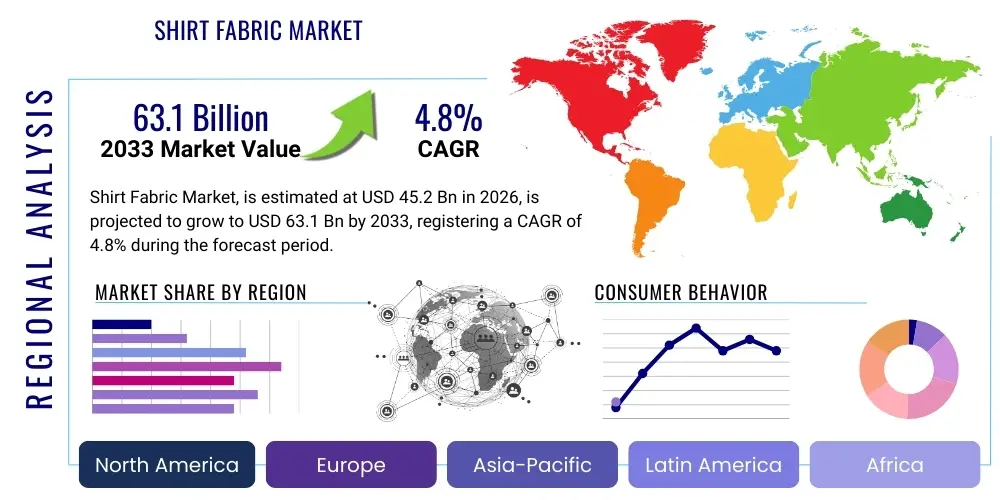

Shirt Fabric Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436906 | Date : Dec, 2025 | Pages : 245 | Region : Global | Publisher : MRU

Shirt Fabric Market Size

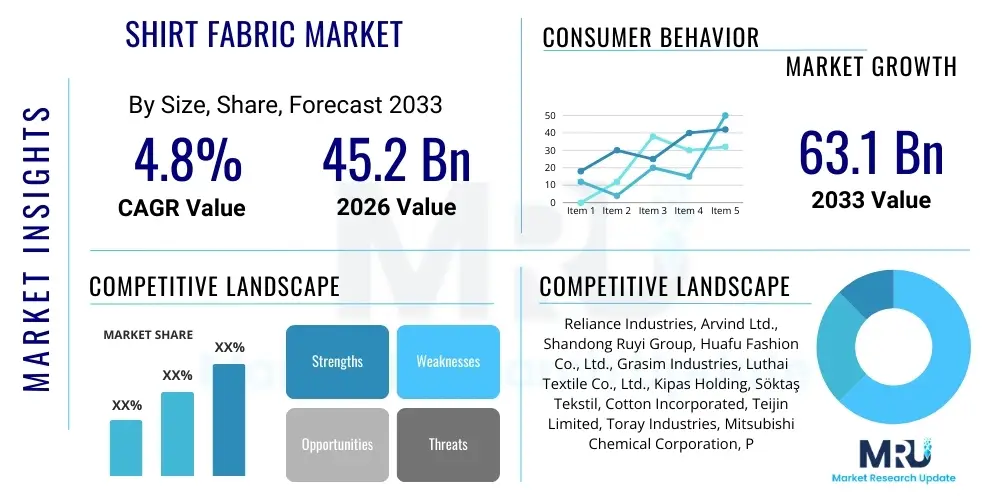

The Shirt Fabric Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at USD 45.2 Billion in 2026 and is projected to reach USD 63.1 Billion by the end of the forecast period in 2033.

Shirt Fabric Market introduction

The Shirt Fabric Market encompasses the global production and distribution of woven and knitted textiles specifically designed for manufacturing shirts, a staple garment in casual, formal, and corporate wear. These fabrics are diverse, ranging from natural fibers like cotton, linen, and silk to synthetic and regenerated materials such as polyester, rayon, and innovative blends. The continuous evolution of fashion trends, coupled with rising disposable incomes in emerging economies, significantly fuels market expansion. Shirt fabric production involves sophisticated processes, including spinning, weaving/knitting, dyeing, finishing, and often specialized treatments like wrinkle-resistance or moisture-wicking properties, catering to specific consumer demands for comfort, durability, and aesthetics. The product description spans classic weaves like poplin and oxford to modern performance fabrics tailored for sportswear or technical apparel.

Major applications of shirt fabrics are segmented across formal wear, casual wear, workwear, and specialized technical shirts. Formal applications demand high thread counts and pristine finishes, often utilizing fine cotton or silk blends, while casual applications embrace a wider variety of materials and bolder patterns, prioritizing comfort and ease of care. The inherent benefits derived from high-quality shirt fabrics include enhanced breathability, superior drape, and longevity, which are critical factors influencing buyer preference. Driving factors for this market include rapid urbanization, the proliferation of e-commerce channels facilitating direct-to-consumer sales, and significant technological advancements in textile manufacturing that enable sustainable production practices and the development of high-performance textiles.

Furthermore, the global shift towards sustainable and circular fashion has become a profound driving force. Consumers are increasingly demanding fabrics produced with minimal environmental impact, pushing manufacturers toward organic cotton, recycled polyester, and closed-loop production systems. Regulatory frameworks promoting textile sustainability, particularly in Europe and North America, also mandate stricter standards for chemical usage and wastewater management, further influencing the supply chain dynamics. The market's resilience is tied directly to the global apparel industry's health, which, despite temporary disruptions like economic downturns, maintains consistent demand due to the essential nature of shirts in human attire across all demographic and professional spheres.

Shirt Fabric Market Executive Summary

The Shirt Fabric Market demonstrates robust growth driven primarily by shifting consumer preferences toward comfortable yet stylish apparel and the relentless innovation within the textile industry focusing on smart fabrics and sustainability. Business trends highlight a strong focus on supply chain transparency and digitalization, enabling faster response times to fast fashion cycles and minimizing inventory risks. Strategic mergers and acquisitions among large textile conglomerates are common, aimed at achieving vertical integration, securing raw material supply, and expanding geographical footprint into high-growth regions like Asia Pacific. The competitive landscape is characterized by established players focusing on premiumization through branding and technical superiority, while emerging manufacturers often compete on cost and speed to market, particularly those leveraging advanced manufacturing capabilities in countries like Vietnam and Bangladesh.

Regionally, Asia Pacific (APAC) continues to dominate the market in both consumption and production volumes, fueled by massive population bases, rapidly industrializing economies, and increasing adoption of Western dress styles in professional environments. North America and Europe, however, remain critical markets for high-value, sustainable, and performance-oriented shirt fabrics, where stringent regulatory requirements push innovation in chemical-free and recycled materials. Segment trends show a significant pivot towards synthetic and blended fabrics that offer performance advantages (e.g., stretch, moisture management) while maintaining the aesthetic appeal of natural fibers. Within material segmentation, the demand for organic cotton is soaring, representing a premium segment of the market that commands higher margins due to its ethical sourcing and environmental certifications. The casual wear application segment, bolstered by the global trend of relaxed corporate dress codes, is outpacing formal wear, demanding fabrics that balance structure and comfort.

The overall market trajectory indicates a clear move toward specialization. Manufacturers are investing heavily in technologies such as digital printing and automated cutting systems to facilitate customized, small-batch production, catering to niche markets and personalized apparel experiences. The convergence of textile science and digital technology is creating new market opportunities, specifically in the B2B sector where customization and rapid prototyping are paramount for apparel brands. Furthermore, the rising awareness of microplastic pollution is starting to temper the growth of purely synthetic fabrics, encouraging hybrid solutions and biodegradable alternatives. Successful market players are those who can effectively navigate raw material price volatility, adhere to evolving sustainability mandates, and maintain flexibility in their manufacturing processes to address highly fragmented consumer demand.

AI Impact Analysis on Shirt Fabric Market

Common user questions regarding AI's impact on the Shirt Fabric Market primarily revolve around how AI can optimize manufacturing efficiency, enhance predictive demand forecasting, and revolutionize textile design. Users frequently inquire about the feasibility of AI-driven quality control systems (detecting weaving or dyeing defects), the potential for AI algorithms to design novel fabric patterns based on real-time fashion trends, and the implementation of machine learning in optimizing raw material inventory and minimizing waste. Key themes summarized from these inquiries include a strong expectation that AI will lead to significant cost reduction, higher product consistency, and a dramatic acceleration of the design-to-shelf cycle, fundamentally transforming traditional textile supply chains into highly data-driven, intelligent systems capable of near-perfect personalization and efficiency.

- AI-driven Predictive Analytics: Optimizing inventory management and forecasting demand for specific fabric types and colors, reducing overproduction and waste.

- Automated Quality Control: Utilizing computer vision and machine learning models to detect microscopic defects in weaving, dyeing, and finishing processes in real-time, significantly boosting fabric quality consistency.

- Generative Design: AI algorithms assist designers in creating unique, market-relevant patterns and color palettes by analyzing consumer data and social media trends, accelerating product development cycles.

- Smart Manufacturing Optimization: AI manages complex machinery, optimizing energy consumption, water usage, and dye mixture recipes in textile finishing, enhancing sustainability and operational efficiency.

- Supply Chain Transparency: Blockchain integrated with AI tracking systems provides end-to-end visibility of raw materials and ethical sourcing verification, fulfilling growing consumer demands for traceability.

DRO & Impact Forces Of Shirt Fabric Market

The Shirt Fabric Market is driven by a complex interplay of consumer demands for advanced functionality and aesthetic variety, while simultaneously being restrained by volatile raw material costs and the heavy environmental footprint of traditional textile processing. Opportunities emerge predominantly from advancements in sustainable textile technology, specifically the development of bio-based, recycled, and low-impact dyeing agents, which meet the increasing regulatory pressures and ethical consumer preferences. The major impact forces reshaping the market include the disruptive influence of fast fashion requiring high-speed supply chains, the imperative for water conservation in textile production, and geopolitical instability affecting cotton and crude oil prices (which impact synthetic fibers). Successfully navigating these forces requires manufacturers to invest heavily in resilient, localized, and agile supply chain strategies.

Key drivers include the global expansion of the organized retail sector and the rising middle class in Asian countries, translating into higher per capita expenditure on clothing. Technological innovation, such as the implementation of digitalization in textile production and the rise of 3D fitting and design software, facilitates rapid prototyping and mass customization, driving demand for versatile fabric bases. Restraints are prominent, notably the high dependence on agricultural products (cotton), making the market susceptible to climate change impacts and commodity price fluctuations. Furthermore, stringent environmental regulations regarding effluent treatment and chemical use significantly increase operational costs, particularly for manufacturers who have not modernized their production facilities.

Opportunities are vast in the realm of performance fabrics, particularly those offering inherent antiviral, anti-odor, or UV-protective properties, catering to niche markets like specialized workwear and outdoor apparel. Furthermore, establishing circular economy models, such as textile-to-textile recycling infrastructure, presents a long-term competitive advantage and revenue stream. The combined impact forces—consumer demand for transparency, regulatory tightening (e.g., REACH in Europe), and the continuous pressure for cost efficiency—mandate a transformation from linear manufacturing models to more sustainable, closed-loop systems, profoundly influencing material choice and investment decisions across the value chain. This shift defines market competitiveness and long-term viability for major players.

Segmentation Analysis

The Shirt Fabric Market segmentation provides a detailed framework for understanding the diverse supply and demand dynamics across various product characteristics and end-user requirements. The market is primarily segmented based on Material Type (natural vs. synthetic), Application (formal, casual, workwear), and Weave Type (which defines the texture and drape of the final product). This granular analysis is crucial for manufacturers to tailor their production strategies, focusing on specific segments where they possess technological superiority or cost advantages. The fastest-growing segment often shifts based on macro trends; currently, performance-oriented synthetic blends designed for casual comfort are exhibiting strong growth, while classic natural fibers like premium cotton maintain their value as staples in the formal wear segment.

- By Material Type:

- Cotton

- Linen

- Silk

- Synthetic (Polyester, Nylon)

- Blends (Poly-Cotton, Cotton-Linen)

- Cellulosic Fibers (Rayon, Lyocell, Viscose)

- By Weave Type:

- Poplin

- Twill

- Oxford

- Dobby

- End-on-End

- Herringbone

- Satin/Sateen

- Denim/Chambray

- By Application:

- Formal Wear

- Casual Wear

- Workwear/Uniforms

- Performance/Sportswear Shirts

- By Distribution Channel:

- B2B (Direct Supply to Apparel Manufacturers)

- B2C (Retail Fabric Stores, E-commerce)

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East and Africa (MEA)

Value Chain Analysis For Shirt Fabric Market

The value chain for the Shirt Fabric Market begins with upstream activities focused on raw material sourcing. This involves the cultivation of natural fibers (cotton, flax) and the production of synthetic polymer chips (petrochemical industry derivatives). This phase is capital-intensive and highly susceptible to global commodity price fluctuations and environmental factors. Key upstream players include large-scale cotton traders, petrochemical corporations, and specialized fiber producers, which determine the quality and cost base of the subsequent textile manufacturing processes. Efficient management of the upstream segment, particularly securing sustainable and certified raw materials, is a growing priority due to consumer and regulatory demands.

Midstream activities involve spinning (converting fibers into yarn), weaving or knitting (transforming yarn into greige fabric), and the highly critical processes of dyeing, printing, and finishing. This stage adds significant value through technological expertise, machinery investment, and specialized chemical treatments (e.g., mercerization, anti-microbial finishing). Downstream activities encompass the distribution and sale of finished fabric to apparel manufacturers, wholesalers, and specialized fabric retailers. Distribution channels are bifurcated: direct channels involve large textile mills selling directly to major apparel brands (B2B), ensuring supply stability and bulk volume pricing. Indirect channels involve agents, distributors, and trading companies that cater to smaller garment makers and localized markets, providing flexibility but often adding layers of complexity to the supply chain.

The shift towards fast fashion and heightened demand for customization has amplified the role of efficient logistics and digitized connectivity across the distribution network. Direct distribution channels are favored by large-scale, vertically integrated companies seeking maximum control over quality and lead times. Conversely, localized fabric retailers serve the bespoke tailoring segment and small-scale designers, maintaining a vital, albeit smaller, presence. The effectiveness of the value chain is increasingly measured by its resilience, transparency, and its ability to rapidly move finished goods from the mill floor to the garment factory, emphasizing lean manufacturing principles and reduced time-to-market metrics.

Shirt Fabric Market Potential Customers

The primary end-users and buyers of shirt fabric are broadly categorized into major apparel manufacturing companies (including private label brands and major international retailers), specialized uniform and workwear suppliers, independent fashion designers, and small-to-medium enterprises (SMEs) engaged in bespoke tailoring and localized garment production. Large multinational apparel corporations, such as those operating in the mass-market and high-street fashion segments, represent the largest volume buyers, often requiring standardized, bulk orders of specific fabric compositions and colors, sourced directly from integrated textile mills globally. These customers prioritize consistency, competitive pricing, and certified compliance with international labor and environmental standards.

A rapidly expanding customer base includes e-commerce-native fashion brands and direct-to-consumer (D2C) companies that require highly flexible sourcing models, often demanding smaller minimum order quantities (MOQs) but with a high frequency of new fabric designs or specialized technical finishes. These digital-first brands leverage the ability to rapidly test new fabric concepts based on immediate consumer feedback, driving demand for digital printing capabilities and quick turnaround times. Uniform and workwear providers constitute another critical customer segment, demanding highly durable fabrics with specific functional requirements such as fire resistance, high visibility, or anti-static properties, focusing intensely on material longevity and stringent regulatory certification specific to various industries (e.g., healthcare, hospitality, construction).

Furthermore, textile converters and wholesalers act as essential intermediaries, bridging the gap between large production mills and the fragmented network of small designers and tailoring businesses. These customers require diverse inventory selections and smaller lot sizes. Ultimately, the potential customer profile is shifting towards those who value traceability and sustainability, forcing fabric suppliers to provide comprehensive documentation regarding fiber origin, chemical processing, and environmental impact metrics. Fabric durability and inherent comfort remain universal requirements across all potential customer segments, whether the final garment is a highly structured formal shirt or a stretch-enhanced casual shirt.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 45.2 Billion |

| Market Forecast in 2033 | USD 63.1 Billion |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Reliance Industries, Arvind Ltd., Shandong Ruyi Group, Huafu Fashion Co., Ltd., Grasim Industries, Luthai Textile Co., Ltd., Kipas Holding, Söktaş Tekstil, Cotton Incorporated, Teijin Limited, Toray Industries, Mitsubishi Chemical Corporation, Park Nonwovens, Sinotex Investment & Development Co., Ltd., Raymond Group, Alok Industries, Vardhman Textiles, Welspun India, Bombay Dyeing, BSL Limited. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Shirt Fabric Market Key Technology Landscape

The technological landscape of the Shirt Fabric Market is rapidly evolving, driven by the dual goals of enhancing functionality and minimizing environmental impact. Key technologies center around advanced weaving and knitting techniques that allow for higher thread density and specialized stretch properties, particularly crucial for modern athletic and performance shirting. Computer-aided design (CAD) and simulation software are now standard, enabling rapid development of complex patterns and optimizing material usage, thereby reducing wastage during the fabric cutting stage. Furthermore, sophisticated finishing processes, including nanotechnology treatments, are employed to impart attributes such as permanent wrinkle resistance, enhanced moisture management, and embedded anti-microbial protection, moving shirt fabrics beyond mere aesthetics into the realm of technical textiles.

A crucial area of technological investment is in sustainable processing. Manufacturers are adopting closed-loop systems for water and chemical management, utilizing advanced membrane filtration and recycling technologies in dyeing houses to dramatically reduce wastewater discharge. The shift from conventional dyeing methods to digital and reactive dyeing technologies minimizes the use of heavy metals and optimizes color consistency while reducing water consumption. Furthermore, the development and commercial scale-up of new fibers, such as Tencel (Lyocell) and specialized recycled polyesters derived from plastic bottles (rPET), require proprietary chemical and mechanical processes that are defining the competitive edge for firms prioritizing eco-friendly product lines and compliance with global certifications like GOTS or Oeko-Tex Standard 100.

Automation and digitalization are pervasive across the production floor. High-speed air-jet and rapier weaving machines equipped with real-time sensor monitoring ensure consistent fabric construction and reduce downtime. The integration of IoT (Internet of Things) devices allows for precise tracking of production parameters and material flow throughout the mill, feeding data back to AI systems for predictive maintenance and operational efficiency improvements. This technological integration transforms textile manufacturing into a highly sophisticated, capital-intensive industry, where leveraging cutting-edge machinery and data analytics is essential for achieving high throughput, superior quality, and adherence to tight production schedules required by global apparel retailers.

Regional Highlights

The Shirt Fabric Market exhibits significant regional disparities in terms of production capacity, consumption patterns, and technological adoption, reflecting varied economic development levels and regulatory environments across the globe. Asia Pacific (APAC) dominates the market, primarily due to large manufacturing bases in countries like China, India, and Vietnam, which benefit from lower labor costs, massive raw material availability (especially cotton), and strong government support for the textile export industry. APAC is both the world's largest consumer and producer of shirt fabrics, catering to massive domestic populations and serving as the key global supply hub for international apparel brands. The region’s growth is fueled by increasing middle-class income and rapid adoption of Westernized professional attire.

Europe represents a mature market characterized by high consumer purchasing power and extremely stringent environmental and quality regulations (e.g., REACH). Demand here is concentrated on premium, high-performance, and demonstrably sustainable fabrics, driving European manufacturers to focus on niche, high-value technical textiles and innovative finishing technologies. While production volumes are lower compared to APAC, European players often command higher margins due to their focus on design innovation, brand heritage, and compliance leadership. Countries like Italy and Germany remain crucial centers for sophisticated finishing and high-end fabric design.

North America is primarily a consumption-driven market with high demand for comfort-focused casual wear and technical workwear. Manufacturers in the region focus heavily on textile innovation, particularly in developing smart fabrics and domestic sourcing of high-quality cotton. Supply chains are highly sensitive to lead times and favor quick-response manufacturing. Latin America and the Middle East and Africa (MEA) are emerging markets experiencing strong growth. LATAM benefits from regional integration and local apparel production, while MEA, particularly Turkey and certain Gulf nations, is developing its textile industry infrastructure, driven by strategic investments aimed at reducing import dependency and capitalizing on geographical proximity to European markets.

- Asia Pacific (APAC): Dominates global production and consumption; growth led by China, India, and Vietnam; focus on cost efficiency and mass production; rapidly growing domestic formal and casual wear segments.

- North America: High demand for performance fabrics and casual textiles; strong focus on technical innovation and sophisticated supply chain management; prioritizing ethical sourcing and brand transparency.

- Europe: Leading market for high-quality, sustainable, and specialized shirt fabrics; stringent regulatory environment driving investment in closed-loop manufacturing and eco-friendly chemical processes.

- Latin America (LATAM): Emerging production hub, especially for regional apparel brands; rising domestic consumption fueled by urbanization and stable economic development in major economies like Brazil and Mexico.

- Middle East and Africa (MEA): Developing textile infrastructure; opportunities in technical fabrics for oil and gas sectors (workwear); Turkey remains a strategic hub connecting Asian supply to European demand.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Shirt Fabric Market.- Reliance Industries

- Arvind Ltd.

- Shandong Ruyi Group

- Huafu Fashion Co., Ltd.

- Grasim Industries

- Luthai Textile Co., Ltd.

- Kipas Holding

- Söktaş Tekstil

- Cotton Incorporated

- Teijin Limited

- Toray Industries

- Mitsubishi Chemical Corporation

- Park Nonwovens

- Sinotex Investment & Development Co., Ltd.

- Raymond Group

- Alok Industries

- Vardhman Textiles

- Welspun India

- Bombay Dyeing

- BSL Limited

Frequently Asked Questions

Analyze common user questions about the Shirt Fabric market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary growth driver for the Shirt Fabric Market?

The primary growth driver is the increasing global demand for performance-enhanced and sustainable textiles, coupled with rising disposable incomes in emerging markets that fuel higher per capita expenditure on diverse apparel, including formal and casual shirts.

How is sustainability impacting material choices for shirt fabrics?

Sustainability is critically reshaping material choices, leading to a strong shift towards organic cotton, recycled synthetic fibers (rPET), and cellulosic fibers (Lyocell, Modal) manufactured using closed-loop processes to minimize water and chemical usage.

Which geographical region dominates the production of shirt fabrics?

Asia Pacific (APAC), particularly China, India, and Vietnam, dominates global shirt fabric production, leveraging competitive manufacturing costs and extensive vertical integration capabilities to serve both regional and international apparel supply chains.

What technological advancements are crucial in modern shirt fabric manufacturing?

Key technological advancements include the adoption of AI-driven quality control, high-speed automated weaving/knitting machines, and advanced textile finishing processes like nanotechnology for permanent wrinkle resistance and anti-microbial treatments, enhancing fabric functionality and durability.

What are the main challenges facing the Shirt Fabric Market supply chain?

The main challenges are the volatility of raw material prices (especially cotton), the increasing stringency of global environmental regulations regarding dyeing and finishing effluents, and the pressure for rapid response times driven by fast fashion cycles.

What is the significance of the twill weave in shirt fabric?

Twill weave is significant as it provides a distinct diagonal pattern, offering excellent durability, good drape, and a slightly heavier weight compared to plain weaves like poplin, making it popular for durable work shirts and premium casual wear.

How do synthetic fibers contribute to shirt fabric innovation?

Synthetic fibers, often blended with natural materials, contribute significantly by providing enhanced functional properties such as stretch, superior wrinkle recovery, moisture-wicking capabilities, and greater color fastness, essential for modern performance and travel shirts.

What role does digitalization play in the B2B segment of the fabric market?

Digitalization in the B2B segment enables highly efficient ordering, inventory management through integrated platforms, digital sampling and visualization of new patterns, and real-time tracking of production and delivery logistics, streamlining the procurement process for apparel brands.

Are organic cotton shirt fabrics commanding a premium price?

Yes, organic cotton shirt fabrics typically command a premium price due to the higher costs associated with certified farming practices, lower yields, and the necessary supply chain segregation required to maintain purity and verify GOTS or similar organic certification standards.

What differentiates poplin from oxford weave fabrics?

Poplin features a plain, tight, crosshatch weave that results in a smooth, crisp, and thin fabric, ideal for formal shirts. Oxford weave uses two fine yarns woven over a thicker yarn, creating a slightly rougher texture and a basket-weave appearance, favored for durable, semi-casual button-down shirts.

How are textile manufacturers addressing water usage concerns?

Manufacturers are addressing water usage by adopting highly efficient closed-loop dyeing and finishing systems, utilizing digital printing technologies which require less water than traditional screen printing, and implementing waterless dyeing techniques such as supercritical carbon dioxide dyeing.

What types of coatings are applied to shirt fabrics for improved performance?

Common coatings include durable water repellent (DWR) finishes for outdoor use, chemical treatments for wrinkle-free performance (often formaldehyde-based, though moving towards cleaner alternatives), and specialized finishes to enhance UV protection or incorporate cooling properties.

What is the role of yarn spinning technology in fabric quality?

Yarn spinning technology is foundational to fabric quality; advanced methods like compact spinning produce highly uniform, stronger, and less hairy yarns, resulting in shirt fabrics with superior smoothness, luster, and reduced pilling, critical for high-end formal wear.

How does the casual wear segment influence fabric trends?

The casual wear segment drives trends toward comfort, stretch, and durability, prioritizing textile attributes like softness, ease of care, and fluid drape, favoring blends and innovative knits over traditional, rigid woven structures.

Why is traceability important for shirt fabric suppliers today?

Traceability is paramount as consumers and corporate buyers demand proof of ethical sourcing, transparency regarding labor practices, and verification of environmental claims, making end-to-end supply chain visibility a critical factor for market access and brand reputation.

What impact does the price volatility of cotton have on the market?

Cotton price volatility creates significant uncertainty in manufacturing costs, potentially compressing profit margins for textile mills and apparel brands, and often encourages greater reliance on stable-priced synthetic and man-made cellulosic fibers as substitutes.

How are technical textiles integrated into the shirt fabric market?

Technical textiles are integrated through specialized finishes or inherent fiber properties providing specific functions, such as fabrics for medical uniforms with high hygiene standards, or workwear shirts with flame retardancy and enhanced durability for industrial environments.

What are the projected growth prospects for linen shirt fabrics?

Linen shirt fabrics are projected to see steady, niche growth, driven by their inherent sustainability, breathability, and desirability for summer and resort wear, although limited by raw material availability and the higher cost of processing compared to cotton.

What is an example of an indirect distribution channel for shirt fabrics?

An indirect distribution channel involves textile agents, wholesalers, or specialized fabric trading houses that purchase bulk quantities from large mills and then sell smaller, diverse lots to independent tailors, local garment makers, and bespoke designers.

How is AI being used in textile design and color matching?

AI analyzes vast datasets of consumer preferences and trend forecasting to generate optimal color palettes and novel pattern designs, assisting designers and ensuring that the manufactured fabric lines align immediately with emerging market aesthetics, speeding up the creative process.

Why is the finishing process critical for shirt fabric value?

The finishing process is critical because it dictates the fabric's final performance characteristics, including hand-feel, drape, wrinkle resistance, shrink control, and moisture management, significantly enhancing its utility and perceived value to the end consumer.

What is the significance of the global shift towards corporate casual dress codes?

This shift drives increased demand for high-quality, comfortable shirt fabrics that blend formal appearance with functional wearability, such as cotton-stretch blends and soft, textured weaves like slub cotton and brushed twill, blurring the line between traditional formal and casual apparel.

Which factors influence a company's selection between direct and indirect distribution?

Factors include the size of the apparel manufacturing customer, the geographic reach required, the need for stringent quality control, and the complexity of the fabric specification. Large, vertically integrated mills serving major brands favor direct sales for control and cost efficiency.

What certification standards are most relevant for sustainable shirt fabrics?

Key certification standards include the Global Organic Textile Standard (GOTS) for organic fibers, Oeko-Tex Standard 100 for harmful substance testing, and certifications related to recycled content like the Global Recycled Standard (GRS), providing essential consumer assurance.

How do geopolitical events affect the price of synthetic shirt fabrics?

Geopolitical events, particularly those impacting oil and gas production or distribution, directly influence the price of petrochemical derivatives required to produce synthetic fibers like polyester and nylon, leading to potential cost increases and supply chain instability.

Explain the concept of fabric mercerization.

Mercerization is a cotton finishing treatment involving caustic soda, which permanently swells the cotton fibers. This process enhances the fabric's luster, dye uptake, strength, and resistance to mildew, highly valued in premium cotton shirtings.

What is the typical thread count range for high-quality formal shirt fabrics?

High-quality formal shirt fabrics typically feature thread counts ranging from 80s to 140s singles, though premium and luxury fabrics can reach counts of 200s or even 300s two-ply, indicating exceptional fineness and smoothness.

How does the demand for personalized apparel affect fabric requirements?

Personalization necessitates flexible manufacturing capable of smaller production batches and diverse specifications, driving demand for efficient digital printing technologies and fabric bases that are versatile enough to accommodate rapid changes in pattern and color.

What are the main advantages of using modal or lyocell (cellulosic fibers) in shirts?

Modal and Lyocell (Tencel) offer superior softness, exceptional breathability, high strength, and excellent moisture absorption compared to conventional rayon, providing a luxurious hand-feel and favorable environmental profiles, highly sought after for premium casual and resort wear.

How do manufacturers manage inventory risks associated with volatile fashion trends?

Manufacturers mitigate inventory risks by adopting lean manufacturing principles, utilizing advanced predictive analytics to forecast demand accurately, and maintaining highly flexible production lines that allow for quick shifts between different fabric types and designs based on immediate order flows.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager