Silver Powders and Flakes Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 431356 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Silver Powders and Flakes Market Size

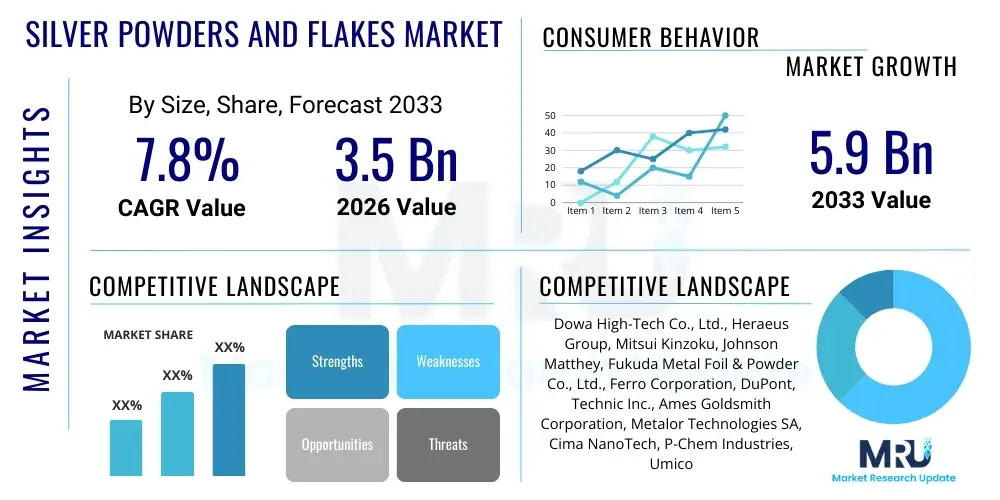

The Silver Powders and Flakes Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at $3.5 Billion in 2026 and is projected to reach $5.9 Billion by the end of the forecast period in 2033.

Silver Powders and Flakes Market introduction

The Silver Powders and Flakes Market encompasses materials utilized primarily for their exceptional electrical and thermal conductivity, crucial across modern high-performance electronic devices and renewable energy systems. Silver powder, often synthesized through chemical reduction or atomization processes, typically serves applications requiring fine dispersion and high surface area, such as thick film conductive pastes and specialized catalysts. Silver flakes, characterized by their high aspect ratio and planar morphology, are preferred in applications demanding lower sintering temperatures and superior packing density, particularly in conductive adhesives and electromagnetic interference (EMI) shielding paints. These materials are foundational components for miniaturization and enhanced functionality in contemporary electronics.

Major applications for silver powders and flakes span several high-growth sectors, including photovoltaics (PV), where they form the crucial front and back contacts on silicon wafers, significantly impacting cell efficiency. In the electronics industry, they are indispensable for manufacturing Multi-Layer Ceramic Capacitors (MLCCs), conductive inks for flexible circuits, and highly reliable solder materials. The core benefits derived from using silver materials include their unmatched electrical conductivity, stability in demanding environments, and ease of integration into various ink and paste formulations, ensuring performance superiority over alternative metals like copper or nickel in sensitive applications.

The primary driving factors propelling market expansion are the global proliferation of consumer electronics, especially 5G infrastructure and high-definition displays, which mandate increased utilization of high-performance conductive materials. Furthermore, the rapid expansion of the solar energy sector, driven by global mandates for carbon neutrality, continuously increases demand for silver pastes used in high-efficiency cell architectures like PERC, TOPCon, and Heterojunction (HJT) technologies. Miniaturization trends in automotive electronics (e.g., ADAS systems and electric vehicles) also fuel the need for ultra-fine, highly reliable silver powders, securing the market's long-term growth trajectory.

Silver Powders and Flakes Market Executive Summary

The global Silver Powders and Flakes market is currently defined by significant volatility in raw material pricing, countered by robust, sustained demand from the Asia Pacific electronics and photovoltaic sectors. Business trends indicate a strong focus on strategic vertical integration among major suppliers to mitigate supply chain risks and ensure quality control, ranging from raw silver sourcing to customized morphology production. There is a perceptible shift towards ultra-fine and nano-structured silver materials, particularly driven by requirements for lower curing temperatures in flexible electronics and the enhanced density necessary for advanced MLCCs, pushing R&D investment towards novel synthesis techniques that optimize particle shape and size distribution.

Regionally, Asia Pacific (APAC) stands as the undisputed center of consumption and manufacturing, primarily due to the concentration of global semiconductor fabrication, consumer electronics assembly, and PV production capabilities in countries like China, South Korea, Taiwan, and Japan. While North America and Europe maintain technological leadership in advanced aerospace and automotive electronics, their market share predominantly revolves around high-purity, specialized flakes for niche defense and high-reliability applications. Geopolitical tensions affecting critical mineral supply chains, including silver refining, present a continuous risk factor that regional suppliers are actively navigating through diversified sourcing and localized refining capacities.

Segment trends demonstrate the persistent dominance of the electronics application segment, particularly thick film pastes for semiconductor packaging and passive components. However, the Photovoltaic segment is exhibiting the highest growth trajectory, spurred by the transition to more efficient solar cell designs which demand specific, high-performance silver pastes for optimal current collection. In terms of product type, dendritic powders remain essential for standard applications, yet sub-micron and nano-silver flakes are capturing increasing value share due to their critical role in next-generation flexible displays, wearable technology, and inkjet-printed circuits, reflecting a premiumization trend within the conductive material space.

AI Impact Analysis on Silver Powders and Flakes Market

User queries regarding AI's influence in the Silver Powders and Flakes sector frequently revolve around improving manufacturing efficiency, predicting supply chain disruptions, and accelerating the discovery of new silver-based composite materials. Users are highly interested in how Machine Learning (ML) models can optimize the complex chemical synthesis processes—such as controlling precipitation rates and surface energy—to yield silver particles with precise morphology (e.g., highly uniform spherical powder or extremely thin flakes) required for high-performance applications like 5G filters and advanced solar cells. A key concern centers on whether AI-driven procurement systems can effectively stabilize costs by predicting the volatile global silver commodity market, thereby offering manufacturers better hedging strategies and minimizing production cost variability, which is crucial given that raw material price constitutes a substantial portion of the final product cost.

The practical application of AI primarily centers on enhancing operational intelligence and quality control. By deploying sensor arrays and processing vast datasets generated during the chemical synthesis or physical atomization processes, AI systems can dynamically adjust parameters like temperature, precursor concentration, and mixing speeds in real-time. This level of process optimization minimizes batch-to-batch variations, drastically reduces waste material, and ensures a consistently high yield of products meeting stringent industrial specifications, particularly crucial for ultra-high-purity applications in defense and medical sensors. This predictive maintenance and quality assurance capability significantly lowers the total cost of ownership for specialized silver materials manufacturers.

Furthermore, AI and generative design tools are being utilized in materials science to model the performance characteristics of silver composites before physical experimentation is undertaken. This accelerates the development cycle for specialized conductive pastes, allowing researchers to predict how varying particle blends (e.g., mixtures of spherical powder and flakes) will impact resistivity, thermal properties, and mechanical durability when cured onto different substrates. This capability is vital for innovation in emerging fields such as additive manufacturing (3D printing of electronics) and highly specialized flexible hybrid electronics, where material failure must be minimized under complex mechanical stress conditions.

- AI-driven optimization of particle synthesis parameters (e.g., size, morphology) to reduce variability and increase yield.

- Predictive modeling of global silver commodity prices and supply chain bottlenecks for strategic procurement.

- Automated quality control using computer vision and machine learning for identifying defective particle clusters or inconsistencies.

- Acceleration of new conductive paste formulation development through generative material modeling.

- Enhancement of energy efficiency in manufacturing processes (e.g., milling, drying) using real-time ML-based adjustments.

- Improved preventative maintenance schedules for high-precision manufacturing equipment, minimizing downtime.

DRO & Impact Forces Of Silver Powders and Flakes Market

The Silver Powders and Flakes market dynamics are defined by a powerful convergence of technological drivers, strategic opportunities, and inherent economic constraints, summarized by the DRO framework. Key drivers include the relentless global push toward high-efficiency electronics and the mandatory adoption of renewable energy technologies, specifically photovoltaic cells, which heavily rely on silver pastes for performance. Opportunities are emerging from advancements in 3D printing of electronics (Additive Manufacturing), where specialized fine silver powders enable precise conductive pathways, and the increasing demand for flexible and stretchable circuits in wearable devices and medical implants, requiring highly specialized nano-flakes. These positive forces, however, are constantly challenged by significant restraints, primarily the extreme volatility and high cost of silver as a commodity, alongside the ongoing pursuit by major end-users to find cost-effective substitutes like copper or specialized carbon nanotubes in less critical applications.

Impact forces currently shaping the competitive landscape include the pressure exerted by major PV manufacturers to reduce silver loading per wafer without sacrificing cell efficiency, driving innovation toward finer line printing and advanced metallization techniques. Regulatory compliance, particularly concerning environmental sustainability and conflict mineral sourcing, imposes additional scrutiny and cost on the supply chain, forcing producers to ensure traceable and ethically sourced materials. Furthermore, the competitive intensity is high, characterized by a few global dominant players controlling proprietary manufacturing technologies necessary for ultra-high-purity products, juxtaposed against numerous regional players focused on commodity-grade silver powder production.

The primary impact force remains the acceleration of digital transformation and electrification across industries. The roll-out of 5G networks necessitates vast quantities of passive components, filters, and high-frequency circuit boards, all of which depend on reliable silver conductivity. Similarly, the explosive growth of the Electric Vehicle (EV) market demands durable, heat-resistant conductive adhesives and thermal management materials, often utilizing silver flakes, which ensures that despite price volatility, the strategic necessity of these materials for performance applications continues to outweigh cost concerns for premium products.

Segmentation Analysis

The Silver Powders and Flakes market is comprehensively segmented based on product type, application, and geographical region, reflecting the diverse technical requirements of various end-use industries. Segmentation by product type differentiates between traditionally synthesized powders (spherical, dendritic, irregular) and high-aspect-ratio flakes (micro- and nano-flakes), each optimized for specific rheological and conductive properties when incorporated into pastes or inks. The dominance of a particular morphology is often determined by the desired application: flakes are superior for minimizing material loading while maintaining conductivity (e.g., in thin-film inks), whereas powders are favored for dense packing and high fill factors (e.g., in solid ceramic components).

The application segment forms the most critical axis of differentiation, highlighting the core demand drivers. The Electronics segment, historically the largest consumer, includes vital sub-sectors such as passive components (MLCCs), semiconductor die-attach, and packaging materials. Simultaneously, the Photovoltaics segment continues its aggressive expansion, primarily consuming silver powder formulated into thick film pastes for solar cell metallization. Other growing applications include catalysis, utilized in specific chemical synthesis processes due to silver's unique surface activity, and medical/biotech, leveraging silver's antimicrobial properties in conductive wearable sensors and specialized coatings. Understanding these application niches is crucial for manufacturers tailoring material specifications (purity, particle size distribution) to specific industrial needs.

The market landscape is also significantly shaped by purity requirements. Ultra-high purity (99.99% and above) silver materials command a substantial premium and are essential for sensitive electronics and aerospace applications where trace impurities can cause device failure. Standard purity materials suffice for bulk applications like EMI shielding or basic conductive adhesives. This purity spectrum creates distinct competitive tiers within the market, where barriers to entry are significantly higher for ultra-high-purity production due to stringent process control requirements and specialized equipment investments.

- By Product Type:

- Silver Powder (Spherical, Dendritic, Irregular)

- Silver Flakes (Micro-flakes, Nano-flakes)

- By Application:

- Electronics (Thick Film Pastes, MLCCs, Conductive Adhesives)

- Photovoltaics (Solar Cell Metallization Pastes - Front and Back Side)

- Catalysis (Chemical Reactors)

- Medical & Biomedical Devices (Conductive Sensors, Antimicrobial Coatings)

- Others (EMI Shielding, 3D Printed Electronics)

- By Purity:

- High Purity (99.9% - 99.99%)

- Ultra-High Purity (99.999% and above)

Value Chain Analysis For Silver Powders and Flakes Market

The value chain for the Silver Powders and Flakes market begins with the upstream segment, dominated by silver mining and refining operations. This stage involves the extraction of raw silver, often as a by-product of mining other base metals like copper, lead, and zinc, followed by high-purity refining to produce silver bullion or fine silver granules. The efficiency and environmental compliance of these refining operations significantly influence the input cost and availability for the subsequent stages. Price volatility at this upstream level is the single largest risk factor transmitted through the entire value chain, requiring material processors to employ complex inventory management and hedging strategies.

The midstream segment is characterized by specialized processing and manufacturing, where refined silver is converted into the desired powder or flake morphology. This highly technical stage involves chemical reduction (for fine powders), physical vapor deposition, or specialized milling/atomization techniques (for flakes). Differentiation at this stage relies heavily on proprietary process technology that achieves precise control over particle size distribution, surface characteristics, and purity levels. Distribution channels are typically a mix of direct sales to large, integrated paste manufacturers (especially in PV and MLCC) and indirect sales through specialized chemical distributors who provide smaller volumes and localized technical support to emerging electronics manufacturers.

The downstream segment consists of the paste and ink formulators who blend the silver powders/flakes with glass frits, organic binders, and solvents to create application-specific products, followed by the diverse end-users. Direct procurement often occurs when global paste manufacturers buy bulk silver materials directly from large processors under long-term supply contracts. Indirect channels cater to smaller electronics assemblers, R&D labs, and niche manufacturers who purchase pre-formulated conductive inks or pastes from distributors. The final profitability in the downstream segment is highly dependent on the performance consistency and reliability of the silver material, as defects in conductivity can lead to catastrophic failure in sensitive electronic components.

Silver Powders and Flakes Market Potential Customers

The primary potential customers and buyers of silver powders and flakes are globally distributed across high-technology manufacturing sectors requiring unparalleled electrical conductivity and thermal stability. The largest customer group includes thick film paste manufacturers, predominantly catering to the Photovoltaic and Passive Component industries. These customers require bulk quantities of highly uniform spherical silver powder for front-side solar contacts and specialized dendritic or irregular powders for base electrode formation in MLCCs, demanding strict specifications on impurities and particle size distribution (PSD) to ensure repeatable electronic performance in final devices.

Another significant customer segment is composed of specialized electronics manufacturers focusing on high-reliability applications, such as automotive electronics (ADAS, power modules for EVs) and aerospace/defense systems. These buyers require ultra-high-purity silver flakes utilized in conductive adhesives for die attach and module interconnection, valued for their ability to maintain mechanical integrity and conductivity under severe thermal cycling and vibration. Their purchasing decisions prioritize material stability and verifiable purity over marginal cost reductions, leading to long-term supply relationships with certified, audited vendors.

Emerging buyers include developers and manufacturers utilizing advanced printing technologies, such as inkjet and aerosol jet printing, to create flexible or complex printed circuits. These customers specifically seek highly specialized nano-silver inks derived from nano-powders or flakes. These materials are characterized by their ability to sinter at low temperatures, making them compatible with delicate polymer substrates used in flexible displays, wearable sensors, and RFID tags. Their volume demand is rapidly growing, signaling a strategic shift towards high-value, low-volume specialty materials that require high technical support from the silver material suppliers.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $3.5 Billion |

| Market Forecast in 2033 | $5.9 Billion |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Dowa High-Tech Co., Ltd., Heraeus Group, Mitsui Kinzoku, Johnson Matthey, Fukuda Metal Foil & Powder Co., Ltd., Ferro Corporation, DuPont, Technic Inc., Ames Goldsmith Corporation, Metalor Technologies SA, Cima NanoTech, P-Chem Industries, Umicore, Potters Industries LLC, Noritake Co., Limited, GGP Metalpowder AG, Shoei Chemical Inc., TANAKA Kikinzoku Kogyo K.K., Novacentrix, Agfa-Gevaert NV |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Silver Powders and Flakes Market Key Technology Landscape

The technological landscape of the Silver Powders and Flakes market is highly dependent on achieving precise control over particle morphology and size distribution, which directly impacts the performance of the final conductive product. Conventional manufacturing routes include chemical reduction (using reducing agents like hydrazine or glucose to precipitate silver ions) and physical methods like atomization, which yields coarser, more irregular particles but is highly scalable. A significant trend involves advanced chemical methods, such as the Polyol process, which allows for tight control over particle shape—producing highly monodisperse spherical powders or high-aspect-ratio flakes critical for advanced packaging and high-frequency applications where consistent dielectric properties are paramount.

A major focus in technological innovation is centered on synthesizing nano-silver materials, typically particles smaller than 100 nm, primarily for use in inkjet and aerosol jet printing. Technologies like wire explosion, laser ablation, and specialized plasma synthesis are being refined to produce these ultra-fine particles with minimal aggregation, ensuring stable dispersion in specialty inks. The key technical challenge addressed by these methods is ensuring the nano-particles maintain high dispersibility and low sintering temperatures (often below 150°C) to be compatible with heat-sensitive flexible plastic substrates, thereby unlocking new opportunities in flexible electronics and smart textiles.

Furthermore, surface modification and coating technologies represent a crucial area of differentiation, particularly for combating oxidation and improving compatibility with various paste vehicles. Manufacturers often apply thin organic coatings or dopants to the silver particle surface to enhance processability, extend shelf life, and optimize the particle-to-particle contact during the final curing stage. For photovoltaic applications, research is focused on developing core-shell structures or alloying silver with other metals to improve migration resistance and lower material consumption without compromising the necessary conductance and adhesion to the silicon wafer and glass frit interface, thereby driving down the levelized cost of energy (LCOE) for solar power generation.

Regional Highlights

- Asia Pacific (APAC): APAC dominates the global Silver Powders and Flakes market, accounting for the largest share of both production and consumption. This dominance is intrinsically linked to the region’s massive manufacturing ecosystem for consumer electronics, including smartphones, laptops, and networking equipment, centered in China, South Korea, and Taiwan. Crucially, APAC is the global hub for photovoltaic cell manufacturing, with countries like China driving intense demand for high-performance silver metallization pastes. The region benefits from lower operating costs and significant governmental support for high-tech manufacturing, ensuring its continued leadership, particularly in the mass production of standard and high-purity grades.

- North America: The North American market is characterized by high demand for ultra-high-purity silver materials required by the aerospace, defense, and specialized medical device sectors. While the volume consumed is lower compared to APAC, the value derived from this market is substantial, driven by stringent quality requirements for conductive adhesives and components used in high-reliability systems, such as advanced radar systems and critical aerospace sensors. Innovation in additive manufacturing (3D printed electronics) and advanced semiconductor packaging also drives demand for specialized, low-temperature nano-silver inks and pastes.

- Europe: Europe represents a mature market focusing on high-end automotive electronics, industrial sensors, and renewable energy technologies. The region’s stringent regulatory environment fosters demand for sustainable and ethically sourced silver materials. European manufacturers are strong consumers of silver flakes and powders for applications in electric vehicle battery management systems (BMS) and sophisticated power electronics modules, requiring materials with superior thermal management capabilities. Germany, France, and the UK are key markets, emphasizing R&D in specialized paste formulations for miniaturization.

- Latin America (LATAM): The LATAM market is emerging, driven primarily by localized consumer electronics assembly and infrastructure development projects. Demand is generally focused on standard-grade silver powders used in traditional applications and some initial uptake in solar panel assembly in countries like Brazil and Mexico. Market growth relies heavily on foreign direct investment in manufacturing capabilities and the development of internal technological ecosystems.

- Middle East and Africa (MEA): The MEA region is currently a smaller contributor but is showing increasing potential, especially driven by large-scale solar power projects (particularly in the Gulf Cooperation Council countries) and growing investment in digital infrastructure. Consumption largely consists of imported formulated pastes and inks, with local manufacturing of silver powders/flakes remaining minimal. Future growth is projected to align with ongoing national diversification strategies away from oil dependence towards renewable energy and smart city development.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Silver Powders and Flakes Market.- Dowa High-Tech Co., Ltd.

- Heraeus Group

- Mitsui Kinzoku

- Johnson Matthey

- Fukuda Metal Foil & Powder Co., Ltd.

- Ferro Corporation

- DuPont

- Technic Inc.

- Ames Goldsmith Corporation

- Metalor Technologies SA

- Cima NanoTech

- P-Chem Industries

- Umicore

- Potters Industries LLC

- Noritake Co., Limited

- GGP Metalpowder AG

- Shoei Chemical Inc.

- TANAKA Kikinzoku Kogyo K.K.

- Novacentrix

- Agfa-Gevaert NV

Frequently Asked Questions

Analyze common user questions about the Silver Powders and Flakes market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the demand for ultra-fine silver powders?

The primary driver is the miniaturization and efficiency requirements of advanced electronics, particularly in Multi-Layer Ceramic Capacitors (MLCCs) and high-density semiconductor packaging, which necessitate silver powders below 1 micron for enhanced packing density and sustained performance under high operating temperatures.

How does silver price volatility impact manufacturers of conductive pastes?

Silver price volatility significantly affects manufacturing costs, forcing paste and ink producers to implement sophisticated hedging strategies and long-term contracts. This instability often results in fluctuating product prices for end-users, although the necessity of silver for high-performance applications limits material substitution.

What are the key technical differences between silver powders and silver flakes?

Silver powders (spherical/dendritic) are optimized for high volume loading and sintering in thick-film applications like MLCC electrodes, providing structural integrity. Silver flakes (planar morphology) are favored for achieving high conductivity at low loading levels in conductive adhesives and inks, due to their large surface area promoting efficient percolation pathways.

Which application segment holds the highest growth potential in the next five years?

The Photovoltaics (PV) segment, specifically driven by the global transition to high-efficiency solar cell technologies (like TOPCon and HJT), holds the highest growth potential. These advanced cells rely on specialized, finer silver pastes for front-side metallization to optimize energy yield and reduce line width.

What is the role of nano-silver materials in flexible electronics?

Nano-silver powders and flakes are essential for flexible electronics as they enable low-temperature sintering (below the melting point of plastic substrates), which is critical for printed circuits on polymer films. This technology facilitates the creation of flexible displays, wearable sensors, and low-cost RFID tags with excellent conductivity.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager