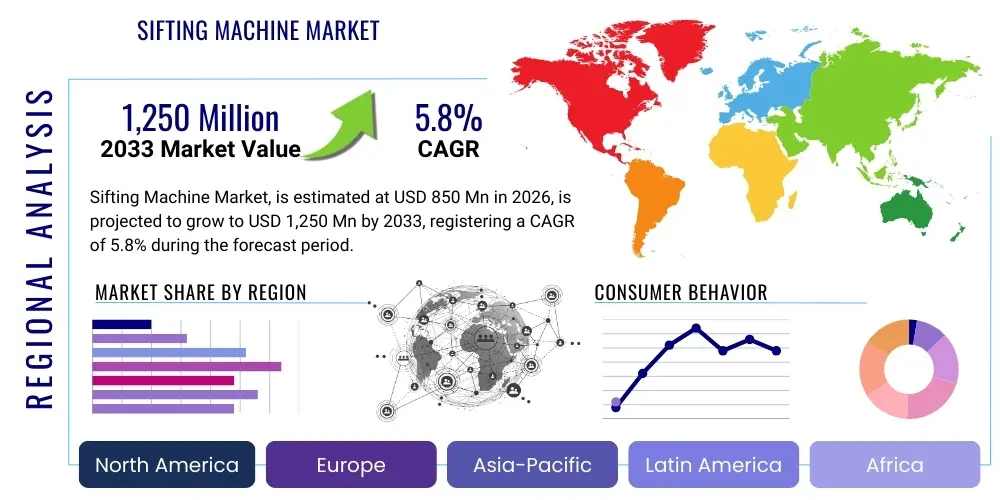

Sifting Machine Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436959 | Date : Dec, 2025 | Pages : 253 | Region : Global | Publisher : MRU

Sifting Machine Market Size

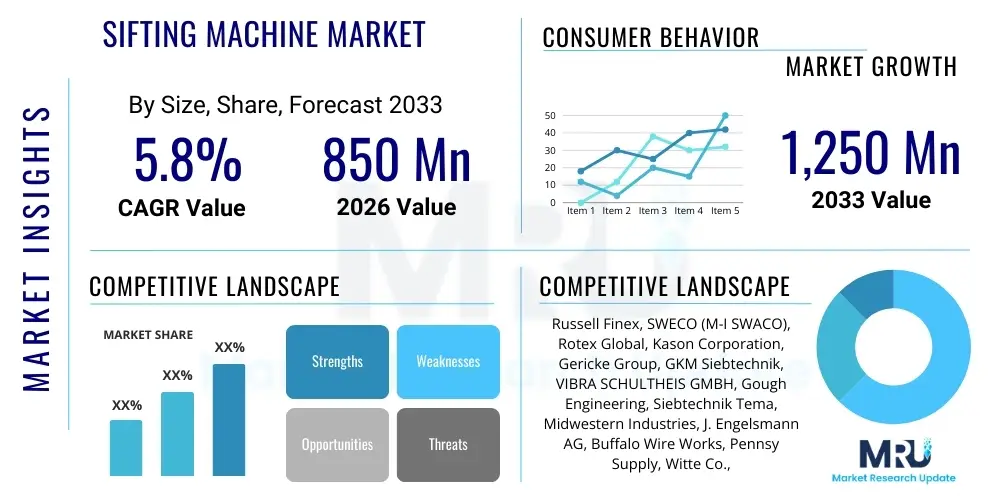

The Sifting Machine Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 850 Million in 2026 and is projected to reach USD 1,250 Million by the end of the forecast period in 2033. This substantial growth is fundamentally driven by the escalating demand for stringent quality control measures across process industries, particularly pharmaceuticals and food processing, where particle size consistency and contamination prevention are paramount regulatory requirements. The continuous adoption of automated processing lines in emerging economies further strengthens this trajectory, positioning the sifting machinery segment as a critical investment area for manufacturers focused on high purity standards and operational efficiency.

Sifting Machine Market introduction

The Sifting Machine Market encompasses industrial equipment designed for separating, classifying, and purifying powders, granules, and slurries based on particle size distribution. These machines, often utilizing mechanical vibration, gyratory motion, or centrifugal force, are essential tools in numerous process industries where the consistency and quality of raw materials or final products are critical performance indicators. Product offerings range from small laboratory-scale sifters to high-capacity industrial separators capable of handling tons of material per hour, catering to diverse throughput and precision requirements. Key manufacturers are continually innovating in mesh materials, cleaning systems, and dust containment to meet rigorous regulatory compliance standards, especially concerning hygiene and explosion safety in hazardous environments.

Major applications for sifting machines include de-agglomeration of bulk solids, quality assurance screening before packaging, foreign material removal (scalping), and fine particle classification (grading). The benefits derived from implementing advanced sifting technology are manifold, primarily encompassing enhanced product quality through particle uniformity, reduced production losses due to efficient material recovery, and compliance with increasingly strict global safety and hygiene standards, such as those imposed by the FDA and GMP guidelines. Furthermore, the efficiency gains associated with minimizing manual quality checks and improving processing speed contribute significantly to lower overall operating costs for manufacturing facilities globally.

Driving factors propelling market expansion are centered around the rapid globalization of the food and pharmaceutical supply chains, necessitating standardized processing equipment. The rise in consumer demand for high-quality, contaminate-free final products places direct pressure on manufacturers to invest in reliable separation technology. Technological advancements, such as ultrasonic de-blinding systems and magnetic separators integrated into sifting lines, are further enhancing efficiency, reducing maintenance downtime, and expanding the application scope of these machines, thereby sustaining robust market growth.

Sifting Machine Market Executive Summary

The global Sifting Machine Market demonstrates a robust growth trajectory, primarily fueled by stringent regulatory frameworks demanding high purity and quality control in sectors like pharmaceuticals, chemicals, and specialized foods. Key business trends include the shift towards high-throughput, sanitary-design equipment optimized for rapid cleaning and minimizing cross-contamination, reflecting increasing investment in automation across established and emerging industrial hubs. Manufacturers are focusing on modular designs and incorporating sensor technology to enable predictive maintenance and real-time particle analysis, enhancing operational efficiency and reliability in continuous processing environments.

Regionally, Asia Pacific is anticipated to exhibit the fastest growth, largely driven by massive investments in infrastructure development, rapid industrialization, and the establishment of numerous pharmaceutical and food processing plants, particularly in India and China. North America and Europe, characterized by highly mature industrial bases, will continue to dominate in terms of market value, focusing primarily on the adoption of high-precision, automated sieving technology to optimize existing facilities and meet stringent safety standards. The trend toward adopting Industry 4.0 principles, integrating sifters into interconnected factory networks, is a major regional driver in developed economies, supporting data-driven quality management.

Segment trends reveal that the Gyratory Sifters segment, offering high efficiency and gentle handling, remains dominant in high-value industries like pharmaceuticals. Concurrently, the increasing demand for continuous operation sifting machines over traditional batch processes reflects the broader industry movement towards high volume, uninterrupted production cycles. The Food & Beverage sector remains the largest end-user, but the Pharmaceutical sector is growing at the highest CAGR, propelled by the complex requirements of fine chemical and active pharmaceutical ingredient (API) processing, demanding superior separation accuracy and hygienic compliance.

AI Impact Analysis on Sifting Machine Market

User inquiries regarding AI's influence on the Sifting Machine Market frequently center on automation levels, predictive maintenance capabilities, and enhanced quality assurance through data analysis. Users are keenly interested in whether AI can interpret complex sieving data to optimize mesh selection and vibration frequency autonomously, thereby minimizing material wastage and maximizing throughput. Common concerns revolve around the cost of integration, the cybersecurity of connected sifting systems, and the reliability of AI algorithms in interpreting anomalies in complex material mixtures, such as those found in chemical or mineral processing. The overarching expectation is that AI will transform sifters from simple mechanical separators into intelligent, self-regulating quality control stations integrated seamlessly into the factory's digital ecosystem, providing unprecedented levels of operational precision and preemptive failure detection.

- AI-driven Predictive Maintenance: Analyzing vibrational patterns and motor current to anticipate equipment failure, minimizing unplanned downtime and optimizing maintenance schedules.

- Real-time Process Optimization: Utilizing machine learning algorithms to adjust sifting parameters (e.g., amplitude, frequency, duration) automatically based on material characteristics and ambient conditions to maintain consistent particle separation efficiency.

- Enhanced Quality Control: AI vision systems integrated with sifters for instantaneous detection and rejection of foreign matter or off-spec particles that bypass mechanical separation.

- Automated Recipe Management: Learning optimal sifting profiles for hundreds of different product formulations, allowing quick, error-free changeovers between production batches.

- Supply Chain Resilience: Predicting the impact of variations in raw material quality on sifting performance and proactively adjusting machine settings to maintain output consistency.

DRO & Impact Forces Of Sifting Machine Market

The Sifting Machine Market dynamics are shaped by a complex interplay of Drivers, Restraints, and Opportunities, collectively forming the core Impact Forces. The primary driver is the accelerating focus on product purity across global manufacturing sectors, necessitating advanced screening technologies to remove contaminants and ensure uniform particle size distributions, vital for pharmaceutical dosage consistency and texture quality in food products. This driver is powerfully reinforced by global regulatory bodies increasing enforcement of Good Manufacturing Practice (GMP) standards, especially concerning material handling and processing equipment design, thereby mandating investment in high-standard, often automated, sifters.

However, the market faces significant restraints, chiefly the high initial capital investment required for specialized, high-capacity hygienic sifting equipment, particularly those utilizing ultrasonic or magnetic separation features. Furthermore, the specialized nature of sifting media (meshes and screens) and the need for frequent replacement due to wear and tear contribute to higher operational expenditure, posing a constraint, particularly for smaller and mid-sized enterprises (SMEs) operating on tighter budgets. Technical challenges related to the handling of difficult-to-sieve materials, such as sticky, abrasive, or extremely fine powders that cause screen blinding, also limit immediate adoption in certain specialized industrial applications.

The major opportunities lie in the adoption of smart manufacturing (Industry 4.0) technologies, allowing sifters to be integrated into centralized control systems for continuous monitoring and data analytics, enhancing overall equipment effectiveness (OEE). Expanding applications in emerging sectors, such as additive manufacturing (3D printing) which requires ultra-fine, highly consistent powder feedstock, represent new high-growth niches. The drive for sustainable manufacturing also offers opportunities, as advanced sifters can improve material recovery rates and reduce waste. These combined forces ensure a sustained, albeit competitive, growth environment for manufacturers prioritizing technology and compliance.

Segmentation Analysis

The Sifting Machine Market is broadly segmented based on Type, Operation, End-User Industry, and Material Processed, reflecting the diverse application landscape across global manufacturing. Understanding these segmentations is critical for market players to tailor their product offerings and strategic focus areas. For instance, the distinction between machine types (e.g., Vibrating vs. Gyratory) directly relates to the application's required precision and throughput capacity, with gyratory models often favored for precise grading in high-value powders, while vibrating models excel in high-capacity scalping applications. The complexity of material handling across different industries necessitates specialized designs, leading to a fragmented but highly specialized market structure. The rise of continuous operation models underscores the industry's shift towards maximizing uptime and integrating separation processes seamlessly into large-scale production lines.

The segmentation by End-User Industry is perhaps the most defining characteristic of the market, as regulatory requirements and material properties vary drastically. The Pharmaceutical segment, for example, demands stainless steel, cGMP-compliant designs with minimal crevices to prevent bacterial growth and cross-contamination, often requiring ultrasonic screen cleaning technology. Conversely, the Mining and Mineral processing sector prioritizes robustness, large capacities, and resistance to highly abrasive materials. This variance drives innovation in materials science and machine construction. Furthermore, the segmentation by Material Processed (powder, granules, slurries) dictates the fundamental engineering approach, whether optimizing for dry classification or dewatering applications, thereby influencing the adoption rates of different machine types globally.

This detailed segmentation structure not only helps in calculating addressable market sizes but also guides R&D efforts. As manufacturing processes become more complex—demanding tighter tolerances for particle size uniformity—the focus within segmentation shifts towards hybrid machines capable of handling multiple tasks or integrating additional technologies (like magnetic separation or de-blinding) to meet multifaceted process requirements. The evolution of specialized segments, such as those catering to metal powders for advanced manufacturing, indicates future growth areas characterized by high complexity and premium pricing structures, driving the overall market value upwards over the forecast period.

- By Type:

- Vibrating Sifters (Linear, Circular)

- Gyratory Sifters

- Centrifugal Sifters (Centrifugal Screeners)

- Tumbler Screeners

- Specialty Sifters (Ultrasonic Assisted)

- By Operation:

- Batch Operation

- Continuous Operation

- By End-User Industry:

- Food & Beverage Processing

- Pharmaceuticals and Nutraceuticals

- Chemicals and Petrochemicals

- Plastics and Rubber

- Mining and Minerals

- Pulp and Paper

- Cosmetics and Personal Care

- By Material Processed:

- Dry Powders and Granules

- Slurries and Liquids

Value Chain Analysis For Sifting Machine Market

The value chain for the Sifting Machine Market begins with upstream activities focused on raw material procurement, encompassing high-grade stainless steel (304, 316L) for hygienic construction, specialized synthetic rubber and elastomeric components for seals and suspensions, and high-precision woven wire mesh or perforated plate for the screens. Key upstream dynamics involve ensuring stable supply chains for these materials, especially high-quality, corrosion-resistant metals essential for regulatory compliance in sensitive industries. Manufacturers often maintain strong, long-term relationships with specialized mesh suppliers, as screen quality directly impacts the sifter’s performance and lifespan. Innovation at this stage focuses on developing advanced screen materials, such as self-cleaning or anti-blinding coatings, which provide competitive advantages further down the chain.

Mid-stream activities involve the design, engineering, and assembly of the sifting machinery. This phase is capital and technology intensive, requiring specialized expertise in mechanical engineering, vibration analysis, and control systems integration. Companies differentiate themselves through patented sifting motions, modular designs, and integration capabilities (e.g., integrating sifters with upstream feeders or downstream packaging lines). The shift towards automation and compliance mandates rigorous testing and certification (e.g., ATEX for explosion safety, 3-A Sanitary Standards for food). Distribution channels are critical, typically involving a dual approach: direct sales teams handling major clients with custom requirements, and an indirect network of specialized industrial distributors or authorized agents handling installation, maintenance, and spare parts supply for smaller, standardized units. This indirect channel is vital for penetration into geographically dispersed emerging markets.

Downstream analysis focuses on installation, commissioning, maintenance, and after-sales service, which contribute significantly to the total cost of ownership and customer loyalty. The end-users, such as pharmaceutical manufacturers or large-scale food processors, require highly reliable service contracts and rapid access to replacement screens and parts to minimize costly production downtime. The move toward digital service models, utilizing IoT and remote diagnostics, is rapidly transforming the downstream segment, enhancing predictive maintenance capabilities. The overall value addition is highest in the engineering and after-sales service stages, as performance optimization and regulatory adherence are paramount concerns for the final buyers.

Sifting Machine Market Potential Customers

Potential customers, or end-users, for sifting machines span virtually every industry involved in processing dry bulk solids or liquid slurries where particle size or purity is a key quality metric. The largest volume buyers include major multinational food conglomerates requiring high-capacity scalping sifters for flour, sugar, and spices, as well as large-scale pharmaceutical manufacturers utilizing high-containment, precision sifters for critical active pharmaceutical ingredients (APIs) and excipients. These industries drive the demand for cGMP-compliant, stainless steel machinery designed for easy dismantling and sterilization. Material handling consultants and engineering firms that design and build complete processing plants also represent critical intermediaries influencing equipment purchasing decisions.

Beyond these primary sectors, the chemical industry utilizes robust sifters for fertilizers, pigments, and specialty chemicals, often requiring equipment rated for hazardous (Ex-rated) environments. The mining and minerals sector, although focusing on different scale and material properties, depends on heavy-duty vibratory screens for processing ores, sand, and aggregates. Emerging customers include businesses operating in specialized, high-growth niche markets, notably those involved in producing fine metal powders for aerospace and medical 3D printing applications, demanding ultra-high purity sifting capabilities. The core purchasing decision across all segments is anchored on reliability, efficiency, adherence to industry-specific hygiene and safety standards, and the manufacturer’s capability to provide robust after-sales support and spare parts availability throughout the equipment’s operational lifespan.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 850 Million |

| Market Forecast in 2033 | USD 1,250 Million |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Russell Finex, SWECO (M-I SWACO), Rotex Global, Kason Corporation, Gericke Group, GKM Siebtechnik, VIBRA SCHULTHEIS GMBH, Gough Engineering, Siebtechnik Tema, Midwestern Industries, J. Engelsmann AG, Buffalo Wire Works, Pennsy Supply, Witte Co., NetterVibration, Hosokawa Micron, Retsch GmbH, Allgaier Process Technology, AZO, and Sefar AG. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Sifting Machine Market Key Technology Landscape

The Sifting Machine Market is currently undergoing a significant technological evolution, moving beyond simple mechanical separation towards highly integrated, intelligent processing units. A key technological advancement is the widespread adoption of ultrasonic screening technology, which applies high-frequency vibration directly to the screen mesh. This innovation effectively breaks down surface tension and prevents 'blinding' or clogging of fine mesh screens, allowing manufacturers to process extremely fine, sticky, or electrostatically charged powders with higher efficiency and significantly increased throughput, particularly critical in pharmaceutical and cosmetic production where particle size often dictates product efficacy and texture. Furthermore, hygienic design technology (Easy-Clean, cGMP-compliant construction) is no longer a niche requirement but a mandatory standard across food and pharma, necessitating tool-free dismantling and smooth, crevice-free stainless steel surfaces to facilitate rapid validation and cleaning cycles, thereby minimizing microbial contamination risks.

Another major pillar of the current technology landscape is the integration of digital capabilities, aligning sifting equipment with the principles of Industry 4.0. Modern sifters are increasingly equipped with embedded sensors—accelerometers, temperature sensors, and pressure transducers—that collect real-time data on machine health, material flow, and separation performance. This data is fed into central control systems or cloud platforms, enabling real-time monitoring, remote diagnostics, and the implementation of predictive maintenance protocols that dramatically reduce unscheduled downtime. This connectivity allows for dynamic adjustment of operational parameters, such as adjusting vibrational amplitude based on fluctuations in material moisture content or feed rate, ensuring optimal separation consistency regardless of minor upstream variations, thus maximizing the overall equipment effectiveness (OEE) across the production line.

In terms of mechanical innovation, high-efficiency gyratory sifters and tumbler screeners continue to gain traction due to their ability to provide precise, multi-deck separation with a gentle motion that preserves the integrity of fragile materials, such as specific food granules or specialized chemical crystals. Additionally, advanced dust containment and vacuum-transfer systems are being integrated directly into the sifter unit designs to ensure operator safety and compliance with strict environmental regulations regarding airborne particulate matter. Manufacturers are also experimenting with proprietary hybrid motion technologies that combine elements of vibration, gyration, and horizontal throw to achieve optimal separation across a wider range of challenging materials, enhancing flexibility and reducing the total footprint required for processing diverse product portfolios.

Regional Highlights

- Asia Pacific (APAC): APAC is projected to be the fastest-growing region, driven primarily by extensive infrastructure development and the rapid expansion of the manufacturing sector, particularly in China, India, and Southeast Asian countries. The region is seeing massive investment in new food processing, bulk chemical plants, and pharmaceutical manufacturing facilities to cater to both local consumption and global export markets. The increasing adoption of Western quality standards and the rising middle-class consumer base demanding packaged, high-quality food and generic medicines necessitate significant investment in high-throughput and quality control machinery, including advanced sifters. The competitive cost environment in countries like China encourages domestic manufacturing innovation focused on reliable, mid-range sifting solutions.

- North America: North America holds a substantial share of the market value, characterized by mature, highly automated industries, particularly pharmaceuticals, nutraceuticals, and high-value specialty chemicals. The regional focus is heavily tilted towards high-precision, sanitary, and fully automated sifting systems that comply with stringent FDA regulations and possess full traceability capabilities. Growth here is primarily driven by the replacement of older machinery with state-of-the-art, IoT-enabled sifters that integrate seamlessly into existing digital factory ecosystems, supporting continuous manufacturing paradigms and driving operational efficiency gains through data-driven performance monitoring and predictive maintenance strategies.

- Europe: Europe is a key market, distinguished by its high regulatory complexity, demanding robust compliance with European Union food safety and ATEX (explosion protection) directives. Countries like Germany, Switzerland, and Italy are hubs for advanced sifting machine manufacturing, exporting specialized, high-quality equipment globally. The market growth is sustained by strong demand from the pharmaceutical sector and the ongoing necessity for modernizing chemical processing plants to meet sustainability and energy efficiency targets. European end-users prioritize customized solutions and specialized materials engineering to handle complex, specialized chemical and fine powder materials with maximum yield and safety.

- Latin America (LATAM): The LATAM region presents moderate growth potential, influenced by fluctuating economic conditions but underpinned by expanding agricultural and commodity processing industries (e.g., sugar, coffee, mining). The market demand focuses on cost-effective, durable, and easily maintainable sifting solutions suitable for high-volume basic processing. As industrialization progresses, particularly in Brazil and Mexico, there is a gradual shift towards adopting higher-quality sanitary standards, slowly increasing the demand for automated, hygienic equipment, especially in the growing processed food and beverages sector catering to urban populations.

- Middle East and Africa (MEA): The MEA market is developing, with growth concentrated in oil and gas processing (requiring specialized separation for drilling materials) and the increasing domestic production of processed foods and pharmaceuticals, reducing reliance on imports. Investments, often government-backed, are focusing on building modern industrial complexes, driving initial procurement of standardized sifting machinery. The primary challenge remains the harsh operating environments (high temperatures, dust), requiring robust machine construction, leading manufacturers to supply heavy-duty, reliable vibratory sifters adapted for these challenging conditions, particularly in mineral rich countries in Africa and large industrial zones in the Gulf Cooperation Council (GCC) states.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Sifting Machine Market.- Russell Finex

- SWECO (M-I SWACO)

- Rotex Global

- Kason Corporation

- Gericke Group

- GKM Siebtechnik

- VIBRA SCHULTHEIS GMBH

- Gough Engineering

- Siebtechnik Tema

- Midwestern Industries

- J. Engelsmann AG

- Buffalo Wire Works

- Pennsy Supply

- Witte Co.

- NetterVibration

- Hosokawa Micron

- Retsch GmbH

- Allgaier Process Technology

- AZO

- Sefar AG

Frequently Asked Questions

Analyze common user questions about the Sifting Machine market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the high adoption rate of sifting machines in the pharmaceutical industry?

The primary factor is the stringent regulatory requirement for ensuring absolute product purity and precise particle size distribution (PSD) for Active Pharmaceutical Ingredients (APIs) and excipients, which directly impacts drug efficacy, bioavailability, and tablet consistency. Pharmaceutical sifters must meet cGMP standards, requiring hygienic stainless steel construction (316L), tool-free disassembly for validation and cleaning, and often integrating ultrasonic systems to achieve high-efficiency separation of extremely fine powders without contamination or screen blinding, making quality control the paramount driver for investment.

How do gyratory sifters differ functionally from traditional vibrating sifters, and where are they typically preferred?

Gyratory sifters utilize a low-intensity, three-dimensional, circular motion, combined with a vertical component, which keeps the material flowing gently across the screen surface, whereas vibrating sifters use high-frequency, intense agitation. Gyratory systems are preferred in applications requiring high efficiency, gentle handling, and precise grading (classification) of fragile, abrasive, or irregularly shaped materials, especially in high-value industries like specialty chemicals, cereal processing, and pharmaceuticals, where particle degradation must be minimized while maintaining high throughput.

What are the main constraints limiting market growth, particularly for small and medium-sized enterprises (SMEs)?

The main constraints include the substantial initial capital investment required for high-grade, automated sifting machines, especially those complying with international hygienic and safety standards (like ATEX or 3-A Sanitary). Additionally, the operational expenditure related to frequent replacement of specialized, high-precision screen meshes, coupled with the requirement for skilled technicians to maintain and validate complex machinery, often presents a financial and technical barrier to entry or modernization for SMEs with limited resources and highly varied production needs.

What role does Industry 4.0 integration play in modern sifting machine technology and overall operational efficiency?

Industry 4.0 integration transforms sifting machines into smart assets by incorporating IoT sensors for real-time data collection (vibration, temperature, flow). This connectivity enables predictive maintenance by detecting anomalies before they cause failure, optimizing sifting parameters autonomously through machine learning to ensure consistent product quality, and providing full data traceability essential for audits and compliance, ultimately maximizing Overall Equipment Effectiveness (OEE) and minimizing costly manual intervention or unplanned production halts in automated facilities.

Which geographical region is expected to demonstrate the highest Compound Annual Growth Rate (CAGR) and what factors are fueling this acceleration?

Asia Pacific (APAC) is projected to exhibit the highest CAGR due to rapid industrialization, massive government and private investments in pharmaceutical and food processing infrastructure across countries like India, China, and Vietnam, and a fundamental shift towards standardized, regulated manufacturing practices. The accelerating urbanization and rising consumer demand for high-quality, packaged, and safe products are compelling regional manufacturers to invest in modern, high-capacity sifting equipment to improve quality control and meet escalating domestic and international export standards, thus driving unparalleled demand growth across the forecast period.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager