Silver Jewellery Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435880 | Date : Dec, 2025 | Pages : 255 | Region : Global | Publisher : MRU

Silver Jewellery Market Size

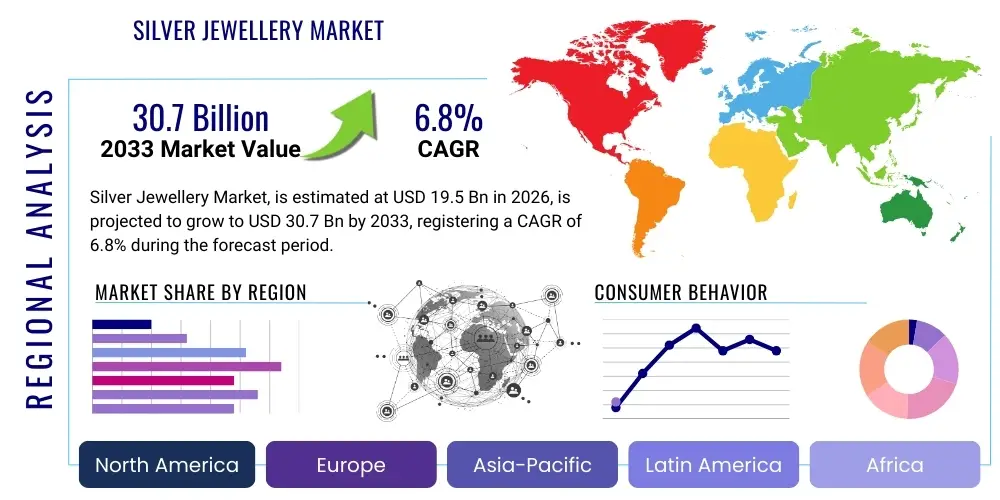

The Silver Jewellery Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 19.5 Billion in 2026 and is projected to reach USD 30.7 Billion by the end of the forecast period in 2033. This growth trajectory is significantly fueled by the increasing consumer preference for affordable luxury items, strong growth in e-commerce platforms specializing in fine and fashion jewelry, and the rising adoption of silver as a versatile and hypoallergenic metal for daily wear.

Silver Jewellery Market introduction

The Silver Jewellery Market encompasses the design, manufacture, distribution, and sale of ornaments predominantly crafted from silver, including sterling silver (925 purity) and fine silver (999 purity). Silver, characterized by its luminous aesthetic, malleability, and affordability compared to gold and platinum, has positioned itself as a critical material in both the fine and fashion jewelry segments. Products range widely, covering necklaces, rings, earrings, bracelets, and specialized items like brooches and charms, catering to diverse consumer tastes from minimalist modern designs to intricate traditional craftsmanship. The global demand is underpinned by its use as a durable accessory and an investment vehicle in certain emerging economies.

Major applications of silver jewellery span personal adornment, gifting for special occasions, and fashion integration, with a notable shift toward pieces suitable for daily wear and stacking. The versatility of silver allows it to be paired seamlessly with various gemstones, enamel, and other metals, expanding its stylistic range and market appeal. Furthermore, the product is highly sought after due to its hypoallergenic properties, making it an ideal choice for sensitive skin. The affordability factor democratizes luxury, enabling broader consumer segments, particularly millennials and Generation Z, to frequently update their jewelry collections, aligning with fast-fashion cycles and trending aesthetics.

Key benefits driving market adoption include its accessible price point, which mitigates the high financial commitment associated with high-karat gold or platinum, and its robust performance across multiple distribution channels, notably online retail. Driving factors include escalating disposable incomes in Asia Pacific, targeted marketing campaigns by major brands highlighting silver's fashionable qualities, technological advancements in manufacturing (such as CAD/CAM for intricate designs), and the increasing consumer awareness regarding ethical sourcing and sustainability in materials, areas where silver can often offer more traceability and transparency compared to certain colored gemstones.

Silver Jewellery Market Executive Summary

The global Silver Jewellery Market is experiencing robust expansion driven by pronounced business trends centered on digitalization and sustainability. Leading manufacturers are focusing heavily on direct-to-consumer (D2C) e-commerce platforms, bypassing traditional intermediaries to improve margins and enhance brand storytelling. Customization and personalization capabilities, often facilitated by digital design tools, are becoming standard offerings, meeting the modern consumer's demand for unique identity expression. Furthermore, the market is characterized by strategic partnerships between jewellers and lifestyle influencers, leveraging social media platforms like Instagram and TikTok to drive engagement and rapid trend adoption, fundamentally altering traditional retail models.

Regionally, Asia Pacific (APAC) dominates the consumption landscape, primarily due to culturally significant demand for silver in countries like India and China, coupled with rapidly expanding middle-class populations with increased purchasing power. North America and Europe, however, lead in the adoption of premium sterling silver products and designer collections, reflecting a maturity in consumer preference toward quality and brand recognition. The proliferation of international brands in emerging markets is standardizing design aesthetics globally while simultaneously prompting local manufacturers to innovate and adhere to international quality standards, thereby elevating the overall market quality and competition dynamics across all geographies.

Segment trends indicate that the Earrings and Rings categories remain foundational, supported by diverse styling options and consistent demand for engagement and wedding pieces, albeit in the affordable luxury space. The Distribution Channel segment is undergoing a rapid transition, with online sales consistently outpacing physical retail growth, a trend accelerated by the pandemic. Consumers are increasingly comfortable purchasing valuable items like jewelry through digital channels, provided the platform offers high-resolution imagery, detailed specifications, secure payment gateways, and robust return policies. Moreover, the 925 Sterling Silver segment maintains its market leadership, offering the ideal balance between durability, purity, and cost-effectiveness for mass-market production and specialized collections.

AI Impact Analysis on Silver Jewellery Market

Common user questions regarding AI's impact on the Silver Jewellery Market primarily revolve around operational efficiency, personalized customer experience, and trend forecasting capabilities. Users frequently ask: "How can AI optimize inventory management for seasonal silver collections?" or "Will AI-driven design tools replace human artisans?" and "How is predictive analytics changing silver procurement strategies?" These inquiries underscore a collective interest in how AI tools can address traditional industry pain points—specifically, managing fluctuating metal prices, predicting volatile fashion trends, and scaling personalization efforts without compromising the handcrafted nature of luxury goods. The key themes emerging from user analysis focus on AI as a critical tool for operational excellence, supply chain resilience, and hyper-targeted marketing, rather than solely a creative replacement.

AI is fundamentally reshaping the Silver Jewellery sector by introducing unprecedented levels of efficiency and consumer engagement. In the design phase, Generative AI models are utilized to iterate quickly on design concepts based on real-time fashion data and consumer feedback, significantly reducing the time-to-market for new collections. For manufacturing, AI-powered quality control systems using computer vision detect minuscule defects in finished pieces, ensuring consistent output and reducing scrap rates, particularly crucial for intricate silver casting and stamping processes. This integration of intelligent automation streamlines production, enabling jewellers to respond faster to demand spikes.

Furthermore, the application of AI extends deeply into the retail and customer relationship management domains. Machine learning algorithms analyze extensive datasets of purchase history, browsing patterns, and social media sentiment to create highly accurate customer profiles, enabling hyper-personalized product recommendations and tailored marketing campaigns. This not only boosts conversion rates but also enhances customer loyalty. AI-driven chatbots and virtual try-on technologies further improve the online shopping experience, addressing the consumer need to visualize how silver pieces look before purchase, thereby mitigating one of the primary hurdles in e-commerce jewelry sales.

- AI-driven trend forecasting optimizes material purchasing and minimizes overstocking of specific styles.

- Generative Design algorithms accelerate the creation of novel silver jewellery blueprints based on real-time consumer data.

- Machine Learning (ML) enhances supply chain visibility, predicting potential disruptions in silver sourcing and logistics.

- Predictive analytics enables dynamic pricing strategies to maximize profitability amidst fluctuating silver commodity rates.

- AI-powered visual search and virtual try-on features significantly improve the digital shopping experience and reduce return rates.

- Robotic process automation (RPA) is deployed in inventory management and order fulfillment for faster processing.

- Automated quality inspection systems using computer vision ensure high consistency in finished silver products.

DRO & Impact Forces Of Silver Jewellery Market

The market dynamics of the Silver Jewellery sector are governed by a complex interplay of inherent growth stimuli, structural constraints, and emerging strategic avenues. The primary driver is the rising global appreciation for silver as an accessible luxury, particularly among younger consumers who prioritize style and sustainability over pure investment value. This is synergized by the exponential growth of dedicated e-commerce channels, which provide global reach for niche designers and established brands alike, fostering greater price transparency and variety. Conversely, the market faces a significant restraint in the inherent volatility of silver commodity prices, which directly impacts production costs and profit margins, making long-term forecasting challenging. Opportunities lie primarily in embracing bespoke manufacturing models and exploiting the growing demand for ethically sourced and recycled silver content, appealing to the environmentally conscious buyer.

Key drivers include demographic shifts, notably the expansion of the middle class in densely populated regions like India and Southeast Asia, translating into higher discretionary spending on lifestyle goods. The strategic adoption of celebrity endorsements and fashion collaborations further normalizes the incorporation of sophisticated silver pieces into everyday attire, moving beyond traditional occasion-wear. However, restraints are not limited to price volatility; intense competition from counterfeit products and imitation metals, often sold through unregulated online marketplaces, erodes legitimate market share and poses risks to consumer trust regarding purity claims. Regulatory complexity across different regions concerning hallmarking standards also acts as a minor impediment to seamless global distribution, requiring specialized logistical planning for international market entry.

Impact forces currently shaping the market include technological advancements in metallurgy and finishing, which allow for the creation of tarnish-resistant alloys and complex textures, enhancing the lifespan and aesthetic appeal of silver jewellery. Furthermore, the increasing consumer focus on environmental, social, and governance (ESG) factors exerts significant pressure on supply chains to demonstrate responsible sourcing practices, transforming ethical considerations into a mandatory competitive edge. This shift is driving innovation in recycling processes and circular economy models within the jewelry industry. Strategic opportunities are abundant in developing specialized product lines, such as men's silver jewellery, which is rapidly expanding, and integrating wearable technology features into classic silver designs, merging aesthetics with functionality to capture new consumer segments.

Segmentation Analysis

The Silver Jewellery Market is intricately segmented across product type, material purity, distribution channel, and end-user, reflecting the diverse consumer preferences and varied applications of silver ornaments worldwide. Understanding these segments is crucial for strategic market entry and product development, as each segment exhibits distinct growth patterns and competitive dynamics. The dominance of certain product types, such as earrings and rings, highlights foundational consumer demand, while the swift evolution of the distribution channel segment, particularly the surge in online sales, dictates modern marketing and logistics strategies. Furthermore, material purity segmentation (e.g., 925 sterling vs. fine silver) allows manufacturers to target specific price points and quality expectations, ranging from high-fashion accessories to heritage fine jewelry pieces.

The segmentation by end-user, primarily divided into Women, Men, and Unisex categories, reveals evolving social trends. Historically dominated by female consumers, the market is witnessing robust growth in the men's silver jewelry segment, driven by shifting fashion norms and the acceptance of masculine silver accessories like chains, cuff links, and heavier rings. The Unisex category is rapidly gaining prominence, reflecting a cultural movement toward gender-fluid fashion, which appeals strongly to Generation Z consumers who value versatility and non-conformity. Manufacturers are increasingly designing pieces that transcend traditional gender binaries, focusing on clean lines and universal appeal to capture this burgeoning market.

Distribution channel segmentation remains critical, with the bifurcation between Online and Offline channels defining consumer accessibility and convenience. While offline channels, comprising specialist retailers, hypermarkets, and department stores, offer the crucial tactile experience necessary for high-value purchases, the online segment provides unparalleled choice, competitive pricing, and global reach. The success of online platforms is contingent upon robust logistics, sophisticated digital marketing, and clear policies regarding product authenticity and purity guarantees, often relying on digital certification technologies to build consumer trust in a virtual purchasing environment.

- By Product Type:

- Necklaces and Pendants

- Rings (including wedding and engagement rings)

- Earrings (studs, hoops, drops)

- Bracelets and Bangles

- Others (Anklets, Brooches, Charms)

- By Material Purity:

- 925 Sterling Silver

- Fine Silver (.999)

- Silver Plated/Alloy

- Other Purities (e.g., 800, 900)

- By Distribution Channel:

- Offline

- Specialty Stores

- Departmental Stores

- Hypermarkets and Supermarkets

- Independent Boutiques

- Online

- E-commerce Websites (Brand Owned)

- Third-party E-commerce Platforms (Amazon, eBay, etc.)

- Offline

- By End-User:

- Women

- Men

- Unisex

Value Chain Analysis For Silver Jewellery Market

The value chain of the Silver Jewellery Market begins with the upstream segment, encompassing silver mining, refining, and alloy production. Upstream analysis reveals that the stability and ethical considerations of raw material sourcing are paramount. Major players focus on securing long-term contracts with large-scale refineries to ensure consistent supply of high-purity silver bullion and granular silver, which is essential for uniform casting quality. Furthermore, an increasing proportion of the upstream value is now derived from recycled silver, driven by sustainability mandates and offering manufacturers a hedge against volatile mined silver prices. Efficiency in this stage, including minimizing waste during the alloying process (typically mixing silver with copper to create sterling silver), directly dictates the foundational cost structure of the final product.

The midstream process involves design, manufacturing, and primary finishing, where the core value is added through craftsmanship and technology. Manufacturing processes include casting (lost-wax technique), stamping, soldering, and stone setting. The distribution channel, which constitutes a crucial part of the downstream segment, has diversified significantly. Direct and indirect sales channels coexist, with direct channels (brand-owned stores and D2C e-commerce) offering higher control over branding and customer experience, resulting in better profit margins. Indirect channels, such as wholesale to department stores or multi-brand online retailers, provide broader market penetration but introduce margin pressure and require careful brand guardianship to ensure consistent representation.

Downstream activities center on marketing, retail logistics, and consumer services. Specialized logistics are required due to the high value and small size of the products, necessitating secure shipping and robust inventory tracking. After-sales services, including repair, cleaning, and resizing, contribute significantly to brand loyalty. The shift towards e-commerce has amplified the importance of digital marketing, relying on high-quality visuals, interactive try-on experiences, and personalized communication. Ultimately, the successful management of the silver jewellery value chain relies on seamlessly integrating ethical sourcing from the upstream with technological innovation in the midstream, capped by a compelling, customer-centric retail experience in the downstream, particularly focusing on trust and authenticity guarantees.

Silver Jewellery Market Potential Customers

The primary consumers of silver jewellery represent a broad spectrum, ranging from economically conscious individuals seeking fashionable accessories to connoisseurs appreciating fine craftsmanship and design. Demographically, the key end-users include the vast segment of women aged 18 to 45 who view silver pieces as essential components of their rotating fashion wardrobe, valuing versatility and affordability. This segment drives high transaction frequency and responds well to seasonal collections and collaborations. Geographically, potential customers are concentrated in urban and semi-urban centers globally, where disposable incomes are rising and exposure to global fashion trends is high. The emphasis on social visibility through platforms like Instagram and Pinterest strongly influences the purchasing decisions of this core demographic.

A rapidly expanding segment of potential customers includes male consumers, particularly those aged 25 to 55, who are increasingly investing in sophisticated silver accessories such as cuff bracelets, thick chains, signet rings, and high-quality belt buckles. This growth is linked to a wider cultural acceptance of men’s fashion accessories and the desire for durable, high-quality, yet understated luxury items that convey status without the ostentation often associated with high-carat gold. Marketing efforts targeted at this group often emphasize durability, minimalist design, and an enduring sense of style rather than fleeting trends. This segment often prefers specialized boutiques or dedicated online men's jewelry stores.

Beyond personal consumption, the gifting market constitutes a significant portion of potential customers, including individuals purchasing for birthdays, anniversaries, and holidays, especially where the consumer budget is moderate but the desire for a perceived high-value gift is strong. Moreover, corporate buyers and specialty event planners represent niche but high-volume buyers for custom-designed silver items used as corporate awards, promotional items, or commemorative pieces. Manufacturers must cater to these diverse buying motivations by offering a range of price points, purity levels, and customization services, ensuring that the intrinsic value of silver aligns with the specific emotional or practical utility demanded by each distinct customer profile.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 19.5 Billion |

| Market Forecast in 2033 | USD 30.7 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Pandora A/S, Tiffany & Co. (LVMH), Swarovski AG, James Avery Artisan Jewelry, PANDORA, Tous, Monica Vinader Ltd., Alex and Ani LLC, Gemporia Ltd., Signet Jewelers Limited, Chow Tai Fook Jewellery Group, Lovisa Holdings Limited, Folli Follie, Cartier (Richemont), Harry Winston (Swatch Group) |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Silver Jewellery Market Key Technology Landscape

The technological evolution within the Silver Jewellery Market is primarily focused on enhancing design complexity, improving manufacturing efficiency, and ensuring product authenticity. Computer-Aided Design (CAD) and Computer-Aided Manufacturing (CAM) systems are foundational, allowing designers to create highly intricate and symmetrical silver models that are otherwise challenging or impossible to achieve through manual craftsmanship. This technology minimizes material wastage during the modeling phase and provides precise digital blueprints for subsequent production. Coupled with 3D printing technologies, specifically utilizing wax or resin prototypes for investment casting (lost-wax casting), CAD/CAM drastically reduces lead times for new collection launches and facilitates rapid prototyping essential for personalized jewelry requests, providing a significant competitive edge in the fast-paced fashion jewelry segment.

In the manufacturing phase, specialized machinery is deployed to enhance the quality and finish of silver pieces. Advanced electroplating techniques, particularly rhodium plating, are extensively used to provide a protective, tarnish-resistant layer over sterling silver, significantly improving the longevity and aesthetic appeal of the product, thereby addressing a primary consumer concern regarding silver maintenance. Furthermore, laser welding and micro-welding technologies ensure stronger, nearly invisible joins between components, enabling the assembly of delicate and complex designs without compromising structural integrity. Automation in polishing and finishing, using robotic arms and vibratory finishing equipment, standardizes the final product quality across large production batches, maintaining consistency required by global retail standards.

Beyond core manufacturing, digital technologies are crucial for supply chain integrity and consumer trust. Blockchain technology is emerging as a powerful tool for tracing silver from the mine or recycler through the manufacturing process to the final consumer, offering irrefutable proof of ethical sourcing and material purity—a high priority for discerning modern consumers. Additionally, advanced anti-tarnish alloy development, where specific trace elements are introduced to the sterling silver mix (e.g., adding palladium or germanium), represents significant material science innovation aimed at enhancing product durability and reducing the need for frequent cleaning. These technological advancements collectively drive the market towards higher quality, greater customization, and demonstrable sustainability.

Regional Highlights

Regional dynamics play a crucial role in defining the competitive structure and growth patterns of the Silver Jewellery Market, reflecting varying cultural significance, economic development stages, and fashion adoption rates across the globe. Asia Pacific (APAC) stands out as the largest and fastest-growing region, driven by countries like India and China, where silver holds deep cultural value for gifting, traditional ceremonies, and investment, alongside a burgeoning, fashion-conscious urban youth population that readily embraces affordable luxury items. The expansion of regional manufacturing hubs and the proliferation of local e-commerce platforms further solidify APAC's dominance.

North America and Europe represent mature markets characterized by high consumer spending power and a preference for branded, designer, and sustainably sourced silver jewellery. These regions prioritize quality, contemporary design, and ethical provenance. Key countries like the United States, the United Kingdom, and Germany show consistent demand for 925 sterling silver products, driven by established jewelry retail chains and strong online sales penetration. European consumers, in particular, often seek pieces that blend traditional craftsmanship with modern minimalist aesthetics, often favoring unique designer collaborations.

Latin America and the Middle East & Africa (MEA) are characterized by significant untapped growth potential. In Latin America, countries such as Brazil and Mexico show steady demand, supported by local silver mining heritage and a strong retail culture. The MEA region, particularly the Gulf Cooperation Council (GCC) nations, exhibits strong demand for high-end, intricate silver jewelry, often combined with precious stones, catering to consumers with high discretionary incomes. Market penetration in these regions is increasingly reliant on international brands establishing a strong physical retail presence to cater to local preferences for tactile evaluation before purchase.

- Asia Pacific (APAC): Dominates the market due to cultural affinity for silver, large consumer base in China and India, and rising disposable incomes fueling demand for fashion accessories.

- North America: High concentration of organized retail and e-commerce penetration; demand is driven by contemporary design trends and strong brand loyalty for established names.

- Europe: Focus on designer collections, sustainable sourcing, and high-quality sterling silver; key markets include the UK, Germany, and Italy, specializing in manufacturing expertise.

- Latin America: Growing market supported by local artisanal traditions and an expanding middle class; Mexico is a key regional manufacturing and consumption hub.

- Middle East and Africa (MEA): Emerging luxury segment demanding intricate designs and high craftsmanship; robust growth in the UAE and Saudi Arabia driven by affluent consumers and gifting culture.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Silver Jewellery Market.- Pandora A/S

- Tiffany & Co. (LVMH)

- Swarovski AG

- James Avery Artisan Jewelry

- PANDORA

- Tous

- Monica Vinader Ltd.

- Alex and Ani LLC

- Gemporia Ltd.

- Signet Jewelers Limited

- Chow Tai Fook Jewellery Group

- Lovisa Holdings Limited

- Folli Follie

- Cartier (Richemont)

- Harry Winston (Swatch Group)

- Tanishq (Tata Group)

- Helzberg Diamonds

- Silverado Jewellery

- Buckley London

Frequently Asked Questions

Analyze common user questions about the Silver Jewellery market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the current growth trend in the Silver Jewellery Market?

The primary growth drivers are the shift towards affordable luxury, particularly among millennial and Gen Z consumers, robust expansion of global e-commerce channels facilitating direct consumer access, and the increasing versatility of silver in aligning with rapidly changing fashion trends, making it a sustainable and cost-effective alternative to gold.

How significant is the role of 925 Sterling Silver in the overall market?

925 Sterling Silver, which is 92.5% pure silver alloyed typically with copper for durability, remains the foundational and most dominant material segment globally. It offers the optimal balance of longevity, luster, and price point, making it suitable for both mass-market accessories and high-end fashion jewelry collections.

Which geographical region holds the largest market share for Silver Jewellery consumption?

The Asia Pacific (APAC) region currently holds the largest market share, driven primarily by high cultural demand in countries like India and China, coupled with significant population size and rapid growth in discretionary spending power on lifestyle products across Southeast Asian nations.

What are the key technological advancements impacting silver jewellery production and sales?

Key technologies include the deployment of Computer-Aided Design (CAD) and 3D printing for rapid prototyping, advanced anti-tarnish plating techniques (like rhodium electroplating) to improve product longevity, and the adoption of blockchain technology for verifiable ethical sourcing and material traceability in the supply chain.

What restraints pose the greatest challenge to sustained market growth?

The most significant restraint is the inherent volatility and unpredictable fluctuation of global silver commodity prices, which directly affects the cost of production, necessitating sophisticated hedging and dynamic pricing strategies for manufacturers to maintain stable profit margins and competitive consumer pricing.

This comprehensive market insights report details the structural analysis of the Silver Jewellery Market, focusing on market size projections, critical segmentation, strategic value chain decomposition, and the profound impact of artificial intelligence on operational efficiency and customer engagement. We analyze key drivers such as rising disposable incomes and the pivotal role of e-commerce, while also examining restraints like commodity price volatility and competition from counterfeits. Regional dynamics emphasize the dominance of Asia Pacific and the maturity of North American and European markets. Technological innovations, including CAD/CAM and blockchain for traceability, are identified as essential components for future competitive advantage. The report is designed to provide actionable intelligence for stakeholders navigating the evolving landscape of affordable luxury and ethical consumer demand in the global silver ornaments industry. The forecast years 2026 to 2033 highlight a stable but robust Compound Annual Growth Rate (CAGR) demonstrating resilient demand across diverse product categories, including rings, necklaces, earrings, and bracelets. Specific emphasis is placed on the shift towards D2C models and the critical need for robust digital strategies, including high-quality product visualization and customer support systems. The analysis of end-user segments, particularly the expansion of the men's and unisex categories, signals a broadening consumer base beyond traditional demographics, necessitating flexible design portfolios. The inclusion of AEO-optimized frequently asked questions (FAQs) ensures maximum discoverability and direct answers to common industry inquiries, establishing the document as a primary source of market data. The detailed profiling of top key players offers insight into current market leadership and competitive strategies focused on branding, global distribution, and sustainability initiatives. The structural integrity of the report adheres strictly to formal market research standards, using clear, defined sections and data-driven analysis to meet the requirements of sophisticated readers and search engines seeking authoritative industry information.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager