Shuttle Racking Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 431956 | Date : Dec, 2025 | Pages : 255 | Region : Global | Publisher : MRU

Shuttle Racking Market Size

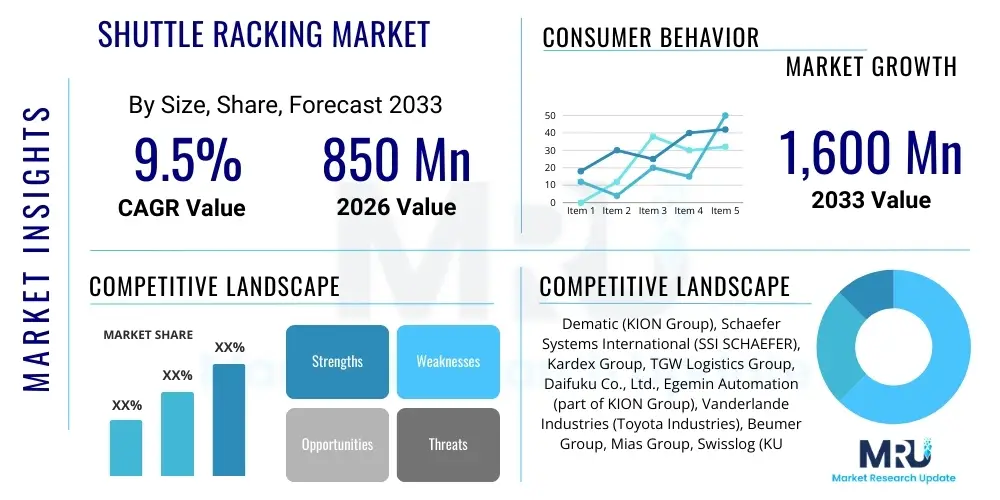

The Shuttle Racking Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.5% between 2026 and 2033. The market is estimated at $850 Million in 2026 and is projected to reach $1,600 Million by the end of the forecast period in 2033.

Shuttle Racking Market introduction

The Shuttle Racking Market encompasses the design, manufacture, and deployment of semi-automated or fully automated storage and retrieval systems that utilize robotic carriers (shuttles) to move pallets or containers within deep racking structures. This sophisticated intralogistics solution dramatically increases warehouse density and operational throughput compared to conventional static racking or selective racking systems. The product primarily includes the racking structure itself, the automated shuttle cars (often battery-powered), and the associated control software (WMS/WCS integration layer). These systems are crucial for industries dealing with high volumes of homogenous SKUs, especially those prioritizing First-In, First-Out (FIFO) or Last-In, First-Out (LIFO) inventory management, such as food and beverage, cold storage, and FMCG sectors.

Major applications of shuttle racking systems are prominently found in distribution centers requiring high-density storage, cold storage facilities where minimizing human exposure to extreme temperatures is paramount, and manufacturing buffers where sequencing and staging of materials are necessary. Key benefits driving the market include superior space utilization, often achieving up to 80-90% density improvement over selective racking, significant reduction in labor costs associated with manual forklift operations, and enhanced inventory accuracy through automated tracking. Furthermore, the modular nature of many modern shuttle systems allows for scalable investment, appealing to a broader range of enterprises seeking phased automation strategies.

Driving factors propelling market expansion include the exponential growth of e-commerce, which demands faster order fulfillment and higher SKU complexity, leading to an acute need for high-throughput automated material handling solutions. Simultaneously, global supply chain pressures, coupled with rising labor scarcity and increasing wages in developed economies, mandate investment in automation to maintain operational competitiveness. Regulatory focus on workplace safety and the technological advancements in battery life, sensor accuracy, and control software further accelerate the adoption of these robust and efficient warehouse automation technologies.

Shuttle Racking Market Executive Summary

The Shuttle Racking Market is undergoing rapid transformation, underpinned by the global trend toward warehouse automation and optimization in response to unprecedented e-commerce demands and escalating operational costs. Business trends indicate a strong shift towards integration, where shuttle systems are no longer standalone solutions but are seamlessly connected with Automated Storage and Retrieval Systems (AS/RS), conveyers, and robotic pickers, forming highly sophisticated, end-to-end automated facilities. Suppliers are focusing heavily on software interoperability, offering advanced Warehouse Execution Systems (WES) that optimize shuttle movement and maximize system uptime, driving up the total value proposition and justifying the significant initial capital expenditure for end-users.

Regionally, Asia Pacific (APAC) stands out as the primary growth engine, fueled by massive infrastructure investments in China and India, coupled with rapid urbanization and the proliferation of mega-distribution centers serving burgeoning consumer bases. North America and Europe, while being mature markets, are characterized by high rates of modernization, particularly replacing legacy selective racking systems with high-density automated solutions to mitigate the chronic shortage of skilled logistics labor. Regulatory frameworks promoting safety and efficiency also support market penetration in these developed regions, leading to increased adoption in highly regulated sectors like pharmaceuticals and food production.

Segment trends reveal that the Pallet Shuttle segment dominates the market due to its application in bulk storage and high-volume industries, especially in cold chain logistics. However, the Mini-Load Shuttle segment, catering to smaller totes and cartons, is experiencing the fastest growth rate, directly correlated with the rise in piece-picking and omni-channel fulfillment strategies. Furthermore, the technological landscape is being redefined by the widespread adoption of lithium-ion batteries for shuttles, replacing older lead-acid variants, thereby reducing charging times and increasing operational availability, fundamentally improving the efficiency metrics across all application areas.

AI Impact Analysis on Shuttle Racking Market

User queries regarding the impact of Artificial Intelligence (AI) on the Shuttle Racking Market frequently revolve around optimizing system performance, predictive maintenance capabilities, and integration with broader supply chain ecosystems. Users are keen to understand how AI-driven algorithms can move beyond basic task execution (like simple FIFO/LIFO execution) to truly dynamic, real-time path planning, congestion avoidance, and resource allocation across large fleets of shuttles. Key concerns often center on the complexity of integrating AI layers into existing legacy Warehouse Management Systems (WMS) and the necessary data infrastructure required to feed the learning models, while expectations are high for AI to deliver quantifiable reductions in system downtime and significant increases in operational throughput and energy efficiency. Specifically, questions often address how machine learning models can anticipate component failure, dynamically re-slot inventory based on predicted demand fluctuations, and coordinate complex movements involving human interaction (e.g., loading/unloading zones) safely and effectively.

The implementation of AI and Machine Learning (ML) transforms shuttle racking from a purely mechanical automation tool into an intelligent logistical asset. AI algorithms enable predictive modeling based on operational data, allowing warehouse operators to schedule maintenance proactively, minimizing unplanned downtime which is critical given the high capital cost of these systems. Furthermore, ML is used in advanced route optimization, calculating the most efficient path for each shuttle in real-time considering variables such as current traffic density, battery status, and priority order status, leading to superior utilization of the entire system fleet. This intelligence layer ensures the system operates closer to its theoretical maximum throughput, a vital factor for large distribution centers.

Moreover, AI profoundly impacts inventory management within shuttle systems. By analyzing historical demand patterns and current fulfillment trends, AI can optimize inventory placement—dynamic slotting—ensuring that the fastest moving goods are positioned closer to input/output channels, drastically reducing retrieval times. This capability shifts the system from a static storage solution to a dynamic fulfillment engine. The integration of computer vision and deep learning models also enhances quality control, automatically verifying correct SKU placement and retrieval, reducing errors, and ensuring adherence to stringent compliance standards in sectors like pharmaceuticals and specialized food logistics, thus improving the overall reliability and accountability of the automated warehouse environment.

- AI-powered Predictive Maintenance: Analyzing sensor data (vibration, heat, current draw) to forecast shuttle component failure, reducing unplanned downtime by up to 30%.

- Dynamic Slotting Optimization: Using machine learning to re-assign inventory locations within the rack based on real-time order velocity and seasonal demand shifts.

- Real-Time Pathfinding Algorithms: Optimizing the movement and scheduling of multiple shuttles simultaneously to prevent congestion and maximize system throughput.

- Enhanced Energy Management: AI systems intelligently manage battery charging cycles based on anticipated workload, optimizing energy consumption and extending battery life.

- WES Integration Optimization: Providing an intelligent interface layer to the Warehouse Execution System (WES) for complex decision-making regarding order batching and resource allocation across the entire material flow infrastructure.

DRO & Impact Forces Of Shuttle Racking Market

The market for shuttle racking systems is significantly influenced by a powerful combination of drivers (D), restraints (R), and opportunities (O), creating complex impact forces that shape investment decisions across the supply chain landscape. The primary drivers are the irreversible trends of e-commerce expansion and the associated need for increased speed and scalability in fulfillment, coupled with global labor market shifts that make manual operations economically unsustainable in key regions. These forces create a compelling, immediate mandate for automation investments. However, the high initial capital expenditure (CapEx) required for these complex integrated systems, alongside the specialized technical expertise needed for their installation, maintenance, and WMS integration, acts as a significant restraint, particularly impacting small to medium-sized enterprises (SMEs) hesitant about substantial long-term financial commitments. This balance of pressing demand versus high cost dictates the penetration rate in various industrial sectors globally.

Key opportunities emerge from the convergence of shuttle technology with ancillary solutions, notably the development of multi-directional shuttles capable of moving vertically and horizontally, offering unparalleled flexibility and density compared to traditional single-axis models. Furthermore, the opportunity to retrofit existing, older warehouse structures with modular shuttle racking provides a lower-cost entry point for companies looking to phase into automation without requiring complete facility reconstruction. The expansion of cold chain logistics, driven by demand for fresh and frozen goods globally, represents a highly specialized and lucrative niche for shuttle systems, which excel in harsh, temperature-controlled environments where human labor is severely restricted. These technological and sectoral opportunities are key to sustaining market growth beyond current e-commerce demands.

The impact forces are substantial, creating both market pull and market push. The 'pull' is generated by end-users seeking operational resilience and cost reduction, especially post-pandemic, reinforcing automation as a necessary competitive edge. The 'push' comes from technology providers continually innovating to reduce system complexity and increase reliability, often through robust, standardized, and easily scalable modular solutions. These market forces collectively favor providers who can offer integrated, lifecycle support—from consultation and design through to advanced software integration and post-installation maintenance. The increasing cost of logistics real estate globally further amplifies the value proposition of high-density shuttle racking, making space utilization a critical metric driving final purchase decisions.

Segmentation Analysis

The Shuttle Racking Market is critically segmented based on the system type, the capacity it handles, and its primary end-user applications, providing detailed insights into demand patterns across various industrial requirements. Understanding these segmentations is vital for manufacturers and suppliers to tailor their product offerings and marketing strategies effectively. The segmentation by system type often differentiates between semi-automated solutions, where an operator interacts with the shuttle, and fully automated configurations, which are typically integrated into a larger Automated Storage and Retrieval System (AS/RS) infrastructure. The capacity-based segmentation focuses primarily on whether the system is designed to handle standard pallets (pallet shuttle) or smaller containers, totes, or cartons (mini-load shuttle), reflecting the bifurcation between bulk storage and high-frequency picking operations.

Application segmentation reveals the diverse utility of shuttle systems, highlighting critical sectors such as food & beverage (often including cold storage), retail & e-commerce (focused on fulfillment speed), and automotive/manufacturing (focused on sequencing and buffer storage). The dynamics within these segments are varied; for instance, the food & beverage sector prioritizes robustness and temperature stability, whereas e-commerce demands high throughput and flexibility to manage constantly changing inventory profiles. This granular analysis demonstrates that the market is not homogenous, requiring tailored technological features, such as specialized materials for corrosion resistance in cold environments or high-speed drive mechanisms for fast-paced e-commerce centers.

The fastest-growing segment in the forecast period is projected to be the Mini-Load/Tote Shuttle segment, driven by the intense growth in unit picking required for omni-channel retail and e-grocery services. While Pallet Shuttles maintain the largest market share by revenue due to their essential role in bulk warehousing and cold storage, the shift toward handling smaller, more frequent orders accelerates the demand for micro-fulfillment centers and high-speed carton handling systems. Furthermore, the operational mode segmentation (LIFO vs. FIFO) dictates the suitability for specific inventory needs, with FIFO gaining traction in sectors dealing with perishable goods or strict batch control requirements, requiring more complex, multi-aisle shuttle configurations.

- By System Type:

- Semi-Automated Shuttle Racking

- Fully Automated (AS/RS Integrated) Shuttle Racking

- By Capacity:

- Pallet Shuttle (Heavy Load)

- Mini-Load/Tote Shuttle (Light Load)

- By Operating Channel:

- LIFO (Last-In, First-Out) Systems

- FIFO (First-In, First-Out) Systems

- By End-Use Industry:

- Food & Beverage (Including Cold Chain)

- Retail & E-commerce

- 3PL (Third-Party Logistics)

- Pharmaceuticals & Healthcare

- Automotive & Manufacturing

- Others (Chemical, Electronics)

Value Chain Analysis For Shuttle Racking Market

The value chain for the Shuttle Racking Market begins with upstream activities focused on raw material sourcing and specialized component manufacturing. This involves the procurement of high-grade structural steel for the racking framework, crucial for load-bearing capacity and seismic stability. Concurrently, highly specialized technology components are sourced, including precision drive motors, sophisticated sensors, batteries (increasingly lithium-ion), and advanced microprocessors necessary for the automated shuttle cars. Key suppliers in this upstream stage include industrial component manufacturers and software developers who create the proprietary control algorithms. Price volatility in steel and the dependency on global semiconductor supply chains for electronic components represent the primary risks in the upstream segment, directly influencing the final cost structure of the integrated system.

The middle segment of the value chain is dominated by the core manufacturers and integrators. These companies design, engineer, and assemble the complete shuttle racking system, integrating the structural elements with the automated machinery and control software. This phase is capital-intensive and requires significant intellectual property related to material handling optimization and proprietary system architecture. Distribution channels are typically bifurcated: Direct sales are common for large, complex, custom-engineered projects, where the manufacturer provides end-to-end consulting, installation, and post-sales support directly to major end-users (e.g., large 3PLs or international retailers). This ensures maximum control over quality and integration specificity.

Indirect distribution involves collaboration with System Integrators (SIs) and specialized Material Handling Distributors. These intermediaries purchase components or semi-finished systems from manufacturers and integrate them with other elements of a warehouse automation project, such as conveyors, WMS, and robotic arms. Downstream activities involve the final end-users—the implementation, operation, and maintenance of the system within distribution centers and production facilities. The sustainability and long-term profitability of the system are heavily reliant on highly skilled maintenance services and continuous software updates. The distribution channel strategy is highly dependent on regional market maturity; developed markets rely heavily on specialized SIs, while emerging markets often utilize direct sales models supplemented by local partners for installation logistics.

Shuttle Racking Market Potential Customers

Potential customers for Shuttle Racking systems are diverse, primarily comprising enterprises that require maximum storage density, rapid order fulfillment capabilities, or robust automation in challenging environments. The archetypal end-user is the Third-Party Logistics (3PL) provider, which operates massive multi-client distribution centers and views automation as essential for scalable service delivery and maintaining competitiveness against rising labor and real estate costs. 3PLs invest heavily in shuttle systems because these solutions allow them to optimize space utilization for numerous clients simultaneously, offering flexible inventory management solutions that cater to both LIFO and FIFO requirements depending on the client’s product type. Furthermore, the ability of shuttle systems to operate 24/7 without significant human intervention is highly attractive for meeting stringent service level agreements (SLAs).

Another significant group of buyers belongs to the Food & Beverage industry, especially entities involved in cold chain logistics. Freezing and chilling warehouses demand high levels of automation because the operational time for human workers is severely limited due, to health and safety regulations, and the energy efficiency of the storage system is paramount. Shuttle racking systems, particularly those using specialized components rated for sub-zero temperatures, minimize the footprint of refrigerated areas and reduce the need for expensive heating equipment for human workers, offering a quick return on investment through energy savings and enhanced productivity. These companies prioritize reliability, temperature resilience, and high density for bulk storage of standardized product pallets.

The booming Retail and E-commerce sector represents the fastest-growing customer base for shuttle racking, particularly for mini-load systems. These companies face immense pressure to fulfill an increasing volume of smaller, highly fragmented orders rapidly (omni-channel fulfillment). Shuttle systems are deployed in dedicated micro-fulfillment centers or within larger regional hubs to stage inventory close to the picking stations, integrating seamlessly with high-speed conveyors and pick-to-light or goods-to-person solutions. The decision-makers in this sector prioritize throughput speed, modular scalability to cope with fluctuating peak demands, and seamless integration with existing complex WMS/Order Management System (OMS) infrastructure.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $850 Million |

| Market Forecast in 2033 | $1,600 Million |

| Growth Rate | 9.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Dematic (KION Group), Schaefer Systems International (SSI SCHAEFER), Kardex Group, TGW Logistics Group, Daifuku Co., Ltd., Egemin Automation (part of KION Group), Vanderlande Industries (Toyota Industries), Beumer Group, Mias Group, Swisslog (KUKA Group), BITO-Lagertechnik, System Logistics S.p.A., Gonvarri Material Handling, Interroll Group, Weland Lagersystem AB, Viastore Systems, Stow Group, Mecalux S.A., DMW&H, and Montel Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Shuttle Racking Market Key Technology Landscape

The technological landscape of the Shuttle Racking Market is defined by continuous innovation focused on enhancing speed, reliability, energy efficiency, and system intelligence. A pivotal technological shift has been the transition from wired or induction power systems to advanced Lithium-Ion (Li-ion) batteries for the shuttle cars. Li-ion technology offers significant advantages, including extended operational run times, rapid charging capabilities (often opportunity charging during retrieval cycles), and a much longer lifecycle, drastically reducing maintenance downtime and increasing the overall availability of the automated system. This focus on maximizing system uptime through superior power management is critical for high-throughput distribution centers operating multiple shifts.

Furthermore, the development of multi-directional and flexible shuttles represents a significant leap forward in system design. Unlike older single-axis shuttles, modern multi-directional systems can navigate across multiple levels and aisles, offering true omni-directional flexibility. This technology is vital for maximizing space utilization in non-traditional warehouse layouts and facilitates highly complex inventory sequencing and retrieval patterns, often integrating seamlessly into Goods-to-Person (GTP) workflows. The intelligence embedded within these shuttles is powered by sophisticated control logic and real-time sensor fusion, enabling highly accurate positioning and collision avoidance, even when operating large fleets simultaneously within a confined space.

Integration technology, particularly the seamless connectivity between the shuttle control layer and the enterprise's Warehouse Management System (WMS) or Warehouse Execution System (WES), is paramount. Modern shuttle systems rely on advanced industrial IoT sensors to constantly monitor performance, health, and location. This stream of operational data feeds into optimization software that leverages AI/ML to make real-time decisions regarding traffic flow, task prioritization, and predictive maintenance alerts. The use of robust industrial Wi-Fi or 5G connectivity ensures low-latency communication, which is essential for coordinating the precise movements of dozens or hundreds of independent automated vehicles, solidifying the role of software intelligence as the core competitive differentiator in this hardware-centric market.

Regional Highlights

The global demand for shuttle racking systems exhibits distinct regional dynamics, influenced by labor market maturity, e-commerce penetration, and government policies concerning industrial automation and logistics infrastructure investment. North America, characterized by high operational costs and a severe shortage of warehouse labor, is a mature market focused on modernization and large-scale facility deployments. Investment is heavily concentrated among major 3PLs and tier-one retailers who are transitioning from manual operations to fully integrated AS/RS solutions, with pallet shuttle systems dominating due to the prevalence of bulk storage requirements. The pressure to provide ultra-fast fulfillment in the U.S. and Canadian markets drives continuous investment in high-throughput mini-load systems for dedicated e-commerce fulfillment centers and urban micro-fulfillment operations.

Europe represents a highly fragmented yet innovative market. Western Europe, particularly Germany, the UK, and the Benelux countries, is driven by stringent safety regulations, high quality control standards (especially in pharmaceuticals and food processing), and the necessity for sophisticated supply chain resilience. Scandinavian countries lead in the adoption of energy-efficient and sustainable automation technologies, often favoring complex, multi-functional shuttle systems that integrate seamlessly with robotic handling systems. Central and Eastern Europe are emerging as significant growth areas, driven by the establishment of major manufacturing and logistics hubs serving the broader European consumer base, leading to large-scale greenfield investments in automated distribution infrastructure designed around high-density storage solutions.

Asia Pacific (APAC) is undoubtedly the engine of future market growth, fueled by unprecedented e-commerce penetration and the rapid expansion of organized retail in countries like China, India, Japan, South Korea, and Southeast Asian nations. China leads the regional adoption curve, investing massively in automation to manage its colossal logistics volume and rising labor wages. The market in APAC is characterized by a strong demand for customized, scalable solutions due to the variance in warehouse sizes and architectural limitations in highly dense urban areas. The cold chain segment, especially in India and Southeast Asia where population density and food storage requirements are growing exponentially, presents a particularly strong opportunity for pallet shuttle systems built for challenging, high-volume environments.

Latin America (LATAM) and the Middle East & Africa (MEA) are emerging markets for shuttle racking, albeit with slower adoption rates compared to developed economies. In LATAM, economic volatility and high interest rates often lead to phased automation investments, with semi-automated shuttle racking being a popular starting point due to lower initial CapEx. The focus is mainly on essential sectors such as food and beverage, utilizing high-density storage to manage large volumes efficiently. In the MEA region, particularly the GCC countries (Gulf Cooperation Council), significant government investments in logistics infrastructure and diversification away from oil economies are driving demand. New mega-ports and free trade zones require world-class automation, making these regions prime targets for high-end, fully automated shuttle and AS/RS installations aimed at optimizing global trade flow and internal supply chains.

- North America: Focus on integrating high-throughput systems, replacing costly labor, and driving large investments in 3PL and e-commerce fulfillment centers.

- Europe: Driven by high quality/safety standards, cold chain requirements, and utilizing automation to address labor shortages and environmental sustainability goals.

- Asia Pacific (APAC): Leading global growth due to e-commerce volumes, rapid urbanization, and massive logistics infrastructure build-outs, particularly strong growth in Mini-Load systems.

- Latin America (LATAM): Gradual adoption, focused on cost-effective, high-density solutions in FMCG and food sectors, often starting with semi-automated systems.

- Middle East & Africa (MEA): High growth potential stemming from government initiatives to build world-class trade hubs and modernizing warehousing capabilities in the GCC region.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Shuttle Racking Market.- Dematic (KION Group)

- Schaefer Systems International (SSI SCHAEFER)

- Kardex Group

- TGW Logistics Group

- Daifuku Co., Ltd.

- Egemin Automation (part of KION Group)

- Vanderlande Industries (Toyota Industries)

- Beumer Group

- Mias Group

- Swisslog (KUKA Group)

- BITO-Lagertechnik

- System Logistics S.p.A.

- Gonvarri Material Handling

- Interroll Group

- Weland Lagersystem AB

- Viastore Systems

- Stow Group

- Mecalux S.A.

- DMW&H

- Montel Inc.

Frequently Asked Questions

Analyze common user questions about the Shuttle Racking market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary ROI driver for investing in Shuttle Racking systems?

The primary Return on Investment (ROI) driver is superior space utilization, often achieving 80-90% density improvements, coupled with significant reductions in labor costs and enhanced throughput speeds necessary for modern e-commerce fulfillment.

How does Shuttle Racking differ from traditional AS/RS?

Shuttle Racking uses autonomous robotic carriers to move within the rack structure, primarily focused on high-density storage, while traditional AS/RS often utilizes cranes or fixed-mast vehicles covering the entire vertical height of an aisle for both storage and retrieval.

Which industries benefit most from Mini-Load Shuttle systems?

The Retail, E-commerce, and Pharmaceuticals industries benefit most, as Mini-Load shuttles are designed for high-frequency handling of smaller items (totes/cartons) essential for piece-picking, omni-channel fulfillment, and handling high volumes of SKUs.

What role does software play in modern Shuttle Racking operations?

Software (WMS/WES) is critical; it manages shuttle coordination, optimizes real-time movement paths, schedules predictive maintenance, and integrates the physical system with inventory and order management processes to maximize operational efficiency and throughput.

Are Shuttle Racking systems suitable for cold storage environments?

Yes, specialized Pallet Shuttle systems are highly suitable for cold storage and freezer environments (down to -30°C/-40°C) as they minimize human presence, reduce energy consumption by decreasing the size of the refrigerated space, and utilize resilient, cold-rated components.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager