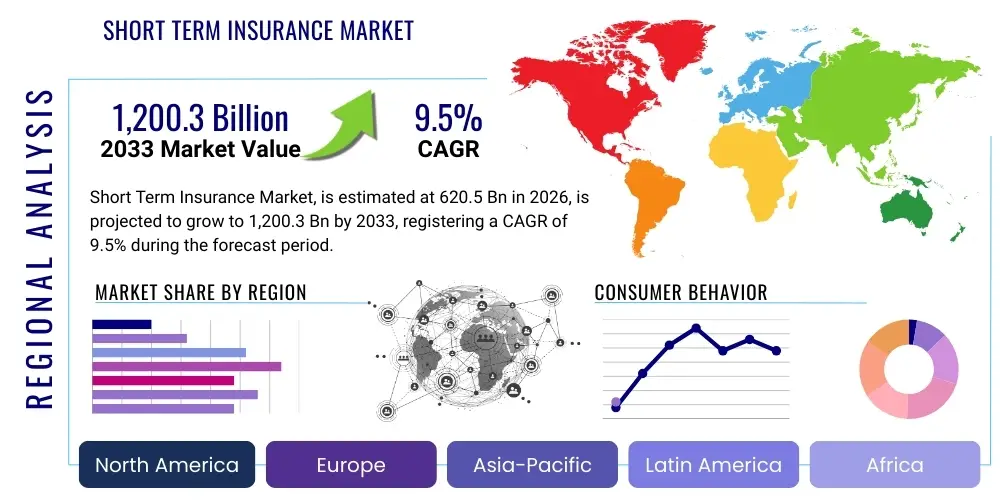

Short Term Insurance Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 440514 | Date : Jan, 2026 | Pages : 246 | Region : Global | Publisher : MRU

Short Term Insurance Market Size

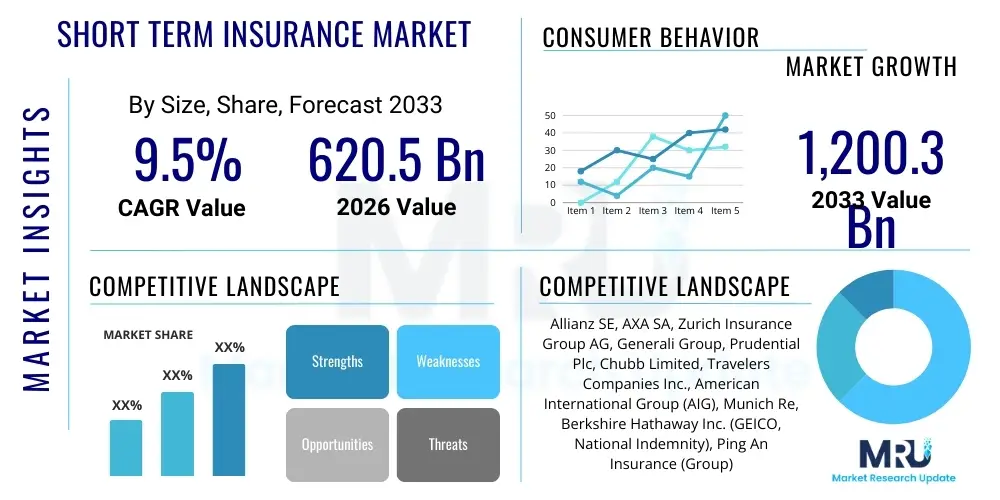

The Short Term Insurance Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.5% between 2026 and 2033. The market is estimated at USD 620.5 billion in 2026 and is projected to reach USD 1,200.3 billion by the end of the forecast period in 2033.

Short Term Insurance Market introduction

The Short Term Insurance Market, often referred to as general or non-life insurance, encompasses a wide array of policies designed to protect individuals and businesses from financial losses arising from specific, unpredictable events over a defined, typically shorter, period. This segment fundamentally differs from long-term insurance, such as life insurance, by covering risks that manifest within a limited timeframe, providing coverage for property damage, liability claims, health expenses (non-life components), and various other unforeseen circumstances. It serves as a crucial mechanism for risk mitigation, ensuring financial stability and peace of mind for policyholders.

Key products within this market include motor insurance, property insurance (residential and commercial), health insurance (excluding life), travel insurance, and various forms of liability coverage. The major applications span from safeguarding personal assets like vehicles and homes to protecting businesses against operational risks, employee liabilities, and property damage. The primary benefits of short term insurance are the transfer of financial risk from the insured to the insurer, enabling individuals and organizations to recover from losses without suffering severe economic setbacks. This protection is vital for maintaining economic continuity and fostering investment.

The market's expansion is driven by several critical factors, including increasing global awareness of risk management, growing urbanization, a rise in disposable incomes in emerging economies, and the escalating frequency and severity of natural disasters. Furthermore, evolving regulatory landscapes often mandate certain types of insurance, such as motor vehicle liability, thereby expanding the market base. Technological advancements, particularly in data analytics, AI, and telematics, are also significantly influencing product development, distribution channels, and claims processing, making insurance more accessible and tailored to individual needs, consequently fueling market growth.

Short Term Insurance Market Executive Summary

The Short Term Insurance Market is undergoing transformative growth, propelled by a convergence of business, regional, and segment-specific trends. Business trends are characterized by intense competition, a strong focus on digital transformation, and the increasing adoption of advanced analytics to enhance underwriting accuracy, personalize product offerings, and streamline operational efficiencies. Insurers are investing heavily in technologies like AI, machine learning, and IoT to gain a competitive edge, improve customer experience, and combat fraud. Furthermore, there is a growing emphasis on ecosystem partnerships, with insurers collaborating with tech companies, automotive manufacturers, and healthcare providers to offer integrated solutions and expand their reach, moving beyond traditional risk coverage to proactive risk prevention and value-added services.

Regional trends indicate diverse growth patterns, with mature markets in North America and Europe focusing on innovation, customer retention, and navigating stringent regulatory frameworks. These regions are witnessing a shift towards usage-based insurance (UBI) and hyper-personalized products. In contrast, the Asia Pacific (APAC) region, particularly emerging economies like China and India, is experiencing robust growth driven by a rapidly expanding middle class, increasing urbanization, rising awareness of insurance benefits, and substantial digital penetration. Latin America and the Middle East & Africa (MEA) are also emerging as high-potential markets, albeit with challenges related to regulatory inconsistency and lower insurance penetration, yet showing significant opportunities for greenfield expansion and digital adoption.

Segmentation trends highlight dynamic shifts across product lines and distribution channels. Property and motor insurance segments continue to be dominant, but specialized lines such as cyber insurance, event cancellation insurance, and parametric insurance are gaining significant traction due driven by evolving risk landscapes. The health insurance segment (non-life) is also experiencing substantial growth, influenced by rising healthcare costs and increased consumer focus on well-being. In terms of distribution, while traditional agents and brokers remain crucial, direct channels, including online platforms and mobile applications, are rapidly expanding, offering greater convenience and transparency to tech-savvy consumers. Bancassurance and affinity partnerships are also playing a vital role in reaching broader customer segments, indicating a multi-channel approach to market penetration.

AI Impact Analysis on Short Term Insurance Market

User questions related to AI's impact on the Short Term Insurance Market frequently revolve around its potential to revolutionize core operations, enhance customer experiences, and introduce new business models. Common inquiries include how AI can improve underwriting accuracy, personalize policies, accelerate claims processing, and detect fraud more effectively. There are also significant concerns regarding job displacement within the industry, the ethical implications of data usage, and the potential for bias in AI-driven decisions. Users are keen to understand the balance between technological advancement, regulatory compliance, and maintaining a human touch in customer interactions, highlighting expectations for both efficiency gains and responsible innovation that benefits both insurers and policyholders.

- Enhanced Underwriting and Risk Assessment: AI algorithms analyze vast datasets, including telematics, IoT data, social media, and traditional claims history, to provide more accurate risk profiles, enabling insurers to offer highly personalized policies and dynamic pricing based on individual behavior and real-time conditions. This precision reduces mispricing risks and improves profitability.

- Automated Claims Processing: AI-powered systems, leveraging natural language processing (NLP) and computer vision, can automate the entire claims journey from first notification of loss (FNOL) to settlement, accelerating processing times, reducing manual errors, and improving customer satisfaction through quicker payouts.

- Superior Fraud Detection: Machine learning models excel at identifying patterns indicative of fraudulent claims that might be missed by human adjusters. By cross-referencing multiple data points and historical fraud indicators, AI can flag suspicious claims, significantly reducing financial losses for insurers and preventing premium increases for honest policyholders.

- Personalized Customer Experience: AI-driven chatbots and virtual assistants provide 24/7 customer support, handle routine inquiries, and guide customers through policy selection and claims submission. This personalization, combined with AI's ability to recommend relevant products, fosters stronger customer loyalty and engagement.

- Development of New Products and Business Models: AI facilitates the creation of innovative insurance products like on-demand insurance, pay-as-you-drive, and hyper-customized micro-insurance. It also supports new business models, enabling insurers to transition from reactive claims handling to proactive risk prevention through predictive analytics and IoT sensor data.

- Operational Efficiency and Cost Reduction: Automation of repetitive tasks across sales, marketing, and administration through robotic process automation (RPA) and AI reduces operational costs, frees up human capital for more complex tasks, and allows insurers to allocate resources more strategically.

- Predictive Analytics for Market Trends: AI tools can predict future market trends, customer behavior, and emerging risks, allowing insurers to adapt their strategies, product development, and resource allocation proactively, maintaining a competitive edge in a dynamic market.

- Data-Driven Decision Making: The integration of AI provides insurers with actionable insights derived from big data, empowering them to make more informed decisions across all facets of their business, from marketing campaigns to capital allocation and solvency management.

DRO & Impact Forces Of Short Term Insurance Market

The Short Term Insurance Market is shaped by a complex interplay of drivers, restraints, opportunities, and powerful impact forces. Key drivers include accelerating economic growth globally, which increases insurable assets and disposable income, coupled with rapid urbanization leading to higher concentrations of risk. The rising frequency and intensity of natural catastrophes, alongside growing awareness of climate-related risks, also compel both individuals and businesses to seek comprehensive insurance coverage. Furthermore, stricter regulatory mandates, such as compulsory motor insurance or evolving health insurance requirements, significantly bolster market demand, while technological advancements like IoT and AI enable new product offerings and more efficient operations.

Despite these growth drivers, the market faces several formidable restraints. Intense price competition, exacerbated by the proliferation of online aggregators, leads to margin compression and challenges for profitability. Economic downturns and inflationary pressures can reduce discretionary spending on insurance, while high customer price sensitivity often makes retention difficult. Regulatory complexities, differing across geographies and constantly evolving, pose compliance burdens for international insurers. Additionally, the persistence of legacy IT systems within many established insurance companies hinders innovation and agile response to market changes, creating operational inefficiencies and increasing costs.

Opportunities abound, particularly in emerging markets where insurance penetration remains low but economic growth is robust, offering vast untapped potential. The rise of parametric insurance, microinsurance, and on-demand insurance presents avenues for niche product development catering to specific, underserved segments. Significant opportunities also lie in leveraging advanced data analytics, telematics, and blockchain for enhanced risk management, fraud prevention, and transparent claims processing. Furthermore, cross-sector collaborations with technology firms, automotive manufacturers, and healthcare providers can unlock new distribution channels and create integrated value propositions, transforming the traditional insurance value chain.

The market is profoundly influenced by several overarching impact forces. Technological disruption, primarily driven by AI, machine learning, and IoT, is reshaping every aspect of the insurance value chain, from product design and pricing to distribution and claims. Regulatory evolution, constantly adapting to new technologies, data privacy concerns, and emerging risks, forces insurers to innovate while ensuring consumer protection. Shifting customer expectations, characterized by demands for personalized, transparent, and seamless digital experiences, necessitate a fundamental rethinking of traditional operating models. Lastly, geopolitical uncertainties and climate change are increasing the volatility of risks, pushing insurers to develop more resilient and adaptive underwriting strategies.

Segmentation Analysis

The Short Term Insurance Market is comprehensively segmented to address diverse risk profiles and client needs, ensuring targeted product development and efficient distribution. This segmentation typically categorizes the market by the type of coverage offered, the channels through which these products are sold, and the end-users they serve. Each segment exhibits unique growth drivers, competitive landscapes, and regulatory environments, allowing market participants to strategically position their offerings and tailor their marketing efforts. Understanding these distinctions is crucial for identifying areas of high growth potential and developing effective market penetration strategies.

- By Product Type:

- Property Insurance: Covers damage to residential and commercial properties from perils like fire, theft, natural disasters, and other specified risks. This includes homeowners insurance, renters insurance, and commercial property policies.

- Motor Insurance: Mandated in many regions, this segment protects vehicle owners against financial loss due to accidents, theft, or damage to their vehicles, and covers third-party liability. Sub-segments include private car insurance and commercial vehicle insurance.

- Health Insurance (Non-Life): Provides coverage for medical expenses, hospitalization, and related healthcare services, distinct from life insurance, focusing on short-term medical needs.

- Travel Insurance: Offers protection against unforeseen events during travel, such as trip cancellations, medical emergencies abroad, lost luggage, and travel delays.

- Liability Insurance: Covers legal liabilities arising from negligence or accidents causing injury or damage to third parties. This includes public liability, professional indemnity, and product liability insurance.

- Accident Insurance: Provides coverage for personal injury, disability, or death resulting from accidents, irrespective of existing health insurance.

- Other Specialty Lines: Encompasses niche coverages such as cyber insurance, marine insurance, aviation insurance, credit insurance, and agricultural insurance, addressing specific industry or emerging risks.

- By Distribution Channel:

- Agents & Brokers: Traditional intermediaries offering personalized advice, comparison services, and handling policy administration.

- Direct (Online & Company Websites): Insurers selling policies directly to customers through their own digital platforms, call centers, or mobile apps, often providing competitive pricing.

- Bancassurance: Partnerships between banks and insurance companies, allowing banks to sell insurance products to their customer base.

- Other Channels: Includes affinity partnerships, aggregators, and alternative distribution networks.

- By End-User:

- Individual: Covers policies purchased by individuals for personal assets and risks, such as home, motor, travel, and personal health insurance.

- Commercial: Includes policies bought by businesses of all sizes (SMEs, large enterprises, government entities) to cover operational risks, property, employee liabilities, and specialized industry-specific risks.

Value Chain Analysis For Short Term Insurance Market

The value chain of the Short Term Insurance Market is a multifaceted ecosystem involving several key stages, from product development and underwriting to claims management and customer service. At the upstream end, the process begins with product design, actuarial analysis, and risk assessment, where insurers leverage data, analytics, and sometimes reinsurers to define policy terms and premium rates. Reinsurers play a critical role by sharing the risk burden, thereby enabling primary insurers to underwrite larger or more complex risks. Technology providers and data analytics firms also contribute significantly upstream, offering tools for advanced risk modeling, fraud detection, and customer segmentation, enhancing the insurer's core capabilities.

Moving downstream, the distribution channel is a pivotal component, determining how insurance products reach end-users. This involves a mix of direct and indirect channels. Direct channels include the insurer's own sales force, online portals, mobile applications, and call centers, allowing for direct interaction and often more personalized offerings. Indirect channels encompass independent agents, brokers, bancassurance partnerships, and aggregators, which offer broader market reach and often provide advisory services to customers. Each channel has its own advantages, catering to different customer preferences and operational efficiencies. The choice of channel significantly impacts customer acquisition costs and market penetration strategies.

Post-sale activities form the final crucial stages of the value chain. This includes policy administration, customer service, and critically, claims management. Effective claims processing, involving investigation, assessment, and settlement, directly impacts customer satisfaction and retention. Downstream also includes engagement with repair networks, legal services, and healthcare providers for claim fulfillment. The entire chain is increasingly digitized, with technology streamlining processes and enhancing transparency. The integration of various components, from upstream risk assessment to downstream claims resolution, is essential for delivering value to policyholders and achieving sustainable profitability in the competitive short-term insurance market.

Short Term Insurance Market Potential Customers

The Short Term Insurance Market caters to a vast and diverse spectrum of potential customers, broadly categorized into individuals and various types of commercial entities. For individuals, the primary drivers are the need to protect personal assets and secure financial stability against unforeseen events. This includes homeowners seeking coverage for their properties against perils like fire, theft, and natural disasters; vehicle owners requiring motor insurance for their cars, motorcycles, or commercial vehicles; travelers looking for protection against trip cancellations, medical emergencies, or lost luggage; and individuals seeking coverage for personal health expenses not covered by other schemes. Young professionals, growing families, and retirees all represent distinct segments within the individual customer base, each with specific risk profiles and insurance needs.

On the commercial front, the potential customer base is expansive and includes businesses of all sizes, from small and medium-sized enterprises (SMEs) to large corporations across various industries, as well as governmental organizations and non-profits. SMEs, for instance, require comprehensive coverage for their property, business interruptions, liability risks, and employee welfare, often seeking bundled solutions that address multiple needs efficiently. Large enterprises, operating on a global scale, typically require more complex, tailored insurance solutions that cover extensive property portfolios, professional liabilities, cyber risks, supply chain disruptions, and unique industry-specific exposures like marine, aviation, or energy. Emerging sectors, such as technology startups and gig economy platforms, also represent growing segments needing specialized liability and operational risk coverage.

Beyond traditional businesses, the market also targets specific niche segments, such as farmers requiring agricultural insurance, event organizers needing event cancellation coverage, and specialized professionals like doctors or lawyers seeking professional indemnity insurance. The evolving risk landscape, including increased cyber threats and climate change impacts, constantly expands the definition of potential customers by creating new categories of insurable risks. Therefore, insurers continually analyze demographic shifts, economic trends, and industry-specific developments to identify and tailor products for these ever-changing customer segments, driving market innovation and penetration.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 620.5 billion |

| Market Forecast in 2033 | USD 1,200.3 billion |

| Growth Rate | 9.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Allianz SE, AXA SA, Zurich Insurance Group AG, Generali Group, Prudential Plc, Chubb Limited, Travelers Companies Inc., American International Group (AIG), Munich Re, Berkshire Hathaway Inc. (GEICO, National Indemnity), Ping An Insurance (Group) Company of China, Ltd., China Life Insurance (Group) Company, Tokio Marine Holdings, Aviva Plc, Liberty Mutual Insurance Company, Samsung Fire & Marine Insurance Co., Ltd., Sumitomo Mitsui Financial Group, Inc. (MS&AD Insurance Group Holdings, Inc.), Mapfre S.A. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Short Term Insurance Market Key Technology Landscape

The Short Term Insurance Market is undergoing a profound transformation driven by an array of cutting-edge technologies that are reshaping every aspect of the value chain, from underwriting and risk assessment to claims processing and customer engagement. Artificial Intelligence (AI) and Machine Learning (ML) are at the forefront, enabling insurers to analyze vast datasets for more accurate risk profiling, personalized pricing, and predictive analytics that anticipate customer needs and potential claims. These technologies power sophisticated fraud detection systems, significantly reducing losses, and facilitate the automation of routine tasks through robotic process automation (RPA), enhancing operational efficiency and reducing manual errors across policy administration and claims processing. AI-driven chatbots and virtual assistants are also revolutionizing customer service, providing instant support and personalized interactions.

The Internet of Things (IoT) plays a crucial role by providing real-time data from connected devices, such as telematics in vehicles and smart home sensors. This data allows for usage-based insurance (UBI) models, where premiums are dynamically adjusted based on actual behavior and risk exposure, fostering safer habits and fairer pricing. For property insurance, IoT devices can monitor conditions like water leaks or smoke, enabling proactive risk mitigation and faster claims response. Big Data analytics infrastructure is essential to process and derive actionable insights from these immense volumes of structured and unstructured data, guiding product development, market strategies, and risk management decisions. Cloud computing provides the scalable and flexible IT infrastructure necessary to support these data-intensive applications, reducing infrastructure costs and speeding up deployment of new services.

Furthermore, blockchain technology is beginning to gain traction for its potential to enhance transparency, security, and efficiency in claims processing and smart contracts, particularly for complex insurance products like reinsurance or parametric insurance. It offers immutable records and automated payouts based on pre-defined triggers, minimizing disputes and administrative overhead. Mobile technology and sophisticated digital platforms are critical for distribution, allowing insurers to reach customers directly, offer on-demand products, and facilitate seamless customer journeys from policy purchase to claims submission. Collectively, these technologies are empowering insurers to move from a reactive claims-based model to a proactive risk prevention and customer-centric service provider, fundamentally altering the competitive landscape and driving innovation in the short-term insurance market.

Regional Highlights

- North America: A mature and highly competitive market, North America, particularly the United States and Canada, leads in technological adoption within short-term insurance. The region exhibits high insurance penetration, driven by strong regulatory frameworks and a robust economy. Key trends include the growth of telematics-based motor insurance, smart home insurance leveraging IoT, and increasing demand for cyber insurance due to heightened digital risks. Innovation in AI and big data analytics for underwriting and claims processing is a significant focus, alongside a shift towards personalized customer experiences.

- Europe: Characterized by diverse regulatory environments and varied market maturity, Europe represents a substantial segment of the short-term insurance market. Western European countries demonstrate high penetration and focus on digital transformation, regulatory compliance (e.g., GDPR, Solvency II), and sustainable insurance practices. Eastern Europe shows faster growth potential due to lower penetration rates and developing economies. Usage-based insurance, embedded insurance, and the emphasis on eco-friendly policies are prominent trends across the continent.

- Asia Pacific (APAC): The APAC region is the fastest-growing market, propelled by rapid economic development, a burgeoning middle class, and increasing urbanization in countries like China, India, and Southeast Asian nations. Low insurance penetration in many areas presents significant growth opportunities. Digitalization is a key driver, with mobile-first strategies and partnerships with fintech companies accelerating market access. The region faces unique challenges from natural disasters, driving demand for innovative property and agricultural insurance solutions.

- Latin America: This region offers considerable untapped potential, marked by expanding economies and a growing awareness of insurance benefits. Brazil, Mexico, and Argentina are key markets, showing increased adoption of digital distribution channels and microinsurance products tailored to underserved populations. Political and economic volatility can pose challenges, yet the ongoing formalization of economies and rising disposable incomes continue to drive market expansion, particularly in motor and property insurance.

- Middle East and Africa (MEA): The MEA region is characterized by diverse market maturities, with Gulf Cooperation Council (GCC) countries showing higher penetration due to wealth and regulatory mandates, while parts of Africa remain largely underserved. Infrastructure development, rising foreign investment, and increasing digitalization are fostering growth. Opportunities lie in developing tailored products for local needs, leveraging mobile technology for distribution, and addressing risks associated with economic diversification and climate change impacts.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Short Term Insurance Market.- Allianz SE

- AXA SA

- Zurich Insurance Group AG

- Generali Group

- Prudential Plc

- Chubb Limited

- Travelers Companies Inc.

- American International Group (AIG)

- Munich Re

- Berkshire Hathaway Inc. (GEICO, National Indemnity)

- Ping An Insurance (Group) Company of China, Ltd.

- China Life Insurance (Group) Company

- Tokio Marine Holdings

- Aviva Plc

- Liberty Mutual Insurance Company

- Samsung Fire & Marine Insurance Co., Ltd.

- Sumitomo Mitsui Financial Group, Inc. (MS&AD Insurance Group Holdings, Inc.)

- Mapfre S.A.

- Admiral Group Plc

- QBE Insurance Group Limited

Frequently Asked Questions

What is short-term insurance?

Short-term insurance, also known as general or non-life insurance, provides financial protection against losses or damages arising from specific, unpredictable events over a defined, typically shorter, period. It covers assets like vehicles, homes, and businesses, as well as liabilities and certain health expenses, offering risk transfer for unexpected occurrences.

How does short-term insurance differ from long-term (life) insurance?

Short-term insurance covers risks that might occur over a limited duration (e.g., a year) and is typically renewable, focusing on property, health (non-life), and liability. Long-term or life insurance, conversely, provides coverage for an extended period, often the policyholder's entire life, primarily focusing on financial security for beneficiaries upon death or for long-term savings and investment.

What are the main drivers of growth in the Short Term Insurance Market?

Key growth drivers include increasing global awareness of risk management, rapid urbanization, rising disposable incomes in emerging markets, the escalating frequency of natural disasters, evolving regulatory mandates, and significant technological advancements such as AI, IoT, and data analytics that enhance product offerings and efficiency.

How is technology impacting the Short Term Insurance Market?

Technology, particularly AI, Machine Learning, IoT, and Big Data, is profoundly impacting the market by enabling more accurate risk assessment, personalized pricing, automated claims processing, superior fraud detection, and the creation of innovative products like usage-based and on-demand insurance. It also enhances customer experience through digital channels and predictive analytics.

What are the primary challenges faced by the Short Term Insurance Market?

The market faces challenges such as intense price competition, customer price sensitivity, economic downturns, complex and evolving regulatory landscapes, the burden of integrating legacy IT systems with new technologies, and increasing expectations for seamless digital experiences, all of which pressure profitability and innovation.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager