Single-phase DIN Rail Electrical Energy Meter Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434084 | Date : Dec, 2025 | Pages : 245 | Region : Global | Publisher : MRU

Single-phase DIN Rail Electrical Energy Meter Market Size

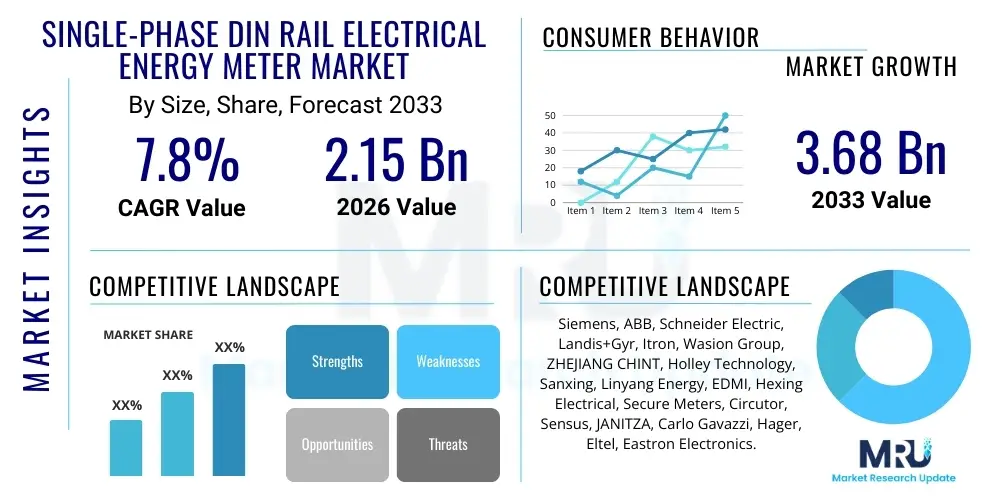

The Single-phase DIN Rail Electrical Energy Meter Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at $2.15 Billion in 2026 and is projected to reach $3.68 Billion by the end of the forecast period in 2033. This consistent expansion is driven by ongoing global investments in smart infrastructure, widespread adoption of advanced metering infrastructure (AMI), and the necessity for accurate, compact, and standardized metering solutions in residential and light commercial settings. The DIN rail form factor provides significant advantages in terms of installation speed and space efficiency within modern electrical panels, further propelling its market penetration across developing economies focused on grid modernization.

Single-phase DIN Rail Electrical Energy Meter Market introduction

The Single-phase DIN Rail Electrical Energy Meter Market encompasses the manufacturing, distribution, and deployment of compact electricity meters designed for mounting on standard 35mm DIN rails. These meters are primarily utilized for measuring active energy (kWh) consumption in residential buildings, apartments, small offices, and light industrial applications where a single-phase connection is prevalent. The critical product description highlights their standardization (DIN rail compatibility), high accuracy (often Class 1 or Class 0.5S), and feature set, which increasingly includes communication capabilities like Modbus, M-Bus, or proprietary wireless protocols for remote data acquisition.

Major applications of these devices span utility sub-metering, tenant billing in multi-unit dwellings, energy management in solar photovoltaic (PV) installations, and precise consumption tracking within industrial control panels. The inherent benefits of DIN rail meters include reduced installation time due to snap-on mounting, space savings compared to traditional panel meters, enhanced safety through fully enclosed designs, and long operational lifecycles requiring minimal maintenance. This form factor facilitates rapid scalability and integration into existing distribution boards without requiring extensive modification.

Key driving factors accelerating market growth include stringent regulatory mandates across regions enforcing accurate sub-metering for accountability and energy efficiency. Furthermore, the global push towards smart grids necessitates the deployment of communicating meters, making the modernized single-phase DIN rail meters essential components for granular data collection. The increasing complexity of energy tariffs and the growing adoption of decentralized generation sources also mandate reliable, two-way measuring devices, solidifying the market's trajectory.

Single-phase DIN Rail Electrical Energy Meter Market Executive Summary

The Single-phase DIN Rail Electrical Energy Meter Market is witnessing robust expansion, characterized by significant technological shifts towards enhanced connectivity and integration capabilities. Business trends highlight a strong emphasis on cybersecurity measures embedded within meter firmware, standardization adherence (IEC and ANSI), and strategic partnerships between meter manufacturers and utility service providers to facilitate large-scale AMI rollouts. There is a growing competitive dynamic driven by Asian manufacturers offering cost-effective, feature-rich solutions, compelling established Western players to focus on premium smart functionalities and advanced analytics integration. Utility investments are increasingly directed toward solutions that support demand response and renewable energy integration, making communication protocols a crucial differentiation point.

Regionally, the Asia Pacific (APAC) stands as the dominant growth engine, fueled by massive electrification projects in nations like India and China, coupled with mandatory smart metering programs designed to curb non-technical losses. Europe, driven by the rollout of second-generation smart meters (SMETS2 in the UK, similar initiatives across the EU), emphasizes high interoperability and stringent data privacy compliance, favoring advanced meters with integrated disconnection capabilities. North America shows stable growth primarily driven by sub-metering regulations in commercial and residential developments and the replacement cycle of older, legacy metering infrastructure, focusing heavily on robust reliability and high data transmission rates suitable for diverse climatic conditions.

Segment trends underscore the rising preference for smart single-phase meters (as opposed to basic conventional meters), dominating revenue generation due to their two-way communication and remote management features. Within application segments, sub-metering for tenant billing and energy efficiency monitoring in commercial real estate exhibits the highest growth rate. Furthermore, the component segment is increasingly leaning towards high-precision metering ICs and powerline communication (PLC) modules, reflecting the market’s pivot towards enhanced data granularity and reliable last-mile connectivity in dense urban environments.

AI Impact Analysis on Single-phase DIN Rail Electrical Energy Meter Market

Common user inquiries regarding the impact of Artificial Intelligence (AI) on the Single-phase DIN Rail Electrical Energy Meter Market typically revolve around how AI can enhance grid stability, improve meter data processing efficiency, and predict device failures. Users are keen to understand if AI integration will lead to entirely new product designs or primarily influence the backend analytics platforms. Key concerns focus on the necessity of high computational power at the edge (the meter itself) versus cloud-based processing, and the security implications of transmitting vast amounts of fine-grained meter data for AI training. There is a clear expectation that AI will move beyond simple consumption logging to real-time anomaly detection, predictive maintenance, and optimized load forecasting, thereby maximizing the value derived from AMI investments.

The influence of AI is most profound not within the physical meter hardware but in the Meter Data Management (MDM) systems and the broader utility operation centers that ingest data from these DIN rail meters. AI algorithms analyze the high-frequency consumption data generated by modern smart meters to identify patterns indicative of potential fraud, pinpoint distribution bottlenecks, and optimize energy procurement strategies. This capability allows utilities to dynamically adjust pricing and load shedding, increasing the efficiency and reliability of the electrical network. For consumers, AI can power personalized energy-saving recommendations based on analyzed usage habits, delivered through utility portals or mobile applications.

Moreover, AI is crucial for maintaining the operational integrity of large meter fleets. By monitoring communication success rates, power quality readings, and internal diagnostic flags transmitted by DIN rail meters, AI models can predict meter failure weeks or months in advance, scheduling proactive maintenance and reducing system downtime. This shift from reactive repair to predictive upkeep lowers operational expenditure (OPEX) for utilities and ensures continuous, accurate billing. The deployment of AI necessitates that single-phase meters are robustly connected and capable of securely delivering large, time-stamped datasets, reinforcing the trend toward smart, high-specification DIN rail devices.

- AI algorithms enhance fraud detection by analyzing atypical consumption profiles.

- Predictive maintenance driven by AI minimizes meter downtime and operational costs.

- Optimized load forecasting using granular meter data improves grid efficiency and stability.

- AI facilitates granular anomaly detection in voltage and current readings, enhancing power quality monitoring.

- Integration with MDM systems allows AI to create personalized energy saving tips for end-users.

DRO & Impact Forces Of Single-phase DIN Rail Electrical Energy Meter Market

The Single-phase DIN Rail Electrical Energy Meter Market is primarily propelled by mandatory governmental regulations supporting smart grid deployment and energy conservation targets globally, positioning regulatory compliance as the fundamental driver. Restraints often include the high initial investment required for nationwide Advanced Metering Infrastructure (AMI) deployment and ongoing public resistance or privacy concerns related to real-time data collection. Significant opportunities emerge from the expansion of renewable energy sources (especially rooftop solar) requiring bidirectional measurement capabilities and the increasing necessity for granular sub-metering in smart buildings. These forces interact to accelerate technological innovation, particularly in integrating robust communication standards and enhancing data security protocols, shaping the market landscape towards highly specialized, connected devices.

The primary drivers encompass favorable government policies promoting energy efficiency, such as the European Union’s Energy Efficiency Directive, which mandates comprehensive metering deployment. Furthermore, the accelerating urbanization and construction of high-density housing units globally necessitate compact, standardized metering solutions that fit seamlessly into modular electrical infrastructure. The inherent simplicity and rapid installation time associated with the DIN rail form factor significantly reduces labor costs, providing a substantial economic incentive for mass deployment. The crucial role of these meters in reducing Aggregate Technical and Commercial (AT&C) losses for utilities through precise measurement and tamper detection further solidifies their adoption rate.

However, the market faces significant restraints, including intense price pressure, particularly in developing markets where cost-effectiveness often trumps advanced features. Technical challenges related to establishing reliable communication in environments with high electromagnetic interference or poor network coverage (e.g., deep indoors or basements) hinder seamless AMI integration. The complexity of ensuring interoperability between various hardware manufacturers and the necessity for backward compatibility with legacy grid systems also present developmental hurdles. Addressing cybersecurity vulnerabilities associated with connected devices remains a continuous challenge, demanding constant investment in secure firmware and communication encryption.

The impact forces influencing the market trajectory are dominated by rapid advancements in semiconductor technology, particularly in metering integrated circuits (ICs) that offer higher accuracy and lower power consumption. The shift towards open standards like DLMS/COSEM promotes greater vendor flexibility and competitive pricing. The societal impact of climate change mitigation strongly encourages the use of smart meters to manage peak loads and integrate distributed generation. This interplay of technological maturity, regulatory support, and economic incentives ensures continuous market momentum, driving suppliers to offer meters capable of supporting complex tariffs and providing utility-grade data security.

Segmentation Analysis

The Single-phase DIN Rail Electrical Energy Meter Market is comprehensively segmented based on technology type, application, component, and end-user, allowing for a detailed analysis of specific growth pockets and market dynamics. The segmentation by technology differentiates between conventional (electromechanical or basic digital) meters and advanced smart meters, with the latter commanding increasing market share due to global AMI initiatives. Application segmentation is crucial, distinguishing between utility primary metering, commercial sub-metering, and specific industrial process monitoring, reflecting varied accuracy and communication needs across sectors. Analyzing these segments provides strategic insights into investment priorities for manufacturers targeting specialized niches.

- By Technology:

- Conventional Single-phase DIN Rail Meters

- Smart Single-phase DIN Rail Meters (with communication capabilities like PLC, RF, or Cellular)

- By Application:

- Residential Utility Billing

- Commercial Sub-metering (Apartments, Offices, Malls)

- Light Industrial Energy Management

- Renewable Energy Monitoring (Solar PV Systems)

- By Component:

- Metering ICs/ASICs

- Communication Modules (PLC, RF, Cellular)

- Display Units

- Housing and Enclosures

- By Communication Protocol:

- Wired (Modbus, M-Bus, RS485)

- Wireless (RF Mesh, Cellular GPRS/LTE, Wi-SUN)

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East & Africa (MEA)

Value Chain Analysis For Single-phase DIN Rail Electrical Energy Meter Market

The value chain for the Single-phase DIN Rail Electrical Energy Meter Market begins with upstream suppliers providing critical electronic components, including highly specialized metering integrated circuits (ICs), precision current transformers, and semiconductor manufacturers responsible for communication modules. This upstream segment is characterized by high R&D intensity and stringent quality control, as the accuracy and lifespan of the meter are heavily reliant on these foundational components. Key manufacturers maintain strong relationships with a limited pool of highly specialized semiconductor vendors to ensure reliable supply and technical compliance with evolving metering standards (e.g., IEC 62052, ANSI C12.20). Efficiency in the upstream phase, particularly component miniaturization and cost reduction, directly influences the final product’s competitiveness.

The midstream phase involves the meter assembly and manufacturing process, where major global players integrate components, design enclosures compatible with DIN rail mounting standards, and deploy proprietary or standardized firmware for measurement and communication. This stage includes calibration, certification, and testing to meet national regulatory requirements. Distribution channels are varied but can be broadly categorized into direct sales to large utility companies undertaking massive AMI projects, and indirect channels relying on electrical wholesalers, system integrators, and distributors to serve the smaller sub-metering and construction markets. Direct sales offer higher margins but demand long-term contractual commitments, while indirect channels provide wider market reach and support for lower-volume specialized applications.

Downstream activities involve meter installation, data aggregation, and maintenance. Utility companies or Measurement and Verification (M&V) service providers handle the installation, typically conducted by certified electricians ensuring proper connectivity to the grid and the communication network. Post-deployment, the focus shifts to data management (MDM systems), where the vast flow of data from the DIN rail meters is collected, validated, and processed for billing, grid operation analysis, and anomaly detection. Maintenance cycles are long due to the meter’s intended 15-20 year lifespan, emphasizing remote diagnostics capabilities built into the smart meters to minimize expensive on-site interventions.

Single-phase DIN Rail Electrical Energy Meter Market Potential Customers

The primary potential customers and end-users of Single-phase DIN Rail Electrical Energy Meters are multifaceted, reflecting the diverse applications enabled by their compact and standardized design. The most substantial customer segment comprises large public and private electric utility companies responsible for managing the national grid infrastructure. These utilities procure meters in massive volumes for deploying or upgrading their Advanced Metering Infrastructure (AMI) across residential service areas, driven by regulatory mandates and the necessity to reduce commercial losses and enhance operational efficiency. Their purchasing decisions prioritize high reliability, scalability, interoperability, and robust security features suitable for nationwide deployment.

A rapidly growing customer base includes developers, property management firms, and facility managers of multi-tenant commercial and residential buildings. These end-users utilize DIN rail meters specifically for sub-metering applications—accurately tracking and billing energy consumption for individual tenants or functional zones within a larger structure. The DIN rail form factor is particularly appealing here due to space constraints in electrical closets and the ease of integrating numerous meters into distribution boards. Furthermore, the push for green building certifications and energy efficiency mandates makes precise sub-metering an essential investment for optimizing resource allocation.

Additionally, the market serves numerous specialized industrial and emerging energy sectors. This includes manufacturers requiring precise energy monitoring for cost allocation across different production lines, solar photovoltaic (PV) system installers who need accurate devices for measuring generation output and net metering, and system integrators specializing in energy management systems (EMS). For these customers, the meters must often adhere to specific communication standards (like Modbus TCP) to integrate seamlessly with industrial control and automation platforms, making ease of integration a key purchase criterion alongside accuracy.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $2.15 Billion |

| Market Forecast in 2033 | $3.68 Billion |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Siemens, ABB, Schneider Electric, Landis+Gyr, Itron, Wasion Group, ZHEJIANG CHINT, Holley Technology, Sanxing, Linyang Energy, EDMI, Hexing Electrical, Secure Meters, Circutor, Sensus, JANITZA, Carlo Gavazzi, Hager, Eltel, Eastron Electronics. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Single-phase DIN Rail Electrical Energy Meter Market Key Technology Landscape

The technology landscape for Single-phase DIN Rail Electrical Energy Meters is defined by the transition from basic electromechanical components to highly integrated digital systems centered around advanced metering integrated circuits (ICs) and robust communication technologies. Modern meters utilize specialized metering ICs, often based on high-performance Analog Front Ends (AFEs) and dedicated Digital Signal Processors (DSPs), to achieve high accuracy (e.g., Class 0.5S) over a wide dynamic range, essential for precision measurement of active, reactive, and apparent energy. These ICs are engineered for low power consumption, allowing the meters to operate effectively for extended periods and even incorporate power quality monitoring features like harmonic analysis and voltage sag detection, moving the device beyond simple billing functionality.

Communication technology represents the most dynamic area of innovation. While traditional meters relied on pulse output or RS485 (Modbus) for data transmission over short distances, contemporary smart DIN rail meters predominantly utilize sophisticated communication modules. Power Line Communication (PLC) remains crucial in dense urban areas where deploying new wiring is costly, leveraging existing power lines for data transmission. However, there is an increasing adoption of wireless technologies, including RF mesh networks (like Wi-SUN or Zigbee) for localized data collection and cellular communication (2G/3G/4G/NB-IoT/LTE-M) for direct, wide-area connectivity, particularly beneficial in rural or geographically dispersed AMI rollouts. The selection of the communication technology is heavily dependent on regional infrastructure maturity and regulatory spectrum availability.

Furthermore, the incorporation of advanced security hardware and firmware is paramount. This includes secure element chips (cryptographic accelerators) to protect meter data integrity, prevent unauthorized firmware modification, and secure communication sessions between the meter and the head-end system. Technology integration also involves standardized protocols such as DLMS/COSEM (Device Language Message Specification/Companion Specification for Energy Metering) to ensure vendor interoperability and data exchange uniformity. The trend is moving towards modular meters, where communication modules can be swapped or upgraded without replacing the entire meter, future-proofing the investment for utilities adapting to rapidly evolving connectivity standards like 5G or advanced IoT protocols.

Regional Highlights

Geographical market dynamics reveal significant disparity in adoption rates and technological maturity, primarily driven by regional economic development and specific government energy policies.

- Asia Pacific (APAC): APAC represents the largest and fastest-growing market due to massive investments in smart grid infrastructure and mandatory metering programs in populous nations such as China, India, and Southeast Asian economies. The focus is on deploying high volumes of cost-effective, durable meters to curb high technical and non-technical losses, often favoring solutions utilizing cellular (LTE/NB-IoT) or PLC communication for wide coverage.

- Europe: The European market is characterized by stringent regulatory oversight (e.g., the EU’s mandates for smart meter rollout) and high demand for advanced, highly secure meters compliant with established standards like MID (Measuring Instruments Directive). Growth is driven by the replacement of first-generation smart meters and a strong emphasis on integrating meters capable of handling bi-directional energy flows from decentralized renewable sources.

- North America: North America exhibits stable growth, primarily focused on sub-metering in commercial and multi-residential buildings, driven by energy efficiency codes and tenant billing accuracy requirements. Utilities primarily deploy DIN rail meters for specialized applications, preferring high-reliability RF mesh and cellular communication systems to overcome vast distances and challenging terrain, with a strong focus on ANSI standards compliance.

- Latin America (LATAM): This region is an emerging market, driven by a growing need to modernize aging infrastructure and combat energy theft. The deployment of single-phase DIN rail meters is accelerating in major economies like Brazil and Mexico, balancing the need for advanced features with aggressive cost constraints, often relying on hybrid communication methods.

- Middle East & Africa (MEA): Growth in MEA is propelled by rapid urban development, particularly in the Gulf Cooperation Council (GCC) countries, focusing on large-scale smart city projects that require centralized, high-specification metering solutions. African markets show potential, spurred by electrification initiatives, where the DIN rail form factor's ease of installation is highly advantageous.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Single-phase DIN Rail Electrical Energy Meter Market.- Siemens

- ABB

- Schneider Electric

- Landis+Gyr

- Itron

- Wasion Group

- ZHEJIANG CHINT

- Holley Technology

- Sanxing

- Linyang Energy

- EDMI

- Hexing Electrical

- Secure Meters

- Circutor

- Sensus

- JANITZA

- Carlo Gavazzi

- Hager

- Eltel

- Eastron Electronics

Frequently Asked Questions

Analyze common user questions about the Single-phase DIN Rail Electrical Energy Meter market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary advantage of a DIN rail form factor for electrical energy meters?

The primary advantage of the DIN rail form factor is its standardization, which allows for rapid, tool-less installation and high integration density within electrical cabinets and distribution boards, significantly reducing labor time and physical space requirements compared to traditional wall-mounted meters.

How do smart Single-phase DIN rail meters contribute to reducing non-technical losses?

Smart DIN rail meters reduce non-technical losses (energy theft or fraud) by incorporating advanced tamper detection features, secure communication protocols, and high-frequency data logging, enabling utility systems to detect suspicious usage patterns and meter bypassing in real-time.

Which communication technologies are most prevalent in modern DIN rail smart meters?

Modern DIN rail smart meters most commonly utilize Power Line Communication (PLC) for reliable transmission over existing wiring and various wireless technologies, particularly cellular standards like NB-IoT and LTE-M, to provide robust, wide-area network connectivity.

What role does sub-metering play in driving the demand for these meters?

Sub-metering, especially in multi-tenant commercial and residential buildings, is a major demand driver. It allows landlords or property managers to accurately measure and bill individual unit consumption, promoting energy conservation and fair cost allocation among occupants.

What is the estimated Compound Annual Growth Rate (CAGR) for this market?

The Single-phase DIN Rail Electrical Energy Meter Market is projected to grow at a CAGR of 7.8% during the forecast period spanning 2026 to 2033, driven by ongoing global smart grid modernization efforts and stringent regulatory environments.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager