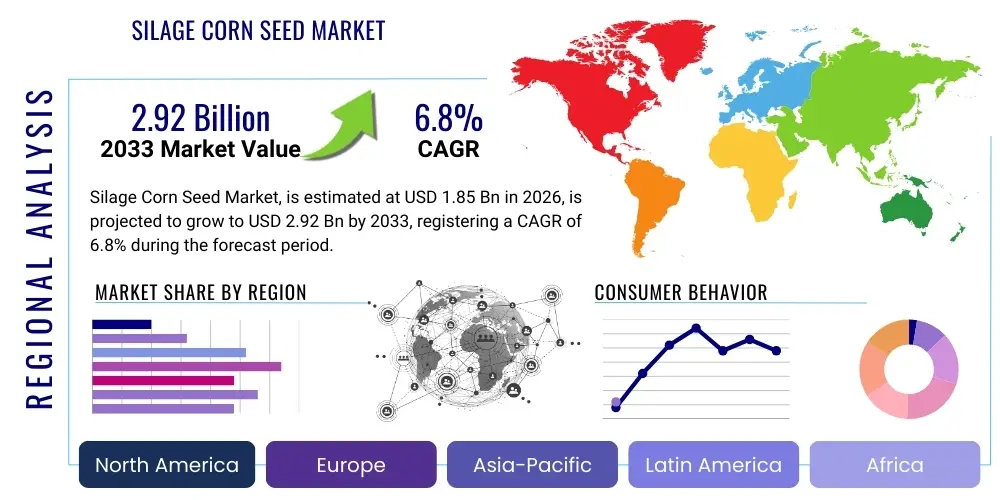

Silage Corn Seed Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434499 | Date : Dec, 2025 | Pages : 245 | Region : Global | Publisher : MRU

Silage Corn Seed Market Size

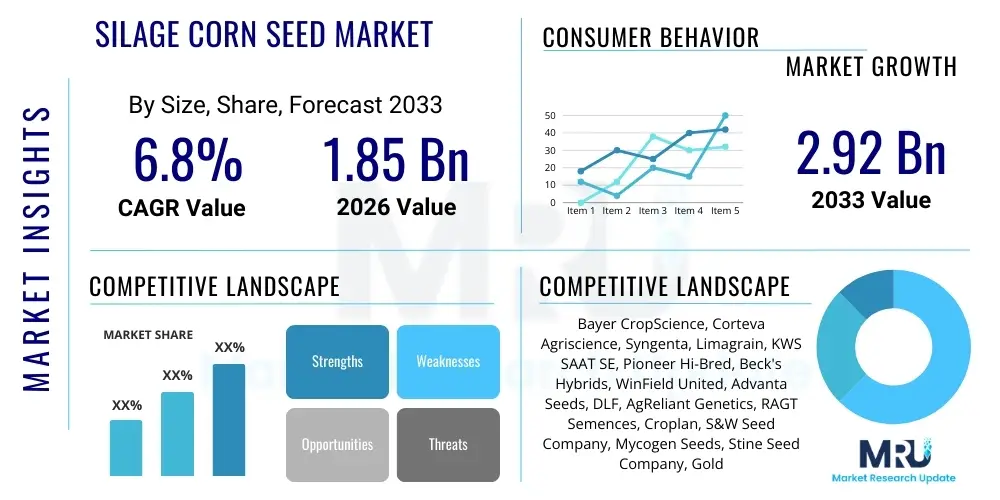

The Silage Corn Seed Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 1.85 Billion in 2026 and is projected to reach USD 2.92 Billion by the end of the forecast period in 2033.

Silage Corn Seed Market introduction

The Silage Corn Seed Market encompasses the commercialization and distribution of specialized corn varieties optimized for forage production rather than grain harvest. Silage corn is characterized by its high yield of total digestible nutrients (TDN), superior fiber digestibility, and overall energy content, making it an indispensable component of feed rations, particularly for the dairy and beef industries. The product description centers on hybrid seeds developed through advanced breeding techniques, often incorporating specific traits such as insect resistance (Bt technology) or herbicide tolerance to maximize field performance and minimize input requirements. These seeds are specifically engineered to optimize the entire plant's biomass (stover and cob/grain) for fermentation and preservation as silage.

Major applications of silage corn seed are overwhelmingly concentrated in livestock farming, serving as the primary energy and bulk source in the diets of ruminants. Dairy operations utilize high-quality silage to boost milk production efficiency and maintain herd health, while beef operations rely on it for accelerated weight gain and cost-effective feeding strategies. Benefits associated with adopting improved silage corn seeds include increased feed quality consistency, higher tonnage per acre, reduced reliance on supplementary feedstuffs, and enhanced sustainability through efficient land use. The demand for these seeds is intrinsically linked to global population growth and the subsequent rise in demand for dairy and meat products, necessitating efficient and high-volume animal production systems.

Driving factors propelling market expansion include continuous innovation in genetic engineering, leading to hybrids with improved stress tolerance (drought, heat), increased fiber digestibility (NDFD), and enhanced disease resistance. Furthermore, the global trend towards intensifying livestock production, especially in emerging economies, necessitates consistent, reliable, and high-energy forage sources, thereby elevating the adoption rate of modern silage corn varieties. Supportive agricultural policies, coupled with farmer education regarding the economic advantages of high-performance silage, further stimulate market growth, positioning silage corn seed as a critical input for modern agricultural productivity and efficiency.

Silage Corn Seed Market Executive Summary

The Silage Corn Seed Market is characterized by robust growth, driven primarily by continuous genetic improvements aimed at maximizing digestible energy content and yield stability. Business trends indicate a strong focus on mergers, acquisitions, and strategic collaborations among leading multinational agricultural corporations to consolidate market share, integrate seed and chemical offerings, and accelerate R&D cycles for climate-resilient and nutrient-efficient hybrids. Furthermore, the increasing integration of precision agriculture technologies, such as variable rate seeding and remote sensing, is influencing purchasing decisions, favoring seed providers that offer integrated digital agronomy platforms alongside their seed products. The competitive landscape is shifting towards specialized product portfolios that address specific regional challenges, such as maturity length requirements and specific local pest pressures, ensuring market segmentation effectiveness.

Regional trends highlight North America and Europe as mature markets characterized by high adoption rates of advanced genetically modified (GM) seeds and premium pricing, backed by large-scale, technically advanced dairy and beef sectors. Conversely, the Asia Pacific (APAC) and Latin America regions are emerging as high-growth potential areas, stimulated by the modernization of their respective livestock industries, particularly the expansion of confined animal feeding operations (CAFOs) in China, India, and Brazil. Government incentives in these developing regions to improve local feed security and reduce import dependency are further accelerating the transition from conventional feed crops to high-yield silage corn. Infrastructure development supporting better cold chain and distribution logistics for seed transportation is also playing a pivotal role in enabling market penetration in previously underserved areas.

Segment trends reveal that genetically modified (GM) seeds, specifically those offering stacked traits (e.g., insect resistance and herbicide tolerance), dominate the market due to their proven efficiency in reducing crop losses and simplifying field management. However, there is a growing niche for high-quality conventional and non-GMO silage corn seeds, driven by consumer preferences in certain European and organic markets. In terms of end-use, the dairy cattle segment remains the most dominant consumer, demanding seeds optimized for maximum NDF digestibility (NDFD) to support peak lactation periods. The medium-maturity segment is projected to exhibit the highest growth rate, offering optimal balance between high yield potential and adaptability across various temperate climatic zones, which appeals to a broader base of global producers.

AI Impact Analysis on Silage Corn Seed Market

User queries regarding the impact of Artificial Intelligence (AI) on the Silage Corn Seed Market primarily revolve around three key themes: how AI enhances seed breeding efficiency (genomic selection, predictive modeling), how AI optimizes on-farm seed use (precision planting, yield forecasting), and the resultant economic benefits (cost reduction, improved ROI). Users are concerned with the speed at which AI-driven breeding programs can deliver new, superior hybrids, especially those resistant to emerging pathogens or capable of tolerating extreme weather events. There is significant interest in AI platforms that integrate field data, weather forecasts, and soil analysis to provide farmers with hyper-localized recommendations on optimal hybrid selection, planting density, and fertilization schedules, moving away from generalized recommendations towards prescriptive, data-driven farming practices that maximize the genetic potential of the silage corn seed.

The integration of AI tools, particularly machine learning and deep learning algorithms, is fundamentally transforming the R&D pipeline for silage corn seed developers. These technologies analyze vast genomic and phenotypic datasets far more rapidly than traditional statistical methods, allowing breeders to identify complex trait markers associated with high digestibility and yield stability with greater accuracy. This accelerates the development of next-generation hybrids, reducing the time required from initial cross to commercial launch. For farmers, AI-powered systems deployed through drones, satellites, and in-field sensors enable unprecedented levels of precision in application timing and quantity, ensuring that high-value seeds are utilized under ideal conditions, thereby maximizing biomass yield and feed quality.

The overarching expectation is that AI will enhance sustainability and profitability across the silage corn value chain. By precisely modeling environmental interactions and genetic potential, AI minimizes resource waste (water, fertilizer, pesticides) and reduces the risk associated with crop failure, thereby stabilizing the supply chain for livestock feed. This transition towards AI-enabled digital agriculture is creating new business opportunities for seed companies to offer integrated solutions—combining seed genetics with advisory services—positioning them not just as input suppliers, but as comprehensive farm optimization partners, drastically improving the return on investment for high-end silage corn seeds.

- AI-driven Genomic Selection: Accelerates breeding cycles and enhances the identification of superior silage traits (e.g., NDFD, yield stability).

- Precision Planting Optimization: Utilizes machine learning to determine variable rate seeding maps based on soil type, topography, and yield goals.

- Predictive Yield Modeling: AI analyzes real-time weather and plant health data to forecast biomass yield and nutritional quality.

- Pest and Disease Detection: AI-powered image recognition tools enable early detection and localized intervention, protecting high-value seed investment.

- Automated Hybrid Recommendation: Platforms suggest the best-suited hybrid maturity and trait stack for specific microclimates and farm objectives.

DRO & Impact Forces Of Silage Corn Seed Market

The market dynamics of the Silage Corn Seed sector are governed by a complex interplay of Drivers, Restraints, and Opportunities (DRO), which collectively shape the Impact Forces on industry stakeholders. The primary driver is the accelerating global demand for high-quality, traceable protein sources (meat and dairy), which mandates efficient and energy-dense animal feed production. Technological advancements, particularly in gene editing (CRISPR-Cas9) and conventional breeding for improved fiber digestibility (NDFD), serve as critical enabling factors, allowing farmers to achieve superior feed conversion ratios. Simultaneously, the inherent volatility and increasing unpredictability of global climate patterns present the most significant restraint, as drought, excessive heat, or prolonged cold directly impact corn yield and quality, forcing farmers to bear substantial financial risks associated with input investment, despite the resilience offered by advanced genetics. These internal and external pressures create a highly competitive environment where innovation and supply chain resilience are key determinants of success.

Key opportunities for expansion are centered on the underserved markets in Asia Pacific and Africa, where livestock industries are rapidly transitioning from subsistence farming to commercialized, intensive systems requiring specialized forage inputs. Furthermore, the rising consumer and regulatory focus on sustainable agriculture and reduced environmental footprint presents a unique opportunity for seeds engineered for improved nitrogen use efficiency (NUE) and water use efficiency (WUE). Companies that successfully market these environmentally optimized seeds, often incorporating microbial seed treatments, can command premium pricing and access green financing initiatives. The impact forces are driving market consolidation, favoring large corporations that possess the financial capacity to invest heavily in multi-year R&D programs, manage complex regulatory hurdles associated with GM crops across different nations, and offer comprehensive insurance and digital advisory services to mitigate climate-related risks for their farmer clientele.

The combined effect of these forces creates a dynamic wherein the value proposition of silage corn seeds is shifting from merely maximizing volume to optimizing nutritional quality and guaranteeing yield stability under stress. The need for precise, specialized products is pushing smaller, regional breeders towards specialization or acquisition, while global leaders focus on creating ‘stacked trait’ solutions that address multiple agronomic challenges simultaneously. Restraints such as stringent GM crop regulations in key European markets and consumer pushback against certain biotechnology methods remain significant, yet opportunities in emerging high-growth regions and continuous scientific breakthroughs in trait development ensure the market maintains its robust growth trajectory, ultimately strengthening its position as a foundational element of the global animal protein supply chain.

Detailed Summary of DRO & Impact Forces:

- Drivers: Rising global demand for dairy and beef products; Genetic innovation leading to improved NDF digestibility (NDFD) and yield stability; Shift towards intensive livestock farming requiring consistent feed quality; Government subsidies supporting advanced agricultural inputs.

- Restraints: Volatility in climate and adverse weather conditions (drought, flood); High initial investment and cost of premium hybrid seeds; Stringent regulatory environment concerning genetically modified (GM) crops in certain regions (e.g., EU); Supply chain disruptions impacting seed distribution.

- Opportunity: Expansion into developing economies (APAC, Latin America) modernizing their livestock sector; Development of specialized seeds for marginal lands and climate stress tolerance (WUE, NUE); Integration with digital farming platforms (AI, IoT) for precision optimization; Growing interest in non-GMO or organic certified silage corn for niche markets.

- Impact Forces: High R&D expenditure barrier maintains oligopolistic market structure; Pricing power shifts towards providers offering resilient, high-trait-stacked products; Increased focus on sustainable farming certification drives demand for resource-efficient hybrids; Climate change necessitates shorter maturity hybrids adaptable to variable planting windows.

Segmentation Analysis

The Silage Corn Seed Market is strategically segmented based on crucial factors including trait, maturity duration, and primary end-use application, enabling market participants to tailor their product offerings to specific agricultural and geographical needs. This multidimensional segmentation is vital because the optimal hybrid selection is highly dependent on local climatic conditions, farm management practices, and the nutritional requirements of the specific livestock being fed. For instance, farmers in northern climates require early-maturity hybrids to ensure harvest before frost, whereas large-scale dairy operations prioritize traits that maximize NDFD, irrespective of whether the seed is genetically modified or conventionally bred. The complexity of these requirements necessitates a finely tuned product portfolio, allowing seed companies to capture specific value pools within the broader forage market.

The segmentation by trait—Genetically Modified (GM) versus Conventional—delineates the market based on technological adoption and regulatory permissibility. GM seeds dominate markets like North America and Brazil due to their enhanced resistance traits against pests (e.g., corn borer) and herbicides (e.g., glyphosate), leading to significant yield protection and reduced labor costs. Conversely, the Conventional segment thrives in regions and markets, such as certain European nations, where consumer or governmental opposition to GM technology remains strong, driving demand for high-performing, non-transgenic hybrids. Analyzing the maturity duration (Early, Medium, Late) provides insights into regional climatic fit, with Medium maturity types offering the most versatility and being the largest segment globally, as they balance robust yield potential with reduced risk of incomplete physiological development.

End-use segmentation, primarily focusing on Dairy Cattle, Beef Cattle, and other livestock, dictates the nutritional characteristics prioritized during breeding. Seeds targeted at the dairy sector are meticulously bred to enhance fiber quality and maximize milk production efficiency, often measured by "Milk per Ton" analysis, demanding extremely high NDF digestibility. Products for beef cattle often emphasize overall biomass yield and high starch content for rapid weight gain, tolerating slightly lower NDFD values. Understanding these distinct segment preferences is critical for market penetration, as seed companies increasingly develop specialized, premium-priced hybrids designed specifically to address the unique metabolic needs and economic drivers of each livestock sector, reinforcing the trend of specialized breeding programs over general-purpose corn seeds.

- By Trait:

- Genetically Modified (GM) Seed (Herbicide Tolerant, Insect Resistant, Stacked Traits)

- Conventional Seed

- By Maturity Duration:

- Early Maturity (Short Growing Season)

- Medium Maturity (Moderate Growing Season, Most Common)

- Late Maturity (Long Growing Season)

- By End-Use:

- Dairy Cattle

- Beef Cattle

- Others (Swine, Poultry, etc., often consumed indirectly or in smaller portions)

Value Chain Analysis For Silage Corn Seed Market

The value chain of the Silage Corn Seed Market is complex and highly capital-intensive, starting with upstream activities dominated by extensive Research and Development (R&D) and proprietary genetic resource management. Upstream analysis involves the painstaking process of germplasm enhancement, hybrid development, trait insertion (in the case of GM seeds), and rigorous field testing to ensure agronomic performance and nutritional specifications are met. This phase is characterized by high barriers to entry due to the necessity of owning vast intellectual property (IP), sophisticated laboratories, and multi-location testing infrastructure. Major players invest billions annually in genomic research to ensure a continuous pipeline of superior, patent-protected hybrids that can withstand evolving environmental and pest pressures, effectively controlling the proprietary knowledge base of the industry.

Midstream activities involve large-scale seed production, conditioning, and processing. This stage includes contract growing the parental lines, harvesting, drying, sorting, treating (with fungicides or insecticides), and packaging the final commercial seed product. Quality control at this stage is paramount, focusing on germination rates, purity, and freedom from disease. Distribution channels, linking the processors to the end-user (the farmer), are bifurcated into direct and indirect routes. Direct distribution involves sales teams from major multinational companies selling directly to large corporate farms or regional distributors, offering integrated technical support and financing options. Indirect distribution relies heavily on an extensive network of independent local dealers, cooperatives, and agricultural retailers, who are crucial for reaching smaller and mid-sized farming operations and providing local expertise and last-mile logistics.

Downstream analysis focuses on the end-use and post-sale support, where the seed's performance is realized in the farmer’s field, culminating in high-quality silage production and subsequent livestock feeding. The effectiveness of the distribution channel is judged by the timely delivery of high-quality, regionally appropriate seeds. Crucially, the indirect channel often involves value-added services provided by dealers, such as personalized agronomic advice, soil sampling services, and financial credit arrangements, which strengthen customer loyalty. The entire chain emphasizes traceability, from the initial genetic material to the final feed consumed by livestock, ensuring compliance with food safety and regulatory standards, thereby justifying the premium price points commanded by advanced silage corn seed hybrids.

Silage Corn Seed Market Potential Customers

The primary consumers and end-users of silage corn seeds are large-scale commercial farming operations focused on intensive livestock production, specifically those managing significant herds of dairy and beef cattle. These professional agricultural enterprises prioritize genetic quality, yield predictability, and the nutritional value of the resultant forage, as the cost-effectiveness of their entire animal production system hinges on the reliability of their primary feed source. Dairy farmers constitute the largest and most quality-demanding customer segment, seeking hybrids engineered for maximum Neutral Detergent Fiber Digestibility (NDFD) to optimize milk yield and butterfat content. Their purchasing decisions are heavily influenced by performance data, regional trial results, and long-term cost-benefit analyses, often maintaining close relationships with seed company agronomists for customized hybrid selection advice tailored to their specific feeding protocols.

The beef cattle sector, including feedlots and backgrounding operations, represents the second major customer base. While also requiring high-yield, high-energy silage, their focus often leans slightly more towards total biomass and starch content for rapid weight gain and finishing, meaning they may adopt different maturity groups or trait stacks compared to dairy producers. These operations often engage in forward contracting for seed to lock in supply and pricing, recognizing the vital role silage plays in consistent animal nutrition across seasonal cycles. The increasing sophistication of these feedlots, particularly in North America and South America, drives consistent demand for high-performance seeds that guarantee high-density, energy-rich silage, minimizing the need for expensive grain supplements.

Beyond the core dairy and beef industries, secondary potential customers include specialized agricultural cooperatives, institutional farms, and swine or poultry producers who might use corn silage components in mixed feed rations, although typically in lower quantities. Furthermore, large integrated food and beverage companies that own or contract major livestock operations (vertical integration) act as influential purchasers, often setting stringent quality standards for the seeds used by their supply chain partners. These institutional buyers prioritize robust supply chain management, certified non-GMO status (in specific markets), and seeds that facilitate compliance with corporate sustainability goals, demonstrating a growing market segment driven by regulatory and corporate social responsibility mandates.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.85 Billion |

| Market Forecast in 2033 | USD 2.92 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Bayer CropScience, Corteva Agriscience, Syngenta, Limagrain, KWS SAAT SE, Pioneer Hi-Bred, Beck's Hybrids, WinField United, Advanta Seeds, DLF, AgReliant Genetics, RAGT Semences, Croplan, S&W Seed Company, Mycogen Seeds, Stine Seed Company, Golden Harvest, Doebler's Pennsylvania Hybrids, Seedway, Legend Seeds |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Silage Corn Seed Market Key Technology Landscape

The technology landscape for the Silage Corn Seed Market is defined by intense innovation across three primary domains: genetic engineering, advanced breeding techniques, and seed treatment/delivery systems. Genetic engineering, encompassing both traditional transgenic modifications (GM) and modern gene editing tools like CRISPR-Cas9, is central to developing hybrids with superior performance characteristics. GM technology allows for the introduction of stacked traits, conferring resistance to multiple pests (e.g., corn rootworm, European corn borer) and tolerance to broad-spectrum herbicides, which significantly reduce in-field input variability and optimize yield stability. Furthermore, targeted gene editing promises to accelerate the creation of novel traits focused purely on nutritional enhancements, such as increased starch deposition or elevated NDF digestibility, without the complex regulatory pathway often associated with transgenic modification, promising faster time-to-market for superior silage hybrids.

Advanced breeding techniques, specifically Marker-Assisted Selection (MAS) and Genomic Selection (GS), represent the second technological pillar. MAS utilizes DNA markers linked to desirable traits (like drought tolerance or disease resistance) to screen thousands of hybrid candidates in the lab, drastically speeding up the selection process compared to traditional phenotype screening. Genomic Selection, employing machine learning models to predict the breeding value of a hybrid based on its entire genomic profile, further optimizes breeding cycles. These data-intensive approaches allow breeders to precisely tailor hybrids to specific regional climates and soil types, ensuring maximum genetic potential is realized in silage production fields. This shift from reliance on multi-year field trials alone to data-driven predictive breeding is a key competitive differentiator.

The third critical area involves Seed Enhancement Technologies (SETs) and integrated digital platforms. SETs include specialized seed coatings, often incorporating bio-stimulants, micronutrients, or beneficial microbes (bio-inoculants), which enhance germination vigor, promote early root development, and improve nutrient uptake efficiency, critical for maximizing the biomass potential of silage corn. Simultaneously, the proliferation of digital agronomy platforms, utilizing IoT sensors, satellite imagery, and AI algorithms, allows farmers to employ Variable Rate Technology (VRT) for planting. These VRT systems optimize seeding rates based on detailed field zone analysis, ensuring that high-value seeds are placed at the optimal density in each part of the field, leading to more uniform stands, maximized yields, and improved economic returns on the advanced seed technology investment.

These technological advancements are converging to create highly customized, high-performance seed packages. The future of silage corn seed technology will be characterized by hybrids that are not only resistant to biotic stress but also hyper-efficient in resource utilization, delivering consistent high-quality feed under increasingly variable climatic conditions, thereby supporting the sustainability and efficiency mandates of modern livestock production systems worldwide.

Specific technological focuses include the development of brown midrib (BMR) genetics, which naturally reduce lignin content, significantly improving fiber digestibility. While BMR technology historically faced yield penalties, modern breeding programs are overcoming these trade-offs, making BMR hybrids increasingly viable for high-performance dairy operations. Furthermore, research into stacked insect resistance genes is vital, particularly as pests develop resistance to first-generation Bt traits, demanding continuous pipeline development to protect crop investment. The interplay between genetic traits and precision planting technology ensures that the inherent quality of the seed translates efficiently into field performance, forming an inseparable technological ecosystem crucial for market leadership and customer satisfaction.

Regional Highlights

The Silage Corn Seed Market exhibits significant regional disparities in terms of technological adoption, market maturity, and growth drivers, necessitating a differentiated strategy for global seed providers. North America, encompassing the United States and Canada, represents the most technologically advanced and mature market segment. This region is characterized by large, integrated dairy and beef operations that have high disposable incomes and readily adopt stacked-trait Genetically Modified (GM) seeds for maximum yield and labor efficiency. The US Midwest is the epicenter of silage corn production, benefiting from extensive R&D and well-established distribution channels. Market relevance here hinges on offering sophisticated digital tools and highly tailored agronomic advice alongside the seed product, focusing on metrics such as Milk per Acre (MPA) and optimal NDF digestibility (NDFD) required by high-producing dairy herds. Regulatory frameworks, while generally supportive of biotech crops, require specialized registration for new traits, maintaining high barriers to entry.

Europe presents a complex market driven by diverging regulatory environments. Western Europe, notably Germany, France, and the UK, shows strong demand for high-quality conventional and specific, approved GM hybrids (where permitted), often fueled by strong consumer preference for non-GMO products in certain food chains. The Northern European countries require early-maturity hybrids due to shorter growing seasons, creating a highly specialized niche. In contrast, Eastern European countries are rapidly modernizing their livestock sectors and show higher growth potential for both conventional and GM seeds, provided they gain local regulatory approval. The overall European market emphasizes sustainability credentials and traceability, pushing seed developers to focus on hybrids with superior resilience and resource-use efficiency (Water Use Efficiency and Nitrogen Use Efficiency).

Asia Pacific (APAC) stands out as the fastest-growing region, driven by the rapid expansion and commercialization of the dairy and beef industries, particularly in China and India. As these nations shift towards intensive farming practices to meet burgeoning domestic protein demand, the need for reliable, high-energy forage inputs surges. Regulatory complexities in APAC vary significantly; for instance, Australia and New Zealand are highly regulated, while other countries are developing their frameworks. The growth is concentrated around investments in cold chain logistics and farmer training programs to ensure the appropriate use of high-yield hybrids. Latin America, particularly Brazil and Argentina, is another crucial high-growth market, benefiting from vast agricultural land and favorable climates, making it a key production hub for both local consumption and international trade, with strong reliance on robust, pest-resistant GM hybrids suited for large-scale operations and longer growing seasons.

- North America (US & Canada): Mature market, high adoption of stacked GM traits, focus on NDFD and integrated digital solutions for precision farming. Dominant dairy and feedlot operations drive demand.

- Europe (EU & Non-EU): Highly fragmented market; strong demand for high-quality conventional/non-GMO seeds in Western Europe; increasing commercial adoption in Eastern Europe; regulatory hurdles concerning GM cultivation impact product strategy.

- Asia Pacific (APAC): Highest growth potential, fueled by livestock industry modernization in China and India; increasing demand for reliable feed input; challenges in distribution and local regulatory compliance.

- Latin America (Brazil & Argentina): Key production region, large-scale use of robust GM hybrids, favorable climate for high yields; strong export orientation in beef production necessitates high-quality feed.

- Middle East and Africa (MEA): Emerging market, focus on drought-tolerant and stress-resilient hybrids due to limited water resources; market growth is contingent on governmental support for feed self-sufficiency programs.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Silage Corn Seed Market.- Bayer CropScience (including legacy Monsanto assets)

- Corteva Agriscience (including legacy DuPont Pioneer assets)

- Syngenta Group (ChemChina/Sinochem)

- Limagrain (Vilmorin & Cie)

- KWS SAAT SE

- Pioneer Hi-Bred (part of Corteva Agriscience)

- Beck's Hybrids

- WinField United

- Advanta Seeds (UPL)

- DLF (through acquisitions in forage)

- AgReliant Genetics

- RAGT Semences

- Croplan (Land O'Lakes)

- S&W Seed Company

- Mycogen Seeds (part of Corteva Agriscience)

- Stine Seed Company

- Golden Harvest (Syngenta)

- Doebler's Pennsylvania Hybrids

- Seedway

- Legend Seeds

Frequently Asked Questions

Analyze common user questions about the Silage Corn Seed market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between silage corn seed and grain corn seed?

Silage corn seed is specifically bred to maximize the overall biomass yield and the digestibility of the entire plant (fiber and starch), measured by metrics like Neutral Detergent Fiber Digestibility (NDFD), making it optimized for animal feed. Grain corn seed is primarily bred to maximize kernel weight and yield.

How significant are Genetically Modified (GM) traits in the Silage Corn Seed market?

GM traits, particularly stacked traits offering insect resistance (Bt) and herbicide tolerance, are highly significant, dominating sales in mature markets like North America and Latin America due to their ability to ensure yield stability and reduce management costs associated with pest control and weed pressure.

Which regions are driving the highest growth rates for silage corn seed adoption?

The highest growth rates are projected in the Asia Pacific (APAC) region, driven by the rapid modernization and expansion of commercial dairy and beef cattle feeding operations in countries such as China and India, increasing the fundamental requirement for consistent, high-energy forage inputs.

What role does Artificial Intelligence (AI) play in the development of new silage corn hybrids?

AI significantly accelerates R&D by utilizing Genomic Selection (GS) to analyze vast genetic data, rapidly identifying markers for desirable traits like enhanced digestibility and stress resilience, thus shortening the time required to commercialize superior, high-performing silage hybrids.

What are the key nutritional metrics that livestock producers prioritize when selecting a silage corn hybrid?

Livestock producers, especially in the dairy sector, primarily prioritize high Neutral Detergent Fiber Digestibility (NDFD), high starch content (energy), and overall total digestible nutrients (TDN), as these metrics directly translate to feed efficiency and subsequent milk or meat production.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager