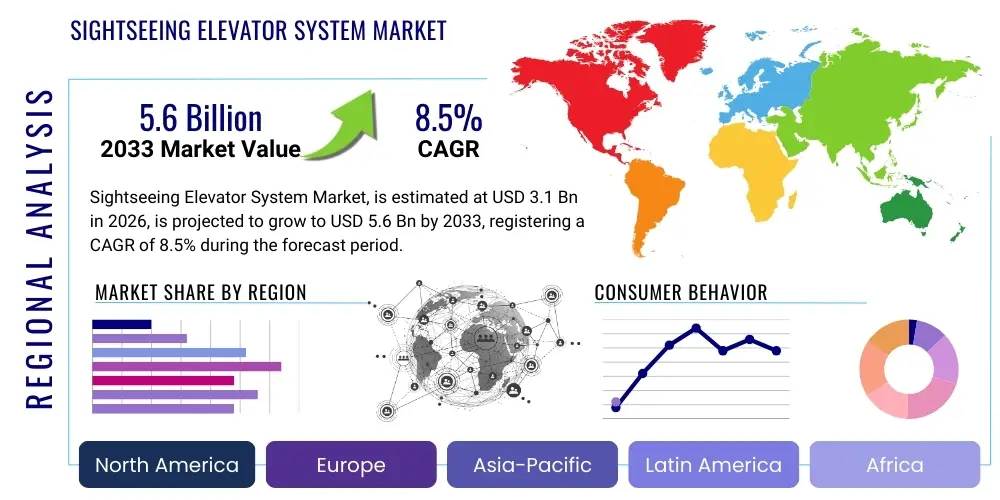

Sightseeing Elevator System Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437471 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Sightseeing Elevator System Market Size

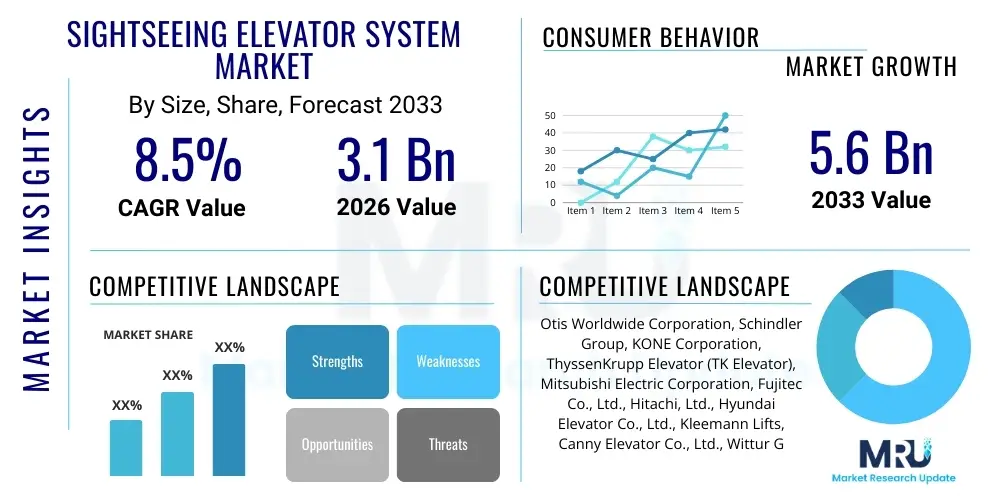

The Sightseeing Elevator System Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at USD 3.1 Billion in 2026 and is projected to reach USD 5.6 Billion by the end of the forecast period in 2033. This growth trajectory is fundamentally driven by the escalating demand for modern, visually appealing infrastructure in urban centers globally, particularly within the commercial real estate and hospitality sectors. The integration of advanced safety features, energy-efficient operations, and aesthetically pleasing designs is redefining vertical transportation, positioning sightseeing elevators as essential architectural components rather than mere utility devices. Market expansion is further fueled by rapid urbanization in developing economies and substantial investments in smart city projects that prioritize both functionality and aesthetic appeal in public and private spaces.

Sightseeing Elevator System Market introduction

The Sightseeing Elevator System Market encompasses the design, manufacturing, installation, and maintenance of vertical transportation units characterized by transparent or semi-transparent cabs and hoistways, specifically engineered to provide passengers with external views during ascent or descent. These systems, often referred to as panoramic or capsule elevators, are deployed primarily in locations where the visual journey is a critical part of the user experience, such as high-rise observation decks, shopping malls, luxury hotels, corporate headquarters, and architectural landmarks. The core product incorporates high-strength glass or polycarbonate materials, sophisticated traction or hydraulic mechanisms, and custom cab designs, ensuring maximum visibility, safety, and operational efficiency while complementing the surrounding architectural environment. Functionally, these elevators serve the essential purpose of vertical movement, but their primary market value lies in their ability to enhance the building's aesthetic appeal and visitor engagement.

Major applications for sightseeing elevators span across several key industry verticals. In the hospitality sector, they are crucial for luxury hotels and resorts, offering guests unique views that significantly elevate the perceived value of the accommodation. Commercial applications include large shopping complexes and entertainment centers, where these elevators serve both functional transportation needs and act as visual focal points, guiding customer flow and improving the overall retail experience. Furthermore, infrastructure projects, such as airports, transit hubs, and public viewing towers, increasingly incorporate these systems to manage high passenger volumes efficiently while offering memorable visual experiences. The increasing global emphasis on developing iconic, experience-driven architectural projects directly correlates with the rising deployment of these specialized elevator systems across metropolitan areas.

The market benefits from several strong driving factors, including the global construction boom, particularly in Asia Pacific and the Middle East, focusing on premium commercial and residential developments. These elevators offer enhanced user experience, contributing significantly to a building’s architectural distinction and marketability. Key benefits include improved daylighting in central building areas, superior aesthetic value, and psychological advantages for occupants, reducing feelings of claustrophobia often associated with standard enclosed lifts. Technological advancements in materials, such as laminated safety glass and robust operational controls, further underpin market growth by ensuring high safety standards and reliable long-term performance, making them increasingly viable for installation in diverse and challenging environments. Furthermore, regulatory frameworks promoting accessibility and safety standards compel existing buildings to consider modernizing their current transportation systems with highly visible and secure alternatives.

Sightseeing Elevator System Market Executive Summary

The Sightseeing Elevator System Market is experiencing robust expansion, driven primarily by evolving architectural trends prioritizing experiential design and structural transparency in commercial and residential high-rise projects. Business trends indicate a strong move toward customization and integration of smart technologies, such as IoT-enabled predictive maintenance systems and personalized cabin experiences, which significantly enhance operational efficiency and user satisfaction. Leading manufacturers are focusing on lightweight, energy-efficient designs, leveraging advanced materials like carbon fiber reinforced polymers and specialized safety glass to reduce installation complexity and overall energy consumption. Competition remains fierce, with companies differentiating themselves through superior design aesthetics, rapid deployment capabilities, and comprehensive after-sales service packages, particularly in highly saturated urban markets where maintenance contracts represent a significant revenue stream.

Regional trends highlight the Asia Pacific (APAC) region as the dominant market shareholder, attributed to unprecedented levels of investment in large-scale commercial complexes, entertainment hubs, and tourism infrastructure, especially in nations like China, India, and Southeast Asian economies. North America and Europe, characterized by high adoption rates of advanced technology and stringent safety standards, emphasize modernization projects and retrofitting existing structures with sleek, energy-efficient sightseeing elevators. The Middle East and Africa (MEA) region is emerging as a critical growth engine, propelled by massive luxury construction projects related to tourism and economic diversification initiatives, demanding premium, bespoke elevator solutions that contribute to iconic architectural profiles. This geographic diversity mandates tailored market strategies focusing on local regulatory compliance and specific aesthetic preferences.

Segment trends reveal that the Traction Sightseeing Elevator segment, particularly those utilizing Machine Room-Less (MRL) technology, maintains a commanding lead due to superior energy efficiency, smoother ride quality, and space-saving advantages compared to hydraulic counterparts. In terms of design, the fully Panoramic Glass category dominates, favored for offering unobstructed 360-degree views, crucial for maximizing the sightseeing experience in landmark buildings. Application analysis shows that the Hospitality sector (hotels, resorts, observation towers) exhibits the highest growth rate, followed closely by Commercial Buildings (malls, offices), reflecting the increasing importance of visitor experience and architectural appeal in these competitive environments. Furthermore, the rising demand for retrofit solutions in older buildings seeking aesthetic and functional upgrades is a notable segment driver.

AI Impact Analysis on Sightseeing Elevator System Market

Analysis of common user questions regarding AI's impact on the Sightseeing Elevator System Market reveals key themes centered around safety, predictive maintenance, and personalized passenger experiences. Users frequently inquire about how AI can detect potential mechanical failures before they occur, enhancing system uptime and reducing catastrophic risks. There is also significant curiosity about AI-driven traffic management systems that optimize elevator dispatching based on real-time passenger flow, minimizing wait times and maximizing energy efficiency in complex high-rise structures. Furthermore, users are keen to understand how AI algorithms can personalize the sightseeing experience, adjusting cabin lighting, music, and multimedia content based on recognized passenger profiles or current viewing conditions. The central expectation is that AI will transform these systems from reactive mechanical devices into highly autonomous, safety-focused, and seamlessly personalized smart platforms.

The deployment of Artificial Intelligence is poised to revolutionize the operational and maintenance landscape of sightseeing elevator systems. AI-powered sensor arrays collect vast amounts of data regarding motor performance, door cycles, vibration patterns, and passenger movement. Machine learning algorithms process this data to identify subtle anomalies indicative of wear and tear, enabling true predictive maintenance rather than scheduled preventative checks. This transition minimizes unexpected downtime, a critical factor for high-traffic tourist attractions and commercial centers, and significantly extends the operational lifespan of expensive mechanical components. Furthermore, AI contributes to environmental sustainability by optimizing power consumption based on historical usage patterns and real-time demand forecasting, reducing the elevator system’s overall carbon footprint while maintaining high service levels.

Beyond operational efficiency, AI is enhancing the core sightseeing experience. Computer vision systems integrated into the cab can identify points of interest as the elevator moves, displaying augmented reality overlays or providing relevant audio narration, turning the ride into an immersive educational or entertainment experience. In terms of safety, AI algorithms can instantly detect and respond to security threats, such as overcrowding or unauthorized access, by communicating directly with building management systems. This integration of smart data processing transforms the conventional glass box into a sophisticated, interconnected node within a smart building ecosystem, offering unparalleled levels of safety, efficiency, and customized user interaction, thereby significantly improving the return on investment for building owners.

- AI enhances predictive maintenance by analyzing vibration and performance data, forecasting component failure, and drastically reducing unplanned downtime.

- Intelligent traffic control systems utilize real-time passenger demand and flow algorithms to optimize elevator allocation and reduce average wait times.

- Computer vision and sensor fusion technologies improve safety by monitoring cabin occupancy, detecting anomalies, and preventing unauthorized use or misuse.

- Personalized user experiences are enabled through AI, adjusting ambient settings, multimedia content, and destination suggestions based on user recognition or current environmental conditions.

- Energy consumption is optimized through machine learning models that predict traffic patterns and adjust system standby and operational modes accordingly.

DRO & Impact Forces Of Sightseeing Elevator System Market

The Sightseeing Elevator System Market is influenced by a dynamic interplay of Drivers, Restraints, and Opportunities (DRO), collectively shaping the competitive landscape and growth trajectory. The primary drivers include the exponential growth in the global tourism and hospitality industry, which heavily relies on unique, memorable guest experiences. Simultaneously, architectural innovation, characterized by a preference for transparent facades and aesthetically integrated vertical transportation in modern high-rise construction, fuels demand. Restraints predominantly revolve around the high initial installation cost associated with complex custom designs, specialized safety glass requirements, and the need for rigorous structural engineering assessments. Furthermore, maintenance costs for these specialized systems tend to be higher than standard elevators due to the complexity of the integrated electronic, structural, and aesthetic components, posing a challenge for budget-sensitive projects. Collectively, these forces push manufacturers toward developing modular, cost-efficient, yet equally stunning panoramic solutions.

Opportunities for market expansion are significant, particularly in the realm of modernization and retrofitting existing commercial and historical structures. Older buildings globally are seeking aesthetic and functional upgrades to remain competitive, often turning to state-of-the-art sightseeing elevators to rejuvenate their appeal without extensive structural overhauls. Furthermore, the development of sustainable and green building technologies presents a substantial opportunity. Manufacturers investing in high-efficiency motors, regenerative drives, and smart operational controls that minimize energy consumption will gain a competitive advantage, appealing to environmentally conscious developers and government mandates for sustainable infrastructure. The burgeoning development of smart cities also opens pathways for integrated elevator systems that communicate seamlessly with broader Building Management Systems (BMS).

The impact forces within this market are primarily influenced by regulatory standards, technological advancements, and economic cycles. Stringent global safety standards (such as EN 81 series and ASME A17.1) necessitate continuous innovation in design, particularly regarding glass integrity, fire resistance, and seismic resilience, acting as a high entry barrier but ensuring quality. Economic downturns, however, can swiftly restrain growth by postponing large-scale commercial construction projects which are the primary consumers of these systems. The key impact force remains technological disruption, where advancements in materials science (lighter, stronger glass alternatives) and software (AI-driven optimization) consistently reshape product performance expectations, compelling all market participants to prioritize Research and Development investment to maintain relevance and competitive differentiation in a rapidly evolving architectural landscape.

Segmentation Analysis

The Sightseeing Elevator System Market is comprehensively segmented based on Type, Design, and Application, providing a clear framework for understanding market dynamics and specific growth areas. Segmentation by Type focuses on the core mechanical drive system, distinguishing between traditional Hydraulic, high-performance Traction, and the highly efficient Machine Room-Less (MRL) technologies. Segmentation by Design differentiates based on the visibility provided and structural enclosure, separating fully Panoramic/Glass cabs from semi-enclosed structures. Application segmentation highlights the primary end-user sectors, including the high-growth Hospitality sector, large-volume Commercial Buildings, and specialized Infrastructure projects. This structured approach allows manufacturers to target specific technological and aesthetic requirements unique to each market segment, optimizing product development and deployment strategies to maximize market penetration across diverse geographical and architectural contexts.

- By Type:

- Hydraulic Sightseeing Elevators

- Traction Sightseeing Elevators (Geared and Gearless)

- Machine Room-less (MRL) Sightseeing Elevators

- By Design:

- Fully Panoramic/Glass Cabs (360-degree viewing)

- Semi-Enclosed Cabs (Partial visibility)

- Capsule/Customized Design Elevators

- By Application:

- Commercial Buildings (Shopping Malls, Office Towers)

- Hospitality Sector (Hotels, Resorts, Observation Decks)

- Residential High-Rise Buildings

- Infrastructure & Public Sector (Airports, Stations, Museums)

Value Chain Analysis For Sightseeing Elevator System Market

The Value Chain for the Sightseeing Elevator System Market commences with Upstream Activities, primarily involving the procurement and processing of specialized raw materials. Key inputs include high-strength, multi-layered laminated safety glass (often requiring specific solar control and structural properties), steel alloys for the structure and guide rails, advanced electronic components for control panels, and specialized motor and drive systems. Suppliers in this phase are subject to stringent quality control and certification requirements, particularly concerning materials that bear load and ensure passenger safety. The focus at this stage is on sourcing materials that offer durability, minimal maintenance, and compliance with seismic and fire resistance standards, driving manufacturers to establish robust relationships with certified, high-quality material providers globally to mitigate supply chain risks and ensure product integrity.

Midstream activities involve the core manufacturing and assembly processes. This stage is dominated by major Original Equipment Manufacturers (OEMs) who design, engineer, and fabricate the customized elevator components, including the cab structure, counterweight systems, traction machines, and sophisticated control systems. Given the bespoke nature of sightseeing elevators—each installation often tailored to a unique shaft shape and building aesthetic—engineering and design customization capabilities are critical differentiators. After manufacturing, the systems proceed to installation, a highly specialized activity requiring certified technicians due to the complexity of integrating the hoistway structure, guide rails, and panoramic components securely into the building’s existing or new infrastructure. Quality control and performance testing during installation are paramount to meet operational safety regulations.

Downstream activities include distribution, sales, and crucial post-installation services. Distribution channels are typically a mix of Direct Sales (for large, complex projects managed directly by major OEMs) and indirect channels utilizing authorized distributors or local agents who manage sales and localized support in specific regional markets. The critical long-term revenue stream lies in maintenance and repair services (M&R). Given the mechanical complexity and the high visibility of these systems, prompt and reliable maintenance is essential. OEMs often offer extensive service contracts, utilizing IoT and predictive maintenance tools to ensure maximum uptime. The relationship with end-users, such as commercial property developers and facility managers, dictates success in this downstream segment, emphasizing the need for comprehensive service networks and rapid response capabilities globally.

Sightseeing Elevator System Market Potential Customers

The primary End-Users or Buyers of Sightseeing Elevator Systems are diverse yet share a common need for high-quality, aesthetically superior vertical transportation solutions that enhance the structural appeal and user experience of their properties. The most significant customer base resides within the Commercial Real Estate Development sector, specifically developers of Class A office towers, large-scale mixed-use developments, and expansive urban shopping malls. These customers utilize sightseeing elevators not just for transportation efficiency but strategically, as key architectural features designed to attract foot traffic, increase property value, and create memorable visitor interactions, thereby justifying the higher investment cost associated with these systems.

Another dominant customer group is the Hospitality and Leisure Industry, including luxury hotel chains, integrated resorts, and owners/operators of major tourist attractions like observation decks, viewing towers, and specialized museums. For these entities, the elevator ride itself is often marketed as a premium experience. Custom-designed capsule or panoramic elevators offer guests unparalleled views, contributing directly to the perceived luxury and unique selling proposition of the property. The purchasing decisions in this sector are heavily weighted toward design originality, reliability, and the ability to operate safely under high-volume passenger loads typical of tourist sites.

Furthermore, government and public infrastructure bodies constitute a growing customer segment. This includes authorities managing large-scale public transit hubs (airports, railway stations), governmental administrative buildings, and urban renewal projects. These entities seek durable, high-capacity, and visually open elevators that align with modern accessibility standards while enhancing the overall appearance of public spaces. Although budget constraints can be a factor, the long-term benefit of robust, appealing public infrastructure drives adoption. The decision-making process here often involves rigorous tendering based on compliance with safety regulations, longevity, and overall lifecycle cost analysis, favoring proven systems with established safety records.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 3.1 Billion |

| Market Forecast in 2033 | USD 5.6 Billion |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Otis Worldwide Corporation, Schindler Group, KONE Corporation, ThyssenKrupp Elevator (TK Elevator), Mitsubishi Electric Corporation, Fujitec Co., Ltd., Hitachi, Ltd., Hyundai Elevator Co., Ltd., Kleemann Lifts, Canny Elevator Co., Ltd., Wittur Group, Eito Elevator Co., Ltd., Ningbo Xinda Group Co., Ltd., Shanghai Mitsubishi Elevator Co., Ltd., Glarie Elevator Co., Ltd., Omega Elevators, Stannah Lifts Holdings Ltd., Cibes Lift Group AB, AOYAMA Elevator Global Ltd., Fahrion GmbH. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Sightseeing Elevator System Market Key Technology Landscape

The Sightseeing Elevator System Market is defined by the application of sophisticated technologies focused on maximizing safety, aesthetic appeal, and operational efficiency. A core technological aspect is the evolution of drive systems, specifically the widespread adoption of Gearless Traction and Machine Room-Less (MRL) technology. Gearless machines utilize Permanent Magnet Synchronous Motors (PMSM), which offer superior energy efficiency, reduced noise and vibration, and require significantly less space compared to traditional geared or hydraulic systems. MRL systems, in particular, allow the machinery to be housed within the hoistway, freeing up valuable roof space and simplifying architectural integration, making them ideal for buildings where aesthetic purity and space optimization are critical objectives. This shift towards MRL technology is a major driver in new construction, offering a high-performance solution without compromising the building's top structure.

Material science and specialized engineering are equally critical components of the technology landscape. The utilization of advanced laminated and tempered safety glass is fundamental, often incorporating features like low-emissivity (Low-E) coatings to control heat transfer, electrochromic smart glass that can dynamically adjust tinting based on sunlight intensity, and specialized structures designed for enhanced seismic resistance. Furthermore, the development of composite materials for cab construction helps reduce the overall weight of the elevator assembly, minimizing the load on the motor and increasing energy efficiency. Manufacturers are also heavily investing in control technology, utilizing advanced microprocessors and proprietary control algorithms to manage complex traffic patterns, ensuring smooth acceleration and deceleration, critical for a pleasant passenger experience in high-speed applications.

The rise of Internet of Things (IoT) connectivity and integrated sensors represents a paradigm shift in system management. Sightseeing elevators are increasingly equipped with extensive sensor networks that monitor everything from door movements and rope tension to environmental factors inside the cab. This connectivity facilitates real-time data transmission to centralized monitoring platforms, supporting condition-based and predictive maintenance models. Software technologies, including sophisticated destination control systems (DCS) and mobile application integration for personalized call features, are transforming the user interface, optimizing passenger flow in high-density areas. These integrated digital technologies ensure the elevators operate at peak efficiency and safety, while simultaneously offering seamless integration with broader smart building management ecosystems, a core requirement for modern infrastructure projects globally.

Regional Highlights

Regional dynamics significantly influence the Sightseeing Elevator System Market, with growth patterns tied to construction activity, tourism investment, and regulatory standards. Asia Pacific (APAC) stands out as the largest and fastest-growing market, primarily fueled by massive infrastructure development, rapid urbanization, and a flourishing hospitality sector. Countries such as China, India, and the UAE are investing heavily in iconic skyscrapers, integrated resorts, and vast commercial complexes, where panoramic elevators are essential components of architectural design. The demand here is centered on high-speed, high-capacity systems that can handle dense urban traffic while providing premium aesthetic value. Economic growth and rising disposable incomes driving domestic and international tourism further solidify APAC’s dominance.

North America and Europe represent mature markets characterized by stringent safety regulations and a strong focus on modernization and technological adoption. In these regions, the growth is less about new large-scale construction and more about replacing or upgrading existing elevator infrastructure in commercial and historic buildings. Developers prioritize energy efficiency, adherence to complex accessibility laws, and the seamless integration of smart technologies (like AI traffic optimization). European markets, particularly Germany and France, emphasize sustainable building practices, creating a high demand for advanced Machine Room-Less (MRL) systems with regenerative drives. North America sees continued strong demand from the entertainment and retail sectors seeking experiential design elements.

The Middle East and Africa (MEA), particularly the GCC states (Saudi Arabia, UAE, Qatar), constitute a high-value growth region driven by government initiatives to diversify economies away from oil and toward tourism and global commerce. Mega-projects, including EXPOs and entirely new smart cities, create immense demand for bespoke, luxury sightseeing elevators that often push the boundaries of design and engineering complexity. Latin America demonstrates steady growth, concentrating on urban centers undergoing significant commercial development, where the need for visually appealing vertical transport solutions in new office parks and luxury residential complexes is increasing. Manufacturers must tailor their offerings to address the unique climatic and seismic considerations present in these diverse geographical areas, ranging from extreme heat in the Middle East to seismic activity in parts of Latin America.

- Asia Pacific (APAC): Dominates the market due to accelerated urbanization, major investment in tourism infrastructure, and massive high-rise construction projects, particularly in China and India.

- North America: Focuses on modernization, technological upgrades (AI integration), and catering to strict safety and accessibility standards in commercial and retail environments.

- Europe: Characterized by high demand for energy-efficient MRL systems and retrofitting solutions for historic and aging commercial properties, driven by sustainability mandates.

- Middle East & Africa (MEA): High-growth market segment driven by luxury construction and governmental investment in iconic architectural and tourist development projects requiring custom, premium solutions.

- Latin America: Emerging growth spurred by new commercial and mixed-use real estate development in major metropolitan hubs, prioritizing cost-effective yet aesthetically pleasing vertical transport.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Sightseeing Elevator System Market.- Otis Worldwide Corporation

- Schindler Group

- KONE Corporation

- ThyssenKrupp Elevator (TK Elevator)

- Mitsubishi Electric Corporation

- Fujitec Co., Ltd.

- Hitachi, Ltd.

- Hyundai Elevator Co., Ltd.

- Kleemann Lifts

- Canny Elevator Co., Ltd.

- Wittur Group

- Eito Elevator Co., Ltd.

- Ningbo Xinda Group Co., Ltd.

- Shanghai Mitsubishi Elevator Co., Ltd.

- Glarie Elevator Co., Ltd.

- Omega Elevators

- Stannah Lifts Holdings Ltd.

- Cibes Lift Group AB

- AOYAMA Elevator Global Ltd.

- Fahrion GmbH

Frequently Asked Questions

Analyze common user questions about the Sightseeing Elevator System market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary safety considerations for panoramic glass elevators?

The primary safety considerations center on the structural integrity of the glass materials, utilizing high-strength, multi-layered laminated safety glass resistant to impact and seismic forces. Furthermore, systems must include robust emergency braking, fire resistance compliance, and rigorous adherence to international standards like EN 81 and ASME A17.1 to ensure passenger protection and structural resilience under all operating conditions.

How does Machine Room-Less (MRL) technology benefit sightseeing elevator installations?

MRL technology benefits sightseeing installations by eliminating the need for a dedicated machine room above the hoistway, saving significant architectural space and reducing construction complexity. MRL systems, utilizing compact gearless motors, offer superior energy efficiency, quieter operation, and smooth ride quality, making them ideal for integration into architecturally sensitive areas where aesthetic minimalism is required.

Which application segment shows the highest growth potential for sightseeing elevators?

The Hospitality sector, encompassing luxury hotels, integrated resorts, and tourist observation decks, shows the highest growth potential. This is driven by the global focus on experiential tourism, where panoramic elevators serve as premium architectural features enhancing guest experience, contributing directly to the property's unique market appeal and perceived luxury value.

What role does AI play in optimizing sightseeing elevator performance?

AI plays a crucial role in optimizing performance through predictive maintenance and intelligent traffic control. AI algorithms analyze real-time operational data (vibration, usage patterns) to predict failures before they occur, maximizing system uptime. They also manage elevator dispatching based on passenger flow and destination demands, significantly reducing wait times and optimizing energy consumption.

What are the key differences between hydraulic and traction sightseeing elevators?

Hydraulic elevators are typically used for low-rise applications (2-4 stops) due to their slower speed and high power consumption, although they offer excellent ride stability. Traction systems, particularly gearless and MRL types, are preferred for high-rise sightseeing applications as they offer higher speeds, superior energy efficiency, smoother operation, and greater capacity, making them suitable for commercial and hospitality towers.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager