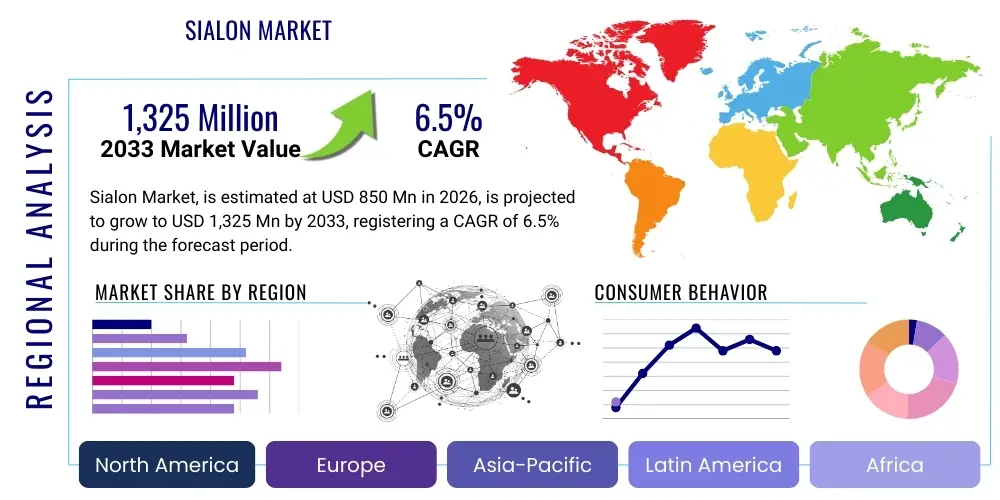

Sialon Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437350 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Sialon Market Size

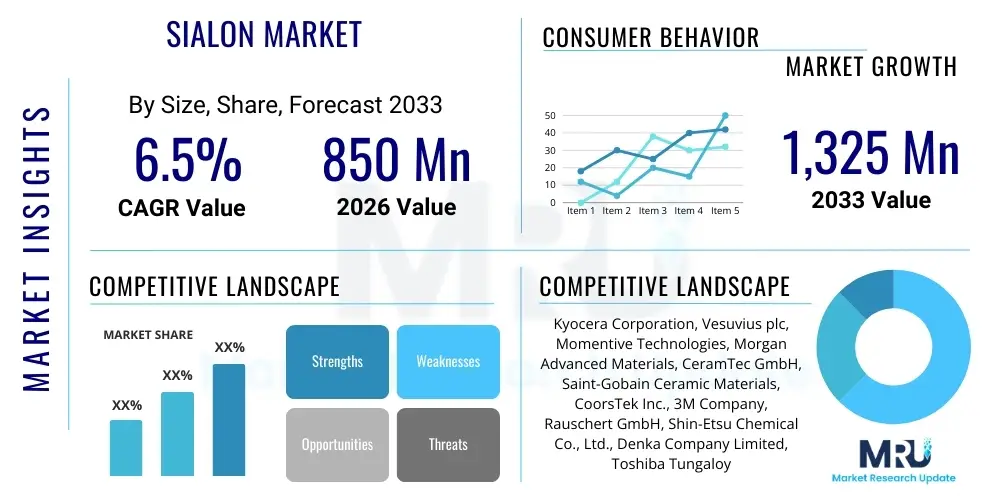

The Sialon Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at $850 Million USD in 2026 and is projected to reach $1,325 Million USD by the end of the forecast period in 2033. This growth trajectory is fundamentally supported by the increasing global demand for high-performance ceramic materials capable of enduring extreme conditions, particularly within the automotive, aerospace, and industrial machinery sectors where material integrity under thermal and mechanical stress is paramount.

Sialon Market introduction

The Sialon Market encompasses advanced engineering ceramics derived from silicon nitride (Si3N4), where aluminum (Al) and oxygen (O) are substituted into the crystal structure. Sialons (Silicon Aluminum Oxynitride) offer superior combinations of properties compared to traditional ceramics, including exceptional strength, high fracture toughness, chemical inertness, and remarkable resistance to thermal shock and creep deformation at elevated temperatures. These characteristics make Sialon an indispensable material in harsh operating environments, replacing metals and conventional ceramics in critical high-wear, high-heat applications, thus driving market expansion globally.

Major applications of Sialon materials span across several heavy industries. In metal processing, Sialons are extensively used for non-ferrous molten metal handling, including riser tubes, thermocouples, and heater sheaths, due to their excellent non-wetting properties and corrosion resistance against molten aluminum. Furthermore, the material is pivotal in manufacturing high-precision cutting tools, such as inserts and tips, for machining nickel-based superalloys and cast iron, where the thermal stability and hardness of Sialon enable higher cutting speeds and longer tool life, significantly boosting productivity and operational efficiency in manufacturing sectors.

Key driving factors accelerating the adoption of Sialon include the continuous pursuit of lightweight and fuel-efficient components in the automotive and aerospace industries, necessitating materials that can operate at higher engine temperatures. The shift towards electrification and hydrogen energy also demands specialized thermal management and sealing solutions where Sialon ceramics excel. Coupled with advancements in powder metallurgy and sintering techniques that improve cost-effectiveness and scalability of Sialon production, these factors collectively reinforce its position as a material of choice for future high-performance industrial and technological applications across North America, Europe, and rapidly industrializing regions in Asia Pacific.

Sialon Market Executive Summary

The Sialon market exhibits robust business trends driven primarily by escalating demand from high-growth end-use industries, particularly precision engineering and renewable energy. Business strategies are centered on capacity expansion, particularly in sophisticated manufacturing processes such as gas pressure sintering (GPS) and hot isostatic pressing (HIP), which enhance material density and performance characteristics crucial for mission-critical applications like turbine components and bearing surfaces. Strategic alliances between raw material suppliers (silicon nitride powder) and ceramic manufacturers are becoming common to secure supply chain integrity and optimize production costs, addressing concerns regarding raw material purity and price volatility that previously constrained market growth.

Regionally, the market is highly dynamic, with Asia Pacific (APAC) emerging as the leading consumption hub, fueled by rapid industrialization, extensive investments in infrastructure, and the dominance of manufacturing sectors in countries like China, Japan, and South Korea. North America and Europe maintain significant market shares, characterized by demand for high-value applications in aerospace and advanced medical devices, focusing on superior material grades and customization. European regulatory frameworks emphasizing energy efficiency and reduced emissions further propel the adoption of Sialon components in high-temperature industrial furnaces and heat exchangers, while competitive pricing from APAC manufacturers increasingly influences global procurement trends and technological standardization.

Segment trends reveal a pronounced shift toward Beta-Sialon varieties due to their superior creep resistance and suitability for structural components exposed to sustained high mechanical loads, overshadowing the traditional use of Alpha-Sialon in certain wear-resistant applications. Furthermore, the cutting tools segment continues to dominate the market by application, reflecting the global expansion of CNC machining and the requirement for efficient processing of hard alloys. Within the industrial sector, demand for Sialon-based furnace components and crucibles is experiencing rapid growth, driven by the expanding secondary aluminum recycling industry and increased manufacturing throughput in sectors reliant on precision casting and high-temperature processing.

AI Impact Analysis on Sialon Market

Common user inquiries concerning the influence of Artificial Intelligence on the Sialon market frequently revolve around optimizing complex manufacturing processes, accelerating material discovery, and enhancing quality control. Users are keen to understand how AI-driven simulations can reduce the expensive and time-consuming trial-and-error approach currently prevalent in developing novel Sialon compositions with tailored properties. Key expectations include utilizing machine learning models to predict optimum sintering parameters (temperature, pressure, holding time) based on specific powder characteristics, thus minimizing defects and maximizing material yield. Furthermore, there is significant interest in applying AI for real-time monitoring and predictive maintenance of high-value Sialon components in extreme industrial environments, ensuring operational continuity and extending component lifespan, thereby integrating AI across the entire Sialon value chain from synthesis to operational deployment.

- AI algorithms facilitate predictive modeling of Sialon microstructure development based on powder input parameters, significantly reducing R&D cycles.

- Machine learning optimizes sintering processes, enabling precise control over density and crystal phase composition (Alpha vs. Beta Sialon), minimizing energy consumption.

- AI-powered visual inspection systems enhance quality control, identifying micro-cracks and defects in Sialon components far more efficiently than human inspection.

- Data analytics derived from in-situ sensor monitoring predicts wear rates and failure points of Sialon cutting tools, enabling just-in-time replacement and improving manufacturing efficiency.

- Generative design tools leverage AI to create novel Sialon component geometries optimized for thermal and mechanical stress, particularly in aerospace applications.

DRO & Impact Forces Of Sialon Market

The Sialon market dynamics are shaped by potent drivers such as stringent performance requirements in aerospace and defense, demanding materials that withstand higher thermal and kinetic loads, coupled with restraints including high production costs and complexity associated with advanced sintering techniques. Opportunities reside in leveraging Sialon's inertness for specialized applications like medical implants and hydrogen fuel cell components, while the overall impact forces are primarily determined by global industrial output growth and the continuous push for energy-efficient, high-speed machining processes across diversified manufacturing hubs worldwide, compelling industries to adopt superior ceramic solutions over traditional metallic alloys.

Drivers: The dominant driver is the non-substitutable performance profile of Sialon ceramics in extreme operational environments. The aerospace industry’s push for lighter gas turbine components and the automotive sector’s drive towards high-efficiency turbochargers operating at elevated temperatures mandate materials with superior creep resistance and low thermal expansion coefficients, properties where Sialon inherently excels. Furthermore, the rapid growth in industrial machining of superalloys (Inconel, Hastelloy) and hardened steels, particularly in large emerging economies, necessitates cutting tool inserts that maintain edge sharpness and chemical stability at high processing temperatures, ensuring faster throughput and lower operational costs compared to carbide tools.

Restraints: The primary constraints impeding widespread market penetration include the high capital expenditure required for establishing Sialon manufacturing facilities, particularly the sophisticated equipment required for gas pressure sintering (GPS) and hot isostatic pressing (HIP), which are essential for achieving optimal material performance. Secondly, the synthesis process relies heavily on ultra-fine, high-purity silicon nitride powder, which is expensive and subject to complex supply chain logistics, contributing significantly to the final product cost. This high entry barrier and relatively high unit cost compared to established metallic or conventional ceramic alternatives restrict adoption in price-sensitive or low-volume general industrial applications.

Opportunities: Significant market opportunities are concentrated in emerging technological fields. The shift toward Electric Vehicles (EVs) and hybrid vehicles presents a niche for Sialon in manufacturing specialized bearings and seals that require excellent electrical insulation combined with mechanical robustness and thermal stability. Additionally, the increasing utilization of Sialon in non-ferrous foundries, specifically for continuous casting machinery and protection tubes, offers substantial expansion potential, particularly as global aluminum production and recycling rates continue to rise. Exploiting these high-value, specialized segments allows manufacturers to offset high production costs and capture premium pricing.

Segmentation Analysis

The Sialon Market is comprehensively segmented based on its structural composition (Alpha, Beta, or composite Sialon), the manufacturing process utilized (such as pressureless sintering or hot isostatic pressing), and its diverse end-use applications across industrial sectors. Analyzing these segments provides crucial insights into material specialization and industry requirements. The performance segment, dominated by cutting tools and molten metal handling equipment, currently accounts for the largest share due to consistent industrial demand for high-wear components, while advancements in composite Sialons are driving growth in niche, specialized structural applications requiring exceptional fracture toughness and reliability.

- By Type:

- Alpha Sialon

- Beta Sialon

- Mixed/Composite Sialon (e.g., Alumina-Sialon)

- By Application:

- Cutting Tools (Turning, Milling, Grinding inserts)

- Molten Metal Handling (Riser Tubes, Thermocouple Sheaths, Crucibles)

- Automotive Components (Turbocharger Rotors, Glow Plugs, Bearing Rollers)

- Industrial Wear Parts (Bearings, Seals, Valves)

- Aerospace Components (Turbine Vane Tips, Heat Exchanger parts)

- Chemical/Process Industry Components

- By Manufacturing Method:

- Gas Pressure Sintering (GPS)

- Hot Isostatic Pressing (HIP)

- Pressureless Sintering (PLS)

- Reaction Bonding (RBSN variants)

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East and Africa (MEA)

Value Chain Analysis For Sialon Market

The Sialon value chain begins with complex upstream activities focused on securing and processing high-purity raw materials. This stage is dominated by specialized chemical suppliers providing fine silicon nitride (Si3N4) powder, along with specific quantities of alumina (Al2O3) and yttria (Y2O3) or magnesia (MgO) sintering aids, which are critical for controlling the final microstructure and properties of the Sialon ceramic. The purity and particle size distribution of the initial powders directly influence the final material performance and cost, making the upstream segment a high-cost, high-specification segment where technological expertise and consistent quality control are paramount determinants of manufacturing success.

The midstream phase involves the actual manufacturing of Sialon components, characterized by intricate powder mixing, green body formation (shaping), and high-temperature densification through processes like hot pressing or gas pressure sintering. Due to the requirement for specific, high-temperature, controlled-atmosphere kilns and specialized pressing equipment, this segment demands substantial capital investment and highly skilled personnel. Manufacturers often differentiate themselves through proprietary additive packages and optimized sintering cycles that yield superior mechanical properties, particularly fracture toughness and high-temperature hardness, allowing for precise customization for demanding aerospace or metal-cutting applications.

Downstream analysis highlights the crucial role of specialized distribution channels, which vary significantly based on the product application. Direct sales channels are typical for high-value, bespoke components supplied to major OEM manufacturers in the aerospace (jet engine parts) and automotive (turbochargers) sectors, ensuring stringent quality assurance and technical support. Conversely, standard products like cutting tool inserts are often distributed through indirect channels involving a network of specialized industrial distributors and tooling houses, providing efficient local stockholding and technical advice to end-users in general machining industries. The effectiveness of the distribution network, including comprehensive technical support, is vital for driving market penetration and user adoption.

Sialon Market Potential Customers

The primary end-users and potential buyers of Sialon ceramics are concentrated in industries that mandate exceptional material performance under severe thermal, mechanical, or corrosive conditions, where traditional metallic alloys or less advanced ceramics fail prematurely. The most significant customer base resides within the hard material machining sector, specifically large-scale manufacturers utilizing Computer Numerical Control (CNC) machinery for processing difficult-to-machine materials like nickel-based superalloys required for energy generation turbines or aerospace engine parts. These customers seek Sialon tooling for its longevity, ability to operate at high speeds, and the subsequent reduction in cycle times and overall manufacturing costs associated with tool replacement and machine downtime.

A second major customer segment is the non-ferrous metals industry, particularly aluminum foundries and recyclers. These buyers require specialized Sialon components, such as heater sheaths, thermocouple protection tubes, and continuous casting break rings, due to Sialon's outstanding resistance to corrosion and non-wetting properties when exposed to molten aluminum. This reduces contamination of the melt and minimizes component degradation, offering crucial efficiency and quality benefits. The adoption rate among these customers is heavily influenced by total cost of ownership rather than initial unit price, as the extended service life of Sialon components significantly outweighs the investment.

Furthermore, potential customers include advanced engineering firms in the automotive and energy sectors specializing in high-performance engines and next-generation power systems. This includes manufacturers of turbochargers, diesel engine glow plugs, and hydrogen fuel cell components, where the combination of thermal shock resistance, high dielectric strength, and mechanical robustness offered by Sialon is critical for enhancing system efficiency and reliability. As these industries continue their technological transition toward higher operating temperatures and pressures, the dependency on advanced material solutions like Sialon is set to increase substantially, making these technology leaders key strategic customers for Sialon producers.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $850 Million USD |

| Market Forecast in 2033 | $1,325 Million USD |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Kyocera Corporation, Vesuvius plc, Momentive Technologies, Morgan Advanced Materials, CeramTec GmbH, Saint-Gobain Ceramic Materials, CoorsTek Inc., 3M Company, Rauschert GmbH, Shin-Etsu Chemical Co., Ltd., Denka Company Limited, Toshiba Tungaloy Corporation, Zibo Huaqing Ceramic Technology Co., Ltd., Resonac Corporation (formerly Showa Denko), Shandong Sinocera Functional Material Co., Ltd., Suzhou Sinoma Advanced Materials Co., Ltd., Precision Ceramics USA, Foseco International (Vesuvius subsidiary), Electro Abrasives LLC, Cumi Murugappa. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Sialon Market Key Technology Landscape

The technological landscape of the Sialon market is primarily defined by advancements in powder synthesis and post-sintering densification techniques, crucial for achieving the ceramic's theoretical mechanical strength and reliability. Gas Pressure Sintering (GPS) remains a foundational technology, enabling the creation of dense, pore-free components by applying nitrogen pressure during the final sintering stage, effectively suppressing the decomposition of silicon nitride and promoting the formation of highly desirable interlocking grain structures. Continuous innovation is focused on enhancing the effectiveness of sintering aids (e.g., yttria and rare earth oxides) to lower sintering temperatures and reduce energy costs while maintaining superior mechanical properties, leading to more scalable and cost-effective production methods.

A critical area of technological focus involves Hot Isostatic Pressing (HIP), often utilized as a post-sintering treatment for highly critical Sialon components used in aerospace and medical applications. HIP subjects the sintered component to extremely high pressure (up to 200 MPa) and high temperature, effectively closing residual internal porosity and eliminating microscopic defects that could compromise component integrity under stress. This technology significantly boosts the reliability and fatigue life of Sialon parts, justifying the higher manufacturing cost for mission-critical applications where failure is unacceptable. The trend is moving towards integrating HIP processes seamlessly into the production line to standardize high-reliability Sialon material grades.

Further technological differentiation occurs in near-net-shape manufacturing techniques. Given the extreme hardness of Sialon, machining complex geometries after sintering is costly and difficult, requiring expensive diamond tooling. Therefore, manufacturers are increasingly investing in sophisticated molding and green body processing techniques—such as advanced injection molding and 3D printing (Additive Manufacturing)—to produce complex parts closer to their final dimensions (near-net-shape). While 3D printing of Sialon ceramics is still nascent, it holds immense potential for rapid prototyping and producing customized, lightweight geometries with internal structures previously impossible to achieve, particularly benefiting R&D efforts and low-volume, high-value component production.

Regional Highlights

- Asia Pacific (APAC) leads the market in consumption and production volume, driven by robust manufacturing sectors in China and India.

- Europe is characterized by high-value niche applications in advanced metallurgy, precision machinery, and environmental technology components.

- North America focuses heavily on stringent quality Sialon components for defense, aerospace, and advanced energy systems.

- Latin America and MEA are emerging markets, primarily driven by expanding infrastructure and resource extraction industries requiring wear-resistant parts.

Asia Pacific (APAC) constitutes the largest and fastest-growing regional market for Sialon ceramics, predominantly due to the region's immense industrial base and aggressive investment in manufacturing infrastructure, particularly in China and India. The dominance stems from high volumes of non-ferrous casting activities, extensive electronics manufacturing requiring high-temperature furnace components, and the proliferation of general machining operations where Sialon cutting tools are widely utilized. Competitive pricing strategies adopted by large regional manufacturers, coupled with strong governmental support for advanced material research, cement APAC's status as the global production and consumption powerhouse, driving both internal use and export volumes of Sialon products globally.

North America and Europe represent mature, high-value markets where demand is centered not on volume, but on the technical sophistication and certified reliability of Sialon components. In North America, demand is heavily concentrated in the aerospace and defense sectors, requiring Sialon materials that meet rigorous quality and performance standards for use in turbine engines and specialized military equipment. European consumption is robust across advanced metallurgy (specialty steel production), high-precision machinery manufacturing, and the energy sector, where Sialon components contribute to efficiency and longevity in demanding applications like incinerators and high-temperature heat exchangers, reflecting a strong emphasis on industrial innovation and regulatory compliance.

Emerging economies in Latin America and the Middle East & Africa (MEA) are witnessing accelerating adoption rates, albeit from a lower base. In LATAM, growth is correlated with increased investment in mining and heavy industrial sectors, where Sialon's wear resistance offers significant operational improvements in abrasive environments. Similarly, MEA’s market expansion is linked to ambitious infrastructure projects, burgeoning oil and gas industries, and the development of local manufacturing capabilities, creating a nascent but expanding demand for reliable, high-performance Sialon parts such as mechanical seals and structural ceramics capable of operating effectively in the region's challenging climate conditions. These regions offer significant potential for specialized Sialon component suppliers.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Sialon Market.- Kyocera Corporation

- Vesuvius plc

- Momentive Technologies

- Morgan Advanced Materials

- CeramTec GmbH

- Saint-Gobain Ceramic Materials

- CoorsTek Inc.

- 3M Company

- Rauschert GmbH

- Shin-Etsu Chemical Co., Ltd.

- Denka Company Limited

- Toshiba Tungaloy Corporation

- Zibo Huaqing Ceramic Technology Co., Ltd.

- Resonac Corporation (formerly Showa Denko)

- Shandong Sinocera Functional Material Co., Ltd.

- Suzhou Sinoma Advanced Materials Co., Ltd.

- Precision Ceramics USA

- Foseco International (Vesuvius subsidiary)

- Electro Abrasives LLC

- Cumi Murugappa

Frequently Asked Questions

Analyze common user questions about the Sialon market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary advantages of Sialon ceramics over traditional materials like silicon carbide or alumina?

Sialon ceramics offer superior fracture toughness, exceptional resistance to thermal shock, and high strength retention at extremely elevated temperatures (up to 1400°C), making them ideal for high-stress, high-heat applications like metal cutting and molten metal handling where silicon carbide may oxidize or alumina may soften.

How is the Sialon market segmented by product type, and what is the difference between Alpha and Beta Sialon?

The market is segmented into Alpha, Beta, and Composite Sialons. Alpha Sialon typically forms equiaxed grains, providing high hardness and better performance in wear resistance. Beta Sialon forms elongated, interlocked grains, offering superior high-temperature strength and creep resistance, making it preferred for structural components and high-temperature furnace parts.

Which industry accounts for the highest demand for Sialon materials globally?

The Cutting Tools segment currently generates the highest demand for Sialon materials globally. Sialon inserts are crucial for the efficient high-speed machining of difficult-to-cut materials such as nickel-based superalloys and cast iron used extensively in aerospace and power generation turbine manufacturing.

What role does the manufacturing process, such as Gas Pressure Sintering (GPS), play in Sialon component quality?

GPS is a critical densification technique that uses high gas pressure and temperature to virtually eliminate internal porosity in the ceramic structure. This process is essential for achieving the maximum theoretical density and strength of the Sialon component, ensuring high reliability required for applications like turbine parts and high-stress industrial wear components.

What are the main growth opportunities for Sialon in the emerging energy sector?

Significant growth opportunities exist in components for hydrogen fuel cells and Electric Vehicle (EV) systems. Sialon is being explored for use in specialized bearings, seals, and insulators within these systems due to its lightweight nature, excellent electrical insulation properties, and high mechanical reliability under varying temperature loads, contributing to overall system efficiency and longevity.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Sialon Powder Market Statistics 2025 Analysis By Application (Immersion Heater and Burner Tubes, Degassing and Injector Tubes in Nonferrous Metals, Metal Feed Tubes in Aluminum Die Casting, Welding and Brazing Fixtures and Pins), By Type ( -Sialon Powder, -Sialon Powder, O-Sialon Powder), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Sialon Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Α-Sialon, Β-Sialon, Others), By Application (Military, Aerospace, Machinery, Metallurgical, Others), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager