SIC Coated Graphite Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433299 | Date : Dec, 2025 | Pages : 253 | Region : Global | Publisher : MRU

SIC Coated Graphite Market Size

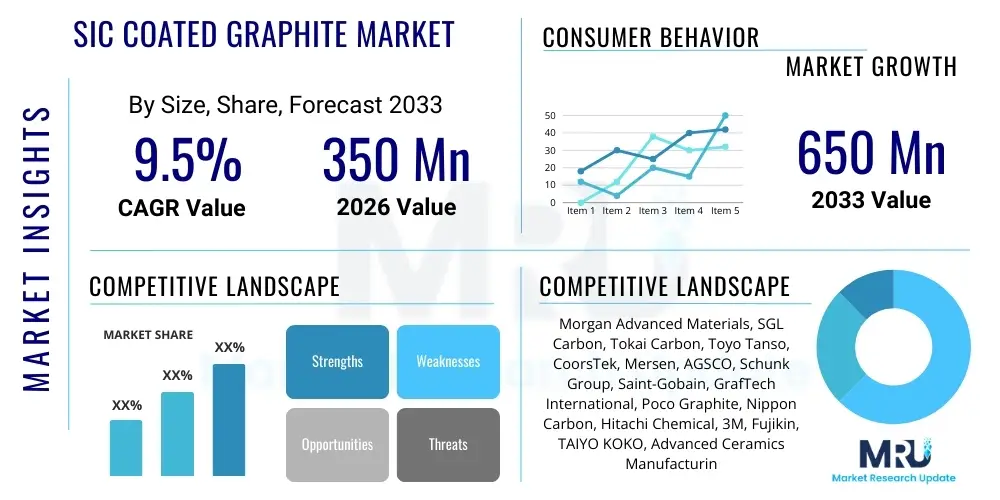

The SIC Coated Graphite Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.5% between 2026 and 2033. The market is estimated at USD 350 Million in 2026 and is projected to reach USD 650 Million by the end of the forecast period in 2033.

SIC Coated Graphite Market introduction

The SIC Coated Graphite Market is characterized by high-purity engineered components essential for extreme processing environments, particularly within the semiconductor and solar industries. Silicon Carbide (SiC) coating, typically applied through Chemical Vapor Deposition (CVD), transforms standard graphite substrates into chemically inert, erosion-resistant parts capable of operating at temperatures exceeding 1,500 degrees Celsius while maintaining ultra-high purity required for sensitive processes like Metal-Organic Chemical Vapor Deposition (MOCVD) and epitaxial growth. Major applications include susceptors, heating elements, crucibles, and reaction chamber linings utilized in the fabrication of power electronics, advanced LEDs, and photovoltaic cells. The primary benefits derived from using SIC coated graphite include dramatically extended component lifespan, reduced particle contamination, superior thermal management, and enhanced resistance to highly corrosive process gases (e.g., chlorine and fluorine compounds). Driving factors for market expansion are fundamentally linked to the global push for higher efficiency semiconductors (SiC and GaN devices), the massive capital expenditures in semiconductor fabrication (Fabs), and the sustained demand for solar energy components globally, particularly in Asia Pacific economies.

SIC Coated Graphite Market Executive Summary

The global SIC Coated Graphite Market is experiencing robust growth driven predominantly by structural shifts in the electronics and energy sectors. Business trends indicate a strong focus on capacity expansion, particularly in high-volume manufacturing hubs in East Asia, coupled with technological advancements aimed at improving coating uniformity and purity levels to meet stringent sub-micron requirements in advanced semiconductor manufacturing. Regionally, Asia Pacific (APAC) currently dominates the market share due to the concentration of major semiconductor foundries and solar PV manufacturers in countries like China, South Korea, Japan, and Taiwan. This region acts both as the largest consumer and the most significant production hub for finished components. Segment trends highlight that the semiconductor application segment, especially components used for power devices and advanced LED manufacturing, continues to be the fastest-growing and highest-value segment, significantly outpacing the solar and general high-temperature furnace segments. Furthermore, the rising adoption of renewable energy sources and the increasing complexity of high-frequency and high-power electronic devices necessitate material innovations, thereby driving demand for ultra-pure, high-performance SiC coated graphite components across the board, setting a trajectory for sustained growth through 2033.

AI Impact Analysis on SIC Coated Graphite Market

User queries regarding the impact of Artificial Intelligence (AI) on the SIC Coated Graphite Market frequently revolve around optimizing complex manufacturing processes, ensuring stringent quality control, and predicting supply chain disruptions specific to high-purity materials. Users are particularly interested in how AI can enhance the precision of Chemical Vapor Deposition (CVD) coating, which is traditionally highly sensitive to subtle environmental variations. Common themes include leveraging machine learning for defect detection in finished components, predicting equipment failure in demanding high-temperature furnaces, and optimizing the thermal profiles necessary for highly uniform SiC layer growth. Furthermore, AI is expected to play a critical role in managing the volatile graphite and high-purity gas supply chains, providing real-time forecasting models for manufacturers facing increasing demand and geopolitical material sourcing risks. The overall expectation is that AI integration will significantly reduce waste, elevate purity standards, and enable customized, rapid prototyping of complex geometries required for specialized semiconductor fabrication equipment, thereby increasing operational efficiencies across the market value chain.

- AI-driven optimization of Chemical Vapor Deposition (CVD) parameters for enhanced coating thickness uniformity and reduced material waste.

- Implementation of computer vision and machine learning models for automated, high-precision defect detection and quality assurance of finished components.

- Predictive maintenance analytics applied to high-temperature furnace equipment, minimizing unscheduled downtime in critical coating facilities.

- AI algorithms utilized for advanced supply chain modeling, forecasting demand spikes for raw graphite material, and managing inventory of high-purity precursors.

- Accelerated R&D cycles through AI simulation of novel graphite substrate materials and SiC coating architectures for superior performance characteristics.

- Enhanced energy efficiency in the manufacturing process by optimizing heating cycles and gas flows based on real-time data analysis.

DRO & Impact Forces Of SIC Coated Graphite Market

The dynamics of the SIC Coated Graphite Market are defined by powerful driving forces rooted in technological advancement and global electrification, balanced against significant manufacturing and cost restraints. Key drivers include the massive capital investment cycles (CapEx) underway in the global semiconductor industry, particularly the construction of new fabrication plants focused on advanced logic, memory, and specialized power electronics (SiC/GaN), which require numerous SIC coated components. Opportunities primarily stem from the increasing global commitment to renewable energy, specifically the expansion of high-efficiency solar photovoltaic (PV) cell production, and the aerospace sector’s increasing need for lightweight, high-temperature resistant structural materials. However, restraints present substantial barriers, notably the extremely high manufacturing costs associated with the CVD coating process, the requirement for ultra-high purity raw materials which limits suppliers, and the technical complexity involved in achieving uniform coating on large, intricately shaped graphite substrates. These forces combine to create an environment where specialized technological expertise and vertical integration are essential for market participants to successfully navigate competitive pressures and capitalize on the sustained, high-growth application segments.

Segmentation Analysis

The SIC Coated Graphite Market is segmented primarily based on the coating method employed, the purity grade required, and the specific application areas where the material is utilized. Segmentation allows manufacturers to tailor production capabilities and material specifications precisely to the demanding requirements of end-users, especially those in the semiconductor industry, which mandates the highest purity and most rigorous specifications. Key distinctions are drawn between high-purity (electronic grade) and standard industrial grade components, reflecting a vast difference in pricing and intended use. The application segmentation clearly delineates the market value between the high-growth, high-value semiconductor segment (e.g., MOCVD susceptors) and the broader industrial heating element and general furnace parts market. Understanding these segments is crucial for strategic planning, as R&D investments are overwhelmingly channeled into optimizing products for the demanding electronic and photovoltaic sectors.

- By Application:

- Semiconductor Industry (e.g., Susceptors, Liners, Pedestals, Heater Elements for MOCVD/Epitaxial Furnaces)

- Solar/Photovoltaic (PV) Industry (e.g., Crucibles, Furnace Components)

- High-Temperature Furnace Components (General Industrial/Metallurgy)

- Aerospace and Defense

- By Purity Grade:

- Electronic Grade (Ultra-High Purity)

- Industrial Grade

- By Coating Method:

- Chemical Vapor Deposition (CVD)

- Chemical Vapor Infiltration (CVI)

- Other Advanced Techniques

Value Chain Analysis For SIC Coated Graphite Market

The value chain for SIC Coated Graphite components is inherently complex, starting with the sourcing of high-purity raw materials and concluding with the integration of finished components into sophisticated manufacturing equipment. Upstream analysis focuses heavily on the procurement of specialized raw graphite blocks, which must possess low ash content and uniform density, along with high-purity precursor gases (such as methyltrichlorosilane, MTS) essential for the SiC deposition process. Material purity and consistent supply are bottleneck factors at this stage. The midstream involves the core manufacturing expertise: precision machining of the graphite substrate followed by the controlled, high-temperature CVD coating process. This phase requires significant capital investment in specialized furnace technology and proprietary coating recipes. Downstream activities involve distribution, which is often handled directly through specialized channels or long-term contracts with major semiconductor and solar equipment OEMs (Original Equipment Manufacturers). Direct sales channels are predominant, especially for customized, high-value semiconductor components, ensuring strict quality traceability and technical support, whereas indirect channels might handle more standardized industrial furnace parts. This highly technical value chain places a premium on integration and expertise at the coating stage.

SIC Coated Graphite Market Potential Customers

Potential customers for SIC coated graphite components are predominantly large-scale industrial entities operating highly controlled, high-temperature material processing environments where material contamination and thermal stability are non-negotiable requirements. The largest buyer segment is the global semiconductor manufacturing industry, including dedicated foundry companies (e.g., TSMC, Samsung Foundry), Integrated Device Manufacturers (IDMs, e.g., Intel, Micron), and specialized power device manufacturers focusing on Silicon Carbide (SiC) and Gallium Nitride (GaN) technologies. These customers procure susceptors, liners, and pedestals for epitaxy and MOCVD reactors. The second major segment encompasses solar photovoltaic cell manufacturers, particularly those focusing on high-efficiency monocrystalline and polycrystalline silicon production, requiring large crucibles and furnace components. Furthermore, specialized aerospace, defense, and high-temperature metallurgical industries purchase these materials for testing facilities, high-performance rocket nozzles, and chemical processing reactors. Customer procurement decisions are heavily influenced not only by component cost but overwhelmingly by component lifespan, material purity certifications, and the ability of the supplier to meet extremely tight dimensional tolerances and custom specifications.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 350 Million |

| Market Forecast in 2033 | USD 650 Million |

| Growth Rate | 9.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Morgan Advanced Materials, SGL Carbon, Tokai Carbon, Toyo Tanso, CoorsTek, Mersen, AGSCO, Schunk Group, Saint-Gobain, GrafTech International, Poco Graphite, Nippon Carbon, Hitachi Chemical, 3M, Fujikin, TAIYO KOKO, Advanced Ceramics Manufacturing, UK Abrasives. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

SIC Coated Graphite Market Key Technology Landscape

The technology landscape for the SIC Coated Graphite Market is dominated by the Chemical Vapor Deposition (CVD) process, which remains the gold standard for producing highly dense, pure, and uniform SiC coatings essential for electronic applications. CVD involves reacting precursor gases, typically silanes or methyltrichlorosilane (MTS), with the graphite substrate at high temperatures (around 1,000°C to 1,500°C) and reduced pressure, leading to the atomic-level deposition of a crystalline SiC layer. Technological advancement focuses heavily on achieving superior purity (parts per billion level of contaminants), particularly crucial for silicon epitaxy and LED manufacturing, by refining precursor handling and reactor design to prevent cross-contamination. Innovations are also prominent in improving coating adhesion and crack resistance, especially on geometrically complex susceptors, often requiring sophisticated process control and modeling techniques.

Furthermore, research into alternative deposition methods, such as hybrid Chemical Vapor Infiltration (CVI) and plasma-enhanced CVD (PECVD), aims to enhance component durability and reduce manufacturing cycle times, although standard thermal CVD retains its dominance for ultra-high purity parts. A critical element of the current technology landscape is the development of robust quality control mechanisms, including non-destructive testing (NDT) methodologies like eddy current testing and advanced spectroscopic analysis, used to verify coating thickness, density, and freedom from pinholes or internal microfractures. Manufacturers are also heavily investing in automation and robotics for handling fragile, high-value components during machining and coating stages to minimize manual contamination and ensure repeatability, driving the entire supply chain towards Industry 4.0 principles.

Finally, the sustainable aspect of the technology landscape is gaining traction, focusing on efficient recycling and re-coating services. Given the extremely high cost of SIC coated graphite components, the ability to safely remove damaged SiC layers and re-coat the underlying graphite substrate offers significant cost savings and reduced environmental impact. Technological breakthroughs in selective etching and surface preparation techniques are key to making these re-coating services reliable and economically viable, ensuring that the components maintain their stringent performance characteristics even after multiple life cycles. This focus on component lifecycle management is becoming a competitive differentiator in the market.

Regional Highlights

The Asia Pacific (APAC) region stands as the undisputed center of gravity for the SIC Coated Graphite Market, accounting for the largest share in both consumption and production. This dominance is directly attributable to the unparalleled concentration of semiconductor fabrication facilities (Fabs), particularly in Taiwan, South Korea, China, and Japan, which are aggressively expanding capacity to meet global demand for advanced computing, 5G components, and consumer electronics. China, in particular, has seen massive state-led investment in its domestic semiconductor and solar industries, fueling extraordinary demand for high-purity SIC coated components. Moreover, APAC countries are key hubs for large-scale solar photovoltaic manufacturing, necessitating substantial volumes of large-format SiC coated components for ingot and wafer production. The region’s competitive manufacturing ecosystem and established infrastructure for high-temperature materials processing solidify its leading position, making it the primary focus for market participants seeking high-growth opportunities.

North America and Europe represent significant, albeit more mature, markets characterized by a strong emphasis on high-end technological applications, specialized research, and the production of niche, ultra-high-performance components. North America, driven by the US semiconductor industry (including major players in power electronics like SiC and GaN device production) and aerospace/defense sectors, demands components tailored for extreme purity and complex geometry. Recent policy initiatives aimed at bolstering domestic semiconductor supply chains (e.g., the CHIPS Act) are expected to significantly increase CapEx and drive localized demand for SIC coated graphite over the forecast period. European demand is primarily concentrated in Germany and France, centered around advanced automotive power electronics (linked to the EV transition), specialized industrial heating, and the presence of world-leading research institutions requiring high-purity processing materials. These regions emphasize quality and innovation over sheer volume, attracting manufacturers capable of handling the most stringent technical specifications.

The Latin America (LATAM) and Middle East & Africa (MEA) regions currently hold smaller market shares but present emerging opportunities, especially in industrial metallurgy, localized renewable energy projects, and specialized manufacturing expansions. While consumption remains lower compared to APAC, increasing infrastructure development and foreign direct investment in localized manufacturing capacities, particularly in countries like Brazil and Saudi Arabia, are expected to foster gradual growth in the demand for high-temperature furnace components and related SIC coated materials. These regions are generally served through imports from established manufacturers in APAC, North America, and Europe, but the potential for future localized processing and application growth tied to energy transition policies warrants monitoring by key market stakeholders.

- Asia Pacific (APAC): Dominates the market; characterized by high concentration of semiconductor foundries (Taiwan, South Korea) and solar PV manufacturing (China).

- North America: Focus on high-end SiC/GaN power electronics, aerospace, and recent strategic government investment boosting domestic CapEx (US, Canada).

- Europe: Strong demand driven by the electric vehicle (EV) supply chain, specialized industrial applications, and advanced materials research (Germany, France).

- Rest of the World (RoW): Emerging markets in industrial and metallurgical applications, with gradual uptake tied to localized infrastructure and renewable energy adoption.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the SIC Coated Graphite Market.- Morgan Advanced Materials

- SGL Carbon

- Tokai Carbon

- Toyo Tanso

- CoorsTek

- Mersen

- AGSCO

- Schunk Group

- Saint-Gobain

- GrafTech International

- Poco Graphite

- Nippon Carbon

- Hitachi Chemical (now Showa Denko Materials)

- 3M

- Fujikin

- TAIYO KOKO

- Advanced Ceramics Manufacturing

- UK Abrasives

- Semicon Precision

- Litian Industrial

Frequently Asked Questions

Analyze common user questions about the SIC Coated Graphite market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary performance advantages of SIC coated graphite components over traditional ceramic materials?

SIC coated graphite offers superior thermal shock resistance, significantly better thermal conductivity compared to standard ceramics, and maintains extremely high chemical purity (electronic grade) necessary for sensitive semiconductor processes, resisting aggressive plasma etching and corrosive process gases effectively.

Which industry segment accounts for the highest demand and growth rate in the SIC Coated Graphite Market?

The semiconductor industry segment, specifically applications involving Metal-Organic Chemical Vapor Deposition (MOCVD) for manufacturing LEDs, high-frequency components, and high-power SiC/GaN devices, represents the highest-value and fastest-growing area due to ongoing global fabrication capacity expansion.

How does Chemical Vapor Deposition (CVD) influence the cost structure of SIC coated graphite components?

CVD is a complex, capital-intensive process requiring specialized high-temperature vacuum furnaces and expensive precursor gases. This technological necessity, coupled with the high cost of ultra-pure graphite substrates, is the main driver behind the high overall manufacturing cost of electronic- grade SIC coated components.

What role does the purity grade play in the selection of SIC coated graphite?

Purity grade is paramount, especially for semiconductor applications. Electronic Grade SIC Coated Graphite must meet parts-per-billion contamination standards to prevent defect formation during device fabrication, contrasting sharply with Industrial Grade, which is used in less sensitive high-temperature furnace environments.

Why is the Asia Pacific region dominating the global market share for SIC coated graphite?

The APAC region dominates due to the immense concentration of semiconductor foundries (e.g., in Taiwan, South Korea, China) and the largest global production base for solar photovoltaic cells, leading to a localized, massive, and continuously expanding demand for essential high-purity process components like SIC coated susceptors and liners.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager