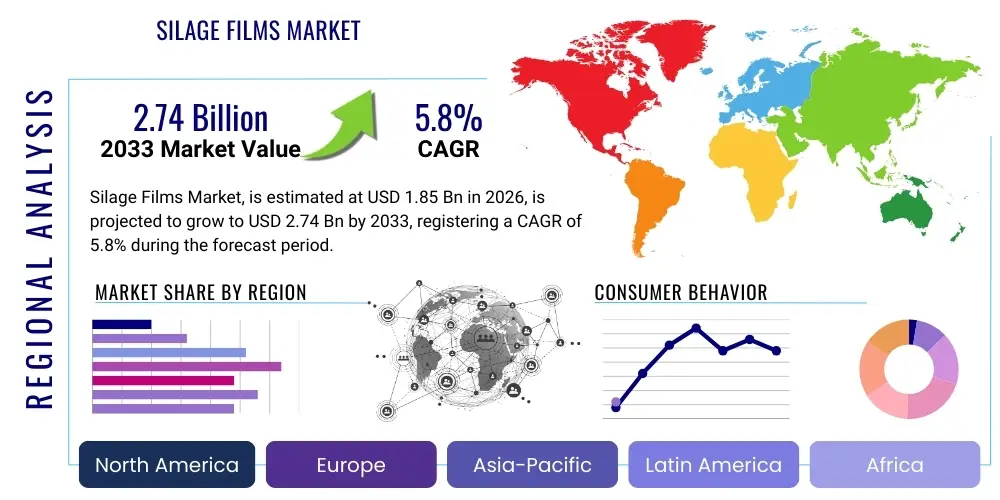

Silage Films Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434679 | Date : Dec, 2025 | Pages : 245 | Region : Global | Publisher : MRU

Silage Films Market Size

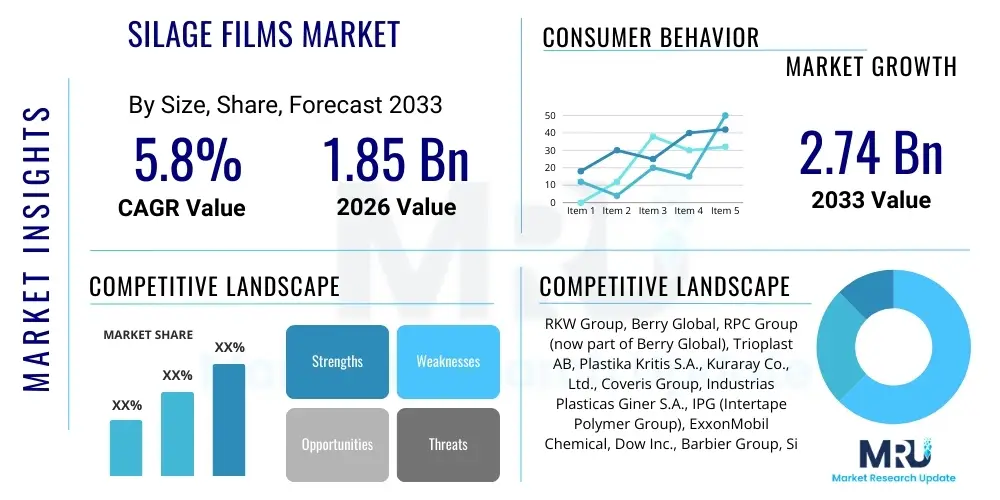

The Silage Films Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 1.85 Billion in 2026 and is projected to reach USD 2.74 Billion by the end of the forecast period in 2033. This consistent expansion is largely attributable to the rising global demand for high-quality animal fodder, increasing mechanization of farming practices, and the critical need to minimize nutritional loss in stored feed, particularly in dairy and beef farming sectors across developed and rapidly developing agricultural economies.

Silage Films Market introduction

The Silage Films Market encompasses the production and distribution of specialized polymer-based films designed for wrapping and covering high-moisture forage crops, such as grass, maize, and legumes, during the ensiling process. These films are engineered to create an anaerobic environment, which is essential for controlled fermentation, preserving the nutritional value and palatability of the feed. Typically manufactured from polyethylene variants like Low-Density Polyethylene (LDPE) and Linear Low-Density Polyethylene (LLDPE), silage films offer high puncture resistance, UV stability, and exceptional oxygen barrier properties, crucial for preventing spoilage and mold growth.

Major applications of silage films span across two primary methodologies: bale wrapping (individual cylindrical or square bales) and covering large silo structures or bunkers (pit silage). The core benefit derived from using these films is the maximization of feed quality retention, translating directly into improved livestock health and productivity, which fundamentally supports the economic viability of modern livestock operations. Key driving factors propelling market growth include the intensification of dairy production, shifting agricultural practices towards larger-scale operations requiring efficient feed storage solutions, and stringent regulations regarding minimizing feed waste.

Silage Films Market Executive Summary

The global Silage Films Market demonstrates robust business trends characterized by a continuous shift towards multi-layer co-extruded films, designed for enhanced durability and superior oxygen transmission rates (OTR), fulfilling the increasing need for longer storage periods and reduced spoilage rates. Technologically, the integration of advanced additives, such as Metallocene catalysts in LLDPE, is improving the film’s mechanical strength without increasing thickness, offering cost-efficiency benefits to end-users. Regulatory trends focused on sustainability are also spurring innovation, driving demand for biodegradable and recyclable film options, thus repositioning the competitive landscape toward eco-friendly product lines.

Regionally, Europe, particularly Western Europe, remains the dominant market segment due to its highly mechanized agricultural sector and large dairy farm concentration, setting the standard for quality and technological adoption. Asia Pacific is emerging as the fastest-growing region, fueled by rapid growth in the beef and dairy industries in countries like China and India, coupled with governmental support for modern farming techniques. Segment trends highlight the dominance of LLDPE material owing to its superior tensile strength and flexibility, while the bale wrap application segment maintains the largest market share, driven by the operational ease and flexibility of storage it offers to farmers across various farm sizes.

AI Impact Analysis on Silage Films Market

User queries regarding the impact of Artificial Intelligence (AI) on the Silage Films Market primarily center on how AI can optimize the efficiency of silage production, minimize film usage, and improve quality control. Specific questions often address AI’s role in predicting ideal harvest windows to maximize nutritional content, optimizing film thickness requirements based on real-time environmental data (e.g., UV index, temperature fluctuations), and automating logistics related to inventory management of films on large farms. Concerns often revolve around the high initial investment required for AI-integrated systems (such as smart sensors and prescriptive analytics) and the necessity for robust data infrastructure to support these sophisticated farming methodologies. Overall user expectations are high, anticipating that AI will move the market toward highly efficient, data-driven ensiling processes, potentially leading to the development of 'smart films' that change properties based on environmental conditions monitored by AI systems.

- AI-driven prescriptive analytics optimize harvesting timing to achieve peak forage quality, thereby justifying investment in high-quality films.

- Machine learning algorithms enhance inventory management and procurement forecasting for silage films on large commercial farms, reducing stockouts and waste.

- Computer vision and remote sensing, often AI-integrated, monitor the integrity of silage wraps post-application, detecting punctures or tears instantly, minimizing aerobic spoilage risks.

- AI models optimize film specifications (thickness, stretch, barrier properties) based on specific climate profiles and storage duration requirements, promoting resource efficiency.

- Automation in wrapping machinery utilizes AI for consistent tension control and overlap precision, ensuring optimal anaerobic conditions are established and maintained.

DRO & Impact Forces Of Silage Films Market

The dynamics of the Silage Films Market are shaped by a complex interplay of Drivers, Restraints, and Opportunities, collectively forming critical Impact Forces that dictate market direction and growth velocity. The foremost driver is the increasing global demand for high-quality milk and meat, necessitating preserved feed to maintain animal productivity year-round. This is compounded by the trend towards modern, industrialized farming methods that prioritize efficiency and yield. Conversely, major restraints include the volatility in petrochemical raw material prices, which directly impacts the production cost of polymer films, and the environmental concerns surrounding the disposal of non-biodegradable plastic waste, pressuring manufacturers to invest heavily in sustainable alternatives.

Opportunities for market players are vast, particularly in developing innovative solutions like biodegradable silage films derived from bio-polymers, which align with circular economy principles and emerging regulatory mandates in Europe and North America. Furthermore, market penetration in untapped regions in Asia and Africa, where traditional feed storage methods still prevail, offers significant long-term growth potential. The convergence of these factors defines the market's impact forces. High impact forces are driven by the essential function of the product in modern agriculture—preventing substantial economic loss due to spoiled feed—ensuring its indispensable nature despite cost pressures.

The primary impact force remains the economic imperative of livestock productivity; the efficiency gains from using silage films, in terms of nutrient preservation (which can exceed 90% retention compared to traditional methods), far outweigh the material costs. However, the rapidly intensifying pressure from environmental groups and policy makers regarding single-use plastics is a counteracting force, forcing rapid evolution toward innovative, potentially higher-cost, sustainable materials, thereby influencing overall pricing structures and supply chain resilience within the forecast period.

Segmentation Analysis

The Silage Films Market is extensively segmented across material type, thickness, and primary application methodology, providing a detailed view of end-user preferences and technological adoption rates across different geographical regions. Understanding these segments is crucial for manufacturers to tailor product specifications, such as optimizing UV stabilization or puncture resistance, to meet diverse agricultural needs, ranging from small-scale family farms utilizing pit silage to large commercial operations employing high-speed baling equipment requiring high-stretch film wraps. The core differentiation often lies in the balance between film cost, mechanical performance (strength and elongation), and oxygen barrier properties, which are critical variables determining final feed quality.

The most significant segment by material type is Linear Low-Density Polyethylene (LLDPE), valued for its superior stretchability and tear resistance, making it ideal for automated wrapping machinery. Thickness segmentation reflects varying regional requirements and storage duration; thinner films (below 100 microns) are generally used for short-term storage or in milder climates, while thicker films (above 100 microns) are mandatory for long-term preservation and harsh environmental conditions, providing essential protection against rodents and mechanical damage. The market is thus highly specialized, requiring precise material engineering to cater to specific ensiling practices and storage infrastructure.

- By Material Type:

- Low-Density Polyethylene (LDPE)

- Linear Low-Density Polyethylene (LLDPE)

- High-Density Polyethylene (HDPE)

- Polyethylene (PE) Blends

- Bioplastics/Biodegradable Polymers

- By Thickness:

- Below 100 Microns

- 100 to 200 Microns

- Above 200 Microns

- By Application:

- Silage Bale Wrapping (Round Bales, Square Bales)

- Silage Pit/Bunker Covering (Large Sheets)

- Silage Tube Systems (Sausage Silage)

- By End-Use Industry:

- Dairy Farming

- Beef Cattle Farming

- Other Livestock Farming (Sheep, Goats)

Value Chain Analysis For Silage Films Market

The value chain of the Silage Films Market begins with the upstream procurement of raw materials, predominantly ethylene derivatives and specialty additives (UV stabilizers, colorants, tackifiers). Key upstream participants include major petrochemical and chemical companies responsible for polymerization. Film manufacturers (converters) purchase polymer resins (like LLDPE granules) and employ advanced manufacturing processes, primarily blown film co-extrusion technology, to produce multi-layer, high-performance silage films. This stage is critical for imparting essential properties such as high oxygen barrier capability and mechanical strength, representing a high-value addition point requiring substantial capital investment in machinery and R&D.

The distribution channel plays a vital role in connecting manufacturers to the end-users—farmers and agricultural contractors. Distribution is often segmented into direct sales for large agricultural cooperatives and indirect sales via agricultural equipment dealers, specialized farm supply stores, and regional distributors. Indirect distribution channels provide crucial logistics support, managing inventory and providing localized product knowledge tailored to specific farming conditions and climate zones. The competitive edge in distribution relies on speed, reliability, and the ability to handle bulky, large-volume products.

Downstream analysis focuses on the end-users: livestock farmers (dairy and beef operations) and custom ensiling service providers who utilize specialized wrapping equipment. The performance feedback from these downstream users is essential for product improvement, driving the demand for films with increased UV resistance, better cling (tack), and reduced environmental footprint. The efficiency of the entire chain is measured by the successful preservation of the forage, demonstrating a strong link between the quality of the upstream material and the final economic outcome for the downstream customer.

Silage Films Market Potential Customers

The primary customers for silage films are entities engaged in the large-scale production of livestock, necessitating the efficient and long-term storage of fermented forage. These customers require films that minimize spoilage, ensuring the stored feed retains maximum nutritional density throughout the storage period, which can sometimes extend for over twelve months. The purchasing decision is heavily influenced by quality certifications, guaranteed UV stability (critical for outdoor storage), and the film's suitability for high-speed automated wrapping machinery, where film breakage is costly in terms of downtime and material waste.

The largest end-user segment is the dairy industry, which has the most consistent and substantial demand due to the necessity of maintaining year-round high-protein feed for optimal milk production. Beef cattle operations, particularly feedlots and intensive farming systems, also represent significant consumers, relying on quality silage to efficiently bulk feed animals prior to market. Furthermore, specialized agricultural contractors, who provide custom baling and wrapping services to multiple smaller farms, act as high-volume buyers, purchasing films in bulk and dictating trends related to ease of application and durability across varied field conditions.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.85 Billion |

| Market Forecast in 2033 | USD 2.74 Billion |

| Growth Rate | CAGR 5.8% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | RKW Group, Berry Global, RPC Group (now part of Berry Global), Trioplast AB, Plastika Kritis S.A., Kuraray Co., Ltd., Coveris Group, Industrias Plasticas Giner S.A., IPG (Intertape Polymer Group), ExxonMobil Chemical, Dow Inc., Barbier Group, Silage Wrap Co., Ginegar Plastic Products Ltd., Groupo Armando Alvarez, Polydress, Raven Industries, Al-Tawfeek Plastic, Balcan Plastics. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Silage Films Market Key Technology Landscape

The technology landscape in the Silage Films Market is dominated by multi-layer co-extrusion processes. This advanced manufacturing technique allows producers to combine different types of polymers (e.g., LLDPE for strength, LDPE for processability) into a single film structure, with each layer engineered to fulfill a specific functional requirement, such as maintaining UV stability on the outer surface and optimizing oxygen barrier performance on the inner surface. This precision engineering enables the creation of high-performance films, often comprising five, seven, or even nine layers, ensuring superior mechanical properties, crucial for minimizing film tears during the high-speed wrapping process.

Another crucial technological focus involves the development and integration of specialized chemical additives. Tackifiers, often based on polyisobutylene (PIB), are incorporated to ensure the film layers stick aggressively together post-wrapping, maintaining the critical anaerobic seal necessary for fermentation. Furthermore, UV stabilization technology is continuously improving, utilizing hindered amine light stabilizers (HALS) to protect the polymer structure from degradation when bales are stored outdoors for extended periods, directly impacting the longevity and reliability of the feed preservation process. Innovation is also prevalent in color science, where different film colors (e.g., black, white, green, or specialized dual-sided films) are utilized to manage thermal load and reflective properties, optimizing fermentation temperature within the bale.

The most forward-looking technology involves the transition to sustainable and circular economy solutions. This includes the widespread adoption of recycling-compatible mono-material solutions (using LLDPE exclusively while adjusting polymerization to mimic multi-layer properties) and the intense research into bio-based and fully compostable polymers. While biodegradable films currently face challenges regarding cost and shelf-life stability compared to conventional PE films, ongoing breakthroughs in polyhydroxyalkanoates (PHAs) and other bio-polyester chemistries are poised to potentially revolutionize the material segment within the latter half of the forecast period, driven by regulatory incentives and corporate sustainability commitments.

Regional Highlights

Regional dynamics heavily influence the Silage Films Market, driven by livestock population density, climate conditions, and the maturity of agricultural mechanization. Europe is the leading market, characterized by advanced farming techniques, stringent quality standards for dairy production, and high adoption rates of high-performance multi-layer silage films. Countries like Germany, France, Ireland, and the UK have established, substantial demand for both bale wrap and bunker covering films, supported by significant government subsidies for agricultural modernization and environmental best practices. The emphasis here is increasingly placed on films offering enhanced recycling profiles and better handling characteristics in automated equipment.

North America, led by the U.S. and Canada, represents another major, mature market. Demand is strong, fueled by vast feedlot operations and large-scale dairy farms, particularly across the Midwest and California. The regional focus often revolves around maximizing throughput and durability, driving preference for thicker, highly puncture-resistant films suitable for diverse climate zones and long transportation cycles. Technological adoption, including GPS-guided harvesting and advanced wrapping equipment, ensures a steady uptake of premium, high-stretch film variants.

Asia Pacific (APAC) is projected to be the fastest-growing region. This explosive growth is driven by substantial government initiatives promoting the modernization of the livestock sector, particularly in China and India, to meet the rapidly rising domestic consumption of dairy and meat products. While APAC currently relies heavily on traditional silage methods, the increasing adoption of specialized agricultural machinery and the establishment of commercial, large-scale farms are creating massive latent demand for cost-effective and reliable silage films. Market growth in this region will be crucial for global volume expansion.

Latin America, particularly Brazil and Argentina, shows significant potential, given their large, export-oriented beef and dairy industries. However, market growth is often constrained by economic volatility and slower adoption of advanced farming machinery compared to Europe. The Middle East and Africa (MEA) present niche opportunities, mainly focused on centralized, technologically advanced agricultural projects aimed at ensuring food security, particularly in climatically challenging environments where silage films play a crucial role in preventing rapid moisture loss and degradation.

- Europe: Dominant market share; characterized by high quality standards, rapid adoption of sustainable films, and strong presence of dairy farming. Key countries: Germany, France, UK, Ireland.

- North America: High-volume market driven by large-scale mechanized agriculture (U.S., Canada); strong demand for durable, heavy-duty films suitable for long storage.

- Asia Pacific (APAC): Fastest-growing region; modernization of livestock farming in China and India is the primary catalyst. Demand is shifting from traditional feed to preserved silage.

- Latin America: Growing market driven by large beef and dairy export sectors (Brazil, Argentina); demand sensitive to economic stability and agricultural investment cycles.

- Middle East & Africa (MEA): Emerging markets; demand concentrated in commercial, climate-controlled farming operations focusing on food security.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Silage Films Market.- RKW Group

- Berry Global Inc.

- Trioplast AB

- Plastika Kritis S.A.

- Kuraray Co., Ltd.

- Coveris Group

- RPC Group (now part of Berry Global)

- Industrias Plasticas Giner S.A.

- IPG (Intertape Polymer Group)

- ExxonMobil Chemical

- Dow Inc.

- Barbier Group

- Silage Wrap Co.

- Ginegar Plastic Products Ltd.

- Groupo Armando Alvarez

- Polydress

- Raven Industries

- Al-Tawfeek Plastic

- Balcan Plastics

- Bale Wrap Products

Frequently Asked Questions

Analyze common user questions about the Silage Films market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function of Silage Film in agriculture?

The primary function of silage film is to create and maintain an airtight, anaerobic environment around stored forage crops (like grass or corn). This exclusion of oxygen facilitates the lactic acid fermentation process essential for preserving the feed's nutritional content and preventing microbial spoilage or mold growth, thereby maximizing feed quality for livestock.

Which material type dominates the Silage Films Market and why?

Linear Low-Density Polyethylene (LLDPE) dominates the market. LLDPE offers superior mechanical properties, specifically high puncture resistance, excellent stretchability (elongation), and tear strength, making it ideally suited for automated high-speed wrapping equipment and ensuring film integrity during handling and long-term outdoor storage.

How do environmental regulations impact the future growth of the Silage Films Market?

Environmental regulations, especially in Europe, are driving innovation towards sustainable solutions. This necessitates significant R&D investment in biodegradable or bio-based polymers, as well as the commercialization of fully recyclable mono-material polyethylene films. While this increases product cost, it ensures market viability by addressing the mounting global challenge of agricultural plastic waste disposal.

What is the ideal thickness range for high-quality silage bale wrap?

The industry standard for high-quality silage bale wrap typically falls within the 25 to 30 micron (100 to 120 gauge) range. This thickness provides an optimal balance between material usage efficiency, stretch performance on automated wrappers, and the necessary puncture resistance and oxygen barrier properties required for effective forage preservation.

Which application segment holds the largest share in the Silage Films Market?

The Silage Bale Wrapping segment holds the largest market share. This dominance is due to the operational flexibility of baled silage, its suitability for various farm sizes, the increasing prevalence of agricultural contractors utilizing specialized baling machinery, and the ease of handling and feeding individual wrapped bales to livestock.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager