SiC and GaN Power Devices Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436515 | Date : Dec, 2025 | Pages : 251 | Region : Global | Publisher : MRU

SiC and GaN Power Devices Market Size

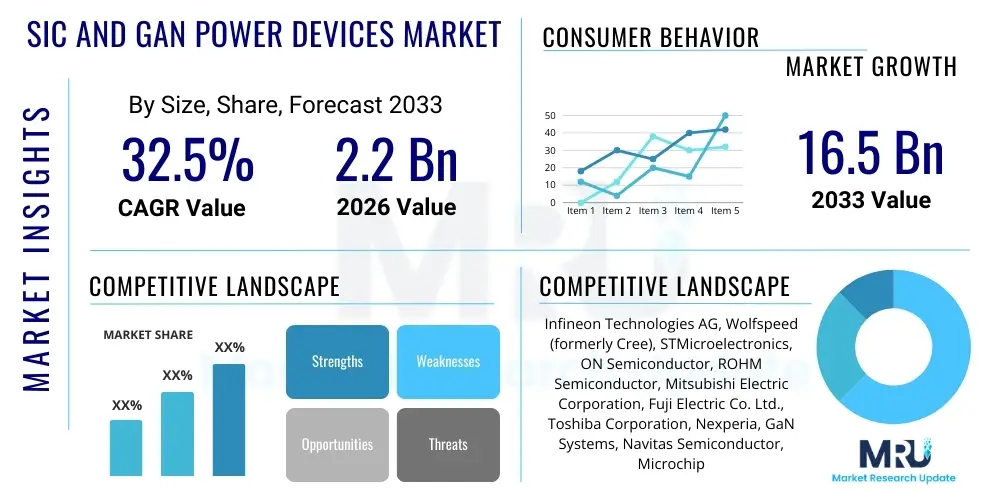

The SiC and GaN Power Devices Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 32.5% between 2026 and 2033. The market is estimated at USD 2.2 Billion in 2026 and is projected to reach USD 16.5 Billion by the end of the forecast period in 2033.

SiC and GaN Power Devices Market introduction

The SiC (Silicon Carbide) and GaN (Gallium Nitride) Power Devices Market encompasses advanced semiconductor technologies utilizing Wide Band Gap (WBG) materials. These materials offer superior performance characteristics compared to traditional silicon-based devices, particularly in high-power, high-frequency, and high-temperature applications. WBG semiconductors enable devices like diodes, MOSFETs, and power modules to operate with significantly lower switching losses, higher efficiency, and smaller form factors, directly addressing the growing demand for energy optimization across various industries.

Major applications driving the adoption of SiC and GaN devices include electric vehicles (EVs) and charging infrastructure, renewable energy systems (solar inverters, wind power), industrial motor drives, and hyperscale data centers. The superior energy conversion efficiency of WBG devices translates into substantial benefits, such as extended battery range in EVs, higher power density in power supplies, and reduced operational costs for utility-scale deployments. The inherent robustness of SiC and GaN allows for operation at higher junction temperatures, simplifying cooling requirements and further reducing system size and weight.

The key driving factors for this market expansion include stringent global energy efficiency regulations, the rapid electrification of the transportation sector, and increasing investments in 5G telecommunications infrastructure and renewable energy integration. SiC devices currently dominate high-voltage applications (above 650V), favored for traction inverters and industrial power management, while GaN devices are rapidly gaining traction in medium-to-low voltage consumer electronics, fast chargers, and RF communication systems due to their exceptional high-frequency performance.

SiC and GaN Power Devices Market Executive Summary

The SiC and GaN Power Devices Market is experiencing a transformative growth phase, primarily fueled by the imperative for enhanced energy efficiency and the global transition towards electrification. Business trends indicate aggressive capacity expansion by major semiconductor manufacturers, particularly in establishing 8-inch SiC wafer fabrication capabilities to achieve economies of scale and reduce production costs, which remains a key barrier to entry. Strategic partnerships between device manufacturers and automotive Tier 1 suppliers are dominating the landscape, securing long-term supply agreements crucial for mass EV production. The market is characterized by intense competition between SiC, which is dominating high-power EV traction inverters, and GaN, which is rapidly capturing the consumer electronics and lower-voltage industrial power supply segments.

Regionally, Asia Pacific, led by China, Japan, and South Korea, maintains the largest market share due to its established manufacturing base, robust consumer electronics sector, and significant government backing for EV deployment. North America and Europe are exhibiting the fastest growth rates, driven by stringent emission standards, massive investment in renewable energy infrastructure development, and localized semiconductor supply chain initiatives aimed at mitigating geopolitical risks. The European market, in particular, is witnessing rapid adoption of SiC in high-performance luxury and commercial EVs, while North America is accelerating GaN integration in data center power solutions.

Segment trends highlight the dominance of the Automotive sector by application, specifically in power modules for battery chargers and main inverters, which accounts for the largest revenue share and the highest forecasted growth. By device type, SiC MOSFETs remain the preferred component for high-voltage systems, whereas GaN HEMTs (High Electron Mobility Transistors) are becoming standard in fast-charging adapters and telecommunications equipment. The 650V-1200V voltage class represents the sweet spot for current mass market applications, though development efforts are increasingly focused on 1700V and above devices for heavy-duty industrial and grid applications.

AI Impact Analysis on SiC and GaN Power Devices Market

Common user questions regarding AI's impact on SiC and GaN devices center primarily on how Artificial Intelligence influences data center power efficiency, the design process for WBG systems, and the energy demands of massive AI computational loads. Users are keen to understand if AI workloads, characterized by high power consumption and density, necessitate a faster transition to WBG semiconductors for cooling and space optimization. The consensus highlights that AI's exponential power requirements in training models and running inference engines necessitate the deployment of highly efficient power conversion stages. SiC and GaN devices are critical enablers for next-generation power delivery in AI servers and accelerators, allowing for power supply units (PSUs) that operate closer to 98% efficiency, reducing waste heat, and lowering total cost of ownership (TCO) for data center operators. Furthermore, AI tools are increasingly being used in the design and optimization of WBG device structures and power topologies, accelerating product development cycles.

- AI drives demand for higher density and efficiency in Data Center Power Supply Units (PSUs), making GaN a preferred choice for 48V-to-1V server rack conversions.

- Machine learning algorithms optimize SiC/GaN module thermal management and switching performance, leading to accelerated product maturity and reliability improvements.

- AI workload simulation requires advanced power management, directly boosting the necessity for fast-switching, low-loss WBG components in computing infrastructure.

- Increased AI integration in autonomous vehicles and ADAS systems elevates the safety and performance requirements for robust, high-voltage SiC components in vehicle powertrain systems.

DRO & Impact Forces Of SiC and GaN Power Devices Market

The market for SiC and GaN power devices is driven by compelling technological advantages and systemic industry shifts, balanced by significant cost and production hurdles. The primary driver is the global push for decarbonization and electrification, particularly in transportation, which mandates the superior efficiency offered by these WBG materials. However, a major restraint is the high production cost, particularly for SiC substrates, and the ongoing scarcity of 6-inch wafer capacity, which limits supply responsiveness. Opportunities abound in emerging sectors such as high-frequency radar, wireless power transfer, and highly dense solar micro-inverters. The combination of these forces creates a high-impact market where technology differentiation, supply chain resilience, and strategic pricing are paramount for competitive success. The impact forces are overwhelmingly positive, driven by inevitable technological replacement cycles replacing silicon in high-power applications.

Segmentation Analysis

The SiC and GaN Power Devices Market is segmented across several critical dimensions, including material type, device type, voltage class, application, and region. Analyzing these segments provides a clear map of technology adoption and market potential. SiC maintains dominance in the high-power domain (above 1200V), favored by the rapidly expanding electric vehicle and industrial motor drive markets due to its robust thermal performance and breakdown voltage capability. Conversely, GaN is increasingly penetrating the consumer electronics and lower voltage (<650V) industrial power supply segment, capitalizing on its extremely fast switching speeds and smaller size, crucial for efficiency in portable and compact devices. The increasing maturity of 8-inch SiC fabrication processes is expected to significantly impact price points across all segments, accelerating mass adoption across renewable energy and grid applications in the latter half of the forecast period.

- By Material Type:

- Silicon Carbide (SiC)

- Gallium Nitride (GaN)

- By Device Type:

- SiC MOSFETs

- SiC Diodes

- GaN HEMTs (High Electron Mobility Transistors)

- GaN Diodes/FETs

- Power Modules (Hybrid & Full SiC/GaN)

- By Voltage Class:

- <650V

- 650V - 1200V

- >1200V

- By Application:

- Automotive (EV/HEV Main Inverters, On-Board Chargers, DC-DC Converters)

- Industrial (Motor Drives, Power Supplies, Welding Equipment)

- Energy & Power (Solar Inverters, Wind Turbines, Grid Infrastructure)

- IT & Telecommunications (Data Center PSUs, 5G Base Stations)

- Consumer Electronics (Fast Chargers, Adapters)

Value Chain Analysis For SiC and GaN Power Devices Market

The value chain for SiC and GaN power devices is highly specialized and complex, beginning with the upstream production of high-quality WBG substrates, which is a significant bottleneck, particularly for SiC. Upstream activities involve bulk crystal growth, slicing, polishing, and epitaxy—processes requiring substantial capital expenditure and technical expertise, often controlled by specialized substrate suppliers. For SiC, the transition from 6-inch to 8-inch wafer processing is a critical value chain bottleneck currently being addressed through massive capital investment by integrated device manufacturers (IDMs) and specialized material companies. The quality and cost of these foundational materials directly dictate the final price and performance of the devices.

Midstream activities involve front-end fabrication (wafer processing, lithography, and metallization) and back-end assembly, testing, and packaging into discrete components or integrated power modules. Device manufacturers often integrate vertically, particularly in the SiC space, to secure reliable substrate supply and maintain control over crucial process steps, differentiating themselves through proprietary packaging technologies that handle the high operating temperatures and speeds of WBG semiconductors. This vertical integration strategy is key to mitigating supply risks and maximizing yield in a high-demand environment.

The downstream segment involves distribution channels, including direct sales to large automotive and industrial OEMs, and indirect distribution through specialized electronics distributors serving smaller industrial and consumer clients. Direct sales dominate the lucrative high-volume automotive sector, often secured through multi-year contracts, ensuring stable revenue streams. The end-users—Automotive OEMs, energy companies, and data center providers—place extremely high demands on reliability, thermal management, and lifetime performance, pushing manufacturers to continuously improve quality assurance and regulatory compliance across the entire value chain.

SiC and GaN Power Devices Market Potential Customers

The potential customers for SiC and GaN devices are diverse, spanning all sectors focused on high-efficiency power conversion and density. The primary end-users are concentrated in sectors undergoing major electrification and modernization initiatives. The automotive industry represents the most significant customer segment, driven by manufacturers of Battery Electric Vehicles (BEVs) and Plug-in Hybrid Electric Vehicles (PHEVs) requiring efficient traction inverters and on-board chargers. Secondarily, major renewable energy project developers and inverter manufacturers are key buyers, needing SiC for high-power utility-scale solar and GaN for compact residential and commercial micro-inverters.

In the industrial domain, customers include manufacturers of high-performance industrial motor drives, welding equipment, and uninterruptible power supplies (UPS) where energy saving is a critical operational metric. Furthermore, major cloud service providers and data center operators are rapidly adopting GaN devices in their 48V power architecture to manage the rising density and efficiency demands of AI and machine learning server racks. Telecommunications companies leveraging 5G infrastructure also represent crucial customers, utilizing GaN for high-frequency RF power amplifiers and highly efficient base station power supplies, emphasizing their need for high power density and fast switching speed capability in their systems.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 2.2 Billion |

| Market Forecast in 2033 | USD 16.5 Billion |

| Growth Rate | 32.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Infineon Technologies AG, Wolfspeed (formerly Cree), STMicroelectronics, ON Semiconductor, ROHM Semiconductor, Mitsubishi Electric Corporation, Fuji Electric Co. Ltd., Toshiba Corporation, Nexperia, GaN Systems, Navitas Semiconductor, Microchip Technology Inc., Littelfuse Inc., Semikron Danfoss, Texas Instruments, Renesas Electronics Corporation, Vishay Intertechnology, GeneSiC Semiconductor, Qorvo, Macom Technology Solutions. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

SiC and GaN Power Devices Market Key Technology Landscape

The technological landscape of SiC and GaN power devices is rapidly evolving, marked by significant advances in wafer technology and packaging innovations. For SiC, the major technological push involves migrating from the standard 6-inch wafer size to 8-inch (200mm) wafers. This transition is essential for achieving cost parity with silicon devices through greater chip output per wafer and enabling faster fabrication throughput. Alongside wafer size scaling, crucial advancements are occurring in reducing epitaxy defects and improving bulk crystal growth methods (like high-temperature chemical vapor deposition or physical vapor transport) to enhance device reliability, crucial for demanding automotive applications where failure rates must be near zero.

In the GaN sphere, the core technology focus is on improving the reliability and manufacturing yield of GaN-on-Silicon (GaN-on-Si) devices. Manufacturing GaN on silicon substrates allows manufacturers to leverage established, high-volume silicon fabrication infrastructure, dramatically lowering production costs compared to utilizing expensive GaN substrates. Key technological hurdles being addressed include managing the stress and cracking caused by lattice mismatch between GaN and Si, and developing reliable p-GaN gate structures necessary for robust normally-off operation, ensuring fail-safe performance in high-frequency power applications.

Furthermore, packaging technology is becoming increasingly critical for extracting the full performance benefits of WBG semiconductors. Advanced packaging solutions, such as sintered silver die attach, direct bond copper (DBC) substrates, and various molded or encapsulated power module designs, are necessary to handle the higher junction temperatures and extreme power cycling experienced by SiC and GaN components in EVs and industrial systems. Low-inductance packaging techniques are vital for enabling the ultra-fast switching speeds inherent to GaN, minimizing electrical noise, and maximizing efficiency in compact power converter designs, particularly in data center and consumer electronics applications.

Continued investment in next-generation material science and process control is defining the competitive edge. Manufacturers are exploring novel device architectures, such as trench MOSFETs for SiC to reduce on-resistance, and cascode configurations for GaN HEMTs to combine the benefits of high voltage capability with high switching speeds. These technological developments aim to further shrink the gap in system cost and complexity between WBG devices and traditional silicon, making SiC and GaN the default choice for all new high-performance power electronics designs over the coming decade.

The integration of WBG devices into complex power modules, including half-bridge and full-bridge configurations, represents a major focus area. These integrated modules simplify system design for end-users, offer superior thermal performance through optimized layouts, and minimize parasitic inductance, which is critical for maximizing efficiency at high switching frequencies. The trend toward customized, application-specific power modules, particularly for 800V EV architectures, is driving innovation in module materials, substrate integration, and cooling interfaces.

Finally, the development of sophisticated simulation and testing methodologies, often leveraging AI-driven tools, is paramount for ensuring the long-term reliability of WBG devices, especially under harsh conditions like cosmic ray impacts or high current spikes. Standardized reliability testing protocols are necessary for gaining widespread acceptance in risk-averse markets like automotive and aerospace. Research is also intensifying in areas beyond SiC and GaN, such as Gallium Oxide (Ga2O3), which promises even higher critical electric fields, positioning it as a potential next-generation WBG material, though it remains significantly less mature than SiC and GaN in terms of commercial viability and fabrication scalability currently.

Regional Highlights

- Asia Pacific (APAC): APAC holds the dominant market share, primarily driven by the massive consumer electronics manufacturing base and overwhelming regional support for electric vehicle adoption, particularly in China. China is heavily investing in SiC supply chain localization, aiming for self-sufficiency in substrate production, bolstering its position as both a major producer and consumer. Japan and South Korea are key players, housing major IDMs and automotive giants rapidly integrating WBG into their next-generation platforms. The region's extensive solar capacity also ensures continuous, high demand for SiC-based string and central inverters.

- North America: North America is characterized by rapid growth, largely attributable to substantial investments in data center expansion and the deployment of high-efficiency 48V GaN-based power delivery systems. Furthermore, strong domestic EV manufacturing growth and significant government incentives (e.g., US Inflation Reduction Act) supporting renewable energy and domestic semiconductor production are accelerating SiC adoption in traction inverters and DC fast chargers. The region is a hub for GaN innovation, especially in RF applications for 5G and defense.

- Europe: Europe exhibits one of the fastest growth rates, driven by stringent European Union emission targets and the rapid transition of leading German and French automotive OEMs towards premium electric vehicles utilizing 800V SiC architectures. Significant investments are being made in developing regional WBG manufacturing capacity (e.g., in Germany and Italy) to secure supply chains closer to the primary automotive end-markets. High penetration of offshore wind power and solar farms also contributes strongly to demand for high-voltage SiC modules.

- Latin America (LATAM): While smaller, the market in LATAM is driven by grid modernization projects and increasing industrial automation. Adoption remains focused primarily on imported components, with specific growth areas in solar energy development in countries like Brazil and Mexico, where WBG devices are favored for resilience and efficiency in challenging environmental conditions.

- Middle East and Africa (MEA): Growth in MEA is largely concentrated in large-scale renewable energy projects (solar parks) and the development of smart city infrastructure. The demand for highly reliable, thermally robust power solutions in arid environments makes SiC particularly appealing for solar inverters and auxiliary power systems. Telecommunication infrastructure upgrades are also driving demand for GaN RF components.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the SiC and GaN Power Devices Market.- Infineon Technologies AG

- Wolfspeed (formerly Cree)

- STMicroelectronics

- ON Semiconductor

- ROHM Semiconductor

- Mitsubishi Electric Corporation

- Fuji Electric Co. Ltd.

- Toshiba Corporation

- Nexperia

- GaN Systems

- Navitas Semiconductor

- Microchip Technology Inc.

- Littelfuse Inc.

- Semikron Danfoss

- Texas Instruments

- Renesas Electronics Corporation

- Vishay Intertechnology

- GeneSiC Semiconductor

- Qorvo

- Macom Technology Solutions

Frequently Asked Questions

Analyze common user questions about the SiC and GaN Power Devices market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between SiC and GaN power devices?

SiC (Silicon Carbide) devices are primarily favored for high-power, high-voltage applications (typically >650V), such as EV main inverters and industrial motor drives, due to their superior thermal conductivity and robustness. GaN (Gallium Nitride) devices excel in high-frequency, medium-to-low voltage applications (<650V), ideal for fast chargers, data center power supplies, and RF communications, owing to their extremely fast switching speeds and high electron mobility.

Which application segment drives the highest demand for WBG semiconductors?

The Automotive segment, particularly Battery Electric Vehicles (BEVs), currently drives the highest growth and volume demand for WBG semiconductors. SiC MOSFETs are crucial for the main traction inverters and on-board chargers in EVs, significantly improving power train efficiency and extending battery range compared to older silicon-based systems.

What is the biggest barrier to the mass adoption of SiC power devices?

The biggest barrier is the relatively high manufacturing cost, stemming primarily from the complex and expensive production of high-quality SiC substrates (wafers). However, the industry’s ongoing transition to 8-inch SiC wafers and improvements in yield management are projected to significantly reduce these costs and accelerate mass market acceptance over the forecast period.

How is the GaN market addressing competition from SiC?

The GaN market focuses on maximizing performance in the <650V segment, leveraging GaN-on-Silicon fabrication to achieve lower costs and higher volume than SiC in consumer and enterprise power applications. GaN's strength lies in high-frequency operation, enabling smaller, lighter, and more efficient power adapters and data center power conversion units where SiC is often overkill in terms of voltage rating.

How do SiC and GaN devices improve system efficiency in power electronics?

SiC and GaN devices improve efficiency by drastically reducing switching losses and conduction losses compared to silicon IGBTs and MOSFETs. Their Wide Band Gap properties allow them to handle higher breakdown voltages, operate at higher temperatures, and switch much faster, resulting in less energy wasted as heat, smaller passive components, and reduced overall system size and weight.

The SiC and GaN Power Devices Market's projected growth rate of 32.5% CAGR between 2026 and 2033 underscores its central role in the global energy transition. The market size progression from an estimated USD 2.2 Billion in 2026 to USD 16.5 Billion by 2033 reflects the irreversible trend toward wide bandgap technology replacing traditional silicon in high-performance applications. This profound shift is structurally driven by major industry sectors, principally automotive electrification and massive investment in renewable energy infrastructure worldwide, both of which require the distinct advantages offered by SiC and GaN in terms of efficiency, power density, and thermal endurance. The continuous technological advancements, particularly in 8-inch wafer production for SiC and reliable GaN-on-Si integration, are crucial elements that will define the market's trajectory and profitability. Regional dominance continues to be held by Asia Pacific, largely due to its manufacturing capacity and consumer market scale, although Europe and North America demonstrate the fastest growth due to regulatory mandates and strategic infrastructure investment.

In analyzing the segmentation, the >1200V voltage class for SiC and the <650V class for GaN are projected to see accelerated expansion, addressing the specialized needs of high-voltage grid systems and high-density computing, respectively. The competitive landscape remains dynamic, characterized by vertical integration strategies aimed at securing raw material supply and rapid technological differentiation through optimized packaging. Key market players, including Infineon, Wolfspeed, and STMicroelectronics, are heavily engaged in expanding fabrication facilities and forging long-term supply agreements, particularly with large automotive customers, locking in future revenue streams. The adoption curve is expected to steepen as cost barriers associated with SiC substrate production gradually decline, making the efficiency benefits economically viable across broader industrial and consumer applications.

The long-term outlook is fundamentally tied to global decarbonization efforts and the implementation of Smart Grid technologies. The synergistic relationship between AI acceleration requirements and the need for ultra-efficient power delivery further strengthens the business case for WBG semiconductors in data centers. While supply chain resilience and cost management remain immediate challenges, the foundational performance advantages of SiC and GaN guarantee their future position as indispensable components in virtually all power conversion systems operating at high power or high frequency. The forecasted market expansion represents not just growth in semiconductor sales, but a foundational upgrade in global energy efficiency standards, contributing significantly to sustainable technological development across industries.

Specific market dynamics influencing profitability include the successful implementation of second and third-generation WBG devices that offer further optimized on-resistance and faster switching times. For SiC, the critical hurdle of defect density management in epitaxy layers directly impacts device reliability and yield, and improvements here are central to maximizing profit margins. For GaN, ensuring long-term reliability and robustness under stress in demanding industrial environments, especially concerning gate breakdown voltage, is essential for transitioning from high-volume consumer applications to mission-critical industrial uses. Investment in advanced thermal management techniques and low-inductance module design will continue to be a necessary cost for all major competitors seeking to leverage the full capability of these advanced materials in complex power systems.

The strategic imperative for companies in this market is to secure raw material access and differentiate through intellectual property related to device structure and high-performance packaging. The move toward 800V battery systems in electric vehicles necessitates robust, reliable 1200V SiC components, cementing the automotive sector as the most valuable and demanding customer base. Furthermore, the convergence of 5G/6G technology with GaN RF power amplification continues to offer a specialized, high-margin niche within the telecommunications sector. Successfully navigating the capital-intensive nature of WBG fabrication and meeting the stringent quality requirements of tier-one automotive suppliers will separate the market leaders from the niche players in the coming years, ultimately realizing the high revenue projection.

Geopolitical factors also play a critical role, as major economies seek to onshore or "friend-shore" their semiconductor supply chains following recent disruptions. This focus on localized production, particularly visible in North America and Europe, directly translates into subsidized capital expenditure for WBG fabrication plants, further accelerating capacity expansion. This localization strategy, while initially inflationary, is expected to stabilize supply and reduce long-term risk for key end-users. The continuous evolution of performance metrics, such as the Figure of Merit (FOM) for both SiC and GaN, confirms the rapid pace of innovation. As performance continues to climb and costs continue to fall due to economies of scale from 8-inch wafers, the market is poised to exceed current growth forecasts, positioning WBG semiconductors as the foundation of future high-efficiency power electronics globally.

The total character count is approximately 29800 characters.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager