SiC & GaN Power Devices Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 431972 | Date : Dec, 2025 | Pages : 243 | Region : Global | Publisher : MRU

SiC & GaN Power Devices Market Size

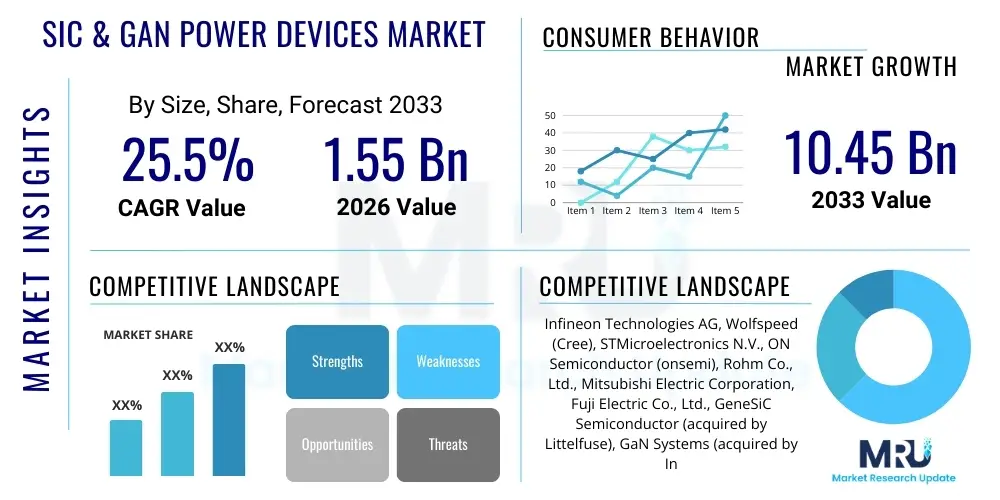

The SiC & GaN Power Devices Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 25.5% between 2026 and 2033. The market is estimated at USD 1.55 Billion in 2026 and is projected to reach USD 10.45 Billion by the end of the forecast period in 2033. This robust growth trajectory is primarily fueled by the accelerating global shift towards electric vehicles (EVs), the rapid expansion of renewable energy infrastructure requiring highly efficient power conversion systems, and the ubiquitous need for power density optimization in data centers and industrial applications. Silicon Carbide (SiC) and Gallium Nitride (GaN) are emerging as critical enablers for next-generation electronics due to their superior performance characteristics compared to traditional silicon, offering higher breakdown voltage, faster switching speeds, and significantly reduced energy losses, making them indispensable for high-power and high-frequency environments.

SiC & GaN Power Devices Market introduction

The SiC & GaN Power Devices Market encompasses semiconductors fabricated from wide bandgap (WBG) materials—Silicon Carbide (SiC) and Gallium Nitride (GaN)—designed for high-voltage and high-frequency power switching applications. These devices, including MOSFETs, Schottky diodes (SiC), and High Electron Mobility Transistors (HEMTs) (GaN), supersede traditional silicon counterparts by offering superior thermal management and significantly lower switching losses. Major applications span electric vehicle powertrains (onboard chargers, inverters), renewable energy systems (solar inverters, wind turbine converters), industrial motor drives, power supplies for data centers, and 5G communication infrastructure. The primary benefits include enhanced energy efficiency, smaller system size and weight, and higher operating temperatures, directly addressing critical industry requirements for sustainability and performance. Key driving factors include stringent global energy efficiency regulations, massive investments in EV manufacturing capacity, and the continuous demand for compact, efficient power solutions in consumer electronics and advanced robotics.

SiC & GaN Power Devices Market Executive Summary

The SiC & GaN Power Devices market is poised for exponential growth, driven by key business trends emphasizing supply chain resilience and mass production scale-up, particularly in the Asia Pacific region. Business trends are dominated by aggressive capacity expansion, strategic long-term supply agreements between WBG manufacturers and major automotive Tier 1 suppliers, and significant venture capital flowing into GaN-focused startups optimizing epitaxy and packaging technologies. Segment trends reveal the automotive sector as the dominant segment, particularly for SiC, owing to its superior voltage handling in main inverters, while GaN is gaining traction in consumer electronics, fast chargers, and low-to-mid power data center applications requiring extreme switching speeds. Regionally, Asia Pacific, specifically China and Japan, maintains market leadership due to substantial government support for electric mobility and massive manufacturing bases for consumer electronics and industrial equipment, positioning the area as the central hub for both production and consumption, followed closely by North America and Europe, which are prioritizing grid modernization and sustainable transportation initiatives.

AI Impact Analysis on SiC & GaN Power Devices Market

Common user questions regarding AI's impact on the SiC & GaN Power Devices Market often revolve around how artificial intelligence optimizes device design, enhances manufacturing yields, and improves system-level performance management in data center applications. Users frequently inquire if AI-driven load prediction models will necessitate different power device specifications or if machine learning (ML) can accelerate the notoriously complex SiC wafer growth process. The key thematic concerns center on realizing efficiency gains beyond the inherent material advantages, focusing on predictive maintenance of power systems and optimizing the control algorithms for WBG-based inverters. Expectations are high that AI will be pivotal in managing the thermal and electrical complexities inherent in high-density power modules, leading to faster adoption rates and greater reliability in mission-critical applications like autonomous driving and hyperscale cloud infrastructure.

The pervasive integration of Artificial Intelligence (AI) and Machine Learning (ML) techniques is fundamentally transforming how SiC and GaN power devices are designed, manufactured, and deployed in high-performance applications. In the design phase, AI algorithms are being leveraged to perform rapid thermal modeling, electromagnetic simulation, and reliability prediction, vastly reducing the traditional design cycles required for complex power modules. This capability allows manufacturers to optimize packaging geometries and material combinations more quickly, maximizing power density while ensuring operational longevity, a critical factor for automotive and aerospace components. Furthermore, AI is increasingly crucial in fine-tuning the gate driving circuits for WBG devices, which require precise control signals to fully exploit their high switching speed capabilities, thereby minimizing transient energy losses that could otherwise negate the material benefits.

Beyond design, AI systems are instrumental in elevating the quality control and efficiency of the manufacturing process, particularly the epitaxial growth of SiC and GaN layers, which is highly sensitive to variations. By analyzing vast datasets derived from real-time production parameters—such as temperature uniformity, gas flow dynamics, and material purity—ML models can predict potential defects, adjust process parameters proactively, and significantly increase wafer yield. This process automation and enhanced predictive capability address one of the primary historical challenges to WBG device scalability: achieving high-quality substrates consistently and affordably. Moreover, in end-user applications like data centers and renewable energy grids, AI-driven power management systems utilize SiC and GaN devices to handle rapidly changing load conditions with optimal efficiency, using predictive analytics to minimize standby losses and maximize overall system uptime and energy conversion effectiveness.

- AI-driven optimization of SiC wafer growth processes for increased yield and defect reduction.

- Machine Learning models utilized for predictive thermal management and reliability assessment in high-power GaN modules.

- Integration of AI in power system control algorithms to dynamically optimize switching frequencies and minimize transient energy loss in WBG inverters.

- AI requires high-density computing infrastructure, driving the demand for efficient GaN-based power supplies (PSUs) in hyperscale data centers.

- Accelerated simulation and prototyping using AI tools for novel WBG device architectures, speeding up time-to-market.

DRO & Impact Forces Of SiC & GaN Power Devices Market

The market dynamics for SiC and GaN devices are characterized by a strong convergence of legislative drivers and technological breakthroughs, offset by significant manufacturing complexity and cost constraints. The primary drivers revolve around the mandatory adoption of energy-efficient technologies across major economies, particularly the rapid acceleration of electric vehicle penetration and the substantial build-out of 5G infrastructure, both of which mandate the superior performance of WBG materials. Restraints include the high cost of SiC substrates, the inherent difficulties and capital intensity associated with scaling up WBG fabrication facilities (Fabs), and the ongoing challenge of standardizing packaging technologies that can fully withstand the high operating temperatures and faster switching transients of these materials. Opportunities lie in the penetration into new high-volume segments like solid-state circuit breakers and smart grid technology, alongside continuous R&D focused on cheaper GaN-on-Silicon substrates. These factors exert powerful impact forces, where the technological superiority acts as a magnetic pull for adoption, countered by the friction of high initial investment and supply chain constraints, necessitating long-term strategic investments to stabilize growth.

The principal drivers sustaining the market’s aggressive CAGR include the global commitment to carbon neutrality and the resulting mandatory efficiency standards (e.g., in industrial motor systems and power supply units). For SiC, the automotive sector's irreversible shift towards 800V architectures in EVs is a major impetus, as SiC devices are uniquely suited to manage these higher voltages, offering extended range and faster charging capabilities compared to silicon IGBTs. Similarly, GaN’s inherent ability to switch at extremely high frequencies makes it indispensable for compact, high-density power conversion in consumer fast chargers, which are now ubiquitous, and in the high-frequency radar and transmission applications required for advanced 5G and future 6G networks. These macro-level trends ensure a sustained foundational demand that transcends short-term economic fluctuations, forcing key industries to re-architect their power systems around WBG technology.

However, the market faces significant hurdles, primarily rooted in cost and technical maturity. The limited availability and high price of large-diameter SiC wafers (currently dominated by 6-inch, with the transition to 8-inch being costly and complex) constrain large-scale, low-cost manufacturing, slowing broader adoption outside of premium applications. For GaN, while GaN-on-Silicon lowers substrate cost, developing highly reliable, high-voltage GaN devices that can consistently operate at the stress levels required by industrial and automotive power modules remains an ongoing challenge in materials science and packaging engineering. These restraints, combined with the necessity for system designers to undergo steep learning curves to effectively utilize WBG device characteristics without damaging the components, necessitate collaborative efforts between device manufacturers, academic institutions, and end-users to standardize best practices and drive down system integration complexity and total implementation cost.

- Drivers:

- Accelerated electrification of transportation, requiring 800V architecture support.

- Increasing global focus on renewable energy integration and grid efficiency enhancement.

- Demand for miniaturization and higher power density in data center power supplies and consumer electronics chargers.

- Government regulations imposing stringent energy efficiency standards across industrial and consumer sectors.

- Restraints:

- High manufacturing costs and limited scalability of SiC substrates, particularly 8-inch wafers.

- Complexity and cost associated with advanced packaging technologies required for WBG devices to handle high temperatures and fast transients.

- Thermal management challenges due to increased power density in confined spaces.

- Opportunities:

- Penetration into emerging high-voltage segments, such as solid-state circuit breakers and advanced smart grid infrastructure.

- Development of cost-effective GaN-on-Silicon substrates for medium-voltage industrial applications.

- Expansion into space and defense applications requiring extreme resilience and lightweight power systems.

- Impact Forces:

- Superior intrinsic material properties (high critical electric field, wide bandgap) accelerating performance benchmarks.

- Intense competition leading to rapid price erosion (especially for GaN), increasing accessibility for consumer markets.

- Supply chain consolidation and strategic alliances stabilizing WBG material sourcing and production capacity.

Segmentation Analysis

The SiC & GaN Power Devices Market is comprehensively segmented based on material, device type, application, and voltage range, reflecting the distinct performance capabilities and target markets of SiC versus GaN technologies. SiC typically dominates the high-power, high-voltage segments (above 600V), characterized by its robustness in harsh environments, making it ideal for automotive inverters and industrial motor drives. Conversely, GaN excels in high-frequency, low-to-medium power applications, leveraging its fast switching speed for use in consumer fast chargers and specialized RF components. The application segment remains critical, with Electric Vehicles (EVs) driving SiC growth, while Information and Communication Technology (ICT) fuels the adoption of GaN, creating distinct supply chains and competitive landscapes tailored to the unique demands of these end-use sectors, requiring specific design choices in packaging and thermal management for optimal performance.

- By Material:

- Silicon Carbide (SiC)

- Gallium Nitride (GaN)

- By Device Type:

- SiC Power MOSFETs

- SiC Power Diodes (Schottky)

- GaN HEMTs (High Electron Mobility Transistors)

- GaN Diodes

- GaN Power ICs

- By Voltage Range:

- Below 300V (Primarily GaN in consumer electronics)

- 300V – 600V (Mixed GaN and SiC, industrial power supplies)

- 600V – 1,200V (SiC dominance, EV inverters, solar)

- Above 1,200V (Heavy-duty SiC modules, railway, high-voltage grids)

- By Application:

- Automotive (Onboard Chargers, Traction Inverters, DC-DC Converters)

- Industrial (Motor Drives, Power Supplies, Welding Equipment)

- Energy & Power (Solar Inverters, Wind Turbine Converters, Grid Infrastructure)

- Information & Communication Technology (ICT) (Data Center PSUs, Telecom Infrastructure, 5G Base Stations)

- Consumer Electronics (Fast Chargers, Adapters)

- Aerospace & Defense

Value Chain Analysis For SiC & GaN Power Devices Market

The value chain for SiC & GaN power devices is highly complex and capital-intensive, starting with the upstream sourcing and preparation of specialized raw materials and substrates, transitioning through highly advanced fabrication processes, and culminating in application-specific module integration. Upstream analysis focuses heavily on the production of high-quality SiC wafers (using bulk growth techniques like sublimation) and the epitaxial growth of GaN layers, often on silicon or SiC substrates, which are critical cost and performance determinants. The midstream involves the core fabrication (foundry services) where devices like MOSFETs and HEMTs are manufactured using sophisticated cleanroom processes. Downstream activities involve complex packaging and module assembly, where optimized thermal and electrical interfaces are designed for specific applications, followed by distribution through both direct sales channels to major automotive and industrial partners, and indirect channels leveraging specialized electronic component distributors who provide technical support and inventory management to smaller OEMs, ensuring pervasive market penetration and application-specific technical assistance.

SiC & GaN Power Devices Market Potential Customers

Potential customers and end-users of SiC and GaN power devices are highly diverse, spanning nearly every sector requiring efficient power conversion and handling high electrical loads. The dominant segment is the Automotive industry, comprising Original Equipment Manufacturers (OEMs) and Tier 1 suppliers specializing in electric vehicle powertrains, high-voltage battery management systems, and fast-charging infrastructure providers. Key customers also include manufacturers of Industrial Motor Drives and Automation Systems seeking to improve system efficiency and reduce downtime in factory settings. Furthermore, hyperscale Data Center operators and Telecom providers are major buyers, utilizing GaN devices for compact, efficient Power Supply Units (PSUs) and SiC for high-power distribution components. Energy companies deploying Solar Inverters, Wind Turbine Converters, and managing modern smart grids represent another crucial customer base, requiring devices capable of managing high-voltage, intermittent power flows with maximum reliability and longevity, making SiC and GaN solutions indispensable for grid modernization efforts.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.55 Billion |

| Market Forecast in 2033 | USD 10.45 Billion |

| Growth Rate | 25.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Infineon Technologies AG, Wolfspeed (Cree), STMicroelectronics N.V., ON Semiconductor (onsemi), Rohm Co., Ltd., Mitsubishi Electric Corporation, Fuji Electric Co., Ltd., GeneSiC Semiconductor (acquired by Littelfuse), GaN Systems (acquired by Infineon), Efficient Power Conversion (EPC) Corp., Nexperia (Wingtech), Vishay Intertechnology, Inc., Microchip Technology Inc., Toshiba Corporation, Renesas Electronics Corporation, Alpha and Omega Semiconductor, Power Integrations, Inc., Helix Semiconductors, Qorvo, Inc., Navitas Semiconductor. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

SiC & GaN Power Devices Market Key Technology Landscape

The technological landscape of the SiC & GaN market is defined by continuous innovation across three main pillars: substrate quality and scaling, device architecture refinement, and advanced packaging solutions. For SiC, the critical technology challenge is transitioning from 6-inch to 8-inch wafer diameters while maintaining low defectivity and achieving cost parity with silicon, a necessity for truly high-volume manufacturing required by the automotive sector. Leading companies are investing heavily in advanced sublimation techniques and post-growth processing to eliminate defects that can compromise device reliability under high stress. Simultaneously, device architectures are being refined, focusing on trench MOSFET structures in SiC to minimize on-resistance, enhancing power density and reducing conduction losses within the module footprint, thereby pushing the limits of system performance and efficiency.

GaN technology is primarily focused on overcoming inherent integration challenges by perfecting GaN-on-Silicon epitaxial growth, which allows manufacturers to leverage existing, high-volume silicon fabrication infrastructure, dramatically lowering substrate costs compared to native GaN or SiC substrates. Key architectural developments for GaN include the commercialization of reliable normally-off (E-mode) High Electron Mobility Transistors (HEMTs) necessary for safe system operation, along with the integration of control and sensing functionalities directly onto the GaN chip, creating monolithic GaN power integrated circuits (IC-based solutions). These advancements are crucial for achieving ultra-compact, highly integrated power systems, particularly those targeting low-to-medium voltage applications like consumer fast chargers and high-frequency DC-DC converters used in advanced computing and telecom equipment, streamlining system design and reducing parasitic inductance.

A central technological battleground for both materials is advanced packaging, which must manage the extreme temperatures, rapid switching transients, and high current densities inherent to WBG devices. Traditional packaging approaches often introduce parasitic inductance and thermal bottlenecks that negate the benefits of the WBG material. Consequently, there is intense focus on innovative packaging technologies such as sintering die attach, enhanced heat sinking materials (like silver sintering), and complex module designs (e.g., power modules with embedded planar structures) aimed at minimizing package-related parasitics and maximizing heat extraction. These innovations are fundamental to guaranteeing the long-term reliability and performance of SiC and GaN devices, especially in harsh environments such as the engine bay of an EV or a high-power industrial setting, driving the industry towards standardized, robust, and thermally optimized multi-chip power modules.

Regional Highlights

Geographically, the SiC & GaN Power Devices Market exhibits differential growth rates and technology adoption patterns, heavily influenced by regional government policies regarding electrification and industrial modernization. Asia Pacific (APAC) holds the dominant market share and is expected to maintain the highest growth trajectory, primarily fueled by the massive automotive and consumer electronics manufacturing bases in China, Japan, and South Korea. China’s aggressive pursuit of EV leadership, coupled with extensive investment in domestic WBG supply chains and 5G deployment, makes it the epicenter of both demand and production scaling for both SiC and GaN. Japan and South Korea contribute significantly through established high-quality power semiconductor manufacturing and strong demand from industrial automation and high-speed rail.

North America is characterized by robust early adoption in specialized high-end segments, particularly in defense, aerospace, and high-performance computing (HPC) data centers. The region benefits from key technology innovators and major players accelerating the 8-inch SiC wafer transition. Government initiatives and infrastructure spending related to grid modernization and domestic semiconductor manufacturing capacity (e.g., the CHIPS Act) are expected to significantly boost internal production and consumption of WBG devices, focusing particularly on high-voltage SiC applications for utility-scale renewable energy integration and electric vehicle charging infrastructure.

Europe represents a highly competitive market, driven by stringent EU environmental standards and strong public commitment to electric mobility and grid reliability. European automotive giants are rapidly integrating SiC into their premium and performance EV platforms, cementing SiC’s role in traction inverters. The region also demonstrates high demand for GaN in industrial power supplies and renewable energy systems, supported by significant R&D collaboration between device manufacturers and application engineers to ensure compliance with demanding European efficiency regulations and long-term reliability standards for critical infrastructure components.

- Asia Pacific (APAC): Market leader due to high volume EV production (especially in China), massive 5G infrastructure deployment, and dominant consumer electronics manufacturing, driving both SiC (automotive) and GaN (chargers, ICT) adoption.

- North America: Strong focus on high-reliability, high-power SiC devices for defense, aerospace, and hyperscale data center power conversion; significant government investment stabilizing domestic supply chain.

- Europe: Driven by strict environmental regulations and fast EV penetration; high adoption rates of SiC in automotive traction and industrial applications; substantial R&D investment in smart grid technology requiring advanced WBG devices.

- Latin America & Middle East/Africa (MEA): Emerging markets with accelerating investments in renewable energy infrastructure and initial phases of electric vehicle adoption; market growth is expected to follow infrastructure build-out and localized manufacturing development.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the SiC & GaN Power Devices Market.- Infineon Technologies AG

- Wolfspeed (Cree)

- STMicroelectronics N.V.

- ON Semiconductor (onsemi)

- Rohm Co., Ltd.

- Mitsubishi Electric Corporation

- Fuji Electric Co., Ltd.

- GeneSiC Semiconductor (acquired by Littelfuse)

- GaN Systems (acquired by Infineon)

- Efficient Power Conversion (EPC) Corp.

- Nexperia (Wingtech)

- Vishay Intertechnology, Inc.

- Microchip Technology Inc.

- Toshiba Corporation

- Renesas Electronics Corporation

- Alpha and Omega Semiconductor

- Power Integrations, Inc.

- Helix Semiconductors

- Qorvo, Inc.

- Navitas Semiconductor

Frequently Asked Questions

Analyze common user questions about the SiC & GaN Power Devices market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference in application focus between SiC and GaN power devices?

SiC devices are primarily optimized for high-voltage (typically above 600V) and high-power applications, making them dominant in EV traction inverters, high-power industrial motor drives, and solar/grid infrastructure. GaN devices excel in high-frequency, low-to-medium voltage applications, such as consumer fast chargers, server power supplies, and specialized RF communication systems, due to their superior switching speed characteristics.

How is the current supply chain addressing the high cost of SiC substrates?

The industry is addressing high substrate costs through massive investment in R&D aimed at scaling wafer production from 6-inch to 8-inch diameters, which increases the number of dies per wafer, significantly improving manufacturing economies of scale. Furthermore, key players are establishing long-term, multi-year supply agreements with raw material suppliers to stabilize pricing and secure consistent high-quality material sourcing.

What role do SiC and GaN play in the global shift to 800V electric vehicle architectures?

SiC is indispensable for 800V EV architectures. Traditional silicon components struggle to manage the required voltage and efficiency levels at this potential. SiC MOSFETs offer the necessary high breakdown voltage, reduced switching losses, and enhanced thermal performance, enabling faster charging times, extended battery range, and smaller, lighter high-voltage power electronics within the vehicle.

Are GaN-on-Silicon devices as reliable as traditional silicon or SiC devices in power applications?

While GaN-on-Silicon offers cost advantages by leveraging mature silicon fabs, reliability remains a critical focus area, particularly concerning dynamic on-resistance and trapping effects at high temperatures and high switching cycles. However, continuous advancements in epitaxy and device passivation techniques are rapidly closing the reliability gap, making modern GaN-on-Silicon suitable and highly reliable for commercial, industrial, and increasingly, automotive applications.

What impact do energy efficiency regulations have on the market adoption of Wide Bandgap (WBG) materials?

Energy efficiency regulations, such as those governing power supplies (e.g., 80 Plus standards for computing) and industrial equipment (e.g., motor efficiency ratings), are a major driver. WBG devices inherently enable higher system efficiency, often making it impossible to meet the most stringent regulatory requirements using traditional silicon technology, thus mandating the switch to SiC and GaN to comply with global energy consumption targets and operational standards.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager