Single Station Extrusion Blow Molding Machine Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434450 | Date : Dec, 2025 | Pages : 251 | Region : Global | Publisher : MRU

Single Station Extrusion Blow Molding Machine Market Size

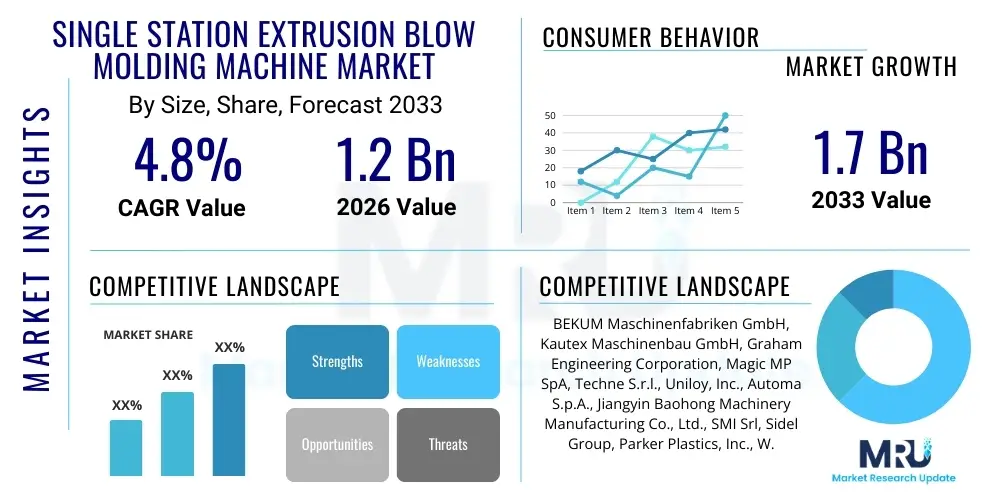

The Single Station Extrusion Blow Molding Machine Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at $1.2 Billion in 2026 and is projected to reach $1.7 Billion by the end of the forecast period in 2033.

Single Station Extrusion Blow Molding Machine Market introduction

The Single Station Extrusion Blow Molding Machine Market encompasses machinery designed for the continuous extrusion of a parison (molten plastic tube) which is then captured by a single mold station for blowing and cooling. These machines are foundational to the mass production of hollow plastic containers, bottles, tanks, and industrial components, typically characterized by their efficiency in high-volume production runs of mid-to-large-sized articles. The core functionality involves melting thermoplastic resins, extruding them vertically, and utilizing robust clamping systems to form the final product. Key products manufactured using this technology include jerrycans, drums, automotive ductwork, and various consumer packaging items.

Major applications of single station extrusion blow molding (EBM) technology span across the packaging, automotive, chemical, and consumer goods industries. In packaging, these machines are essential for producing containers requiring high barrier properties or large volumes, such as motor oil bottles, cleaning supplies containers, and chemical storage drums. Benefits of utilizing single station EBM systems include high operational throughput, exceptional repeatability in part dimensions, the ability to handle a wide variety of polymer types (HDPE, PP, PVC, PETG), and the ease of maintenance due to their relatively simple mechanical structure compared to multi-station systems. Furthermore, modern machines incorporate sophisticated hydraulic and electric controls to optimize cycle times and material usage, contributing to lower overall manufacturing costs per unit.

Driving factors for the expansion of this market include the relentless global demand for plastic packaging, particularly in emerging economies where industrialization and consumer spending are escalating. The shift towards lightweighting materials in the automotive sector also drives demand for blow-molded components that reduce vehicle weight and improve fuel efficiency. Moreover, continuous technological advancements focused on enhancing energy efficiency, improving parison control systems (such as MOOG or progressive programming), and integrating robotics for automated deflashing and secondary operations, significantly boost the appeal and adoption rates of new single station EBM machines across various manufacturing hubs worldwide.

Single Station Extrusion Blow Molding Machine Market Executive Summary

The Single Station Extrusion Blow Molding Machine Market is experiencing robust growth driven by favorable business trends centered around increased automation and the demand for specialized large-volume containers. Manufacturers are focusing intensely on developing hybrid (electric-hydraulic) and all-electric machines to meet stringent energy efficiency standards and reduce operational noise, thereby appealing to modern manufacturing facilities aiming for Industry 4.0 compliance. The trend toward customized, high-density polyethylene (HDPE) and polypropylene (PP) products, especially in the industrial and chemical storage sectors, necessitates the deployment of durable, single station machines capable of handling complex tooling and producing precise wall thicknesses. Consolidation among machinery suppliers and strategic partnerships aimed at geographic expansion, particularly into high-growth Asian markets, characterize the current competitive landscape.

Regionally, Asia Pacific maintains its dominance, spurred by massive investments in local manufacturing capabilities, particularly in China and India, which are rapidly expanding their capacities for consumer goods, automotive components, and agricultural chemical packaging. North America and Europe, while mature markets, demonstrate strong demand for sophisticated machinery focused on high precision, rapid mold changes, and sustainability features, such as compatibility with recycled resins (PCR). Geopolitical stability and local regulatory frameworks concerning plastic waste management and manufacturing subsidies significantly influence regional procurement decisions. The Middle East and Africa (MEA) are emerging as high-potential regions, driven by expansion in infrastructure development and subsequent growth in demand for piping, water tanks, and large industrial packaging.

In terms of segmentation, machines categorized by clamping force (e.g., 50-100 Tons and 100-200 Tons) are dominating the volume share, catering to standard container production (up to 50 liters). However, the segment concerning machines with over 200 Tons of clamping force is projecting the highest growth due to escalating demand for large industrial drums, intermediate bulk containers (IBCs), and large automotive fuel tanks. By application, the packaging sector remains the largest segment, but the industrial components and construction materials segments are exhibiting accelerated uptake, driven by specialized applications requiring robust, thick-walled parts. Material processing capabilities remain a critical differentiating factor, with machines optimized for HDPE dominating due to its widespread use in consumer and industrial packaging.

AI Impact Analysis on Single Station Extrusion Blow Molding Machine Market

User queries regarding AI's influence primarily revolve around optimizing operational efficiency, enhancing predictive maintenance capabilities, and improving material usage precision in the extrusion blow molding process. Users frequently ask how AI can manage complex variables like parison temperature profiles, melt elasticity, and cooling cycles to minimize scrap rates and maximize throughput. There is significant concern about the technical difficulty and cost associated with retrofitting existing hydraulic machines with advanced AI-driven sensor arrays and control systems. Expectations center on AI providing real-time quality control checks, moving beyond traditional statistical process control (SPC) towards instantaneous adjustment of machine parameters based on visual or thermal inspection data, thereby ensuring superior wall thickness distribution and material integrity.

The implementation of Artificial Intelligence and Machine Learning (ML) algorithms is set to revolutionize the efficiency and sustainability of single station EBM operations. AI systems can analyze vast datasets concerning historical production runs, material properties, ambient temperature variations, and machine wear patterns to construct highly accurate predictive models. This predictive capability allows operators to anticipate equipment failure, schedule preventative maintenance precisely when needed, and adjust operational parameters before defects occur, leading to significant reductions in unplanned downtime. Furthermore, ML models are being utilized to optimize energy consumption by modulating heating elements and chiller units based on real-time feedback loops, contributing directly to lower manufacturing utility costs and a reduced carbon footprint for blow-molding operations.

Crucially, AI assists in achieving precision in parison programming—the most complex aspect of extrusion blow molding. By employing sophisticated algorithms, AI can determine the optimal axial distribution of plastic material within the parison to ensure uniform wall thickness in complex container geometries. This capability minimizes material overconsumption in areas that do not require excessive strength, leading to substantial raw material savings. While the initial investment in AI-enabled machinery is higher, the long-term benefits derived from increased operational uptime, reduced material waste (potentially 5% to 15% savings), and consistent product quality firmly establish AI as a crucial technological differentiator in high-end Single Station Extrusion Blow Molding machinery.

- AI-Driven Predictive Maintenance: Reduces unplanned downtime by forecasting component failure based on vibration and temperature analysis.

- Optimized Parison Control: Uses ML to adjust melt flow and extrusion speed in real-time for precise wall thickness distribution.

- Enhanced Quality Inspection: Integrates visual AI (machine vision) for high-speed detection of defects like pinholes or flash variations.

- Energy Consumption Optimization: ML algorithms manage hydraulic pump speeds and heater profiles to minimize power usage per cycle.

- Automated Process Parameter Tuning: Allows the machine to self-adjust critical variables based on resin batch variations and ambient conditions.

DRO & Impact Forces Of Single Station Extrusion Blow Molding Machine Market

The market dynamics are defined by several critical factors: Drivers include the pervasive global need for packaging, particularly industrial containers and specialized automotive parts, coupled with continuous innovation toward higher efficiency and automation. Restraints primarily involve the high capital investment required for advanced machinery, volatile raw material prices (especially polymers like HDPE), and increasingly stringent environmental regulations targeting single-use plastics and recycling mandates. Opportunities arise from expanding industrial applications (e.g., medical devices, specialized technical parts) and the untapped potential in developing economies seeking localized manufacturing capabilities. The overarching impact forces—market concentration, technological advancement, substitution threat, and regulatory pressures—dictate the speed and direction of market growth, forcing manufacturers toward sustainable and precise molding solutions.

Key drivers significantly shaping market expansion include the sustained growth of the consumer goods and fast-moving consumer goods (FMCG) sectors globally, which rely heavily on blow-molded containers for liquids and solids. Furthermore, the specialized requirements of the automotive industry for high-performance fluid reservoirs, air ducts, and fuel systems, often manufactured using the single station EBM process due to its ability to handle complex geometries and engineering plastics, provide a stable demand stream. The continual pursuit of operational efficiency through machine speed and reduced cycle times also acts as a primary driver, compelling end-users to upgrade to technologically superior single station models that offer higher output rates and better control over material distribution.

Conversely, the market faces significant hurdles, notably the substantial capital expenditure required to purchase and install high-tonnage single station EBM machines, which can deter smaller manufacturers or those in emerging markets. Economic instability can exacerbate the volatility of polyethylene and polypropylene prices, directly affecting the cost structure of blow-molded products and subsequently impacting machine purchasing decisions. Regulatory restraints, such as plastic bans and stricter recycling mandates in Europe and North America, force machine manufacturers to redesign equipment to efficiently handle recycled or bio-based polymers, adding complexity to machine design and operation. Despite these restraints, the opportunity to enter specialized markets, such as the production of fluorinated barrier packaging for aggressive chemicals, represents a high-margin growth avenue.

Segmentation Analysis

The Single Station Extrusion Blow Molding Machine Market is meticulously segmented based on key operational and structural parameters, allowing for detailed analysis of market needs and trends across various industrial applications. Primary segmentation revolves around the machine type, notably categorized by accumulator head volume and the number of layers (single layer vs. co-extrusion). Furthermore, machine capacity, often defined by the maximum container volume it can produce (e.g., below 5 liters, 5L-50L, and above 50 liters), offers crucial insight into end-user preference, ranging from small consumer packaging to large industrial storage solutions. Geographically, the market is dissected into major regions, reflecting differences in industrial maturity, regulatory environment, and adoption rate of automation technologies.

Another pivotal dimension of segmentation is the clamping force measured in tons, which dictates the size and complexity of the molds the machine can handle. Machines with higher clamping forces are essential for producing large industrial drums, automotive components, and complex multi-cavity molds. Additionally, the type of thermoplastic resin processed—primarily High-Density Polyethylene (HDPE), Polypropylene (PP), and Polyvinyl Chloride (PVC)—creates distinct market segments, as machines are often optimized for specific melt characteristics and processing temperatures. This nuanced segmentation is vital for suppliers to tailor machine features, such as screw design and heating zones, to specific material requirements of their target customers, thereby ensuring optimal performance and material efficiency in demanding applications.

- By Machine Type:

- Standard Single Layer EBM Machine

- Co-Extrusion EBM Machine (Multi-Layer)

- Reciprocating Screw EBM Machine

- By Clamping Force (Tonnage):

- Less than 50 Tons

- 50 Tons to 100 Tons

- 100 Tons to 200 Tons

- Above 200 Tons

- By Application:

- Packaging (Bottles, Jars, Jerrycans)

- Automotive Components (Fuel Tanks, Ducts, Reservoirs)

- Industrial & Chemical (Drums, IBCs, Storage Tanks)

- Construction (Piping, Conduits)

- Consumer Goods & Toys

- By Material Processed:

- High-Density Polyethylene (HDPE)

- Polypropylene (PP)

- Polyvinyl Chloride (PVC)

- Others (PETG, PC, Polyamides)

Value Chain Analysis For Single Station Extrusion Blow Molding Machine Market

The value chain for the Single Station Extrusion Blow Molding Machine market begins with the upstream suppliers of critical raw materials, primarily specialized steel alloys for molds and machine frames, high-precision hydraulic components (pumps, valves), electrical components (PLCs, servo motors, heating elements), and sophisticated control system software. Suppliers in this segment focus on providing components that ensure high reliability, energy efficiency, and operational precision, which are crucial differentiators for the final machine builder. Intense competition among component suppliers drives innovation in areas such as energy-saving servo-hydraulic systems and advanced temperature control units, directly influencing the overall quality and efficiency of the blow molding machinery produced.

Mid-stream activities are centered on the core manufacturing processes conducted by the original equipment manufacturers (OEMs). This involves complex mechanical design, assembly, testing, and integration of the specialized extrusion unit, clamping mechanisms, and parison control systems. OEMs manage direct distribution channels, serving large industrial conglomerates that purchase machinery in bulk, as well as indirect channels involving distributors and agents who provide localized sales, installation, and after-sales support, particularly in geographically diverse markets. The effectiveness of the distribution channel is heavily reliant on the technical expertise of local agents to handle complex installation and maintenance procedures, ensuring minimal operational downtime for the end-user.

The downstream segment encompasses the end-users—the plastic converters and manufacturers across various sectors. These buyers purchase the single station EBM machines to transform thermoplastic resins (the primary consumable input, also supplied downstream) into finished products, which are then distributed to retailers, automotive assembly lines, or industrial consumers. The value addition at this stage involves complex mold design, efficient production scheduling, and specialized finishing operations such as leak testing, cutting, and packaging. Direct sales channels are often employed for large, highly specialized machinery deals, allowing OEMs to provide bespoke training and technical service agreements directly to the client, whereas smaller, standard machines might move through established regional distributors.

Single Station Extrusion Blow Molding Machine Market Potential Customers

Potential customers for Single Station Extrusion Blow Molding Machines are primarily large-scale plastic converters and captive manufacturing divisions within major corporations across specific industrial verticals. The core buyer demographic comprises packaging manufacturers specializing in medium-to-large containers (5 liters to 250 liters), where the single station setup excels in producing high-volume, robust products such as chemical drums, oil containers, and household cleaning product packaging. These buyers prioritize machine robustness, consistent wall thickness control, and the ability to process recycled content effectively, aligning with increasingly stringent corporate sustainability goals. The decision-makers are typically Vice Presidents of Operations, Production Managers, and Chief Procurement Officers focused on long-term Total Cost of Ownership (TCO) rather than mere sticker price.

A secondary, yet rapidly growing, segment of potential customers includes specialized manufacturers in the automotive and industrial components sector. Automotive original equipment manufacturers (OEMs) or their Tier 1 suppliers require single station EBM systems for producing highly technical parts like air intake manifolds, selective catalytic reduction (SCR) tanks, and highly specialized fuel tanks, often involving complex 3D blow molding or co-extrusion capabilities. These buyers demand extreme precision, tight dimensional tolerances, and certification for handling high-performance engineering plastics. For industrial applications, buyers include manufacturers of large storage tanks for water, wastewater components, and large agricultural sprayer parts, where machine tonnage and platen size are the determining purchasing criteria.

Furthermore, emerging markets, particularly in Southeast Asia and Latin America, represent high-growth potential customer bases consisting of regional packaging firms scaling up their local production capabilities. These customers are often price-sensitive but highly motivated by efficiency gains and machine reliability, driving demand for cost-effective, durable machinery capable of continuous operation in challenging environments. The shift towards large-scale infrastructure projects globally also creates opportunities among customers needing large-diameter plastic pipes and geo-textile containers used in construction and municipal applications, further diversifying the end-user profile beyond traditional consumer packaging.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $1.2 Billion |

| Market Forecast in 2033 | $1.7 Billion |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | BEKUM Maschinenfabriken GmbH, Kautex Maschinenbau GmbH, Graham Engineering Corporation, Magic MP SpA, Techne S.r.l., Uniloy, Inc., Automa S.p.A., Jiangyin Baohong Machinery Manufacturing Co., Ltd., SMI Srl, Sidel Group, Parker Plastics, Inc., W. Müller GmbH, Jomar Corp., Chen Hsong Holdings Limited, Queen's Machinery Co., Ltd., Fuxin Machinery, Chia Ming Machinery Co., Ltd., Plastiblow S.r.l., Everplast Machinery Co., Ltd., AOKI Technical Laboratory, Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Single Station Extrusion Blow Molding Machine Market Key Technology Landscape

The technological landscape of the Single Station Extrusion Blow Molding Machine market is rapidly evolving, driven by the need for enhanced energy efficiency, material flexibility, and superior quality control. A fundamental technological shift is the transition from purely hydraulic systems to hybrid (servo-hydraulic) or fully electric machine drives. Servo-hydraulic systems use variable speed pumps controlled by servo motors, resulting in significant energy savings (up to 40% compared to traditional hydraulics) and quieter operation, while maintaining the high clamping forces necessary for large parts. Fully electric machines offer the highest precision and repeatability, critical for intricate automotive components, but are typically limited to smaller-to-medium container sizes due to cost and technical complexity in scaling clamping force.

Another crucial technological advancement involves sophisticated parison control systems, which utilize MOOG controllers and proportional valves to dynamically adjust the extrusion gap in the die head as the parison descends. This programmable parison capability is essential for ensuring uniform wall thickness across parts with complex contours, minimizing material usage, and maximizing structural integrity. Multi-layer co-extrusion technology has also become standard for single station machines serving the food, beverage, and chemical industries, enabling the creation of containers with integrated barrier layers (e.g., EVOH or tie layers) to extend shelf life or safely contain aggressive substances. These co-extrusion heads require highly precise melt flow control and temperature management across multiple extruders feeding the same die.

Furthermore, machine builders are increasingly integrating Industry 4.0 concepts, incorporating advanced sensors for real-time monitoring of melt temperature, pressure, and mold cooling circuits. Integrated software allows for machine-to-machine communication, remote diagnostics, and data analytics capabilities that leverage AI/ML for process optimization and fault prediction. Automated deflashing, integrated robotic trimming, and in-line quality inspection systems (using thermal imaging or vision systems) are now standard features on high-end single station machines, contributing to higher yield rates and reduced reliance on manual labor. These technological innovations collectively position modern single station EBM machines as intelligent, highly efficient production units.

Regional Highlights

The Asia Pacific (APAC) region stands as the undisputed leader in the Single Station Extrusion Blow Molding Machine Market, both in terms of production capacity and consumption. This dominance is fundamentally driven by the region's massive manufacturing base, particularly in China, India, and Southeast Asian nations, where robust economic growth fuels demand for consumer goods packaging, automotive manufacturing, and chemical storage. Governments in these regions often incentivize local manufacturing and infrastructure development, leading to continuous investment in new, high-speed machinery. While the focus remains on high-volume production, there is a growing trend in APAC towards adopting advanced co-extrusion and high-tonnage machines to meet the specialized needs of export markets and increasing local standards for industrial containers.

Europe represents a mature but technologically sophisticated market, characterized by stringent environmental regulations and a strong emphasis on precision engineering and efficiency. European manufacturers predominantly seek high-end, all-electric or hybrid single station EBM machines that offer excellent repeatability and minimal energy consumption, aligning with the EU's Green Deal objectives. The demand is heavily focused on machines capable of processing high percentages of Post-Consumer Recycled (PCR) content and bio-plastics. Countries like Germany and Italy are major producers and consumers of this machinery, catering to specialized applications in the automotive (3D blow molding) and pharmaceutical sectors, prioritizing quality and sustainability over sheer volume.

North America maintains a consistent market share, driven primarily by the need for replacement and modernization of existing aging fleets, alongside stable demand from the industrial and chemical packaging sectors. The US market, in particular, exhibits high demand for large-capacity, high-tonnage machines (over 200 tons) used for manufacturing large drums, outdoor equipment, and specialty containers. The increasing trend towards reshoring manufacturing operations and the adoption of automation technologies, including robotic handling systems integrated with EBM units, are key market drivers. Latin America and the Middle East & Africa (MEA) are emerging regions, where infrastructure development (water tanks, piping) and expansion of the petrochemical industry drive moderate but accelerating demand for standard, reliable single station machinery.

- Asia Pacific (APAC): Market leader driven by rapid industrialization, large consumer base, and significant investments in packaging and automotive manufacturing, particularly in China and India.

- Europe: High-value market focusing on technologically advanced, energy-efficient hybrid and all-electric machines, compliance with strict recycling mandates, and specialty applications like 3D blow molding.

- North America: Stable demand fueled by fleet modernization, strong industrial packaging sector, and high adoption rates of large-tonnage machinery for large container and automotive part production.

- Latin America (LATAM): Growth spurred by expanding local manufacturing capabilities, infrastructure projects, and increasing consumer packaging needs, focusing primarily on cost-effective, durable machinery.

- Middle East & Africa (MEA): Emerging market driven by petrochemical industry growth, construction projects, and subsequent requirements for industrial drums, storage tanks, and large-scale water containers.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Single Station Extrusion Blow Molding Machine Market.- BEKUM Maschinenfabriken GmbH

- Kautex Maschinenbau GmbH

- Graham Engineering Corporation

- Magic MP SpA

- Techne S.r.l.

- Uniloy, Inc.

- Automa S.p.A.

- Jiangyin Baohong Machinery Manufacturing Co., Ltd.

- SMI Srl

- Sidel Group

- Parker Plastics, Inc.

- W. Müller GmbH

- Jomar Corp.

- Chen Hsong Holdings Limited

- Queen's Machinery Co., Ltd.

- Fuxin Machinery

- Chia Ming Machinery Co., Ltd.

- Plastiblow S.r.l.

- Everplast Machinery Co., Ltd.

- AOKI Technical Laboratory, Inc.

Frequently Asked Questions

Analyze common user questions about the Single Station Extrusion Blow Molding Machine market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary technical difference between single station and double station extrusion blow molding machines?

A single station EBM machine uses one mold for the entire cycle (extrusion, clamping, blowing, cooling, and ejection), offering simpler construction and often higher output for very large containers. A double station machine uses two mold stations, allowing the machine to clamp, blow, and cool in one station while the other station is extruding a new parison, typically resulting in higher overall throughput for smaller to medium parts due to optimized cycle time utilization.

How significant is the adoption of all-electric technology in the single station EBM market?

The adoption of all-electric technology is highly significant, especially in mature markets like Europe and North America, driven by demands for reduced energy consumption, cleaner operation, and higher precision. While electric machines dominate smaller clamping force segments (under 50 tons), hybrid servo-hydraulic systems remain the preferred choice for large-capacity single station machines due to their cost-effectiveness in generating high tonnage clamping force.

Which materials are most commonly processed by single station extrusion blow molding machines?

High-Density Polyethylene (HDPE) is the most commonly processed material, owing to its excellent stiffness, chemical resistance, and wide use in packaging for industrial and household chemicals. Polypropylene (PP) is also widely used, particularly for high-temperature applications or specialized technical components. Other frequently processed materials include PVC, PETG, and various engineering plastics requiring advanced temperature control capabilities.

What role does programmable parison control play in the efficiency of single station EBM?

Programmable parison control (PPC) is crucial for efficiency as it allows the operator to control the wall thickness distribution of the parison axially. By adjusting the die gap during extrusion, PPC ensures that material is placed precisely where structural strength is needed (e.g., corners, handles), minimizing material waste in non-critical areas, thereby reducing overall container weight and raw material costs while maintaining product integrity.

Which application segment drives the highest revenue in the single station EBM market?

The Packaging application segment drives the highest revenue, primarily due to the constant, large-scale global demand for containers ranging from small consumer bottles to large industrial jerrycans and drums. Within packaging, the industrial and chemical sub-segment requiring robust, high-volume containers (often produced exclusively on single station machines) contributes substantially to machine sales revenue and market valuation.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager