Silane Modified Polymers (SMP) Adhesives and Sealants Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435130 | Date : Dec, 2025 | Pages : 257 | Region : Global | Publisher : MRU

Silane Modified Polymers (SMP) Adhesives and Sealants Market Size

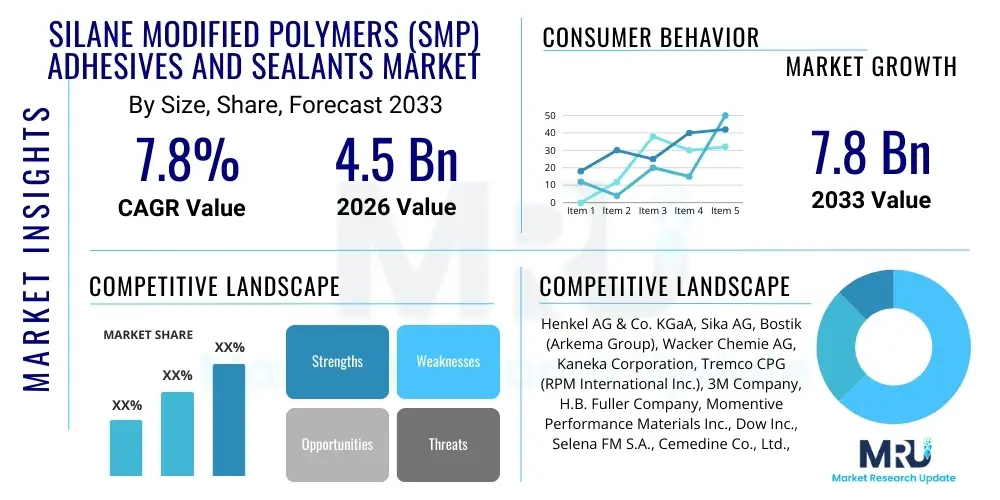

The Silane Modified Polymers (SMP) Adhesives and Sealants Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at USD 4.5 Billion in 2026 and is projected to reach USD 7.8 Billion by the end of the forecast period in 2033.

Silane Modified Polymers (SMP) Adhesives and Sealants Market introduction

The Silane Modified Polymers (SMP) market represents a rapidly expanding segment within the broader adhesives and sealants industry, fundamentally driven by the need for high-performance, environmentally friendly bonding solutions. SMP technology, often referred to as MS Polymer (Modified Silane) or hybrid sealants, combines the desirable properties of polyurethanes, such as excellent elasticity and adhesion, with the weather resistance and UV stability characteristic of silicones. These polymers contain silane functional groups which react with atmospheric moisture to cure, forming durable, elastic bonds without the need for solvents or isocyanates, addressing critical health and safety concerns prevalent in traditional adhesive chemistry.

Major applications of SMP products span across construction, automotive, industrial assembly, and transportation sectors. In construction, they are highly valued for structural glazing, joint sealing, and facade bonding due to their long-term durability and resistance to harsh environmental conditions. The automotive industry utilizes SMP adhesives for bonding body panels, interior components, and specialized seals, benefiting from their vibration damping characteristics and strong performance in thermal cycling. The inherent benefits of SMP, including low volatile organic compound (VOC) emissions and solvent-free formulations, position them as essential components in meeting increasingly stringent global regulatory standards focused on sustainability and occupational safety.

The primary driving factors fueling this market expansion include the global shift towards green building materials and sustainable infrastructure projects, particularly in developed economies like Western Europe and North America. Furthermore, the robust growth in automotive manufacturing, particularly the transition toward electric vehicles (EVs) which require lighter, stronger, and more flexible bonding agents for battery packs and chassis components, significantly boosts demand for high-quality SMP solutions. Continuous innovation in polymer chemistry, leading to enhanced performance characteristics such as faster cure times, superior primerless adhesion to diverse substrates, and improved heat resistance, further solidifies SMP’s dominance over conventional technologies.

Silane Modified Polymers (SMP) Adhesives and Sealants Market Executive Summary

The Silane Modified Polymers (SMP) Adhesives and Sealants market is characterized by robust business trends emphasizing sustainable chemistry and high-performance product development. Manufacturers are intensely focused on phasing out solvent-based systems and isocyanate-containing polyurethanes, driving significant investment into research and development of next-generation, high-strength SMP formulations. Key business strategies currently observed involve capacity expansion, particularly in high-growth regions, and strategic partnerships aimed at securing specialized silane precursors. The market exhibits competitive intensity, with major players leveraging patented curing technologies and advanced polymer backbones to differentiate their product offerings, focusing on niche applications requiring stringent aesthetic or structural performance, such as structural elastic bonding in prefabricated housing and shipbuilding.

Regionally, Asia Pacific (APAC) stands out as the primary growth engine, fueled by massive infrastructure development projects, rapid urbanization, and the region’s dominant position in global automotive and electronics manufacturing. While North America and Europe remain crucial markets, driven by strict environmental regulations (mandating low-VOC alternatives) and renovation activities, the exponential industrial growth in countries like China, India, and Southeast Asian nations contributes the most significant volume demand. Regulatory alignment across major economic blocs regarding chemical safety and construction standards is further harmonizing product specifications, enabling easier market penetration for globally standardized SMP formulations.

Segment trends highlight the dominance of the construction sector, specifically in architectural sealing and elastic bonding, owing to the superior longevity and flexibility of SMP sealants compared to traditional materials. Within the product type segment, Polyether SMPs are gaining traction due to their enhanced flexibility and excellent weathering properties, although Polyurethane-based SMPs still hold a substantial share due to their high tensile strength. Crucially, the adhesives sub-segment is expected to grow faster than sealants, propelled by the automotive industry's increasing adoption of bonding over welding or mechanical fastening to reduce vehicle weight and improve energy efficiency, a critical factor for both traditional and electric vehicle platforms.

AI Impact Analysis on Silane Modified Polymers (SMP) Adhesives and Sealants Market

User queries regarding the impact of Artificial Intelligence (AI) on the Silane Modified Polymers (SMP) market frequently center on three critical themes: optimizing formulation complexity, predicting material performance under varying conditions, and enhancing manufacturing efficiency. Users are concerned with how AI can expedite the discovery of novel silane chemistries and polymer blends that meet specific performance criteria, such as ultra-fast curing or enhanced temperature stability, without lengthy empirical testing. There is a strong expectation that AI will streamline the supply chain, particularly managing the volatile procurement of specialized silane monomers and crosslinkers, and provide predictive maintenance for complex reaction vessels used in SMP synthesis. Overall, the consensus view anticipates AI transitioning SMP research from traditional trial-and-error methodologies to predictive, data-driven material science, significantly accelerating product development cycles and lowering the environmental footprint of production processes.

- AI-driven Predictive Formulation: Utilizing machine learning algorithms to simulate and predict the physical properties (adhesion, elasticity, cure time) of hundreds of different SMP formulations simultaneously, drastically reducing the required laboratory testing time for new product development.

- Quality Control Automation: Implementing computer vision and AI analytics in manufacturing lines to monitor consistency and purity of SMP batches in real-time, identifying and correcting minor variances that could impact final product performance.

- Supply Chain Optimization: Employing advanced analytics to forecast demand for key raw materials (e.g., methoxysilanes, specialized polyols) and optimize procurement timing and inventory levels, mitigating risks associated with supply volatility.

- Performance Modeling: Developing digital twins of construction or automotive applications to simulate the long-term aging and stress performance of SMP bonds under various climates and operational loads, enhancing warranty planning and product reliability.

- Process Efficiency Enhancement: Using AI to optimize reaction parameters (temperature, pressure, mixing speed) during SMP polymerization, leading to reduced energy consumption and higher yield rates in chemical synthesis.

DRO & Impact Forces Of Silane Modified Polymers (SMP) Adhesives and Sealants Market

The market dynamics of Silane Modified Polymers (SMP) adhesives and sealants are shaped by a complex interplay of environmental mandates, technological advancements, and raw material volatility. The primary drivers revolve around the regulatory push for sustainable building materials and the automotive industry’s drive for lightweighting, which naturally favor solvent-free, high-performance SMP products. Conversely, the market faces significant restraints stemming from the high costs and supply chain instability of specialized silane precursors, which are often petrochemical derivatives, coupled with the extended curing times required for certain high-density SMP formulations compared to traditional solvent-based systems. Opportunities are particularly pronounced in emerging applications like photovoltaic panel installation and electric vehicle battery encapsulation, areas where the unique combination of weather resistance, flexibility, and non-conductivity offered by SMPs provides a distinct technological advantage over competing chemistries. These dynamics combine to generate powerful impact forces across the value chain, dictating pricing strategies and technological investment priorities.

The impact forces within the SMP market are primarily exerted by stringent environmental, social, and governance (ESG) standards, which compel manufacturers to prioritize non-hazardous and low-VOC alternatives. This regulatory pressure acts as a barrier to entry for conventional, less sustainable products, effectively transferring market share towards SMP technology. Furthermore, the rapid growth of prefabricated construction methods, which rely heavily on high-speed, durable structural bonding for modular assembly, creates a significant demand pull for highly specialized, fast-curing SMP adhesives. However, the influence of large, consolidated chemical suppliers on the pricing and availability of core silane ingredients presents a constant threat, necessitating strategic material sourcing and long-term supply agreements by SMP compounders.

Successful navigation of the SMP market requires manufacturers to continually balance high product performance demands with cost control and regulatory compliance. The opportunity to penetrate underserved industrial assembly markets in regions undertaking rapid modernization, such as Southeast Asia and parts of Latin America, offers substantial growth avenues. Nevertheless, competition from established polyurethane and silicone sealants, which benefit from lower production costs and entrenched user familiarity, remains a continuous hurdle. Therefore, sustained investment in R&D to improve the cross-linking efficiency and reduce the overall material loading while maintaining superior performance is crucial for long-term competitive success and market penetration against rival chemistries.

Segmentation Analysis

The Silane Modified Polymers (SMP) Adhesives and Sealants market segmentation provides a comprehensive breakdown based on chemical composition (Type), functional output (Product), and end-use application (End-User). This detailed segregation is essential for understanding the nuanced demand patterns across different industrial verticals and technological requirements. The categorization by Type primarily differentiates between Polyether backbone SMPs and Polyurethane backbone SMPs, which exhibit distinct performance attributes, particularly concerning UV stability, tensile strength, and flexibility. The distinction between adhesives and sealants hinges on the product's primary function—bonding strength versus gap filling and elasticity—both of which are critical in demanding applications like construction and transportation.

The application segmentation is crucial for strategic market planning, with the Construction sector historically dominating the market share, driven by extensive use in roofing, flooring, weatherproofing, and structural glazing applications due to SMP's excellent moisture resistance and durability. However, the Automotive and Transportation segment is projected to show the fastest CAGR, stimulated by electric vehicle production and the increasing use of lightweight composites and heterogeneous material bonding required to meet fuel efficiency targets. Understanding these segmental dynamics allows market players to tailor product development, focusing resources on high-growth, high-value applications where specialized SMP formulations can command premium pricing.

Further granularity in the segmentation reveals critical growth nodes, such as the increasing demand for fire-rated and low-smoke SMP sealants in public infrastructure projects, and the specific requirements for electronics assembly where non-corrosive, highly precise dispensing is necessary. The continuous development of SMPs offering enhanced adhesion to low-energy surfaces (like certain plastics and powder-coated metals) is expanding their reach into general industrial assembly and DIY markets, diversifying the revenue streams beyond the core construction and automotive verticals. This segmented view emphasizes the versatility and adaptability of SMP technology across the modern industrial landscape.

- By Type:

- Polyether SMP

- Polyurethane SMP

- Other (e.g., Acrylic SMP, Epoxy SMP)

- By Product:

- Adhesives

- Sealants

- By Application:

- Construction (Residential, Commercial, Infrastructure)

- Automotive and Transportation (OEM, Aftermarket, Rail)

- Industrial Assembly (Appliances, HVAC, Filtration)

- DIY/Retail

- Others (Marine, Aerospace)

Value Chain Analysis For Silane Modified Polymers (SMP) Adhesives and Sealants Market

The value chain for Silane Modified Polymers (SMP) is complex, beginning with the upstream supply of specialized chemical raw materials, progressing through polymerization and compounding, and culminating in distribution to diverse end-use markets. The upstream segment is dominated by large chemical companies that manufacture essential components like polyols, functionalized silanes (e.g., methoxysilane groups), and specialty catalysts. The cost and purity of these specialized monomers heavily influence the final product pricing and performance attributes. Critical upstream activities include the synthesis of the polymer backbone (polyether or polyurethane) and the subsequent functionalization step where silane groups are terminally attached, a technologically intensive process requiring significant proprietary knowledge and capital investment.

The midstream involves the polymerization and compounding of the SMP base material. Manufacturers in this stage purchase the functionalized silanes and blend them with various additives, including plasticizers, fillers (such as calcium carbonate or fumed silica), pigments, and performance enhancers (like UV stabilizers and anti-sag agents). Formulation expertise is paramount here, as the precise blend determines the finished product characteristics, such as viscosity, extrusion rate, cure speed, and ultimate mechanical properties. Quality control during compounding is vital, ensuring batch consistency to meet stringent industry standards required by construction and automotive clients. This stage often involves sophisticated mixing equipment and specialized handling due to the moisture sensitivity of the polymer.

The downstream distribution channel involves moving the packaged adhesives and sealants to end-users. Distribution is bifurcated into direct sales to large Original Equipment Manufacturers (OEMs) in the automotive and industrial sectors, and indirect sales through extensive networks of specialized distributors, hardware stores, and building material suppliers serving the construction and DIY markets. Direct distribution provides technical support and application expertise crucial for specialized industrial bonding, while the indirect channel leverages the reach and logistical capabilities of regional partners to serve fragmented smaller customers. The effectiveness of the supply chain in managing shelf life (as SMPs are moisture-sensitive) and providing timely technical service is a key competitive differentiator in the downstream segment.

Silane Modified Polymers (SMP) Adhesives and Sealants Market Potential Customers

The potential customer base for Silane Modified Polymers (SMP) adhesives and sealants is highly diversified, reflecting the versatility of the product across industries requiring durable, flexible, and environmentally compliant bonding and sealing solutions. Primary consumers are large construction firms and contractors specializing in residential, commercial, and infrastructure projects, who utilize SMP sealants for facade weatherproofing, joint sealing, and flooring installations. These buyers prioritize products with long service life, high elasticity, and resistance to UV radiation and thermal cycling, minimizing maintenance costs and ensuring compliance with stringent building codes, particularly those emphasizing green and sustainable construction practices. Furthermore, manufacturers of prefabricated and modular buildings represent a rapidly expanding customer segment, demanding fast-curing SMP adhesives capable of providing structural integrity in factory settings.

The second major group of customers comprises automotive and transportation Original Equipment Manufacturers (OEMs). These buyers use SMP adhesives extensively in vehicle assembly for bonding structural components, sealing windshields and lights, and encapsulating battery packs in electric vehicles. Their buying criteria focus heavily on crash safety performance, vibration damping, ability to bond dissimilar materials (e.g., metals to composites), and rapid production cycle integration. Tier 1 suppliers within the automotive ecosystem also represent significant buyers, incorporating SMP products into sub-assemblies delivered to the final vehicle manufacturers. The drive towards vehicle lightweighting directly increases the reliance on advanced bonding solutions, making these customers central to the market’s growth trajectory.

Other significant end-users include general industrial assembly manufacturers involved in HVAC systems, white goods (appliances), filtration units, and electronics. These customers seek SMP products for their clean application (solvent-free) and excellent adhesion to various plastics and metals. Additionally, the retail and DIY sectors are growing markets, where consumers and small professional contractors seek easy-to-use, versatile, and non-hazardous sealants for home repairs and minor construction projects. The broad appeal of SMPs due to their safety profile and high performance across multiple substrates ensures a consistently expanding and technologically demanding customer portfolio.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.5 Billion |

| Market Forecast in 2033 | USD 7.8 Billion |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Henkel AG & Co. KGaA, Sika AG, Bostik (Arkema Group), Wacker Chemie AG, Kaneka Corporation, Tremco CPG (RPM International Inc.), 3M Company, H.B. Fuller Company, Momentive Performance Materials Inc., Dow Inc., Selena FM S.A., Cemedine Co., Ltd., Denka Company Limited, Beijing San-An Chemical Co., Ltd., Evonik Industries AG, Merck KGaA, Chemetall (BASF SE), KCC Corporation, MAPEI S.p.A., Illinois Tool Works Inc. (ITW) |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Silane Modified Polymers (SMP) Adhesives and Sealants Market Key Technology Landscape

The technological landscape of the Silane Modified Polymers (SMP) market is defined by continuous innovation focused on enhancing curing mechanisms, optimizing polymer backbone structure, and improving long-term performance stability. Central to this evolution is the control over the moisture-curing reaction, which transforms the liquid SMP material into a solid elastomer through silanol condensation. Current research emphasizes developing latent or blocked silane technologies that allow for controlled, faster curing times under specific, often accelerated, environmental conditions (e.g., UV or heat activation), making them suitable for high-throughput industrial assembly lines, a significant technical improvement over traditional atmospheric moisture curing which can be slow and climate-dependent. Furthermore, advancements in catalyst systems are being explored to accelerate the cross-linking process without compromising the material’s final mechanical strength or elasticity.

Another crucial technological frontier involves the engineering of the polymer backbone itself, particularly the move towards specialized Polyether-based SMPs. These newer systems offer superior resistance to yellowing and better UV stability than some traditional polyurethane hybrids, making them highly desirable for exterior construction applications like facade joints and exposed structural glazing. Concurrently, manufacturers are investing heavily in technologies that allow for the incorporation of high amounts of renewable or bio-based content into the SMP formulation, aligning with global sustainability mandates without sacrificing critical performance parameters such as adhesion strength to difficult substrates (e.g., highly plasticized PVC or composite materials). This involves developing new polyol sources derived from bio-mass feedstock and optimizing the compatibility of these non-traditional materials within the highly functionalized SMP system.

Integration technology, including specialized dispensing and application equipment, also plays a pivotal role in the market’s technological maturity. As SMPs transition into structural and precision bonding roles in automotive and electronics manufacturing, automated, robotic application systems capable of depositing precise beads and ensuring consistent layer thickness are essential. Innovation in packaging technology, such as specialized cartridge and foil pack designs that prevent premature moisture exposure and extend shelf life, is also critical for maintaining product integrity across complex global supply chains. Ultimately, the technological trajectory of the SMP market is aimed at achieving the trifecta of solvent-free chemistry, superior mechanical performance, and optimized application speed, making them competitive against the fastest two-component epoxies and polyurethanes.

Regional Highlights

Regional dynamics within the Silane Modified Polymers (SMP) Adhesives and Sealants market demonstrate significant variance driven by differing regulatory environments, industrial output levels, and construction activities. The Asia Pacific (APAC) region currently represents the largest and fastest-growing market, primarily fueled by massive infrastructure investments, rapid urbanization, and a dominant position in global manufacturing sectors, especially automotive and electronics assembly in China, India, and Southeast Asia. The demand in APAC is characterized by a high volume requirement across both premium structural applications and more cost-sensitive general sealing projects, leading to intense competition and localized product development focused on regional climate challenges, such as high humidity and extreme temperatures.

Europe holds a substantial share and serves as a critical technological hub for SMP innovation. This region is driven by extremely strict environmental regulations, notably the REACH framework and various national low-VOC requirements, which strongly favor solvent-free SMP technologies over traditional alternatives. The European market demand is concentrated in the renovation and refurbishment of existing buildings, alongside the rigorous standards for energy-efficient construction, which rely heavily on durable, elastic, and airtight sealants. Countries like Germany, France, and the Benelux region are key consumers, demonstrating high willingness to pay for premium, certified, sustainable SMP solutions.

North America, led by the United States, is a mature market distinguished by high technology adoption and stringent performance specifications, particularly in large-scale commercial construction and automotive assembly. Regulatory drivers, such as the increasing emphasis on worker safety and environmental protection at the state level (e.g., California’s environmental standards), accelerate the substitution of traditional, hazardous chemistries with advanced SMP formulations. The market here is characterized by a strong focus on high-performance structural adhesives required for high-rise buildings and advanced composite materials used in transportation, ensuring North America remains a significant consumer and innovator in specialized, high-margin SMP products.

- Asia Pacific (APAC): Dominates market growth due to expansive construction and automotive manufacturing; high urbanization rates in China, India, and Indonesia driving volume demand.

- Europe: Characterized by stringent low-VOC regulations and high adoption rates in sustainable building renovation and energy-efficient construction projects; strong presence of R&D centers.

- North America: High demand for premium, high-strength structural SMP adhesives for complex commercial construction and specialized applications in automotive and aerospace maintenance.

- Latin America (LATAM): Emerging market with increasing adoption driven by industrialization in Brazil and Mexico, focusing initially on local automotive production and infrastructure modernization.

- Middle East and Africa (MEA): Growth driven by mega construction projects and demand for sealants with extreme weather resistance (high heat and UV stability) suitable for desert climates.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Silane Modified Polymers (SMP) Adhesives and Sealants Market.- Henkel AG & Co. KGaA

- Sika AG

- Bostik (Arkema Group)

- Wacker Chemie AG

- Kaneka Corporation

- Tremco CPG (RPM International Inc.)

- 3M Company

- H.B. Fuller Company

- Momentive Performance Materials Inc.

- Dow Inc.

- Selena FM S.A.

- Cemedine Co., Ltd.

- Denka Company Limited

- Beijing San-An Chemical Co., Ltd.

- Evonik Industries AG

- Merck KGaA

- Chemetall (BASF SE)

- KCC Corporation

- MAPEI S.p.A.

- Illinois Tool Works Inc. (ITW)

Frequently Asked Questions

Analyze common user questions about the Silane Modified Polymers (SMP) Adhesives and Sealants market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary performance advantages of Silane Modified Polymers (SMP) over traditional polyurethane and silicone materials?

SMP adhesives and sealants offer a unique combination of benefits, most notably being solvent-free and non-isocyanate, making them safer and low-VOC compliant. Performance-wise, they provide excellent elasticity, superior primerless adhesion to diverse substrates (metals, plastics, composites), outstanding weather resistance, and long-term UV stability, often surpassing the durability of conventional polyurethanes while retaining better paintability than standard silicones.

Which end-use application drives the highest demand for SMP technology globally?

The Construction industry is the largest end-use sector for SMP, accounting for the highest volume demand, driven by applications such as facade sealing, structural glazing, floor joints, and roofing. However, the Automotive and Transportation segment, particularly the electric vehicle (EV) market requiring advanced bonding for battery encapsulation and lightweight chassis components, exhibits the highest projected growth rate (CAGR).

How do regulatory trends influence the adoption and growth of the SMP market?

Stringent global regulatory frameworks, especially in North America and Europe (like REACH and various environmental protection agency mandates), heavily favor SMP adoption. Since SMPs are inherently low in volatile organic compounds (VOCs) and free of hazardous isocyanates, they are the preferred choice for manufacturers aiming to comply with increasingly strict standards regarding air quality, occupational health, and sustainable building certifications (e.g., LEED or BREEAM).

What are the main technological challenges facing SMP manufacturers today?

Key technological challenges include controlling and accelerating the moisture-curing time, especially in deep joints or high-humidity environments, and reducing the total production cost by securing stable and cost-effective sourcing of specialized silane precursors. Manufacturers are also focused on improving adhesion reliability across new, difficult-to-bond substrates like specific composite materials and low-energy plastics.

What is the role of the Polyether SMP segment compared to Polyurethane SMP?

Polyether SMPs generally offer superior resistance to UV degradation and yellowing, excellent flexibility, and improved weathering properties, making them highly suitable for external applications where aesthetics and long-term outdoor exposure are critical, such as high-end facade sealing. Polyurethane SMPs, while sometimes having lower UV resistance, typically offer higher tensile strength and mechanical performance, making them preferred for demanding structural adhesive applications in automotive and heavy industrial assembly.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager