Single Scull Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434034 | Date : Dec, 2025 | Pages : 251 | Region : Global | Publisher : MRU

Single Scull Market Size

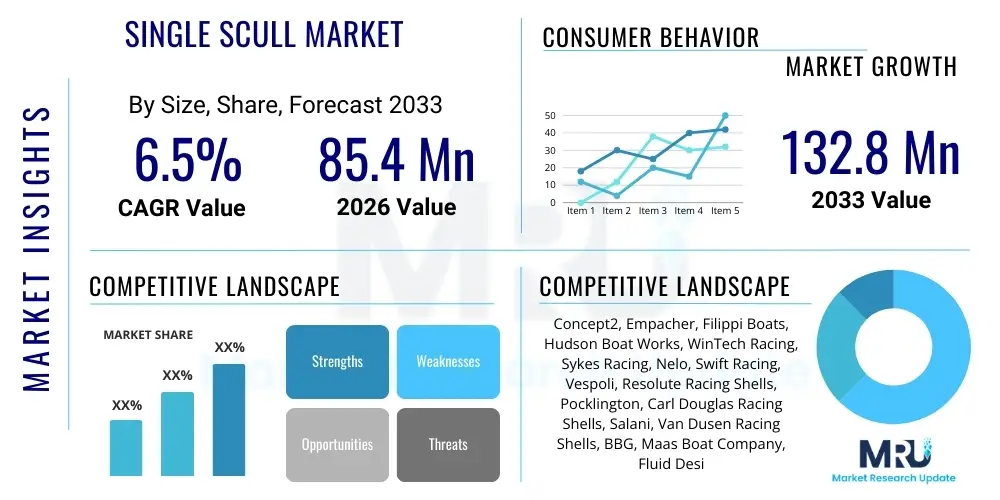

The Single Scull Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at $85.4 Million USD in 2026 and is projected to reach $132.8 Million USD by the end of the forecast period in 2033. This growth is predominantly fueled by the increasing globalization of competitive rowing events and continuous technological advancements in boat construction materials, particularly the shift towards ultra-lightweight carbon fiber composites designed for maximizing speed and minimizing drag.

Single Scull Market introduction

The Single Scull Market encompasses the manufacturing, distribution, and sale of specialized rowing shells designed for one person, often utilized in competitive Olympic-style rowing events or intense recreational training. These highly engineered boats are characterized by their long, narrow hulls, stabilizing riggers, and sliding seats, prioritizing hydrodynamic efficiency and structural stiffness. The primary objective of a single scull is to translate the rower's power into maximum forward velocity, making material science and precise hydrodynamics critical components of product development and market differentiation. Key materials utilized include advanced carbon fiber, Kevlar, and high-performance resin systems, which contribute significantly to the overall cost and performance profile of the vessel.

Major applications of single sculls span professional competitions, including World Championships and the Olympic Games, collegiate athletic programs, and extensive high-level training conducted by national rowing federations and private clubs. The inherent benefits of single sculling—such as the development of precise individual technique, balance, and isolated cardiovascular endurance—drive their demand among elite athletes. Furthermore, the increasing popularity of masters rowing and high-end recreational paddling contributes a steady demand stream for durable, mid-range performance models. The market is intrinsically linked to global sporting infrastructure and the investment capabilities of rowing organizations and dedicated individual athletes seeking marginal gains in performance.

Driving factors for sustained market expansion include the rising prominence of water sports globally, increased investment in athletic programs in educational institutions across North America and Europe, and the development of sophisticated digital training tools that complement high-performance shell usage. Moreover, manufacturers are continuously innovating to reduce boat weight while enhancing rigidity and durability, addressing the core needs of competitive users. The expansion of emerging rowing markets in Asia Pacific, particularly China and Japan, where investment in Olympic sports infrastructure is rapidly accelerating, provides substantial long-term growth opportunities for premium single scull manufacturers.

Single Scull Market Executive Summary

The Single Scull Market is experiencing robust business trends characterized by a dual focus on ultra-high-performance competitive shells and standardized, durable training models. Key industry players are increasingly leveraging advanced composite manufacturing techniques, leading to higher average selling prices (ASPs) for professional-grade equipment. The primary business shift observed is the migration toward subscription- or service-based maintenance agreements alongside traditional sales, particularly among institutional buyers like universities and national teams, aiming to maximize fleet longevity and performance consistency. Supply chain resilience, especially concerning the procurement of aerospace-grade carbon fiber and specialized resins, remains a critical strategic priority for market leaders, driving localized production or strong long-term supplier partnerships to mitigate geopolitical risks and logistics bottlenecks.

Regionally, North America and Europe currently dominate the market due to deep-rooted rowing traditions, well-funded collegiate sports programs, and high athlete participation rates. However, the Asia Pacific (APAC) region is projected to register the fastest growth rate, driven by significant government funding directed towards Olympic success and the establishment of new elite training centers, particularly in countries with extensive coastlines and navigable waterways. Latin America and the Middle East and Africa (MEA) present emerging market opportunities, constrained currently by lower infrastructure development but poised for gradual growth as rowing gains visibility through international events and targeted developmental programs sponsored by World Rowing. Infrastructure investment, especially in dedicated boathouses and training facilities, directly correlates with regional market maturity.

Segment trends highlight the dominance of carbon fiber materials, which capture the largest market share due to their superior stiffness-to-weight ratio, essential for competitive performance. Within the application segment, competition shells command the highest value per unit, although the training/recreational segment accounts for a greater volume of sales, reflecting broader participation levels. End-user analysis indicates that Rowing Clubs and Organizations represent the foundational buying bloc, driven by the need to refresh or expand their competitive fleets. The increasing segmentation within professional equipment—such as models tailored specifically for lighter or heavier rowers—demonstrates manufacturers’ efforts to capture niche performance optimization markets, supporting higher customization and premium pricing strategies across the competitive landscape.

AI Impact Analysis on Single Scull Market

User inquiries regarding AI's influence in the Single Scull Market primarily revolve around how artificial intelligence and machine learning can enhance athlete training, optimize boat design, and improve equipment lifespan. Key concerns focus on the integration of real-time performance analytics—such as stroke rate, power application symmetry, and biomechanical feedback—and the ethical implications of data privacy collected during training sessions. Users also frequently ask about AI-driven generative design methods for hull shaping, expecting optimization beyond traditional CFD (Computational Fluid Dynamics) simulations to achieve previously unattainable levels of hydrodynamic efficiency. Furthermore, there is considerable interest in how predictive maintenance algorithms, informed by sensor data, can alert users to potential structural weaknesses or material fatigue in high-stress areas of the scull, prolonging the effective competitive life of the equipment and justifying the high initial investment.

- AI-Powered Biomechanics Analysis: Real-time feedback systems integrated into the boat structure and riggers analyze stroke effectiveness, symmetry, and force curves, offering prescriptive guidance to athletes and coaches for immediate technique adjustments.

- Generative Design Optimization: Machine learning algorithms rapidly iterate through thousands of hull geometry variations based on desired speed, weight, and water conditions, leading to optimized, custom scull designs that minimize drag coefficients.

- Predictive Maintenance: Sensor arrays (e.g., strain gauges, accelerometers) embedded within carbon fiber layups collect fatigue data, which AI models analyze to forecast structural failure risks, enabling proactive repairs and extending equipment lifespan.

- Personalized Training Load Management: AI processes vast datasets of physiological and on-water performance metrics to recommend optimized training schedules and intensity levels tailored to the individual rower, minimizing injury risk and maximizing performance peaks.

- Automated Manufacturing Quality Control: Machine vision systems utilize AI for flawless detection of microscopic defects or imperfections during the composite layup and curing process, ensuring uniform structural integrity across all manufactured units.

DRO & Impact Forces Of Single Scull Market

The dynamics of the Single Scull Market are shaped significantly by interconnected drivers, restraints, and opportunities (DRO), which collectively define the impact forces influencing industry growth and market penetration. A primary driver is the increasing global focus on high-performance athletic achievement, coupled with substantial institutional investment in water sports, particularly in regions preparing for major international rowing events. This momentum is slightly countered by significant restraints, chiefly the extremely high capital expenditure required for acquiring elite single sculls, which utilize advanced, costly materials like aerospace-grade carbon composites, rendering them inaccessible to many developing clubs and individual athletes. Furthermore, the specialized nature of the product demands skilled technicians for maintenance and repair, contributing to higher operational costs over the equipment’s lifecycle.

Opportunities for market expansion are substantial, particularly through advancements in material science offering the potential for lighter, stronger, and more cost-effective production methods in the medium term. The rising global engagement in recreational and masters rowing, alongside increasing emphasis on fitness and well-being, expands the potential customer base beyond elite competitors to affluent enthusiasts seeking premium recreational shells. Strategic market penetration into the highly populated yet underserved Asian markets through localized manufacturing and distribution partnerships represents a critical opportunity for volume growth. The overall impact forces suggest a moderately high barrier to entry for new competitors due to technological complexity and established brand loyalty, but a strong growth trajectory driven by both elite sports funding and growing affluent participation.

Key impact forces include technological substitution risk—where alternative boat designs or training methods could potentially reduce demand—and the powerful influence of regulatory bodies such as World Rowing (FISA), which sets standards for competitive equipment dimensions and minimum weight, directly affecting design parameters. Economic impact forces, particularly global recessions or supply chain disruptions affecting composite material costs, can severely compress profit margins. Conversely, the sociological impact force related to the prestige and heritage associated with the sport of rowing reinforces consistent demand among established wealthy nations and institutions. Balancing high-tech, low-volume production with quality standardization and competitive pricing remains central to long-term market success.

Segmentation Analysis

The Single Scull Market segmentation provides a detailed structural overview of the diverse product offerings and end-user demands that constitute the industry. Analyzing the market based on material, application, and end-user allows manufacturers to tailor product development, pricing strategies, and marketing efforts efficiently. The underlying principle of segmentation in this market is the direct correlation between material science and performance, where the highest value segments are dictated by the use of advanced composites offering marginal speed advantages essential for competitive success. Understanding these boundaries helps stakeholders quantify the addressable market for standard recreational sculls versus specialized, custom-built Olympic-class shells.

The segmentation structure reveals a pronounced dichotomy between high-cost, high-performance competitive equipment and more durable, lower-cost training or recreational alternatives. Carbon Fiber dominates the high-performance material segment, commanding premium prices and serving elite institutions and individual competitors willing to invest heavily in speed. Fiberglass and wooden sculls, while significantly smaller in market value, maintain relevance in introductory training and traditional/masters rowing niches where durability and classical aesthetics are prioritized over absolute minimal weight. End-user segmentation further clarifies demand structure, showing that institutional purchases (Clubs, Universities) often involve fleet procurement, valuing bulk discounts and standardized maintenance features, whereas individual athlete purchases prioritize customization and absolute performance metrics.

These distinct segments respond differently to macroeconomic trends; for instance, competitive segments are heavily influenced by global sporting events and institutional funding cycles, while the recreational segment is more susceptible to general consumer wealth and trends in high-end leisure activities. Strategic segmentation allows market players to mitigate risk by ensuring diversification across these distinct demand drivers. Companies focused purely on elite competitive sculls face volatile demand linked to high-level athletic cycles, whereas those serving the broader educational and recreational markets benefit from more stable, albeit lower-margin, volume sales throughout the forecast period.

- By Material:

- Carbon Fiber Composites

- Fiberglass/Kevlar

- Wood (Traditional and Modern Hybrids)

- By Application:

- Competition (International and National Level)

- Training/Recreational (Club Level and Individual Use)

- By End-User:

- Rowing Clubs and Organizations

- Educational Institutions (Universities and Schools)

- Individual Professional Athletes

Value Chain Analysis For Single Scull Market

The Single Scull Market value chain begins with highly specialized upstream activities centered around the procurement and processing of raw composite materials. This includes securing high-modulus carbon fiber tows, advanced epoxy or vinyl ester resins, core materials (such as structural foam or honeycomb), and specialized hardware (e.g., high-performance bearings, specialized steel components for riggers). Success at the upstream stage hinges on establishing robust relationships with Tier 1 composite material suppliers, often requiring long-term contracts to ensure quality consistency and price stability, as input costs constitute a significant portion of the final product’s manufacturing expense. Quality control and material tracing are crucial at this stage to maintain the structural integrity and minimal weight standards required for competitive sculls.

Midstream activities involve the highly skilled and labor-intensive process of shell manufacturing. This involves precise mold preparation, the meticulous hand layup of composite materials, vacuum bagging and autoclave curing to achieve optimal strength-to-weight ratios, and subsequent hull finishing (sanding, painting, and fitting components). Manufacturing operations are typically centralized and rely heavily on proprietary intellectual property related to hull geometry (molds) and composite layup schedules. Effective manufacturing necessitates specialized tooling and adherence to extremely tight tolerances, making operational efficiency and waste reduction critical determinants of profitability. This stage also includes the integration of essential components such as specialized riggers, seating systems, and electronics.

Downstream activities focus on distribution, sales, and aftermarket support. Single sculls are often distributed through a combination of direct sales channels, catering to national teams and large institutions, and highly specialized indirect distributors or regional representatives who offer tailored fitting and rigging services. Due to the high-value nature and customization required, e-commerce typically serves as a lead generation tool rather than the primary point of sale, with personal consultation remaining crucial. Aftermarket support, including professional repairs, maintenance, and parts supply (e.g., specialized fittings, sliding seat rollers), is a vital component of the value proposition, ensuring customer satisfaction and long-term brand loyalty within the high-performance sporting community. The effectiveness of the service network directly impacts the perceived durability and value retention of the sculls.

Single Scull Market Potential Customers

The primary end-users and buyers of single sculls fall predominantly into institutional and elite athlete categories, defined by high performance requirements and substantial purchasing power. Rowing Clubs and Organizations represent the largest institutional buying segment, requiring fleets of varying performance levels for members ranging from novices to competitive masters. These organizations often prioritize fleet consistency, durability, and manufacturer reliability, often entering into long-term procurement agreements. Secondly, Educational Institutions, specifically university and high school rowing programs in regions like North America (NCAA) and the UK (Oxbridge), are major buyers, driven by regular equipment renewal cycles and the need to maintain competitive parity against rivals, often demanding the latest in composite technology.

The second major group consists of Individual Professional Athletes and dedicated amateur competitors. These buyers are typically highly sensitive to performance metrics, seeking customized equipment that provides a marginal competitive advantage. This segment is characterized by a high willingness to pay for premium materials, tailored ergonomics, and custom rigging setups. Purchases in this segment are less frequent but involve the highest average unit price due to extensive customization and specialized features. Furthermore, the emerging market of high-net-worth individuals engaged in masters rowing presents a growing potential customer base, seeking top-tier equipment for recreational yet serious fitness pursuits, valuing both performance and brand prestige.

A crucial niche customer segment involves National Rowing Federations and Olympic Training Centers. These governmental or quasi-governmental entities procure equipment in large batches for national teams, often demanding the absolute highest performance and the implementation of exclusive technological features. Their purchasing decisions are heavily influenced by technical specifications, established competitive track records, and the capacity of the manufacturer to provide immediate technical support during major international events. Satisfying the stringent demands of this segment often validates a manufacturer's technological leadership across the entire market.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $85.4 Million USD |

| Market Forecast in 2033 | $132.8 Million USD |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Concept2, Empacher, Filippi Boats, Hudson Boat Works, WinTech Racing, Sykes Racing, Nelo, Swift Racing, Vespoli, Resolute Racing Shells, Pocklington, Carl Douglas Racing Shells, Salani, Van Dusen Racing Shells, BBG, Maas Boat Company, Fluid Design, Croker Oars, Dreher Oars. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Single Scull Market Key Technology Landscape

The technological landscape of the Single Scull Market is dominated by advancements in composite engineering aimed at maximizing stiffness-to-weight ratios while ensuring hull longevity. The current state-of-the-art involves the strategic layering of unidirectional and woven carbon fiber fabrics, often combined with aramid fibers (Kevlar) in impact-prone areas, cured using vacuum infusion or autoclave processes to eliminate voids and achieve structural perfection. Hydrodynamic optimization relies heavily on advanced Computational Fluid Dynamics (CFD) modeling, allowing designers to precisely tune hull shapes to specific athlete weights and target speed ranges, minimizing wave drag and wetted surface area. Furthermore, the integration of advanced sensors (e.g., specialized strain gauges and GPS modules) is now standard, moving the technology focus beyond just materials to include real-time performance data capture and analysis.

A significant shift is occurring in the area of rigging technology, moving towards highly adjustable, quick-release systems that allow for precise setup changes of the pitch, span, and height of the oar locks (rigger settings) without compromising structural integrity. Manufacturers are utilizing CNC machining for high-precision rigger components, often made from specialized aluminum alloys or high-tensile carbon components, which reduce unnecessary weight while withstanding immense forces. This focus on component technology ensures that the total boat system is optimized for power transfer. Furthermore, there is continuous innovation in the sliding seat and foot stretcher interfaces, seeking to improve kinetic efficiency and minimize energy loss during the drive phase of the stroke, leading to highly engineered rail and roller systems with specialized low-friction materials.

The future technology trajectory points towards even greater digital integration and customization. Telemetry systems are becoming more sophisticated, allowing coaches to monitor scull performance remotely and in real time, aiding immediate tactical adjustments during training. The application of 3D printing technology is being explored for complex, non-structural components like custom seat molds or unique rigging brackets, enabling rapid prototyping and highly personalized fittings for elite athletes. Environmental considerations are also beginning to drive technology development, with increasing research into high-performance bio-resins and more sustainable, yet equally durable, core materials to reduce the environmental footprint of scull manufacturing, positioning sustainability as a key competitive technological differentiator in the next decade.

Regional Highlights

- North America (NA): Characterized by high market maturity, North America dominates the demand for single sculls, driven primarily by the robust collegiate rowing system (NCAA programs) and well-funded rowing clubs in regions like the Northeast, California, and the Pacific Northwest. Demand here is characterized by large institutional fleet purchases requiring standardized, high-performance equipment and strong aftermarket support. The market is highly competitive, with a mix of domestic and international suppliers vying for prestigious university contracts.

- Europe: Europe is the traditional heartland of competitive rowing, exhibiting the highest concentration of elite manufacturers (Empacher, Filippi, Nelo) and major competitive events. Demand is sustained by strong national federations, established clubs, and a vast base of masters and recreational rowers. The European market emphasizes artisanal quality alongside technological innovation, with notable strength in countries like Germany, Italy, and the UK. Customization and heritage branding play a significant role in purchasing decisions within this region.

- Asia Pacific (APAC): APAC is the fastest-growing market segment, fueled by governmental investment in sports infrastructure, particularly in preparation for major regional and global events in countries such as China, Japan, and Australia. While the market base is smaller than NA and Europe, the rate of institutional purchasing is accelerating rapidly. Growth opportunities are concentrated in establishing localized manufacturing and distribution hubs to meet increasing domestic demand and navigate complex logistics challenges across diverse geographical territories.

- Latin America: This region represents an emerging market with concentrated pockets of demand, mainly focused around major metropolitan areas and coastal nations (e.g., Brazil, Argentina). Market penetration is constrained by economic volatility and lower levels of institutional funding for rowing compared to established markets. However, targeted development programs and increasing awareness through international competitions are expected to provide gradual, steady growth, primarily in the training and recreational segments.

- Middle East and Africa (MEA): The MEA market is currently nascent, highly fragmented, and focused almost exclusively on niche elite training centers and high-end resorts catering to affluent expatriates. Growth potential is largely tied to significant government-led infrastructure projects (e.g., in the UAE and Saudi Arabia) aimed at developing aquatic sports facilities. The low base level provides substantial percentage growth potential, though absolute volume remains low, demanding a focus on premium, customized, and import-reliant distribution models.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Single Scull Market.- Empacher

- Filippi Boats

- Hudson Boat Works

- WinTech Racing

- Nelo

- Concept2 (Rigging Components and Accessories influence)

- Sykes Racing

- Swift Racing

- Vespoli

- Resolute Racing Shells

- Carl Douglas Racing Shells

- Salani

- Van Dusen Racing Shells

- Fluid Design

- BBG

- Pocklington

- Maas Boat Company

- Croker Oars (Significant influence on integrated performance)

- Dreher Oars (Significant influence on integrated performance)

- Durham Boat Company (Representing WinTech and associated brands)

Frequently Asked Questions

Analyze common user questions about the Single Scull market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected Compound Annual Growth Rate (CAGR) for the Single Scull Market?

The Single Scull Market is projected to exhibit a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033, driven by technological adoption and increasing global participation in competitive rowing.

Which material segment dominates the Single Scull Market in terms of value?

Carbon Fiber Composites dominate the market value segment due to their superior stiffness-to-weight ratio, essential for elite competitive sculls, commanding the highest average selling prices compared to fiberglass or wood alternatives.

Which geographical region is expected to demonstrate the fastest growth in scull demand?

The Asia Pacific (APAC) region is forecasted to show the fastest market growth, largely propelled by significant government investment in Olympic sports infrastructure and the rapid establishment of new elite rowing training centers across key nations like China and Australia.

How does AI impact the manufacturing process of single sculls?

AI primarily impacts manufacturing through Generative Design Optimization for hydrodynamic efficiency and Automated Quality Control systems that utilize machine vision to detect microscopic defects in composite layups, ensuring high structural integrity and consistency.

What are the primary restraints affecting the expansion of the Single Scull Market?

The key restraints include the extremely high initial capital expenditure required for purchasing performance-grade sculls and the reliance on specialized, volatile global supply chains for advanced composite materials like aerospace-grade carbon fiber.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager