Ship Lights Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 431603 | Date : Dec, 2025 | Pages : 253 | Region : Global | Publisher : MRU

Ship Lights Market Size

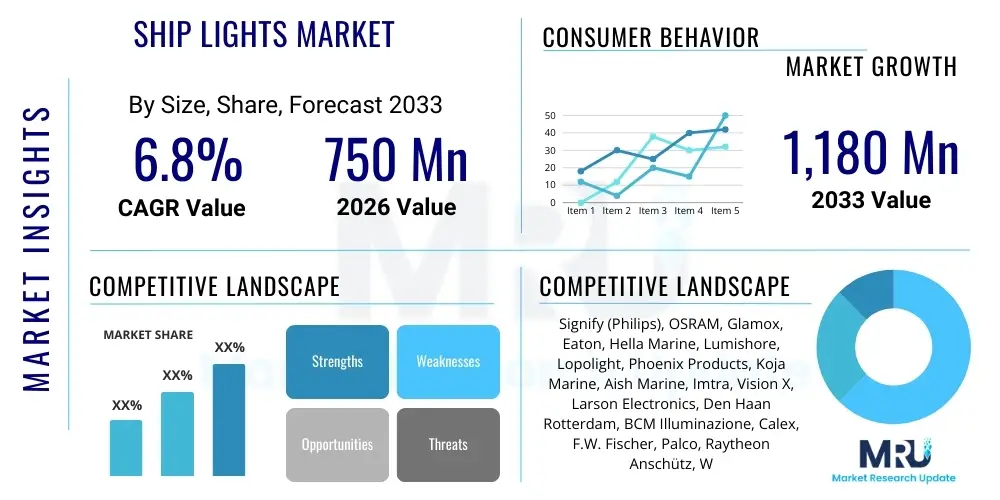

The Ship Lights Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at $750 Million in 2026 and is projected to reach $1,180 Million by the end of the forecast period in 2033.

Ship Lights Market introduction

The Ship Lights Market encompasses the manufacturing, distribution, and installation of various lighting systems designed specifically for maritime vessels, including navigation lights, signaling lights, searchlights, deck lighting, and interior illumination. These systems are crucial not only for operational efficiency and crew comfort but, critically, for ensuring compliance with international maritime safety regulations, primarily governed by the International Maritime Organization (IMO). The evolution of this market is intrinsically linked to advancements in illumination technology, with a significant shift observed from traditional incandescent and halogen lamps towards highly energy-efficient and durable Light Emitting Diode (LED) systems. LEDs offer extended lifespan, reduced maintenance costs, lower power consumption, and superior visibility, making them the preferred choice for new vessel construction and extensive retrofitting projects across commercial, naval, and leisure segments globally. The integration of robust, certified lighting apparatus capable of withstanding harsh marine environments—including extreme temperatures, vibration, and saltwater corrosion—remains a core focus for manufacturers in this specialized sector.

The primary products dominating the market include certified navigation lights, essential for collision avoidance under the International Regulations for Preventing Collisions at Sea (COLREGs), and functional lighting for vital ship areas such as engine rooms, cargo holds, and accommodation decks. Major applications span across bulk carriers, container ships, cruise liners, oil tankers, offshore support vessels (OSVs), and military ships, each segment imposing unique requirements regarding brightness, color temperature, and ingress protection (IP) ratings. The benefits derived from modern ship lighting solutions are substantial, extending beyond energy savings to include enhanced safety due to reliable operation and reduced downtime attributable to equipment failure. Furthermore, ergonomic lighting design in crew quarters and operational areas contributes positively to crew alertness and overall wellbeing, addressing human factors crucial for safe maritime operations. The increasing global fleet size, coupled with stringent environmental regulations pushing for energy optimization, acts as a pivotal driving force for market expansion.

Driving factors propelling the Ship Lights Market forward are multifaceted and interconnected. The mandatory enforcement of international maritime safety standards necessitates continuous upgrade cycles for older vessels and guaranteed compliance for all new builds. Technological innovation, particularly in solid-state lighting (SSL), provides compelling economic incentives for vessel operators to transition to LED solutions, offering rapid return on investment through significant fuel and energy savings. The growing emphasis on digitalization within the maritime industry also promotes the adoption of smart lighting systems equipped with sensors and networking capabilities, allowing for centralized control, predictive maintenance, and dynamic lighting adjustments based on environmental conditions or operational status. This confluence of regulatory compliance, economic viability, and technological advancement solidifies the market's trajectory towards sustainable and intelligent lighting solutions tailored for the demanding marine environment.

Ship Lights Market Executive Summary

The Ship Lights Market is characterized by a strong global transition toward sustainable and digitally integrated lighting solutions, reflecting broader trends in maritime decarbonization and smart ship initiatives. Business trends indicate aggressive mergers, acquisitions, and strategic partnerships focused on expanding product portfolios, particularly in specialized, high-durability LED marine fixtures and smart control systems compliant with DNV, Lloyd's Register, and other classification society standards. Manufacturers are prioritizing innovation in light output optimization and thermal management to ensure product longevity in harsh operating conditions, while facing increasing competition from Asian manufacturers offering cost-effective, high-volume products. The emphasis on total cost of ownership (TCO), rather than initial purchase price, is shaping procurement decisions among major shipbuilding companies and fleet operators, reinforcing the value proposition of premium, highly certified products.

Regionally, Asia Pacific (APAC) stands as the dominant market driver, primarily due to the concentration of major global shipbuilding hubs in China, South Korea, and Japan, which generate significant demand for new installation components. However, established markets in Europe and North America exhibit robust growth driven by extensive retrofitting activities, especially across cruise lines and specialized naval vessels, where sustainability mandates and advanced technology integration are paramount. European companies often lead in developing sophisticated, proprietary lighting technologies and integrated bridge systems. Emerging markets in Latin America and the Middle East are showing accelerated adoption rates, fueled by investments in offshore energy infrastructure and naval modernization programs, thereby diversifying the geographical demand landscape and influencing global distribution strategies.

Segment trends reveal that the LED technology segment holds the largest market share and is expected to exhibit the highest CAGR, completely displacing traditional lighting technologies in most applications due to regulatory pressures and superior operational economics. Within the application segmentation, the Commercial Vessels segment—including container ships and tankers—accounts for the vast majority of volume demand, while the Naval Vessels segment commands significant value due to the requirement for highly specialized, ruggedized, and often stealth-compliant lighting systems. The retrofitting segment is poised for rapid expansion, propelled by the need for existing global fleets to comply with evolving energy efficiency directives (such as the IMO’s EEXI and CII frameworks), making the replacement of older, inefficient lighting a low-hanging fruit for immediate operational improvement. Furthermore, dynamic and customizable interior lighting systems in the Cruise and Ferry segment are becoming increasingly important for enhancing passenger experience.

AI Impact Analysis on Ship Lights Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Ship Lights Market typically revolve around three core themes: the potential for autonomous navigation, enhanced predictive maintenance, and optimizing energy consumption. Users are keen to understand how AI-driven algorithms will influence COLREGs compliance and light signaling in autonomous vessels, specifically questioning the reliability and regulatory acceptance of automated decision-making regarding light patterns and intensity modulation based on real-time environmental data (fog, visibility). Concerns also focus on whether AI integration will lead to proprietary, closed lighting systems, impacting interoperability and maintenance practices. Expectations are high concerning the ability of AI to analyze sensor data from smart lighting networks to predict fixture failures before they occur, drastically reducing maintenance downtime and associated costs, thereby maximizing operational efficiency across large, geographically dispersed fleets. Furthermore, users anticipate AI playing a pivotal role in dynamically adjusting light levels across the ship based on occupancy, operational phase, and ambient light, leading to unprecedented energy savings and optimized operational performance metrics.

- AI enables predictive maintenance by analyzing usage patterns and sensor data (temperature, voltage) from smart lighting fixtures, anticipating failures and scheduling proactive replacements.

- AI integration supports autonomous and remotely operated vessels by automating light signaling (COLREGs compliance) based on real-time situational awareness and navigational data.

- Optimization algorithms driven by AI dynamically control interior and exterior lighting intensity and color temperature, minimizing power consumption while maximizing crew performance and safety.

- AI assists in complex photometric analysis and design during the shipbuilding phase, optimizing light distribution and reducing glare specific to marine environments.

- Data aggregation from smart lighting networks feeds into holistic ship management systems, allowing AI to contribute to overall energy efficiency indicators and regulatory reporting compliance.

- Machine learning models can analyze long-term performance data to inform manufacturers about necessary design improvements in durability and resilience against specific maritime stressors.

DRO & Impact Forces Of Ship Lights Market

The Ship Lights Market is significantly influenced by a complex interplay of global regulatory mandates, technological advancements, and macroeconomic factors impacting the shipping industry. The primary drivers are the mandatory global transition to energy-efficient technologies, particularly LED lighting, reinforced by international commitments to reduce greenhouse gas emissions and enhance vessel energy efficiency ratings (EEXI, CII). Restraints largely center on the relatively high initial capital expenditure required for installing advanced LED systems, especially for retrofitting older vessels, and the technical challenge of ensuring electromagnetic compatibility (EMC) and vibration resistance in specialized marine applications. Opportunities arise from the rapidly expanding smart ship segment, allowing for the integration of lighting into ship-wide IoT networks, offering enhanced diagnostics and operational efficiencies. The core impact forces include stringent classification society approvals, fluctuating raw material costs (especially for electronic components), and the intense competitive pressure from manufacturers optimizing the cost-to-performance ratio of their certified marine lighting products.

Drivers include the accelerating pace of naval modernization programs worldwide, which demand sophisticated, military-grade lighting solutions incorporating features like infrared (IR) capability and reduced spectral signatures for stealth operations. Furthermore, growing public and commercial interest in cruise tourism necessitates premium, aesthetically pleasing, and highly customizable interior lighting systems that enhance the passenger experience while maintaining energy efficiency. The long operational lifespan of LED products—often exceeding 50,000 hours—significantly reduces operational expenditures (OPEX) related to maintenance and replacement cycles, providing a strong economic incentive for adoption across all vessel types. The continuous refinement of LED technology, leading to higher luminous efficacy and reliability under severe conditions, further solidifies its dominance as the preferred illumination method, driving market volume growth.

However, the market faces headwinds from several restraints. The complexity and duration of the certification process required by classification societies (such as ABS, DNV, LR) for new marine lighting products can slow down market entry and innovation uptake. Additionally, the global maritime supply chain remains susceptible to geopolitical tensions and logistical bottlenecks, which can significantly impact the availability and pricing of specialized components, thereby slowing down both new construction and retrofitting timelines. Opportunities for growth are abundant through strategic partnerships with system integrators specializing in maritime IoT solutions, allowing lighting manufacturers to transition from selling simple fixtures to providing integrated data and illumination management services. The substantial addressable market of older vessels needing mandatory energy-efficient upgrades represents a multi-year window of opportunity for focused retrofit specialists, particularly in regions with aging commercial fleets.

Segmentation Analysis

The Ship Lights Market segmentation provides a detailed framework for understanding market dynamics across different technology types, application areas, installation requirements, and geographical regions. Analysis by technology highlights the fundamental transition to LED, which drives both technological innovation and market value. Segmentation by application distinguishes between the high-volume demand from commercial shipping (tankers, containers) and the high-value, specialized demand from naval and cruise segments. Installation analysis, separating new builds from retrofits, is crucial for assessing growth opportunities, as the retrofit segment currently experiences a significant surge driven by regulatory compliance and operational cost reduction mandates. Understanding these segments allows stakeholders to tailor their product development, marketing, and distribution strategies to meet the precise technical and commercial needs of specific maritime users, ensuring regulatory adherence and superior operational performance in diverse marine environments.

- By Type of Technology:

- LED Lights (Light Emitting Diode)

- Halogen Lights

- Fluorescent Lights

- Incandescent Lights

- By Application/Vessel Type:

- Commercial Vessels (Tankers, Bulk Carriers, Container Ships)

- Naval Vessels and Military Ships

- Cruise Ships and Ferries

- Offshore Support Vessels (OSVs)

- Leisure and Recreational Boats

- By Product Location:

- Exterior and Navigation Lights (Masthead, Sidelights, Stern, Anchor Lights)

- Interior Lighting (Accommodation, Engine Room, Bridge, Galley)

- Specialty/Auxiliary Lights (Searchlights, Floodlights, Explosion-Proof Lighting)

- By Installation Type:

- New Ship Construction (OEM)

- Retrofit and Aftermarket Replacement

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East and Africa (MEA)

Value Chain Analysis For Ship Lights Market

The value chain for the Ship Lights Market begins with the upstream suppliers of core components, primarily specialized LED chips (diodes), semiconductor components, optics (lenses and reflectors), and high-durability housing materials (corrosion-resistant aluminum alloys, stainless steel). Critical upstream challenges include ensuring the quality and long-term reliability of semiconductor elements under continuous vibration and moisture exposure, making sourcing critical. These raw materials and components are then procured by primary manufacturers who specialize in marine lighting system design, ensuring compliance with strict International Electrotechnical Commission (IEC) and Classification Society standards for thermal management, electromagnetic compatibility (EMC), and ingress protection (IP ratings). The manufacturing stage involves complex processes like potting, sealing, and rigorous stress testing specific to maritime applications, differentiating certified marine lights from general-purpose industrial lighting fixtures.

The downstream segment involves the distribution and final installation processes. Products reach end-users—shipyards, vessel owners, fleet managers, and repair facilities—through a dual channel system. The direct channel often involves major lighting manufacturers collaborating directly with large, established shipyards (OEM sales) during the new construction phase, requiring specialized technical consultation and bulk supply agreements. The indirect channel relies heavily on a network of specialized marine distributors, ship chandlers, and repair yards who handle aftermarket and retrofit sales, providing essential local inventory and technical support for replacement parts and system upgrades. Effective downstream operations require strong logistical capabilities and certifications to handle international marine spares trade, guaranteeing rapid availability of critical navigation lighting components globally to minimize ship downtime.

The critical success factors in the value chain involve robust product certification management and efficient logistics for global service delivery. Manufacturers must constantly manage the complexity of meeting varied standards across different classification societies (e.g., ABS, DNV, LR, RINA, CCS), which acts as a barrier to entry for non-specialized producers. For end-users, the maintenance and replacement cycle are significant components of the value chain; thus, the availability of reliable, globally certified spare parts and the expertise of local installation technicians (electricians and ship engineers) significantly influence customer satisfaction and supplier selection. Optimization across the entire chain is increasingly focused on digitizing documentation and integrating supply chain tracking, particularly as smart lighting systems require software updates and remote diagnostics capabilities, linking the physical product to digital service delivery platforms.

Ship Lights Market Potential Customers

The primary consumers in the Ship Lights Market are diverse entities operating within the global maritime industry, driven by either the necessity of new construction specifications or the mandatory requirements of maintaining operational fleets. Shipyards constitute a massive end-user segment, acting as initial buyers (OEM customers) for lighting systems that are integrated into vessels during the construction process. This segment demands high volumes, consistent quality, and timely delivery aligned with stringent construction schedules, often preferring vendors who can supply complete, integrated lighting solutions for the entire vessel (both interior and exterior). The second major segment comprises vessel owners and fleet management companies, who are the core buyers in the retrofit and aftermarket segment. These customers are highly sensitive to energy consumption, durability, maintenance costs, and compliance, making LED retrofitting projects a significant investment focus to improve the operational expenditure profile of their existing assets, especially aging vessels facing new environmental regulations.

Specialized end-users include naval and defense organizations globally, which procure lighting systems for warships, submarines, and specialized auxiliary vessels. This segment requires products that meet military specifications for extreme ruggedness, electromagnetic interference (EMI) suppression, specific light spectrum output (e.g., night vision compatible), and absolute reliability under combat conditions. Cruise line operators represent another high-value customer base, prioritizing aesthetic design, passenger comfort (using dynamic and tunable white lighting), and high reliability for complex, custom interior and exterior lighting schemes that contribute significantly to the passenger experience. Furthermore, offshore companies and operators of specialized vessels like drill ships, platform supply vessels (PSVs), and tugboats demand lighting fixtures with high explosion-proof ratings (e.g., ATEX or IECEx certified) for use in hazardous zones, prioritizing safety and compliance above all else.

The procurement decisions across these customer types are influenced by regulatory cycles, global commodity shipping volumes, and access to specialized technical service. For large commercial fleet owners, buying decisions are driven by the total cost of ownership over the vessel's lifecycle, strongly favoring vendors offering long-term warranties and documented compliance with all major classification standards (e.g., IMO SOLAS requirements for navigation lights). Smaller leisure boat manufacturers and individual owners primarily utilize the robust leisure marine distribution channels, prioritizing ease of installation, weather resistance, and aesthetics. Overall, the market demand structure is characterized by a stable base demand from new construction (OEM) complemented by strong, periodic spikes in demand from mandatory regulatory-driven retrofitting cycles within the global operational fleet.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $750 Million |

| Market Forecast in 2033 | $1,180 Million |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Signify (Philips), OSRAM, Glamox, Eaton, Hella Marine, Lumishore, Lopolight, Phoenix Products, Koja Marine, Aish Marine, Imtra, Vision X, Larson Electronics, Den Haan Rotterdam, BCM Illuminazione, Calex, F.W. Fischer, Palco, Raytheon Anschütz, Wartsila. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Ship Lights Market Key Technology Landscape

The technological landscape of the Ship Lights Market is dominated by Solid-State Lighting (SSL), specifically LED technology, which has fundamentally redefined maritime illumination standards. Modern marine lighting systems are not merely components but integrated electrical and electronic fixtures designed to withstand the most demanding conditions. Key advancements focus on maximizing luminous efficacy (lumens per watt) to meet aggressive energy efficiency goals, coupled with sophisticated thermal management systems (often utilizing advanced heat sinks and specialized materials) to dissipate heat effectively, which is critical for maintaining the operational life and color stability of LEDs in enclosed marine fixtures. Compliance with electromagnetic compatibility (EMC) standards is paramount, requiring robust filtering and shielding within the fixture design to prevent interference with sensitive navigational and communication equipment aboard the vessel. Furthermore, the trend toward spectral tuning, allowing for adjustment of color temperature and light intensity, is increasingly applied in bridge areas and accommodation quarters to support crew circadian rhythms and minimize eye strain during long watches, enhancing overall safety.

A significant technological shift involves the integration of connectivity and smart features, positioning ship lights as nodes within the vessel’s larger Internet of Things (IoT) network. This includes incorporating standardized digital communication protocols (e.g., DALI or proprietary marine bus systems) directly into the fixtures, enabling remote monitoring, diagnostics, and centralized control from the integrated bridge system (IBS). Smart lighting allows for features such as dynamic lighting profiles that adjust intensity based on time of day, operational mode, or external visibility conditions, thereby optimizing energy use beyond simple on/off control. For navigation lights, technology focuses on enhanced optics to maximize light throw and intensity consistency across the required horizontal and vertical angles, ensuring strict adherence to COLREGs visibility standards under all certified operational conditions, often utilizing specialized materials resistant to UV degradation and salt spray corrosion.

The manufacturing process itself incorporates advanced technologies to ensure durability. Manufacturers utilize state-of-the-art encapsulation techniques and high IP-rated seals to prevent water and dust ingress (e.g., IP66, IP67, IP68 ratings), mandatory for deck and engine room applications. Explosion-proof (Ex) lighting technology, critical for tankers and LNG carriers, requires highly specialized enclosures capable of containing internal explosions or preventing external sparks. Ongoing research is dedicated to developing lighting materials with superior chemical resistance and reduced weight, particularly for application on high-speed vessels where weight minimization is crucial for fuel efficiency. The continuous drive for miniaturization and increased power density allows for brighter output from smaller, more discreet fixtures, especially valuable in naval and luxury yacht applications where space and aesthetic integration are key design constraints. This convergence of efficient LEDs, intelligent controls, and ruggedized construction defines the current technology landscape.

Regional Highlights

- Asia Pacific (APAC): APAC is the epicenter of global shipbuilding and thus commands the largest share of the Ship Lights Market, driven by the colossal output of new vessels from major shipbuilding nations like China, South Korea, and Japan. The region benefits from lower manufacturing costs for mass-produced components, although the demand for high-end, certified products remains strong. Government initiatives supporting naval expansion and massive domestic commercial shipping fleets further solidify the region's dominance.

- Europe: Europe is characterized by high demand for specialized, high-value lighting solutions, particularly for cruise ships, mega-yachts, and highly specialized offshore support vessels. European manufacturers often lead in the development of sophisticated, customized, and smart lighting systems, focusing heavily on aesthetic quality, compliance with strict environmental regulations, and comprehensive lifecycle support. The robust retrofit market, driven by stringent EU energy efficiency directives, provides continuous growth.

- North America: The North American market is dominated by replacement and upgrade activities, especially across naval and coast guard fleets, which prioritize ruggedness and specific military compliance standards. Growth is also sustained by the active recreational boating and commercial fishing industries, requiring durable, corrosion-resistant lighting solutions. Demand is primarily focused on high-specification LED searchlights and advanced signaling systems.

- Middle East and Africa (MEA): Growth in MEA is closely tied to investment in hydrocarbon transportation (tankers, gas carriers) and offshore energy infrastructure. The requirement for explosion-proof (Ex) lighting is particularly high here. Naval modernization in the Gulf nations also contributes significantly to specialized, high-security lighting procurement, leading to a steady, concentrated growth in high-value fixtures.

- Latin America (LATAM): The LATAM market is emerging, with demand focused on infrastructure projects related to port expansion and the modernization of local commercial and fishing fleets. Price sensitivity is higher in this region, leading to a strong preference for cost-effective, durable LED solutions, though international regulatory compliance remains a critical purchasing factor, particularly for vessels engaged in global trade routes.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Ship Lights Market.- Signify (Philips)

- OSRAM

- Glamox

- Eaton

- Hella Marine

- Lumishore

- Lopolight

- Phoenix Products Company

- Koja Marine

- Aish Marine Systems

- Imtra Corporation

- Vision X Lighting

- Larson Electronics

- Den Haan Rotterdam

- BCM Illuminazione

- Calex Holland

- F.W. Fischer

- Palco Marine

- Raytheon Anschütz

- Wartsila Corporation

Frequently Asked Questions

Analyze common user questions about the Ship Lights market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the key regulations governing navigation lighting on commercial ships?

The primary governing regulations are the International Regulations for Preventing Collisions at Sea (COLREGs), enforced globally by the International Maritime Organization (IMO). These regulations specify the exact type, color, arc of visibility, and luminous intensity required for all navigation lights based on the vessel’s size and operational status.

Why is LED technology dominating the Ship Lights Market?

LED technology is dominant due to its superior energy efficiency, significantly lower power consumption (reducing fuel costs), exceptionally long lifespan (minimizing maintenance downtime), high shock and vibration resistance, and immediate full brightness output, essential factors for maritime operational reliability and meeting EEXI/CII environmental mandates.

What is the difference between OEM and Retrofit market segments?

The OEM (Original Equipment Manufacturer) segment involves sales to shipyards for installation in new vessel construction. The Retrofit segment involves sales to existing fleet owners for replacing older, less efficient lighting systems with modern solutions, primarily driven by energy saving goals and mandatory regulatory compliance upgrades.

How important are Classification Society approvals for marine lighting products?

Classification Society approvals (e.g., DNV, LR, ABS) are critically important. They certify that the lighting fixtures meet stringent standards for safety, material quality, durability, ingress protection, and electromagnetic compatibility (EMC), mandatory for insuring and operating commercial vessels globally and ensuring system reliability in harsh marine conditions.

How does smart lighting integrate into a vessel's management system?

Smart lighting fixtures incorporate sensors and utilize digital protocols (like DALI or specialized bus systems) to connect to the vessel's Integrated Bridge System (IBS) or Ship Management System. This integration allows for centralized control, dynamic light adjustments based on ship status, remote diagnostics, and detailed data reporting on power consumption and operational status, enhancing vessel automation.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager