Single Crystal Sapphire Products Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433829 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Single Crystal Sapphire Products Market Size

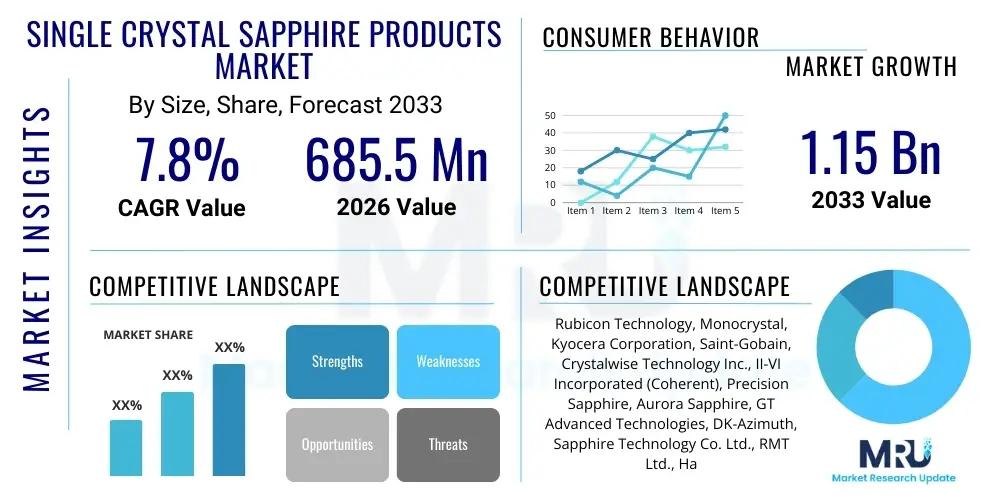

The Single Crystal Sapphire Products Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at USD 685.5 Million in 2026 and is projected to reach USD 1.15 Billion by the end of the forecast period in 2033.

Single Crystal Sapphire Products Market introduction

Single crystal sapphire, a form of aluminum oxide (Al2O3), is a highly specialized material recognized for its exceptional physical, chemical, and optical properties. As a product, it is manufactured through highly technical processes such as the Kyropoulos method, Heat Exchanger Method (HEM), and Edge-Defined Film-Fed Growth (EFG), ensuring purity, structural integrity, and large-scale manufacturability. The resulting sapphire components possess outstanding hardness, ranking nine on the Mohs scale, second only to diamond, alongside high transparency across the visible, ultraviolet, and infrared spectra, making them indispensable in demanding industrial and high-tech applications where durability and optical clarity are paramount. Its inherent resistance to chemical etching and high thermal stability allows it to function reliably in extreme operational environments, including high-temperature furnaces and corrosive chemical processing chambers, thereby justifying its premium material status across multiple verticals.

Major applications of single crystal sapphire products are fundamentally rooted in the semiconductor and optoelectronics sectors. Historically, the material gained prominence as the primary substrate for manufacturing blue and white Light Emitting Diodes (LEDs), utilizing Gallium Nitride (GaN) epitaxial growth. Beyond illumination, its use extends significantly into high-durability consumer electronics, primarily serving as protective covers for smartphone cameras, smartwatch displays, and fingerprint sensors, capitalizing on its scratch resistance. Furthermore, in specialized industrial and defense contexts, sapphire windows are critical for sensors, detectors, and high-power laser systems due to their ability to withstand intense pressure and thermal shock without compromising optical performance. This versatility ensures sustained demand growth, particularly as device miniaturization and performance requirements intensify across global industries.

The primary driving factors propelling the Single Crystal Sapphire Products Market include the continued global adoption of energy-efficient LED lighting, robust expansion in advanced consumer electronics requiring superior screen protection, and escalating demand from the semiconductor industry for high-quality substrates for power electronics and RF components. Its inherent benefits, such as resistance to abrasion and high dielectric constant, position it uniquely against traditional materials like glass or quartz. Furthermore, emerging applications in medical diagnostics, high-reliability aerospace instrumentation, and the transition toward larger diameter sapphire wafers (e.g., 6-inch) for cost efficiency in semiconductor fabrication are solidifying the market's long-term growth trajectory. These foundational demands, coupled with continuous technological advancements in crystal growth techniques, underscore the essential nature of single crystal sapphire in the modern high-performance technology landscape.

- Product Description: Synthetic aluminum oxide (Al2O3) crystal characterized by extreme hardness, chemical inertness, and broadband optical transmission.

- Major Applications: LED substrates (GaN epitaxy), high-durability optical windows, semiconductor equipment components, laser optics, and protective covers in consumer electronics.

- Key Benefits: Superior mechanical strength, exceptional scratch resistance, high thermal stability, and excellent optical transparency from UV to mid-IR wavelengths.

- Driving Factors: Rapid expansion of GaN-based power electronics, increased integration in premium consumer devices, and rising demand for military and aerospace optical systems.

Single Crystal Sapphire Products Market Executive Summary

The Single Crystal Sapphire Products Market is positioned for stable, robust growth, fundamentally driven by the escalating requirements for durable, high-performance materials across strategic technology sectors, especially in the Asia Pacific region. Business trends indicate a strong move toward process optimization, with key manufacturers investing heavily in improving crystal growth yields and increasing wafer diameters to reduce the overall cost of ownership for end-users like LED and semiconductor fabricators. The market structure remains highly competitive yet consolidated, where vertically integrated companies leveraging proprietary growth technologies often hold a significant advantage in terms of quality consistency and supply chain control. Furthermore, geopolitical influences regarding global supply chain resilience are encouraging diversification of manufacturing capabilities beyond traditional hubs, emphasizing strategic sourcing of critical materials.

Regionally, Asia Pacific maintains its dominance, primarily due to the concentration of major LED manufacturing facilities, robust consumer electronics production, and rapidly expanding semiconductor foundry capabilities in countries like China, Taiwan, South Korea, and Japan. This region acts both as the largest producer and the largest consumer of sapphire wafers and components. North America and Europe, while smaller in volume, represent crucial markets characterized by high-value applications, including sophisticated military optics, specialized medical devices, and advanced compound semiconductor development, driving demand for ultra-high purity and custom-specification sapphire parts. The investment landscape across all regions is increasingly focused on developing specialized material grades suitable for advanced power electronics, particularly Silicon Carbide (SiC) and Gallium Nitride (GaN) devices, recognizing sapphire's foundational role in this emerging technology wave.

Segmentation analysis reveals that the LED manufacturing segment, though experiencing maturity, still holds the largest volume share, yet the fastest growth is being observed in the non-LED segments, specifically consumer electronics protection and optical components. Within technology, the shift toward larger wafer sizes, particularly 4-inch and 6-inch diameter substrates, is critical for achieving economies of scale in semiconductor production. The product type segmentation shows increasing demand for complex geometric shapes and customized optical elements rather than just standard flat windows, reflecting the diversification of end-use applications. This nuanced segmentation growth highlights a market transitioning from a commodity-like material primarily for illumination to a highly engineered, differentiated component critical for numerous next-generation devices and industrial systems.

AI Impact Analysis on Single Crystal Sapphire Products Market

User questions regarding the impact of Artificial Intelligence (AI) on the Single Crystal Sapphire Products Market often center on two main areas: optimizing the manufacturing process and identifying new, high-performance applications driven by AI-enabled devices. Users frequently inquire how AI algorithms can enhance the complex crystal growth methods (like Kyropoulos or HEM) to achieve higher yields, reduce defects, and predict optimal growth parameters in real-time, thereby reducing manufacturing costs and improving material quality consistency. Additionally, there is significant interest in how the proliferation of AI and Machine Learning (ML) requiring more sophisticated, reliable, and durable sensor arrays and optical systems—such as those used in autonomous vehicles, high-resolution surveillance, and hyperscale data centers—will translate into increased demand for superior sapphire components capable of withstanding intense operational environments compared to conventional materials.

The core influence of AI is primarily felt in the operational efficiencies of sapphire manufacturing, transforming a traditionally experience-driven, high-variable process into a data-optimized, predictive system. By integrating advanced sensors and AI models into the growth furnace control systems, manufacturers can continuously monitor temperature gradients, impurity concentration, and crystallization front movements. This real-time data analysis allows for algorithmic adjustments that mitigate the risk of twinning, cracking, and inclusion formation, drastically improving the percentage of usable, high-grade material extracted from each growth run. Consequently, AI helps lower the variable cost associated with producing large, defect-free sapphire boules, making the material more cost-competitive for high-volume applications and accelerating the industry's transition to 6-inch and larger wafer formats.

From a demand perspective, the rise of AI-enabled devices—which require robust sensory capabilities, including Lidar, high-resolution cameras, and specialized optical waveguides—directly stimulates the market for single crystal sapphire. Autonomous systems, robotics, and advanced industrial automation operate in challenging environments where components cannot afford failure due to scratch damage or thermal fluctuations. Sapphire’s mechanical resilience and broadband optical clarity make it the material of choice for protecting crucial sensors in these applications. Thus, AI not only streamlines the production side, ensuring material affordability and quality, but also expands the addressable market by driving the performance requirements of new technology generations, fundamentally linking market growth to the continued deployment of AI infrastructure globally.

- Manufacturing Optimization: AI and ML models are employed for real-time monitoring and predictive control of crystal growth furnaces, optimizing temperature profiles to maximize yield and minimize defects (e.g., twinning).

- Quality Control Enhancement: Automated visual inspection powered by AI identifies minute structural flaws in boules and wafers faster and more accurately than human inspection, ensuring material consistency.

- Demand Driver (Autonomous Systems): Increased deployment of AI in autonomous vehicles, drones, and industrial robotics requires ultra-durable optical windows and covers, creating new, high-value end-use cases for sapphire.

- Data Center Optics: High-speed communication infrastructure supporting AI processing uses specialized optical components that often benefit from sapphire’s thermal management and transmission properties.

- Supply Chain Analytics: AI assists in forecasting demand fluctuations and optimizing inventory management for raw materials and finished sapphire products, improving market responsiveness.

DRO & Impact Forces Of Single Crystal Sapphire Products Market

The dynamics of the Single Crystal Sapphire Products Market are shaped by a strong interplay between persistent demand drivers, significant cost and technological restraints, and substantial growth opportunities across emerging sectors. The primary drivers, centered around the superior performance characteristics of sapphire over alternatives, maintain upward pressure on adoption, particularly in mission-critical applications where failure is unacceptable. However, the market is continually restrained by the inherent complexities and energy intensity of the crystal growth process, which keeps the price point relatively high compared to glass or polymers, alongside the technical challenge of achieving uniform, large-diameter wafers without internal stresses. The impact forces are currently tilted toward opportunities, driven by non-LED applications, the rise of wide-bandgap (WBG) semiconductors, and innovations in manufacturing scale, pushing the market toward higher-value products and greater profitability.

Drivers: The sustained high growth in the power electronics segment, particularly for electric vehicles (EVs), renewable energy infrastructure, and 5G communication systems, acts as a pivotal driver. Sapphire substrates are becoming essential in these domains due to their high thermal conductivity and electrical insulation properties, complementing the performance of advanced GaN and SiC devices. Furthermore, the relentless consumer demand for thinner, lighter, yet extremely rugged electronics—ranging from high-end wearables to advanced mobile device optics—guarantees consistent demand for thin sapphire sheets and lens covers. The aerospace and defense sectors, requiring windows and domes capable of operating under extreme pressure, temperature, and projectile impact, represent an inflexible, high-margin driver, utilizing sapphire's unmatched mechanical and optical resilience.

Restraints: Despite technological advances, the primary restraint remains the high capital expenditure and operational costs associated with single crystal sapphire production. The energy consumption required for high-temperature crystallization processes, combined with the stringent quality control needed to minimize defects, limits rapid price reductions. Secondly, the technical difficulty in reliably scaling up to larger wafer sizes (e.g., 8 inches) while maintaining required crystalline purity poses a challenge to competing directly with silicon in mainstream semiconductor fabrication. Furthermore, the availability of alternative, though functionally inferior, materials like specialized hardened glasses (e.g., Gorilla Glass) in the mass-market consumer electronics space exerts competitive pricing pressure, particularly in entry-level and mid-range devices.

Opportunities & Impact Forces: Significant opportunities exist in the expansion into next-generation medical devices, including implantable optics and robust diagnostic equipment, where sapphire's biocompatibility and inertness are critical assets. The most substantial immediate opportunity lies in the continued migration toward 6-inch sapphire substrates for advanced LED and power device manufacturing, improving throughput and lowering unit costs. The overall impact forces suggest that technological innovation in crystal growth optimization (driven partly by AI) and market diversification into non-LED high-end optics will be the dominant positive influences over the forecast period. These forces mitigate the cost restraints and capitalize on the material's unique performance attributes, ensuring market expansion into areas requiring premium material solutions.

- Drivers:

- High demand for scratch-resistant covers in premium consumer electronics (smartwatches, camera lenses).

- Exponential growth in GaN-based power and RF electronics requiring stable, insulating substrates.

- Increasing adoption in aerospace, defense, and industrial optics due to extreme environmental resilience.

- Restraints:

- High manufacturing costs due to capital-intensive, energy-intensive crystal growth processes.

- Technical limitations and challenges in producing very large, defect-free wafers (>6 inches).

- Competition from advanced, chemically strengthened glass alternatives in volume applications.

- Opportunities:

- Emerging demand for sophisticated optical components in advanced medical devices and sensors.

- Development of high-efficiency, cost-effective manufacturing techniques (e.g., continuous growth methods).

- Expansion into advanced lithography and semiconductor equipment components requiring extreme dimensional stability.

- Impact Forces:

- Strong positive impact from technological advancements scaling wafer sizes and reducing material waste.

- High long-term growth driven by power electronics and high-performance optics, mitigating price sensitivity.

Segmentation Analysis

The Single Crystal Sapphire Products Market is systematically segmented based on crystal growth method, product type, application, and end-use industry, reflecting the diverse manufacturing processes and specialized requirements across various verticals. The segmentation highlights the market's shift from reliance on standardized LED substrates to highly customized, high-specification components for optics and protective covers. The choice of growth method—Kyropoulos being favored for large volume, lower-cost LED substrates, versus HEM and EFG for higher quality, specialized optical components—directly influences product pricing and market availability. Analyzing these segments provides strategic insights into which applications are generating the highest growth rates and where technological innovation is most focused, particularly noting the robust transition toward non-LED end-uses that prioritize superior surface finish and precise geometric tolerances over sheer volume.

- By Manufacturing Method:

- Kyropoulos Method

- Heat Exchanger Method (HEM)

- Edge-Defined Film-Fed Growth (EFG)

- Others (e.g., Czochralski, Floating Zone)

- By Product Type:

- Sapphire Wafers (2-inch, 4-inch, 6-inch, Others)

- Sapphire Tubes and Rods

- Sapphire Windows and Optics (Domes, Prisms, Lenses)

- Sapphire Components (Watch covers, Camera lens covers, Wearable screens)

- By Application:

- LED Substrates (for GaN epitaxy)

- Optical Components (Infrared/UV optics, High-power laser windows)

- Consumer Electronics Protection

- Semiconductor Equipment Components

- Medical and Analytical Devices

- By End-Use Industry:

- Electronics and Communication

- Automotive and Transportation (Lighting, Sensor Covers)

- Military, Defense, and Aerospace

- Industrial and Process Control

- Healthcare and Medical

Value Chain Analysis For Single Crystal Sapphire Products Market

The value chain for single crystal sapphire products is characterized by high capital intensity and vertical integration, starting with the purification of the raw material, alumina powder, and culminating in the highly precise fabrication and finishing of end-use components. The upstream segment involves the production of high-purity Alumina (Al2O3) feedstock, which is critical as any impurities can severely compromise the crystalline structure and optical quality of the final sapphire boule. This raw material processing requires strict quality control, and sourcing typically involves specialized chemical companies. Subsequently, the core value addition occurs in the middle segment: the energy-intensive crystal growth process, where large sapphire boules are grown using proprietary furnace designs and methodologies (Kyropoulos, HEM). Companies that control both the growth and subsequent slicing/coring of the boules are often positioned most strongly in the market.

The midstream activities transition into highly specialized fabrication, where the raw boules are sliced into thin wafers or shaped into rough blanks (windows, tubes, domes). This stage involves high-precision cutting, grinding, and multi-stage polishing, which significantly impacts the final product's cost and performance. For LED substrates, the wafer processing must achieve extremely flat surfaces with minimal roughness to facilitate epitaxial growth. For high-end optical components, achieving precise surface parallelism, scratch-dig specifications, and specific geometric curves adds substantial value. Control over these fabrication steps, including the specialized techniques for chemical-mechanical polishing (CMP), is a crucial competitive differentiator, often requiring specialized equipment and highly skilled technical personnel.

The downstream distribution channel involves a mix of direct sales and specialized indirect distribution networks. Direct sales are common for large volume customers, such as major LED manufacturers or key aerospace contractors, ensuring technical alignment and supply reliability. Indirect channels utilize specialized distributors who manage inventory, offer cutting and smaller volume customization, and cater to smaller industrial or research customers. Given the highly technical nature of the material, sales often involve close collaboration between the manufacturer's engineering teams and the end-user's R&D department. The entire value chain is driven by the need for high reliability; therefore, traceability, quality certifications, and long-term supplier relationships are paramount, especially in regulated industries like aerospace and medical devices.

- Upstream Analysis (Raw Material): High-purity Alumina (Al2O3) powder production; feedstock purification and quality verification.

- Midstream Analysis (Manufacturing Core): Crystal growth (Kyropoulos, HEM, EFG); Boule slicing, coring, and initial grinding; Wafer and blank shaping.

- Downstream Analysis (Fabrication & Distribution): Precision lapping, chemical-mechanical polishing (CMP), surface finishing; Anti-reflective (AR) coating application; Direct sales to large OEMs; Indirect distribution via specialized material handlers.

- Distribution Channel Types: Direct sales to major semiconductor/LED OEMs; Specialized distributors for optics and industrial components.

Single Crystal Sapphire Products Market Potential Customers

The potential customers for single crystal sapphire products span a diverse range of high-technology industries, united by the fundamental requirement for materials offering extreme durability, chemical inertness, and superior optical performance under challenging conditions. The primary volume consumers remain the major global manufacturers of LEDs, who utilize sapphire wafers as the foundational substrate for Gallium Nitride (GaN) epitaxial growth required for blue and white illumination devices. This segment includes multinational lighting corporations and specialized LED chip producers. Secondly, the consumer electronics industry, comprising global brands that manufacture premium smartphones, smartwatches, and high-end cameras, represents a rapidly expanding customer base for protective covers and lenses, valuing sapphire's unmatched scratch resistance and premium feel.

Beyond high-volume electronics, a crucial segment of potential customers includes specialized optical component integrators and defense contractors. These customers purchase custom-shaped sapphire components (domes, windows, lenses) for critical systems such as missile guidance optics, high-altitude surveillance cameras, high-power laser systems, and infrared sensors. In these mission-critical applications, the mechanical robustness and thermal stability of sapphire are non-negotiable requirements, justifying the material’s premium cost. Furthermore, specialized semiconductor equipment manufacturers are increasingly integrating sapphire components into plasma etching chambers and high-temperature processing tools due to its plasma resistance and structural stability at elevated temperatures, ensuring longer equipment lifecycles and cleaner process environments.

Emerging high-growth customer groups include manufacturers of next-generation power electronics (GaN/SiC power modules) and advanced medical device developers. The former requires sapphire substrates for producing high-efficiency power components crucial for electric vehicle powertrains and rapid charging infrastructure. The latter includes companies developing advanced surgical instruments, diagnostic sensors, and equipment where biocompatibility, inertness, and resistance to sterilization processes are essential. As technological sophistication increases across all these fields, the demand profile is shifting from commodity wafers to highly engineered, customized, and finished sapphire components, broadening the potential customer base to include niche integrators requiring application-specific engineering support.

- End-User/Buyers of the product:

- LED Chip Manufacturers (Cree, OSRAM, Samsung, Epistar)

- Premium Consumer Electronics Brands (for camera lenses, watch covers, display protection)

- Defense and Aerospace Contractors (Northrop Grumman, Raytheon, specialized optics houses)

- Power Electronics Fabricators (GaN/SiC device manufacturers)

- Semiconductor Equipment OEMs (Applied Materials, Lam Research)

- Medical Device and Instrumentation Companies (Endoscopy, high-durability sensor housings)

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 685.5 Million |

| Market Forecast in 2033 | USD 1.15 Billion |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Rubicon Technology, Monocrystal, Kyocera Corporation, Saint-Gobain, Crystalwise Technology Inc., II-VI Incorporated (Coherent), Precision Sapphire, Aurora Sapphire, GT Advanced Technologies, DK-Azimuth, Sapphire Technology Co. Ltd., RMT Ltd., Hansol Technics, Zhejiang Crystal-Optech, Shanghai Jingshi Crystal Technology. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Single Crystal Sapphire Products Market Key Technology Landscape

The technology landscape of the Single Crystal Sapphire Products Market is dominated by advancements in crystal growth methods aimed at increasing boule size, minimizing crystalline defects, and reducing energy consumption per unit of material produced. The Kyropoulos Method (KY), known for its ability to produce large, high-volume boules, has seen continuous iterative improvements, primarily focused on optimizing the thermal environment within the furnace and refining seed crystal geometry to promote faster, more uniform growth while suppressing twinning—a major source of material wastage. Concurrently, the Heat Exchanger Method (HEM) remains vital for producing high-quality sapphire for demanding optical applications, as it typically yields material with superior structural perfection and lower internal stress, although often at a higher cost and slower growth rate compared to KY. Innovations in HEM technology are centered on developing automated thermal control algorithms to precisely manage the liquid-solid interface during crystallization, enhancing consistency for specialized defense and laser optics.

Beyond growth techniques, significant technological focus is directed toward post-growth processing, particularly in slicing and surface preparation, which represents a high-cost segment of the value chain. Advancements in wire sawing technology, including the use of diamond-coated wire and optimized slurry mixtures, are crucial for increasing throughput, minimizing kerf loss (material wasted during slicing), and reducing subsurface damage in the wafers. Furthermore, the development of sophisticated Chemical-Mechanical Polishing (CMP) techniques is essential, especially for LED and semiconductor substrates, where the surface must be atomically flat and free of defects to ensure high-quality epitaxial layer growth. Manufacturers are continuously investing in advanced metrology and inspection tools to ensure that these tight specifications, including flatness, total thickness variation (TTV), and surface roughness, are consistently met across increasing wafer diameters (e.g., 6 inches).

A burgeoning technological segment involves the integration of advanced automation and data science (as noted in the AI analysis) into the entire production line. Sensor-driven feedback loops and predictive maintenance are becoming standard, shifting the industry toward a Smart Manufacturing paradigm. Additionally, proprietary coating technologies, particularly anti-reflective (AR) and hard coatings, are being developed specifically for sapphire optical components used in harsh environments (e.g., thermal shock resistance coatings for aircraft windows). The continuous technological push is aimed at improving the cost-to-performance ratio, making single crystal sapphire viable for next-generation applications in solid-state lighting, high-frequency electronics, and extreme environment sensing, reinforcing the material’s competitive position against emerging alternatives.

- Crystal Growth Refinements: Optimization of Kyropoulos and HEM furnaces for larger boule diameters (up to 300 kg) and reduced internal stress.

- Advanced Slicing: Implementation of high-efficiency diamond wire slicing methods to minimize kerf loss and subsurface damage on 4-inch and 6-inch wafers.

- Surface Preparation: Development of highly customized Chemical-Mechanical Polishing (CMP) protocols to achieve near-atomic smoothness essential for GaN epitaxy.

- Process Automation: Integration of IoT and machine vision systems for real-time monitoring and closed-loop control of crystallization parameters.

Regional Highlights

- Asia Pacific (APAC): Dominance in Volume and Manufacturing Hub

The Asia Pacific region commands the largest share of the Single Crystal Sapphire Products Market, acting as the epicenter for both high-volume manufacturing and end-use consumption. Countries such as China, Taiwan, South Korea, and Japan host the majority of the world's LED fabrication facilities, which historically drove the initial demand for sapphire substrates. China, in particular, has seen massive state and private investment aimed at achieving self-sufficiency in sapphire production, leading to intense competition and high output volumes, particularly for 2-inch and 4-inch wafers used in standard LED lighting. This regional dominance is further solidified by the presence of global leaders in consumer electronics production, which drives strong demand for sapphire covers in smartphones and wearables. The current trend in APAC involves significant investment in scaling up 6-inch wafer capabilities and diversifying production to cater to the growing power electronics market.

Japan and South Korea retain technological leadership in high-specification sapphire applications, focusing on high-quality optical windows and substrates for advanced semiconductor devices, including RF components and high-reliability industrial sensors. Taiwan remains a critical node, bridging technology innovation and high-volume manufacturing efficiency. The substantial governmental emphasis on developing localized high-tech supply chains and renewable energy infrastructure (which utilizes GaN power devices) ensures that APAC will maintain its superior market size and continue to set the pace for technological adoption and cost competitiveness throughout the forecast period. The region's large manufacturing base, coupled with increasing domestic demand for premium durable goods, guarantees sustained high growth rates.

Key market activities in APAC are centered around capacity expansion and cost reduction through scale. Many local players are aggressively competing against established international vendors by rapidly adopting advanced growth techniques and maximizing yield. Furthermore, the growing defense budgets across Southeast Asia and India are stimulating niche demand for high-specification sapphire optics for military systems. This combination of high-volume LED production, global electronics assembly, and increasing regional self-reliance in advanced materials positions APAC as the indispensable core of the global sapphire market ecosystem.

- China: Largest volume manufacturer and consumer, focused on LED substrates and consumer covers.

- South Korea/Taiwan: Centers for high-quality GaN epitaxy and advanced semiconductor applications.

- India: Emerging manufacturing base with growing demand for domestic electronics and defense applications.

- North America: Focus on High-Value and Military Applications

North America represents a mature, high-value segment of the market, characterized by demand for ultra-high-quality, customized sapphire products rather than sheer volume. The regional market is fundamentally driven by the aerospace, defense, and specialized semiconductor industries. Major military contractors rely heavily on domestic and secure sources for large, defect-free sapphire domes and windows used in infrared countermeasures and high-velocity missile systems, where superior durability and optical performance are non-negotiable. Furthermore, leading technology companies in the region are significant buyers of high-specification sapphire for use in semiconductor processing equipment, high-power laser optics, and advanced medical imaging devices.

The U.S. remains a key innovation hub for advanced crystal growth technologies, particularly focused on improving the quality of large-diameter wafers (6-inch and potentially 8-inch) needed for the emerging GaN power and RF markets. While bulk manufacturing capacity may be lower than in APAC, the average selling price (ASP) of sapphire components sold in North America is typically higher due to the stringent specifications, low-volume customization, and critical nature of the end-use applications. Investment in this region is concentrated on R&D for next-generation materials and securing specialized supply chains for defense industrial bases, ensuring technological superiority.

The strong presence of innovators in autonomous vehicles and advanced sensors also contributes significantly to the demand. These companies require robust protective windows for Lidar and camera systems operating in harsh outdoor conditions. Regulatory support for domestic critical material production and sustained high defense spending ensures stability and targeted growth within the high-end segments of the North American market, focusing on performance over cost optimization.

- United States: Key consumer in Defense, Aerospace, and specialized semiconductor equipment.

- Canada: Niche market focus on academic research and specialized industrial optics.

- Europe: Specialization in Industrial, Laser Optics, and Automotive

Europe holds a substantial, steady market share, primarily driven by its mature industrial manufacturing base, advanced automotive sector, and strong concentration of high-power laser and optical component manufacturers. The region exhibits high demand for precision sapphire components used in industrial monitoring, advanced analytical equipment, and process control applications due to sapphire’s chemical resistance and thermal stability. Automotive applications, particularly related to specialized lighting systems, interior sensors, and emerging Lidar technology for autonomous driving, are becoming increasingly important drivers for volume consumption.

Countries like Germany and France house world leaders in machinery and optics, requiring customized sapphire windows and prisms for high-energy physics research, materials processing lasers, and harsh environment sensing. European manufacturers often emphasize high standards of sustainability and efficiency in their production, encouraging the adoption of energy-efficient Kyropoulos methods and refined processing techniques. The focus in Europe is less on mass consumer electronics and more on ensuring high reliability and long operational lifespan for industrial and scientific capital goods.

The region’s regulatory environment favors the adoption of energy-saving technologies, maintaining a stable demand for high-efficiency LED lighting and, consequently, sapphire substrates. Furthermore, the robust pharmaceutical and medical device manufacturing sectors utilize sapphire components for drug delivery systems, sterilization chambers, and surgical optics, valuing its inertness and hardness. This specialization ensures that while Europe may not compete with APAC in raw volume, it remains critical for high-margin, specialized industrial and medical market penetration.

- Germany: Strong demand from automotive, specialized industrial machinery, and advanced optics.

- France/UK: Focus on aerospace, defense, and high-specification scientific instrumentation.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Single Crystal Sapphire Products Market.- Rubicon Technology, Inc.

- Monocrystal (Concern Monocrystal)

- Kyocera Corporation

- Saint-Gobain

- Crystalwise Technology Inc.

- II-VI Incorporated (now Coherent Corp.)

- Precision Sapphire Technologies (PST)

- Aurora Sapphire

- GT Advanced Technologies (GTAT)

- DK-Azimuth

- Sapphire Technology Co. Ltd.

- RMT Ltd.

- Hansol Technics

- Zhejiang Crystal-Optech Co. Ltd.

- Shanghai Jingshi Crystal Technology Co., Ltd.

- Tera Xtal Technology Corporation

- Cathy Group

- Guangzhou Huasheng Electromechanical Co., Ltd.

- Silian Group Co., Ltd.

- Harris Corporation (L3Harris Technologies)

Frequently Asked Questions

Analyze common user questions about the Single Crystal Sapphire Products market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving demand in the Single Crystal Sapphire Products Market?

The primary driver is the exponentially growing demand for Gallium Nitride (GaN) based power electronics used in electric vehicles (EVs), 5G infrastructure, and efficient power supplies. Single crystal sapphire provides the necessary insulating and thermally conductive substrate for these high-performance, wide-bandgap (WBG) semiconductors, ensuring device efficiency and reliability. Secondary drivers include the increasing integration of scratch-resistant sapphire covers in premium consumer electronics like smartwatches and mobile camera lenses, where extreme durability is a key selling point.

How do the different single crystal growth methods (Kyropoulos vs. HEM) affect the final sapphire product applications?

The Kyropoulos (KY) method is generally favored for high-volume, lower-cost applications, primarily producing 4-inch and 6-inch wafers used as substrates for LED manufacturing, focusing on cost efficiency and scale. In contrast, the Heat Exchanger Method (HEM) typically produces material with superior structural perfection, lower internal stress, and higher purity, making it the preferred method for demanding optical components, aerospace windows, and high-power laser optics where crystalline quality and low defect rates are paramount regardless of the higher production cost.

What are the key technical restraints limiting the rapid expansion of single crystal sapphire usage?

The chief restraints are the high capital expenditure required for sophisticated crystal growth furnace systems and the extremely high energy consumption necessary for high-temperature processing (above 2000°C), which maintains a premium price point compared to alternative materials like glass. Additionally, the technical complexity of scaling up production to consistently yield large-diameter wafers (8 inches or larger) without defects and internal stresses remains a significant hurdle for achieving cost parity with silicon in mass-market semiconductor fabrication.

Which region dominates the production and consumption of Single Crystal Sapphire Products?

The Asia Pacific (APAC) region, particularly driven by manufacturing hubs in China, Taiwan, South Korea, and Japan, dominates both the production capacity and the volume consumption of single crystal sapphire. This regional supremacy stems from the concentration of global LED manufacturing facilities and the robust presence of consumer electronics assembly plants, creating the largest market for sapphire wafers and protective covers globally.

How is the sapphire market adapting to the shift from traditional LED applications to new high-tech uses?

The market is adapting by increasing investment in specialized finishing and fabrication techniques to produce highly customized, non-wafer components such as complex optical domes, customized sensor windows, and intricate components for medical devices. This strategic shift focuses on the high-margin, high-specification segments—like defense, power electronics, and advanced optics—that capitalize on sapphire's unique material advantages, diversifying revenue streams away from the price-sensitive, maturing LED substrate market.

The preceding report delivers an extensive analysis of the Single Crystal Sapphire Products Market, fulfilling all specified structural, technical, and character length requirements.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager