Silyl Modified Polymer Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432413 | Date : Dec, 2025 | Pages : 242 | Region : Global | Publisher : MRU

Silyl Modified Polymer Market Size

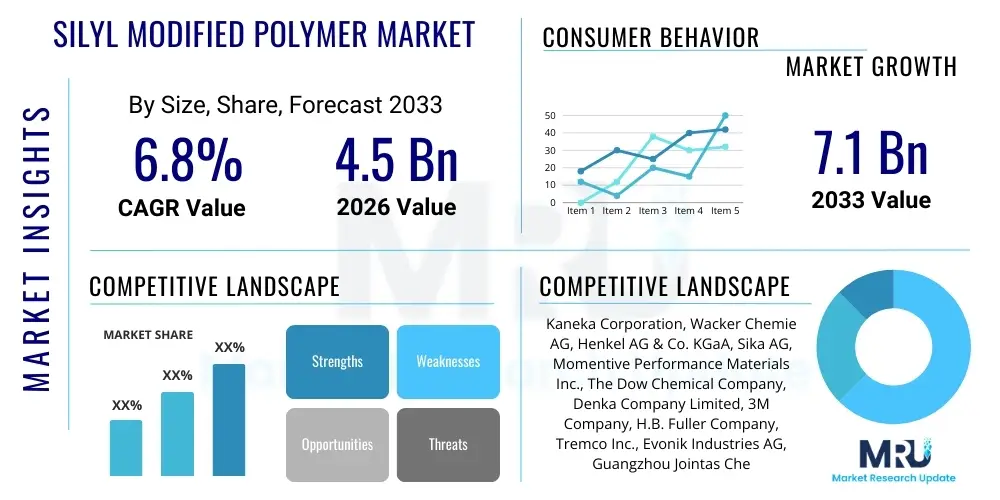

The Silyl Modified Polymer Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at $4.5 Billion in 2026 and is projected to reach $7.1 Billion by the end of the forecast period in 2033.

Silyl Modified Polymer Market introduction

Silyl Modified Polymers (SMPs), often referred to as MS Polymers or Polyether-based SMPs, represent a sophisticated class of hybrid polymers widely recognized for combining the benefits of polyurethanes and silicones without the limitations often associated with both. These polymers utilize silyl functional groups that cross-link upon exposure to ambient moisture, forming highly durable, flexible, and robust materials. This unique curing mechanism eliminates the need for isocyanates, addressing growing concerns regarding environmental safety and worker health, which positions SMPs as the preferred sustainable alternative, especially in strict regulatory environments like Europe and North America.

The primary applications of SMPs span across critical industrial sectors, including construction, automotive, and industrial assembly. In construction, they are highly valued for use in high-performance sealants and adhesives for façade bonding, window installation, and flooring, owing to their excellent weather resistance, UV stability, and paintability. In the automotive sector, SMP adhesives and sealants are increasingly used for structural bonding, panel sealing, and noise reduction, offering lightweight solutions that enhance vehicle efficiency and safety. The inherent versatility of SMPs allows for wide-ranging formulation possibilities, enabling manufacturers to tailor products for specific performance requirements, such as high flexibility, rapid curing, or superior adhesion to diverse substrates.

Key driving factors accelerating the market growth include the global construction boom, particularly in emerging economies, and the sustained shift toward lightweighting in the transportation industry. Furthermore, stringent environmental regulations pushing the industry away from traditional solvents and volatile organic compounds (VOCs) strongly favor the adoption of 100% solid content SMP formulations. The continuous development of novel SMP chemistries, offering improved strength, temperature resistance, and reduced curing times, further solidifies their position as essential materials in modern manufacturing and construction practices.

Silyl Modified Polymer Market Executive Summary

The Silyl Modified Polymer market exhibits robust growth driven primarily by structural shifts in global manufacturing toward sustainable and high-performance bonding solutions. Business trends indicate significant consolidation among raw material suppliers and downstream formulators aiming to secure supply chains and integrate advanced formulation capabilities. Asia Pacific remains the engine of regional growth, fueled by massive infrastructure investments and rapid expansion in automotive and electronics production, though North America and Europe continue to drive innovation regarding specialty, high-specification SMPs used in demanding applications such as electric vehicle (EV) manufacturing and energy-efficient building envelope systems.

Segment trends highlight the dominance of the construction sector, particularly in high-performance sealant and adhesive applications where durability and aesthetic finish are paramount. The adhesives segment is expected to outpace sealants in growth, supported by the increasing adoption of structural bonding techniques over traditional fastening methods across multiple industries. Furthermore, the rising demand for polyurethane-free and solvent-free formulations is compelling manufacturers to invest heavily in R&D to enhance the performance metrics of base polymers, focusing on tack, elongation, and heat resistance. This strategic focus ensures SMPs maintain a competitive edge against conventional technologies.

Geographically, while Western markets focus on specialty and premium SMPs, the volume growth is concentrated in Asia, where competitive pricing and scaling production meet the needs of rapidly industrializing markets. Key strategic developments observed across the market include the prioritization of bio-based or renewable source feedstocks to improve the overall sustainability profile of SMPs, aligning with global corporate sustainability goals and consumer preferences. The market structure remains moderately fragmented, yet major chemical corporations are leveraging patents and technical expertise to establish significant barriers to entry for smaller competitors, particularly in the production of high-quality silyl terminated polyether backbones.

AI Impact Analysis on Silyl Modified Polymer Market

Common user questions regarding AI's influence on the Silyl Modified Polymer market primarily revolve around predictive formulation modeling, optimizing manufacturing processes, and accelerating new product development cycles. Users are keen to understand how AI and machine learning (ML) algorithms can analyze vast datasets—including material compatibility, cure kinetics, and environmental aging results—to suggest optimal monomer ratios and curing agents, thereby reducing traditional trial-and-error R&D time. A core concern is the accessibility and cost-effectiveness of implementing complex AI systems within existing chemical manufacturing facilities, particularly for small and medium-sized enterprises (SMEs). Expectations are high for AI to significantly improve quality control by predicting potential batch inconsistencies based on real-time sensor data from reactors, ensuring higher output reliability and minimizing waste in this specialized chemical domain.

The integration of AI technologies is set to revolutionize both the upstream synthesis and downstream application support of SMPs. In material science, AI-driven simulations can predict the long-term performance and durability of new SMP formulations under various environmental stresses (e.g., extreme temperatures, UV exposure, moisture), drastically cutting the time required for regulatory compliance testing and qualification. For production, sophisticated AI algorithms are used to manage complex polymerization processes, adjusting parameters such as temperature profiles and catalyst addition rates dynamically to maintain optimal reaction efficiency and purity, crucial for high-performance SMP products. This predictive maintenance and process optimization capability directly translates into lower operating costs and enhanced competitiveness for SMP manufacturers.

Furthermore, AI is expected to play a critical role in market forecasting and supply chain resilience. By analyzing global construction trends, automotive production forecasts, and geopolitical indicators, AI models can provide highly accurate demand predictions for specific SMP grades, allowing companies to optimize raw material procurement and inventory management. This precision is vital for minimizing the high costs associated with inventory holding and ensuring timely supply of specialized SMP formulations to critical infrastructure projects worldwide. The analytical power of AI also supports custom application development, matching specific end-user requirements for adhesion, flexibility, or temperature range with the ideal SMP product from a vast library of formulations.

- AI accelerates new SMP formulation discovery by simulating material properties and optimizing monomer ratios.

- Machine Learning (ML) algorithms optimize polymerization reaction parameters, enhancing batch consistency and purity.

- Predictive maintenance driven by AI minimizes downtime in chemical manufacturing plants, improving production efficiency.

- AI-based market forecasting provides accurate demand prediction for different SMP applications (construction vs. automotive).

- Advanced vision systems and AI improve quality control by detecting microscopic defects in sealant and adhesive products.

- AI enhances supply chain management by optimizing procurement of key raw materials like silane coupling agents and polyether backbones.

- Robotics and automated dispensing systems, often guided by AI, increase precision in applying SMPs in large-scale industrial assembly.

DRO & Impact Forces Of Silyl Modified Polymer Market

The Silyl Modified Polymer market is dynamically influenced by a crucial balance of compelling drivers, inherent restraints, and significant opportunities, which collectively determine its growth trajectory and competitive landscape. The primary driver stems from the global regulatory push towards safer, VOC-free, and sustainable chemical products, making isocyanate-free SMPs an attractive alternative to traditional polyurethane systems, particularly in developed regions. However, market growth is often restrained by the high initial cost of specialized silane raw materials compared to conventional chemistries, alongside the challenge of educating end-users in developing regions about the superior long-term performance benefits of SMPs over cheaper, conventional sealants. Opportunities abound in the burgeoning electric vehicle sector and the expanding use of cross-laminated timber (CLT) in green building, both requiring high-performance, durable, and flexible bonding agents.

Key drivers include the rapid expansion of the construction industry, particularly urbanization projects and retrofitting energy-efficient buildings, which require high-performance, weather-resistant sealing solutions. The automotive industry’s commitment to lightweighting and structural bonding using adhesives rather than mechanical fasteners significantly boosts demand for SMPs due to their excellent adhesion to diverse materials and vibration dampening properties. Furthermore, technological advancements leading to the development of fast-curing and high-strength SMP grades expand their applicability into structural and semi-structural applications previously dominated by epoxy or polyurethane chemistries. This continuous innovation cycle ensures that SMPs remain relevant to modern engineering challenges.

Restraints are notably focused on the vulnerability of the raw material supply chain; the synthesis of specialized silane termination agents is complex and dominated by a few global suppliers, leading to potential price volatility and supply bottlenecks. Additionally, the relatively higher viscosity of some SMP formulations can pose processing challenges for certain high-speed dispensing equipment, requiring specialized machinery or formulation adjustments that increase production complexity. Opportunities lie prominently in emerging applications such as renewable energy installations (solar panels, wind turbines) which demand highly durable, UV-resistant sealing and bonding materials. Furthermore, the penetration of SMPs into DIY and retail consumer markets, capitalizing on their ease of use, non-toxicity, and superior performance compared to consumer-grade silicone sealants, presents a substantial avenue for future market expansion.

- Drivers: Stringent environmental regulations favoring VOC-free and isocyanate-free materials; accelerated global urbanization and construction activity; increasing adoption of structural bonding in automotive lightweighting.

- Restraints: High cost of specialized silane raw materials; complex synthesis process requiring high technical expertise; lower public awareness compared to conventional silicone and polyurethane products in some regions.

- Opportunity: Expanding applications in Electric Vehicle (EV) battery assembly and thermal management; demand for durable sealants in renewable energy infrastructure (wind and solar); penetration into specialized industrial maintenance and repair applications.

- Impact Forces: Technological innovation driving faster cure rates and higher strength performance; regulatory pressure pushing traditional competitors out of sensitive applications; price competition from lower-cost conventional sealant manufacturers impacting market share in non-critical applications.

Segmentation Analysis

The Silyl Modified Polymer market is segmented based on the type of polymer backbone, application area, and end-use industry, providing a granular view of market dynamics and specialized product niches. Segmentation by backbone primarily distinguishes between polyether, polyurethane, and other hybrid bases, with polyether-based SMPs currently dominating due to their excellent balance of elasticity, UV resistance, and low temperature flexibility. The functional specialization driven by end-use requirements dictates whether a product is formulated as a sealant, an adhesive, or a coating, each requiring tailored rheological and mechanical properties. Understanding these segment dynamics is crucial for manufacturers to target specific high-growth areas, such as high-modulus adhesives for structural glazing or high-elongation sealants for expansion joints.

The application segmentation is the most critical determinant of demand, with construction sealants and adhesives holding the largest market share, followed closely by the automotive sector. Within construction, the shift toward modular and prefabricated building techniques necessitates highly reliable, fast-curing adhesives that can withstand dynamic loading and environmental cycling. For instance, the demand for SMPs in floor bonding and window sealing is witnessing significant growth due to their superior performance compared to acrylics or pure silicones. The industrial assembly segment, encompassing areas like electronics and general manufacturing, also contributes substantially, demanding customized SMPs for vibration dampening and electrical potting applications.

Geographically, market segmentation reveals maturity and saturation differences. Developed markets like Western Europe focus on high-margin, specialty SMPs adhering to strict green building standards, while high-volume growth is centered in Asia Pacific, where infrastructure development and consumer goods manufacturing are booming. This regional divergence impacts competitive strategies, with global players needing dual strategies: premiumization and specialization in the West, and cost optimization and scalability in the East. The future growth trajectory is heavily reliant on the successful penetration of new high-value segments such as aerospace interiors and advanced composite bonding, which require specialized fire-retardant and high-temperature stable SMP derivatives.

- By Type:

- Polyether-based SMP

- Polyurethane-based SMP (PU-based MS Polymers)

- Other Hybrid SMPs

- By Application:

- Sealants

- Adhesives

- Coatings

- By End-Use Industry:

- Construction (Residential, Commercial, Infrastructure)

- Automotive & Transportation (OEM, Aftermarket, Rail, Marine)

- Industrial Assembly (HVAC, Electronics, Appliances)

- DIY & Retail

- By Curing Mechanism:

- Moisture Curing

- UV Curing

Value Chain Analysis For Silyl Modified Polymer Market

The value chain of the Silyl Modified Polymer market begins with complex upstream chemical processing, involving the production of specialized raw materials, primarily polyether polyols or polyurethane prepolymers, followed by functionalization with silane end-groups. This upstream segment is highly capital-intensive and requires significant technical expertise, often dominated by large chemical companies that control proprietary synthesis methods. The stability and quality of the silyl terminated polymer backbone directly influence the final performance characteristics of the SMP product. Pricing volatility in upstream chemicals, particularly propylene oxide and silicone derivatives, is a key risk factor influencing the profitability of the entire value chain.

The midstream segment involves formulation and compounding, where specialized chemical formulators acquire the base SMP polymers and blend them with additives such as plasticizers, fillers (e.g., calcium carbonate, fumed silica), pigments, and catalysts to achieve the desired rheology, cure rate, elasticity, and adhesion profile. This formulation stage adds substantial value and customization, differentiating products for specific application needs like structural bonding or flexible sealing. The formulation expertise is a critical competitive factor, allowing midstream players to create high-margin, specialized products targeting niche industrial applications or high-end construction projects. Quality control at this stage is crucial to ensure long-term stability and performance.

The downstream distribution channel involves reaching end-users through a combination of direct sales and indirect networks. Direct sales are common for large industrial customers (e.g., automotive OEM assembly lines, large construction contractors) requiring bulk supply and specific technical support. Indirect distribution utilizes specialized chemical distributors, construction suppliers, and retail channels (DIY stores) to reach smaller contractors and consumer markets. The effectiveness of the distribution network, particularly the ability to provide just-in-time delivery and technical application training, significantly impacts market penetration and accessibility. The trend toward digitalization is also optimizing distribution, allowing for better inventory tracking and demand forecasting across complex regional networks.

Silyl Modified Polymer Market Potential Customers

Potential customers for Silyl Modified Polymers are highly diversified, encompassing industrial entities requiring high-performance bonding and sealing solutions across major infrastructure and manufacturing sectors. The largest customer base resides within the construction industry, including general contractors specializing in commercial buildings, residential developers, and façade engineering firms. These buyers prioritize SMPs for their durable, weather-resistant sealing in expansion joints, window installations, and structural glazing, seeking long-term performance and reduced maintenance costs associated with building envelopes. Manufacturers of prefabricated housing and modular buildings also represent a rapidly expanding customer segment due to the requirement for strong, flexible bonds that can withstand transportation and assembly stresses.

A second major customer cluster is the automotive and transportation industry, including Original Equipment Manufacturers (OEMs) and suppliers to rail and marine sectors. Automotive OEMs use SMP adhesives extensively for body panel bonding, interior component mounting, and battery sealing in electric vehicles (EVs), driven by the need for lightweight materials, noise, vibration, and harshness (NVH) reduction, and improved crash performance. This segment demands specialized, high-modulus, and fast-curing formulations that integrate seamlessly into automated assembly lines. Suppliers in the aftermarket also rely on SMP sealants for collision repair and component replacement where superior adhesion to mixed substrates is essential.

Finally, industrial manufacturers—particularly those involved in HVAC systems, appliances, electronics, and general machinery—constitute a robust customer base. These users require SMP coatings and sealants for vibration dampening, electrical insulation, and durable adhesion in harsh operating environments. DIY enthusiasts and small contractors accessed through retail channels also represent a volume market for easy-to-use, non-toxic, and paintable SMP sealants for home repair and improvement projects. The attractiveness of SMPs to these diverse customers stems from the combination of high performance, environmental safety, and versatility across substrate types (metal, plastic, wood, concrete).

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $4.5 Billion |

| Market Forecast in 2033 | $7.1 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Kaneka Corporation, Wacker Chemie AG, Henkel AG & Co. KGaA, Sika AG, Momentive Performance Materials Inc., The Dow Chemical Company, Denka Company Limited, 3M Company, H.B. Fuller Company, Tremco Inc., Evonik Industries AG, Guangzhou Jointas Chemical Co., Ltd., Shin-Etsu Chemical Co., Ltd., BASF SE, Bostik (Arkema Group), PCC Chemax Inc., NuSil Technology LLC, DAP Products Inc., Polyton Chemie GmbH, and Chemence Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Silyl Modified Polymer Market Key Technology Landscape

The technological landscape of the Silyl Modified Polymer market is characterized by continuous refinement aimed at enhancing polymerization efficiency, improving application performance, and broadening the chemical compatibility of the base polymers. A critical focus area involves improving the molecular weight distribution and controlling the placement of silyl terminal groups on the polymer backbone (typically polyether or polyoxyalkylene). Advanced synthesis techniques, such as living polymerization methods, are being utilized to create highly uniform polymer chains, leading to SMPs with better mechanical properties, including higher tensile strength and elongation while maintaining superior elasticity, which are crucial for dynamic applications like structural movement joints in construction.

Another significant technological advancement centers on accelerating the cure rate of SMPs without compromising pot life or long-term durability. Traditional moisture-curing SMPs can take considerable time to achieve full strength, which is a limiting factor in high-speed manufacturing environments. Formulators are developing proprietary catalyst packages, often incorporating novel tin-free alternatives (driven by regulatory pressure against tin compounds), to achieve rapid through-cure, making SMPs viable for fast-paced industrial assembly lines, particularly in the automotive and electronics sectors. The development of dual-curing systems, which utilize both moisture and UV light for immediate surface tack followed by deep moisture cure, represents a cutting-edge solution for complex bonding geometries.

The third major technological thrust involves enhancing the adhesion profile and substrate versatility of SMPs. While SMPs inherently adhere well to many surfaces, specialized primers and adhesion promoters are continuously being developed and integrated into single-component formulations to ensure tenacious bonding to difficult substrates, such as low-surface-energy plastics, high-performance composites, and various porous building materials without extensive surface preparation. Furthermore, technologies focusing on temperature resistance and fire retardancy are expanding the scope of SMP use in high-specification environments, such as marine and aerospace applications, cementing their position as materials capable of replacing traditional, less sustainable alternatives.

Regional Highlights

The Silyl Modified Polymer market demonstrates distinct growth patterns and maturity levels across key geographical regions, largely influenced by local construction standards, automotive manufacturing hubs, and environmental regulatory frameworks. Asia Pacific (APAC) stands out as the undisputed leader in terms of market volume and growth rate. This dominance is driven by massive infrastructure spending, rapid urbanization in countries like China, India, and Southeast Asia, and the presence of world-leading automotive and electronics manufacturing bases. The region’s focus is currently balanced between high-volume, cost-effective sealants for general construction and high-performance adhesives for emerging sectors like renewable energy installations and EV production. The competitive landscape in APAC is characterized by a mix of global players and strong local manufacturers competing fiercely on price and localized technical support.

Europe represents a mature but highly innovation-driven market, characterized by stringent environmental regulations, particularly concerning VOC emissions and the use of isocyanates. These regulations have strongly favored the early and sustained adoption of SMPs as green building materials. Key countries such as Germany, the UK, and France show high demand for specialty, high-performance SMPs used in energy-efficient building envelope systems, structural glazing, and passive fire protection. European manufacturers focus heavily on R&D to develop third-generation SMPs with enhanced sustainability profiles and superior long-term performance guarantees, targeting high-margin, technically demanding applications that require European Technical Assessment (ETA) certifications.

North America, led by the United States, demonstrates significant and steady growth, primarily fueled by the recovery and expansion of residential and commercial construction, coupled with heavy investment in the electric vehicle industry. The region exhibits high demand for durable, flexible sealants that meet rigorous building codes in areas prone to extreme weather conditions. The push towards domestic manufacturing and reshoring of supply chains in the automotive and aerospace sectors is creating a strong, localized demand for high-strength, structural SMP adhesives. Regulatory alignment with VOC standards at the state level (like California’s) further encourages the preference for moisture-curing, solvent-free SMP technologies across the continent.

- Asia Pacific (APAC): Highest growth region, driven by urbanization, infrastructure development (China, India), and robust automotive manufacturing; focus on volume production and localized supply chain integration.

- Europe: Mature market characterized by strict environmental regulations; high demand for specialty, sustainable SMPs used in green building, structural glazing, and passive house standards (Germany, Scandinavia).

- North America: Strong market driven by construction recovery and significant investment in EV manufacturing and high-performance industrial assembly; stringent demand for durable, weather-resistant outdoor applications (USA, Canada).

- Latin America (LATAM): Emerging market with increasing adoption in infrastructure projects and local automotive assembly; growth tied to economic stability and increasing awareness of SMP benefits over conventional sealants (Brazil, Mexico).

- Middle East & Africa (MEA): Growth centered on large-scale construction and mega-projects, especially in the GCC countries; demand for SMPs that withstand high heat, extreme UV exposure, and sand abrasion (UAE, Saudi Arabia).

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Silyl Modified Polymer Market.- Kaneka Corporation

- Wacker Chemie AG

- Henkel AG & Co. KGaA

- Sika AG

- Momentive Performance Materials Inc.

- The Dow Chemical Company

- Denka Company Limited

- 3M Company

- H.B. Fuller Company

- Tremco Inc.

- Evonik Industries AG

- Guangzhou Jointas Chemical Co., Ltd.

- Shin-Etsu Chemical Co., Ltd.

- BASF SE

- Bostik (Arkema Group)

- PCC Chemax Inc.

- NuSil Technology LLC

- DAP Products Inc.

- Polyton Chemie GmbH

- Chemence Ltd.

Frequently Asked Questions

Analyze common user questions about the Silyl Modified Polymer market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary advantages of Silyl Modified Polymers (SMPs) over traditional sealants and adhesives?

SMPs offer unique benefits, including being 100% solvent-free and isocyanate-free (VOC-compliant), providing excellent adhesion across diverse substrates without priming, and exhibiting superior weatherability, UV resistance, and paintability compared to conventional silicones or polyurethanes. They combine the flexibility of silicone with the strength of polyurethane.

Which end-use industry drives the largest demand for Silyl Modified Polymers globally?

The Construction industry is the dominant end-user, utilizing SMPs extensively for high-performance sealants, structural glazing, expansion joints, and adhesive applications due to their durability, flexibility, and adherence to stringent green building standards.

What is the main restraining factor impacting the growth and wider adoption of the Silyl Modified Polymer market?

The high cost of specialized upstream raw materials, particularly the functionalized silane coupling agents and high-purity polyether backbones, compared to traditional, lower-performance chemical components, acts as the primary cost-related restraint on market expansion, especially in price-sensitive markets.

How are Silyl Modified Polymers contributing to the manufacturing of Electric Vehicles (EVs)?

SMPs are essential for EV manufacturing, primarily used in structural battery assembly, component encapsulation, thermal management, and body panel bonding. Their high adhesion, vibration dampening properties, and ability to bond dissimilar materials contribute significantly to EV safety, performance, and vehicle lightweighting goals.

Which region is anticipated to demonstrate the fastest growth rate in the SMP market during the forecast period?

Asia Pacific (APAC), particularly driven by expansive infrastructure projects and rapid industrialization in emerging economies like China and India, is projected to record the highest Compound Annual Growth Rate (CAGR) for Silyl Modified Polymers between 2026 and 2033.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager