Single and Dual Channel Dashboard Cameras Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432251 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Single and Dual Channel Dashboard Cameras Market Size

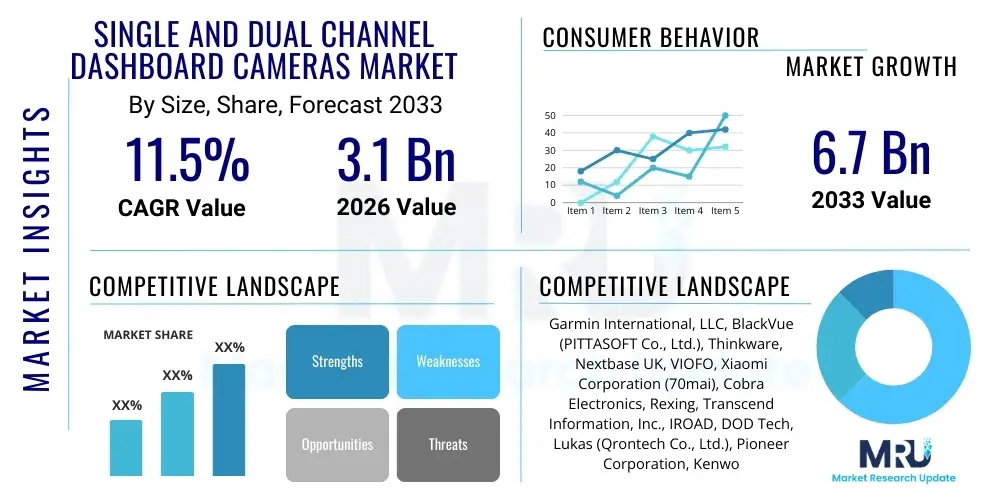

The Single and Dual Channel Dashboard Cameras Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 11.5% between 2026 and 2033. The market is estimated at USD 3.1 Billion in 2026 and is projected to reach USD 6.7 Billion by the end of the forecast period in 2033.

Single and Dual Channel Dashboard Cameras Market introduction

The Single and Dual Channel Dashboard Cameras Market encapsulates the sector dedicated to vehicular video recording devices, categorized by their field of view. Single channel cameras focus exclusively on capturing the forward-facing road environment, serving as primary evidence tools for frontal collisions and immediate traffic events. Conversely, dual channel systems significantly enhance evidentiary scope by integrating a secondary camera, typically aimed at the rear of the vehicle or the interior cabin. These devices have transcended their initial role as simple accident recorders, evolving into sophisticated vehicular safety and monitoring systems critical for liability defense, incident investigation, and proactive driver behavior assessment. The rapid evolution is underpinned by advancements in image stabilization, GPS telemetry integration, and seamless smartphone connectivity, ensuring accessibility and reliability for a growing user base worldwide.

The core product value proposition centers on minimizing risk and financial exposure for vehicle owners and commercial operators. Key product features driving consumer uptake include high dynamic range (HDR) or wide dynamic range (WDR) technologies, which ensure clear video capture in challenging lighting conditions, such as entering or exiting tunnels or during nighttime driving. The dual channel category is witnessing pronounced growth, driven by specific vertical needs, especially in the ridesharing and logistics industries, where comprehensive coverage—both external and internal—is mandatory for managing disputes, monitoring cargo security, and ensuring driver accountability. Product quality standards, including temperature resilience through supercapacitor adoption, have also dramatically improved, addressing previous reliability concerns associated with harsh automotive operating environments.

Market expansion is robustly supported by a confluence of regulatory push and technological pull factors. Governments in several major economies have instituted or are considering legislation mandating the use of recording equipment in commercial fleets, thus guaranteeing a consistent stream of demand from the B2B segment. Simultaneously, aggressive technology integration, particularly the incorporation of embedded Artificial Intelligence (AI) for real-time analysis and collision detection, is pushing the average selling price (ASP) of premium devices higher, increasing total market value. The availability of low-cost, yet highly functional, entry-level models ensures broad market penetration, making dashboard cameras an almost indispensable aftermarket accessory in modern vehicle ownership, moving closer to being standard OEM equipment.

Single and Dual Channel Dashboard Cameras Market Executive Summary

The global Single and Dual Channel Dashboard Cameras Market is navigating a transformative phase characterized by a decisive shift toward smart, connected systems and a strong bifurcation in consumer versus commercial feature requirements. Business trends highlight a consolidation among Tier 1 manufacturers who are investing heavily in intellectual property related to proprietary compression algorithms, cloud storage platforms, and integrated telematics. A significant trend involves insurance providers actively partnering with certified dashcam brands, offering incentives that effectively institutionalize the product within the auto insurance ecosystem. This strategic alignment accelerates consumer adoption and establishes quality benchmarks, favoring brands that offer robust data integrity and user-friendly evidence retrieval mechanisms. The focus is shifting from merely recording footage to providing actionable, geo-tagged, and time-stamped incident data.

Regionally, Asia Pacific maintains its dominance, not only in consumption volume but also in manufacturing capability, holding the key to component sourcing and assembly efficiency. However, North America and Europe demonstrate a superior average expenditure per unit, reflecting higher demand for premium dual-channel, 4K, and cloud-integrated models, primarily driven by enterprise adoption in logistics and insurance-heavy sectors. European market dynamics are heavily influenced by the imperative of GDPR compliance, requiring manufacturers to implement sophisticated local processing capabilities and transparent data handling protocols. This regulatory hurdle often mandates customized software solutions for the region, differentiating the European market from the more flexible North American environment where cloud integration and remote access features are prioritized.

Segment analysis reveals the Dual Channel category as the overwhelmingly superior performer in terms of revenue growth, projecting significant market share gains over the forecast period. Within technology segmentation, the 4K and Ultra HD resolution segment, despite its higher cost, is experiencing accelerated adoption among both enthusiasts and professional users who require unquestionable clarity for license plate reading and detailed incident reconstruction. The Application segment is witnessing intensified focus on the Commercial Vehicle subset. This is driven by fleet managers seeking systems capable of integrating seamlessly with existing Vehicle Tracking Systems (VTS) and offering advanced features such as driver identification, cab behavior monitoring, and remote video access for security checks, moving the dashcam firmly into the realm of fleet safety telematics.

AI Impact Analysis on Single and Dual Channel Dashboard Cameras Market

The increasing complexity of user questions about AI in the dashcam market reflects a growing consumer expectation for proactive safety and intelligence, moving beyond basic recording functions. Common user inquiries center on the reliability of AI-powered Advanced Driver Assistance Systems (ADAS) features—specifically, how accurately systems can distinguish non-critical objects from collision threats in real-time, and whether AI can genuinely reduce driver distractions in dual-channel systems monitoring the cabin. There is significant interest in how machine learning is used to categorize video data (e.g., differentiating a harsh brake from a genuine collision), minimizing the storage of irrelevant footage, and ensuring that essential accident data is preserved instantly. Furthermore, users are keen to understand the extent of automation in filing insurance claims, asking if AI-enabled dashcams can automatically generate preliminary accident reports that are universally accepted by insurance entities, signaling a strong user desire for integrated, end-to-end incident management solutions.

AI’s influence is profound, fundamentally transforming dashboard cameras through the implementation of machine vision algorithms, predominantly based on Convolutional Neural Networks (CNNs). These algorithms are deployed at the edge (on the camera's internal chipset) to perform real-time analysis of video frames. This enables highly sophisticated functions, such as lane departure warning (LDW) and forward collision warning (FCW), by performing semantic segmentation of the road, identifying lanes, vehicles, and pedestrians with high precision. In dual-channel systems, AI analyzes infrared footage of the cabin to detect minute cues indicative of driver fatigue (e.g., eyelid closure rate, head position) or distraction (e.g., prolonged phone usage), providing instant audio alerts to the driver and potentially transmitting critical data back to a fleet operations center, thereby significantly reducing occupational hazards.

Furthermore, AI algorithms are crucial for overcoming the physical limitations of storage and power management in continuous recording devices. Intelligent parking surveillance systems, a major consumer demand, use AI to differentiate between harmless environmental events (wind, vibration from loud trucks) and genuine impacts or intrusion attempts. By precisely classifying the event, the camera can remain in low-power mode and only initiate high-resolution recording when truly necessary, conserving battery power and maximizing the efficiency of limited storage space. The next generation of dashcam AI will increasingly focus on predictive analytics, utilizing aggregated driving data to identify high-risk zones or patterns, thereby moving the product from reactive evidence collection to proactive accident prevention, cementing its role as an active component of the vehicle's safety apparatus.

- Deployment of deep learning models for accurate object detection and distance measurement (FCW).

- Utilization of internal camera streams and AI for robust Driver Monitoring Systems (DMS) detecting fatigue and distraction.

- Intelligent video tagging and indexing to ensure crucial incident footage is instantly identified and locked against overwriting.

- Advanced algorithms for optimizing H.265/H.266 video compression, improving storage efficiency without compromising forensic image quality.

- Enhanced thermal management of chipsets through AI-optimized processing loads, ensuring performance stability during high-resolution dual-channel recording.

- Facial recognition or biometric scanning integration for secure driver authentication and automated profile loading in shared commercial vehicles.

DRO & Impact Forces Of Single and Dual Channel Dashboard Cameras Market

The market dynamics are defined by powerful regulatory drivers that accelerate adoption, particularly in commercial logistics, counterbalanced by persistent technological restraints and evolving ethical considerations regarding continuous surveillance. The convergence of favorable insurance policies and expanding legal acceptance of video evidence acts as a primary driving force, creating a financial incentive for both consumers and businesses to install these devices. However, the market faces structural challenges, including intense price pressure in the competitive entry-level segment, the physical limitations of components operating in extreme temperatures, and regulatory fragmentation regarding data use across international borders. These conflicting forces necessitate continuous technological innovation and robust lobbying efforts to standardize data handling protocols globally.

Core drivers of the market include the exponential rise in road traffic accidents globally, increasing the likelihood of disputes and the need for objective verification. Coupled with this, insurance industry statistics showing significant monetary losses due to fraudulent claims have made dashcams a cost-effective solution for risk mitigation. Furthermore, urbanization and the resulting rise in parking lot incidents and hit-and-runs have boosted demand for advanced parking surveillance modes. Regulatory drivers, such as mandatory installation for heavy goods vehicles (HGVs) in specific European regions and requirements for TNC (Transportation Network Company) drivers to record cabin interactions, cement the dashcam’s necessity in professional domains, translating directly into high-volume sales for dual-channel, professional-grade equipment.

Restraints are complex, encompassing not only technological hurdles but also deep-seated privacy concerns. The technical limitation related to thermal throttling—the reduction in performance or shutdown of the device due to excessive heat exposure—remains a major complaint, undermining consumer trust in reliability, particularly in southern and tropical climates. Data privacy, enforced vigorously by regulations like GDPR, limits the deployment and storage of continuous public footage, requiring manufacturers to develop specific features like loop recording limits and enhanced data encryption. Furthermore, the reliance on high-endurance memory cards (microSD) introduces a recurring consumable cost and potential point of failure, which can deter some price-sensitive buyers or lead to system failures if low-quality storage is utilized.

Opportunities are largely centered on convergence with the broader automotive connectivity ecosystem and the development of specialized, robust devices. The rollout of 5G infrastructure provides a platform for truly real-time, uninterrupted cloud connectivity, enabling features like emergency automated crash notification (e-call) with live video streaming capabilities—a transformative opportunity for police and emergency services integration. Niche opportunities exist in developing highly durable, tamper-proof systems for off-road industrial machinery and specialized security vehicles. Furthermore, the integration with vehicle diagnostics (OBD-II port data) allows the dashcam to correlate video evidence with mechanical parameters (speed, braking force, throttle position), creating forensic reports far more valuable than video data alone, offering a significant avenue for premium market differentiation.

- Drivers: Intensified focus on vehicular safety and legal protection against fraudulent insurance claims. Regulatory mandates for commercial fleet monitoring and driver behavior analysis. Increasing adoption of ridesharing services requiring internal vehicle security documentation. Insurance provider subsidies and premium discounts for certified dashcam installation.

- Restraints: Strict data privacy laws (e.g., GDPR) impacting continuous public recording policies. Technical challenges related to high-temperature operation and battery/supercapacitor longevity. High consumer perception of installation complexity and high maintenance requirements for premium models.

- Opportunities: Seamless integration with 5G networks for instant cloud upload and remote fleet management. Development of comprehensive ADAS and AI-driven predictive safety features. Expansion of OEM integration programs, making dashcams standard factory-installed components. Specialized ruggedization for niche industrial and logistics vehicle markets.

- Impact Forces: Rapid obsolescence cycle driven by sensor and chipset manufacturers (pushing 4K/8K resolution). Strong influence of consumer review platforms on brand reputation and market share. Necessity of global data standardization to facilitate cross-border commercial operations.

Segmentation Analysis

Detailed segmentation reveals critical insights into consumption patterns and market potential across different user demographics. The segmentation based on Channel Type (Single vs. Dual) is the most impactful, indicating a clear, growing preference for dual-channel devices, which currently account for the majority of new revenue streams due to their comprehensive coverage and suitability for both personal security-conscious users and commercial operators. Resolution segmentation confirms the market migration: while Full HD (1080p) remains the volume leader, the 4K and Above segment dictates the technology leadership and drives ASP growth, reflecting user demand for video clarity essential for accurately capturing details like license plates and road signs, especially during high-speed incidents or low-light conditions.

The Application segment highlights a divergence in feature prioritization: Personal Use consumers value aesthetic design, ease of installation, and parking surveillance duration, often selecting high-quality single or discreet dual systems. Conversely, Commercial Use applications, including fleet management and law enforcement, prioritize data integrity, system ruggedness, centralized data access (cloud telematics), and complex integration capabilities with existing vehicle monitoring systems. This commercial requirement necessitates sophisticated software platforms and encrypted data storage, creating a premium sub-segment focused on B2B solutions rather than consumer gadgets.

Segmentation by Technology underscores the critical role of connectivity. Devices "With Connectivity" (Wi-Fi, Bluetooth, 4G/5G) command a significant price premium and dominate the professional and upper-end consumer market. These features facilitate essential functions such as remote monitoring, automated data backup to the cloud, and crucial firmware over-the-air (FOTA) updates, which maintain device security and performance. The enduring presence of "Without Connectivity" models primarily serves the highly price-sensitive, entry-level, or niche markets where simple, non-networked recording suffices, though this segment is steadily shrinking in developed economies due to the perceived value of real-time data access.

- By Channel Type: Single Channel Dashboard Cameras, Dual Channel Dashboard Cameras (Front-Rear, Front-Interior)

- By Resolution: Full HD (1080p), 4K and Above (UHD), HD (720p) and Standard Definition

- By Application: Personal Vehicles (Everyday Commuters, Enthusiasts), Commercial Vehicles (Fleet Management, Logistics, Taxis and Ridesharing, Emergency Services)

- By Technology: With Connectivity (Wi-Fi/Bluetooth, 4G/5G Embedded Telematics, GPS), Without Connectivity (Local Storage Only)

- By Sales Channel: Online Retail (E-commerce Platforms, Brand Websites), Offline Retail (Automotive Specialty Stores, Dealerships, Big Box Electronics Retailers)

- By Storage Method: MicroSD Card Based, Internal eMMC Storage, Cloud Storage Integrated

Value Chain Analysis For Single and Dual Channel Dashboard Cameras Market

The Value Chain begins with the Upstream Segment, dominated by highly sophisticated electronic components. The performance and cost structure of the final product are largely determined by the sourcing of high-sensitivity CMOS image sensors (e.g., Sony STARVIS), advanced System-on-Chips (SoCs) provided by companies like Ambarella, Novatek, or HiSilicon for complex video processing and AI calculations, and specialized optical lens assemblies required for wide-angle and low-distortion viewing. Component standardization is low, meaning manufacturers must establish robust relationships with Tier 1 component suppliers to ensure quality and supply security, which can be vulnerable to global semiconductor shortages. Efficient supply chain management and component procurement are the primary areas of cost control and quality differentiation at this stage.

The Midstream Segment involves manufacturing, assembly, software development, and quality assurance. This phase includes the integration of hardware components, the development of proprietary firmware (which often contains the core intellectual property for ADAS and AI functionalities), and extensive testing, particularly for thermal resilience and G-sensor accuracy. Manufacturing is highly concentrated in East Asia, benefiting from specialized labor and established supply networks. Companies successful in this stage invest heavily in automated testing protocols to ensure that G-sensor sensitivity, WDR performance, and capacitor reliability meet stringent automotive-grade standards, differentiating high-end products from generic budget alternatives based purely on quality control rigor.

The Downstream Segment focuses on distribution, marketing, and aftermarket support. Distribution is segmented into Direct and Indirect channels. Direct channels involve OEM supply agreements, integrating dashcam functions into new vehicles, and B2B sales to large fleet operators, often including installation and ongoing maintenance contracts. Indirect distribution relies heavily on global e-commerce platforms (Online Retail), specialized automotive accessory stores (Offline Retail), and mass-market electronics retailers. The rise of e-commerce has put significant pressure on pricing and necessitates high investment in digital marketing and customer review management. Aftermarket support, including user installation guides, firmware updates, and rapid warranty service, is crucial for brand loyalty, especially in the premium sector where customers expect high reliability and long-term software enhancements. The final customer interaction often involves professional installation services, either outsourced or provided through dealership networks, which adds value and ensures correct device operation.

Single and Dual Channel Dashboard Cameras Market Potential Customers

The consumer base for Single and Dual Channel Dashboard Cameras is highly diverse, ranging from the security-minded individual to large, regulated enterprises. The primary personal consumer demographic includes daily commuters who are statistically more likely to be involved in minor traffic incidents and seek evidence for quick, undisputed insurance claims. This group often targets dual channel systems with reliable parking mode functionality to protect their vehicle against vandalism or hit-and-runs while unattended. Secondary personal customers include young, first-time car owners and technology enthusiasts who prioritize high-resolution 4K video, seamless smartphone integration, and advanced safety features like ADAS, viewing the dashcam as a crucial technology upgrade rather than just a protective necessity.

The Commercial Sector constitutes the most rapidly expanding and high-value segment. Key customers here include large logistics and trucking fleets, demanding systems that offer centralized cloud management, tamper-proof design, and integration with telematics platforms for comprehensive data analysis of driver performance and route efficiency. TNCs (Uber, Lyft, Didi) form another vital customer group, requiring robust dual-channel (front and cabin) systems to mitigate liability risks arising from passenger disputes and ensure driver safety. Law enforcement and emergency services represent a highly specialized, institutional customer base, requiring rugged, encrypted systems with specific chain-of-custody protocols for evidence management, often procuring devices under long-term governmental contracts.

Beyond traditional end-users, insurance carriers and automotive OEMs function as crucial indirect customers. Insurance companies actively recommend or subsidize certified dashcams because the data significantly lowers their claims processing costs and exposure to fraud. OEMs are increasingly potential customers for upstream component suppliers, as they move towards pre-installing dashcam functionality—either embedded discreetly within the rearview mirror or integrated into the vehicle's existing camera and sensor network. This shift will transform the aftermarket segment by making the technology a standard, expected feature, creating lucrative B2B opportunities for chip and sensor manufacturers who can meet strict automotive-grade durability and integration requirements.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 3.1 Billion |

| Market Forecast in 2033 | USD 6.7 Billion |

| Growth Rate | 11.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Garmin International, LLC, BlackVue (PITTASOFT Co., Ltd.), Thinkware, Nextbase UK, VIOFO, Xiaomi Corporation (70mai), Cobra Electronics, Rexing, Transcend Information, Inc., IROAD, DOD Tech, Lukas (Qrontech Co., Ltd.), Pioneer Corporation, Kenwood Corporation, FineVu, PAPAGO Inc., AZDOME, Waylens, Vantrue, MIO Technology. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Single and Dual Channel Dashboard Cameras Market Key Technology Landscape

The technological sophistication of the Single and Dual Channel Dashboard Cameras Market is heavily reliant on advances in semiconductor manufacturing, particularly the continuous improvement of CMOS image sensors and specialized video processing chipsets. Market leaders predominantly utilize high-end sensors (e.g., Sony’s STARVIS technology) renowned for minimizing image noise and maintaining detail in extremely low-light conditions, which is essential for nighttime driving evidence. The core processing power is supplied by energy-efficient yet high-performance SoCs capable of handling simultaneous streams from dual 4K sensors (totaling 8K processing load) while executing complex AI algorithms for ADAS features at the edge. The critical shift from lithium-ion batteries to supercapacitors across premium and mid-range devices is a major technological trend aimed at ensuring stable operation and mitigating fire risk under prolonged solar exposure and high cabin temperatures, enhancing overall product lifespan and reliability.

Connectivity and data management represent another vital area of innovation. The integration of high-precision multi-constellation GNSS (GPS, GLONASS, Galileo) modules ensures forensic quality data logging, providing irrefutable speed and location context for accident reconstruction. Furthermore, the mandatory inclusion of high-speed Wi-Fi (often 5 GHz) and Bluetooth facilitates rapid data transfer to mobile devices and automated pairing. The frontier of connectivity lies in embedded 4G and 5G modules, transforming the dashcam into a full-fledged Internet of Things (IoT) device capable of persistent, low-latency communication with cloud platforms. This advancement supports premium services like real-time theft tracking, remote parking monitoring alerts, and immediate post-crash video upload, making telematics capability a key differentiator for commercial and high-end consumer products.

Future technological evolution is focused heavily on integrating the dashcam more deeply into the vehicle’s CAN bus system and enhancing the integrity of data storage. Research is underway to improve the endurance and lifespan of flash memory (microSD cards), which currently represents a significant failure point. Furthermore, security protocols are becoming stricter, incorporating end-to-end encryption and digital watermarking to ensure footage admissibility in court. The blending of dashcam video processing with the vehicle’s existing sensor suite, particularly ultrasound and radar data, allows for a holistic perception system that improves the accuracy of AI-driven warnings and paves the way for the dashcam to function as a crucial subsystem in future autonomous vehicle safety architectures. The move towards lighter, more compact, and aesthetically discreet designs utilizing advanced optical materials is also a continuous technological objective to appeal to the consumer market.

Regional Highlights

- Asia Pacific (APAC): APAC commands the leading position in market share, primarily due to high consumer awareness, favorable regulatory environments in key nations like South Korea and Russia (where dashcam usage has been prevalent for over a decade), and strong manufacturing infrastructure in China. South Korea mandates certain features for insurance purposes, ensuring high penetration rates. China's massive market size and rapid growth in vehicle ownership, coupled with the dominance of local brands like Xiaomi (70mai), drive volume. The region exhibits high demand across all price points, but emerging middle classes in Southeast Asia are particularly receptive to affordable dual-channel systems, maintaining APAC’s role as the engine of global market volume.

- North America: North America is characterized by robust demand for premium, highly connected dual channel systems, especially within the vast logistics and commercial fleet sectors in the United States and Canada. The strong regulatory push for mandatory ELD (Electronic Logging Device) usage and safety monitoring in trucking contributes significantly to B2B growth. High consumer spending power and a general acceptance of telematics and cloud services allow manufacturers to market high-ASP products emphasizing AI-driven ADAS features and real-time remote surveillance. Insurance industry influence is pronounced, with many major carriers promoting certified dashcams to reduce their liability exposure, further boosting adoption rates.

- Europe: The European market displays steady growth, primarily concentrated in Western Europe (Germany, UK, France). This region faces unique market dynamics due to strict data privacy regulations (GDPR), which mandate that devices must offer features protecting third-party privacy, often requiring specific settings to minimize continuous public recording or blurring technology. The UK and Russia are strong adopters of dashcams for insurance and legal purposes. The commercial sector, adhering to strict EU safety standards and seeking operational efficiency, heavily utilizes advanced dual-channel systems with GPS logging and encrypted data transmission capabilities, focusing on data localization and compliance.

- Latin America (LATAM): LATAM represents a high-potential, high-growth region. Market penetration is accelerating, driven by escalating concerns over vehicle security, high rates of vehicle theft, and increasing traffic congestion in major metropolitan areas such as São Paulo and Mexico City. Price sensitivity is a key market characteristic, leading to strong sales volumes for value-oriented Full HD and HD single-channel cameras. However, improving digital infrastructure and increasing foreign investment are gradually allowing premium, connected models to gain traction, primarily among higher-income segments and international logistics companies operating within the region.

- Middle East and Africa (MEA): Growth in MEA is primarily segmented, with affluent GCC countries (UAE, Qatar, Saudi Arabia) showing a strong preference for high-end, ruggedized dashcams capable of withstanding extreme desert heat, necessitating specialized component testing and superior thermal management. Government investments in intelligent transportation systems and smart city infrastructure in the Gulf are driving commercial fleet adoption. The African segment remains nascent, limited by lower vehicle penetration and economic constraints, but presents future growth opportunities in the high-end vehicle security sector, driven by geopolitical stability and economic development.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Single and Dual Channel Dashboard Cameras Market.- Garmin International, LLC

- BlackVue (PITTASOFT Co., Ltd.)

- Thinkware

- Nextbase UK

- VIOFO

- Xiaomi Corporation (70mai)

- Cobra Electronics

- Rexing

- Transcend Information, Inc.

- IROAD

- DOD Tech

- Lukas (Qrontech Co., Ltd.)

- Pioneer Corporation

- Kenwood Corporation

- FineVu

- PAPAGO Inc.

- AZDOME

- Waylens

- Vantrue

- MIO Technology

Frequently Asked Questions

Analyze common user questions about the Single and Dual Channel Dashboard Cameras market and generate a concise list of summarized FAQs reflecting key topics and concerns.What distinguishes an automotive-grade dashcam component from a standard consumer electronic component?

Automotive-grade components, particularly supercapacitors and memory controllers, are specifically designed to withstand extreme temperature fluctuations (typically ranging from -20°C to over 80°C) without failure. This resilience is critical for reliability in a vehicle cabin exposed to intense solar heat, ensuring continuous operation where standard consumer electronics would fail.

What resolution is currently considered the industry standard for forensic-quality video evidence?

While Full HD (1080p) is widely accepted, 4K resolution (Ultra HD) is rapidly becoming the industry standard, especially for commercial and premium consumer models. 4K provides four times the detail of 1080p, offering the clarity needed to reliably capture crucial details like license plates and road signage under diverse lighting conditions, significantly enhancing evidentiary value.

How do dual channel cameras address fleet management requirements beyond simple recording?

Dual channel systems integrate Driver Monitoring Systems (DMS) via the internal camera, utilizing AI to track driver behavior (fatigue, phone use) and correlate these events with external road recordings. This provides fleet managers with comprehensive data for compliance, training, risk mitigation, and remote vehicle security monitoring through integrated 4G/5G telematics.

What is the importance of integrated GPS/GNSS technology in a dashboard camera?

GPS/GNSS technology is essential for providing irrefutable forensic context by accurately logging the vehicle's location and speed simultaneously with the video recording. This verified metadata is critical for validating insurance claims and ensuring the integrity and admissibility of the video evidence in legal proceedings.

How is the market addressing the need for tamper-proof data in commercial applications?

Commercial dashcams incorporate features such as locked, encrypted internal storage (eMMC), password-protected access to footage, and mandatory data logging that records any attempt to tamper with or remove the device. This ensures the strict chain of custody required for professional evidence handling and regulatory compliance.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager