Silver Film Recycling Service Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435653 | Date : Dec, 2025 | Pages : 257 | Region : Global | Publisher : MRU

Silver Film Recycling Service Market Size

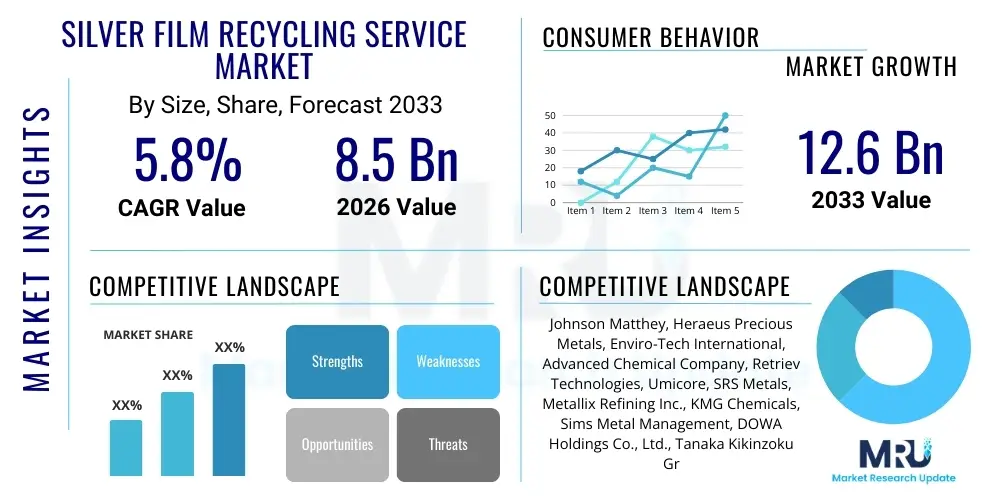

The Silver Film Recycling Service Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 8.5 Billion in 2026 and is projected to reach USD 12.6 Billion by the end of the forecast period in 2033.

Silver Film Recycling Service Market introduction

The Silver Film Recycling Service Market encompasses specialized processes dedicated to the recovery of silver metal from spent radiographic films, graphic arts films, and photographic films. Silver, a valuable commodity and a finite resource, is embedded in these films primarily as silver halides within the emulsion layer. The services offered include collection, transportation, and sophisticated refining processes such as electrolytic recovery, metallic replacement (chemical precipitation), and incineration followed by smelting. The primary objective is twofold: achieving high-purity silver recovery for industrial reuse and ensuring the environmentally sound disposal of the remaining film substrate (usually PET or cellulose triacetate), thereby mitigating potential landfill contamination and resource depletion.

Product descriptions within this market focus on the efficiency and purity levels of the recovered silver, often graded as 99.9% or higher, making it suitable for applications in electronics, jewelry, and new photographic material production. Major applications stem from the healthcare sector, specifically hospitals, diagnostic centers, and dental clinics that generate large volumes of X-ray film waste, although the transition to digital imaging systems (PACS) has led to a focus on legacy film inventory management and archiving destruction. Furthermore, industrial non-destructive testing (NDT) and the graphic arts industry remain significant, albeit shrinking, sources of recyclable film waste, driving demand for scalable and compliant recycling services across various geographies.

Key benefits driving market adoption include adherence to stringent environmental, health, and safety (EHS) regulations pertaining to hazardous waste disposal, realizing economic value from precious metal reclamation, and enhancing corporate sustainability profiles. Driving factors include the volatile, but generally upward, trajectory of global silver prices, prompting generators to view waste film as an asset rather than a liability. Moreover, mandatory Extended Producer Responsibility (EPR) schemes in various developed economies are pushing film manufacturers and end-users toward certified recycling channels, ensuring responsible resource management and fueling the expansion of specialized recycling infrastructure globally.

Silver Film Recycling Service Market Executive Summary

The Silver Film Recycling Service Market is characterized by a strong interplay between commodity pricing and regulatory compliance, shaping both business trends and operational strategies. Current business trends indicate a consolidation among smaller recyclers and the development of comprehensive, integrated waste management solutions offered by major players, moving beyond simple silver recovery to full asset destruction and certification services. There is a noticeable shift towards adopting cleaner, more efficient recovery technologies, minimizing chemical usage, and maximizing material purity, which elevates operational expenditure but significantly improves margins derived from the recovered metal. Furthermore, the market is experiencing increasing scrutiny regarding tracking and reporting mechanisms to ensure compliance throughout the supply chain, often leveraging digital platforms for transparent documentation.

Regional trends highlight divergence based on healthcare infrastructure maturity and regulatory enforcement. North America and Europe demonstrate mature markets, emphasizing stringent environmental permits, sophisticated logistics, and high-purity standards. The Asia Pacific (APAC) region, particularly China and India, presents the highest growth potential, driven by rapid expansion of healthcare facilities and increasing regulatory awareness concerning hazardous waste, leading to substantial investment in local recycling capacities. Conversely, developing economies in Latin America and MEA face challenges related to informal recycling sectors and inconsistent silver price hedging, though opportunities exist for establishing modern, standardized operations catering to large institutional waste generators.

Segmentation trends reveal that the "X-ray Film" segment, despite digitization, remains the dominant source segment due to extensive existing film archives held by hospitals and the continued use of analog systems in remote settings. Segmentation by recycling technology shows that advanced methods like high-efficiency electrolysis, which offers superior purity and lower environmental impact compared to basic chemical precipitation, are gaining traction, especially among large-scale recyclers. Moreover, the segmentation based on end-use application is stable, with the recovered silver predominantly feeding into industrial applications (e.g., solar cells, electronics) rather than solely photographic re-use, emphasizing the market's role in the broader industrial silver supply chain.

AI Impact Analysis on Silver Film Recycling Service Market

User queries regarding the impact of Artificial Intelligence (AI) on the Silver Film Recycling Service Market frequently revolve around three core themes: efficiency gains in sorting and logistics, predictive modeling for silver price risk management, and automation of quality control processes. Users are concerned about how AI can optimize the collection routes for spent film, given the scattered nature of waste generators (hospitals, labs). They also seek confirmation on whether AI-driven predictive analytics can help recycling firms hedge against the highly volatile price of silver, which directly impacts profitability. Furthermore, there is significant user interest in using computer vision and machine learning (ML) to automatically classify film types, detect contaminants, and assess the silver content yield before processing, ensuring operational throughput is maximized.

The integration of AI, particularly through machine learning algorithms and optimized routing software, is poised to significantly enhance the operational efficiency of silver film recycling services. Logistics optimization, a major cost center due to the need for secure and often specialized transportation of medical waste, benefits immensely from AI-driven route planning, minimizing travel time and fuel consumption across dispersed collection points. Furthermore, AI can process vast amounts of historical data related to waste generation rates by various clients, enabling recycling service providers to create more accurate and predictable inventory forecasts, ensuring efficient scheduling of processing plants and reducing unnecessary storage costs.

Beyond logistics, AI tools are increasingly being adopted in the core recovery processes. Predictive maintenance, facilitated by AI, monitors the performance of complex refining equipment (like electrolytic cells or chemical reactors), predicting potential failures before they occur, thus reducing costly downtime and extending the lifespan of critical machinery. More strategically, AI-driven econometric models are becoming invaluable for forecasting silver price movements, allowing recyclers to time their procurement of waste film and subsequent sales of recovered silver more advantageously, optimizing profit margins in a highly competitive and price-sensitive commodities market. This intelligent adoption moves the market towards data-driven operational excellence.

- AI optimizes complex collection routes, reducing transportation costs and carbon footprint.

- Machine learning improves predictive maintenance of refining equipment, minimizing operational downtime.

- AI-driven computer vision systems enhance automated film sorting and contamination detection, boosting recovery purity.

- Predictive analytics models assist recyclers in hedging against silver price volatility for strategic material procurement and sales.

- Automation of documentation and compliance reporting through AI ensures rapid adherence to stringent waste management regulations.

DRO & Impact Forces Of Silver Film Recycling Service Market

The dynamics of the Silver Film Recycling Service Market are heavily influenced by a potent combination of environmental mandates and economic incentives, creating powerful directional forces. Key drivers include the persistently high market price of silver, rendering the recovery economically viable, and escalating global environmental regulations, particularly regarding heavy metals and hazardous waste disposal (Restraint, Opportunity, and Impact forces). Restraints typically center on the rapid decline in new analog film usage, especially in diagnostic imaging, which decreases the primary source volume over the long term, and high capital expenditure required for sophisticated, compliant refining technologies. Opportunities lie in penetrating emerging markets with growing healthcare sectors and expanding services to include other associated materials like photographic paper and chemicals, leveraging established logistical networks.

The primary Drivers of growth are rooted in resource sustainability and regulatory pressure. Governments and international bodies are placing increasing emphasis on the circular economy model, positioning silver recycling as a critical component of sustainable material management. This demand is further amplified by the industrial requirement for high-purity silver in high-growth sectors such as photovoltaics and specialized electronics, sectors that often mandate sustainably sourced materials. Furthermore, the imperative for corporate social responsibility (CSR) initiatives encourages major waste generators, such as large hospital networks, to partner exclusively with certified, environmentally responsible recycling service providers, driving standardization and quality improvements across the market.

Restraints, however, pose significant challenges to continuous market expansion. The digital transformation within medicine and imaging technology represents a structural threat, steadily eroding the overall volume of new silver-bearing film entering the market lifecycle. Economic viability is also constantly challenged by fluctuating processing costs, particularly energy and chemical inputs. Furthermore, the presence of informal or unregulated recycling operations in some regions, which often bypass strict environmental compliance, creates unfair price competition for formal market participants. Impact Forces, such as technological obsolescence (the shift from film to digital) and the global volatility of the silver commodity market, exert constant pressure requiring recyclers to maintain agility in operational structure and pricing strategy to remain profitable.

Segmentation Analysis

Segmentation analysis of the Silver Film Recycling Service Market provides crucial insights into the diverse operational requirements and market demands across different service types, source materials, and end-use applications. The market is primarily segmented based on the type of film being processed, the recycling technology employed, and the geographic region. Understanding these distinct segments allows service providers to tailor their collection logistics, processing methods, and regulatory compliance strategies to maximize yield and profitability, particularly as the composition of recoverable film waste evolves due to technological shifts in the healthcare and graphic arts sectors.

The segmentation by Film Source Type is critical, differentiating between high-volume, relatively standardized X-ray film waste from healthcare facilities and the more specialized, lower-volume waste generated by industrial testing (NDT) or graphic arts, which often require specialized handling due to varying silver concentrations and substrate materials. Technology-based segmentation highlights the industry's move toward environmentally superior methods. While chemical recovery is simpler and widely accessible, sophisticated methods such as pyrolysis followed by smelting, or advanced electrolytic recovery, dominate large-scale industrial operations due to their ability to yield higher purity silver and handle large throughput volumes efficiently while adhering to strict air quality standards.

Furthermore, segmentation by Service Provider (e.g., Independent Recycling Firms versus Integrated Waste Management Companies) reflects the competitive landscape. Integrated companies offer end-to-end solutions, often managing all types of medical and hazardous waste for a client, providing convenience, whereas independent specialists might focus solely on optimizing silver recovery, offering potentially higher financial returns to the waste generator. This structured market view is essential for developing targeted marketing strategies and identifying areas for strategic mergers or acquisitions, particularly in fragmented regional markets where local regulatory knowledge is paramount for operational success.

- Film Source Type:

- X-ray Film (Medical Diagnostics, Dental)

- Photographic Film (Amateur, Professional)

- Graphic Arts Film (Printing, Microfilming)

- Industrial Non-Destructive Testing (NDT) Film

- Recycling Technology:

- Chemical Precipitation (Metallic Replacement)

- Electrolytic Recovery

- Incineration and Smelting (Thermal Processing)

- Pyrolysis and Refining

- Service Type:

- Collection and Logistics

- Processing and Refining

- Certified Destruction and Documentation

- Consulting and Compliance Services

- Service Provider:

- Independent Silver Recyclers

- Integrated Waste Management Companies

- Film and Chemical Manufacturers (Backward Integration)

Value Chain Analysis For Silver Film Recycling Service Market

The value chain of the Silver Film Recycling Service Market begins with upstream activities focused on generating and collecting the spent film and extends through complex midstream processing to downstream sales of the recovered commodity. Upstream analysis highlights that the efficiency of collection is a primary determinant of profitability, heavily relying on effective logistics management and strong relationships with major waste generators (hospitals, military bases, film archives). Key upstream players include specialized waste handlers and logistics firms that ensure secure, regulatory-compliant transport of hazardous waste materials, optimizing routes to aggregate sufficient volumes for economical processing.

The midstream segment constitutes the core value creation: the refining process itself. This stage involves significant capital investment in technology—electrolytic cells, chemical reactors, or smelting furnaces—and rigorous quality control to achieve high-purity silver. Processors must manage complex regulatory permits for handling hazardous chemicals and air emissions. The choice of technology directly impacts the yield, purity, and environmental footprint. Downstream analysis involves the sales of the recovered silver metal, primarily through commodity exchanges, direct sales to industrial users (electronics, solar), or specialized metal traders. The profitability at this stage is highly sensitive to global silver market pricing and the refiner’s ability to secure favorable long-term supply contracts with stable industrial buyers.

Distribution channels in this specialized market are typically direct or semi-direct. Direct channels involve the recycler collecting film directly from the large generator and selling the refined silver directly to an industrial buyer or commodity exchange. Indirect channels often involve intermediaries, such as brokers or waste management consultants, who aggregate waste from smaller generators (e.g., independent dental practices) before passing it to the central recycler, or silver traders who purchase the refined commodity for broader distribution. Certification and full traceability documentation are essential throughout the value chain, ensuring transparency for both the generator (for compliance purposes) and the final buyer (for purity and origin verification).

Silver Film Recycling Service Market Potential Customers

Potential customers for Silver Film Recycling Services are predominantly institutions and organizations that generate substantial volumes of silver-bearing film waste as a byproduct of their core operations. The healthcare sector represents the largest and most consistent end-user segment, driven by the persistent need to decommission old film archives and manage ongoing waste from facilities that have not fully transitioned to digital radiography. Hospitals, large university medical centers, private diagnostic labs, and governmental health departments are prime targets, often seeking certified destruction services to comply with patient data privacy regulations (like HIPAA) alongside environmental compliance.

Another major customer segment includes industrial organizations reliant on analog imaging for quality control and non-destructive testing (NDT). This comprises aerospace and defense manufacturers, oil and gas pipeline operators, and large construction or engineering firms that use radiography to inspect critical components for structural integrity. These customers value reliability, certified destruction, and compliance documentation, as their processes are subject to rigorous regulatory and quality assurance standards. Furthermore, the graphic arts industry, including commercial printers, film developers, and microfilming services, although diminished, continues to require responsible disposal solutions for their specialized silver-bearing waste.

The expansion of potential customers is also focusing on specialized archival facilities and governments dealing with legacy waste management. National archives, military facilities, and large corporations often possess vast, aging inventories of silver-bearing film that require secure and certified destruction, creating project-based revenue streams for recycling services. The purchasing decision for these customers is typically based less on the immediate return value of the silver and more on the assurance of regulatory compliance, secure data destruction capabilities, and environmental responsibility certifications offered by the service provider.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 8.5 Billion |

| Market Forecast in 2033 | USD 12.6 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Johnson Matthey, Heraeus Precious Metals, Enviro-Tech International, Advanced Chemical Company, Retriev Technologies, Umicore, SRS Metals, Metallix Refining Inc., KMG Chemicals, Sims Metal Management, DOWA Holdings Co., Ltd., Tanaka Kikinzoku Group, Gannon & Scott Inc., Photochemical Systems, Alpha Recyclage, Agor Ag Ltd., Sabin Metal Corporation, Materion Corporation, TMT Recycling, Stericycle. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Silver Film Recycling Service Market Key Technology Landscape

The technology landscape for silver film recycling is characterized by mature, established chemical and metallurgical processes undergoing continuous refinement to improve purity, yield, and environmental compliance. The most fundamental recovery method remains metallic replacement (or chemical precipitation), where waste film is treated with a chemical solution to precipitate the silver onto a metal such as iron or zinc. While low-cost and simple, this method produces lower purity silver sludge requiring subsequent refinement. The trend is shifting towards advanced techniques like high-efficiency electrolytic recovery, which uses electricity to strip the silver from the film or the spent fixative bath, yielding high-purity silver directly suitable for immediate commercial reuse, thereby minimizing subsequent processing steps.

For high-volume waste streams, particularly large film archives, thermal processing technologies like controlled incineration or pyrolysis are critical, followed by smelting and cupellation to recover precious metals from the resulting ash. Modern thermal plants are equipped with sophisticated flue gas scrubbing and air quality monitoring systems to mitigate environmental risks associated with burning plastic substrates (PET, cellulose). The technological innovation in this sector is driven by the necessity to reduce hazardous waste outputs, minimize energy consumption during refining, and maximize the recovery rate, often reaching yields above 98% for optimized systems. Investing in robust pre-shredding and washing systems also forms a key part of the landscape, preparing the film substrate efficiently for either chemical or thermal treatment.

Furthermore, technology adoption includes advanced instrumentation and digitalization. X-ray fluorescence (XRF) analyzers are routinely used for rapid, non-destructive analysis of silver content in the incoming film batches, allowing for accurate yield prediction and optimized processing parameters. Specialized software is becoming crucial for tracking the entire lifecycle of the waste—from generator pickup to final silver sale—ensuring regulatory adherence, particularly important for handling medical film data. The future technology focus lies in integrating automation and robotics for sorting and handling film rolls to minimize manual intervention and increase throughput capacity while improving worker safety in hazardous processing environments.

Regional Highlights

North America: The North American market is characterized by high levels of regulatory compliance and strong demand for documented, certified destruction services, particularly from the extensive and often federally regulated healthcare sector. The region, dominated by the United States, possesses a mature recycling infrastructure with several large, technologically advanced refining companies capable of handling vast volumes of X-ray and industrial films. Market growth is primarily driven by the ongoing decommissioning of legacy film archives (driven by HIPAA compliance requirements for data destruction) and the relatively stable, high price of silver, which provides strong economic incentive. The focus here is less on volume growth of new waste and more on high-value, secure management of existing inventories and specialized industrial waste streams. Service providers in this region excel in comprehensive reporting and environmentally sound practices.

The regulatory framework in North America, including federal (EPA) and state-level environmental mandates, imposes high barriers to entry for new, smaller players, favoring established firms with robust permitting and compliance track records. Logistics and collection services are highly optimized due to the vast geographic area, often relying on outsourced specialized transportation services. While the generation of new X-ray film has declined significantly due to digital adoption, the high purity standards and demand for quick, certified processing continue to sustain premium pricing for recycling services in the US and Canada. Investment trends are focused on automated sorting technology and advanced water treatment systems to minimize environmental discharge.

Europe: The European Silver Film Recycling Service Market is highly integrated with the European Union’s Circular Economy Action Plan and stringent directives like WEEE and RoHS, which impose strict responsibilities for material recovery and waste minimization. Germany, the UK, and France are the largest markets, benefitting from well-established industrial sectors and advanced medical infrastructures. Europe prioritizes clean technology, leading to widespread adoption of electrolytic recovery and rigorous environmental permitting for thermal processing. The emphasis on sustainability and corporate responsibility is particularly pronounced here, compelling companies across all sectors to utilize proven recycling services to meet their sustainability targets and avoid heavy non-compliance penalties.

The structure of the European market often involves cross-border logistics and processing, facilitated by EU regulations concerning waste shipment, although adherence to individual national environmental agencies remains crucial. Silver pricing volatility impacts European recyclers significantly, leading many major players to hedge their sales through financial instruments. A notable trend is the move toward specialized collection programs targeting smaller generators like independent dental clinics and veterinary practices to maintain waste volume stability. European firms are technological leaders in developing continuous processing techniques that increase efficiency and reduce the need for batch processing, offering a competitive edge in refined metal purity and processing cost management.

Asia Pacific (APAC): The APAC region represents the fastest-growing market globally for silver film recycling, propelled by rapid urbanization, massive infrastructural development, and the expansion of the healthcare sector, particularly in emerging economies like China, India, and Southeast Asia. While regulatory compliance and enforcement are variable, increasing awareness about environmental degradation and the need for resource recovery is driving standardization. China, with its vast manufacturing base and high demand for industrial silver, is both a major generator and a primary consumer of recovered silver, creating robust internal market dynamics.

The challenge in APAC often lies in managing a fragmented collection infrastructure and competing with less regulated informal recycling sectors. However, large multinational hospital chains and industrial entities entering the region demand Western-standard recycling and documentation, providing significant opportunities for international service providers or local firms adopting best practices. Government initiatives focusing on pollution control and hazardous waste management are key market accelerators. Investment is flowing into building large-scale, modern processing facilities compliant with international environmental standards, specifically targeting the exponential growth in medical diagnostics film usage and industrial non-destructive testing requirements across the region.

Latin America (LATAM): The Latin American market exhibits considerable variation, with Brazil and Mexico leading in terms of industrial activity and healthcare development, translating into higher volumes of recyclable film waste. The market is primarily driven by economic incentives tied to the value of recovered silver, rather than strict regulatory enforcement, although environmental awareness is gradually increasing, particularly in major urban centers. Service provision is often localized, and logistics across diverse geographical terrain pose significant challenges to centralizing recycling operations efficiently.

Formal service providers focus on securing long-term contracts with large public and private hospitals, where volumes are highest and the need for transparent disposal is recognized. Market development opportunities center on educating generators about the economic return potential of their waste and the environmental risks associated with improper disposal. Foreign investment and partnerships are crucial for introducing advanced electrolytic and thermal recycling technologies, which are currently less prevalent than basic chemical recovery methods in many parts of the region, ensuring better recovery rates and minimizing local pollution.

Middle East and Africa (MEA): The MEA region is nascent but evolving, particularly in the Gulf Cooperation Council (GCC) states (UAE, Saudi Arabia) due to heavy investment in world-class healthcare infrastructure and large construction and petrochemical industries (which use NDT film). This investment generates a predictable and growing stream of silver-bearing waste. In contrast, parts of Africa face significant infrastructural and regulatory hurdles, leading to a highly fragmented market where informal recycling dominates, presenting environmental risks.

Growth in the MEA region is strongly linked to government mandates promoting economic diversification and sustainability objectives, such as Saudi Arabia’s Vision 2030. Service providers entering this market must offer robust, certified solutions that meet the high standards demanded by international joint ventures and expatriate-run healthcare facilities. The key market driver remains the economic benefit derived from silver recovery, but increasingly, compliance with international waste handling protocols is becoming a mandatory requirement for large institutional contracts.

- North America: Focus on secure data destruction (HIPAA) and maximizing recovery from legacy archives; mature infrastructure with high regulatory compliance.

- Europe: Driven by strict EU environmental directives (WEEE, Circular Economy); emphasis on clean technology and high sustainability standards.

- Asia Pacific (APAC): Highest growth region due to healthcare expansion and industrial development; increasing regulatory enforcement in China and India driving investment in modern facilities.

- Latin America: Growth tied heavily to economic value of silver; localized services with opportunities for technology infusion, particularly in Brazil and Mexico.

- Middle East and Africa (MEA): Emerging market driven by GCC infrastructure development and high standards required by large petrochemical and healthcare projects; strong reliance on certified international partners.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Silver Film Recycling Service Market.- Johnson Matthey

- Heraeus Precious Metals

- Enviro-Tech International

- Advanced Chemical Company

- Retriev Technologies

- Umicore

- SRS Metals

- Metallix Refining Inc.

- KMG Chemicals

- Sims Metal Management

- DOWA Holdings Co., Ltd.

- Tanaka Kikinzoku Group

- Gannon & Scott Inc.

- Photochemical Systems

- Alpha Recyclage

- Agor Ag Ltd.

- Sabin Metal Corporation

- Materion Corporation

- TMT Recycling

- Stericycle

Frequently Asked Questions

Analyze common user questions about the Silver Film Recycling Service market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the current market growth of silver film recycling services?

The primary driver is the high global market price of silver, which makes its recovery from waste film economically lucrative. This is compounded by increasingly stringent environmental regulations (such as EPR schemes) that mandate responsible disposal and resource recovery, particularly concerning hazardous medical and industrial waste.

How does the shift to digital imaging systems affect the sustainability of the silver film recycling market?

The digital shift acts as a long-term restraint by reducing the input volume of new film. However, it simultaneously creates a significant short-to-medium- term opportunity centered on the decommissioning and certified destruction of vast existing film archives held by hospitals and government entities, sustaining market demand for secure recycling services.

What are the most effective and environmentally compliant technologies used for silver recovery from film?

High-efficiency electrolytic recovery is considered one of the most effective and environmentally compliant methods, yielding high-purity silver with minimal chemical waste. Advanced thermal processing (controlled incineration/pyrolysis) followed by smelting is also highly effective for large volumes, provided the facility adheres to strict air emission standards.

Which end-user segment generates the highest volume of recyclable silver film waste?

The healthcare sector, specifically hospitals, diagnostic centers, and dental clinics, generates the highest overall volume of silver film waste, predominantly through spent X-ray and radiographic films. This segment also requires specialized services for secure data destruction and compliance verification.

How does AI contribute to improving profitability within silver film recycling operations?

AI improves profitability primarily through logistics optimization (reducing collection costs), predictive maintenance (minimizing expensive equipment downtime), and using sophisticated models for predicting silver price movements, which informs optimal timing for raw material purchasing and refined metal sales.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager