Single Channel Digital Soldering Station Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436475 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Single Channel Digital Soldering Station Market Size

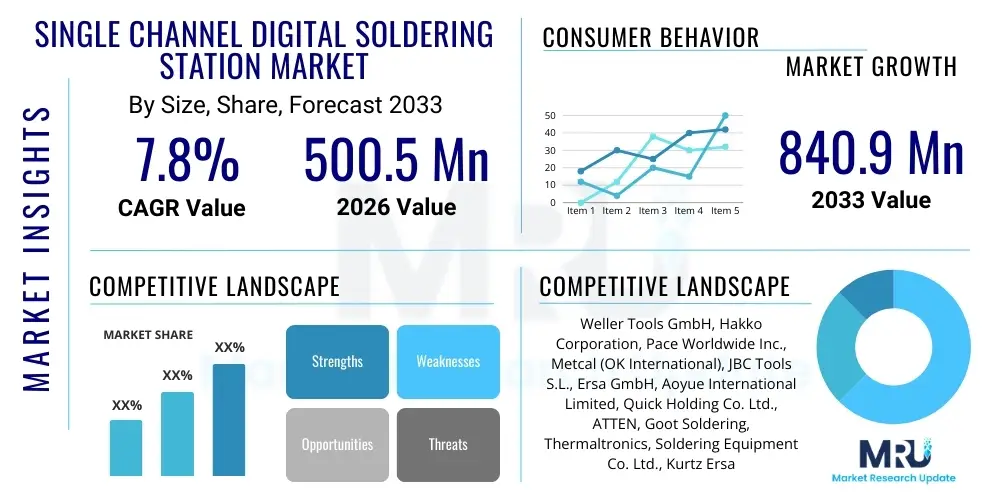

The Single Channel Digital Soldering Station Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at $500.5 Million USD in 2026 and is projected to reach $840.9 Million USD by the end of the forecast period in 2033.

Single Channel Digital Soldering Station Market introduction

The Single Channel Digital Soldering Station Market encompasses specialized equipment designed for precise, controlled thermal applications in electronics manufacturing, assembly, and repair. These stations are characterized by a single heating output channel, precise digital temperature control, and enhanced thermal recovery capabilities, which are crucial for handling sensitive electronic components and complying with stringent lead-free soldering standards. The core product provides consistent, verifiable heat delivery through a controlled tip, ensuring high-quality solder joints essential for microelectronics, telecommunications equipment, consumer gadgets, and automotive circuitry. Major applications span professional electronics rework, educational laboratory settings, high-reliability production lines, and intricate hobbyist projects requiring professional-grade tools.

The primary benefits derived from adopting digital single-channel stations include vastly improved temperature accuracy, rapid heat-up times, and superior thermal stability compared to traditional analog units. This precision reduces the risk of component damage, enhances process repeatability, and significantly increases overall manufacturing throughput and quality adherence, particularly when dealing with heat-sensitive components like BGAs and surface-mount devices (SMDs). The digital interface often includes programmable preset temperatures, password protection for process control, and large, clear displays for instantaneous temperature feedback, making them indispensable tools in modern electronics workshops compliant with ISO and IPC standards.

Driving factors for market expansion are multifaceted, anchored by the relentless growth of the global electronics industry, particularly the proliferation of IoT devices, advanced driver-assistance systems (ADAS) in automotive manufacturing, and the increasing complexity and miniaturization of PCBs. Furthermore, the global shift towards mandatory lead-free soldering (RoHS compliance) necessitates the use of high-performance digital stations capable of efficiently maintaining the higher melting temperatures required for lead-free alloys. Educational and vocational institutions are also consistently upgrading their soldering equipment to digital models to train the next generation of technicians using industry-standard tools, thereby contributing substantially to stable market demand.

Single Channel Digital Soldering Station Market Executive Summary

The Single Channel Digital Soldering Station Market is experiencing robust expansion driven by stringent quality requirements in electronics assembly and the rapid adoption of highly miniaturized components necessitating precise thermal management. Business trends highlight a strong focus on incorporating smart features, such as connectivity (Wi-Fi/Bluetooth) for data logging and remote calibration, and integrating advanced thermal technologies like high-frequency induction heating to achieve unparalleled thermal recovery speed, addressing the demands of high-volume manufacturing environments. Key competitive strategies involve enhancing tip longevity, improving user ergonomics, and developing modular systems that allow for quick tip replacement and compatibility across different platforms, positioning manufacturers to capture niche markets requiring extreme reliability and process traceability.

Regionally, Asia Pacific (APAC) dominates the market share due to its entrenched position as the global hub for electronics manufacturing, driven primarily by China, Taiwan, South Korea, and emerging markets like Vietnam and India, which are scaling up domestic production capabilities for consumer electronics and automotive parts. North America and Europe demonstrate mature market growth, focusing less on volume and more on high-value, specialized applications such as aerospace, defense electronics, medical device manufacturing, and high-specification R&D facilities where traceability and compliance are paramount. These regions prioritize sophisticated digital features and compliance with standards like MIL-SPEC and relevant environmental regulations over pure cost efficiency, propelling demand for premium, high-end digital stations.

Segment trends indicate that the market is heavily influenced by the adoption of high-power soldering stations (120W and above) driven by the necessity to handle complex multi-layer PCBs and thermal demanding ground planes found in 5G infrastructure and data center equipment. The segment catering to repair and rework applications remains critical, utilizing stations optimized for rapid, localized heating without affecting surrounding components. Furthermore, the segment based on the end-use industry, particularly automotive electronics, is poised for accelerated growth due to the electrification of vehicles (EVs) and the increasing density of electronic control units (ECUs), requiring extremely reliable and repeatable soldering processes mandated by automotive safety standards.

AI Impact Analysis on Single Channel Digital Soldering Station Market

User queries regarding AI's influence typically revolve around how artificial intelligence and machine learning might enhance the precision, automation, and predictive maintenance capabilities of soldering systems. Users frequently question if AI can optimize soldering profiles automatically based on material properties, how it might integrate with quality control systems (like automated optical inspection, AOI), and whether it can predict component failure or equipment wear before it affects production yield. The key themes summarized across these inquiries emphasize using AI not necessarily to replace the manual operation of single-channel stations but rather to improve the efficiency, quality assurance, and traceability of the soldering process itself, especially in complex, high-mix, low-volume manufacturing settings where specialized rework is common. There is a clear expectation that AI integration will primarily support process validation, data analysis, and operator training modules.

- AI-Enhanced Quality Control: Integration with vision systems to instantly analyze solder joint morphology, compare against IPC standards, and flag deviations, automating decision-making regarding rework requirements.

- Predictive Maintenance: Machine learning algorithms analyze station usage data (tip temperature fluctuations, power cycles, usage hours) to predict when soldering tips or heating elements need replacement, minimizing unplanned downtime.

- Optimized Thermal Profiling: AI suggests and adjusts optimal temperature settings and dwell times based on real-time feedback from the PCB and component characteristics, improving process repeatability for varied components.

- Operator Skill Augmentation: AI provides real-time guidance and feedback to operators, identifying suboptimal angles or movement speeds during manual soldering tasks, acting as a virtual trainer.

- Data Traceability and Compliance: Automated logging of every soldering operation, linking process parameters (temperature, time) to specific component IDs using AI-driven data management, crucial for aerospace and medical device compliance.

- Automated Calibration Scheduling: Utilizing usage patterns to autonomously schedule and recommend calibration procedures for the digital station, ensuring regulatory compliance and measurement accuracy over time.

DRO & Impact Forces Of Single Channel Digital Soldering Station Market

The market dynamics for Single Channel Digital Soldering Stations are governed by a complex interplay of rapid technological advancements (Drivers), significant capital investment and skill requirements (Restraints), and emerging applications in high-growth sectors (Opportunities). The primary driving force is the relentless demand for high-density electronic assemblies (HDI PCBs) and the requirement for stable, high-efficiency heat transfer required by lead-free alloys. Restraints largely center around the high initial cost of advanced digital stations compared to basic analog alternatives, especially for small-scale workshops, coupled with the need for specialized operator training to maximize the benefits of precision digital control. Opportunities are vast, particularly in integrating these stations into semi-automated or fully connected smart factory environments (Industry 4.0) and capitalizing on emerging markets for advanced medical and automotive electronics manufacturing.

Impact forces significantly shape the market trajectory. Supplier power is moderate; while there are many manufacturers, a few dominant players (e.g., Weller, Hakko, Pace) hold strong intellectual property regarding advanced heating technologies (like induction heating and closed-loop control), allowing them to maintain premium pricing for high-end digital models. Buyer power is high, especially in large-scale contract manufacturing, where procurement departments negotiate heavily based on volume, requiring proof of compliance, energy efficiency, and low total cost of ownership (TCO). The threat of substitutes is low to moderate; while specialized laser soldering or reflow processes exist for highly automated tasks, single-channel digital stations remain irreplaceable for intricate rework, prototyping, and specific manual assembly tasks due to their flexibility and precision.

Competitive rivalry is intense, characterized by continuous innovation in thermal technology, digital interface features, and ergonomic design. Manufacturers compete vigorously on price, performance specifications (especially wattage and thermal recovery rates), and the availability of extensive accessory ecosystems (tips, specialized handles). Environmental regulations, particularly those mandating lead-free soldering and promoting energy efficiency in manufacturing equipment, serve as critical external impact forces, compelling manufacturers to invest in newer, digitally controlled, energy-efficient designs, thereby accelerating the replacement cycle of older, less compliant analog equipment globally.

- Drivers:

- Increased demand for precision in lead-free soldering processes (high melting point alloys).

- Miniaturization of electronic components (SMDs, micro-BGAs) requiring stable, fine-tip temperature control.

- Proliferation of complex high-density interconnect (HDI) printed circuit boards (PCBs).

- Growth in high-reliability sectors such as aerospace, medical devices, and defense electronics demanding process traceability.

- Rising global production of automotive electronics, particularly for electric vehicles (EVs) and autonomous systems.

- Integration into smart factory (Industry 4.0) setups requiring data logging and connectivity.

- Restraints:

- High initial capital investment compared to low-cost analog soldering tools.

- Requirement for skilled technicians to operate and maintain advanced digital systems effectively.

- Vulnerability to global supply chain disruptions affecting specialized component availability.

- Market saturation in certain mature electronics manufacturing segments using legacy equipment.

- Opportunities:

- Development of portable, battery-powered digital stations for field service and remote repair applications.

- Expansion in emerging markets adopting stringent electronics manufacturing standards.

- Integration of advanced sensor technology for enhanced thermal feedback and control loops.

- Customization and modularity of stations to fit diverse manufacturing line requirements and specific tip geometries.

- Focus on energy-efficient designs and reduced standby power consumption appealing to environmentally conscious buyers.

- Impact Forces:

- Threat of Substitutes (Low to Moderate): Alternatives like laser soldering or hot air rework stations address specific needs but not the general versatility of single-channel digital soldering.

- Bargaining Power of Buyers (High): Large contract manufacturers command significant volume discounts and stringent performance guarantees.

- Bargaining Power of Suppliers (Moderate): Suppliers of core heating elements and microprocessors hold some leverage due to technical specialization.

- Intensity of Rivalry (High): Continuous R&D investment and aggressive pricing strategies among leading global competitors.

Segmentation Analysis

The Single Channel Digital Soldering Station Market is broadly segmented based on output power, heating technology employed, target application, and the primary end-use industry. Segmentation by power output (low, medium, and high wattage) is crucial as it dictates the station’s capacity to handle different thermal mass requirements, ranging from delicate micro-soldering tasks to heavy-duty soldering on large ground planes. Segmentation by technology recognizes the fundamental differences between ceramic heating elements, resistive heating elements, and the more advanced induction heating systems, each offering varying levels of thermal recovery speed and cost. Application segmentation differentiates between general-purpose assembly, specialized rework, and highly regulated R&D environments. These segmentation categories allow manufacturers to precisely target their product development and marketing efforts towards specific user needs, addressing variations in budget, skill level, and regulatory compliance requirements across the global electronics ecosystem.

- By Output Power:

- Low Power Stations (Under 60W)

- Medium Power Stations (60W to 120W)

- High Power Stations (Above 120W)

- By Heating Technology:

- Resistive Heating Technology

- Induction Heating Technology

- Ceramic Heating Technology

- By Application:

- General Assembly and Production

- Repair, Rework, and Maintenance

- Research and Development (R&D)

- Educational and Training Laboratories

- Prototyping and Small-Scale Manufacturing

- By End-Use Industry:

- Consumer Electronics (Smartphones, Tablets, Laptops)

- Automotive Electronics (ECUs, Sensors, Infotainment Systems)

- Aerospace and Defense (Avionics, Specialized Communication Systems)

- Medical Devices (Diagnostics, Implantable Electronics)

- Telecommunications (5G Infrastructure, Network Equipment)

- Industrial Manufacturing and Robotics

Value Chain Analysis For Single Channel Digital Soldering Station Market

The value chain for Single Channel Digital Soldering Stations begins with upstream activities focused on the sourcing and processing of specialized raw materials, primarily high-grade plastics for housings, advanced ceramics and alloys for heating elements, microprocessors for digital control, and proprietary metals for soldering tips. Key challenges in the upstream sector include maintaining a stable supply of rare earth elements and specialized alloys necessary for high-performance heating cores and ensuring strict quality control over complex electronic components like microcontrollers and temperature sensors, which are critical for the digital accuracy of the final product. Strong partnerships between station manufacturers and component suppliers are essential to ensure the reliability and thermal efficiency mandated by global electronics standards.

Midstream activities involve the core manufacturing processes: PCB fabrication for the control unit, precision assembly of the heating element and handle, calibration, software integration for the digital interface, and final product quality testing. The distribution channel is bifurcated into direct sales channels, typically utilized for large industrial contracts and high-volume purchasers (such as major Contract Electronic Manufacturers, CEMs), and indirect sales channels, which rely heavily on specialized electronics distributors, technical wholesalers, and e-commerce platforms. The indirect channel is vital for reaching small to medium enterprises (SMEs), repair shops, and hobbyist markets globally, requiring robust logistics and localized technical support.

Downstream activities focus on the end-user interaction, encompassing installation, operator training, maintenance, and after-sales support, including the provision of specialized consumables like replacement tips and calibration services. Direct distribution often allows manufacturers to offer customized training and maintenance contracts directly to major industrial clients, fostering deeper relationships. In contrast, the indirect channel requires distributors to possess sufficient technical expertise to provide first-line support. The value chain is constantly optimized for efficiency, aiming to reduce lead times for custom accessories and ensuring that the highly sensitive electronic equipment arrives calibrated and ready for immediate deployment in demanding production environments.

Single Channel Digital Soldering Station Market Potential Customers

The potential customer base for Single Channel Digital Soldering Stations is highly diversified, spanning multiple high-growth and established industrial sectors, each requiring varying levels of precision and compliance. The primary buyers are large-scale Contract Electronic Manufacturers (CEMs) and Original Equipment Manufacturers (OEMs) specializing in mass production of consumer electronics, requiring rugged, high-throughput stations capable of operating continuously in 24/7 manufacturing environments while maintaining strict thermal tolerances for lead-free processes. These customers prioritize high wattage, rapid thermal recovery, and integration capabilities for automated data logging and centralized process control.

A second major customer segment includes specialized repair and rework facilities, independent electronics repair shops, and internal maintenance departments within large corporations. These buyers seek stations known for their versatility, ergonomic design, and ability to handle a wide range of components, from fine pitch QFNs to large through-hole components. For this segment, the availability of specialized tips, ease of temperature adjustment, and reliability during intermittent use are key purchase criteria, often driving demand for medium-to-high power stations from reputable brands known for their after-market support and durability.

Finally, governmental, educational, and research institutions form a critical purchasing segment. Universities, vocational training centers, military maintenance depots, and corporate R&D laboratories require highly accurate, user-friendly digital stations primarily for prototyping, failure analysis, small-batch circuit fabrication, and technician training. These customers often value advanced features like temperature locking (for adherence to training protocols), precise calibration documentation, and stations that meet stringent laboratory safety and equipment standards, ensuring accurate and repeatable results in experimental settings.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $500.5 Million USD |

| Market Forecast in 2033 | $840.9 Million USD |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Weller Tools GmbH, Hakko Corporation, Pace Worldwide Inc., Metcal (OK International), JBC Tools S.L., Ersa GmbH, Aoyue International Limited, Quick Holding Co. Ltd., ATTEN, Goot Soldering, Thermaltronics, Soldering Equipment Co. Ltd., Kurtz Ersa North America, Tenma, Velleman, Easy Braid Co., Esico-Triton, American Beauty. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Single Channel Digital Soldering Station Market Key Technology Landscape

The technological landscape of the Single Channel Digital Soldering Station Market is continuously evolving, driven by the need for superior thermal performance, speed, and precision control. The shift from basic resistive heating to advanced high-frequency induction heating represents a major technological leap. Induction heating stations generate heat directly within the soldering tip's material through electromagnetic induction, allowing for near-instantaneous heat-up times and significantly better thermal recovery when soldering large thermal mass joints. This superior recovery rate is critical for maintaining consistent tip temperature during rapid, consecutive soldering tasks, which is essential for high-volume production lines utilizing lead-free solder alloys that demand higher processing temperatures.

Another pivotal technology is the implementation of highly sophisticated closed-loop temperature control systems, often utilizing sensors embedded extremely close to the tip’s working end (cartridge technology). These systems offer vastly improved temperature stability and accuracy, typically achieving control tolerances within ±2°C or less. Digital control interfaces allow users to program specific temperature profiles, set password locks to maintain process integrity, and facilitate integration with external process monitoring systems via USB or network ports. The modularity of tip and cartridge design, allowing quick, tool-free exchange, also contributes to efficiency and reduces overall downtime in manufacturing environments.

Furthermore, the incorporation of IoT and Industry 4.0 principles is fundamentally reshaping the high-end market segment. Modern digital soldering stations are increasingly equipped with network connectivity features (Ethernet or Wi-Fi) enabling remote calibration checks, centralized firmware updates, real-time data logging of soldering parameters, and integration with Manufacturing Execution Systems (MES) for enhanced traceability. This technological convergence ensures that the soldering process can be fully documented, monitored, and optimized across large production facilities, making digital soldering stations an active data point within the smart factory ecosystem, thereby enhancing quality assurance and compliance efforts significantly.

Regional Highlights

The global Single Channel Digital Soldering Station Market exhibits significant regional variations in terms of growth rates, demand drivers, and technological adoption profiles. Asia Pacific (APAC) currently holds the dominant position, accounting for the largest market share globally. This supremacy is directly attributable to the region's massive manufacturing footprint, particularly in electronics assembly for consumer devices, telecommunications equipment, and computer hardware concentrated in countries like China, South Korea, Japan, and Taiwan. The fierce competition and high-volume demand in APAC drive strong sales for both high-performance stations needed for dense circuit boards and cost-effective, durable models for general assembly lines, fueling consistent investment in new, compliant digital soldering infrastructure.

North America and Europe represent mature markets characterized by steady, quality-driven growth rather than rapid volume expansion. Demand in these regions is heavily focused on niche, high-reliability sectors such as aerospace and defense, medical devices, and sophisticated industrial automation. Purchasers in these geographies prioritize advanced features like process traceability, precise adherence to strict regulatory standards (e.g., MIL-SPEC, FDA regulations), and investment in advanced heating technologies (induction soldering) that offer documented performance metrics and low total cost of ownership over the long term. This results in strong demand for premium, high-wattage digital stations, despite the relatively higher unit price.

Latin America (LATAM) and the Middle East & Africa (MEA) are emerging markets demonstrating accelerating demand, driven primarily by localized infrastructure projects, increasing foreign direct investment in electronics assembly, and the establishment of local repair and service centers for imported goods. While growth starts from a smaller base, these regions show a growing need for reliable, mid-range digital soldering stations to meet basic manufacturing and repair requirements. The increasing adoption of digital technologies in education and vocational training in these areas is also contributing to the gradual phase-out of older analog equipment, setting the stage for steady market penetration throughout the forecast period as local technical skills mature and industrial standards rise.

- Asia Pacific (APAC): Dominates the global market share; driven by high-volume manufacturing of consumer electronics, 5G infrastructure, and automotive components; China, South Korea, and Taiwan are key consumers.

- North America: Strong demand concentrated in high-reliability applications (aerospace, defense, medical); focus on high-end digital stations with advanced data logging and traceability features; driven by stringent regulatory compliance.

- Europe: Mature market prioritizing energy efficiency and compliance with EU regulations (RoHS, REACH); significant adoption in high-precision industrial electronics and automotive sectors (especially Germany and Italy); preference for technologically advanced German and Spanish brands.

- Latin America (LATAM): Emerging market with growing demand in telecommunications maintenance and local manufacturing facilities; market growth tied to infrastructure development and vocational training initiatives.

- Middle East & Africa (MEA): Small but rapidly growing market; driven by regional service centers, oil & gas industry electronics maintenance, and government initiatives to diversify industrial base; often relies on imported equipment from Europe and Asia.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Single Channel Digital Soldering Station Market.- Weller Tools GmbH (Apex Tool Group)

- Hakko Corporation

- Pace Worldwide Inc.

- JBC Tools S.L.

- Metcal (OK International)

- Ersa GmbH (Kurtz Ersa)

- Quick Holding Co. Ltd.

- ATTEN Technology Co., Ltd.

- Goot Soldering (Taiyo Electric Ind. Co., Ltd.)

- Thermaltronics

- Aoyue International Limited

- Esico-Triton

- American Beauty Soldering Tools

- Velleman Group nv

- Tenma (Test Equipment Depot)

- X-Tronic International, Inc.

- Easy Braid Co.

- Solder-Rite

- Hakko Products, Inc.

- Blackstone-Ney Ultrasonics

Frequently Asked Questions

Analyze common user questions about the Single Channel Digital Soldering Station market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary advantage of a single channel digital soldering station over an analog station?

The primary advantage is superior temperature accuracy and stability, offering precise digital control (often within ±2°C) and rapid thermal recovery, which is essential for compliant and high-quality lead-free soldering processes and preventing damage to sensitive components.

Which heating technology offers the fastest thermal recovery for high-volume soldering?

High-frequency induction heating technology offers the fastest thermal recovery. It generates heat directly within the soldering tip's material, minimizing temperature drops and ensuring consistent performance even on high thermal mass connections frequently encountered in modern PCBs.

How does the market address the demand for lead-free soldering compliance?

The market addresses this by developing high-wattage (typically 120W+) digital stations capable of achieving and maintaining the higher operating temperatures required for lead-free alloys, coupled with advanced feedback systems to ensure process repeatability and adherence to standards like RoHS and IPC.

What role does Industry 4.0 play in the Single Channel Digital Soldering Station market?

Industry 4.0 integration enables stations to feature network connectivity for real-time data logging, remote process monitoring, centralized calibration management, and full traceability of soldering parameters, transforming the station into a smart, accountable manufacturing tool.

Which end-use segment is projected to show the highest growth rate during the forecast period?

The Automotive Electronics segment is projected to show the highest accelerated growth rate, driven by the global transition to Electric Vehicles (EVs), the proliferation of complex Electronic Control Units (ECUs), and the stringent reliability requirements for autonomous driving systems.

The comprehensive analysis of the Single Channel Digital Soldering Station Market reveals a segment undergoing significant transformation, where basic functionality is being rapidly replaced by high-precision, connected, and compliant digital solutions. The core growth drivers are inextricably linked to the increasing complexity and miniaturization found in nearly all electronic devices globally. Furthermore, the mandatory requirements for lead-free soldering across most industrialized economies necessitate the continuous upgrade of thermal processing equipment, creating a sustained demand cycle for advanced digital stations. The integration of advanced technological features, such as induction heating and IoT connectivity, is not merely an added benefit but is rapidly becoming a standard expectation for professionals in high-reliability manufacturing sectors, ensuring that the market trajectory remains robust and focused on quality and data integrity.

Competitive dynamics remain intense, with leading global manufacturers continually investing in ergonomic design and modular systems to offer greater flexibility to end-users. The geographical distribution of demand clearly highlights the economic significance of the APAC region as the manufacturing epicenter, juxtaposed against the high-value, quality-sensitive markets of North America and Europe. Future success in this market will depend heavily on the manufacturer's ability to provide scalable solutions that effectively balance the trade-off between sophisticated digital features and the total cost of ownership, while also successfully navigating evolving global supply chain complexities, particularly concerning specialized materials required for high-performance tips and heating elements, guaranteeing market relevance and continuous adoption by a professional user base seeking uncompromising thermal performance.

As electronics continue to penetrate every facet of modern life—from medical diagnostics to advanced military hardware and everyday consumer gadgets—the foundational importance of high-quality soldering cannot be overstated. Single Channel Digital Soldering Stations, serving as the workhorse for assembly, rework, and prototyping, remain fundamentally indispensable tools. Their evolution towards smart, AI-augmented devices that log, analyze, and optimize performance autonomously signals a strong commitment to quality assurance in the electronic manufacturing ecosystem. The market is therefore positioned for predictable growth, underpinned by foundational shifts in manufacturing standards and the ubiquitous proliferation of increasingly complex electronic circuitry demanding exceptional thermal control.

The market for accessories and consumables associated with these stations, particularly specialized soldering tips crafted from proprietary alloys for longevity and thermal efficiency, forms a significant revenue stream supporting the market's stability. Manufacturers who can leverage material science advancements to extend tip life and improve heat transfer efficiency will gain a competitive edge. Moreover, the focus on sustainable manufacturing practices is also driving innovation towards more energy-efficient stations that reduce power consumption in standby mode without compromising the rapid heat-up capabilities when actively needed. This dual focus on precision performance and environmental responsibility encapsulates the ongoing technological direction of the Single Channel Digital Soldering Station Market through the forecast period to 2033.

The segment concerning R&D and educational applications, though smaller in volume than large-scale production, is critical for future technology diffusion. Equipping engineering students and research scientists with the latest digital tools ensures that the industry's workforce is prepared to handle next-generation components and soldering challenges, maintaining a skilled talent pipeline. This demand stream, combined with the ongoing need for upgrades in industrial facilities to comply with the latest revision of quality standards (e.g., IPC J-STD-001), guarantees a sustained replacement and expansion cycle for single-channel digital soldering equipment across diverse global economies. The competitive landscape will continue to favor companies demonstrating reliability, compliance, and commitment to the rapid evolution of thermal management solutions.

Furthermore, cybersecurity considerations are beginning to influence the design of network-enabled digital soldering stations. As these tools become integrated into MES and factory networks, protecting the logged process data and ensuring the integrity of the station's control software against unauthorized access or manipulation is becoming increasingly important, especially in high-security manufacturing environments. Manufacturers are responding by incorporating enhanced authentication protocols and secure data transmission methods, ensuring that the precision and traceability offered by digital control are not compromised by connectivity risks. This technological trend positions digital soldering stations as highly reliable, secure instruments within the modern, connected manufacturing facility.

The continuous push toward miniaturization in consumer electronics necessitates stations capable of operating with extremely fine tips and micro-soldering tools. The ability of a single channel digital station to accurately deliver micro-fine heat to small pads without overheating adjacent components is a major purchasing determinant for manufacturers of smartphones and wearables. This technological necessity drives manufacturers to perfect their cartridge-style tips and optimize the internal architecture of their control units to deliver highly responsive, low-mass thermal energy transfer. The high cost associated with developing these advanced thermal systems solidifies the position of established leaders and raises the barrier to entry for smaller market players seeking to compete in the high-performance digital segment. Thus, technological prowess and patent protection are key differentiating factors in the intensely competitive global market.

The importance of robust user interfaces and intuitive control schemes cannot be overlooked in the shift to digital systems. While precise temperature control is fundamental, the ease with which an operator can access pre-set profiles, perform calibration offsets, and view performance diagnostics enhances productivity and reduces errors. Manufacturers are increasingly utilizing high-resolution color displays and touch interfaces, improving the user experience and facilitating quicker training. This emphasis on human-machine interface (HMI) design ensures that the technological sophistication of the internal components translates into tangible operational benefits on the factory floor, catering to a global workforce with varied technical literacy levels, ultimately boosting the market appeal of these advanced single channel digital platforms.

Finally, the growing environmental consciousness among global consumers and regulators impacts the entire value chain. Beyond lead-free compliance, demand is rising for equipment manufactured using sustainable materials and processes, with a focus on minimizing waste generated by consumables like soldering tips. Companies that offer recycling programs for used tips or design tips with extended life expectancies are likely to be favored, particularly by corporations with strict internal sustainability targets. This alignment of technological advancement with environmental responsibility ensures the market’s long-term viability and attractiveness to large, multinational corporations committed to green manufacturing standards across their supply chain.

The structure and stability of the Single Channel Digital Soldering Station Market is further reinforced by the regulatory environment. The strict quality mandates from bodies such as IPC (Association Connecting Electronics Industries) and ISO necessitate the use of calibrated, digitally controlled equipment to prove process control. Without verifiable digital temperature logging capabilities, many high-reliability manufacturing contracts cannot be secured or executed. Consequently, investment in certified digital soldering technology is viewed less as an optional upgrade and more as a foundational requirement for maintaining industrial competitiveness and accessing high-value markets, creating a guaranteed baseline demand for compliant, sophisticated digital soldering solutions throughout the forecast period, thereby minimizing market volatility and ensuring consistent investment in R&D to meet ever-increasing precision standards.

The geographical diversity in manufacturing needs—from the sheer volume demands of Asian contract manufacturers requiring rugged, high-throughput systems to the specialized, low-volume, high-compliance requirements of European medical device makers—requires manufacturers to maintain highly adaptable product portfolios. This necessity drives the segmentation by application and end-use industry, allowing targeted marketing and product development efforts. For instance, stations sold to aerospace firms must adhere to unique thermal stability requirements under extreme operating conditions, driving innovation in sensor technology and materials science that eventually trickles down to standard commercial models, boosting the overall market quality profile and technological sophistication across all segments. This trickle-down effect of high-compliance requirements acts as a continuous catalyst for market advancement.

The competition between proprietary heating technologies, such as Weller’s Silver Line and JBC’s heating systems, remains a core driver of technological advancement. These proprietary innovations focus intensely on reducing thermal resistance between the heater, sensor, and tip (often by integrating them into a single cartridge), maximizing the energy efficiency and responsiveness of the system. This competitive push results in improved soldering performance, reduced risk of component damage due to inconsistent temperatures, and faster recovery times, providing tangible economic benefits (higher throughput, lower rework rates) to the end-user. As the density of modern PCBs continues to increase, the ability of a soldering station to manage localized heat precisely becomes paramount, ensuring that the market for best-in-class digital single-channel solutions continues its upward trajectory in terms of both value and technological complexity.

The maintenance and service ecosystem supporting these digital stations is also a growing area of market activity. Since digital stations are sophisticated electronic tools, they require periodic recalibration and certified maintenance. Companies that offer extensive global service networks and robust spare parts availability gain a significant market advantage, particularly when serving multinational corporations with distributed manufacturing facilities. The provision of certified training programs for technicians on the proper use and calibration of digital stations further strengthens the market infrastructure, ensuring that high performance is maintained throughout the equipment's lifecycle and solidifying customer loyalty to brands that offer comprehensive support packages beyond the initial purchase price, driving recurring service revenue streams.

Finally, the global economic climate, while introducing periodic headwinds, generally favors the adoption of high-quality digital equipment. In recessionary or uncertain economic periods, manufacturers tend to focus intensely on quality control and minimizing scrap rates. Investing in high-precision digital soldering stations, despite the initial cost, is often justified by the resulting reduction in costly rework and component failures, positioning these tools as essential investments for quality assurance rather than discretionary capital expenditure. This quality-driven purchasing behavior ensures a baseline level of resilience for the high-end segment of the Single Channel Digital Soldering Station Market, maintaining stable demand even when broader capital equipment spending faces pressures.

The ongoing development of new solder materials, including specialized low-temperature solders and conductive epoxies, introduces new challenges and opportunities for digital soldering station manufacturers. While some low-temperature solders mitigate thermal stress on components, others require highly specific, tightly controlled temperature windows. Digital stations are uniquely positioned to meet these demands through programmable profiles and highly accurate feedback loops, ensuring compatibility with emerging material science innovations. This adaptability is key to the longevity and sustained relevance of the digital soldering station as the electronics industry continues to experiment with novel interconnection technologies and processes, requiring thermal management flexibility and absolute precision in execution.

The increasing focus on operator health and safety is also influencing product design. Digital stations are being developed with improved fume extraction integration, low voltage hand pieces, and ergonomic designs that reduce operator fatigue during prolonged use. Features such as built-in tip cleaning mechanisms and automated tip-wetting reminders contribute to both operational efficiency and a safer working environment. Manufacturers who successfully blend high technical performance with superior ergonomics and safety features will capture the attention of major industrial buyers committed to comprehensive worker welfare programs, thereby gaining a distinct competitive edge in tenders for large-scale production line deployments of single channel digital soldering equipment.

The market faces a unique challenge in standardizing communication protocols for Industry 4.0 integration. Currently, various manufacturers use proprietary communication standards, complicating the seamless integration of different brands of soldering equipment into a single MES system. A growing market opportunity lies in developing universally compatible, open-source communication standards for production equipment, which would drastically simplify implementation for large contract manufacturers who often operate mixed-vendor production lines. Should such standards emerge, the adoption rate of networked digital soldering stations could accelerate significantly, further cementing their role as critical, data-generating nodes within the smart factory architecture, driving incremental market growth.

In conclusion, the Single Channel Digital Soldering Station Market is fundamentally strong, supported by non-negotiable requirements for precision and quality in global electronics manufacturing. The forecasted CAGR of 7.8% reflects continuous technological refinement, essential compliance upgrades, and the enduring demand from high-growth sectors like automotive electrification and advanced medical device production. The ongoing technological arms race between key players, centered on thermal efficiency and digital integration, ensures that the market will remain dynamic, innovative, and essential to the future of electronic assembly worldwide.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager