Sign Films and Reflective Sheeting Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432064 | Date : Dec, 2025 | Pages : 248 | Region : Global | Publisher : MRU

Sign Films and Reflective Sheeting Market Size

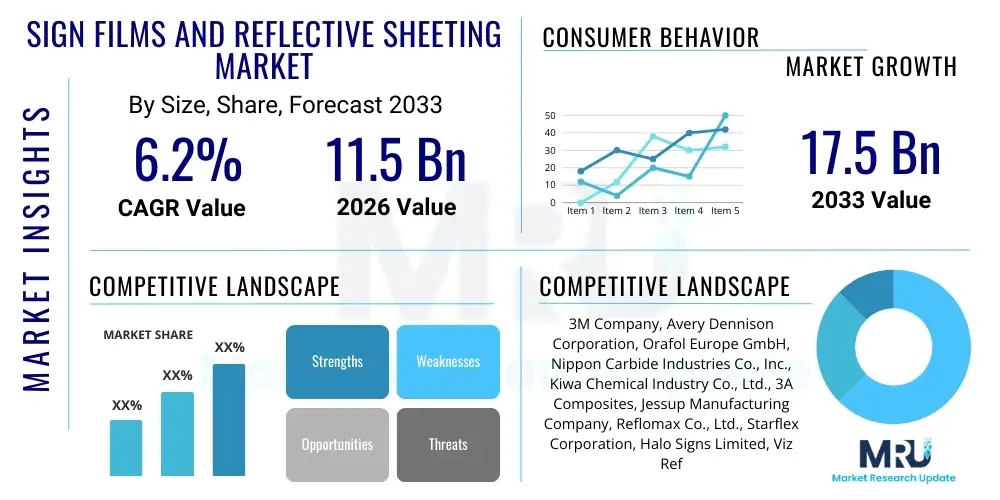

The Sign Films and Reflective Sheeting Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.2% between 2026 and 2033. The market is estimated at USD 11.5 billion in 2026 and is projected to reach USD 17.5 billion by the end of the forecast period in 2033.

Sign Films and Reflective Sheeting Market introduction

The Sign Films and Reflective Sheeting Market encompasses highly specialized polymer-based materials used predominantly for visual communication, safety marking, and vehicular conspicuity. Sign films, generally referring to non-reflective vinyl or cast films, are crucial for advertising, wayfinding, and decorative purposes, offering durability and excellent color fidelity under various environmental conditions. Reflective sheeting, conversely, utilizes advanced technologies like glass beads or microprisms embedded within the film structure to retroreflect light back to the source, significantly enhancing nighttime visibility and safety. These films are engineered to meet stringent regulatory standards, particularly in traffic control and public safety applications.

The core product applications span a wide spectrum, including highway signage, vehicle graphics, license plates, construction zone markers, safety apparel, and promotional displays. The increasing global focus on road safety, coupled with governmental mandates enforcing the use of high-intensity reflective materials on roads and commercial vehicles, serves as a primary driver for market expansion. Furthermore, the rapid growth of the advertising and architectural sectors demanding high-quality, weather-resistant graphic solutions fuels the demand for sign films. The materials offer benefits such as ease of application, long service life, resistance to UV degradation, and flexibility for use on contoured surfaces.

Major driving factors include massive governmental investments in infrastructure development, particularly in emerging economies where road networks are expanding and modernizing. The technological advancements in material science, leading to the development of durable, sustainable, and easily printable films (such as solvent-free and non-PVC options), also contribute significantly to market growth. The ongoing shift toward digital printing technologies requires specialized film surfaces that can handle high-resolution imagery while maintaining adhesive strength and weather resistance, thereby continuously evolving the product landscape.

Sign Films and Reflective Sheeting Market Executive Summary

The Sign Films and Reflective Sheeting Market is experiencing robust expansion driven by mandatory safety regulations and significant infrastructural spending globally. Business trends indicate a strong move toward high-performance, long-lasting products, particularly those utilizing microprismatic technology, which offers superior reflectivity compared to traditional glass-bead sheeting. Key manufacturers are focusing heavily on integrating sustainability into their product lines, developing non-PVC and biodegradable films to meet growing environmental mandates and consumer preferences. Consolidations and strategic partnerships aimed at securing raw material supply chains and expanding geographical footprint into high-growth regions like Asia Pacific are prevalent among industry leaders. Furthermore, the convergence of digital printing technology with specialized film coatings is opening new avenues for customized, short-run sign production, shifting the business model towards greater flexibility and responsiveness.

Regionally, Asia Pacific (APAC) stands out as the fastest-growing market, propelled by rapid urbanization, extensive highway construction projects in countries like China and India, and increasing adherence to international safety standards. North America and Europe, representing mature markets, maintain strong demand, primarily driven by maintenance, replacement cycles, and continuous updates to vehicle and road safety legislation requiring higher grades of reflective materials. Political stability and economic growth directly correlate with infrastructural investment, making these regions pivotal for high-end product adoption. Latin America and the Middle East & Africa are showing promising potential, particularly as oil-rich nations and developing economies invest heavily in tourism infrastructure and maritime safety signaling.

In terms of segmentation, the Reflective Sheeting segment dominates the market by value, primarily due to its non-negotiable role in traffic safety and the associated premium pricing of high-intensity materials (ASTM Type IX, XI). Within the application segment, Traffic Control and Safety remains the largest consumer, dictated by regulatory requirements for road markers, traffic signs, and pedestrian visibility aids. However, the Advertising and Promotional segment is witnessing the highest growth rate, fueled by the adoption of large-format digital printing and the demand for dynamic, visually impactful graphic films for vehicle wraps and storefront displays. The shift from permanent signage towards temporary, customizable media further accelerates the adoption of various polymeric film types, ensuring market diversity and resilience across different economic cycles.

AI Impact Analysis on Sign Films and Reflective Sheeting Market

User queries regarding the impact of Artificial Intelligence (AI) on the Sign Films and Reflective Sheeting Market frequently center on themes such as automated material inspection, predictive maintenance of signage infrastructure, optimization of film production processes, and AI-driven design personalization. Users are keenly interested in how AI can enhance the quality control of reflective materials, ensuring compliance with strict retroreflectivity standards without human bias. Another major area of inquiry involves the deployment of Computer Vision and AI algorithms to monitor the degradation of existing road signage, facilitating timely replacement and thus improving public safety efficiency. Concerns also revolve around how AI can optimize inventory and production scheduling, especially in a market characterized by thousands of SKUs covering various colors, reflectivity grades, and adhesive types. Users expect AI to reduce waste, accelerate new product development, and create highly targeted marketing campaigns based on urban traffic flow data analysis.

The immediate influence of AI is observable in manufacturing efficiency and quality assurance. AI-powered vision systems are being integrated into coating and lamination lines to detect minute material defects, inconsistencies in adhesive application, or variances in microprismatic structure instantly, dramatically reducing scrap rates and ensuring product batch consistency. This precision is critical for high-end reflective films used in aviation and traffic control where failure is unacceptable. Furthermore, AI models are optimizing the chemical composition and curing processes of adhesives and coatings, leading to faster production cycles and improved material durability against environmental stressors like extreme UV exposure or chemical washes.

Beyond manufacturing, AI is revolutionizing the application and utility of these materials. Predictive analytics, utilizing AI, can forecast the maintenance needs of road infrastructure, determining exactly when and where reflective sheeting must be replaced based on weather patterns, traffic volume, and known degradation rates of specific materials used in an area. This shifts infrastructure management from reactive to proactive, ensuring optimal safety performance. In the advertising sector, AI is influencing dynamic signage design and placement, analyzing audience behavior and generating optimized graphic layouts that maximize visual impact, which subsequently drives demand for specific high-performance digital printing films.

- AI-driven Quality Control: Enhanced defect detection in reflective sheeting using machine vision, ensuring strict retroreflectivity compliance.

- Predictive Infrastructure Maintenance: AI algorithms analyze environmental and traffic data to forecast sign degradation and schedule timely replacement.

- Optimized Production Scheduling: Machine learning models improve manufacturing throughput, minimizing material waste and energy consumption.

- Advanced Adhesive Formulation: AI assists in rapid R&D for novel adhesive systems offering superior bond strength and low VOC profiles.

- Automated Design and Personalization: AI tools generate region-specific or context-aware sign designs, increasing demand for customizable digital films.

- Supply Chain Resilience: AI predicts raw material price volatility and optimizes inventory levels for specialized polymers and pigments.

DRO & Impact Forces Of Sign Films and Reflective Sheeting Market

The Sign Films and Reflective Sheeting Market is profoundly shaped by a confluence of regulatory enforcement, technological innovation, and volatile raw material pricing. Key drivers include stringent governmental regulations concerning road safety, particularly the enforcement of retroreflective standards for commercial vehicles and public infrastructure signage globally, which guarantees constant replacement and upgrade cycles. Simultaneously, the persistent volatility in the price of key raw materials, specifically petrochemical derivatives like PVC resins, PET, and specialized polymers used in microprismatic technology, acts as a significant restraint, challenging manufacturers' profit margins and forcing continuous supply chain diversification efforts. Opportunities, however, lie in the rapid proliferation of smart city initiatives, which require advanced, high-visibility, and often sensor-compatible reflective films for smart road markers and autonomous vehicle communication systems. These impact forces necessitate strategic adaptation, compelling market players to invest heavily in vertically integrated supply chains and sustainable material alternatives to mitigate risks and capitalize on long-term safety mandates.

Drivers: The primary driver is the non-discretionary nature of safety requirements. Global mandates from bodies like ASTM (American Society for Testing and Materials) and UNECE (United Nations Economic Commission for Europe) stipulate minimum reflectivity levels for signs, often necessitating the replacement of older, lower-grade materials with modern high-intensity (Type VIII, IX, or XI) sheeting. Furthermore, the massive global infrastructure push, especially in high-growth regions like APAC and MEA, requires millions of kilometers of new roads and associated signage systems. The continuous need for fleet modernization and vehicle conspicuity markings, driven by insurance requirements and safety consciousness, also provides a consistent demand floor for reflective films. Technological improvements that increase the material’s lifespan and visual performance reduce maintenance frequency but simultaneously increase the initial value proposition.

Restraints: The market faces substantial resistance from the fluctuating costs and limited availability of crucial raw materials, particularly plastics and specialized resins needed for film substrates and protective topcoats. Price instability creates uncertainty in long-term contract pricing and material procurement. Another significant restraint is the environmental impact associated with PVC-based films, historically the most common material. Growing regulatory pressure to phase out PVC due to disposal issues and harmful chemical components forces manufacturers into costly transitions toward environmentally friendlier alternatives, which may currently be less cost-effective or lack the performance track record of traditional materials. Furthermore, the market is highly fragmented in the lower-grade film segment, leading to intense price competition and margin erosion.

Opportunities: Opportunities are significant in three main areas: sustainability, digital integration, and emerging applications. The shift towards non-PVC, bio-based, and recyclable films presents a chance for manufacturers to differentiate their products and capture premium pricing from environmentally conscious buyers. The integration of films with emerging technologies, such as those compatible with sensors or capable of interacting with autonomous vehicles (through specific color spectrums or embedded RFID/NFC tags), opens entirely new high-value application areas within the mobility sector. Geographically, untapped potential in rural road networks in developing countries, where safety standards are just beginning to be enforced, offers substantial long-term volume growth. The market can also capitalize on the growing demand for specialty architectural films used for internal decoration and energy-saving window applications.

Impact Forces: The overarching impact force is the regulatory environment; legislative changes concerning reflectivity standards (e.g., mandating diamond grade sheeting) instantly invalidate millions of existing signs, creating enormous replacement cycles. Economic cycles impact discretionary spending on advertising signage, making the promotional segment sensitive to recessions, while the safety segment remains relatively resilient. Technological parity is also an impact force; once a competitor achieves a breakthrough in microprismatic design or adhesive durability, it forces others to rapidly innovate or face obsolescence. Finally, consumer awareness regarding environmental responsibility is forcing a shift in manufacturing methodologies, favoring companies that can demonstrate a closed-loop or sustainable product life cycle.

Segmentation Analysis

The Sign Films and Reflective Sheeting Market is fundamentally segmented based on product type (differentiating between retroreflective and standard sign films), raw material composition (polymer type), application area (traffic, advertising, personal safety), and technology employed (glass bead, microprismatic). This granular segmentation is essential for understanding the varying demand drivers and regulatory requirements across end-use industries. Reflective sheeting, driven primarily by government infrastructure and road safety mandates, commands higher prices due to the complex optical engineering required. Conversely, non-reflective sign films, utilized extensively in general advertising, are highly competitive and volume-driven, relying heavily on cost-effective production and vibrant digital printing compatibility. The market dynamics show a clear trend toward high-performance films, irrespective of whether they are reflective or non-reflective, emphasizing durability, superior adhesion, and environmental compliance.

Segmentation by product technology reveals a major shift toward microprismatic technology. Although initially more expensive than traditional enclosed lens (glass bead) systems, microprismatic films offer significantly higher brightness and angularity performance, crucial for meeting modern safety standards and enhancing visibility for older drivers and in adverse weather conditions. Manufacturers are continually innovating to reduce the cost of producing these sophisticated materials through faster casting and lamination techniques. Furthermore, the raw material segmentation highlights the ongoing transition away from commodity PVC films towards high-performance alternatives like Polyethylene Terephthalate (PET) and Polyurethane (PU), driven by environmental regulations and the need for greater conformability and resilience in demanding applications such as vehicle wraps.

The application segmentation clearly indicates that the Traffic Control and Safety segment remains the cornerstone of the market, generating the most stable and regulated demand. This includes signage for highways, temporary construction zones, and mandated vehicle markings. However, the high-growth potential lies within the Commercial and Advertising sector, spurred by retail growth and the increasing sophistication of vehicle fleet branding, which requires extensive use of both reflective (for night safety) and non-reflective (for daytime graphics) films. Customization, ease of application, and print quality are the critical purchasing criteria within this dynamic segment, driving demand for specialized cast vinyl films and printable reflective materials.

- By Product Type:

- Reflective Sheeting (Microprismatic, Glass Bead, High-Intensity Prismatic, Diamond Grade)

- Non-Reflective Films (Cast Films, Calendered Films, Specialty Films)

- By Material:

- Polyvinyl Chloride (PVC)

- Polyethylene Terephthalate (PET)

- Acrylic

- Polyurethane (PU)

- Other Resins and Polymers

- By Application:

- Traffic Control & Safety (Road Signs, Construction Zones, License Plates)

- Advertising & Commercial Graphics (Vehicle Wraps, Billboards, Window Graphics)

- Personal Safety & Apparel (Safety Vests, Reflective Clothing)

- Automotive & Transportation (Rail, Marine, Aircraft Markings)

- By End-use Industry:

- Government & Infrastructure

- Construction

- Retail & Commercial

- Transportation

Value Chain Analysis For Sign Films and Reflective Sheeting Market

The value chain for Sign Films and Reflective Sheeting is complex, starting with the sourcing of specialized chemical inputs and extending through highly technical manufacturing processes, conversion, distribution, and final installation by application professionals. The upstream segment is dominated by petrochemical giants and chemical companies providing essential raw materials, including specialized polymer resins (PVC, PET, acrylic), pigments, advanced adhesives, and optical components (glass beads or prismatic film molds). The cost and quality of these inputs significantly dictate the final product's performance and margin structure. Manufacturers in this segment often face vulnerability due to volatile crude oil prices and the limited number of suppliers capable of producing high-grade, optically clear polymers required for top-tier reflective materials. Vertical integration or establishing long-term sourcing contracts are common strategies used by large film manufacturers to mitigate upstream risks.

The midstream involves the core manufacturing process, where raw polymer resins are converted into finished films through techniques like calendering or casting, followed by highly specialized processes such as adhesive coating, lamination, and the embedding of reflective elements (either microprisms or glass beads). Conversion is a crucial stage, where large film rolls are cut, printed using digital or screen methods, and shaped according to customer specifications. Major manufacturers like 3M and Avery Dennison invest heavily in proprietary manufacturing intellectual property, specifically related to prismatic molding and advanced weather-resistant coatings, to maintain competitive differentiation. The efficiency and precision of this stage determine the films' retroreflectivity performance and long-term durability, directly impacting regulatory compliance.

The downstream distribution channels are typically segmented into direct sales to large governmental bodies (e.g., highway authorities) for regulated safety products, and indirect sales through a network of specialized distributors, sign makers, large format printers, and certified installers for commercial and advertising applications. Direct channels ensure quality control and adherence to tender specifications for safety-critical products. Conversely, indirect channels rely on the technical expertise of distributors and sign shops, who often provide value-added services like cutting, plotting, and complex installation. The effectiveness of this downstream network, particularly the certified installer base, is paramount, as improper installation can negate the product's lifespan and performance. The trend is moving towards manufacturers offering more comprehensive training and certification programs to maintain high service standards across the indirect distribution network.

Sign Films and Reflective Sheeting Market Potential Customers

Potential customers for Sign Films and Reflective Sheeting span multiple sectors, fundamentally categorized by their need for visibility, safety compliance, or commercial branding. The largest and most stable group consists of government and municipal transportation authorities, including state and federal highway agencies, local traffic departments, and public works organizations. These entities are the primary buyers of high-grade reflective sheeting (e.g., ASTM Type IV through XI) used for permanent road signs, work zone delineation, and critical safety markings, driven purely by non-negotiable regulatory requirements and cyclical infrastructure maintenance budgets. Their purchasing decisions are highly influenced by product performance specifications, long-term warranties, and compliance certifications.

A rapidly expanding customer base is the commercial sector, encompassing large fleet owners, logistics companies, retail chains, and advertising agencies. Fleet owners mandate reflective graphics on trucks and trailers for both corporate branding (daytime visibility) and compliance with conspicuity requirements (nighttime safety), requiring durable, high-adhesion films suitable for complex vehicle contours. Retail businesses utilize high-quality sign films for storefront graphics, indoor displays, and promotional wraps, prioritizing vibrant color reproduction and ease of removal/replacement, catering to the cyclical nature of marketing campaigns. These customers often seek digital printing compatibility and specialized finishes like metallic or textured films.

Finally, specialized end-users include construction companies, aviation and maritime operators, and manufacturers of safety equipment. Construction firms require temporary, high-visibility reflective films for machinery and barriers on site. Aviation and marine customers use highly durable, chemical-resistant films for mandated markings and identification on aircraft and vessels. Furthermore, personal safety product manufacturers (PPE suppliers) are significant buyers, utilizing low-grade reflective materials for integration into safety vests, helmets, and protective gear, ensuring worker visibility in hazardous environments. The diversity of these end-users underscores the market's resilience, as demand is distributed across safety, infrastructure, and commercial sectors.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 11.5 Billion |

| Market Forecast in 2033 | USD 17.5 Billion |

| Growth Rate | 6.2% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | 3M Company, Avery Dennison Corporation, Orafol Europe GmbH, Nippon Carbide Industries Co., Inc., Kiwa Chemical Industry Co., Ltd., 3A Composites, Jessup Manufacturing Company, Reflomax Co., Ltd., Starflex Corporation, Halo Signs Limited, Viz Reflectives, Changzhou Hua R Sheng Reflective Material Co., Ltd., China Swarco Corporation, DM-Reflex, Euro-Supplies |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Sign Films and Reflective Sheeting Market Key Technology Landscape

The technological landscape of the Sign Films and Reflective Sheeting Market is currently defined by advancements in retroreflection optimization, adhesive chemistry, and digital printing compatibility. The most significant innovation centers around microprismatic technology, which involves molding tiny cube-corner prisms into the film structure to achieve near-perfect retroreflection. This technology, exemplified by high-intensity prismatic (HIP) and diamond-grade materials, allows signs to return substantially more light than older enclosed lens (glass bead) systems, greatly enhancing visibility and meeting the highest regulatory specifications (ASTM Type IX and XI). Manufacturers are continuously refining the geometry of these prisms and developing production methods to reduce the cost of molding these complex structures, making high-performance films accessible for a broader range of applications beyond primary highways.

Adhesive technology is equally critical, moving toward advanced pressure-sensitive adhesives (PSAs) that offer long-term durability, weather resistance, and, increasingly, clean removability (repositionable or bubble-free application features). The market demands specialized adhesives tailored for different substrates—such as low-energy surfaces (like certain plastics) or complex vehicle curves—while maintaining a specified lifespan of up to 10 years or more. Furthermore, sustainability requirements are driving the development of solvent-free, water-based acrylic adhesive systems to reduce Volatile Organic Compound (VOC) emissions during manufacturing and installation. These advancements are vital for applications like vehicle wrapping, where ease of installation directly impacts labor costs and project turnaround time.

The confluence of sign films with digital output technologies is rapidly transforming the industry. Specialized films are engineered with receptive top-coats compatible with various printing methods, including eco-solvent, latex, UV-curable, and solvent inks, ensuring vibrant color reproduction without compromising the reflective properties or material integrity. This focus on printability supports the high-growth advertising segment, enabling short runs, high-resolution graphics, and rapid customization. Emerging technological research also explores integrating functional elements, such as self-cleaning coatings (hydrophobic or photocatalytic films) that maintain retroreflectivity in polluted environments, and films with embedded smart features like temperature indicators or color-changing properties in response to specific stimuli, paving the way for advanced interactive signage systems.

Regional Highlights

- Asia Pacific (APAC): The Growth Engine

APAC is projected to exhibit the highest Compound Annual Growth Rate (CAGR) due to massive government expenditure on infrastructure modernization and urbanization projects, particularly in China, India, and Southeast Asian nations. The region is characterized by extensive highway network development and a rapid increase in vehicle population, which mandates improved safety signage and conspicuity markings. Furthermore, the adoption of international safety standards (e.g., aligning local regulations with ASTM) drives the shift from low-grade traditional materials to high-intensity reflective sheeting. While local manufacturers dominate the low-to-mid grade segment, multinational companies are expanding their footprint to cater to the growing demand for premium, regulated traffic safety products.

- North America (NA): Regulatory Dominance and Replacement Cycles

North America is a mature market, yet it maintains a significant share driven primarily by strict federal and state regulations, especially the Manual on Uniform Traffic Control Devices (MUTCD) in the United States, which dictates signage quality and replacement schedules. Demand here is characterized by continuous maintenance cycles, demanding high-durability and premium-grade microprismatic films (ASTM Type VIII, IX, and XI). The advertising sector is highly sophisticated, driving continuous innovation in large-format digital printing films, vehicle wraps, and architectural applications. Environmental concerns also push manufacturers toward sustainable, non-PVC film alternatives, commanding premium pricing.

- Europe: Focus on Sustainability and Safety Harmonization

The European market is heavily influenced by EU directives aimed at harmonizing traffic safety standards and aggressively promoting environmental sustainability. There is a strong regulatory preference for non-PVC materials and products with reduced environmental footprints. Countries like Germany and the Netherlands are leaders in adopting specialized reflective films for bicycle paths and urban low-speed zones. The market is also driven by vehicle marking legislation (e.g., ECE 104 regulations for trucks) which ensures mandatory retroreflective taping for visibility. Innovation often centers on developing films with superior anti-graffiti and self-cleaning properties suitable for complex urban environments.

- Latin America (LATAM): Emerging Infrastructure Needs

The LATAM region presents significant growth potential, although market stability can be subject to economic fluctuations. Major investment in transportation infrastructure, particularly in countries like Brazil and Mexico, is fueling demand for reflective sheeting. The primary challenge is the enforcement of safety regulations, which can be inconsistent across different countries, leading to a fragmented market structure where both low-cost and high-performance films coexist. However, the region’s growing logistics and commercial fleet sectors are driving consistent demand for vehicle safety markings.

- Middle East & Africa (MEA): Strategic Investment in High-End Projects

The MEA market is largely driven by large-scale infrastructural projects, smart city developments (such as NEOM in Saudi Arabia and projects in the UAE), and significant investments in logistics and tourism infrastructure. These high-profile projects often mandate the highest international safety standards, leading to significant demand for premium, durable, and temperature-resistant reflective materials capable of withstanding extreme desert heat and intense UV radiation. The market is highly dependent on imports of sophisticated film technology from major global players.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Sign Films and Reflective Sheeting Market.- 3M Company

- Avery Dennison Corporation

- Orafol Europe GmbH

- Nippon Carbide Industries Co., Inc.

- Kiwa Chemical Industry Co., Ltd.

- 3A Composites

- Jessup Manufacturing Company

- Reflomax Co., Ltd.

- Starflex Corporation

- Halo Signs Limited

- Viz Reflectives

- Changzhou Hua R Sheng Reflective Material Co., Ltd.

- China Swarco Corporation

- DM-Reflex

- Euro-Supplies

- Fuxin Reflective Materials Co., Ltd.

- Sefar AG

- Arlon Graphics, LLC

- Ritrama S.p.A. (now part of Fedrigoni Group)

- Kayaku Advanced Materials, Inc.

Frequently Asked Questions

Analyze common user questions about the Sign Films and Reflective Sheeting market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the growth of the high-intensity reflective sheeting segment?

The growth is primarily driven by global governmental mandates, such as updated versions of the MUTCD and European regulations, enforcing the use of premium, microprismatic sheeting (ASTM Types VIII, IX, and XI) to enhance road safety, especially at night and in poor weather conditions, ensuring greater conspicuity for all road users.

How are environmental regulations impacting the material selection in this market?

Environmental regulations, particularly anti-PVC sentiment in Europe and North America, are compelling manufacturers to rapidly transition toward sustainable, non-chlorinated alternatives like PET, specialized acrylics, and polyurethane films. This shift supports the development of greener product lines and reduces disposal challenges.

What role does digital printing play in the market expansion?

Digital printing compatibility is crucial for the high-growth advertising and commercial graphics segment. Specialized sign films that accept eco-solvent, latex, and UV inks enable high-resolution, short-run customization, accelerating vehicle wrap applications and dynamic retail signage production.

Which geographical region offers the most significant growth opportunities for new entrants?

Asia Pacific (APAC), particularly Southeast Asia and India, offers the most significant growth opportunities due to massive, ongoing infrastructure development, rapid urbanization, and increasing regulatory enforcement of basic and medium-grade road safety standards, leading to high volume demand.

What is the primary technological difference between microprismatic and glass bead reflective sheeting?

Microprismatic sheeting uses molded cube-corner prisms to retroreflect light, offering superior brightness and angle performance, while glass bead sheeting relies on microscopic glass spheres embedded in the film. Microprismatic technology generally provides a higher grade of reflectivity required for modern high-speed roads.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager