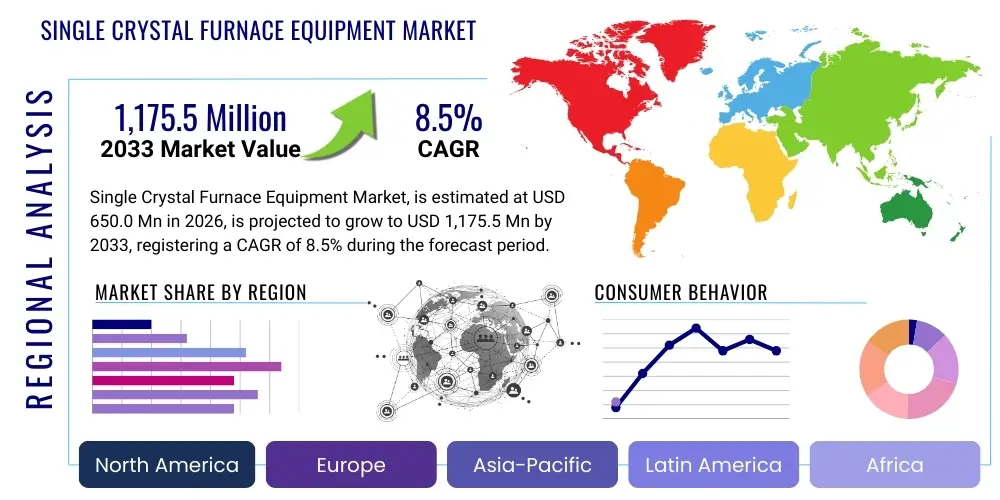

Single Crystal Furnace Equipment Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437741 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Single Crystal Furnace Equipment Market Size

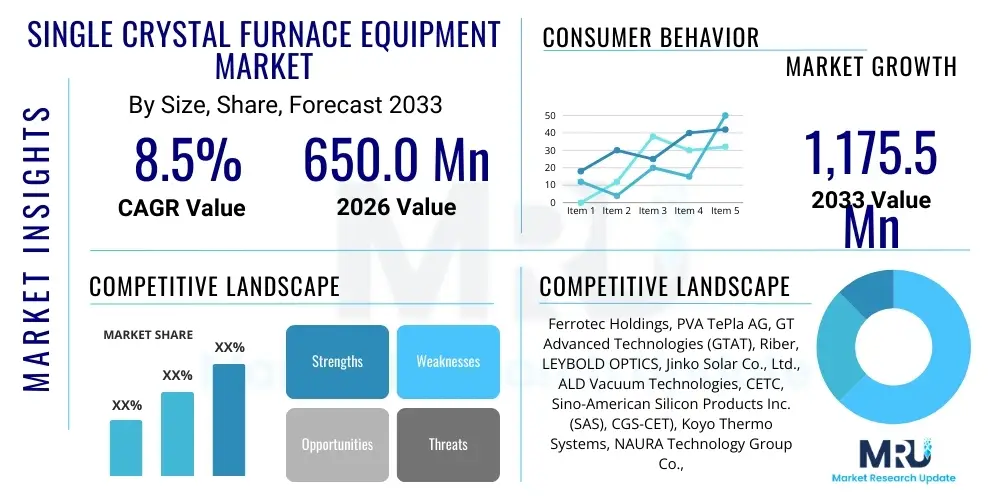

The Single Crystal Furnace Equipment Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at USD 650.0 million in 2026 and is projected to reach USD 1,175.5 million by the end of the forecast period in 2033. This growth trajectory is fundamentally driven by the escalating global demand for high-performance semiconductor devices, particularly those utilizing silicon carbide (SiC) and gallium nitride (GaN) substrates, which require highly sophisticated crystal growth processes. The expansion of 5G infrastructure, electric vehicles (EVs), and advanced consumer electronics mandates defect-free, large-diameter single crystals, pushing manufacturers to invest heavily in modern Czochralski (CZ) and Vertical Gradient Freeze (VGF) furnace technologies capable of achieving higher yields and superior purity levels necessary for leading-edge microelectronics manufacturing.

Single Crystal Furnace Equipment Market introduction

The Single Crystal Furnace Equipment Market encompasses highly specialized machinery used for the precise and controlled growth of high-purity crystalline materials, such as silicon (Si), silicon carbide (SiC), sapphire, and gallium arsenide (GaAs). These materials form the foundational substrates essential for semiconductor wafers, optoelectronics, and photovoltaic cells. The core function of single crystal furnaces, regardless of the method employed (CZ, VGF, or Float Zone), is to melt raw polycrystalline material in an inert environment and then slowly solidify it into a large, uniform, and defect-free monocrystalline structure under precisely regulated temperature and pressure conditions. The quality and performance of the final electronic device are directly dependent on the structural integrity and purity of the single crystal substrate produced by this equipment.

Key applications of this equipment span across several critical high-tech sectors. In the semiconductor industry, silicon grown via the Czochralski method remains dominant for CMOS integrated circuits, while advanced furnaces are increasingly tailored for SiC and sapphire used in power electronics and LEDs, respectively. The benefits derived from using sophisticated single crystal furnace equipment include superior crystal uniformity, significantly reduced defect density, and the ability to produce larger diameter wafers (e.g., 300mm or 450mm silicon), leading to higher production yields and reduced manufacturing costs per die. Furthermore, the modern equipment incorporates advanced automation and process monitoring systems, ensuring reproducibility and enabling tighter control over crystallization kinetics, which is crucial for next-generation material requirements.

Driving factors for this market are intrinsically linked to technological proliferation worldwide. The pervasive digitalization of industries, coupled with monumental investment in renewable energy infrastructure—specifically high-efficiency solar cells—and the relentless pace of miniaturization in consumer electronics, underpin sustained demand. Furthermore, government initiatives across North America, Europe, and Asia Pacific aimed at bolstering domestic semiconductor supply chain resilience necessitate the establishment of new fabrication facilities equipped with the most advanced crystal growth technology. The transition from standard silicon to wide-bandgap (WBG) materials, driven by the electric vehicle revolution and demand for high-frequency 5G components, specifically mandates the deployment of specialized, high-temperature single crystal SiC furnaces, thereby injecting significant capital into this equipment sector.

- Product Description: Specialized high-temperature, high-vacuum systems designed for melt growth or solution growth of monocrystalline materials like silicon, sapphire, SiC, and GaAs, essential for semiconductor and optical substrates.

- Major Applications: Fabrication of semiconductor wafers (CMOS, power electronics), LED substrates (sapphire, SiC), solar photovoltaic cells, and advanced sensor components.

- Benefits: High purity material output, low dislocation density, improved wafer size scalability, precise process control (temperature and atmosphere), and high production efficiency.

- Driving Factors: Global chip shortage remediation efforts, massive growth in electric vehicle production (requiring SiC power devices), 5G network deployment, and continuous R&D in wide-bandgap semiconductors.

Single Crystal Furnace Equipment Market Executive Summary

The Single Crystal Furnace Equipment Market is characterized by intense technological competition, driven primarily by the shift towards larger wafer sizes (e.g., 300mm for Si and 6-inch/8-inch for SiC) and the rigorous purity demands of advanced semiconductor fabrication. Key business trends indicate a strong move toward integration and automation, with leading equipment manufacturers prioritizing predictive maintenance capabilities and enhanced thermal management systems to improve throughput and reduce energy consumption. Strategic collaborations between furnace equipment providers and major foundry players or material suppliers are becoming commonplace, aimed at co-developing specialized growth techniques optimized for novel materials like SiC boule growth, which is significantly more complex and energy-intensive than traditional silicon growth. Investment in digitalization, enabling real-time process control via Industrial IoT (IIoT) frameworks, is a dominant theme, ensuring rapid adaptation to changing material specifications and maintaining competitive edge in a highly capital-intensive sector.

Segment trends highlight the overwhelming dominance of the Czochralski (CZ) method segment due to its established position in high-volume silicon wafer production. However, the Vertical Gradient Freeze (VGF) and Vertical Bridgman (VB) segments are exhibiting the fastest growth, fueled directly by the rising commercialization of SiC power devices used extensively in automotive electrification and industrial motor control applications. Geographically, Asia Pacific, particularly China, Taiwan, and South Korea, maintains its position as the largest and most rapidly expanding regional market due to colossal government investment in self-sufficiency within the semiconductor manufacturing sector (Semiconductor Manufacturing Equipment Market) and the ongoing construction of numerous new 300mm fabrication plants (Fabs). North America and Europe, while slower in sheer volume growth, represent hubs for advanced SiC and specialized materials R&D, focusing on premium, high-specification equipment for aerospace and military applications, demanding systems with extreme reliability and superior purity control features.

Overall, the market faces strong tailwinds from persistent global silicon demand and the revolutionary transition to SiC technology, counterbalanced by inherent challenges such as the high cost of implementation, long lead times for specialized components, and the necessity for highly skilled technical personnel to operate and maintain these complex machines. Successfully navigating intellectual property disputes related to advanced crystallization techniques (e.g., doping methods and hot zone design) remains crucial for market players aiming for global dominance. The forecast period emphasizes sustainable growth, underpinned by foundational demand from the electric vehicle supply chain and cloud computing infrastructure build-out, making strategic investments in SiC furnace capacity a primary driver of market valuation and technology advancement within this niche but vital equipment sector.

AI Impact Analysis on Single Crystal Furnace Equipment Market

User queries regarding the impact of Artificial Intelligence (AI) on Single Crystal Furnace Equipment primarily revolve around efficiency gains, predictive quality control, and reducing the learning curve associated with complex crystal growth recipes. Common concerns center on how AI can stabilize the inherently unstable high-temperature growth environment and minimize costly yield losses caused by undetected defects (e.g., dislocations, voids, or twinning). Users frequently ask about the application of machine learning (ML) models for real-time thermal gradient management, automated optimization of pull rates and rotation speeds, and the development of 'digital twins' of the furnace hot zone to simulate material behavior before physical runs. The consensus expectation is that AI systems will dramatically shorten the time required to develop and scale up new crystal recipes, particularly for challenging materials like large-diameter SiC boules, which are currently plagued by inconsistent growth results and low overall yield rates in commercial production environments.

The implementation of AI/ML algorithms is transforming the operation and maintenance of single crystal furnace equipment from a manual, experience-based process into a data-driven, highly optimized manufacturing step. By processing terabytes of sensor data generated during a single growth cycle (covering temperature profiles, pressure changes, weight measurements, and power consumption), AI systems can identify subtle correlations indicative of impending crystal defects long before they become structurally significant. This capability supports predictive process adjustments, moving beyond simple feedback loops to complex feedforward control mechanisms. Furthermore, AI facilitates the rapid analysis of experimental variations, allowing R&D teams to efficiently map the relationship between input parameters and crystal quality metrics, significantly accelerating the qualification process for new equipment models and complex material compositions, thereby maximizing the utilization rates of high-capital machinery and reducing the overall material wastage inherent in crystal production.

The long-term impact of AI integration will manifest in the democratization of high-quality crystal production, making it less dependent on institutional knowledge held by a few experts. Through integrated AI-driven control systems, furnace manufacturers can offer 'self-optimizing' equipment packages that autonomously adjust parameters based on target specifications, leading to standardized, reproducible, and higher-yielding growth across different geographic locations and operators. This shift aligns perfectly with the semiconductor industry’s push towards higher quality and lower variance in upstream material supply, essential for enabling sub-10nm chip technology and highly reliable power electronics. AI represents a fundamental enabler for transitioning challenging material processes, such as 8-inch SiC boule growth, from the R&D stage to stable, high-volume manufacturing environments.

- AI-driven Predictive Maintenance: Utilizing sensor data and ML algorithms to forecast equipment failure, minimizing unplanned downtime and optimizing maintenance schedules for vacuum systems and heating elements.

- Real-Time Growth Optimization: Employing sophisticated control algorithms to dynamically adjust crystal pulling speed and temperature gradients based on instantaneous measurements of melt height and crystal diameter, maximizing yield.

- Automated Defect Detection: Using computer vision and deep learning techniques to analyze in-situ images of the growth interface, automatically flagging the onset of dislocations or twinning, allowing immediate parameter correction.

- Digital Twin Simulation: Creation of virtual models of the furnace environment to simulate crystallization kinetics under various scenarios, significantly reducing the need for costly and time-consuming physical experimental runs.

- Accelerated Recipe Development: Machine learning facilitates the rapid exploration of vast parameter spaces, cutting down the cycle time for qualifying new materials or larger wafer sizes by automating experimental design and analysis.

- Enhanced Energy Efficiency: AI optimizes thermal ramp-up and cool-down cycles, along with holding temperatures, leading to reduced energy consumption per boule, a critical factor given the high power draw of SiC furnaces.

DRO & Impact Forces Of Single Crystal Furnace Equipment Market

The market for Single Crystal Furnace Equipment is governed by a dynamic interplay of factors that both propel and impede its growth, resulting in significant strategic complexity for market participants. The primary driver is the exponentially increasing global appetite for advanced semiconductor materials, especially wide-bandgap (WBG) materials like SiC and GaN, which require new generations of specialized high-temperature furnaces. Opportunities are predominantly centered around the transition to larger wafer diameters (e.g., 200mm SiC), promising economies of scale, and the emerging field of oxide crystal growth for advanced optical and acoustic wave filter applications. However, significant restraints exist, including the extremely high initial capital expenditure required for purchasing and installing these specialized furnaces, the technical difficulty inherent in achieving high yields of defect-free SiC boules, and the reliance on a limited global supply chain for ultra-high purity refractory materials used in the furnace hot zones.

Impact forces are heavily skewed by technological mandates originating from leading semiconductor foundries and automotive tier-one suppliers. The push for higher power density and faster charging capabilities in electric vehicles directly translates into non-negotiable demand for high-quality SiC substrates, making equipment capable of 6-inch and 8-inch SiC growth highly valued. This demand acts as a compelling force driving innovation, particularly in thermal engineering and atmospheric control systems. Conversely, the market faces the restraint of long qualification cycles in the semiconductor industry; new furnace designs often take years to be fully validated and adopted by major manufacturers, creating a lag between technological availability and commercial implementation. Navigating this constraint requires equipment providers to engage in early-stage joint development with end-users to preemptively meet future certification standards and ensure rapid market penetration upon product launch.

Strategic maneuvering within this market requires capitalizing on opportunities presented by geopolitical trends, specifically the drive towards regional self-sufficiency in chip manufacturing (e.g., CHIPS Act in the U.S., European Chips Act). These initiatives unlock massive public funding for domestic crystal growth capacity expansion. Companies that offer comprehensive, turnkey solutions encompassing not only the furnace equipment but also associated process knowledge and post-sale technical support for SiC and sapphire growth are uniquely positioned to leverage these opportunities. The overall market force dynamics favor innovation, scalability, and integration of smart manufacturing capabilities (like AI/ML for process control), allowing equipment manufacturers to overcome the high technical barriers and capital intensity associated with serving the foundational needs of the world’s most critical technology supply chains.

Segmentation Analysis

The Single Crystal Furnace Equipment Market is segmented primarily by the type of crystal growth technology utilized and the specific application sector it serves, reflecting the diverse material requirements of the microelectronics and optics industries. Segmentation by technology is crucial because the physical principles, operating temperatures, and complexity of equipment differ fundamentally across methods like the Czochralski (CZ) method, which dominates standard silicon wafer production, and the Vertical Gradient Freeze (VGF) or Physical Vapor Transport (PVT) methods essential for high-melting point materials like GaAs and SiC. The performance characteristics, cost structure, and energy consumption profile are unique to each segment, dictating which equipment type is selected by manufacturers for a specific material and target wafer size.

The application segmentation reveals the primary drivers of demand, where the Semiconductor sector, encompassing advanced logic and memory devices based on silicon, forms the largest volume consumption segment. However, the Solar Power segment, focused on high-efficiency photovoltaic silicon growth, and the Sapphire Production segment, serving LED lighting and specialized consumer electronics displays, are critical growth engines. Recent market shifts emphasize the accelerating importance of the Semiconductor segment specifically for power electronics, driven by the indispensable need for SiC substrates in high-voltage and high-current applications found in electric vehicles and smart grid infrastructure. Understanding these application nuances allows equipment vendors to tailor their offerings, for instance, providing specialized PVT furnaces to SiC material suppliers or large-capacity CZ furnaces to established silicon wafer manufacturers.

Geographic segmentation is also highly relevant, with capacity installation strongly concentrated in Asia Pacific due to the regional concentration of major wafer fabrication facilities (Fabs) and PV cell producers. Future segmentation growth is anticipated in equipment optimized for emerging materials, such as GaN bulk growth, although this remains highly nascent compared to Si and SiC. The market structure, therefore, is defined by the high capital investment required for silicon capacity (CZ) and the high technical expertise demanded for SiC/sapphire capacity (PVT/Kyropoulos), ensuring distinct competitive landscapes within each technological and application segment, requiring specialized marketing and product development strategies.

- By Type:

- Czochralski (CZ) Method Furnaces

- Vertical Gradient Freeze (VGF) / Vertical Bridgman (VB) Method Furnaces

- Physical Vapor Transport (PVT) Method Furnaces (Primarily for SiC)

- Float Zone (FZ) Method Furnaces

- Kyropoulos (KY) Method Furnaces (Primarily for Sapphire)

- By Application:

- Semiconductor Manufacturing (Silicon Wafers, SiC Power Devices, GaAs RF Components)

- Solar Power/Photovoltaics (High-Purity Silicon Ingots)

- Sapphire Production (LED Substrates, Optical Windows, Watch Covers)

- Research & Development and Specialty Materials

- By Wafer Size Capability:

- Up to 150 mm (6-inch)

- 200 mm (8-inch)

- 300 mm (12-inch) and above

Value Chain Analysis For Single Crystal Furnace Equipment Market

The value chain for the Single Crystal Furnace Equipment Market begins with the upstream suppliers responsible for providing essential, highly specialized components and raw materials. This upstream analysis focuses heavily on ultra-high purity graphite, molybdenum, tungsten, and specialized ceramics necessary for constructing the furnace hot zones, crucibles, and insulation packages. The performance and lifespan of the furnace equipment are critically dependent on the quality and thermal properties of these components, making the selection of reliable, certified suppliers paramount. Given the extreme temperatures and corrosive atmospheres involved in SiC and sapphire growth, sourcing refractory metals and high-purity graphite electrodes involves a limited number of specialized global providers, creating potential supply bottlenecks that directly impact the lead times and final cost of the single crystal furnace equipment itself. Optimization in the upstream segment focuses on material innovation, such as developing ceramic composite materials with enhanced thermal shock resistance and longer operational lifetimes.

The midstream involves the core manufacturing process carried out by the equipment manufacturers, which includes system design, integration of sophisticated control software, precision machining of the furnace mechanics (pulling mechanism, rotation systems), and rigorous testing under simulated operational conditions. Distribution channels for this highly specialized, capital-intensive equipment are predominantly direct. Due to the high value, complexity, and need for customization specific to the material being grown (e.g., a CZ furnace for silicon vs. a PVT furnace for SiC), equipment manufacturers typically engage in direct sales consultation, installation, and long-term service contracts with the end-user. Indirect distribution, involving local agents or specialized distributors, may occur in smaller, emerging markets, but the technical support required often necessitates direct manufacturer involvement throughout the equipment's lifecycle.

Downstream analysis focuses on the end-users: the wafer manufacturers, large integrated device manufacturers (IDMs), specialized SiC material producers, and solar cell companies. These downstream players utilize the single crystal furnace equipment to produce the final substrates that are then sold to semiconductor fabrication plants (Fabs). The profitability and competitive positioning of the downstream sector are directly tied to the efficiency and crystal quality provided by the furnace equipment. Therefore, purchasing decisions are highly influenced by total cost of ownership (TCO), demonstrated yield rates, and the furnace's ability to transition to larger wafer sizes. The symbiotic relationship between equipment manufacturers and downstream producers drives continuous iterative improvement in furnace design, ensuring the equipment meets the increasingly stringent material specifications demanded by the ultimate consumers of high-tech electronics and power devices.

Single Crystal Furnace Equipment Market Potential Customers

Potential customers for Single Crystal Furnace Equipment are primarily situated within the core supply chain of the microelectronics, optoelectronics, and renewable energy sectors. These buyers can be broadly categorized into three main groups: dedicated silicon wafer manufacturers, integrated device manufacturers (IDMs) that handle both crystal growth and device fabrication, and specialized material suppliers focusing exclusively on high-value, niche materials like SiC, GaAs, or sapphire. For instance, large-scale silicon wafer producers like Shin-Etsu Chemical or SUMCO are continuous buyers of high-capacity Czochralski furnaces capable of 300mm and 450mm growth, driven by volume demand from the CMOS market. Their purchasing criteria center on maximizing throughput, reducing cost per wafer, and achieving minimal defect rates for memory and logic components.

A second major customer segment comprises manufacturers focused on compound and wide-bandgap semiconductors, particularly those supplying the rapidly expanding electric vehicle, 5G base station, and industrial power management markets. These customers require specialized Physical Vapor Transport (PVT) equipment for SiC and VGF/VB furnaces for GaAs. Companies like Cree/Wolfspeed, II-VI (Coherent), and various Chinese state-supported enterprises investing heavily in SiC capacity represent critical buyers in this segment. Their purchasing decisions are primarily guided by the furnace's capability to achieve high-quality, large-diameter boules (e.g., 6-inch or 8-inch SiC) with low micro-pipe density, which is essential for manufacturing reliable, high-power transistors and diodes necessary for EV inverters and charging infrastructure.

The third significant customer category includes companies focused on sapphire and specialty crystal growth (e.g., for laser optics or acoustic wave filters), as well as governmental or academic research institutions. Sapphire producers utilize Kyropoulos or specialized heat exchanger method (HEM) furnaces to create substrates for LED production, a market segment sensitive to manufacturing efficiency and raw material cost. While R&D customers represent smaller volume purchases, they often drive demand for bespoke, high-flexibility furnace systems capable of experimenting with novel materials and growth parameters, serving as crucial early adopters for next-generation crystal growth technologies before they achieve mass commercialization. All potential customers share a common need for robust after-sales support, process training, and long-term spare parts availability, reflecting the high-stakes nature of crystal substrate manufacturing.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 650.0 Million |

| Market Forecast in 2033 | USD 1,175.5 Million |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Ferrotec Holdings, PVA TePla AG, GT Advanced Technologies (GTAT), Riber, LEYBOLD OPTICS, Jinko Solar Co., Ltd., ALD Vacuum Technologies, CETC, Sino-American Silicon Products Inc. (SAS), CGS-CET), Koyo Thermo Systems, NAURA Technology Group Co., Ltd., Beijing Jingyee Precision Machinery Co., Ltd., DISCO Corporation, Mitsubishi Electric Corporation, Hanmi Semiconductor Co., Ltd., Applied Materials, Inc., ADT-Advanced Dicing Technologies, TEMPRESS, and Zhejiang University Crystal Growth Equipment Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Single Crystal Furnace Equipment Market Key Technology Landscape

The technology landscape of the Single Crystal Furnace Equipment Market is defined by the coexistence of established, high-volume methods (like CZ for Si) and emerging, high-temperature methods (like PVT for SiC). The core technological challenge across all methodologies remains precise thermal management and contamination control within the hot zone. For the dominant Czochralski (CZ) method, advancements focus heavily on magnetic Czochralski (MCZ) technology, which uses an external magnetic field to suppress melt convection, enhancing crystal uniformity and reducing oxygen precipitation defects crucial for advanced memory chips. Furthermore, modern CZ furnaces are engineered for larger charges (up to 1200 kg) and fully automated pull-down processes, enabling the production of defect-free 300mm and developmental 450mm silicon ingots necessary to sustain the semiconductor roadmap and drive down cost per die in advanced fabrication facilities worldwide.

In contrast, the technology utilized for wide-bandgap materials is inherently more complex and highly specialized. Physical Vapor Transport (PVT) equipment, used for Silicon Carbide (SiC) crystal growth, operates at extremely high temperatures (above 2000 °C) and requires highly specialized graphite heating elements and crucibles that can withstand these harsh conditions without introducing impurities. Key technological breakthroughs in PVT furnaces revolve around optimizing the thermal gradients within the growth chamber and refining the seed crystal preparation process to minimize structural defects like micropipes, which are detrimental to device performance. The successful commercialization of 8-inch SiC wafers hinges directly on PVT furnace technology improvements, particularly in achieving long-duration, stable high-temperature operation and implementing advanced pressure and gas flow control mechanisms to manage the vapor phase kinetics crucial for defect suppression.

Other vital technological aspects include advanced sensor integration and software control. Modern furnace systems incorporate in-situ monitoring technologies, such as infrared cameras and high-precision load cells, to provide real-time data on the melt surface, solid-liquid interface position, and crystal weight. This data feeds into sophisticated Process Control Systems (PCS), often augmented by AI, which allows for minute adjustments to furnace power and crystal rotation speed to maintain optimal growth conditions. Furthermore, there is an industry-wide push for modular furnace design, facilitating easier maintenance and faster configuration changes between different growth recipes (e.g., transitioning from N-type to P-type doping). The technological trajectory is clear: future equipment must offer higher yields, greater energy efficiency, minimal human intervention, and the capability to consistently produce larger, purer crystals to meet the foundational demands of the global high-tech electronics industry, especially in the context of wide-bandgap material commercialization.

Regional Highlights

The global Single Crystal Furnace Equipment Market exhibits distinct regional dynamics, heavily concentrated in regions with robust semiconductor manufacturing and solar energy sectors. Asia Pacific (APAC) holds the undeniable market leadership position, accounting for the largest share of equipment installations and consumption. This dominance is primarily driven by massive, ongoing government-backed investments in China, South Korea, and Taiwan, aimed at localizing semiconductor production and expanding existing silicon and SiC manufacturing capacities. China’s push for self-sufficiency in materials production, particularly for silicon and sapphire utilized in its vast electronics and LED markets, mandates continuous, high-volume procurement of advanced CZ and Kyropoulos equipment. South Korea and Taiwan, home to leading global foundries and memory manufacturers, are key drivers for sophisticated 300mm CZ furnace upgrades and the adoption of high-performance MCZ systems to meet the demands of advanced process nodes.

North America and Europe represent significant markets characterized not necessarily by volume, but by a focus on high-specification, cutting-edge technology, particularly in the SiC and specialized compound semiconductor space. North America, led by the United States, is actively investing in domestic SiC supply chains, heavily influenced by demand from defense applications and the electric vehicle industry. Major players in this region are rapidly scaling up PVT capacity, driving demand for the most technologically advanced, highly controllable SiC furnaces. Similarly, Europe is witnessing a revitalization in its semiconductor infrastructure, underpinned by the European Chips Act, focusing on high-power SiC components for automotive and industrial automation. This region is a crucial hub for R&D and specialized equipment tailored for niche applications, often requiring smaller, highly customizable VGF and high-pressure furnaces.

Latin America, the Middle East, and Africa (MEA) currently hold smaller market shares, but exhibit emerging potential, primarily tied to local solar power initiatives and nascent electronics manufacturing efforts. Growth in these regions is often project-specific, relying on international collaborations or state-owned enterprises establishing basic crystal growth capabilities for domestic consumption. The global geopolitical climate, characterized by the desire to secure critical technology supply chains, ensures that investment in single crystal furnace equipment remains strategically vital across all major economies, driving sustained expenditure on new capacity installations and the replacement of older, less efficient furnace models globally, reinforcing the market’s resilience through the forecast period.

- Asia Pacific (APAC): Dominates the market due to concentrated semiconductor manufacturing bases in China, Taiwan, South Korea, and large-scale solar production in India and Southeast Asia. Heavy investment in CZ and PVT technologies.

- North America: Strong demand fueled by defense applications, electric vehicle supply chain build-out, and significant capital expenditure on advanced SiC PVT furnaces (8-inch readiness). Hub for R&D in compound semiconductors.

- Europe: Focus on high-reliability power electronics (SiC) for automotive and industrial segments. European Chips Act drives local capacity expansion and favors high-performance, energy-efficient equipment models.

- MEA and Latin America: Emerging markets driven primarily by long-term solar energy projects and initial investments in domestic semiconductor assembly and test operations, relying on imported technology and expertise.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Single Crystal Furnace Equipment Market.- Ferrotec Holdings

- PVA TePla AG

- GT Advanced Technologies (GTAT)

- Riber

- LEYBOLD OPTICS

- Jinko Solar Co., Ltd. (Equipment Division)

- ALD Vacuum Technologies

- CETC (China Electronics Technology Group Corporation)

- Sino-American Silicon Products Inc. (SAS)

- Koyo Thermo Systems

- NAURA Technology Group Co., Ltd.

- Beijing Jingyee Precision Machinery Co., Ltd.

- DISCO Corporation (Peripheral Equipment)

- Mitsubishi Electric Corporation

- Hanmi Semiconductor Co., Ltd.

- Applied Materials, Inc. (Selected Furnace Systems)

- ADT-Advanced Dicing Technologies

- TEMPRESS

- Zhejiang University Crystal Growth Equipment Co., Ltd.

- Hebei Jichuang Electronic Technology Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Single Crystal Furnace Equipment market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the current investment in new single crystal furnace equipment?

The primary driver is the global transition toward wide-bandgap (WBG) semiconductors, specifically Silicon Carbide (SiC). The massive growth in electric vehicle (EV) production and related charging infrastructure necessitates high-performance SiC power devices, which, in turn, requires significant investment in specialized, high-temperature Physical Vapor Transport (PVT) furnace equipment capable of producing large-diameter SiC boules with high crystalline quality and reduced defect density.

How does the Czochralski (CZ) method differ from the PVT method in terms of application?

The Czochralski (CZ) method is predominantly used for growing standard, large-diameter silicon (Si) crystals for traditional CMOS logic and memory devices, operating at silicon's melting point (around 1420 °C). In contrast, the Physical Vapor Transport (PVT) method is required for growing high-melting-point materials like Silicon Carbide (SiC), operating via sublimation at extremely high temperatures (above 2000 °C) under precise atmospheric control, making the equipment far more specialized and complex.

Which geographical region dominates the installation of Single Crystal Furnace Equipment?

Asia Pacific (APAC) dominates the installation landscape, driven by the massive and ongoing expansion of semiconductor manufacturing capacity, particularly in China, Taiwan, and South Korea. These regions are actively investing in both volume silicon capacity (300mm CZ furnaces) and strategic SiC capacity (PVT furnaces) to support global electronics supply chains and regional self-sufficiency initiatives.

What are the main technological challenges limiting the production of 8-inch SiC wafers?

The main technological challenges include achieving uniform thermal gradients within the PVT furnace over extended growth cycles, effectively suppressing structural defects like micropipes and basal plane dislocations across larger diameters, and controlling impurities at high temperatures. These issues severely impact crystalline quality and overall manufacturing yield rates, making the equipment design highly sensitive to process parameters.

What is the role of AI and machine learning in optimizing single crystal growth processes?

AI and machine learning are increasingly used to process real-time sensor data from the furnace, enabling automated optimization of complex growth parameters (pull rate, temperature, rotation speed). This leads to predictive defect detection, faster development of new material recipes, reduced reliance on manual expertise, and significantly improves the consistency and yield rates of high-purity crystal boules.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager