Shipbuilding Cables Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433667 | Date : Dec, 2025 | Pages : 242 | Region : Global | Publisher : MRU

Shipbuilding Cables Market Size

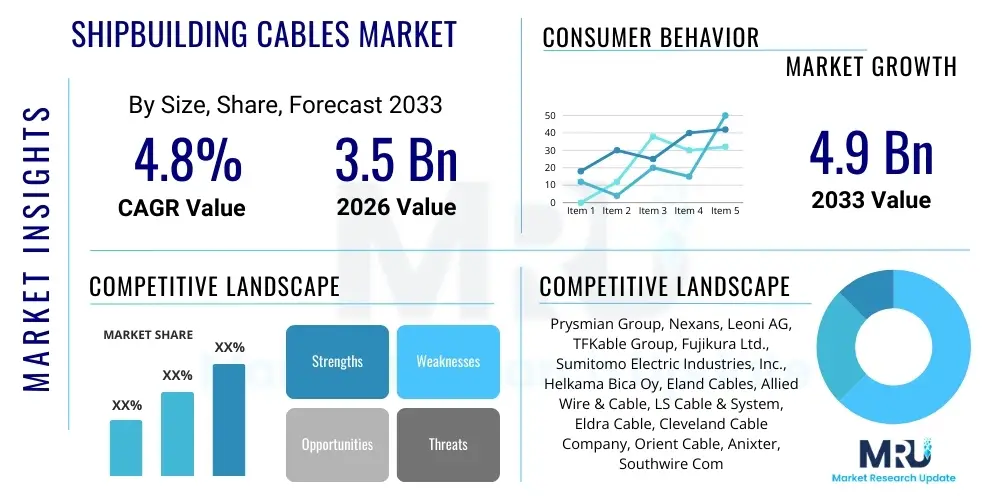

The Shipbuilding Cables Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at USD 3.5 Billion in 2026 and is projected to reach USD 4.9 Billion by the end of the forecast period in 2033. This consistent expansion is fundamentally driven by the resurgence in global maritime trade activities, increasing naval modernization programs across major economies, and the sustained regulatory pressure demanding safer, high-performance, and environment-friendly cable solutions in marine environments.

Shipbuilding Cables Market introduction

The Shipbuilding Cables Market encompasses the supply and utilization of specialized electrical and optical cables engineered specifically for marine vessels, including commercial ships, naval fleets, cruise liners, and offshore drilling platforms. These cables are critical infrastructure, responsible for power distribution, communication systems, navigation controls, and complex instrumentation within highly demanding and often hazardous maritime settings. Due to the inherent challenges of marine operation—such as exposure to moisture, salinity, extreme temperatures, vibrations, and fire risk—shipbuilding cables must comply with stringent international maritime standards, including those set by classification societies like DNV, ABS, and Lloyd’s Register, often requiring halogen-free, flame-retardant (HFFR) materials for enhanced crew safety and vessel integrity. The primary applications range from connecting propulsion systems and ballast pumps to facilitating integrated bridge systems and advanced data networking across the vessel's structure, ensuring reliable operation under severe conditions.

The core product description centers on high-reliability cables categorized by function (power, control, data), voltage rating (low, medium), and insulation type (XLPE, EPR, PVC, MICA tape). Major applications span across new vessel construction, vessel repair and maintenance (R&M), and sophisticated offshore energy projects. Key benefits derived from modern shipbuilding cables include significantly reduced fire load, improved operational lifespan, immunity to electromagnetic interference (EMI), and reduced weight compared to legacy systems, which contributes positively to fuel efficiency and overall vessel performance. Moreover, the demand for high-speed data transmission cables, such as marine-grade fiber optics, is escalating rapidly, driven by the increasing digitalization of maritime operations, the implementation of 'smart ship' technologies, and the need for robust cybersecurity measures integrated into the vessel's network architecture.

The market is currently experiencing robust driving factors, chiefly characterized by the global transition towards Liquefied Natural Gas (LNG) and other alternative fuel vessels, which necessitates specialized power and control cables adapted for intrinsically safe zones and cryogenic environments. Furthermore, geopolitical tensions are spurring significant investments in naval shipbuilding and fleet modernization, particularly in the Asia Pacific and North American regions, ensuring a sustained high demand for high-specification, military-grade cables that require superior shielding, robust mechanical protection, and extended operational temperature ranges. These drivers collectively establish a strong foundation for sustained market growth throughout the forecast period, positioning shipbuilding cables as a vital and technologically evolving component of the global maritime industry.

Shipbuilding Cables Market Executive Summary

The Shipbuilding Cables Market is poised for substantial growth, underpinned by favorable business trends focused on decarbonization, digital transformation, and naval expansion. Segment trends indicate a sharp acceleration in the adoption of Halogen-Free, Mud-Resistant, and Low Smoke Zero Halogen (LSZH) cables, driven by increasingly strict safety regulations imposed by international bodies and classification societies aiming to minimize risks associated with fire and toxic fume exposure onboard vessels. Commercially, the market is shifting towards integrated cable systems and pre-fabricated harnesses, optimizing installation time and reducing labor costs in modern shipyards. Technologically, there is a distinct move toward lightweight yet durable materials and high-capacity data cables (Category 7 or higher and specialized fiber optics) to support complex integrated navigation and automation systems integral to smart ship architecture. This convergence of regulatory compliance and technological advancement dictates the primary investment pathways for manufacturers and suppliers globally.

Regional trends highlight the Asia Pacific (APAC) region, dominated by shipbuilding giants like China, South Korea, and Japan, maintaining its stronghold as the largest market for shipbuilding cables due to unparalleled output in commercial vessel construction, including VLCCs, container ships, and LNG carriers. However, Europe is projected to demonstrate strong growth, driven by its leadership in specialized vessel construction such as cruise ships, yachts, and complex offshore support vessels (OSVs), coupled with intense R&D focusing on sustainable and high-performance cable solutions suitable for challenging deep-sea operations. North America, though smaller in commercial volume, represents a highly lucrative segment, fueled almost entirely by substantial long-term government contracts for advanced naval vessel construction, refurbishment of existing fleet assets, and investments in next-generation submarine cables, mandating extremely rigorous military specifications (MIL-SPEC) for electrical components.

The competitive landscape is characterized by consolidation among major global players seeking vertical integration and expansion into niche high-specification product lines, such as robotic and flexible cables used in automated ship machinery and advanced sensor networks. Supply chain management is increasingly focused on resilience and localized manufacturing capacity, particularly following recent global disruptions, leading to strategic partnerships between cable manufacturers and regional shipyards to streamline procurement and ensure compliance with localized content requirements. Overall, the market's trajectory is positive, supported by structural demand drivers—maritime trade growth, environmental mandates, and consistent defense spending—which collectively ensure robust, albeit cyclical, market performance throughout the 2026–2033 period.

AI Impact Analysis on Shipbuilding Cables Market

Common user questions regarding AI's impact on the Shipbuilding Cables Market frequently revolve around how AI can enhance cable integrity monitoring, optimize supply chain logistics for complex cable routing, and automate the design phase to minimize waste and ensure compliance. Users are concerned with whether AI can predict cable failure before it occurs, thereby enhancing operational uptime and reducing maintenance costs, and how intelligent systems might optimize inventory management for thousands of unique cable types used in a single vessel. The consensus expectation is that AI will move beyond simple data logging, providing predictive maintenance insights, enabling faster and more accurate automated quality control during cable manufacturing, and influencing future cable design specifications by analyzing real-world performance data under various stress conditions. This shift promises increased efficiency in procurement, significant reductions in unplanned downtime, and a higher overall standard of safety and reliability for integrated cable networks on modern ships.

- AI-Powered Predictive Maintenance: Utilizing sensor data embedded in smart cables or monitoring operational parameters (temperature, load, vibration) to forecast potential failure points and schedule proactive replacement, thus extending cable lifecycle and preventing catastrophic system failures at sea.

- Optimized Cable Routing and Design: AI algorithms assist naval architects and ship designers in automatically generating the most efficient, weight-optimized, and compliant cable routing paths, minimizing electromagnetic interference (EMI) risks and reducing material usage within the dense confines of a ship hull.

- Enhanced Manufacturing Quality Control: Implementing machine vision and deep learning models on manufacturing lines to detect minuscule flaws, variations in insulation thickness, or conductor continuity issues at high speed, ensuring zero-defect cable batches suitable for mission-critical marine applications.

- Supply Chain and Inventory Management: AI systems forecast demand for specific cable types based on projected shipyard construction schedules and regional R&M needs, optimizing inventory levels and mitigating delays associated with the long lead times often required for specialized marine cables.

- Autonomous Vessel Integration: AI drives the need for high-redundancy, ultra-reliable communication and control cables capable of handling the massive data flow generated by sensors and control systems essential for fully autonomous or remotely operated marine platforms.

DRO & Impact Forces Of Shipbuilding Cables Market

The dynamics of the Shipbuilding Cables Market are shaped by powerful Drivers (D), systemic Restraints (R), evolving Opportunities (O), and potent Impact Forces (I) that collectively determine its short-term volatility and long-term trajectory. Key drivers include the global mandate for fleet renewal, spurred by IMO's EEXI and CII regulations pushing older, less efficient vessels into retirement, coupled with the rapid expansion of naval capabilities globally, demanding continuous supply of high-specification cables. However, the market faces significant restraints, primarily cyclical shipbuilding industry downturns that can momentarily halt large-scale orders, coupled with the escalating cost and volatility of raw materials like copper, aluminum, and specialized polymer compounds, which directly impact manufacturing margins and end-product pricing stability.

Opportunities are abundant, centered around the rapid proliferation of renewable energy infrastructure at sea, specifically offshore wind farms and floating solar installations, which require specialized high-voltage submarine power export and dynamic mooring cables that share similar stringent environmental requirements with traditional shipbuilding cables. Furthermore, the transition toward complex hybrid and electric propulsion systems in maritime transport creates a specialized, high-growth niche for robust high-voltage direct current (HVDC) power cables designed for confined marine battery storage and distribution. These opportunities require manufacturers to invest heavily in specialized R&D to meet the unique electrical and mechanical demands of these nascent maritime sectors, particularly focusing on miniaturization and higher power density without compromising safety.

The dominant impact forces on this market include regulatory stringency, which mandates the shift towards safer materials (Low Smoke, Halogen-Free, Fire Resistant), making compliance a continuous cost factor but also a barrier to entry for non-compliant competitors. Geopolitical instability also serves as a major force, driving up demand for naval vessels but simultaneously disrupting global supply chains for critical components. The primary market-shaping force remains technological innovation focused on achieving better performance metrics—specifically, enhanced longevity, reduced weight, and superior data transmission capabilities—all vital for the functioning of future highly automated and environmentally compliant maritime fleets. Managing these forces requires manufacturers to adopt flexible production models and maintain robust certification portfolios.

Segmentation Analysis

The Shipbuilding Cables Market is comprehensively segmented across several dimensions, allowing for precise market sizing and strategic analysis based on functionality, material composition, and application complexity. The primary segmentation distinguishes between the type of cable, such as power, control, communication, and high-frequency data transmission cables, reflecting the foundational electrical architecture of any vessel. Further detailed segmentation examines the insulation material, which is critical for meeting fire safety and environmental specifications, with halogen-free and cross-linked polyethylene (XLPE) materials gaining prominence over older PVC-based alternatives. Additionally, the market is differentiated by voltage level (low, medium, high voltage) corresponding to different applications, from instrumentation to main propulsion systems, and most importantly, by the end-use vessel type, which dictates the specific certification and mechanical robustness required for the cable solution.

- By Type:

- Power Cables (Main distribution, feeders)

- Control Cables (Instrumentation, signaling)

- Communication and Data Cables (Ethernet, Fieldbus, Fiber Optic)

- Instrumentation Cables (Sensor connectivity)

- By Voltage:

- Low Voltage (Up to 1 kV)

- Medium Voltage (1 kV to 35 kV)

- High Voltage (Above 35 kV, primarily for large vessels and specialized applications)

- By Insulation Material:

- XLPE (Cross-linked polyethylene)

- EPR (Ethylene Propylene Rubber)

- PVC (Polyvinyl Chloride - decreasing due to regulation)

- LSZH/HFFR (Low Smoke Zero Halogen / Halogen-Free Flame Retardant)

- Silicon Rubber

- By Vessel Type:

- Commercial Vessels (Container ships, Tankers, Bulk carriers)

- Naval Vessels (Frigates, Submarines, Aircraft Carriers)

- Specialized Vessels (Cruise Ships, Ferries, Yachts)

- Offshore Platforms and Marine Infrastructure (Drilling Rigs, FPSOs)

Value Chain Analysis For Shipbuilding Cables Market

The Value Chain for the Shipbuilding Cables Market begins with the Upstream Analysis, which focuses heavily on the procurement of critical raw materials. This stage is dominated by commodity markets for high-ppurity copper and aluminum conductors, and specialized chemical industries supplying high-performance polymer compounds required for insulation and sheathing, particularly XLPE, EPR, and the crucial LSZH/HFFR components necessary for meeting fire safety standards. Price volatility in these raw material markets significantly affects the profitability and strategic sourcing decisions of cable manufacturers. Successful upstream management relies on long-term supplier contracts, strategic hedging against commodity price fluctuations, and maintaining rigorous quality control over incoming materials to ensure they meet marine-grade specifications required for harsh environments. The relationship between material suppliers and cable manufacturers is highly specialized, necessitating collaborative R&D to develop next-generation fire-resistant and lightweight materials, reducing overall vessel weight and improving safety parameters.

The midstream segment involves the core manufacturing process, where raw materials are converted into finished marine cables through drawing, stranding, insulating, shielding, and jacketing processes. This stage is capital-intensive, requiring advanced extrusion and compounding technologies to achieve precise cable geometries and meet stringent regulatory tolerances for fire resistance, oil and chemical resistance, and UV stability. Post-manufacturing, the cables undergo rigorous testing and certification by recognized maritime classification societies (DNV, ABS, RINA, etc.), which adds a significant value step and acts as a necessary quality assurance mechanism before market entry. The competitive advantage at this stage rests on manufacturing efficiency, the breadth of product certification across various global standards, and the ability to produce high-specification, low-volume military or specialized cables alongside high-volume commercial cables.

The Downstream Analysis involves the distribution channel and eventual installation. Distribution primarily occurs through specialized marine electrical distributors and supply chain integrators who maintain certified stock and provide localized logistics support directly to shipyards and repair facilities (Direct Channels). Indirect distribution channels often involve large global electrical wholesalers who serve both marine and general industrial markets but typically handle lower-specification, standard cables. The final customer (shipyard or end-user) highly values suppliers who offer comprehensive support, including custom cable length cutting, bundled solutions, and just-in-time delivery to support complex, tightly scheduled shipbuilding projects. The entire value chain is characterized by a high need for certification, demanding robust traceability systems from the source material to the installed product to ensure regulatory compliance and guarantee performance reliability over the vessel's operational lifespan.

Shipbuilding Cables Market Potential Customers

The primary consumers and end-users of shipbuilding cables are multifaceted, spanning various sectors of the global maritime industry. The largest segment of potential customers comprises major global Shipyards responsible for new construction projects, particularly those specializing in high-value commercial vessels such as massive container ships (ULCS), LNG carriers, and sophisticated passenger vessels (cruise liners). These shipyards require high volumes of standardized and specialized power, control, and data cables for installation during the initial build phase. The purchasing decisions of these large shipyards are driven by total cost of ownership, installation speed (favoring pre-terminated or highly flexible cables), and adherence to tight project timelines, necessitating reliable supply from established, certified manufacturers capable of handling massive logistical demands and quality assurance protocols for hundreds of kilometers of cable per vessel.

A second crucial segment includes Naval Forces and Defense Contractors globally. These customers represent the high-specification, high-margin niche of the market. Naval vessels, including submarines, destroyers, and specialized support craft, require cables that meet extremely strict military specifications (MIL-SPEC), demanding superior electromagnetic compatibility (EMC), shock resistance, nuclear hardening (where applicable), and extreme fire resistance (zero halogen, minimal smoke). Procurement for this segment is often handled through long-term government contracts, and the emphasis is placed overwhelmingly on performance, reliability, and security of supply rather than raw cost, often requiring bespoke cable designs and extensive security clearances from manufacturers to ensure national security interests are protected.

Finally, the Maintenance, Repair, and Overhaul (MRO) sector and the Offshore Energy Industry constitute significant ongoing demand. MRO facilities and fleet owners frequently purchase cables for routine replacement and refurbishment, ensuring sustained demand regardless of new construction cycles. Offshore platforms (Drilling Rigs, FPSOs, FSOs) and the burgeoning Offshore Wind sector are unique end-users that require mud-resistant, oil-resistant, and dynamically flexible cables designed to withstand continuous movement and corrosive environments in critical, hazardous zones. These customers prioritize long-term durability and the highest possible resistance to environmental degradation, making compliance with standards like NEK 606 (Mud Resistant) essential for any supplying cable manufacturer seeking to penetrate this highly profitable and technically challenging market segment.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 3.5 Billion |

| Market Forecast in 2033 | USD 4.9 Billion |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Prysmian Group, Nexans, Leoni AG, TFKable Group, Fujikura Ltd., Sumitomo Electric Industries, Inc., Helkama Bica Oy, Eland Cables, Allied Wire & Cable, LS Cable & System, Eldra Cable, Cleveland Cable Company, Orient Cable, Anixter, Southwire Company, Belden Inc., Marmon Group, NKT A/S, Tratos, Habia Cable AB |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Shipbuilding Cables Market Key Technology Landscape

The technological landscape of the Shipbuilding Cables Market is defined by continuous innovation focused on optimizing cable performance, reducing environmental impact, and enhancing safety in increasingly complex vessel designs. A major technological thrust involves the development of advanced insulation and sheathing materials that are Halogen-Free Flame Retardant (HFFR) and Low Smoke Zero Halogen (LSZH). This shift moves away from traditional PVC materials to compounds like XLPE and specialized thermoplastic polyurethanes (TPU) and silicon rubbers, which significantly reduce the emission of corrosive, toxic smoke during a fire incident. The innovation focuses on maintaining critical performance attributes like resistance to oil, fuel, and drilling muds (essential for offshore applications, meeting standards such as NEK 606) while achieving superior fire resistance ratings (e.g., meeting IEC 60331 for circuit integrity).

Another dominant technological trend is the miniaturization and weight reduction of cables. As vessels become more automated and densely packed with equipment, reducing cable volume and weight is crucial for increasing payload capacity and improving fuel efficiency. This involves utilizing advanced conductor materials, such as specific aluminum alloys or optimized copper strand geometries, paired with thinner, yet equally robust, insulation layers. Furthermore, the rise of "smart ship" technology and high-speed vessel networking systems has accelerated the adoption of marine-grade Fiber Optic Cables (FOC). FOC technology offers vastly superior bandwidth, immunity to electromagnetic interference (EMI), and significant weight savings compared to traditional copper data cables, making them essential for integrated bridge systems, surveillance networks, and remote diagnostics, necessitating robust armor and specialized water-blocking features for long-term marine reliability.

Finally, the push towards electric and hybrid propulsion systems introduces the necessity for High Voltage Direct Current (HVDC) and High-Voltage Alternating Current (HVAC) power cables specifically designed for marine environments. These cables must safely manage high power loads and thermal stress within confined spaces, often requiring advanced shielding and optimized thermal management features to prevent overheating and ensure system stability. The technological evolution in this segment includes highly flexible and robust connections suitable for battery banks and propulsion motors, requiring manufacturers to develop customized cable constructions that adhere to extremely strict safety margins and offer longevity under continuous high-stress operational profiles unique to electric maritime transport.

Regional Highlights

- Asia Pacific (APAC) Dominance: APAC remains the undisputed global leader in shipbuilding cable consumption, anchored by China, South Korea, and Japan. These nations collectively dominate the commercial shipbuilding market, producing the majority of container ships, tankers, and bulk carriers. The region is characterized by high volume demand, competitive pricing, and a strong regulatory drive towards local content compliance. Future growth is strongly linked to China's increasing investment in naval modernization and South Korea's leadership in constructing high-value LNG and specialized eco-friendly vessels.

- Europe: Focus on Specialization and Compliance: European demand, particularly from Germany, Italy, and Scandinavia, centers on specialized, high-margin vessels such as luxury cruise ships, advanced mega-yachts, and complex offshore support vessels (OSVs) used in renewable energy projects. This region drives innovation in fire safety and environmental compliance, demanding premium LSZH, HFFR, and robust mud-resistant cables. European manufacturers often lead in technology development for hybrid/electric propulsion cabling systems, capitalizing on stringent EU safety directives.

- North America: Driven by Naval and Defense Spending: The North American market, predominantly the United States, is heavily influenced by sustained high-level defense spending, resulting in a consistent demand for military-grade, high-specification cables for naval fleets (submarines, destroyers, aircraft carriers). Demand is highly specifications-driven (MIL-SPEC requirements), prioritizing performance, durability, and security of supply over cost. The presence of significant offshore oil and gas infrastructure in the Gulf of Mexico also maintains strong, specialized regional demand.

- Latin America & Middle East/Africa (LAMEA): Emerging Growth Centers: Latin America, particularly Brazil, focuses on offshore oil and gas exploration vessels, requiring specific deepwater and seismic cables. The Middle East and Africa are growing markets due to strategic naval buildup and infrastructure projects related to port expansion and regional tanker fleets. Growth in these regions is often project-specific and tied directly to fluctuating global energy prices and sovereign investment priorities, focusing primarily on maintenance and new builds for national fleets.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Shipbuilding Cables Market.- Prysmian Group

- Nexans

- Leoni AG

- TFKable Group

- Fujikura Ltd.

- Sumitomo Electric Industries, Inc.

- Helkama Bica Oy

- Eland Cables

- Allied Wire & Cable

- LS Cable & System

- Eldra Cable

- Cleveland Cable Company

- Orient Cable

- Anixter

- Southwire Company

- Belden Inc.

- Marmon Group

- NKT A/S

- Tratos

- Habia Cable AB

Frequently Asked Questions

Analyze common user questions about the Shipbuilding Cables market and generate a concise list of summarized FAQs reflecting key topics and concerns.What major regulatory standards govern the certification of shipbuilding cables globally?

Shipbuilding cables must adhere to rigorous international standards established by the International Electrotechnical Commission (IEC), specifically IEC 60092 series for marine installations, alongside fire safety standards like IEC 60331 (circuit integrity) and IEC 60332 (flame propagation). Additionally, certification is mandatory from classification societies such as Lloyd's Register (LR), DNV (Det Norske Veritas), American Bureau of Shipping (ABS), and Bureau Veritas (BV), ensuring compliance with marine-specific requirements for toxicity, smoke density, and resistance to environmental stress factors like mud and oil, which are crucial for global deployment and insurance purposes.

How is the push for decarbonization impacting the demand and technology of marine cables?

Decarbonization mandates, driven by IMO regulations like EEXI and CII, are significantly driving the demand for specialized High Voltage (HV) and Direct Current (DC) cables necessary for hybrid, fully electric, and alternative fuel (LNG, methanol) propulsion systems. This shift requires cables capable of handling higher power density and thermal loads within confined spaces, pushing manufacturers to innovate in thermal management and insulation materials, ensuring that the electrical infrastructure supports efficient power distribution from modern battery banks and fuel cells, thereby minimizing vessel emissions and enhancing energy efficiency.

Which cable type is experiencing the fastest growth in the shipbuilding market, and why?

Fiber Optic Cables (FOCs) and specialized high-bandwidth Category 7/7A data cables are experiencing the fastest growth. This acceleration is driven by the rapid digitalization of the maritime industry, including the implementation of 'smart ship' technologies, integrated navigation bridges, remote diagnostics, and crew connectivity requirements. FOCs offer superior electromagnetic interference immunity, vastly higher data rates, and significant weight savings compared to traditional copper communications cables, making them essential infrastructure for complex, data-intensive modern vessel operations and enhancing shipboard network performance.

What are the primary challenges faced by manufacturers in the Shipbuilding Cables Market?

Manufacturers face key challenges including the high volatility and unpredictable pricing of essential raw materials, particularly copper and specialized polymers, which impacts cost forecasting and margins. Furthermore, navigating the complex and continually evolving web of mandatory international and classification society certifications for every product line demands substantial time and financial investment in testing and documentation. Additionally, the inherent cyclical nature of the global shipbuilding industry creates fluctuating demand, requiring flexible production capacities and robust supply chain resilience to manage sudden surges or drops in major project orders effectively.

How does the demand for naval vessels differ from commercial vessel demand in terms of cable specifications?

Naval demand mandates far stricter specifications, prioritizing operational security, extreme durability, and survivability over cost efficiency. Naval cables must comply with stringent MIL-SPEC standards, focusing on superior resistance to shock, vibration, and severe environments, along with enhanced electromagnetic shielding (EMC) to prevent signal interception and interference. In contrast, commercial demand prioritizes cost-efficiency, weight reduction, and rapid installation, focusing on meeting necessary baseline classification safety rules (LSZH/HFFR) for large-volume, standardized power and data applications, resulting in a fundamental divergence in required cable construction and material quality between the two sectors.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager