SiC Coating Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432551 | Date : Dec, 2025 | Pages : 257 | Region : Global | Publisher : MRU

SiC Coating Market Size

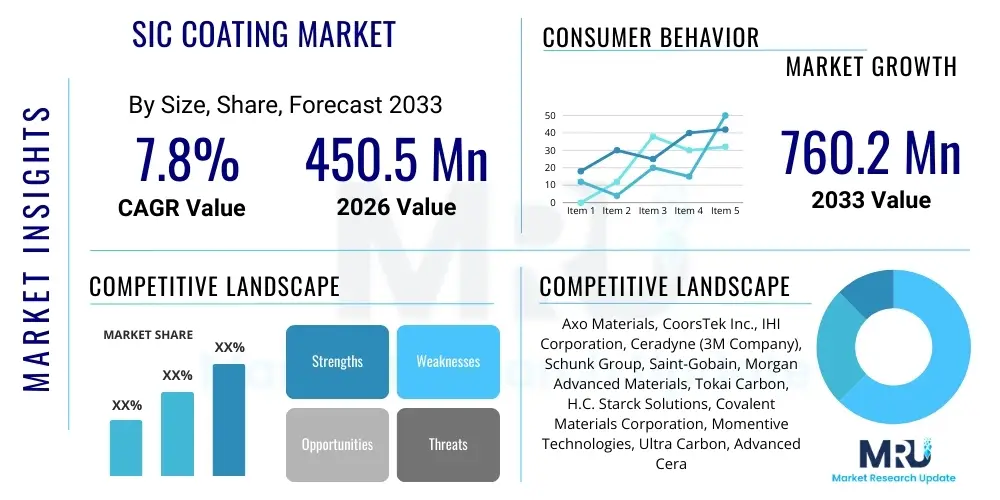

The SiC Coating Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at USD 450.5 Million in 2026 and is projected to reach USD 760.2 Million by the end of the forecast period in 2033. This growth trajectory is fundamentally driven by the escalating demand for high-performance materials capable of withstanding extreme operating conditions, particularly within the semiconductor manufacturing, aerospace, and nuclear energy sectors. The inherent superior properties of Silicon Carbide (SiC) coatings, such as exceptional thermal stability, chemical inertness, and resistance to erosion, make them indispensable for critical component protection.

The market expansion is particularly visible in applications requiring prolonged operation in corrosive or high-temperature environments, where traditional metallic or polymeric coatings fail rapidly. Key growth accelerators include the technological shift towards advanced plasma etching processes in the semiconductor industry, which necessitates ultra-high purity and durable components, mostly protected by Chemical Vapor Deposition (CVD) SiC coatings. Furthermore, global investment in advanced nuclear reactor designs and fusion energy research continues to bolster demand for SiC-coated materials, which are crucial for enhancing fuel cladding integrity and structural components within these challenging environments.

SiC Coating Market introduction

Silicon Carbide (SiC) coatings are specialized ceramic layers applied to substrates, primarily to enhance surface properties such as hardness, corrosion resistance, erosion resistance, and high-temperature stability. These coatings are crucial for components operating in harsh environments, offering protection against thermal shock and chemical attack. The primary methods for applying these coatings include Chemical Vapor Deposition (CVD), which is favored for its ability to produce highly conformal and dense coatings, and Physical Vapor Deposition (PVD), utilized for specific film requirements. The resulting protective layer exhibits a high melting point, high strength at elevated temperatures, and excellent resistance to radiation damage, making it a critical material in advanced engineering.

The major applications driving the SiC coating market include the protection of susceptors, liners, and electrodes in semiconductor processing equipment, particularly during demanding plasma etching and deposition steps where ultra-high purity is paramount to prevent wafer contamination. In the aerospace sector, SiC coatings are vital for Ceramic Matrix Composites (CMCs) utilized in jet engine hot sections, extending component life and enabling higher operating temperatures for improved fuel efficiency. Additionally, the nuclear industry relies on SiC coatings for triso fuel particles and cladding materials in advanced reactors, providing a robust barrier against fission product release and enhancing safety margins.

The core benefits of adopting SiC coatings—which include superior thermal management, reduced wear and friction, and enhanced longevity—directly address the stringent material requirements of next-generation technologies. Driving factors encompass the rapid expansion of the semiconductor industry, the continuous push for lighter and more efficient aircraft engines, increasing defense spending globally focusing on hypersonics, and heightened regulatory standards mandating superior safety and performance in the energy sector, particularly nuclear power generation. These combined technical and commercial pressures underscore the essential role of SiC coatings in supporting modern industrial advancement and extreme-environment engineering.

SiC Coating Market Executive Summary

The SiC Coating Market is experiencing robust growth fueled by technological advancements in coating application methods and soaring demand from critical end-use sectors like semiconductor fabrication and aerospace. Business trends indicate a continued preference for high-purity Chemical Vapor Deposition (CVD) techniques, especially for semiconductor applications where purity levels are non-negotiable, leading to significant investment in specialized CVD facilities globally. Furthermore, strategic partnerships between coating manufacturers and Original Equipment Manufacturers (OEMs) in aerospace and defense are becoming common, focused on co-developing tailored SiC-coated Ceramic Matrix Composites (CMCs) designed for extreme thermal loads and mechanical stresses, particularly in turbine engines and missile components. The market structure remains highly competitive, with differentiation based heavily on deposition process precision, scalability, and ability to coat complex geometries.

Regional trends highlight the Asia Pacific (APAC) region as the primary growth engine, predominantly driven by massive capacity expansion in the semiconductor industry, notably in China, South Korea, and Taiwan. APAC's dominance is further solidified by its robust electronics manufacturing base and growing presence in advanced materials R&D. North America remains a crucial market, leading in high-value applications such specifically in defense, specialized aerospace materials, and nuclear R&D, often involving government funding and stringent quality standards. Europe demonstrates steady growth, supported by strong industrial machinery manufacturing and a focus on renewable and advanced nuclear energy technologies, utilizing SiC coatings for various specialized industrial processes and power generation systems.

Segment trends underscore the dominance of the CVD method due to its unparalleled conformal coating capabilities essential for internal component structures, especially in complex semiconductor chambers. Application-wise, the semiconductor segment holds the largest market share, directly correlated with the global demand for advanced computing chips and the subsequent need for extremely durable, contamination-free processing environments. The aerospace segment is projected to show the highest growth rate, primarily due to the ongoing adoption of CMC components in new aircraft programs, where SiC coatings are mandatory environmental barrier layers. This segmentation pattern confirms that market evolution is intrinsically linked to material performance requirements scaling with industry demands for higher efficiency and reliability.

AI Impact Analysis on SiC Coating Market

Common user inquiries regarding AI's influence on the SiC Coating Market often revolve around optimizing synthesis parameters, predicting material performance, and accelerating R&D cycles. Users are keen to know if AI can lower the high production costs associated with CVD and PVD processes, maintain or improve the ultra-high purity standards required by the semiconductor industry, and expedite the discovery of novel coating formulations or composite structures. The overarching themes reflect a strong expectation that Artificial Intelligence and Machine Learning (ML) will serve as crucial tools for predictive quality control, optimizing complex deposition kinetics—which involve numerous variables such as temperature, precursor flow rate, and pressure—and enhancing throughput without sacrificing the structural integrity or compositional purity of the resulting coating. AI is anticipated to drastically reduce empirical testing time, providing faster routes to certification for new materials in regulated sectors like aerospace and nuclear energy, thereby streamlining the entire manufacturing and deployment lifecycle of SiC-coated components.

- AI-driven optimization of Chemical Vapor Deposition (CVD) parameters to achieve superior density, uniformity, and reduced deposition time.

- Predictive modeling of SiC coating lifetime and failure mechanisms under extreme thermal cycling and corrosive environments, improving material selection.

- Machine Learning algorithms assisting in high-throughput screening of raw material precursors and identifying optimal stoichiometric ratios for high-purity coatings.

- Enhanced quality control through automated image analysis and defect detection systems during the manufacturing process, ensuring AEO standards for critical components.

- Simulation tools powered by AI accelerating the design and validation of complex SiC structures, crucial for aerospace and nuclear applications.

- Optimization of energy consumption during high-temperature coating processes, contributing to lower operational costs and improved sustainability.

DRO & Impact Forces Of SiC Coating Market

The SiC Coating Market is dynamically shaped by a critical balance of Drivers, Restraints, Opportunities, and inherent Impact Forces. A primary driver is the accelerating advancement in the semiconductor sector, where the move toward smaller feature sizes and more aggressive plasma processes demands components with unmatched resistance to etching and contamination, strongly favoring ultra-high purity SiC coatings. Concurrently, the global push towards superior energy efficiency and performance in aerospace and defense applications drives the adoption of SiC-based Ceramic Matrix Composites (CMCs), requiring protective SiC environmental barrier coatings (EBCs) to withstand combustion temperatures exceeding 1300 degrees Celsius, dramatically expanding the market scope. These strong drivers establish a foundation of sustained, high-value demand across multiple critical technology domains.

However, the market faces significant restraints, chiefly the extremely high capital investment required for establishing and maintaining specialized coating facilities, particularly those employing CVD techniques which demand precision control over temperature and gas flow dynamics. This high barrier to entry limits competition and often results in extended qualification and certification periods, especially for components used in nuclear or aerospace safety-critical systems. Another significant restraint is the inherent complexity and cost associated with coating non-planar or highly intricate component geometries, often leading to yield issues or requiring iterative process optimization which increases overall manufacturing expense and slows widespread industrial adoption beyond niche high-value parts.

Opportunities for future market expansion are substantial, particularly in emerging fields such as Electric Vehicle (EV) battery technology, where SiC coatings are being researched to enhance thermal management and safety properties of battery components, and in advanced energy systems, including materials for commercial nuclear fusion reactors which require exceptional radiation and thermal stability. Impact forces, such as global supply chain disruptions affecting precursor chemicals (silicon and carbon sources) and increasing geopolitical focus on sovereign manufacturing capacity for strategic materials, heavily influence pricing stability and production localization strategies within the market. Technological innovation, particularly advancements in Plasma Enhanced CVD (PECVD) and development of novel high-temperature precursors, acts as a continuous positive impact force, driving down operational costs and improving coating quality and throughput for next-generation applications.

Segmentation Analysis

The SiC Coating Market is comprehensively segmented primarily by application method, end-use industry, and geography, reflecting the highly specialized nature of the product. The method of deposition—dominated by Chemical Vapor Deposition (CVD) due to its purity and conformality, followed by Physical Vapor Deposition (PVD) and other techniques like thermal spray—determines the applicability to specific component requirements and material substrates. The end-use segmentation clearly delineates demand drivers, with the semiconductor segment commanding the largest current share, while the aerospace segment is poised for the fastest compound annual growth rate due to ongoing defense modernization and commercial aircraft engine upgrades. Analyzing these segments provides a clear framework for understanding varied market dynamics, pricing structures, and regulatory requirements across different sectors, emphasizing that coating solutions are often highly customized to meet stringent application-specific performance criteria.

- By Deposition Method:

- Chemical Vapor Deposition (CVD)

- Physical Vapor Deposition (PVD)

- Thermal Spray/Slurry Coating

- Others (e.g., Plasma Enhanced CVD - PECVD)

- By End-Use Industry:

- Semiconductor

- Aerospace and Defense

- Nuclear Energy

- Automotive (EV components)

- Medical and Industrial Machinery

- By Geography:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America

- Middle East and Africa (MEA)

Value Chain Analysis For SiC Coating Market

The value chain for the SiC Coating Market begins with the upstream segment, which involves the sourcing and purification of critical raw materials, primarily high-purity silicon precursors (like silane, methyltrichlorosilane) and carbon sources (like hydrocarbons or acetylene). The quality and consistency of these precursors are paramount, especially for applications in the semiconductor industry where trace impurities can lead to component failure or wafer contamination, making vendor qualification a rigorous and necessary process. These materials are then supplied to coating manufacturers who form the core of the midstream value chain, specializing in the highly controlled, capital-intensive deposition processes, notably CVD, PVD, and specialized reactor operations. Integration backward into precursor synthesis is a potential strategy for ensuring supply stability and quality control among major market players.

The midstream process involves the specialized engineering required to design and execute coating processes for complex geometries under extremely controlled environments (vacuum chambers, high-temperature reactors). This stage includes process optimization, quality assurance, and often relies heavily on proprietary technology and intellectual property regarding adherence layers and process parameters necessary to achieve the desired structural integrity and performance characteristics of the SiC film. The distribution channel is predominantly direct, especially for high-value contracts in aerospace and nuclear energy, where close collaboration between the coating manufacturer and the end-use component OEM is necessary for customized specifications, testing, and regulatory adherence. For more commoditized industrial applications or standard components, indirect distribution through specialized industrial suppliers may occur, but custom solutions drive the vast majority of the market value.

The downstream segment encompasses the integration of the coated component into the final application—whether it be installation into a semiconductor plasma etching chamber, assembly into a jet engine turbine hot section, or utilization in nuclear fuel cladding. End-users often require extensive post-coating services, including advanced inspection, certification documentation, and material traceability, which further necessitates a direct relationship with the coating supplier. The dominance of direct distribution channels reflects the need for high technical support and the critical nature of these components. The performance feedback loop from the downstream users back to the midstream manufacturers is vital for continuous process improvement and innovation, ensuring that coating solutions evolve rapidly to meet increasing demands for temperature tolerance, erosion resistance, and extended service life.

SiC Coating Market Potential Customers

The primary consumers of SiC coatings are organizations operating equipment in environments characterized by extreme temperatures, highly corrosive chemicals, or intense radiation, requiring materials with superior stability and longevity. The most significant customer base resides within the semiconductor manufacturing ecosystem, encompassing major equipment Original Equipment Manufacturers (OEMs) such as Applied Materials, Lam Research, and Tokyo Electron, which require SiC-coated graphite components for plasma etching chambers (e.g., susceptors, focus rings, liners). These customers prioritize ultra-high purity, plasma resistance, and minimal particle generation to ensure high-yield wafer processing, making them the largest and most demanding consumer group in terms of quality specifications.

Another crucial customer segment is the global aerospace and defense industry, including engine manufacturers like General Electric (GE), Pratt & Whitney, and Rolls-Royce, alongside major defense contractors. These entities procure SiC coatings primarily for environmental barrier layers on Ceramic Matrix Composite (CMC) components utilized in the hot sections of gas turbine engines and in missile systems. The driving requirement here is maximizing operating temperature and reducing component weight while maintaining structural integrity over thousands of flight hours, translating directly into enhanced fuel efficiency and operational capability for both commercial and military aircraft.

Furthermore, the nuclear energy sector represents a significant long-term potential customer, particularly organizations focused on developing Accident Tolerant Fuels (ATF) and next-generation nuclear reactors, including companies involved in TRISO fuel production and advanced small modular reactor (SMR) development. For these customers, the SiC coating serves as a protective barrier to prevent fission product release under severe accident conditions and to improve the integrity of fuel cladding and structural components under high irradiation doses. Industrial machinery manufacturers, especially those involved in high-temperature heat exchangers, chemical processing equipment, and specialized industrial furnaces, also form a steady base of customers seeking SiC coatings to minimize component wear and chemical degradation, ensuring prolonged equipment operational life and reduced maintenance cycles in demanding industrial environments.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450.5 Million |

| Market Forecast in 2033 | USD 760.2 Million |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Axo Materials, CoorsTek Inc., IHI Corporation, Ceradyne (3M Company), Schunk Group, Saint-Gobain, Morgan Advanced Materials, Tokai Carbon, H.C. Starck Solutions, Covalent Materials Corporation, Momentive Technologies, Ultra Carbon, Advanced Ceramics Manufacturing, ZC-Tech, Materion Corporation, Kyocera Corporation, Shin-Etsu Chemical Co., Ltd., Surface Technology Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

SiC Coating Market Key Technology Landscape

The SiC Coating Market is predominantly defined by Chemical Vapor Deposition (CVD), which remains the gold standard for producing high-purity, dense, and conformal SiC layers critical for microelectronics and nuclear applications. CVD involves introducing precursor gases (typically silane and hydrocarbons) into a vacuum chamber where they react on the heated substrate surface, forming a uniform SiC film. The major technological challenge in CVD lies in achieving perfect uniformity across large or intricately shaped components while maintaining ultra-high purity, necessitating sophisticated reactor design and precise control over temperature gradients and gas flow dynamics. Recent advancements in CVD technology focus on optimizing precursor chemistry and reactor geometry to improve deposition rates and reduce internal stress within the coating, thereby increasing component reliability in extreme service conditions.

Physical Vapor Deposition (PVD) techniques, including sputtering and evaporation, also hold a significant position, particularly when targeting specific thin-film properties or when substrate material constraints limit the high processing temperatures required for CVD. PVD methods are often employed for creating multi-layered structures or coatings on substrates that are temperature-sensitive. However, PVD typically offers less conformality than CVD, posing challenges for internal surfaces or complex component features. Emerging technological innovations include Plasma Enhanced Chemical Vapor Deposition (PECVD), which operates at lower temperatures, making it suitable for a wider range of substrates, and Atomic Layer Deposition (ALD), which offers atomic-level precision for ultra-thin films required in advanced semiconductor nodes, although ALD currently faces scaling challenges for thick protective coatings.

For large-scale components, repair, or less critical applications, non-vacuum methods like thermal spraying (e.g., plasma spray, HVOF) and slurry coating techniques provide cost-effective alternatives. Slurry coating involves mixing fine SiC powder with a binder and solvent, applying it, and then heat-treating it to form a dense layer. While these methods are generally simpler and more scalable, the resulting coating typically lacks the high density, purity, and superior adhesion characteristic of CVD or PVD films. The future technology landscape is heavily invested in digital manufacturing, leveraging AI and sensor technology to monitor and control deposition processes in real-time, aiming to reduce defect rates, improve material utilization, and significantly shorten the development and qualification cycle for next-generation SiC-coated components across aerospace and semiconductor supply chains.

Regional Highlights

- Asia Pacific (APAC): APAC dominates the SiC Coating Market, driven primarily by the unparalleled concentration of semiconductor manufacturing foundries and outsourced semiconductor assembly and test (OSAT) facilities, particularly in Taiwan, South Korea, Japan, and China. The continuous investment in fabricating next-generation microchips necessitates constant upgrading and expansion of plasma etching equipment, directly fueling the demand for high-purity CVD SiC components. Furthermore, rapid industrialization, increasing governmental investment in defense capabilities, and a growing energy sector contribute to sustained demand, positioning APAC as the highest growth region globally. The region benefits from localized supply chains for raw materials and precursor manufacturing, facilitating competitive pricing and rapid scaling of production capacity necessary for supporting global technology demands.

- North America: North America represents a mature, high-value segment of the SiC coating market, led by the robust aerospace, defense, and specialized nuclear energy sectors. The region is home to major aircraft engine OEMs and advanced materials research institutions, where SiC coatings are vital for Environmental Barrier Coatings (EBCs) on CMC parts, essential for high-performance military and commercial aircraft. Significant government R&D funding for advanced materials, coupled with stringent performance standards imposed by regulatory bodies like the FAA and Department of Defense (DoD), mandates the use of highly certified, domestically produced SiC coatings, ensuring stable, albeit slower, growth focused on technological leadership and customization for extreme environment applications.

- Europe: The European market demonstrates steady growth, supported by its strong presence in specialized industrial machinery, automotive component manufacturing, and a renewed focus on advanced nuclear and fusion research initiatives. Demand is particularly notable in specialized high-temperature industrial furnaces and chemical processing equipment. Germany and France lead in adopting advanced coating technologies for industrial efficiency and environmental compliance. While the semiconductor manufacturing base is smaller than APAC, European demand for SiC coatings is critical for enhancing the lifespan and performance of specialized manufacturing tools and components used in high-tech machinery exported globally.

- Latin America, Middle East, and Africa (MEA): These regions currently represent smaller market shares but offer long-term potential. Growth in the MEA is primarily linked to strategic defense investments and diversification efforts in the energy sector, including potential nuclear power expansion. Latin America's market activity is primarily driven by industrial maintenance and repair operations (MRO) in the resource extraction sector, where SiC coatings can offer protection against abrasive wear and chemical corrosion, though large-scale manufacturing demand remains limited compared to the dominant regions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the SiC Coating Market.- Axo Materials

- CoorsTek Inc.

- IHI Corporation

- Ceradyne (3M Company)

- Schunk Group

- Saint-Gobain

- Morgan Advanced Materials

- Tokai Carbon

- H.C. Starck Solutions

- Covalent Materials Corporation

- Momentive Technologies

- Ultra Carbon

- Advanced Ceramics Manufacturing

- ZC-Tech

- Materion Corporation

- Kyocera Corporation

- Shin-Etsu Chemical Co., Ltd.

- Surface Technology Inc.

- Honeywell International Inc.

- Kennametal Inc.

Frequently Asked Questions

Analyze common user questions about the SiC Coating market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary deposition method used for high-purity SiC coatings?

The primary method is Chemical Vapor Deposition (CVD). CVD is favored because it produces highly dense, uniform, and ultra-pure SiC layers essential for applications requiring strict contamination control, particularly in semiconductor manufacturing equipment.

Which industry drives the largest current demand for SiC coatings?

The Semiconductor industry drives the largest current demand. SiC coatings are critical for protecting components like susceptors and liners in plasma etching and deposition chambers, ensuring component longevity and preventing wafer contamination in advanced microchip fabrication.

How do SiC coatings enhance performance in aerospace engines?

In aerospace, SiC coatings function as Environmental Barrier Coatings (EBCs) on Ceramic Matrix Composites (CMCs) used in engine hot sections. They protect the underlying CMCs from oxidation and corrosion at extreme operating temperatures (above 1300°C), extending component lifespan and enabling higher engine efficiency.

What are the main restraints hindering the growth of the SiC coating market?

The main restraints include the extremely high capital investment and operational cost associated with high-precision coating techniques like CVD. Furthermore, the complexity of achieving uniform coating on intricate geometries and long qualification periods for aerospace and nuclear parts restrict rapid adoption.

Where is the SiC Coating Market expected to see the fastest regional growth?

Asia Pacific (APAC) is projected to experience the fastest growth, largely due to unprecedented expansion in semiconductor manufacturing capacity across countries like China, Taiwan, and South Korea, coupled with significant governmental investment in advanced material technology.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager