SiC Schottky Diodes Bare Dies Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432830 | Date : Dec, 2025 | Pages : 255 | Region : Global | Publisher : MRU

SiC Schottky Diodes Bare Dies Market Size

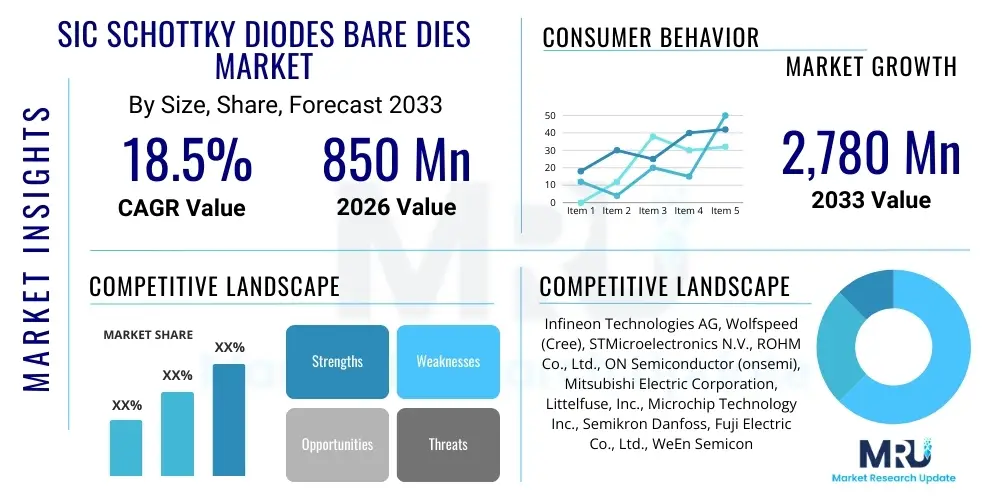

The SiC Schottky Diodes Bare Dies Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 18.5% between 2026 and 2033. The market is estimated at $850 Million USD in 2026 and is projected to reach $2,780 Million USD by the end of the forecast period in 2033.

SiC Schottky Diodes Bare Dies Market introduction

The Silicon Carbide (SiC) Schottky Diodes Bare Dies Market encompasses unpackaged semiconductor chips utilized primarily in high-power and high-frequency applications. These bare dies leverage the superior material properties of SiC, specifically its wide bandgap, high thermal conductivity, and high critical electric field strength, enabling performance characteristics far exceeding traditional silicon-based diodes. SiC Schottky diodes offer minimized reverse recovery charge, resulting in lower switching losses and improved system efficiency, making them essential components in advanced power electronics modules, particularly where space and weight constraints are critical.

Major applications driving the demand for SiC Schottky Diodes Bare Dies include Electric Vehicle (EV) chargers (both on-board and off-board), renewable energy systems such as solar inverters and wind converters, high-density power supplies for data centers, and various industrial power conditioning equipment. The inherent reliability of SiC at elevated operating temperatures allows system designers to simplify cooling mechanisms, thereby reducing overall system complexity and cost over the product lifecycle. The transition towards higher DC voltages (e.g., 800V architectures in EVs) necessitates the use of robust SiC devices capable of handling such stress efficiently.

The primary benefit derived from SiC bare dies is the flexibility they offer module manufacturers to customize packaging solutions tailored for specific thermal and electrical requirements, often resulting in multi-chip modules (MCMs) or power integrated modules (PIMs) with superior power density. Driving factors include aggressive governmental policies promoting electrification and renewable energy integration, the exponential growth in global data traffic necessitating highly efficient server power supplies, and the constant push for increased energy efficiency mandates across all sectors. These combined factors solidify the SiC Schottky Diodes Bare Dies Market as a high-growth segment within the broader power semiconductor industry.

SiC Schottky Diodes Bare Dies Market Executive Summary

The SiC Schottky Diodes Bare Dies market is experiencing robust expansion, fundamentally driven by the global transition toward high-efficiency power conversion systems. Business trends indicate a significant consolidation of the supply chain, with major wafer manufacturers vertically integrating or forming strategic long-term supply agreements with module assemblers to ensure stable sourcing of high-quality bare dies. Furthermore, there is an increasing focus on developing larger wafer sizes, moving from 6-inch to 8-inch SiC wafers, which promises substantial reductions in cost per die and improved manufacturing yield, critical for scaling adoption across mass-market applications like EVs and consumer power supplies. Technological advancements are centered on reducing the specific on-resistance (Rds,on) and optimizing the JBS (Junction Barrier Schottky) structure to enhance robustness against surge currents.

Regionally, Asia Pacific, particularly China and Japan, dominates consumption, fueled by aggressive domestic EV manufacturing targets and massive investments in solar and wind farm installations that require efficient power conditioning units. North America and Europe are pivotal markets driven by regulatory demands for grid modernization and the burgeoning demand from hyperscale data centers requiring high-voltage, high-efficiency power factor correction (PFC) circuitry. European automotive manufacturers are leading the adoption of 800V architectures, directly accelerating the demand for 650V and 1200V SiC bare diodes and MOSFETs within their traction inverters and charging infrastructure.

Segment trends highlight the dominance of the 650V and 1200V voltage classes, catering predominantly to EV charging and industrial motor drive segments, respectively. The segment based on end-use application shows the automotive sector maintaining the highest CAGR, followed closely by the energy and power sector. The competitive landscape is characterized by intense R&D investment focused on minimizing defects in the SiC epitaxial layers, which directly impacts the performance and reliability of the bare dies. This technological race among key market players ensures continuous performance improvement and cost reduction, further accelerating market penetration across traditionally silicon-dominant applications.

AI Impact Analysis on SiC Schottky Diodes Bare Dies Market

The rapid proliferation of Artificial Intelligence (AI) and Machine Learning (ML) applications, particularly in hyperscale data centers and autonomous systems, fundamentally influences the demand profile for SiC Schottky Diodes Bare Dies. Users frequently inquire about how the substantial power requirements of AI accelerators and high-performance computing (HPC) clusters translate into specialized demands for power semiconductors. Key themes revolve around thermal management challenges, the necessity for extremely low latency in power delivery, and the overall system efficiency required to minimize operational expenditure in large-scale AI infrastructure. The consensus is that traditional silicon power supplies cannot efficiently handle the transient current demands and power densities required by AI servers equipped with dozens of powerful GPUs or TPUs.

The implementation of AI models, from training to inference, necessitates robust and highly efficient power architectures to manage loads exceeding 50kW per rack. This requirement drives demand for SiC devices in power supplies, particularly in the Active PFC and LLC resonant converter stages, where SiC Schottky diodes significantly reduce heat generation and increase switching frequencies, thereby shrinking the physical size of power supplies. The increased switching speed inherent to SiC allows for smaller passive components, directly addressing the space constraints within increasingly dense server racks. Furthermore, in the emerging market of autonomous vehicles, AI systems require guaranteed, reliable power delivery under harsh environmental conditions, making the high temperature tolerance and reliability of SiC bare dies indispensable for safety-critical applications.

Consequently, market expectations are high for SiC bare die manufacturers to deliver products optimized specifically for 48V input bus architectures increasingly adopted in AI servers and data centers. The analysis suggests that AI adoption will not only increase the volume demand for SiC devices but also push the envelope regarding performance specifications, especially regarding high current density and thermal stability. This sustained, specialized demand confirms AI as a significant long-term growth driver, compelling suppliers to scale production and enhance quality control processes specific to the demands of Mission Critical Infrastructure.

- AI adoption in hyperscale data centers mandates ultra-high efficiency power supplies (greater than 96%), achievable primarily through SiC devices.

- Increased power density in AI servers drives the use of SiC bare dies in multi-phase power modules to minimize footprint and improve thermal dissipation.

- Autonomous vehicles utilize SiC bare dies for reliable power management units feeding sophisticated AI processing units, requiring high temperature and vibration tolerance.

- AI manufacturing optimization tools are being deployed by SiC bare die producers to improve yield rates and reduce material defects.

- The shift towards 48V DC distribution buses in data centers increases the need for high-voltage, high-current SiC bare diodes in DC-DC conversion stages.

DRO & Impact Forces Of SiC Schottky Diodes Bare Dies Market

The market dynamics for SiC Schottky Diodes Bare Dies are shaped by a complex interplay of strong drivers and critical restraints, moderated by emerging opportunities that define the market's long-term trajectory. The primary driver is the pervasive global mandate for energy conservation and carbon emission reduction, which inherently favors the superior efficiency offered by SiC components over silicon. This demand is further amplified by the burgeoning electric vehicle ecosystem and the necessity for fast-charging infrastructure, both requiring high power density and reliable switching elements. Simultaneously, restraints such as the persistently high manufacturing cost of SiC wafers, primarily due to complex crystal growth processes and relatively low current yield rates compared to silicon, pose significant short-term hurdles. Furthermore, the limited availability of high-quality, large-diameter SiC substrates creates supply chain bottlenecks, impacting the ability of manufacturers to quickly scale production to meet explosive demand, thus maintaining a cost premium.

Opportunities for market expansion are substantial, rooted in the aggressive adoption of wide bandgap materials across new sectors, including aerospace, defense, and high-reliability industrial controls. Specific opportunities arise from developing advanced hybrid modules (integrating SiC MOSFETs and diodes) that cater specifically to 1500V solar farm inverters and specialized pulsed power systems. Furthermore, the migration toward 8-inch SiC wafers represents a crucial opportunity for cost reduction and eventual price parity with high-end silicon devices, which will unlock new mass-market applications. Addressing the skill gap in designing SiC-based power systems and standardizing packaging formats are also key avenues for accelerating market acceptance and penetration.

The impact forces driving this market can be categorized as technological momentum and regulatory push. Technologically, the continuous improvement in epitaxial growth techniques and defect reduction directly impacts bare die quality and reliability, enhancing user confidence and accelerating adoption. Regulationally, mandates such as China's New Energy Vehicle (NEV) targets, European Union efficiency standards (e.g., Ecodesign directive), and various global renewable portfolio standards compel industries to utilize the most efficient power conversion technology available, cementing SiC bare dies as a necessary component rather than an optional upgrade. These forces collectively ensure sustained growth, even while navigating the challenges posed by high initial material costs and complex manufacturing requirements.

Segmentation Analysis

The SiC Schottky Diodes Bare Dies Market is comprehensively segmented based on parameters such as voltage range, end-use application, and specific product structure, allowing for precise market analysis and strategic targeting. The segmentation by voltage range is critical as it dictates the primary application scope, with 650V, 1200V, and 1700V devices covering the bulk of the market demand, ranging from consumer electronics power supplies to robust industrial and grid-tied systems. End-use segmentation clearly delineates the fastest-growing sectors, with automotive and energy leading due to fundamental shifts in global infrastructure and transportation technologies. The inherent reliability and efficiency benefits provided by the bare die format allow for superior performance customization within advanced power module constructions used in these high-stakes applications.

Analysis by specific product type often centers around the forward current rating, which directly correlates with the amount of power the bare die can handle, thereby defining its suitability for high-power modules versus low-power consumer integration. The dominance of the automotive sector is attributable not just to EV traction inverters, which require SiC MOSFETs, but also significantly to high-power on-board chargers (OBCs) and DC-DC converters, which rely heavily on SiC Schottky diodes for high-frequency rectification and boosting circuits. Conversely, the high-voltage (1700V and above) segment is crucial for specialized markets like high-voltage rail traction and renewable energy grid interfaces, where robust insulation and high breakdown voltage are paramount.

This structured segmentation provides clarity on where investment in manufacturing capacity and R&D should be focused. For instance, addressing the automotive demand requires stringent AEC-Q101 qualification processes for the bare dies, ensuring reliability over the vehicle's lifespan. The continuous technological push towards hybrid components and monolithic integration of SiC bare dies into complex power modules suggests a future segmentation based on module integration level (e.g., chip-on-board vs. fully encapsulated PIMs), driving further value creation up the supply chain. Understanding these segment dynamics is essential for market participants seeking competitive advantages through targeted product development and capacity expansion.

- By Voltage Range:

- 650V

- 1200V

- 1700V and Above

- By Current Rating:

- Low Current (0A - 10A)

- Medium Current (10A - 50A)

- High Current (50A and Above)

- By End-Use Application:

- Automotive (On-Board Chargers, DC-DC Converters, Fast Charging Stations)

- Energy and Power (Solar Inverters, Wind Converters, Grid Infrastructure)

- Industrial (Motor Drives, Uninterruptible Power Supplies (UPS), Welding Equipment)

- Consumer Electronics (High-Efficiency Power Supplies, Adapters)

- Telecommunications and Data Centers (Server Power Supplies, Telecom Rectifiers)

Value Chain Analysis For SiC Schottky Diodes Bare Dies Market

The value chain for SiC Schottky Diodes Bare Dies is complex and capital-intensive, starting with the synthesis of high-purity SiC powder and culminating in the assembly of final power electronic modules. The upstream segment is dominated by specialized crystal growth manufacturers responsible for producing SiC bulk substrates. This initial stage is the most technologically challenging and expensive, highly dependent on precise temperature control and defect management to create high-quality, large-diameter wafers (currently transitioning from 6-inch to 8-inch). Following substrate creation, epitaxy providers deposit a thin, precisely doped SiC epitaxial layer onto the substrate, which is crucial for the electrical performance and breakdown voltage characteristics of the final diode structure. Key players often vertically integrate these substrate and epitaxy steps to maintain quality control and secure supply.

The midstream of the value chain involves wafer fabrication, where semiconductor manufacturers utilize advanced lithography, etching, and metallization processes to create the bare dies (Schottky structure, passivation, and metal contacts). Due to the hardness of SiC, fabrication processes, including ion implantation and high-temperature annealing, require specialized and expensive equipment, further contributing to the cost structure. The output of this stage is the bare die, which is then shipped, often in waffle packs or on sticky film, to module manufacturers. Quality assurance, including burn-in testing and visual inspection of the bare die surface, is a critical step before shipment.

The downstream segment involves module assembly and the final integration into end-user systems. Distribution channels are typically dual-layered: Direct sales channels are utilized for large, strategic customers such as Tier 1 automotive suppliers or major energy infrastructure providers, enabling closer collaboration on design specifications and quality control. Indirect sales rely heavily on specialized electronic component distributors who manage inventory, logistics, and sales to smaller industrial and consumer electronics manufacturers. The final tier involves Original Equipment Manufacturers (OEMs) who integrate the packaged power modules into their finished products, whether they be EV chargers, solar inverters, or server power supplies. The increasing complexity of SiC power modules often necessitates strong technical support and application engineering expertise from the bare die provider throughout the downstream integration phase.

SiC Schottky Diodes Bare Dies Market Potential Customers

The potential customer base for SiC Schottky Diodes Bare Dies is highly diversified but centers primarily on industries requiring superior power efficiency, high switching frequency, and robust thermal performance. End-users are generally sophisticated manufacturers and integrators who possess the capability to utilize bare dies in advanced power module constructions rather than off-the-shelf discrete components. The automotive sector, specifically Tier 1 and Tier 2 suppliers involved in electrification components (e.g., Vitesco, Bosch, Denso), represent the largest and fastest-growing customer segment. These companies purchase bare dies for integration into traction inverters, auxiliary power systems, and high-power DC fast-charging infrastructure, often demanding high volumes and AEC-Q101 grade reliability.

The second major customer group is the Energy and Power sector, comprising manufacturers of utility-scale renewable energy converters (solar and wind) and developers of smart grid infrastructure. Companies like SMA Solar, Sungrow, and Vestas are increasingly using SiC bare dies in their high-voltage inverters (1500V systems) to maximize energy harvesting efficiency and reduce operational losses across large installations. Furthermore, manufacturers specializing in Uninterruptible Power Supplies (UPS) and industrial motor drives, such as ABB, Siemens, and Schneider Electric, form a core customer segment, seeking the reduced size and increased durability offered by SiC diodes in critical industrial controls where lifetime reliability is paramount.

Finally, the Telecommunications and Data Center industry constitutes a rapidly expanding customer segment. Leading hyperscale data center operators and power supply manufacturers (e.g., Delta Electronics, Lite-On Technology) require SiC bare dies to build highly efficient, compact server power supplies (PSUs). The competitive edge in this sector relies heavily on power efficiency (e.g., achieving Titanium or Platinum Plus standards), driving the mandated inclusion of SiC components. These customers are focused on high-density packaging solutions, making the small footprint and superior thermal characteristics of the bare die format highly attractive for optimizing rack space and minimizing cooling costs associated with massive server farms and 5G telecommunication infrastructure.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $850 Million USD |

| Market Forecast in 2033 | $2,780 Million USD |

| Growth Rate | 18.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Infineon Technologies AG, Wolfspeed (Cree), STMicroelectronics N.V., ROHM Co., Ltd., ON Semiconductor (onsemi), Mitsubishi Electric Corporation, Littelfuse, Inc., Microchip Technology Inc., Semikron Danfoss, Fuji Electric Co., Ltd., WeEn Semiconductors, Renesas Electronics Corporation, Nexperia, UnitedSiC (Qorvo), Allegro MicroSystems. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

SiC Schottky Diodes Bare Dies Market Key Technology Landscape

The foundational technology underpinning the SiC Schottky Diodes Bare Dies market is the superior material science of Silicon Carbide. Unlike Silicon, SiC possesses a bandgap of approximately 3.2 eV, nearly three times that of Si, which is the primary enabler for high breakdown voltage and low leakage current in the diodes. The core technological advancement in the manufacturing process revolves around the control of crystal growth, specifically the sublimation method (Lely method or variations thereof) used to create high-quality SiC boule. Minimizing crystal defects, particularly basal plane dislocations (BPDs) and micropipes, remains a persistent technological challenge, as these defects directly compromise the reliability and performance of the resultant bare die, especially under high-voltage stress. Efforts are continually directed toward achieving near-perfect 8-inch substrates, which is the necessary prerequisite for cost-effective mass production.

In terms of device architecture, the prevalent technology is the Junction Barrier Schottky (JBS) diode. The JBS structure integrates P-N junctions within the Schottky contact area. This design significantly improves the diode’s surge current handling capability and its robustness against electrical transients compared to simple Schottky diodes. The P-N junction serves to reduce the electric field crowding at the Schottky contact edge under high reverse bias, thereby increasing the effective breakdown voltage and enhancing ruggedness. Research is continuously focused on optimizing the spacing and depth of these implanted P-N regions and improving the quality of the metal-SiC interface to simultaneously reduce forward voltage drop (Vf) and maintain high reverse voltage stability, which is critical for maximizing system efficiency in high-power applications.

Furthermore, packaging and interconnect technologies are becoming increasingly critical even for bare dies, as the thermal efficiency of the entire system hinges on the die’s ability to transfer heat. Key technological trends include the development of advanced passivation layers to protect the bare die surface and edges from environmental contaminants and electrical breakdown. Sintering technologies (e.g., silver sintering) are replacing traditional solder for die attachment within power modules, offering superior thermal conductivity and higher operating temperature limits, allowing system designers to fully exploit the thermal advantages of SiC bare dies. These advancements ensure that the bare dies can operate reliably at junction temperatures exceeding 175°C, a key differentiator from silicon devices.

Regional Highlights

Asia Pacific (APAC): Dominating Manufacturing and Consumption

The Asia Pacific region currently holds the largest share and exhibits the highest growth potential in the SiC Schottky Diodes Bare Dies Market. This dominance is intrinsically linked to the region's position as the global hub for both electric vehicle manufacturing and renewable energy infrastructure deployment. China, in particular, drives immense volume demand due to its aggressive New Energy Vehicle (NEV) targets and extensive investments in utility-scale solar and wind projects. The sheer scale of consumer electronics and industrial manufacturing in countries like Japan, South Korea, and Taiwan also creates a substantial, underlying demand for efficient power supplies, utilizing SiC bare dies in adapters, telecom base stations, and industrial automation equipment. Local governments in APAC are actively supporting the development of domestic SiC supply chains, fostering competition and accelerating the transition to 8-inch wafer fabrication.

Japan remains a technological leader, housing several key players involved in SiC substrate development and wafer fabrication, focusing on high-reliability and high-voltage products essential for high-speed rail and utility grid applications. South Korea’s focus on advanced consumer and automotive electronics integration is also a key growth factor. The intense competition among regional EV battery and component suppliers compels them to adopt SiC technology rapidly to achieve superior performance and range, ensuring APAC maintains its lead in both production capacity and raw material consumption of SiC bare dies throughout the forecast period. The increasing establishment of hyperscale data centers across major cities further solidifies the need for high-efficiency power management solutions based on SiC.

- China: Highest volume demand driven by NEV production and extensive photovoltaic (PV) inverter manufacturing. Focus on achieving self-sufficiency in SiC substrates.

- Japan: Center for advanced SiC crystal growth technology and high-reliability product development for industrial and rail applications.

- South Korea: Strong adoption in consumer electronics power supplies and increasing utilization in domestic automotive component supply chains.

North America: Innovation and Data Center Deployment

North America is a pivotal region characterized by high technological innovation and significant investment in critical infrastructure, particularly data centers and electric grid modernization. The US government’s push for infrastructure renewal and domestic semiconductor manufacturing (e.g., the CHIPS Act) provides direct incentives for expanding SiC bare die fabrication capacity within the region. Demand is concentrated in specialized, high-value applications such as aerospace and defense, which require the extreme temperature tolerance and robust reliability inherent in SiC components. Furthermore, the region is home to major electric vehicle manufacturers and pioneers in fast-charging technology, who are continuously pushing the power limits, thereby necessitating SiC bare dies in their 800V system architectures.

The exponential growth of hyperscale data centers, driven by AI and cloud computing demands, is a primary factor stimulating demand for high-efficiency 48V server power supplies that incorporate SiC Schottky diodes. North American semiconductor companies are heavily invested in R&D aimed at overcoming the current limitations of SiC wafer cost and defectivity. This strategic focus ensures that, while manufacturing capacity might trail APAC, the region maintains a leading edge in developing next-generation SiC bare die structures and integration techniques. Moreover, the stringent power efficiency standards and utility regulations in states like California drive rapid technological adoption across commercial and residential energy management systems, including advanced battery energy storage solutions (BESS).

- United States: Strong demand from aerospace/defense sectors and hyperscale data centers; significant governmental support for domestic SiC manufacturing.

- Canada: Growing application in renewable energy storage systems and high-efficiency industrial motor controls.

- Focus on high-reliability applications and deployment of high-voltage SiC products (1200V and 1700V).

Europe: Regulatory Driven Electrification and Grid Modernization

Europe demonstrates substantial growth, primarily fueled by strict environmental regulations and aggressive targets for electrification of transport and energy grids. European automotive OEMs are global leaders in pushing high-voltage (800V) EV platforms, which dictates mandatory use of SiC in their power modules, creating a consistently high demand for bare dies used in inverters and OBCs. The European Green Deal and related initiatives heavily promote renewable energy integration, requiring advanced SiC converters and diodes for connection to the aging continental grid infrastructure. This regulatory environment acts as a constant, powerful driver for the adoption of high-efficiency semiconductor components.

The region benefits from a robust ecosystem of specialized power module manufacturers and industrial automation firms (Germany, Italy, and France) that integrate SiC bare dies into high-end manufacturing equipment, rail transport systems, and specialized medical power supplies. Investment is focused on creating stable, localized supply chains to reduce reliance on Asian manufacturers, particularly through collaborative research projects and industrial partnerships. The strong emphasis on quality and long-term reliability in European heavy industry ensures a sustained preference for premium, high-performance SiC Schottky bare dies, even at a higher initial cost compared to silicon alternatives. The region is particularly strong in the integration of 1200V and 1700V diodes for industrial motor drives and high-voltage power transmission applications.

- Germany/France: Key centers for automotive power electronics development and manufacturing, demanding stringent quality bare dies.

- Nordic Countries: High penetration of renewable energy necessitates robust SiC components for grid interfacing and energy storage.

- Strict EU efficiency mandates accelerate market transition away from legacy silicon devices across industrial and commercial sectors.

Latin America, Middle East, and Africa (MEA): Emerging Infrastructure Markets

The MEA and Latin America regions currently represent smaller but rapidly emerging markets for SiC Schottky Diodes Bare Dies, driven primarily by investments in critical infrastructure modernization and renewable energy capacity expansion. In the Middle East, large-scale solar power projects and the construction of smart cities, such as NEOM, necessitate state-of-the-art power electronics for stable energy conversion and transmission. The extremely high ambient temperatures in this region make the superior thermal characteristics of SiC components particularly advantageous, ensuring operational reliability where silicon devices might struggle with heat dissipation and derating.

Latin America's market growth is mainly driven by the expanding industrial sector, modernization of existing power grids, and slow but steady adoption of EVs in major metropolitan areas like Brazil and Mexico. The demand in these regions is typically funneled through international module manufacturers and distributors who supply localized system integrators. Key factors include the need for highly efficient power supplies to mitigate energy costs and reduce reliance on unstable grids, particularly in remote mining and industrial operations. As renewable energy projects (hydro, solar) mature across Brazil and Chile, the requirement for reliable, high-voltage SiC components in centralized converters will continue to grow, making this segment critical for future expansion.

- Middle East: High demand due to large-scale solar PV farm deployment and smart city development requiring high-temperature SiC reliability.

- Brazil/Mexico: Industrial automation and initial stages of EV charging infrastructure deployment drive demand for 650V and 1200V diodes.

- Growth is tied to utility-scale project financing and international supplier engagement.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the SiC Schottky Diodes Bare Dies Market.- Infineon Technologies AG

- Wolfspeed (Cree)

- STMicroelectronics N.V.

- ROHM Co., Ltd.

- ON Semiconductor (onsemi)

- Mitsubishi Electric Corporation

- Littelfuse, Inc.

- Microchip Technology Inc.

- Semikron Danfoss

- Fuji Electric Co., Ltd.

- WeEn Semiconductors

- Renesas Electronics Corporation

- Nexperia

- UnitedSiC (Qorvo)

- Allegro MicroSystems

- Sichuan Star Semiconductor Co., Ltd.

- GeneSiC Semiconductor (acquired by Littelfuse)

- Vishay Intertechnology, Inc.

- Hitachi Power Semiconductor Device, Ltd.

- BASF SE (SiC Precursors)

Frequently Asked Questions

Analyze common user questions about the SiC Schottky Diodes Bare Dies market and generate a concise list of summarized FAQs reflecting key topics and concerns.Why are SiC Schottky Diodes preferred over Silicon diodes in high-power applications?

SiC Schottky diodes offer significantly superior performance primarily due to SiC’s wide bandgap and high thermal conductivity. This results in minimal reverse recovery charge (Qrr), leading to drastically reduced switching losses, higher operating temperatures (up to 200°C), and the ability to operate at much higher switching frequencies, enabling smaller, lighter, and more efficient power systems compared to conventional silicon diodes.

What major technological advancement is expected to reduce the cost of SiC bare dies?

The primary technological advancement expected to drive down costs is the transition from 6-inch to 8-inch SiC wafer manufacturing. Larger wafers increase the number of bare dies produced per wafer run (die count yield), significantly reducing the material and processing cost per individual die. Improvements in crystal growth techniques to minimize defectivity are also crucial for yield and cost reduction.

Which voltage classes of SiC Schottky bare dies are dominating the current market demand?

The 650V and 1200V voltage classes currently dominate the market. The 650V class is essential for high-efficiency power factor correction (PFC) in data center power supplies and consumer EV on-board chargers (OBCs). The 1200V class is critical for applications involving higher DC bus voltages, such as industrial motor drives, utility-scale solar inverters, and high-power EV fast-charging stations.

How does the bare die format benefit Electric Vehicle (EV) power module manufacturers?

The bare die format allows EV power module manufacturers to create highly customized, densely packed power integrated modules (PIMs) or multi-chip modules (MCMs). Using bare dies enables superior thermal management through specialized packaging (like silver sintering) and minimizes parasitic inductance, which is vital for maximizing the switching performance and power density of traction inverters and charging systems.

What are the main supply chain constraints affecting the SiC bare dies market?

The main constraints stem from the limited global supply of high-quality SiC substrates. SiC crystal growth is challenging, slow, and expensive, resulting in limited availability of high-diameter, low-defect wafers. This bottleneck in the upstream segment restricts the overall production capacity of SiC bare dies, contributing to price volatility and long lead times for module assemblers.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager