Shock Tower Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 431497 | Date : Dec, 2025 | Pages : 243 | Region : Global | Publisher : MRU

Shock Tower Market Size

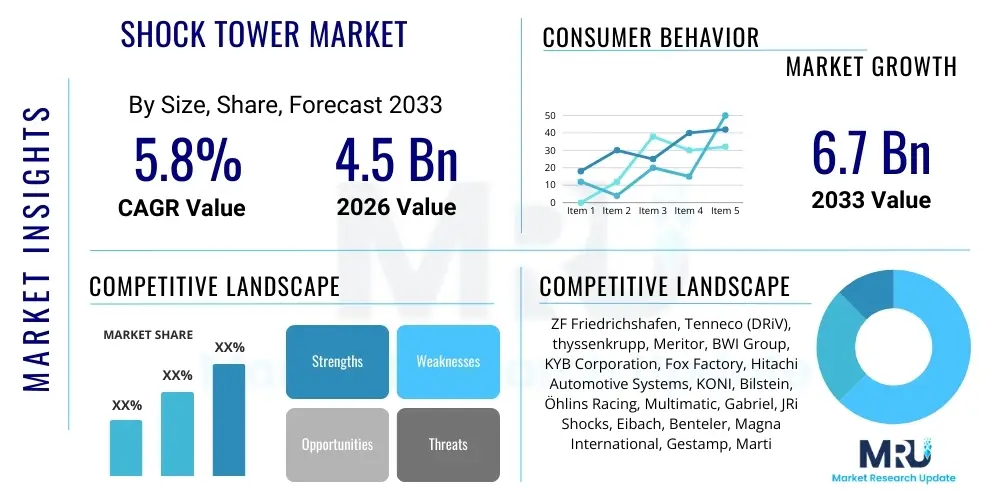

The Shock Tower Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 4.5 Billion in 2026 and is projected to reach USD 6.7 Billion by the end of the forecast period in 2033. This consistent growth trajectory is primarily underpinned by the global increase in vehicle production, particularly in emerging economies, coupled with stringent safety and performance requirements driving the demand for optimized suspension components. Modern vehicle architecture, characterized by advanced chassis integration and the push towards lightweighting, necessitates sophisticated shock tower designs capable of handling dynamic loads while contributing to overall structural rigidity and safety performance during collision events.

The market expansion is further influenced by the shift towards performance-oriented vehicles, including high-end sports cars and specialized off-road vehicles, which demand higher quality and more durable shock towers often manufactured from specialized materials like aluminum alloys or carbon fiber composites. While passenger vehicles remain the largest volume consumer, the commercial vehicle sector is showing increased adoption of advanced shock tower designs to manage heavier payloads and ensure driver comfort over long distances. The transition to electric vehicles (EVs) is also a significant factor, as EV platforms often require redesigned shock towers to accommodate battery placement and manage the increased vehicle curb weight, driving innovation in material science and manufacturing processes within the industry.

Shock Tower Market introduction

The Shock Tower Market encompasses the manufacturing, distribution, and sale of structural components crucial to a vehicle's suspension system. A shock tower is essentially a reinforced mounting point in the vehicle’s chassis or frame designed to anchor the top of the suspension assembly, including the shock absorber, coil spring, or strut assembly, to the vehicle body. This component bears significant operational loads, including vertical forces from road irregularities, horizontal forces during cornering, and energy absorption during frontal or side impacts. The quality and design of the shock tower directly impact vehicle handling, stability, ride comfort, and crucial safety parameters.

Major applications of shock towers span the entire automotive sector, categorized broadly into Passenger Vehicles (sedans, SUVs, hatchbacks), Commercial Vehicles (trucks, buses), and Specialized Off-Road and Racing Vehicles. Key benefits derived from well-engineered shock towers include enhanced vehicle control, improved suspension geometry maintenance under duress, optimized load transfer characteristics, and increased structural integrity, particularly important in modern unibody construction. Driving factors for this market include the global expansion of the automotive manufacturing sector, increasing consumer demand for superior ride quality and vehicle performance, and the regulatory environment prioritizing occupant safety through robust structural designs.

The design and material used for shock towers have evolved significantly, moving from traditional stamped steel components to advanced constructions utilizing high-strength steel alloys, specialized aluminum castings, and, increasingly in performance applications, lightweight carbon fiber composites. This evolution is necessitated by the pursuit of reduced vehicle mass (lightweighting), which improves fuel efficiency and dynamic performance, while simultaneously requiring higher strength components to meet rigorous crash safety standards and accommodate the powerful forces exerted by modern high-performance suspension systems, especially those featuring active or semi-active damping technologies.

Shock Tower Market Executive Summary

The Shock Tower Market demonstrates robust growth driven by accelerating vehicle electrification and the persistent focus on vehicle lightweighting across the global automotive industry. Business trends indicate a strong move towards modular manufacturing processes and the increased utilization of advanced simulation tools (FEA) to optimize shock tower geometry for complex load scenarios and crash management. Manufacturers are investing heavily in new fabrication techniques, such as hydroforming and advanced die-casting for aluminum, to produce components that offer superior strength-to-weight ratios compared to conventional steel stamping. This emphasis on R&D is fostering greater collaboration between Tier 1 suppliers and original equipment manufacturers (OEMs) to integrate the shock tower design seamlessly within the overall chassis architecture early in the vehicle development cycle.

Regional trends reveal Asia Pacific (APAC) as the dominant and fastest-growing region, fueled by high volume production in countries like China, India, and Japan, coupled with the rapid urbanization and rising middle-class consumer demand for passenger vehicles. North America and Europe maintain a leading position in adopting premium and performance shock tower materials, driven by stringent safety regulations and the prevalence of sophisticated luxury and sports car segments. Meanwhile, Latin America and the Middle East & Africa (MEA) are emerging markets showing steady expansion, primarily driven by replacement demand in the aftermarket segment and gradual increases in localized vehicle assembly operations.

Segment trends highlight the dominance of the Passenger Vehicle category both in volume and value, though the Off-Road Vehicle segment shows the highest growth rate due to increased popularity of specialized performance and recreational vehicles requiring heavy-duty, highly durable shock towers. Regarding materials, while Steel remains the core material for mass-market vehicles due to cost efficiency, the Aluminum segment is experiencing accelerated growth, particularly within the SUV and EV platforms, where weight reduction is paramount. The Aftermarket segment is also vital, focusing on replacement components and high-performance upgrades, offering substantial opportunities for specialized component manufacturers focusing on high damping capabilities and durability enhancements.

AI Impact Analysis on Shock Tower Market

Common user inquiries regarding the impact of Artificial Intelligence (AI) on the Shock Tower Market frequently revolve around design optimization, material selection, predictive maintenance, and manufacturing efficiency. Users question whether AI can predict structural failures before they occur, how machine learning algorithms optimize stress distribution in complex geometries, and if smart factory applications can reduce waste in specialized alloy processing. Key themes emerging from this analysis include the expectation that AI will dramatically reduce the design cycle time for new vehicle platforms, enhance the fidelity of crash simulation models, and enable generative design techniques that produce novel, lighter, and stronger shock tower geometries that human engineers might overlook. There is also significant interest in using AI-driven vision systems for quality control during high-volume production, ensuring that complex welding and assembly tolerances are met precisely, thereby reducing defect rates that are critical for safety-related structural components.

- AI-driven Generative Design: Optimizing shock tower topology for minimum mass and maximum stiffness, leading to complex, efficient geometries.

- Predictive Failure Analysis: Using sensor data and machine learning to forecast fatigue life and potential failure points in real-time, especially in high-performance or commercial applications.

- Advanced Simulation: Enhancing Finite Element Analysis (FEA) models with AI to more accurately predict performance under extreme dynamic loads and various environmental conditions.

- Automated Quality Control (AQC): Implementing AI vision systems in manufacturing lines for real-time inspection of weld integrity, dimensional accuracy, and material uniformity.

- Supply Chain Optimization: Utilizing AI algorithms to manage raw material inventory (e.g., specialized aluminum and steel alloys) and predict demand fluctuations, improving responsiveness and cost control.

DRO & Impact Forces Of Shock Tower Market

The dynamics of the Shock Tower Market are governed by a complex interplay of Drivers, Restraints, and Opportunities, collectively influenced by various impact forces stemming from technological advancement, regulatory mandates, and macroeconomic shifts. A primary driver is the accelerating shift towards electric vehicle production, requiring redesigned chassis components to handle the added weight of battery packs and manage specific thermal and load characteristics unique to EV architecture. Coupled with this is the continuous demand from consumers and regulators for improved vehicle safety standards, mandating robust and impact-resistant structural components, which elevates the performance requirements for shock towers, moving them beyond mere mounting points to integral parts of the vehicle's crash energy absorption pathway. However, the market faces significant restraints, notably the intense volatility and high cost of raw materials such as specialized high-strength steel and aluminum alloys. Furthermore, the complexity involved in manufacturing high-precision, safety-critical components, especially integrating multi-material shock towers (e.g., steel and composite hybrids), presents substantial engineering and investment barriers, limiting smaller players' entry into the high-end OEM segment.

Opportunities for growth are abundant, particularly in the realm of lightweighting and advanced manufacturing. The opportunity to integrate carbon fiber and other advanced composite materials into shock tower production, especially for premium and performance vehicles, promises significant weight savings without compromising structural integrity. Furthermore, the expanding global aftermarket, driven by the aging vehicle fleet worldwide and the increasing trend among enthusiasts to upgrade suspension systems for better performance, offers a lucrative avenue for specialized component manufacturers. Technological advancements, particularly in adaptive suspension systems and advanced passive damping, also necessitate corresponding upgrades in shock tower design, creating a pull for innovation from component suppliers.

The impact forces shaping this market include PESTEL factors. Technologically, the shift towards modular electric skateboards fundamentally alters chassis design, demanding innovative shock tower solutions that interface efficiently with battery enclosures. Economically, global inflationary pressures affect manufacturing costs, but increasing disposable incomes in key developing regions drive overall vehicle sales. Regulatory forces, particularly the implementation of stricter NCAP (New Car Assessment Program) crash safety protocols globally, directly influence the minimum required strength and design robustness of these structural components. The cumulative effect of these forces suggests a market moving towards higher sophistication, multi-material usage, and greater integration with active vehicle control systems.

Segmentation Analysis

The Shock Tower Market is systematically segmented based on material type, vehicle type, and sales channel, providing a granular view of market dynamics and identifying areas of highest growth potential. Material segmentation is crucial as it dictates the component's strength, weight, and cost, directly affecting its application across different vehicle price points and performance tiers. Vehicle type segmentation defines the volume and specific load requirements, with passenger vehicles dominating volume but off-road vehicles requiring the most specialized and robust designs. Finally, sales channel segmentation differentiates between the primary supply chain for new vehicle manufacturing (OEM) and the secondary market for replacement and upgrade components (Aftermarket).

The segmentation structure highlights the dual nature of the market: volume-driven standardization in the OEM segment, particularly utilizing high-strength steel, and value-driven customization and high-performance material adoption in the aftermarket and specialty vehicle segments. Understanding these segments is vital for suppliers to tailor their product offerings, whether focusing on cost-effective, high-volume stamping operations or investing in advanced casting and composite fabrication for niche high-margin applications. The interplay between vehicle electrification (Vehicle Type) and lightweighting pressures (Material Type) is driving the strongest current shifts within these segments.

- By Material:

- Steel (High-Strength Steel, Mild Steel)

- Aluminum (Cast Aluminum, Forged Aluminum)

- Carbon Fiber Composites

- Other Materials (e.g., Hybrid combinations)

- By Vehicle Type:

- Passenger Vehicles (Sedans, SUVs, Crossovers)

- Commercial Vehicles (Light Commercial Vehicles, Heavy Commercial Vehicles)

- Off-Road Vehicles and Performance Racing

- By Sales Channel:

- Original Equipment Manufacturer (OEM)

- Aftermarket (Replacement, Performance Upgrade)

Value Chain Analysis For Shock Tower Market

The value chain for the Shock Tower Market begins with upstream activities focused on securing raw materials, primarily specialized ferrous and non-ferrous metals, including high-grade steel alloys and various aluminum grades necessary for casting or forging. Key upstream players include major steel and aluminum producers who provide the foundational input materials. The complexity here lies in managing material costs and ensuring the consistent quality of alloys, as shock towers are safety-critical components demanding strict mechanical property adherence. Suppliers must also navigate fluctuating commodity prices, which significantly influence the final manufacturing cost. Efficient sourcing and establishing long-term contracts with reliable metallurgical suppliers are critical success factors at this stage.

The midstream involves manufacturing and assembly, where raw materials are processed through stamping, casting, forging, or composite layup processes, followed by precision machining, welding, and surface treatment (e.g., anti-corrosion coating). Tier 1 suppliers specializing in chassis components dominate this stage, utilizing advanced robotics and quality assurance systems to meet OEM specifications. Downstream activities focus on distribution, which is largely bifurcated. The direct channel involves supplying fully assembled shock towers directly to vehicle Original Equipment Manufacturers (OEMs) for integration into the assembly line. This relationship is characterized by long-term contracts, just-in-time delivery, and stringent quality audits. The indirect channel serves the Aftermarket, involving distributors, wholesalers, and independent repair shops that stock replacement or performance upgrade shock towers. This channel demands robust inventory management and regional warehousing to ensure rapid availability.

The efficiency of the distribution channel, particularly the ability to minimize logistics costs while maintaining product traceability, significantly impacts profitability. The trend towards globalized automotive platforms necessitates a synchronized global supply chain capable of delivering identical, high-quality components to assembly plants worldwide. Furthermore, intellectual property surrounding novel designs, particularly those leveraging lightweight materials or integrated sensor mounts for advanced driver-assistance systems (ADAS), adds significant value and acts as a barrier to entry for new competitors in the high-end segments.

Shock Tower Market Potential Customers

Potential customers in the Shock Tower Market are primarily categorized by the nature of their involvement with the final vehicle product—ranging from large-scale vehicle manufacturers who require components for mass production to specialized retailers and end-users seeking performance enhancements. The largest customer base resides within the Original Equipment Manufacturer (OEM) segment, which includes global automotive conglomerates such as General Motors, Volkswagen Group, Toyota, Ford, and various emerging electric vehicle startups. These buyers require large volumes of custom-designed, highly reliable, and cost-optimized shock towers integrated seamlessly into their platform architectures, prioritizing long-term supplier relationships and adherence to stringent quality and crash test standards.

Another significant customer segment is the Aftermarket network. This includes large automotive parts retailers (e.g., Autozone, O'Reilly), independent wholesale distributors, and specialized performance tuning shops. These buyers focus on replacement parts, where durability and broad vehicle compatibility are key, and performance upgrade components, where material quality (aluminum, composites) and specific features (e.g., reinforced mounts for racing suspension) drive purchasing decisions. This segment is characterized by price sensitivity for replacement parts and feature sensitivity for upgrade parts.

Finally, specialized vehicle manufacturers, including producers of military vehicles, construction equipment, specialized agricultural machinery, and high-performance racing teams (e.g., Formula 1, NASCAR), represent niche but high-value customers. These buyers demand extremely customized, high-specification shock towers designed for exceptional stress management and performance under extreme conditions. Their purchasing decisions are driven purely by technical performance and material superiority rather than volume-based pricing. The expanding sector of specialized off-road recreational vehicles (UTVs, ATVs) also falls under this high-performance end-user category, seeking heavy-duty, reinforced components.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.5 Billion |

| Market Forecast in 2033 | USD 6.7 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | ZF Friedrichshafen, Tenneco (DRiV), thyssenkrupp, Meritor, BWI Group, KYB Corporation, Fox Factory, Hitachi Automotive Systems, KONI, Bilstein, Öhlins Racing, Multimatic, Gabriel, JRi Shocks, Eibach, Benteler, Magna International, Gestamp, Martinrea International, Aisin Seiki. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Shock Tower Market Key Technology Landscape

The technology landscape of the Shock Tower Market is characterized by innovations focused on achieving optimal structural performance with minimum weight, essential for meeting modern fuel efficiency and safety standards. Key technological advancements revolve around advanced manufacturing techniques such as specialized high-pressure aluminum die casting and hydroforming for complex steel shapes. Hydroforming allows manufacturers to produce hollow, lightweight shock towers with superior rigidity and fewer welded joints, significantly improving structural integrity and crashworthiness compared to traditional stamped and welded assemblies. Furthermore, the integration of advanced material testing and non-destructive evaluation (NDE) techniques, like ultrasonic testing and X-ray inspection, ensures the integrity of critical weld seams and castings, which is paramount given the component's role in occupant safety.

Material science is another critical technological driver. The increased use of multi-material design, where different materials (e.g., high-strength steel for crash zones and aluminum for overall weight reduction) are combined through advanced joining methods like specialized friction stir welding or adhesive bonding, is becoming standard for premium vehicles. For high-performance and racing applications, the use of carbon fiber reinforced polymer (CFRP) composites is gaining traction, facilitated by innovations in automated fiber placement and resin transfer molding (RTM), allowing for components that are extremely lightweight yet possess exceptional damping and stiffness characteristics. These composite technologies require significantly higher upfront investment but offer unparalleled performance benefits.

Digitization and simulation technologies also form a core part of the modern shock tower landscape. Suppliers utilize sophisticated Computer-Aided Engineering (CAE) tools, including topology optimization and explicit dynamics simulation, to digitally iterate on designs, predict failure modes, and optimize the component's interaction with the entire suspension and chassis system before physical prototyping. This use of advanced simulation, often accelerated by cloud computing resources, drastically reduces the time and cost associated with product development while ensuring compliance with global crash safety protocols such as FMVSS and ECE regulations. These digital tools enable quick adaptation to new EV platform requirements, which often involve unique mounting points and load paths compared to internal combustion engine vehicles.

Regional Highlights

Regional dynamics play a significant role in shaping the demand, technology adoption, and manufacturing footprint of the Shock Tower Market. Asia Pacific (APAC) currently dominates the market in terms of production volume and is projected to exhibit the highest CAGR during the forecast period. This dominance is attributed to the presence of large manufacturing hubs in China, India, South Korea, and Japan, coupled with robust domestic demand for both budget and mid-range passenger vehicles. Government initiatives supporting electric vehicle production, particularly in China, are accelerating the adoption of lightweight aluminum and specialized steel components tailored for new energy vehicle (NEV) platforms, making APAC a critical region for future growth and technological investment.

North America and Europe represent mature markets characterized by stringent safety regulations and a high concentration of premium and performance vehicle manufacturers. In these regions, the focus is heavily skewed towards high-value shock towers utilizing advanced materials (aluminum, composites) and integrated features that support sophisticated suspension systems (e.g., those for semi-active and active damping). The European market, driven by strict CO2 emission targets, is a major adopter of lightweighting technologies. North America sees strong demand driven by the large SUV, pickup truck, and performance off-road vehicle segments, demanding highly durable and reinforced shock tower structures capable of handling extreme loads and large suspension travel.

Latin America (LATAM) and the Middle East and Africa (MEA) are developing markets characterized by steady growth, primarily fueled by local vehicle assembly operations and significant replacement demand in the aftermarket. These regions often prioritize cost-effective solutions, favoring high-strength steel shock towers for robustness and affordability. However, increasing infrastructure investments and rising luxury vehicle imports in certain MEA nations are gradually creating a niche demand for higher-specification, performance-oriented components, signaling potential diversification in material requirements in the long term.

- China: Leading global manufacturing hub; primary driver of volume growth, especially in the burgeoning domestic EV market.

- United States: Key market for high-duty shock towers driven by large SUV, truck, and specialized off-road segments; major adopter of advanced aluminum casting technologies.

- Germany: Center for premium automotive engineering; focus on precision-engineered shock towers integrated with complex, adaptive suspension systems.

- India: Rapidly expanding automotive production base; increasing demand for reliable, cost-effective steel-based components for mass-market passenger vehicles.

- Japan: Pioneer in advanced material science and manufacturing precision; strong internal focus on lightweighting and durability across all vehicle classes.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Shock Tower Market.- ZF Friedrichshafen

- Tenneco (DRiV)

- thyssenkrupp

- Meritor

- BWI Group

- KYB Corporation

- Fox Factory

- Hitachi Automotive Systems

- KONI

- Bilstein

- Öhlins Racing

- Multimatic

- Gabriel

- JRi Shocks

- Eibach

- Benteler

- Magna International

- Gestamp

- Martinrea International

- Aisin Seiki

Frequently Asked Questions

Analyze common user questions about the Shock Tower market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function of a shock tower in a vehicle?

The shock tower serves as the critical structural anchor point in a vehicle's chassis, securely mounting the top of the suspension system (strut, shock absorber, and coil spring) to the vehicle body. Its primary function is to bear vertical and lateral forces generated by the suspension and distribute these loads across the vehicle structure, significantly impacting handling and crash safety.

How is the electric vehicle (EV) transition impacting shock tower design?

The EV transition demands significant design modifications, primarily because EVs have a higher curb weight due to the battery pack. Shock towers must be redesigned using stronger, often lighter, materials (like high-strength aluminum) to manage the increased dynamic loads while potentially being reshaped to optimize packaging space around the battery and motor components.

Which materials are most commonly used for manufacturing shock towers?

The most common materials are high-strength steel and aluminum alloys. Steel is favored for its cost-effectiveness and durability in mass-market vehicles. Aluminum is increasingly preferred in premium vehicles and EVs for its lightweighting advantages, offering superior stiffness-to-weight ratios essential for performance and fuel efficiency.

Is the Aftermarket segment crucial for shock tower sales?

Yes, the Aftermarket segment is crucial, driven by the need for replacement components due to wear or accident damage, and high-performance upgrades sought by enthusiasts. This segment offers significant revenue opportunities for specialized suppliers focusing on enhanced durability and custom performance specifications.

What role does advanced manufacturing technology play in shock tower production?

Advanced manufacturing technologies, including hydroforming, high-pressure die casting, and robotic welding, ensure high precision, structural integrity, and reduced component weight. These technologies are vital for meeting stringent OEM safety requirements and maximizing crashworthiness through optimal material utilization and geometry.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager