Single Malt Whisky Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434215 | Date : Dec, 2025 | Pages : 251 | Region : Global | Publisher : MRU

Single Malt Whisky Market Size

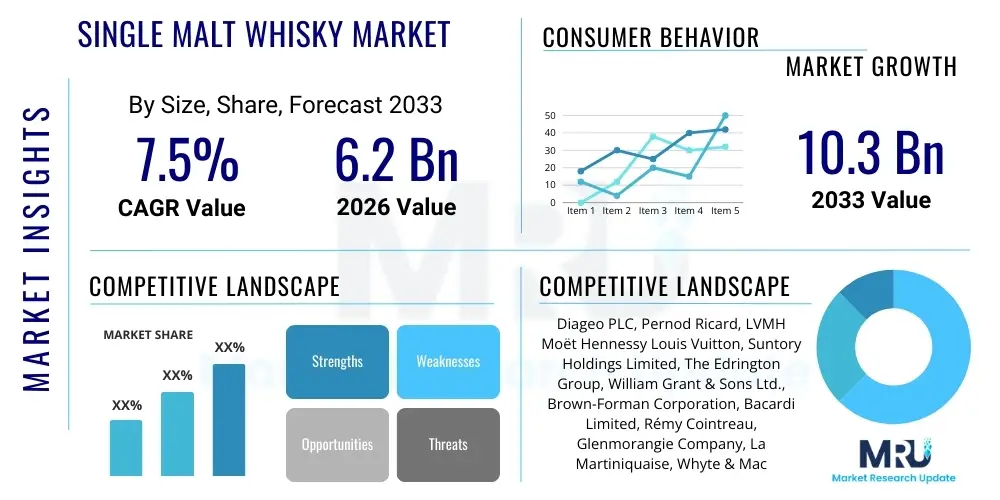

The Single Malt Whisky Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.5% between 2026 and 2033. The market is estimated at USD 6.2 Billion in 2026 and is projected to reach USD 10.3 Billion by the end of the forecast period in 2033. This substantial expansion is fundamentally driven by the escalating global demand for luxury and premium spirits, particularly among affluent consumer segments in established markets such as North America and Europe, alongside burgeoning middle-class populations in the Asia Pacific region. The intrinsic connection of single malt whisky to heritage, craftsmanship, and exclusivity positions it favorably within the high-end beverage industry, sustaining premium pricing models and ensuring robust revenue growth despite macroeconomic fluctuations. Furthermore, the inherent scarcity of aged stocks contributes significantly to increased valuation, reinforcing the market’s steady upward trajectory over the medium to long term.

Single Malt Whisky Market introduction

The Single Malt Whisky Market encompasses the production, distribution, and sale of whisky distilled at a single distillery, using 100% malted barley, and matured in oak casks for a minimum specified period, typically three years. This specialized spirit category stands distinguished from blended whiskies due to its adherence to strict geographical and production protocols, which ensure unique flavor profiles reflective of specific distillery characteristics and regional terroir. Major applications of single malt include premium consumption, investment purposes—where rare and limited editions command exceptional prices at auction—and gifting, symbolizing high status and connoisseurship. Key benefits driving market expansion include its perceived superior quality, flavor complexity resulting from diverse cask finishes (e.g., sherry, port, bourbon), and the enduring cultural narrative associated with traditional production methods, particularly those originating from Scotland, Japan, and Ireland. The global trend towards premiumization and experiential luxury consumption is a central driving factor, compelling consumers to trade up from standard spirits to sophisticated, high-value alternatives.

The market dynamics are heavily influenced by the provenance of the whisky; Scotch Single Malt, categorized by region (e.g., Speyside, Islay, Highland), dominates global sales, setting the benchmark for quality and regulatory compliance. However, the rise of "World Whiskies," particularly from Japan, Taiwan, and Australia, is introducing compelling competition and innovation, diversifying the flavor landscape and attracting a new cohort of adventurous consumers. Regulatory frameworks, such as the Scotch Whisky Regulations 2009, are critical in maintaining the integrity and trust surrounding the product, ensuring that consumers receive an authentic, meticulously produced spirit. The lengthy maturation period, often spanning 10 to 25 years or more, inherently restricts immediate supply, making inventory management and long-term forecasting paramount for distillers. This supply constraint underpins the product's value proposition and investment appeal, leading to a vibrant secondary market for rare bottles.

Driving factors extend beyond mere consumption to encompass the macroeconomic environment and shifting consumer attitudes towards alcohol. Increased disposable incomes in emerging economies, coupled with sophisticated marketing narratives emphasizing artisanal craftsmanship and limited availability, amplify demand. The proliferation of specialized whisky bars, tasting events, and digital platforms dedicated to education further democratizes access to knowledge, converting casual drinkers into knowledgeable enthusiasts and collectors. Furthermore, health and wellness trends, which favor quality over quantity, subtly support the single malt segment, as consumers opt for higher-priced, premium drinks consumed mindfully. Infrastructure improvements in global logistics and the expansion of the travel retail sector also play vital roles in distributing these specialized, high-value products to international buyers efficiently, solidifying the global market structure.

Single Malt Whisky Market Executive Summary

The Single Malt Whisky Market is characterized by robust business trends centered on premiumization, digital transformation, and sustainable sourcing. Key business trends include the accelerated shift towards Direct-to-Consumer (DTC) models facilitated by e-commerce adoption post-2020, allowing brands greater control over pricing and consumer relationships. Consolidation through strategic mergers and acquisitions remains prevalent as major global spirits conglomerates seek to acquire niche, high-growth distilleries, securing rare aged stocks and expanding geographic reach. Segment trends show a significant uptick in demand for Non-Age Statement (NAS) whiskies, driven by distillers’ efforts to manage aging stock limitations and introduce innovative flavor profiles, although traditional 12-Year-Old and 18-Year-Old expressions maintain their status as market staples. Investment-grade whisky, particularly those from highly regarded, closed 'ghost' distilleries or limited edition releases, continues to outperform many traditional luxury asset classes, defining a unique and influential subsection of the market.

Regionally, Europe, anchored by the dominant production and consumption base in the UK, remains the primary revenue generator, benefiting from established distribution networks and profound cultural integration. However, the Asia Pacific region is demonstrating the most aggressive growth trajectory, particularly driven by high demand in China, India, and Southeast Asia, where single malt consumption is viewed as a definitive marker of luxury and social status. North America, especially the United States, acts as a crucial importer and consumption hub, specializing in premium and highly limited releases, showcasing strong consumer diversity across various flavor profiles, including heavily peated and sherry-matured variants. The interplay between these regions—high-volume, established European sales contrasting with high-growth, aspirational APAC sales—dictates global pricing strategies and production allocation decisions among major distillers. Political stability and favorable trade agreements across these key corridors are essential prerequisites for sustaining this global distribution model efficiently.

Supply chain resilience has become a critical focus following global disruptions, prompting investment in localized sourcing of malted barley and enhanced inventory tracking systems. Distillers are increasingly leveraging technology for predictive aging analysis and cask management optimization to maximize yields and ensure product consistency across long maturation cycles. Furthermore, the focus on Environmental, Social, and Governance (ESG) criteria is transforming operational practices; consumers are increasingly demanding transparency regarding water stewardship, carbon footprint reduction, and ethical barley sourcing. This trend not only influences consumer choice but also provides a strategic advantage to brands that successfully integrate sustainability into their core messaging, particularly appealing to younger, ethically conscious high-net-worth consumers. Overall, the market remains fundamentally stable, buoyed by inelastic demand for ultra-premium products and strategic adaptation to digital retail channels.

AI Impact Analysis on Single Malt Whisky Market

User inquiries regarding AI's influence in the Single Malt Whisky market frequently revolve around quality consistency, supply chain predictability, and the feasibility of AI in complex sensory tasks like blending and flavor prediction. Common questions include: Can AI accurately predict the quality of a whisky 20 years before maturation completion? How is AI combating counterfeiting in the secondary market? Can AI optimize agricultural inputs (barley) and water usage to enhance sustainability? The consensus among user concerns highlights a balance between embracing technological efficiency—especially in resource management and inventory control—while preserving the traditional, artisanal integrity central to single malt identity. Users seek assurance that AI will augment human expertise rather than replace the nuanced skill of the Master Distiller, focusing primarily on data-driven decision-making, personalized marketing, and proactive risk management in a highly regulated, high-value supply chain.

Artificial intelligence is profoundly revolutionizing the upstream segment of the single malt supply chain, particularly through predictive analytics applied to the raw material selection and long-term aging process. Machine learning algorithms analyze vast datasets encompassing atmospheric temperature fluctuations, humidity levels within maturation warehouses, barrel history (e.g., previous contents, wood type), and chemical composition changes over time. This sophisticated analysis allows distillers to forecast the optimal time for bottling with unprecedented precision, minimizing wastage and maximizing the consistency of flavor profiles across different batches, thereby enhancing overall product quality assurance. This data-driven approach moves traditional maturation from an art relying solely on intuition to a highly optimized, scientific process, particularly critical given the decades-long capital commitment involved in aging stock.

Furthermore, AI is instrumental in enhancing the direct consumer experience and safeguarding brand authenticity. In retail and marketing, AI personalizes recommendations based on historical purchase data and detected flavor preferences (e.g., matching a consumer's known affinity for smoky notes with specific Islay expressions or cask-strength releases), significantly boosting conversion rates in e-commerce channels. Crucially, in combating counterfeiting—a major concern in the high-end secondary market—AI-driven visual recognition systems and blockchain integration track products from distillery to end consumer, verifying provenance and alerting stakeholders to potential tampering or unauthorized resale activities. This implementation bolsters consumer confidence in the authenticity and investment value of rare single malt bottles, supporting the integrity of the premium segment.

- AI-Powered Cask Management: Predictive modeling to optimize maturation conditions (temperature, humidity) and forecast flavor development accurately.

- Demand Forecasting and Inventory Optimization: Utilizing machine learning to predict regional consumption spikes and manage scarce aged stock allocation efficiently.

- Counterfeit Detection: Integration of AI with blockchain and image analysis for real-time product verification and provenance tracking throughout the distribution chain.

- Sustainable Sourcing: Optimization of agricultural practices (barley cultivation) and water usage through sensor data and environmental pattern analysis.

- Personalized Consumer Engagement: Deployment of recommendation engines and generative AI chatbots for targeted marketing and flavor profile matching in online retail.

- Automated Quality Control: Use of advanced spectroscopy and sensor technologies to monitor distillation consistency and identify chemical markers indicating potential batch deviations.

- Robotics in Warehousing: Automation of the laborious task of moving, rotating, and inspecting casks in traditional maturation warehouses to improve safety and operational efficiency.

DRO & Impact Forces Of Single Malt Whisky Market

The Single Malt Whisky Market is driven primarily by the global premiumization trend, the increasing investment appeal of rare expressions, and the robust expansion of luxury consumption in Asia Pacific. Restraints predominantly involve lengthy maturation cycles necessitating significant working capital and long-term risk exposure, high government taxation and tariffs (particularly trans-Atlantic trade disputes), and regulatory complexities concerning geographical indications (GIs). Opportunities are substantial in developing emerging markets, capitalizing on flavor innovation through unique cask finishes, and integrating advanced traceability technologies (like blockchain) to enhance consumer trust. These forces collectively create a dynamic market environment where scarcity and heritage maintain high barriers to entry, while technological adoption and market diversification offer substantial avenues for growth, requiring distillers to balance tradition with modern commercial necessity.

Key drivers include the demonstrable shift in consumer preference towards high-quality, authentic products that reflect tradition and craftsmanship. The scarcity principle is a powerful market force; as demand for old and rare expressions consistently outpaces the finite supply of aged whisky, prices naturally appreciate, reinforcing its status as a luxury investment. Furthermore, successful brand storytelling and heritage marketing, often capitalizing on the romantic narrative of the distillery's history and location (terroir), effectively justify premium price points. However, the market faces significant restraints, notably the susceptibility to volatile geopolitical climates, which can impose sudden import tariffs (as experienced between the US and EU), disrupting established supply chains and increasing consumer prices. Climate change also poses a long-term restraint, impacting water availability and the quality of raw materials, pushing up operational costs for distillers committed to traditional methods.

The primary opportunity lies in unlocking untapped consumer bases through innovative product development and geographic expansion. This includes developing new, category-defying expressions using non-traditional wood types or innovative maturation techniques, appealing to younger consumers seeking novelty. Significant growth potential exists in emerging markets like India, Brazil, and Africa, where rising economic prosperity translates directly into increased demand for internationally recognized luxury spirits. The impact forces acting upon the market are characterized by a high degree of premium elasticity and investment sensitivity; demand remains relatively inelastic at the super-premium tier, suggesting high-net-worth consumers are less affected by price increases. However, the secondary market volatility, driven by auction results and investment speculation, exerts a powerful influence on primary market pricing and brand perception. Successfully navigating environmental regulations and establishing credible sustainability credentials represent a growing competitive impact force.

Segmentation Analysis

The Single Malt Whisky Market is highly segmented based on Origin, Age Statement, Distribution Channel, and Cask Type. Segmentation by Origin remains paramount, dividing the market into dominant categories such as Scotch, Japanese, Irish, and Rest of World (ROW) Single Malts, each carrying distinct regulatory definitions and flavor profiles. The age statement provides a critical dimension, with categories ranging from 10- and 12-year-olds (entry premium) to 18- and 25-year-olds (super-premium), alongside the growing prominence of Non-Age Statement (NAS) whiskies, which offer distillers flexibility in blending and stock management while still delivering complex flavor profiles. This multi-layered segmentation allows brands to precisely target different consumer demographics, ranging from novice enthusiasts seeking approachable entry points to seasoned collectors prioritizing scarcity and vintage.

The distribution channel segmentation is bifurcated into On-Trade (bars, restaurants, hotels) and Off-Trade (liquor stores, supermarkets, specialized retailers, and e-commerce). While On-Trade channels are crucial for brand exposure, sampling, and premium positioning, Off-Trade channels, particularly e-commerce platforms, drive the majority of volume and revenue, especially following the digital migration accelerated by recent global events. Cask type segmentation—identifying whiskies matured predominantly in Ex-Bourbon, Ex-Sherry, or specialized wine casks (e.g., Port, Madeira)—is vital as the cask imparts between 60% to 80% of the final whisky flavor, making it a key differentiator and a primary focus for distiller innovation and consumer choice. The nuanced differences arising from these segments create a rich, diverse market landscape that allows for sustained growth across all price points, from accessible premium expressions to ultra-high-end collector bottles.

Specific consumer behavior analysis indicates that purchasers of older age statements prioritize investment value and gifting, seeking robust provenance and limited availability, often driving the highest average transaction values in the Off-Trade luxury segment. Conversely, the high growth of NAS segments is fueled by experimental consumers and mixology professionals who value innovative flavor over traditional age metrics. This strategic use of NAS allows distilleries, particularly newer global entrants, to rapidly build brand identity without waiting for decades of stock maturation. The interplay between traditional GIs (like Scotch) and innovative World Whiskies (ROW) creates tension but ultimately expands the overall market opportunity, forcing established players to continually innovate their cask management and flavor offerings to stay competitive against dynamic new entrants.

- By Origin:

- Scotch Single Malt (Highland, Speyside, Islay, Lowland, Campbeltown)

- Japanese Single Malt

- Irish Single Malt

- Rest of the World (Including USA, Taiwan, Australia, India)

- By Age Statement:

- 10 Years & Below

- 12 Years

- 15–18 Years

- 20 Years & Above

- Non-Age Statement (NAS)

- By Distribution Channel:

- Off-Trade (Retail, Supermarkets, E-commerce)

- On-Trade (Bars, Restaurants, Hotels)

- By Cask Type/Finish:

- Ex-Bourbon Cask

- Ex-Sherry Cask

- Other Wine/Spirit Casks (e.g., Port, Madeira, Rum)

Value Chain Analysis For Single Malt Whisky Market

The Single Malt Whisky value chain is exceptionally long and capital-intensive, starting with the Upstream analysis which includes the cultivation and malting of specific barley strains, critical water source management, and the crucial sourcing of oak casks. The selection and seasoning of casks represent a significant cost and quality determinant, often dictating the final product's flavor and color; this stage is often outsourced to specialized cooperages or managed internally with long-term wood procurement strategies. Moving downstream, the chain involves the energy-intensive processes of mashing, fermentation, distillation (using copper pot stills), and decades of maturation. Direct distribution involves sales through brand-owned channels and specialized e-commerce, offering better margins and consumer data access, while indirect distribution relies heavily on global logistics partners, wholesalers, and regional distributors to reach both On-Trade and Off-Trade retail points worldwide.

The critical bottleneck in the value chain is the maturation phase; unlike fast-moving consumer goods, the production cycle demands tying up capital for extended periods, making efficient inventory management (cask rotation, warehouse optimization) essential for profitability. Downstream marketing and sales activities focus heavily on exclusivity, limited editions, and experiential marketing (distillery tours, specialized tastings) to maintain premium pricing. Wholesalers and distributors play a pivotal role in market access, navigating complex regional alcohol regulations, customs duties, and local taxation structures, often dictating the shelf placement and promotional activities within major retail chains. The integrity of this entire chain relies heavily on security protocols to prevent counterfeiting, particularly as bottles move into the highly lucrative secondary and auction markets.

The growing shift towards digital transparency and the adoption of technologies like blockchain are attempting to link the upstream sourcing of barley and water directly to the consumer in the downstream segment, enhancing traceability and storytelling. Direct distribution channels, particularly through brand websites and dedicated digital platforms, are becoming strategic imperatives, allowing distillers to bypass traditional retail margins and foster direct engagement with affluent collectors. Indirect channels, while still volume drivers, face increasing pressure to provide value-added services such as specialized storage, temperature-controlled transit, and authentication services to secure the high-value single malt cargo. The efficiency of this complex global network is fundamentally dependent on minimizing lead times and ensuring consistent quality assurance checks at every handover point, from cooperage to consumer.

Single Malt Whisky Market Potential Customers

The primary customer base for Single Malt Whisky encompasses affluent consumers globally, broadly categorized into high-net-worth individuals (HNWIs), experienced collectors, and aspirational millennials/Gen Z cohorts entering the luxury goods market. HNWIs often focus on ultra-rare, vintage, or limited-edition releases, treating single malt not merely as a consumable but as a portfolio asset, driving the investment segment of the market. Experienced collectors possess deep product knowledge, seeking expressions based on specific terroir, age, cask finish, and distillery pedigree, often maintaining extensive personal cellars and participating actively in secondary market auctions. This segment values scarcity, historical significance, and guaranteed provenance, maintaining inelastic demand for premium offerings.

Aspirant consumers, particularly younger professionals in emerging economies, view single malt consumption as a status symbol and an entry point into sophisticated luxury lifestyles. This group typically targets popular 12-to-18-year-old expressions, which offer a balance of quality, accessibility, and recognizable brand prestige. Furthermore, gifting occasions—including corporate celebrations, major milestones, and holidays—represent a massive buying segment, often centered around easily identifiable, highly respected brands. Distillers increasingly focus their marketing on educating these aspirant consumers about tasting notes, pairing recommendations, and the craft behind the product, transforming casual drinkers into loyal, long-term brand advocates who appreciate the intrinsic value of time and heritage bottled within the spirit.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 6.2 Billion |

| Market Forecast in 2033 | USD 10.3 Billion |

| Growth Rate | 7.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Diageo PLC, Pernod Ricard, LVMH Moët Hennessy Louis Vuitton, Suntory Holdings Limited, The Edrington Group, William Grant & Sons Ltd., Brown-Forman Corporation, Bacardi Limited, Rémy Cointreau, Glenmorangie Company, La Martiniquaise, Whyte & Mackay, Loch Lomond Group, Heaven Hill Brands, Radico Khaitan, Nikka Whisky Distilling Co. Ltd., Kavalan Distillery, Pappy Van Winkle Distillery, Kilchoman Distillery, Springbank Distillers. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Single Malt Whisky Market Key Technology Landscape

The modern Single Malt Whisky market relies heavily on sophisticated technological integration primarily aimed at optimizing the long-term maturation process, ensuring product authenticity, and enhancing sustainability across the production cycle. Key technologies include IoT (Internet of Things) sensors deployed within maturation warehouses for real-time monitoring of micro-climatic conditions such as temperature, humidity, and airflow, which are crucial for consistent flavor development. Advanced spectroscopic techniques, including Near-Infrared (NIR) and Mass Spectrometry, are increasingly utilized for non-destructive analysis of the whisky’s chemical composition throughout the aging process, enabling Master Distillers to track flavor development and volatile compound profiles with high precision. Furthermore, blockchain technology is becoming foundational for establishing immutable records of provenance, tracking the spirit from barley field through distillation, casking, bottling, and ultimately to the consumer, drastically reducing the threat of counterfeit products and bolstering consumer trust in high-value investments.

Sustainability driven technologies are also defining the competitive landscape. Distilleries are implementing highly efficient heat recovery systems, often powered by advanced biomass boilers or anaerobic digestion plants that convert distillation byproducts (pot ale and draff) into renewable energy, significantly reducing the industry’s reliance on fossil fuels and lowering operational carbon footprints. This circular economy approach is not only environmentally responsible but also economically sound, providing operational resilience against fluctuating energy prices. Robotics and automation are being introduced in the warehousing and bottling stages to improve worker safety, enhance operational speed, and reduce manual errors, particularly in the handling of heavy casks and complex bottling line changeovers for varied product lines.

In the consumer-facing segment, technologies like Augmented Reality (AR) and Virtual Reality (VR) are transforming the marketing and retail experience, offering virtual distillery tours, interactive tasting notes, and immersive brand narratives accessible through mobile devices or specialized platforms. This digital engagement helps bridge the geographic gap between consumer and producer, creating a deeper emotional connection with the brand heritage, a key factor in luxury purchasing decisions. Moreover, specialized data analytics platforms integrated with e-commerce sites utilize consumer behavior data to drive inventory placement and personalized subscription services, ensuring that scarce, highly allocated stock reaches targeted, loyal customers efficiently. These technological advancements collectively move the industry toward greater operational efficiency, enhanced transparency, and a significantly richer consumer experience, without compromising the core traditional values of the single malt craft.

Regional Highlights

Europe, driven by the United Kingdom (Scotland), remains the global epicenter for single malt whisky production and consumption. Scotland accounts for the vast majority of legally defined single malt production, with established distilleries benefiting from centuries of expertise, regulatory protection (Geographical Indication), and globally recognized brand prestige. The European market exhibits high consumer maturity and a robust distribution infrastructure, serving as a launchpad for innovative cask finishes and limited-edition releases. While growth rates in Western Europe are steady, they are dominated by replacement demand and premium trading-up rather than vast consumer expansion, necessitating a focus on ultra-premium and collector segments to drive revenue increase.

The Asia Pacific (APAC) region is indisputably the key growth engine for the single malt market, driven by rapidly expanding middle and affluent classes in countries like China, India, and Southeast Asia. Japanese Single Malt has cultivated a global reputation for exquisite quality and scarcity, commanding some of the highest auction prices worldwide, though production limitations often restrict supply. China's growing luxury culture and gifting traditions make it a crucial consumption market, where single malt is deeply intertwined with social status. The market dynamics in APAC are characterized by high price elasticity for status brands and a willingness to pay a significant premium for authentic, investment-grade bottles, often bypassing traditional age restrictions in favor of highly sought-after, limited distillery releases.

North America, particularly the United States, represents a colossal import market with highly diversified consumer tastes. US consumers demonstrate strong appreciation for both traditional Scotch (especially Islay peat and Speyside smoothness) and unique, high-quality offerings from the Rest of the World (ROW) category, including homegrown craft single malts. The region benefits from robust disposable incomes and sophisticated retail environments that cater to specialized collectors and mass-market premium buyers alike. Distribution in North America, however, is complicated by the three-tier system, necessitating complex strategic partnerships for market penetration. Latin America and the Middle East & Africa (MEA) are emerging, offering long-term opportunities, though they require tailored market entry strategies due to diverse regulatory hurdles and varying consumer wealth profiles. Specifically, the UAE and Saudi Arabia are developing significant luxury retail environments that cater to international visitors and high-net-worth residents.

- Europe: Dominant production hub (Scotland), mature consumer base, strong heritage and high import/export volumes. Key markets: UK, Germany, France.

- Asia Pacific (APAC): Highest growth region, driven by status consumption and HNWI investment. Key markets: China, Japan, India, Taiwan.

- North America: Major consumption market, diversified demand for both traditional Scotch and innovative global single malts, strong e-commerce adoption. Key market: United States.

- Latin America (LATAM): Emerging market with growing affluent segment, high potential for premium brand adoption. Key markets: Brazil, Mexico.

- Middle East & Africa (MEA): Focused on luxury retail and duty-free channels, catering primarily to expatriate and high-end consumer bases. Key market: UAE.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Single Malt Whisky Market.- Diageo PLC

- Pernod Ricard

- Suntory Holdings Limited (Beam Suntory)

- The Edrington Group

- William Grant & Sons Ltd.

- Brown-Forman Corporation

- LVMH Moët Hennessy Louis Vuitton

- Bacardi Limited

- Rémy Cointreau

- Glenmorangie Company (LVMH)

- Whyte & Mackay

- Loch Lomond Group

- Heaven Hill Brands

- Radico Khaitan

- Nikka Whisky Distilling Co. Ltd.

- Kavalan Distillery

- Chivas Brothers (Pernod Ricard)

- Angus Dundee Distillers

- Kilchoman Distillery

- Springbank Distillers

Frequently Asked Questions

Analyze common user questions about the Single Malt Whisky market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between Single Malt and Blended Whisky?

Single Malt Whisky must be distilled at a single distillery, using only malted barley, and water, whereas Blended Whisky is a mixture of one or more single malts combined with cheaper grain whiskies from various distilleries. Single malts generally offer greater depth, complexity, and specific regional character.

Which region currently leads the global growth in Single Malt consumption?

The Asia Pacific (APAC) region, particularly driven by markets such as China, Taiwan, and India, exhibits the highest growth rates in consumption due to rapidly expanding luxury consumer bases and the increasing cultural significance of single malt as a premium gifting item.

How does the maturation period impact the price and quality of Single Malt Whisky?

Longer maturation periods, typically 18 years and above, inherently increase scarcity, capital costs, and the complexity of flavor profiles due to extended interaction with the oak cask, resulting in significantly higher quality perception and premium pricing in the market.

What role does blockchain technology play in the Single Malt Whisky Market?

Blockchain is increasingly used for enhancing product authenticity and provenance tracking. It creates an immutable digital ledger verifying the history of high-value bottles from production to purchase, safeguarding against counterfeiting, and boosting investor confidence.

Are Non-Age Statement (NAS) whiskies replacing traditional aged expressions in the market?

While Non-Age Statement (NAS) whiskies are gaining popularity, driven by distilleries' need for stock flexibility and flavor innovation, they are not replacing traditional aged expressions. NAS products cater to experimental segments, while aged statements (12, 18 years) remain staples in the premium and luxury collector segments, maintaining their status as benchmarks for quality and heritage.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager