highly reliable, sophisticated hydrostatic release units (HRUs) that ensure automatic deployment and inflation even if the vessel sinks, minimizing human intervention risk. Further enhancements include improved gas mixture technologies and valve designs that guarantee rapid, stable inflation across a wide range of temperatures, essential for compliance with cold-weather operating standards. Research is also concentrated on incorporating self-righting features and improved boarding ramps, particularly crucial for ensuring occupant safety and ease of access in high seas and poor visibility.

Emerging technologies focus on connectivity and monitoring. The integration of sensors (often leveraging IoT frameworks) within the liferaft canopy and floor allows for real-time monitoring of atmospheric conditions, internal CO2 levels, and even GPS location transmission. These “smart liferafts” enhance the probability of successful Search and Rescue (SAR) operations and allow fleet managers to remotely verify the operational status of the installed safety equipment. The digitalization of service records using blockchain or secure cloud platforms is also streamlining the audit process during mandatory inspections, reducing potential administrative errors and improving traceability throughout the product lifecycle.

Regional Highlights

Global demand for ship liferafts is heavily concentrated in regions dominating shipbuilding and commercial maritime traffic, demonstrating significant variances in growth drivers, regulatory stringency, and technological adoption across geographical boundaries. These regional markets are often interdependent, with manufacturing centered in Asia Pacific supplying demanding consumer bases in Europe and North America, while regulatory standards established by European bodies often become global industry benchmarks.

- Asia Pacific (APAC): APAC is the largest and fastest-growing region, driven by its status as the world's primary shipbuilding hub (China, South Korea, Japan). The sheer volume of new vessel construction, coupled with growing intra-regional maritime trade and expanding local fishing fleets, necessitates immense demand for new liferaft installations. Furthermore, local manufacturing capabilities, often competing on cost, contribute significantly to the global supply chain, although regulatory adherence to IMO standards remains a critical requirement for exports.

- Europe: Europe represents a mature market characterized by extremely strict adherence to international and regional maritime safety directives (e.g., EU Flag State requirements). The demand here is primarily focused on the replacement and maintenance of existing fleets, requiring high-quality, technologically advanced, and often customized liferaft solutions, especially for the high-end cruise and ferry industries based in the Mediterranean and Northern Europe. European manufacturers often lead innovation in material science and smart safety system integration.

- North America: This market is stable, distinguished by significant procurement from governmental and defense sectors (U.S. Navy, Coast Guard) requiring specialized, high-durability liferafts. The active offshore oil and gas industry in the Gulf of Mexico and coastal fishing operations also contribute substantially. Demand is driven less by shipbuilding volume and more by the need for compliance in highly regulated offshore environments and consistent fleet modernization across military and commercial sectors.

- Middle East & Africa (MEA): Growth is primarily linked to the expansion of regional oil and gas export infrastructure and the modernization of strategically important shipping routes. Demand centers around specialized liferafts for offshore installations and large tankers, often procured through international tender processes requiring robust, heat-resistant, and high-capacity equipment. Regulatory compliance linked to major international shipping standards is the chief purchasing criterion.

- Latin America: This market exhibits moderate growth, tied to regional commodity exports (e.g., Brazil, Chile) and coastal maritime activities. Procurement is often cost-sensitive, balancing mandatory compliance with budget constraints, leading to a mixed demand for both standard inflatable units and reliable, low-maintenance options for local fishing and commercial vessels.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Ship Liferafts Market.- Survitec Group

- Viking Life-Saving Equipment A/S

- Wartsila Corporation (Services Division)

- Zodiac Nautic

- Fujikura Rubber Ltd.

- CSM Production

- Shanghai Cunhong Marine Lifesaving Equipment

- Ningbo Zhenhua Life-Saving Equipment

- Hatecke Marine

- Lalizas

- RFD Beaufort

- Revere Survival Products

- DSB (Deutsche Schlauchboot)

- Shanghai Youlong Rubber Products

- Jiangyin Wolong Life-Saving Equipment

Frequently Asked Questions

Analyze common user questions about the Ship Liferafts market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary regulations governing the installation and maintenance of ship liferafts?

The primary regulations are mandated by the International Maritime Organization (IMO) under the Safety of Life at Sea (SOLAS) convention, specifically Chapter III (Life-Saving Appliances and Arrangements). These rules dictate liferaft capacity, certification standards, material specifications, deployment mechanisms (e.g., hydrostatic release units), and mandatory inspection/servicing schedules (typically every 12 months, with full service every 5 years).

How often must ship liferafts be inspected and serviced?

Ship liferafts must undergo annual inspection and servicing by certified service stations. Additionally, full, detailed service and component testing (including inflation testing) are typically required every five years, ensuring that all aspects of the equipment meet the stringent operational standards mandated by class societies and flag state administrations.

What are the main differences between throw-overboard and davit-launched liferafts?

Throw-overboard liferafts are designed to be manually deployed or automatically released via hydrostatic units, inflating upon contact with the water. Davit-launched liferafts are lowered to the water level using a crane-like davit system while fully inflated and boarded, often preferred on large passenger vessels to facilitate orderly and efficient evacuation, particularly in heavy weather conditions.

Which market segment holds the largest share in the Ship Liferafts Market?

The Inflatable Liferafts segment, categorized by Product Type, holds the largest market share due to their superior capacity-to-stowage ratio and widespread application across the dominant commercial cargo and passenger ship sectors. In terms of Application, Commercial Cargo Vessels represent the largest purchasing segment due to the sheer volume of global maritime trade fleet.

How does technological advancement affect the lifespan and cost of liferafts?

Technological advancements, particularly in the use of advanced synthetic rubber (like Hypalon/Neoprene composites), extend the material durability and resistance to harsh environmental factors, potentially increasing the overall certified lifespan of the liferaft system. Furthermore, improvements in HRUs and pressure vessel technology reduce maintenance complexity, contributing to a lower Total Cost of Ownership (TCO) despite a potentially higher initial procurement price.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager