Ship Searchlight Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434792 | Date : Dec, 2025 | Pages : 255 | Region : Global | Publisher : MRU

Ship Searchlight Market Size

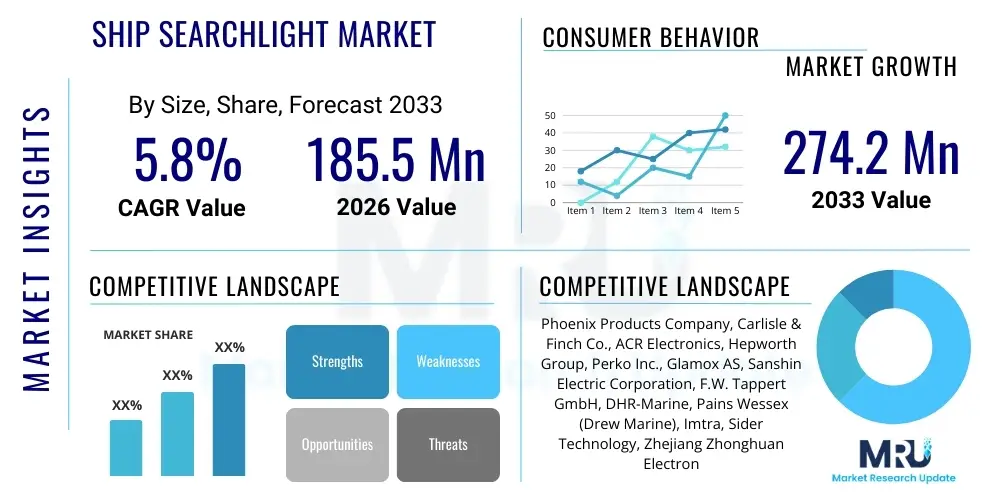

The Ship Searchlight Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 185.5 Million in 2026 and is projected to reach USD 274.2 Million by the end of the forecast period in 2033. This growth trajectory is fundamentally driven by stringent international maritime safety regulations, particularly those enforced by the International Maritime Organization (IMO) and specific national coast guard requirements, mandating high-intensity illumination systems for safe navigation, search and rescue operations, and security protocols in complex waterways and open seas.

Ship Searchlight Market introduction

The Ship Searchlight Market encompasses the design, manufacturing, distribution, and maintenance of high-intensity directional lighting systems utilized across various types of maritime vessels. These essential navigation and safety devices provide focused, powerful beams of light necessary for identifying navigational hazards, conducting search and rescue missions, signaling other vessels, and enhancing security surveillance during nighttime or poor visibility conditions. The primary products available include modern LED searchlights, which offer superior energy efficiency and longevity, alongside traditional Halogen and high-intensity discharge (HID) lamps like Xenon, tailored for specific operational requirements such as extreme distance visibility or instantaneous full power output. The shift towards LED technology is a critical driver defining the current market landscape.

Major applications of ship searchlights span the entire maritime ecosystem, ranging from commercial shipping (tankers, container ships, bulk carriers) and naval vessels (destroyers, frigates, patrol boats) to specialized marine craft (offshore supply vessels, cruise ships, tugboats) and luxury yachts. Searchlights are mandatory safety equipment under various international treaties, ensuring compliance with Safety of Life at Sea (SOLAS) conventions. The inherent benefits of these systems include enhanced operational safety, reduced collision risk, improved port security, and effectiveness in anti-piracy measures, especially when integrated with modern thermal imaging and camera stabilization systems.

The market is currently being driven by several macro factors, chief among them being the rapid expansion of the global commercial shipping fleet, increasing naval defense expenditures focusing on maritime patrol and border security, and continuous technological advancements leading to more durable, weather-resistant, and energy-efficient searchlight designs. Furthermore, the mandatory replacement cycles for older, less efficient lighting systems in mature fleets, pushed by evolving environmental regulations concerning energy consumption, contribute significantly to sustained market demand across all key geographic regions.

Ship Searchlight Market Executive Summary

The Ship Searchlight Market is characterized by steady, regulation-driven growth, anchored predominantly in the increasing emphasis on maritime security and the transition to energy-efficient LED technology across all vessel classes. Key business trends indicate intensified research and development activities focused on smart searchlights featuring remote control functionality, integrated stabilization mechanisms to counteract pitch and roll, and seamless integration with bridge navigation systems (Integrated Bridge Systems - IBS). The competitive landscape remains moderately fragmented, with specialized manufacturers focusing on high-specification, ruggedized units for naval and offshore markets, while volume producers address the commercial shipping sector with standardized, compliant products. Supply chain resilience, particularly regarding specialized optics and advanced driver circuitry for high-power LEDs, remains a focal point for market leaders.

Regional trends reveal that Asia Pacific (APAC) holds the largest market share, fueled by its dominant shipbuilding industry (South Korea, China, Japan) and significant naval modernization programs across nations like India and China, demanding large volumes of advanced, military-grade searchlights. North America and Europe maintain strong market positions, driven by high demand for specialized units for offshore energy exploration, sophisticated coast guard fleets, and the luxury yacht segment, which prioritizes aesthetic design coupled with high performance. Latin America, the Middle East, and Africa (MEA) exhibit emerging growth potential, particularly concerning port security upgrades and localized naval capability enhancements, often facilitated through international procurement programs and technology transfer agreements.

Segment trends confirm the definitive dominance of the LED searchlight segment, which is rapidly displacing traditional Halogen and Xenon lamps due to superior total cost of ownership (TCO) stemming from extended operational life and reduced maintenance requirements. By application, the Naval Vessels segment is anticipated to display the highest growth rate, primarily due to increased defense spending globally and the constant need to equip new frigates, corvettes, and patrol vessels with advanced visual and signaling capabilities essential for complex mission profiles. The remote-controlled segment is also seeing substantial traction, offering critical operational safety improvements by allowing crew members to adjust illumination direction without leaving the bridge.

AI Impact Analysis on Ship Searchlight Market

User queries regarding AI's impact on ship searchlights frequently center on how automation and computer vision can enhance functionality beyond mere illumination. Common themes include the potential for AI-driven object detection using integrated searchlight cameras, automated tracking of hazards (AIT), and optimizing beam focus based on real-time environmental data (e.g., fog density, wave motion). Users are keen to understand if AI can turn the searchlight into a smart sensor rather than just a dumb light source. Concerns often revolve around the cyber security of these networked systems and the reliability of AI algorithms in rapidly changing marine environments. The general expectation is that AI integration will primarily lead to advanced operational efficiency, reduced human error during surveillance, and enhanced search and rescue capabilities by minimizing search time through predictive illumination patterns.

- AI-Powered Object Recognition: Integration with infrared and visible spectrum cameras allows searchlights to automatically detect, classify (e.g., vessel, buoy, debris), and track targets, enhancing situational awareness.

- Automated Beam Stabilization and Focusing: AI algorithms use vessel motion data (pitch, roll, yaw) and target distance to maintain a stable beam on a selected object, crucial during heavy seas or high-speed maneuvers.

- Predictive Search Patterns: AI analyzes historical data and real-time navigation inputs (GPS, radar) to suggest or execute optimal, non-linear search patterns for missing persons or objects, significantly accelerating rescue missions.

- Energy Optimization: Smart power management systems utilizing AI adjust light intensity based on visibility conditions and proximity to shore, reducing power consumption while ensuring regulatory compliance.

- Remote Diagnostics and Maintenance: AI monitors the operational health of the light source, drivers, and motors, predicting failures before they occur and streamlining preventative maintenance schedules.

DRO & Impact Forces Of Ship Searchlight Market

The Ship Searchlight Market is currently shaped by a robust interplay of regulatory mandates (Drivers), technological hurdles related to thermal management and cost (Restraints), and expansive opportunities derived from naval modernization and emerging maritime autonomy. The primary driving force is the global commitment to maritime safety, reinforced by mandatory installations and periodic system checks dictated by classification societies like Lloyd's Register and DNV. This steady demand is underpinned by the essential function searchlights perform in preventing collisions and aiding search operations. However, restraints such as the high initial investment cost for advanced LED and Xenon systems, combined with complex environmental certification requirements for extreme marine conditions, slow down adoption rates in price-sensitive commercial segments. Opportunities abound in developing markets and the nascent industry of autonomous shipping, which will require specialized, highly durable, and networked illumination systems.

Impact forces within the market are predominantly driven by technological substitution and regulatory tightening. The rapid improvement in LED efficacy (lumens per watt) continues to exert pressure on manufacturers of traditional Halogen and HID lamps, forcing a complete overhaul of product lines to meet sustainability goals. Simultaneously, increasing geopolitical tensions and resulting investments in naval defense across the US, China, and EU directly translate into high-value contracts for military-grade searchlights, which necessitate advanced features such as infrared filters and electromagnetic compatibility (EMC) shielding. The cyclical nature of shipbuilding and fluctuating raw material costs (especially metals and specialized optical polymers) also act as moderating impact forces, influencing short-term pricing and supply chain stability.

A key structural dynamic is the influence of international standards (IEC 60092-306 for electrical installations in ships) and environmental standards. Compliance ensures market access but requires significant R&D investment, effectively raising barriers to entry for smaller manufacturers. Furthermore, the increasing complexity of control interfaces, moving from simple joystick controls to integrated touchscreen systems compatible with modern vessel dashboards, is an accelerating factor. The market stakeholders are continually balancing the need for extreme durability (resistance to saltwater corrosion and vibration) with the demand for higher light output and smaller physical footprint, requiring specialized material science and sophisticated passive cooling designs.

Segmentation Analysis

The Ship Searchlight Market is segmented based on critical technical and operational parameters, allowing for targeted product development and market penetration strategies. Primary segmentation includes technology type (LED, Halogen, Xenon), operation type (Manual, Remote-Controlled), and end-use application (Naval Vessels, Commercial Shipping, Specialty Vessels). This detailed segmentation reflects the highly diverse requirements of the maritime industry, where a small fishing vessel requires a fundamentally different illumination solution compared to an ice-class LNG carrier or a high-speed naval patrol craft. The trend clearly indicates a market shift towards remote-controlled LED systems, offering safety and efficiency benefits across all segments.

The detailed analysis of these segments reveals that while commercial shipping holds the volume majority, the naval segment contributes disproportionately high value due to the stringent military specifications and ruggedization required, often involving specialized materials like marine-grade aluminum and complex ingress protection (IP) ratings. Specialty vessels, including research ships, seismic survey vessels, and luxury cruise liners, represent niche but highly profitable segments demanding customized solutions integrating advanced optics and aesthetic design. Understanding these cross-segment dynamics is crucial for manufacturers aiming to diversify their product portfolio and optimize their presence across the global marine supply chain.

- By Technology Type:

- LED Searchlights

- Halogen Searchlights

- Xenon/HID Searchlights

- By Operation Type:

- Manual Searchlights

- Remote-Controlled Searchlights

- By Application:

- Naval Vessels (e.g., Frigates, Patrol Boats)

- Commercial Shipping (e.g., Tankers, Container Ships)

- Specialty Vessels (e.g., Offshore Supply Vessels, Tugboats, Cruise Ships)

- By Wattage/Lumen Output:

- Low Output (Under 50W)

- Medium Output (50W - 200W)

- High Output (Above 200W)

Value Chain Analysis For Ship Searchlight Market

The value chain for the Ship Searchlight Market begins with upstream activities focused on securing specialized raw materials and components, specifically high-power LEDs, precise optics (lenses and reflectors, often custom-designed for beam focus), robust marine-grade alloys (like 316L stainless steel or specific aluminum grades for corrosion resistance), and highly reliable electronic driver circuitry. Key upstream suppliers include LED chip manufacturers (e.g., Cree, Osram), specialized optical firms, and component providers focusing on shock and vibration resistance. Effective sourcing of these components, particularly high-efficiency thermal management solutions necessary for LED longevity, significantly dictates the final product quality and manufacturing cost. Optimization at this stage is crucial for maintaining competitive pricing and ensuring product durability against harsh marine environments.

Midstream activities involve the core manufacturing processes: housing fabrication, sophisticated surface treatments (powder coating or anodization), assembly of electrical and mechanical components (motors for remote control units), quality control, and testing for adherence to rigorous international maritime standards (e.g., IP67/IP68 ingress protection, salt spray resistance, and EMC certification). Searchlight manufacturers often differentiate themselves here through proprietary cooling systems and advanced reflector designs that maximize beam distance and intensity. The integration of complex control systems, including CAN bus or Ethernet communication protocols for bridge integration, is a growing midstream activity requiring specialized software engineering capabilities.

Downstream analysis focuses on distribution and end-user engagement. The distribution channel is primarily bifurcated: direct sales to major shipyards (OEM market) for new builds, and indirect distribution through specialized marine equipment suppliers, technical service providers, and authorized dealers for the aftermarket replacement and retrofit segment (MRO). Direct channels dominate high-volume naval and specialized vessel contracts, while the aftermarket relies on a global network capable of providing immediate spare parts and installation support. The final stage involves installation, commissioning, and periodic mandatory maintenance services performed by certified marine electricians and maintenance crews, ensuring the continued operational compliance and safety performance of the illumination system.

Ship Searchlight Market Potential Customers

The core potential customers and end-users of ship searchlights are inherently linked to the global maritime infrastructure, spanning both governmental and commercial entities that own, operate, or maintain marine vessels. Naval forces worldwide represent a highly valuable customer base, demanding technologically advanced, highly reliable, and often custom-built searchlights integrated with fire control or surveillance systems for defense and security operations. These buyers prioritize ruggedness, long throw distance, and stealth features (e.g., invisible light spectrum options). The procurement cycles for these customers are lengthy, involving strict qualification and high compliance barriers.

The largest volume consumer is the commercial shipping sector, encompassing operators of bulk carriers, oil and chemical tankers, container ships, and general cargo vessels. For this segment, compliance with SOLAS regulations and maximizing the return on investment through durability and energy efficiency (LED conversion) are the primary purchasing criteria. Procurement is often centralized through large fleet management companies or directly by shipyards during the new build phase. This segment is highly price-sensitive but requires global service support.

Lastly, specialized end-users, including offshore energy operators (drilling rigs, Floating Production Storage and Offloading - FPSO vessels, support vessels), coast guard and border patrol agencies, marine research organizations, and the luxury yacht sector, constitute niche markets. These buyers demand highly specialized features, such as explosion-proof ratings (for offshore oil and gas), precise beam control for scientific work, or aesthetic integration and smart home connectivity (for luxury yachts), offering higher profit margins for manufacturers capable of customization.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 185.5 Million |

| Market Forecast in 2033 | USD 274.2 Million |

| Growth Rate | CAGR 5.8% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Phoenix Products Company, Carlisle & Finch Co., ACR Electronics, Hepworth Group, Perko Inc., Glamox AS, Sanshin Electric Corporation, F.W. Tappert GmbH, DHR-Marine, Pains Wessex (Drew Marine), Imtra, Sider Technology, Zhejiang Zhonghuan Electronic, ENA, and Luminator Technology Group. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Ship Searchlight Market Key Technology Landscape

The technological landscape of the Ship Searchlight Market is undergoing a rapid evolution, primarily centered around the adoption and refinement of Light Emitting Diode (LED) technology. Modern marine searchlights utilize high-flux, multi-chip LED arrays combined with advanced thermal management systems, such as heat pipes and specialized fin structures, to efficiently dissipate the high heat generated. This is crucial as effective cooling directly determines the longevity and light output stability in high-vibration, high-temperature marine environments. Manufacturers are employing computer-aided design (CAD) for optimizing reflector and lens geometry (e.g., TIR optics) to achieve extremely narrow and powerful beams necessary for long-distance visibility, often exceeding five nautical miles, while minimizing light spill and glare.

Beyond the light source itself, connectivity and control technologies are paramount. The industry is moving away from bulky analog control panels towards modern digital interfaces integrated with the vessel's overall bridge management system (BMS). This includes using standardized communication protocols like NMEA 2000 or proprietary Ethernet links, allowing for precise control and diagnostic feedback. Furthermore, gyro-stabilization technology, initially prevalent only in naval and high-end yachting searchlights, is becoming more commonplace. This technology uses internal sensors and fast-acting motors to automatically compensate for vessel motion, ensuring the light beam remains fixed on the target regardless of sea state, dramatically improving operational effectiveness during surveillance or rescue operations.

A significant area of technical differentiation lies in material science and environmental ruggedization. Searchlights require housings and mounting structures capable of resisting severe salt spray corrosion, UV degradation, and temperature extremes. This necessitates the use of marine-grade stainless steel or robust, surface-treated aluminum alloys. Furthermore, compliance with Electromagnetic Compatibility (EMC) standards is critical, especially for modern LED drivers, to ensure the searchlight operation does not interfere with sensitive navigation or communication electronics onboard. Ongoing research focuses on developing lightweight composite materials that maintain structural integrity while reducing the top-weight contribution of the searchlight system to the vessel's structure.

Regional Highlights

- Asia Pacific (APAC): APAC dominates the global Ship Searchlight Market both in terms of production volume and demand, driven by its status as the world's leading shipbuilding hub (China, South Korea, Japan). The region's naval modernization programs, particularly China's rapid fleet expansion and India's growing maritime security needs, generate massive demand for high-specification military searchlights. The increasing volume of commercial maritime traffic transiting busy Asian sea lanes mandates stringent safety adherence, boosting the replacement market for advanced, compliant systems.

- North America: North America represents a mature, high-value market characterized by stringent regulatory oversight (US Coast Guard mandates) and substantial defense spending. Demand is concentrated in highly sophisticated sectors, including offshore oil and gas exploration, high-performance coast guard cutters, and the premium luxury yacht segment. Innovation adoption, particularly advanced gyro-stabilized and thermal-integrated searchlights, is rapid, supported by key manufacturers based in the region.

- Europe: Europe is a key innovation center and a significant end-user market, particularly driven by large-scale cruise ship construction, advanced fisheries fleets, and strong naval forces among NATO members. Scandinavian countries, known for their harsh environmental conditions, drive demand for specialized ice-class rated and highly durable searchlight systems. Regulatory push towards energy efficiency (EU mandates) accelerates the retrofitting of older fleets with LED technology.

- Latin America (LATAM): LATAM is an emerging market focused primarily on coastal patrol, resource protection, and port security upgrades. Market growth is sporadic but steady, tied closely to government investments in naval assets and the modernization of infrastructure supporting the region's burgeoning commodity exports. Price sensitivity is higher in this region, leading to preference for reliable, mid-range products over ultra-high-end specialized systems.

- Middle East and Africa (MEA): MEA is driven by rapidly expanding port infrastructure development, critical choke point security (e.g., Suez Canal, Strait of Hormuz), and increased anti-piracy operations. The Middle East segment, fueled by oil and gas revenue, invests significantly in modern naval and specialized offshore support fleets, demanding high-output, ruggedized searchlights suitable for extreme heat and dust environments. Africa's growth is centered on coastal surveillance and border patrol fleet upgrades.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Ship Searchlight Market.- Phoenix Products Company

- Carlisle & Finch Co.

- ACR Electronics (Ocean Signal)

- Glamox AS (Aqua Signal)

- Hepworth Group

- Sanshin Electric Corporation

- Perko Inc.

- F.W. Tappert GmbH

- DHR-Marine

- Luminator Technology Group (P. Searchlight brand)

- Pains Wessex (Drew Marine)

- Imtra (BocaTech)

- Zhejiang Zhonghuan Electronic Co., Ltd.

- Sider Technology Co., Ltd.

- Wema System AS

- Peters & Bey GmbH

- Den Haan Rotterdam B.V. (DHR)

- Francis Searchlights Ltd.

- Golight, Inc.

- Kahlenberg Bros. Co.

Frequently Asked Questions

Analyze common user questions about the Ship Searchlight market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary advantages of LED searchlights over Xenon technology in marine applications?

LED searchlights offer significant advantages in marine applications including vastly superior operational lifespan (50,000+ hours versus 1,000-2,000 hours for Xenon), reduced power consumption, immediate start-up (no warm-up required), and high resistance to shock and vibration, leading to reduced maintenance costs and lower total cost of ownership (TCO).

How do international maritime regulations (e.g., SOLAS) affect the Ship Searchlight Market?

SOLAS conventions and regulations set mandatory minimum performance standards for visibility, intensity, and reliability of onboard lighting systems, ensuring navigational safety. These regulations act as a core market driver, requiring all commercial vessels to install and maintain certified searchlights, continually stimulating the replacement and retrofit segments.

What role does gyro-stabilization play in modern high-performance marine searchlights?

Gyro-stabilization is critical for maintaining a fixed beam on a target regardless of the vessel's movement (pitch and roll). This technology, primarily used in naval and specialized vessels, ensures effective tracking and surveillance during adverse sea conditions, maximizing the operational utility of the searchlight for security and search and rescue missions.

Which application segment is expected to show the fastest growth rate in the forecast period?

The Naval Vessels application segment is anticipated to exhibit the fastest growth rate. This acceleration is driven by intensifying global defense spending, strategic naval fleet modernization, and the increasing complexity of maritime patrol missions that demand advanced, integrated, and highly ruggedized illumination and signaling solutions.

What are the key technical specifications required for searchlights used on offshore oil and gas vessels?

Offshore vessels require searchlights that adhere to extremely high ruggedization standards, including specific certifications for hazardous environments, such as explosion-proof ratings (ATEX/IECEx compliance), superior IP ratings (IP68), and robust resistance to corrosive saltwater and chemicals, ensuring operational safety in volatile environments.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager