Single Crystal Blades Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434849 | Date : Dec, 2025 | Pages : 243 | Region : Global | Publisher : MRU

Single Crystal Blades Market Size

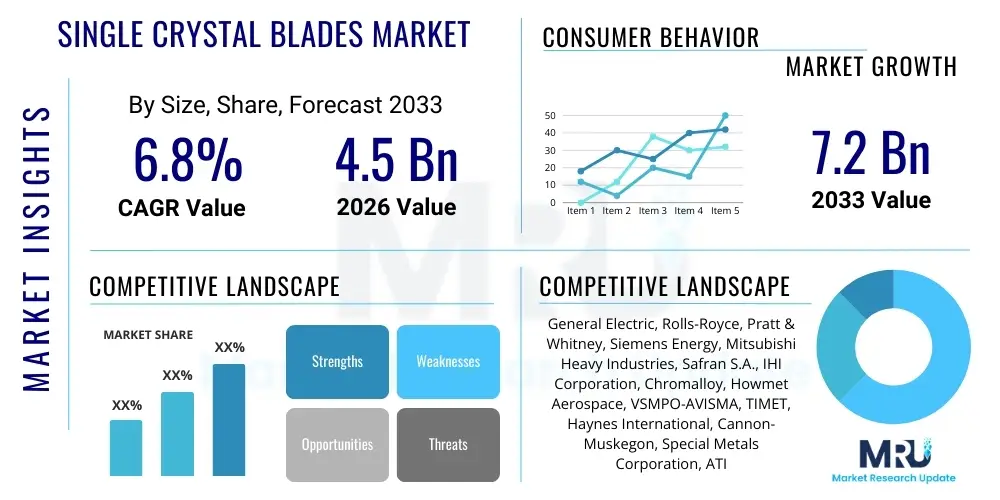

The Single Crystal Blades Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 4.5 Billion in 2026 and is projected to reach USD 7.2 Billion by the end of the forecast period in 2033.

Single Crystal Blades Market introduction

Single crystal (SC) blades represent a pinnacle of advanced metallurgical engineering, primarily utilized in the high-pressure turbine sections of gas turbine engines, essential for both aerospace propulsion and high-efficiency power generation. These components are characterized by a microstructure consisting of a single, continuous crystal grain throughout the entirety of the blade, eliminating the high-angle grain boundaries found in conventional cast or directionally solidified parts. The absence of these boundaries significantly enhances the material's mechanical properties, particularly resistance to thermal creep, fatigue, and oxidation at the extreme temperatures prevalent in modern turbine environments, directly correlating with improved engine efficiency and reduced fuel consumption.

The manufacturing process, typically advanced investment casting coupled with highly controlled solidification techniques, is complex and costly but yields components capable of operating reliably at temperatures approaching their melting point. Single crystal superalloys, predominantly nickel-based, are designed with precise compositions that leverage elements like Rhenium, Tantalum, and Tungsten to form strengthening gamma prime precipitates. Major applications span commercial aircraft engines, military jet propulsion systems, and large industrial gas turbines (IGTs) used in combined cycle power plants. The superior thermal stability and structural integrity provided by single crystal architecture are critical enablers for next-generation, high-thrust, and ultra-efficient turbine designs globally.

The principal market drivers include the continuous push by the aerospace industry for lightweight, fuel-efficient engines (LEAP, GTF programs) and the requirement for increased power density in industrial gas turbines to meet stringent global emissions standards. The inherent benefits—such as extended component life, reduced maintenance intervals, and substantial operational savings derived from higher thermodynamic efficiency—underscore the necessity and value proposition of single crystal technology, positioning it as indispensable for future high-performance thermal machines across transportation and energy sectors.

Single Crystal Blades Market Executive Summary

The Single Crystal Blades Market is experiencing robust growth, primarily propelled by global decarbonization mandates necessitating higher thermal efficiency in both aerospace and power generation sectors. Business trends indicate a strategic vertical integration among major engine manufacturers (OEMs) who seek to control the intellectual property and complex manufacturing process associated with these critical components. There is an increasing focus on developing fifth-generation and beyond SC superalloys that incorporate novel alloying elements and advanced coating technologies (Thermal Barrier Coatings - TBCs) to withstand operating temperatures exceeding 1,700°C, thereby maximizing engine performance and lifespan. The competitive landscape is defined by long-term contractual relationships and stringent quality certifications, acting as significant barriers to entry for new market participants.

Regionally, Asia Pacific (APAC) is projected to exhibit the highest growth rate, driven by significant investments in commercial aviation expansion, particularly in China and India, alongside sustained industrialization leading to increased demand for high-capacity power generation turbines. North America and Europe, while mature, continue to dominate in terms of technological innovation and market volume, spurred by defense spending and ongoing engine modernization programs. Segment trends highlight that Nickel-based superalloys maintain market supremacy due to their unparalleled high-temperature creep resistance, while the Aerospace & Defense application segment accounts for the largest market share, directly correlated with global aircraft production cycles and engine replacement schedules.

The market faces operational restraints related to the complexity and high capital expenditure required for SC blade production, coupled with geopolitical volatility affecting the supply of key strategic raw materials like Rhenium and Cobalt. However, significant opportunities are emerging through additive manufacturing (AM) techniques, which promise to revolutionize the geometric complexity and material wastage aspects of blade production. Successful scaling of AM for single crystal parts could fundamentally alter the cost structure and production timelines, offering substantial long-term growth potential and mitigating traditional casting limitations, thereby future-proofing the technology.

AI Impact Analysis on Single Crystal Blades Market

User inquiries regarding the intersection of Artificial Intelligence (AI) and Single Crystal Blades primarily revolve around optimizing material composition, predicting component failure, and refining the highly sensitive manufacturing process. Users are keen to understand how AI can reduce the prohibitively high manufacturing scrap rates associated with investment casting and solidification control, a key cost constraint. Furthermore, there is strong interest in leveraging machine learning algorithms to rapidly analyze complex, multi-element superalloy compositions and predict their long-term performance (creep life, fatigue limits) under various operational cycles, accelerating the development of new alloy generations. Concerns often focus on the required data infrastructure and the complexity of training models given the proprietary nature and limited publicly available data on SC manufacturing defects and in-service failure modes, suggesting expectations for AI-driven quality assurance and predictive maintenance are high but moderated by data accessibility challenges.

- AI-driven optimization of superalloy composition through high-throughput screening simulations, significantly reducing R&D timelines.

- Machine learning models used for predictive maintenance (PdM) in gas turbines, analyzing sensor data (vibration, temperature) to estimate SC blade life and prevent catastrophic failures.

- Computer vision and AI integration in Non-Destructive Testing (NDT) processes (e.g., X-ray, fluorescence inspection) to rapidly identify minute defects (e.g., stray grains, porosity) during manufacturing, enhancing yield rates.

- Optimization of investment casting parameters (mold temperature, withdrawal rate) using reinforcement learning to minimize defects and achieve perfect single crystal alignment.

- Development of Digital Twins for SC blades, allowing virtual simulation of operational wear, stress propagation, and thermal effects over the component's lifecycle.

DRO & Impact Forces Of Single Crystal Blades Market

The market dynamics for Single Crystal Blades are dictated by a sophisticated interplay of technological necessity, high capital barriers, and strategic raw material availability. The primary driver is the unrelenting global commitment to thermodynamic efficiency, particularly in the aviation sector where engines must operate hotter and faster to meet fuel economy and reduced emission targets. This technological requirement mandates the superior creep and fatigue resistance offered exclusively by SC alloys, thereby locking in demand regardless of broader economic volatility. Concurrent growth in global electricity demand, especially in rapidly industrializing economies, fuels the market for high-efficiency industrial gas turbines (IGTs) where SC technology is increasingly utilized to maximize output and operational stability, solidifying its essential status in critical infrastructure.

Conversely, the market faces significant restraints rooted in manufacturing complexity and cost. The investment casting process required for single crystal growth is highly sensitive to variations, resulting in substantial scrap rates and long lead times. Furthermore, the reliance on strategic metals like Rhenium and Cobalt introduces geopolitical risk and severe price volatility, directly impacting the profitability and final cost of SC components. These high upfront material and production costs often limit the deployment of SC technology to only the most critical, high-performance applications, restricting market expansion into mid-range turbine segments or replacement markets where lower-cost, directionally solidified (DS) alternatives remain viable options.

Opportunities for growth are concentrated in the development and adoption of next-generation alloy systems (e.g., Rhenium-free compositions to mitigate supply chain risks) and the integration of advanced manufacturing paradigms such as Powder Bed Fusion (PBF) additive manufacturing. If AM can reliably produce defect-free, load-bearing SC components at scale, it presents a transformational opportunity to lower material waste and geometric complexity limitations. The impact forces show high buyer bargaining power due to the limited number of large-scale OEMs who dictate material specifications, while supplier power remains medium-to-high due to the finite nature of strategic raw materials and the specialization required in their refinement and supply chain management. Overall, technological advancement and efficiency mandates exert a powerful, sustained positive impact force on market trajectory.

Segmentation Analysis

The Single Crystal Blades Market is rigorously segmented primarily based on the composition of the superalloy utilized and the specific end-use application, which defines the operational environment and performance requirements of the blade. Analysis by alloy type reveals the dominance of Nickel-based superalloys, which offer the highest stability and strength at elevated temperatures, essential for modern turbine cores. Segmentation by application clearly demonstrates the overwhelming influence of the Aerospace & Defense sector, which drives the highest volume and technological evolution due to the critical nature and high certification standards required for jet engine components. Understanding these segments is vital for stakeholders to allocate R&D investment and tailor specific manufacturing processes, as the requirements for a military fighter jet engine blade differ fundamentally from those of a land-based power generation turbine.

- By Alloy Type:

- Nickel-based Superalloys

- Cobalt-based Superalloys

- Iron-based Superalloys

- By Manufacturing Process:

- Investment Casting (Conventional SC)

- Additive Manufacturing (Emerging SC)

- By Application:

- Aerospace & Defense (Military and Commercial Jet Engines, Helicopters)

- Power Generation (Industrial Gas Turbines, Combined Cycle Power Plants)

- Marine Propulsion (Naval Gas Turbines)

- Others (e.g., Automotive High-Performance Turbos)

Value Chain Analysis For Single Crystal Blades Market

The value chain for Single Crystal Blades is characterized by high integration and rigorous quality control across all stages, starting with the extraction and refining of strategic raw materials. The upstream segment is dominated by specialized suppliers who source and process high-purity nickel, cobalt, chrome, and crucial refractory elements like Rhenium, Tantalum, and Hafnium. This stage involves complex alloying and preparation of master alloys tailored to specific generational superalloy compositions. The limited number of suppliers capable of meeting the stringent purity and trace element control requirements for single crystal casting grants them considerable leverage, although long-term supply contracts often mitigate excessive price volatility for major engine OEMs.

Midstream activities center on the highly technical production process, primarily advanced investment casting by specialized foundries or integrated OEM facilities. This phase encompasses mold creation (using ceramic cores), precise melting, vacuum casting, and crucially, the directional solidification process required to grow the single crystal structure. Due to the high intellectual property associated with preventing stray grains and minimizing micro-porosity, OEMs often maintain tight control over this segment. Following casting, extensive post-processing, heat treatments, machining, and application of specialized Thermal Barrier Coatings (TBCs) occur to ensure the final component meets stringent geometric and material specifications for high-stress operation.

The downstream segment involves distribution, dominated by direct channels between component manufacturers and the major aircraft and turbine engine OEMs (e.g., General Electric, Rolls-Royce). Indirect distribution, involving Maintenance, Repair, and Overhaul (MRO) service providers, exists primarily for replacement parts and refurbishment activities. Due to the critical, mission-specific nature of SC blades, procurement decisions are highly centralized, focusing on performance guarantees, certification compliance, and established supplier track records rather than simple cost competition. This strict value chain ensures traceability and quality but reinforces the oligopolistic structure of the market.

Single Crystal Blades Market Potential Customers

The primary consumers of Single Crystal Blades are large, multinational Original Equipment Manufacturers (OEMs) specializing in advanced turbine machinery, where performance and reliability in extreme thermal environments are non-negotiable requirements. These core customers include global aerospace engine producers and leading industrial power generation companies. For aerospace, the focus is on maximizing thrust-to-weight ratios and minimizing fuel burn across commercial fleet modernization and defense procurement programs. The purchasing decision process for these entities is extended, involving qualification periods stretching several years, emphasizing adherence to rigorous regulatory standards (FAA, EASA, military certifications) and a demonstrated capacity for long-term component supply and technical support.

Secondary, but growing, customer segments include major global Maintenance, Repair, and Overhaul (MRO) providers and large utility companies that operate extensive fleets of Frame 7, 9, or similar high-capacity industrial gas turbines. These customers require replacement SC blades as part of routine hot section maintenance or scheduled overhauls, driven by specific engine operating hours or cyclic fatigue limits. Furthermore, advanced defense organizations and naval entities deploying high-performance marine gas turbines also represent a niche, high-value customer base, prioritizing durability and immediate operational readiness over cost optimization. The commonality across all potential customers is the absolute requirement for components that deliver maximum thermal efficiency and extended operational life, mitigating the severe costs associated with turbine engine downtime.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.5 Billion |

| Market Forecast in 2033 | USD 7.2 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | General Electric, Rolls-Royce, Pratt & Whitney, Siemens Energy, Mitsubishi Heavy Industries, Safran S.A., IHI Corporation, Chromalloy, Howmet Aerospace, VSMPO-AVISMA, TIMET, Haynes International, Cannon-Muskegon, Special Metals Corporation, ATI (Allegheny Technologies Incorporated), MTU Aero Engines. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Single Crystal Blades Market Key Technology Landscape

The technological landscape of the Single Crystal Blades Market is dominated by advancements in superalloy metallurgy and precision casting techniques, with a rapidly evolving shift toward additive manufacturing (AM). Traditional production heavily relies on the high-vacuum investment casting method, specifically the withdrawal process, where precise thermal gradients are maintained to ensure the growth of a single, continuous grain structure devoid of defects. Key metallurgical innovations center on the development of successive generations of nickel-based superalloys (e.g., 4th and 5th generation alloys utilizing up to 6wt% Rhenium) designed to enhance the volume fraction and stability of the strengthening gamma prime phase (γ’), pushing operational temperatures closer to 90% of the material's melting point and significantly improving creep rupture life under extreme stress.

Crucially intertwined with the blade substrate technology is the deployment of advanced protection systems, primarily sophisticated multi-layer Thermal Barrier Coatings (TBCs). These ceramic coatings, often based on Yttria-Stabilized Zirconia (YSZ) or more advanced pyrochlore structures, are applied using Electron Beam Physical Vapor Deposition (EB-PVD) or Air Plasma Spray (APS) techniques. TBCs provide a critical thermal insulation layer, reducing the temperature experienced by the metallic blade structure by hundreds of degrees, which is essential for maximizing both efficiency and blade lifespan. The continuous technological thrust in this area focuses on improving TBC durability against foreign object damage, oxidation, and spallation, allowing for increased gas inlet temperatures.

The most disruptive emerging technology is Additive Manufacturing, particularly Directed Energy Deposition (DED) and specific variants of Powder Bed Fusion (PBF). Researchers and industry leaders are actively investigating how AM can be controlled to replicate or exceed the material properties achieved through conventional single crystal casting. Success in AM would allow for the creation of previously unachievable cooling channel geometries within the blade structure, significantly enhancing internal cooling effectiveness and reducing material wastage compared to traditional casting. While challenges remain concerning porosity control and ensuring the precise crystallographic orientation required for SC performance, AM is positioned to be a cornerstone technology for rapid prototyping and eventually, high-volume, complex blade production in the latter half of the forecast period.

Regional Highlights

The regional market dynamics reflect a concentration of demand and advanced manufacturing capabilities in North America and Europe, alongside rapid emerging market growth in Asia Pacific (APAC). North America, driven predominantly by the United States, holds the largest market share, fueled by massive defense expenditures (F-35, B-21 engine programs) and the presence of globally dominant commercial engine OEMs (GE Aerospace, Pratt & Whitney). This region is the epicenter of R&D for next-generation alloy systems and advanced manufacturing technologies (including AI integration in foundries), ensuring its technological lead persists throughout the forecast period. Demand here is characterized by high specification requirements and long-term modernization cycles.

Europe represents the second major hub, characterized by strong players like Rolls-Royce, Safran, and Siemens Energy. The European market benefits from substantial investment in both aerospace (Airbus programs) and high-efficiency industrial gas turbines, aligning with EU sustainability mandates that push for maximal energy conversion efficiency. Furthermore, Europe maintains a strong research base in materials science and coating technologies, supporting continuous incremental improvements in SC blade performance and durability.

Asia Pacific (APAC) is forecast to exhibit the fastest Compound Annual Growth Rate (CAGR). This acceleration is attributed to massive commercial aviation fleet expansion in China and India, necessitated by rising middle-class travel and liberalization of air routes. Furthermore, extensive infrastructure and industrial power generation projects across Japan, South Korea, and Southeast Asia require large fleets of IGTs, driving demand for new installations and maintenance-related SC blade replacements. While historically reliant on technology imports, domestic manufacturing capabilities, particularly in China, are rapidly maturing, potentially altering global supply chains in the long term.

- North America: Dominates the market share due to large domestic aerospace and defense spending and the presence of major engine OEMs; Focus on 5th generation superalloys and Additive Manufacturing implementation.

- Europe: Strong technological base supporting major OEMs; High demand linked to advanced commercial aviation programs and stringent energy efficiency regulations for industrial gas turbines.

- Asia Pacific (APAC): Fastest growing region, driven by explosive growth in commercial air travel demand, fleet modernization, and significant investments in new power generation capacity.

- Latin America (LATAM) & Middle East and Africa (MEA): Growing replacement and MRO market, fueled by expanding regional air fleets and investments in oil & gas sector power infrastructure where IGTs are essential for stable energy supply.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Single Crystal Blades Market.- General Electric (GE Aerospace)

- Rolls-Royce plc

- Pratt & Whitney (a division of RTX Corporation)

- Siemens Energy AG

- Mitsubishi Heavy Industries, Ltd. (MHI)

- Safran S.A.

- IHI Corporation

- Chromalloy Gas Turbine Corporation

- Howmet Aerospace Inc.

- VSMPO-AVISMA Corporation

- TIMET (Titanium Metals Corporation)

- Haynes International, Inc.

- Cannon-Muskegon Corporation

- Special Metals Corporation (a PCC company)

- ATI (Allegheny Technologies Incorporated)

- MTU Aero Engines AG

Frequently Asked Questions

Analyze common user questions about the Single Crystal Blades market and generate a concise list of summarized FAQs reflecting key topics and concerns.What fundamentally differentiates a single crystal blade from other turbine blades?

Single crystal (SC) blades are solidified to possess only one continuous crystal grain throughout their structure, eliminating high-angle grain boundaries. This removal of grain boundaries dramatically improves the blade's resistance to creep (deformation under prolonged high stress/temperature) and thermal fatigue, enabling operational temperatures hundreds of degrees higher than those achievable with conventional cast or directionally solidified (DS) blades, thereby maximizing turbine efficiency.

Which industry accounts for the highest utilization of single crystal blades?

The Aerospace and Defense industry is the largest consumer, specifically for use in high-pressure turbine sections of commercial and military jet engines. The critical need for maximum thrust, fuel efficiency, and lightweight components in aviation propulsion systems makes single crystal superalloys indispensable, driving the majority of the market's technological development and volume demand.

What are the primary raw material constraints affecting SC blade production?

The key constraints involve the supply and price volatility of strategic refractory metals, primarily Rhenium and Cobalt. These elements are essential alloying additions that significantly enhance high-temperature strength but have limited global supply sources. Fluctuations in their availability and cost directly impact the pricing and supply chain stability for SC blade manufacturers worldwide.

How is Additive Manufacturing (AM) impacting the future of single crystal blades?

Additive Manufacturing (AM) offers the potential to significantly reduce material waste and enable complex internal cooling geometries not feasible with traditional casting. Researchers are working to perfect AM techniques (like specialized PBF or DED) to reliably achieve the required single crystal structure and material density, aiming to lower manufacturing costs and accelerate new blade design cycles.

What is the projected Compound Annual Growth Rate (CAGR) for the Single Crystal Blades Market through 2033?

The Single Crystal Blades Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. This robust growth is primarily driven by global air traffic recovery, modernization of existing turbine fleets, and the continuous push for efficiency improvements in both aerospace and industrial power generation applications.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager