SIC Powder Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 431748 | Date : Dec, 2025 | Pages : 243 | Region : Global | Publisher : MRU

SIC Powder Market Size

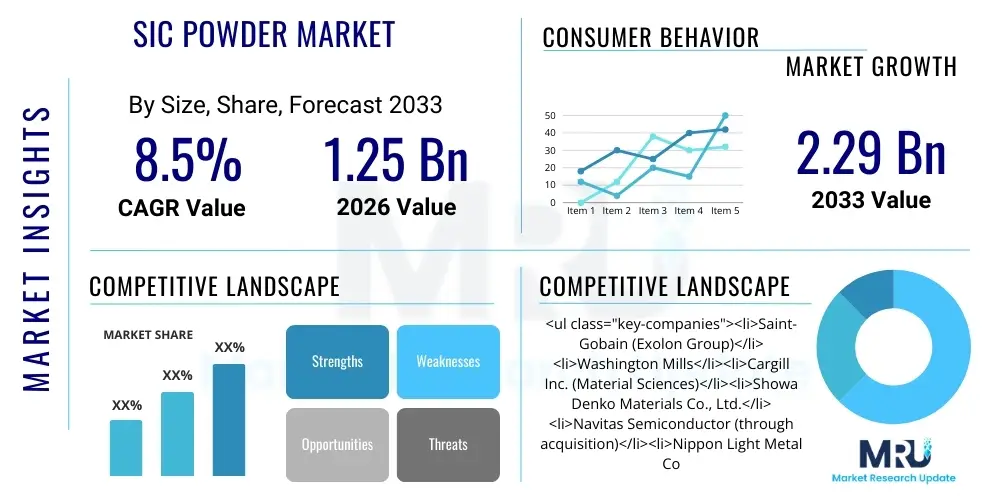

The SIC Powder Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at USD 1.25 Billion in 2026 and is projected to reach USD 2.29 Billion by the end of the forecast period in 2033.

SIC Powder Market introduction

The Silicon Carbide (SiC) powder market is fundamentally driven by the expanding need for advanced materials capable of withstanding extreme conditions, particularly high temperatures, high voltages, and abrasive environments. SiC powder, a synthetic ceramic material, possesses superior properties such as high thermal conductivity, excellent hardness (ranking just below diamond and boron carbide), chemical inertness, and wide bandgap characteristics. These attributes position it as critical input in the manufacturing of high-performance technical ceramics, abrasives, refractories, and, most notably, semiconductor substrates essential for power electronics.

Major applications of SiC powder span various high-tech sectors, including automotive (especially electric vehicles, EVs), aerospace, defense, and energy production. In the EV sector, SiC-based power modules are crucial for enhancing inverter efficiency, reducing overall system weight, and extending battery range. Furthermore, the material is extensively utilized in grinding and polishing operations due to its abrasive nature, ranging from coarse grain applications in metallurgy to fine powders used for lapping silicon wafers and optical components. Its application in refractories stems from its stability at elevated temperatures, making it invaluable for furnace linings and kilns.

The primary benefit of adopting SiC powder-derived components is the significant performance enhancement they offer over traditional materials like silicon. Driving factors include aggressive government mandates promoting energy efficiency, rapid industrialization across Asia Pacific, and continuous technological advancements in manufacturing processes, such as 3D printing of SiC parts and improvements in powder synthesis (e.g., plasma processing and crystallization techniques) that yield purer, more uniform particle sizes tailored for specific high-end uses like medical devices and microelectronics.

SIC Powder Market Executive Summary

The global SIC Powder market exhibits robust growth characterized by a strong shift toward high-purity, ultrafine grades necessitated by the semiconductor and advanced ceramics industries. Business trends indicate intensified mergers and acquisitions activity aimed at securing raw material supplies and leveraging proprietary synthesis technologies, particularly among producers focusing on green SiC for non-oxide ceramics and black SiC for metallurgical and refractory applications. Pricing dynamics are complex, influenced by fluctuating energy costs required for the Acheson process and the specialized demands for high-quality precursor materials necessary for the bulk crystallization methods used in wafer manufacturing, driving premiumization in the electronic grade segment.

Regionally, Asia Pacific maintains its dominance, spurred by massive investments in semiconductor fabrication plants (fabs) and the prolific growth of electric vehicle production in China, Japan, and South Korea. This region not only serves as the largest consumer but also as a primary production hub, leading in the establishment of large-scale SiC material infrastructure. North America and Europe demonstrate rapid adoption rates, primarily due to the stringent regulatory push for carbon neutrality and the resulting demand for high-efficiency power management systems in renewable energy infrastructure and high-power military systems, favoring the import of specialized, electronic-grade SiC powder.

Segment trends reveal that the 'Electronic Grade' segment, though smaller in volume than the abrasive or refractory grades, commands the highest value and is growing fastest due to its critical role in Wide Bandgap (WBG) technology. By application, the power electronics and semiconductor segment is the foremost value driver, transitioning rapidly from traditional silicon to SiC for components like Schottky diodes and MOSFETs. Furthermore, fine and ultrafine powder sizes are experiencing increased demand across all regions, reflecting the industry's need for higher precision, thinner cutting applications, and denser ceramic bodies with improved mechanical integrity.

AI Impact Analysis on SIC Powder Market

User queries regarding the impact of Artificial Intelligence (AI) on the SIC Powder Market frequently center on themes of operational efficiency, material discovery, and enhanced quality control in manufacturing. Key user concerns revolve around whether AI integration can significantly reduce the energy intensity of the traditional SiC production methods (like the Acheson process), how predictive maintenance models can improve equipment longevity in severe operating conditions, and the potential for AI-driven simulation to accelerate the development of novel SiC composite structures. Users also seek clarity on how machine learning algorithms are being employed to ensure the near-perfect crystal quality required for electronic-grade substrates, minimizing defects which are prohibitively expensive in WBG semiconductor production.

The deployment of AI and machine learning (ML) within the SiC powder value chain offers transformative potential, primarily focusing on optimizing the complex synthesis and sintering stages. AI algorithms are currently being utilized for real-time monitoring and dynamic adjustment of furnace temperatures and pressure during high-temperature reactions, leading to tighter control over particle size distribution and crystal phase purity. This automated precision minimizes batch variability, which is critical for customers in the advanced ceramics and semiconductor sectors. Furthermore, predictive modeling powered by ML helps manufacturers forecast demand fluctuations for specific grades of SiC powder, optimizing inventory levels and reducing waste associated with overproduction or mismatched quality grades.

Beyond process optimization, AI is instrumental in accelerating material research. Generative AI models are assisting chemists and material scientists in simulating the properties of new SiC-based composites or doping strategies, significantly shortening the R&D cycle for next-generation WBG devices. By analyzing vast datasets of experimental synthesis parameters and resulting material performance, AI identifies optimal processing windows that were previously undiscoverable through traditional trial-and-error methods. This shift ensures that the SiC powder supplied to high-stakes applications, such as high-frequency radar or extreme environment sensors, meets increasingly stringent performance specifications and reliability standards, solidifying AI’s role as an enabler of advanced material science.

- AI-driven Predictive Quality Control: Minimizes micro-defects in electronic-grade SiC crystals via real-time image analysis.

- Manufacturing Process Optimization: ML algorithms refine energy consumption and reaction parameters in the Acheson furnace, enhancing yield efficiency.

- Automated Material Discovery: Generative AI simulates novel SiC composite structures for applications in high-power density components.

- Supply Chain Resilience: Predictive analytics improve forecasting for raw material (silica and coke) sourcing and distribution of final powdered products.

- Equipment Health Monitoring: AI implements predictive maintenance strategies for high-temperature kilns and milling equipment, reducing unplanned downtime.

DRO & Impact Forces Of SIC Powder Market

The SIC Powder Market is strongly influenced by a robust combination of driving factors (D), significant restraints (R), and compelling opportunities (O), creating complex impact forces across the supply chain. Key drivers include the exponential adoption of Electric Vehicles (EVs), where SiC inverters dramatically boost efficiency and range, coupled with continuous advancements in 5G infrastructure and high-power applications demanding wide bandgap semiconductor materials. However, the market faces structural restraints, primarily the high capital expenditure required for establishing high-purity production facilities, the extreme energy consumption inherent in SiC manufacturing processes, and inherent challenges in synthesizing near-perfect, defect-free crystals necessary for advanced electronic applications, which limits volume scalability.

Opportunities for market growth are vast, centered on technological substitution and geographical expansion. The market stands to gain significantly from the increasing deployment of renewable energy systems (solar inverters, wind turbine converters) and the exploration of new frontiers such as quantum computing components and advanced nuclear reactor claddings, all requiring SiC’s unique thermal and electrical properties. Furthermore, regional efforts to localize semiconductor supply chains, driven by geopolitical considerations, present substantial opportunities for new entrants or capacity expansion in North America and Europe, diversifying the existing Asia-centric production base. The development of cost-effective, non-Acheson synthesis routes, such as chemical vapor deposition (CVD) or solution processing, also holds immense potential to lower entry barriers and reduce manufacturing complexity.

These dynamics result in significant impact forces. The high substitution threat posed by Gallium Nitride (GaN) in certain low-to-medium power applications exerts downward pressure on pricing, forcing SiC manufacturers to focus on high-power, high-voltage segments (above 1200V) where SiC excels. Simultaneously, the bargaining power of major buyers (e.g., Tesla, Infineon, Wolfspeed) remains high due to their specialized requirements for customized purity and particle specifications, necessitating deep collaboration between powder producers and end-users. Regulatory support for energy efficiency acts as a powerful external force, continually pushing manufacturers to invest in cleaner, more efficient SiC production methodologies, ultimately shaping future market structure toward sustainability and quality assurance.

Segmentation Analysis

The SIC Powder market is comprehensively segmented based on its physical properties, manufacturing grade, primary application, and geographical landscape. This segmentation allows for granular analysis of demand patterns, pricing structures, and competitive intensity across different value chains. The segmentation by grade is critical as it distinguishes high-value electronic and nuclear grades from high-volume abrasive and metallurgical grades, reflecting vastly different production complexities and profit margins. Application segmentation highlights the driving forces, with power electronics exhibiting the highest growth trajectory, while size categorization addresses specific end-user requirements, ranging from coarse grits for traditional grinding to ultrafine nanopowders used in advanced polishing and composite matrices.

- By Grade:

- Black SIC

- Green SIC

- Electronic Grade SIC

- Metallurgical Grade SIC

- Refractory Grade SIC

- By Type/Purity:

- Alpha SIC (Hexagonal Crystal Structure)

- Beta SIC (Cubic Crystal Structure)

- High Purity SiC (>99.5%)

- Standard Purity SiC (97%-99.5%)

- By Particle Size:

- Coarse Grain (>100 µm)

- Fine/Micro Grit (1 µm to 100 µm)

- Ultrafine/Nanopowder (<1 µm)

- By Application:

- Abrasives (Grinding, Cutting, Lapping, Polishing)

- Refractories and Metallurgy (Furnace linings, Deoxidizers)

- Technical Ceramics and Composites (Mechanical Seals, Armor, Heat Exchangers)

- Power Electronics and Semiconductors (Substrates, MOSFETs, Diodes)

- Automotive and Aerospace

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East and Africa (MEA)

Value Chain Analysis For SIC Powder Market

The value chain for the SIC Powder market is highly centralized and characterized by energy-intensive upstream processes, meticulous midstream refinement, and a highly specialized downstream distribution network focused on delivering customized product specifications. Upstream analysis involves the sourcing of primary raw materials: high-purity silica sand (SiO2) and high-quality petroleum coke or high-grade anthracite coal (carbon sources). The critical step here is the conversion of these materials into crude SiC using the power-intensive Acheson furnace method, typically requiring temperatures exceeding 2,500°C. Suppliers in this phase, often integrated with large energy providers, possess significant leverage due to the high barrier to entry and the specialized geological requirements for sourcing pure silica, establishing the foundational cost structure for the entire market.

The midstream process focuses on crushing, milling, and grading the crude SiC into usable powder. This refinement phase involves extensive processing, including water classification, magnetic separation to remove metallic impurities (especially iron), and advanced acid washing for electronic and fine ceramic grades. The shift towards ultrafine and nano-sized SiC powder demands highly sophisticated milling and classification equipment, adding significant value and technical complexity. Companies specializing in advanced material processing technologies dominate this middle segment, tailoring particle morphology and distribution to meet stringent customer specifications for sintering density and surface finish in final applications.

Downstream analysis covers the distribution channels, which are bifurcated into direct sales for large, high-value contracts (semiconductors, major refractory producers) and indirect channels utilizing specialized distributors for smaller volume or regional abrasive customers. Direct channels ensure close collaboration between the SiC powder manufacturer and the end-user (e.g., a power module assembler) regarding precise particle characteristics and purity documentation. Indirect distribution relies on technical distributors who manage inventory and provide localized technical support, particularly crucial for the thousands of smaller abrasive and grinding shops globally. The ultimate success in the downstream sector relies on maintaining uncompromising quality control and providing deep application expertise tailored to diverse industries from high-tech electronics to heavy metallurgy.

SIC Powder Market Potential Customers

The primary customers and end-users of SIC powder are organizations operating in high-performance, high-durability, and high-efficiency sectors requiring materials that surpass the capabilities of conventional ceramics or metals. The most substantial buyer segment, in terms of current market value, is the power electronics industry, encompassing manufacturers of semiconductor wafers, discrete power devices (MOSFETs, JFETs, diodes), and integrated power modules. These customers are highly sensitive to material purity and crystal quality, as defects directly compromise device performance and longevity in high-voltage applications like EV inverters, fast chargers, and smart grid infrastructure.

Another major consumer cluster is the industrial and manufacturing sector, specifically companies specializing in precision engineering and surface finishing. This includes manufacturers of high-end abrasive tools, grinding wheels, and lapping compounds utilized in the production of automotive components, aerospace parts, and critical industrial machinery. These users prioritize hardness, fracture toughness, and consistent particle size distribution (PSD) of the SiC powder, which directly influences the efficiency and quality of their grinding or cutting operations. The refractory industry also constitutes a reliable, high-volume customer base, using SiC to create non-reactive, high-temperature linings for kilns, furnaces, and metal processing ladles, valuing thermal shock resistance and chemical stability.

Emerging, high-growth potential customers include additive manufacturing companies focused on 3D printing ceramic components for aerospace and medical devices, leveraging SiC’s lightweight strength and bio-inertness. Furthermore, defense and armor manufacturers represent a strategic buying segment, utilizing SiC ceramics for ballistic protection due to its extreme hardness and low density. The purchasing behavior across all segments is increasingly leaning toward customized specifications and verified traceability, necessitating that SIC powder suppliers provide comprehensive documentation regarding particle characteristics, impurity profiles, and compliance with standards such as RoHS or REACH regulations, solidifying customer focus on reliability and technical partnership rather than simple commodity pricing.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.25 Billion |

| Market Forecast in 2033 | USD 2.29 Billion |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered |

|

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

SIC Powder Market Key Technology Landscape

The technology landscape governing the SIC Powder market is defined by a dichotomy between the traditional, high-volume Acheson process and nascent, high-precision methods essential for electronic-grade material production. The Acheson method remains the commercial backbone for manufacturing black and green SiC used in abrasives and refractories, leveraging the carbothermic reduction of silica and coke at extremely high temperatures. While highly efficient for bulk production, this technique struggles to achieve the ultra-high purity (>99.999%) required for semiconductor substrates and is highly energy-intensive, spurring ongoing research into furnace efficiency and emission reduction technologies.

For electronic applications, the technology focus shifts dramatically towards bulk crystallization techniques, most notably Physical Vapor Transport (PVT), often termed the modified Lely method. PVT involves sublimating SiC powder precursors at high temperatures and recrystallizing the material onto a seed crystal to grow large, single-crystal boules, which are then sliced into wafers. The purity and structural perfection of the precursor SiC powder directly dictate the quality of the final wafer. Therefore, technological advancements are focused on developing high-purity Beta-SiC (cubic phase) precursors and improving the PVT reactor design to minimize defect density, particularly micropipes and stacking faults, which are catastrophic to WBG device yield.

Furthermore, emerging technologies are focused on synthesizing fine and nanopowders with tight control over morphology and crystalline phase. Chemical Vapor Deposition (CVD) methods are increasingly used not only for thin film deposition but also for producing highly pure SiC powders with controlled size in the nanometer range, crucial for advanced composite reinforcement and thermal management interfaces. Plasma synthesis techniques are also gaining traction, offering a faster, more controlled reaction environment compared to the Acheson process, enabling manufacturers to rapidly tailor particle size and achieve superior stoichiometry, which is particularly valued by additive manufacturing and biomedical component producers seeking powders with exceptional flowability and high sinterability at lower temperatures.

Regional Highlights

Regional dynamics play a crucial role in shaping the SIC Powder market due to localized industrialization rates, distinct regulatory environments, and regional concentrations of high-tech manufacturing hubs. Asia Pacific (APAC) currently holds the dominant market share, driven primarily by its immense semiconductor manufacturing capacity and the aggressive rollout of electric vehicle production, particularly in China and South Korea. This region not only consumes the majority of electronic-grade SiC wafers but also houses a significant proportion of the world’s bulk abrasive and refractory SiC production facilities, capitalizing on lower operating costs, albeit with rising environmental compliance challenges. The market in APAC is characterized by intense price competition in lower-grade segments and rapidly escalating demand for ultra-high purity materials.

North America and Europe represent mature markets distinguished by high demand for specialized, high-margin SiC products, often tied to stringent performance requirements in aerospace, defense, and high-reliability industrial applications. In North America, the growth is heavily catalyzed by domestic mandates to onshore semiconductor production (e.g., the CHIPS Act) and substantial public investment into modernizing power grids and high-voltage transmission systems, necessitating high-performance SiC power components. European demand is bolstered by the continent's commitment to renewable energy integration (solar and wind power inverters) and the premium automotive sector’s rapid pivot towards high-voltage electric propulsion systems, leading to strong collaboration between SiC powder suppliers and European Tier 1 automotive component manufacturers.

The markets in Latin America (LATAM) and the Middle East and Africa (MEA) are emerging, primarily driven by infrastructure development and metallurgical applications. LATAM's demand is largely focused on refractory and abrasive grades supporting mining and basic industrial processing, while MEA exhibits nascent growth tied to diversification efforts in countries like Saudi Arabia and UAE, which are investing in renewable energy projects and developing local manufacturing capabilities. While smaller in scale, these regions offer potential long-term growth as local energy infrastructure modernizes and high-temperature industrial capacity expands, requiring reliable, durable SiC components.

- Asia Pacific (APAC): Dominates the market due to concentrated EV production and the presence of major semiconductor fabs (China, Japan, South Korea). Focus on both high-volume abrasives and high-value electronic substrates.

- North America: High growth rate fueled by government incentives (CHIPS Act) supporting domestic WBG manufacturing and robust demand from defense and aerospace sectors for high-temperature ceramics.

- Europe: Strong demand driven by the Green Energy transition, particularly in Germany and Scandinavia, necessitating SiC for advanced power conditioning in renewable energy and high-efficiency automotive inverters.

- Latin America (LATAM): Growth centered in industrial applications, particularly refractories, metallurgy, and mining operations requiring durable, abrasive-resistant materials.

- Middle East and Africa (MEA): Emerging market characterized by increasing investment in solar power generation and industrial diversification projects, leading to initial demand for abrasive and basic refractory SiC grades.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the SIC Powder Market.- Saint-Gobain (Exolon Group)

- Washington Mills

- Cargill Inc. (Material Sciences)

- Showa Denko Materials Co., Ltd. (Resonac)

- Navitas Semiconductor

- Nippon Light Metal Co., Ltd.

- Resourca SiC Grits Inc.

- Snam Abrasives Pvt. Ltd.

- Elmet Technologies

- Elektrogorsk Abrasive Plant (EAZ)

- H.C. Starck GmbH

- Momentive Technologies

- Wolfspeed (formerly Cree)

- Wacker Chemie AG

- China Silicon Carbide Co., Ltd.

- GTR Ultra Hard Materials

- Treibacher Industrie AG

- Zibo Fengfan Industrial Co., Ltd.

- Ortech Inc.

- Pacific Rundum Co., Ltd.

- Xiamen Konon Chemical Co., Ltd.

- ESK-SIC GmbH

Frequently Asked Questions

Analyze common user questions about the SIC Powder market and generate a concise list of summarized FAQs reflecting key topics and concerns.What differentiates Electronic Grade SiC powder from standard abrasive grades, and why is it exponentially more expensive?

Electronic Grade SiC powder requires ultra-high purity (typically 99.999% or higher) and extremely low concentrations of specific metallic impurities (like Boron, Aluminum, and Nitrogen) which act as electrical dopants, compromising semiconductor performance. Unlike standard abrasive grades produced via the bulk Acheson process, electronic-grade material often undergoes multiple, complex purification steps, including acid leaching, high-temperature treatments, and meticulous classification to ensure perfect stoichiometry and consistent particle morphology. This material serves as the critical precursor for growing single-crystal SiC boules using the Physical Vapor Transport (PVT) method. The elevated cost is directly attributable to the energy-intensive purification requirements, stringent quality control measures, and the necessity to minimize crystal defects, ensuring the final wafer yield is acceptable for high-voltage power electronics applications.

How is the growth of the Electric Vehicle (EV) industry directly influencing demand for SiC powder?

The EV industry is the single most potent driver for high-purity SiC powder demand, specifically for the production of SiC power semiconductors (MOSFETs and diodes) used in the traction inverters and on-board chargers. SiC devices operate at significantly higher switching frequencies, higher temperatures, and higher voltages compared to traditional silicon (Si) devices. This inherent efficiency boost reduces energy loss, minimizes the size and weight of cooling systems, and ultimately extends the vehicle's driving range and reduces charging time. As global automotive manufacturers aggressively transition their fleets to high-voltage platforms (800V and above), the demand for high-quality SiC wafers, and thus the precursor SiC powder, is experiencing compounded annual growth rates significantly exceeding the broader material market average. Furthermore, the push for smaller, lighter power modules reinforces the need for extremely fine, defect-minimized SiC powders for advanced sintering techniques.

What are the primary technological restraints currently hindering mass production of cost-effective, defect-free SiC wafers?

The major technological restraint lies in achieving scale while maintaining crystal quality during the Physical Vapor Transport (PVT) process. Defects, such as micropipes, stacking faults, and basal plane dislocations (BPDs), inherent in the crystal structure grown from the SiC powder precursor, severely limit the yield and reliability of power devices. While SiC powder purity has improved, the sublimation and deposition process itself is highly sensitive to thermal gradients and impurities, making large-diameter wafer growth (e.g., 8-inch) exceptionally difficult and expensive. Furthermore, the slicing of the extremely hard SiC boule into thin wafers requires specialized diamond wire sawing, which contributes significantly to material waste and processing cost. Research efforts are heavily focused on innovative seeding techniques and proprietary furnace designs to reduce defect density to commercially viable levels, targeting high-volume adoption.

Which geographical region is predicted to experience the most significant growth in the SiC powder market and why?

Asia Pacific (APAC), particularly China and Southeast Asian nations, is predicted to experience the most significant volumetric and value growth in the SIC Powder market throughout the forecast period. This acceleration is due to the unparalleled concentration of both semiconductor fabrication facilities (fabs) and Electric Vehicle manufacturing capacity located within the region. China is rapidly building out its domestic WBG supply chain, reducing reliance on Western imports, which translates into massive localized demand for electronic-grade SiC powder. Simultaneously, APAC countries are dominant in consumer electronics production and general industrialization, ensuring sustained high-volume demand for abrasive and refractory grades. Favorable governmental policies supporting infrastructure investment and localized technology development further consolidate APAC's position as the primary engine of market expansion, attracting both domestic and international investment into SiC material processing facilities.

Beyond semiconductors, how is the demand for SiC powder evolving in the advanced technical ceramics and composites segments?

In advanced technical ceramics, SiC powder demand is evolving toward specialized applications requiring exceptional mechanical strength, wear resistance, and high-temperature performance. Ultrafine and nanopowders are critical for pressureless sintering techniques, allowing manufacturers to create complex, dense components like mechanical seals, turbocharger rotors, and high-performance armor ceramics with minimal porosity. The demand is expanding significantly in the aerospace and defense sectors, where SiC composites are replacing lighter, less durable materials in engine components and protective plating due to their superior specific strength and thermal stability. Furthermore, SiC’s excellent thermal shock resistance is driving its adoption in lightweight brake systems for high-speed trains and luxury automobiles, diversifying the application portfolio beyond traditional grinding and refractory uses into high-end structural components.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager