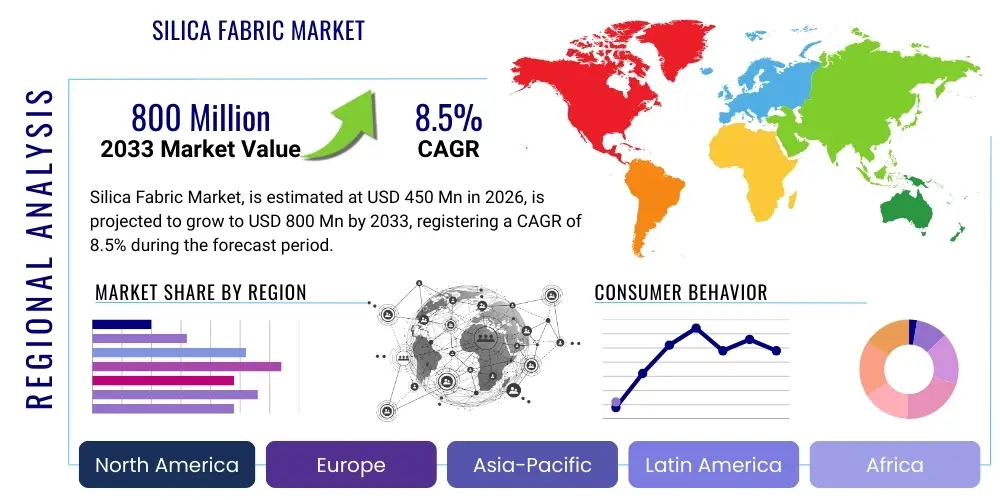

Silica Fabric Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438473 | Date : Dec, 2025 | Pages : 248 | Region : Global | Publisher : MRU

Silica Fabric Market Size

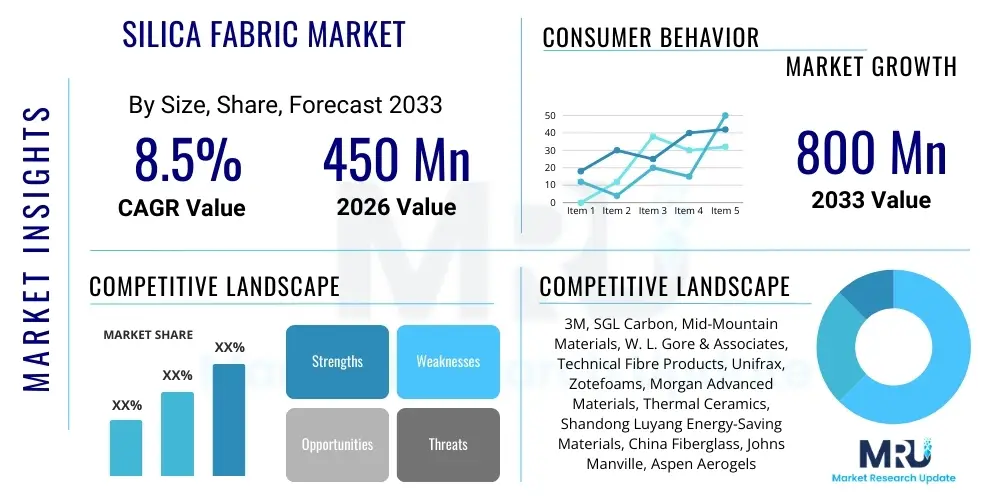

The Silica Fabric Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at USD 450 Million in 2026 and is projected to reach USD 800 Million by the end of the forecast period in 2033.

Silica Fabric Market introduction

Silica fabric is a high-performance textile material distinguished by its exceptional resistance to high temperatures, typically maintaining integrity up to 1800°F (982°C) or higher for short durations, and continuous service temperatures around 1000°C. This textile is chemically inert, resistant to most acids and alkalis, and possesses superior dielectric properties, making it invaluable in environments where extreme heat or chemical exposure is present. The primary product description encompasses woven textiles derived from high-purity amorphous silica fiber (SiO2 content often exceeding 96%), providing a robust and flexible alternative to traditional fiberglass or ceramic fiber materials in demanding industrial applications. The inherent safety profile, due to its non-respirable fiber structure compared to some older refractory materials, enhances its appeal in stringent regulatory environments.

Major applications for silica fabric span across critical industrial sectors, including sophisticated thermal insulation blankets and pads used in petrochemical processing and power generation, welding and cutting protection screens to shield equipment and personnel from molten spatter and slag, and as high-temperature expansion joints in complex ductwork. Furthermore, the aerospace and defense industries utilize these fabrics extensively for ablative shields, composite reinforcements, and insulating components within aircraft engines and rocket casings, leveraging their low thermal conductivity and lightweight nature. The growing adoption of advanced manufacturing techniques requiring localized heat management and superior fireproofing capabilities continues to drive demand across diverse end-user segments globally, positioning silica fabric as a crucial material for safety and efficiency enhancements.

The market is significantly driven by stringent global fire safety regulations, particularly in the construction and marine industries, which mandate the use of non-combustible materials for passive fire protection systems such as fire curtains and smoke barriers. The rising investment in infrastructure development, coupled with the modernization of aging industrial facilities, necessitates durable and effective thermal management solutions that silica fabric reliably provides. These fabrics offer substantial benefits, including improved energy efficiency by minimizing heat loss, enhanced worker safety through superior heat and spark containment, and extended equipment lifespan by protecting sensitive components from thermal stress. These factors collectively solidify the material's role as a cornerstone of modern high-temperature protection strategies, influencing steady market expansion through the forecast period.

Silica Fabric Market Executive Summary

The Silica Fabric Market is characterized by robust growth stemming from the accelerating demand for advanced thermal insulation solutions across industrial and aerospace sectors. Key business trends indicate a focused shift toward developing ultra-high purity grades (over 98% SiO2) and specialized coatings, such as vermiculite or silicone, to enhance abrasion resistance, water repellency, and mechanical strength, thereby expanding application scope beyond basic heat shielding. Consolidation among major manufacturers aiming to control the silica fiber supply chain and optimize production efficiency is a noticeable commercial strategy. Furthermore, sustainability is becoming a crucial driver, with manufacturers exploring environmentally friendly production methods and reusable product life cycles to align with evolving corporate and governmental environmental standards, influencing procurement decisions in major industrial economies.

Regionally, Asia Pacific maintains its dominance, primarily fueled by massive industrialization, high growth in the automotive sector, and substantial ongoing infrastructure projects in countries like China, India, and Southeast Asia, requiring significant passive fire protection materials. North America and Europe, while mature, exhibit strong demand driven by strict regulatory requirements concerning worker safety (OSHA standards, REACH regulations) and high-value applications in the aerospace and defense sectors, pushing innovation in specialized, low-weight, high-performance fabrics. The Middle East and Africa (MEA) region shows emerging potential, largely driven by large-scale oil and gas investments and rapidly expanding construction activities that mandate durable thermal and fire protection solutions for new facilities and pipelines.

Segmentation trends highlight the Ultra-High Purity Silica Fabric segment as the fastest-growing type, preferred for highly technical applications such as aircraft engine components and complex composite manufacturing where even minimal impurities are detrimental to performance under extreme conditions. By application, the Thermal Insulation and Fire Curtains segments collectively account for the largest market share, reflecting the pervasive need for energy conservation and standardized fire safety across commercial and industrial buildings. End-user growth is particularly pronounced in the Aerospace & Defense and Industrial Manufacturing sectors, where the requirement for materials that can withstand continuous temperatures up to 1000°C without degrading provides a compelling competitive advantage over traditional, lower-rated technical textiles, cementing silica fabric's market position.

AI Impact Analysis on Silica Fabric Market

User queries regarding the impact of AI on the Silica Fabric Market primarily revolve around three central themes: optimizing the manufacturing process, enhancing quality control and defect detection in weaving, and using predictive analytics for demand forecasting and supply chain management of raw silica materials. Users are highly interested in how Machine Learning (ML) algorithms can be integrated into the complex textile production line to minimize material waste, particularly given the high cost of high-purity silica precursors. There is also significant concern regarding the future role of AI in material innovation, specifically the potential for AI to simulate new fabric structures or predict the performance of coated silica materials under novel thermal stress conditions, leading to faster product development cycles and tailored solutions for niche aerospace applications. The underlying expectation is that AI will drastically improve operational efficiency and product consistency, reducing the human element variability inherent in traditional high-temperature textile production.

The application of AI in this niche market is currently focused on the optimization layers rather than radical product alteration. AI-driven predictive maintenance in large weaving and finishing machines ensures maximum uptime, critical for specialized fabric production runs. Furthermore, Computer Vision (CV) systems powered by AI are being deployed post-weaving to inspect the fabric surface at high speed, identifying subtle defects, uneven coatings, or structural weaknesses that are invisible to the human eye or rudimentary sensor systems. This rigorous, AI-enhanced quality control significantly improves the reliability and adherence to strict specifications required by end-users, especially in the military and aerospace industries where failure is catastrophic. The implementation of digital twin technology based on operational data is also emerging, allowing manufacturers to simulate production changes before physical implementation, accelerating process refinement.

The longer-term impact forecasts an AI-assisted shift in material formulation and composite design. Generative AI tools are being experimented with to explore novel weaving patterns and coating compositions that maximize thermal performance while minimizing weight, addressing a persistent challenge in high-performance insulation. This acceleration in Research and Development (R&D) minimizes time-to-market for specialized silica fabric variants required for next-generation defense platforms and sustainable energy systems (e.g., concentrated solar power). Ultimately, AI integration promises to transform silica fabric manufacturing from a largely empirical process to a data-driven, highly optimized industry, ensuring material quality consistency and responsiveness to rapidly changing technological demands across critical industries.

- AI-driven optimization of weaving machine parameters reduces material waste and increases throughput efficiency in high-ppurity silica fiber production.

- Machine Vision systems utilize AI for real-time, automated defect detection, ensuring stringent quality standards for aerospace and defense-grade fabrics.

- Predictive analytics enhance supply chain resilience by accurately forecasting demand for raw silica precursors and managing inventory levels.

- AI simulates and analyzes the performance of new coating formulations, accelerating the development of specialized silica fabrics with enhanced abrasion or chemical resistance.

- Integration of digital twins allows manufacturers to simulate factory floor changes, optimizing energy consumption and maintenance schedules for sustainable operations.

DRO & Impact Forces Of Silica Fabric Market

The market dynamics for silica fabric are shaped by a complex interplay of robust demand drivers, critical material and regulatory restraints, and significant opportunities emerging from technological shifts and geopolitical stability. The primary driving force centers on the mandatory requirement for superior thermal protection and passive fire safety across heavily regulated sectors, notably aerospace, marine, and high-heat industrial manufacturing, where conventional materials fail to meet operating temperature thresholds. Restraints often revolve around the high initial cost of ultra-high purity silica fibers and the energy-intensive nature of their manufacturing, alongside supply chain vulnerability tied to a limited number of specialized fiber producers. Opportunities arise particularly from the global push for lightweight materials in electric vehicles (EVs) and advanced aerospace platforms, alongside the potential for integrating silica fabrics into high-efficiency energy storage solutions. These factors create an environment where the market's progression is dependent on balancing technological advancement against cost constraints and regulatory compliance.

The significant impact forces governing this market include the global price fluctuation of energy, which directly influences production costs, and the increasing stringency of environmental, health, and safety (EHS) regulations globally. EHS standards related to fire resistance (e.g., IMO standards for marine use, stringent building codes) directly elevate demand for compliant silica fabrics, overriding potential cost restraints. Furthermore, geopolitical stability and trade policies significantly affect the supply of critical raw materials, primarily high-purity quartz, which is essential for manufacturing the precursor fibers. Technological advancements in weaving and finishing processes—such as plasma treatment or specialized chemical vapor deposition (CVD) coatings—act as powerful forces to improve product performance (durability, flexibility) and lower the total cost of ownership for end-users, ensuring that the market remains highly competitive based on performance specifications.

The long-term growth trajectory is further supported by the substantial opportunity presented by emerging insulation technologies, such as next-generation aerogels or hybrid materials that utilize silica fabric as a foundational structural component, enhancing their high-temperature stability. However, the market faces structural constraints from the competitive threat posed by alternatives like advanced basalt fibers or specific ceramic fiber products in lower-temperature applications, necessitating continuous R&D investment to maintain silica fabric's superior performance edge in extreme heat environments. The ongoing modernization of aging industrial infrastructure in developed economies provides a cyclical replacement demand driver, while rapid industrial expansion in developing nations generates new market entry points, establishing a robust foundation for consistent growth provided that raw material costs are managed effectively.

Segmentation Analysis

The Silica Fabric Market is segmented based on product type, application, and end-user industry, reflecting the specialized requirements of diverse high-temperature environments. Segmentation by type differentiates between High Purity Silica Fabric (typically 96% SiO2 content) and Ultra-High Purity Silica Fabric (exceeding 98% SiO2), driven by varying tolerance needs for contaminants and thermal loads in specific applications, with ultra-high purity fabrics dominating technical, high-specification uses. The application segmentation, ranging from critical welding protection and thermal insulation to engineered composite reinforcement, outlines the core functional requirements met by the material. This multi-dimensional segmentation allows manufacturers to tailor product specifications, focusing on parameters like fabric weight, thickness, weave structure, and specific chemical resistance, ensuring optimized performance for demanding environments.

The end-user industry segmentation clearly illustrates the market's dependence on capital-intensive sectors such as Aerospace & Defense, Industrial Manufacturing (including metallurgy and foundries), Automotive, and Marine transport. The Aerospace sector, for instance, requires fabrics that meet stringent flame, smoke, and toxicity (FST) standards, driving demand for the highest performance grades. Conversely, industrial manufacturing and construction utilize robust, high-volume silica fabrics for large-scale insulation and protective covers. Geographical segmentation is critical for market penetration strategies, recognizing that regulatory environments (like stricter European fire codes or rapid industrial expansion in Asia Pacific) significantly influence the adoption rates and volume requirements across regional markets, necessitating distinct commercial approaches tailored to local standards and industry maturity levels.

- By Type:

- High Purity Silica Fabric (96% SiO2)

- Ultra-High Purity Silica Fabric (>98% SiO2)

- By Application:

- Welding Protection and Stress Relief

- Thermal Insulation Blankets and Pads

- Fire Curtains and Smoke Barriers

- High-Temperature Gaskets and Seals

- Aerospace and Composite Reinforcement

- By End-User Industry:

- Aerospace & Defense

- Industrial Manufacturing (Metals, Glass, Petrochemicals)

- Automotive (Heat Shields, Exhaust Wraps)

- Marine (Shipbuilding and Offshore)

- Construction and Infrastructure

Value Chain Analysis For Silica Fabric Market

The value chain for the Silica Fabric Market begins with the highly specialized upstream procurement of high-purity quartz and the energy-intensive process of drawing and manufacturing amorphous silica fibers, often involving chemical treatment and high-temperature fusion. Due to the technical complexity, the upstream sector is characterized by a limited number of specialized global suppliers who control the quality and purity of the precursor materials, which critically impacts the final fabric performance and cost. Key activities at this initial stage include raw material refining and strict process control to achieve the required 96% to over 98% silica content. Price volatility and the stability of the global supply of high-purity quartz are major risk factors upstream, directly influencing the profitability of midstream weaving operations.

The midstream involves the transformation of silica fiber into technical textiles, encompassing weaving, knitting, and specialized finishing processes. Manufacturers utilize highly sophisticated looms and require precise control over weave patterns (e.g., satin, plain, twill) to achieve specific mechanical and thermal properties desired by end-users. Downstream activities involve coating and fabrication; fabrics are often treated with vermiculite, silicone, or proprietary high-temperature binders to improve abrasion resistance, flexibility, or water/oil repellency, followed by cutting and stitching into final products such as welding blankets, customized insulation jackets, or complex composite preforms. This stage adds significant value by tailoring the generic fabric into application-specific solutions, often through highly skilled labor and automated fabrication techniques.

Distribution channels for silica fabrics are typically segmented into direct and indirect routes. Direct distribution is common for high-volume, highly customized orders, especially those destined for the Aerospace & Defense or large-scale industrial projects (e.g., power plants, large refineries), allowing for direct technical consultation between the fabricator and the end-user engineer. Indirect channels utilize specialized industrial distributors and technical textile suppliers who maintain inventory and provide localized logistical support to smaller manufacturers, automotive aftermarket suppliers, and general industrial maintenance operations. These indirect partners play a vital role in market penetration by providing readily available standardized products, ensuring widespread market access and minimizing lead times for common applications like welding protection.

Silica Fabric Market Potential Customers

The primary customers for silica fabric are large industrial entities and specialized manufacturers operating in environments characterized by extreme heat, the necessity of absolute fire safety, and complex thermal management requirements. End-users fall mainly within capital-intensive sectors where material failure poses high risks, both financially and in terms of safety. Key buyers include aerospace manufacturers (OEMs and MRO providers) requiring lightweight, high-temperature composite reinforcement and exhaust/engine insulation; large energy and petrochemical companies purchasing thermal insulation blankets for process piping, reactors, and turbines; and shipbuilding yards and marine outfitters needing non-combustible fabrics for fire barriers and safety curtains that comply with international marine regulations (e.g., IMO standards).

Furthermore, the foundry and metallurgy industries represent significant buyers, utilizing silica fabrics for protective clothing, furnace curtains, and ladle covers to manage molten metal splash and radiant heat, safeguarding both personnel and sensitive equipment. The automotive sector, especially manufacturers of high-performance vehicles and Electric Vehicles (EVs), utilizes silica fabric for critical heat shielding around exhaust systems, catalytic converters, and increasingly, as thermal barriers for battery packs to mitigate thermal runaway risks, creating a burgeoning market segment. These buyers prioritize product specifications such as continuous service temperature, dimensional stability, chemical resistance, and certified compliance with relevant industry safety standards (e.g., NFPA, ISO, MIL-SPEC), making performance metrics more critical than unit cost.

A crucial category of potential customers includes specialized fabricators and thermal solution providers who purchase the bulk silica fabric and convert it into customized, ready-to-install products like removable insulation jackets, welding curtains, or complex expansion joints tailored to specific machinery and site requirements. These converters act as intermediaries, serving smaller or diverse end-users who lack the in-house capability for high-temperature textile fabrication. This customer type values consistency of supply, wide product portfolio options (various weights and coatings), and robust technical support from the original silica fabric manufacturer, facilitating their ability to deliver tailored thermal management solutions efficiently to a fragmented customer base.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450 Million |

| Market Forecast in 2033 | USD 800 Million |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | 3M, SGL Carbon, Mid-Mountain Materials, W. L. Gore & Associates, Technical Fibre Products, Unifrax, Zotefoams, Morgan Advanced Materials, Thermal Ceramics, Shandong Luyang Energy-Saving Materials, China Fiberglass, Johns Manville, Aspen Aerogels, Pyrotek, Saffire Textile, Texpack, Hi-Temp Insulation Inc., Firetex Systems, Ametek, Inc., Promat International |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Silica Fabric Market Key Technology Landscape

The technology landscape for the Silica Fabric Market is primarily characterized by advancements in raw fiber production, specialized weaving techniques, and sophisticated surface modification processes designed to optimize mechanical durability and functional performance under extreme conditions. A foundational technology involves the continuous filament spinning process, which ensures the high degree of fiber uniformity and purity necessary for high-specification fabrics. Recent innovations in this area focus on reducing the diameter variability of the silica fibers to create textiles with superior flexibility and minimal shedding, crucial for applications involving frequent handling or mechanical stress, such as removable insulation jackets. Furthermore, proprietary chemical treatments during the fiber formation stage are employed to minimize residual elements, ensuring the final fabric remains electrically insulating and chemically inert, especially important for use in semiconductor manufacturing equipment and high-voltage power generation.

In the midstream processing, the adoption of advanced weaving architectures represents a significant technological leap. Techniques like 3D weaving and complex multi-layer knitting are gaining traction, allowing manufacturers to create fabrics with controlled porosity, increased bulk without excessive weight, and enhanced resistance to delamination and tear propagation. This structural engineering is vital for high-performance applications like ablative shields in aerospace where material integrity under thermal shock is paramount. Moreover, the integration of automation and precise tension control systems in the weaving process ensures consistency across large production runs, maintaining the tight tolerances demanded by the defense and aviation industries. These technological shifts are lowering production variability and enabling the creation of fabrics with customizable insulation properties based on specific heat flux requirements.

The most active area of technological development lies in surface modification and post-treatment coatings. Key technologies include vacuum deposition methods and specialized dipping processes utilizing high-temperature polymers or inorganic compounds like vermiculite, ceramic, or silicone rubber. Vermiculite coatings dramatically improve abrasion resistance, making the fabric more robust for industrial handling, and often increase the fabric's ability to shed molten splash, a critical feature for welding blankets. Silicone rubber coatings offer excellent flexibility, water resistance, and electrical insulation properties, extending the fabric's utility into outdoor and high-humidity environments. The integration of nanocoatings is an emerging area, aiming to improve the fabric's emissivity and reflectivity, thereby enhancing its thermal barrier performance while maintaining flexibility and minimizing overall weight. The convergence of material science and textile engineering drives continuous innovation, ensuring silica fabric remains the material of choice for demanding thermal management needs.

Regional Highlights

The regional analysis of the Silica Fabric Market indicates significant divergence in growth drivers, maturity levels, and application focus across major geographic areas. Asia Pacific (APAC) dominates the global market, primarily driven by rapid industrial expansion, massive infrastructure development, and substantial government investments in manufacturing capabilities in China, India, and South Korea. The region’s strong presence in sectors like automotive production, metals processing, and petrochemical refining creates a high-volume demand for both basic and high-purity silica fabrics used for industrial insulation and safety barriers. Furthermore, lower labor and production costs, coupled with the increasing adoption of global fire safety standards in regional construction codes, fuel robust market growth, solidifying APAC's position as both the largest consumer and the primary global manufacturing hub for specialized technical textiles.

North America holds a substantial market share, characterized by high adoption rates of premium, ultra-high purity silica fabrics, particularly within the heavily regulated Aerospace & Defense sector and the advanced manufacturing industry. Strict environmental and worker safety standards (e.g., OSHA, EPA regulations) mandate the use of non-carcinogenic, high-performance thermal insulation materials, favoring silica fabric over traditional ceramic or asbestos alternatives. The U.S. remains the core market, driven by continuous military modernization programs and significant R&D spending on next-generation composite materials for space exploration and high-speed aviation. The market in this region is less price-sensitive and focuses intensely on product innovation, technical certifications, and the ability of manufacturers to deliver tailor-made solutions for complex, high-stakes engineering challenges.

Europe represents a mature yet high-value market, distinguished by some of the most stringent fire protection and environmental regulations globally (e.g., REACH, specific EU Construction Products Regulations). Demand here is propelled by mandatory upgrades of existing industrial facilities, the modernization of power generation plants, and a robust marine industry that strictly adheres to the International Maritime Organization (IMO) fire safety standards. Countries like Germany, the UK, and France are key consumers, utilizing silica fabric extensively in the fabrication of specialized thermal and acoustic insulation solutions for high-speed rail and automotive luxury segments. The European market emphasizes sustainable production, demanding suppliers demonstrate robust environmental stewardship and energy-efficient manufacturing processes, further driving the adoption of premium, certified materials.

Latin America and the Middle East & Africa (MEA) are emerging regions exhibiting accelerated growth potential. In Latin America, growth is tied to the expansion of the industrial sector, particularly mining, metal processing, and energy infrastructure projects in Brazil and Mexico, creating new requirements for occupational safety and high-temperature process insulation. The MEA region, heavily reliant on oil and gas production, drives substantial demand for silica fabric for protective piping wraps, insulation jackets, and fireproof barriers within refineries, petrochemical plants, and offshore platforms. Government initiatives to diversify economies away from reliance solely on fossil fuels, leading to investments in infrastructure and manufacturing hubs, particularly in the Gulf Cooperation Council (GCC) countries, are setting the stage for significant long-term growth in the construction and general industrial end-user segments, though market penetration remains highly influenced by international project timelines and political stability.

- Asia Pacific (APAC): Dominant market due to rapid industrialization, high volume production of automotive components, and extensive infrastructure development in China and India.

- North America: High-value market focused on ultra-high purity fabrics, driven by stringent regulatory frameworks and robust demand from the Aerospace and Defense sectors in the United States.

- Europe: Mature market characterized by strict fire safety standards (IMO, EU regulations) and high adoption of premium silica fabrics for marine, automotive, and power generation facility upgrades.

- Middle East & Africa (MEA): Emerging high-growth region linked to major investments in oil and gas infrastructure, petrochemical refining, and large-scale commercial construction projects demanding thermal insulation and fire protection.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Silica Fabric Market, covering their product offerings, geographic presence, strategic initiatives, and recent developments that influence market competition and innovation.- 3M

- SGL Carbon

- Mid-Mountain Materials

- W. L. Gore & Associates

- Technical Fibre Products

- Unifrax

- Zotefoams

- Morgan Advanced Materials

- Thermal Ceramics

- Shandong Luyang Energy-Saving Materials

- China Fiberglass

- Johns Manville

- Aspen Aerogels

- Pyrotek

- Saffire Textile

- Texpack

- Hi-Temp Insulation Inc.

- Firetex Systems

- Ametek, Inc.

- Promat International

Frequently Asked Questions

Analyze common user questions about the Silica Fabric market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between high-purity and ultra-high purity silica fabric, and where are they used?

High-purity silica fabric typically contains 96% to 98% SiO2 and is used widely in industrial applications such as welding curtains and general thermal insulation. Ultra-high purity silica fabric, containing over 98% SiO2, is utilized in highly sensitive, high-specification applications like aerospace composites, advanced engine insulation, and semiconductor manufacturing, where minimal impurities are critical for performance integrity at extreme temperatures.

What is the Compound Annual Growth Rate (CAGR) projected for the Silica Fabric Market between 2026 and 2033?

The Silica Fabric Market is projected to exhibit a steady Compound Annual Growth Rate (CAGR) of 8.5% during the forecast period from 2026 to 2033. This growth is primarily fueled by rising global safety regulations and increasing demand for advanced thermal management solutions in the aerospace and industrial sectors.

How do coatings, such as vermiculite or silicone, enhance the performance of silica fabric?

Coatings significantly enhance the mechanical and functional properties of silica fabric. Vermiculite coatings improve abrasion resistance and aid in shedding molten spatter and slag, making the fabric ideal for welding protection. Silicone coatings provide superior water repellency, enhanced flexibility, and excellent electrical insulation, extending the fabric's lifespan and application in outdoor or high-humidity industrial environments.

Which end-user industries are the main drivers of demand for silica fabric?

The main drivers of demand are the Aerospace & Defense industry, utilizing silica fabric for high-performance composite reinforcement and engine insulation, and the Industrial Manufacturing sector, which relies on these textiles for thermal insulation, furnace linings, and passive fire protection in petrochemical, foundry, and metallurgy operations. The growing Electric Vehicle (EV) segment also represents a key emerging consumer for thermal barrier protection.

Is the Silica Fabric Market primarily driven by cost or regulatory compliance?

The Silica Fabric Market is primarily driven by mandatory regulatory compliance and performance requirements. Since these fabrics are typically used in critical safety and high-temperature environments (e.g., fire curtains, engine insulation), compliance with international safety standards (IMO, NFPA, MIL-SPEC) and guaranteed performance at high service temperatures often outweighs initial material cost considerations for end-users.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager