Single-Use Technologies for the Biologic Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436692 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Single-Use Technologies for the Biologic Market Size

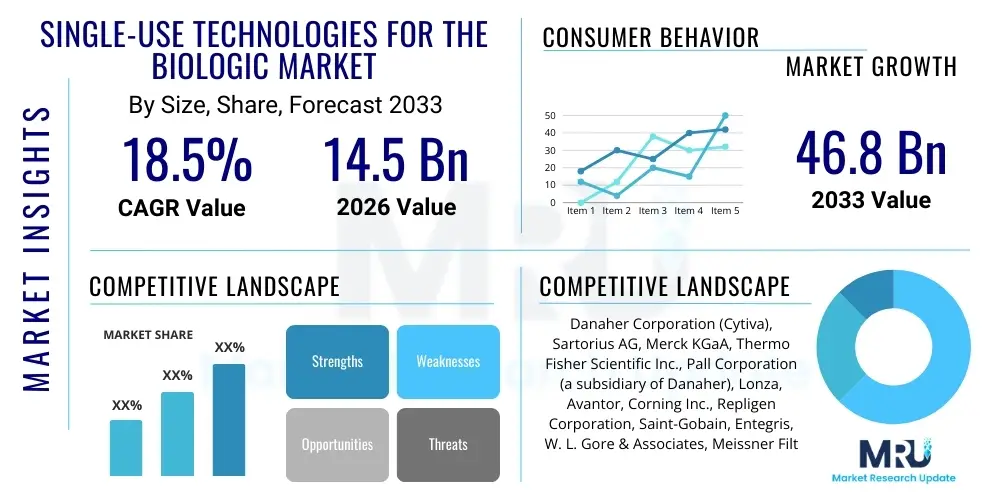

The Single-Use Technologies for the Biologic Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 18.5% between 2026 and 2033. The market is estimated at USD 14.5 Billion in 2026 and is projected to reach USD 46.8 Billion by the end of the forecast period in 2033.

Single-Use Technologies for the Biologic Market introduction

The Single-Use Technologies (SUTs), often referred to as disposable bioprocessing systems, encompass a range of pre-sterilized equipment and components designed for a single batch of biopharmaceutical production. These systems, which include bioreactors, mixers, storage bags, filtration units, and connection devices, are pivotal in modern biologic manufacturing processes, replacing traditional stainless steel infrastructure. The core value proposition of SUTs lies in their ability to reduce turnaround time, eliminate complex and expensive Cleaning-In-Place (CIP) and Sterilization-In-Place (SIP) procedures, and minimize the risk of cross-contamination, thereby significantly enhancing operational flexibility and cost-efficiency in drug development and manufacturing.

The primary applications of SUTs span the entire bioproduction workflow, from upstream cell culture and fermentation to downstream purification, formulation, and fill/finish operations. Major biological products benefiting from SUT adoption include monoclonal antibodies (mAbs), vaccines, cell and gene therapies (CGT), and recombinant proteins. The rapid expansion of the global biologics pipeline, particularly in novel therapeutic areas like personalized medicine and high-potency drugs, has necessitated scalable, adaptable, and compliant manufacturing solutions, which SUTs are uniquely positioned to provide. Furthermore, the modular nature of SUTs supports smaller, decentralized production facilities and allows manufacturers to respond quickly to fluctuating demand, such as during pandemic preparedness or rapid clinical trial material production.

Driving factors for sustained market growth include stringent regulatory standards promoting contamination control, the increasing outsourcing of biomanufacturing activities to Contract Development and Manufacturing Organizations (CDMOs), and continuous technological advancements leading to robust and sophisticated single-use components. The ongoing evolution in material science, focusing on low leachables and extractables (E&L) films, is mitigating historical concerns regarding product safety and integrity, further cementing the role of SUTs as the standard platform for future biologic manufacturing. The integration of advanced sensor technology within single-use bags and reactors also improves process monitoring and control, delivering enhanced consistency and yield compared to older manufacturing paradigms.

Single-Use Technologies for the Biologic Market Executive Summary

The Single-Use Technologies for the Biologic Market is characterized by robust commercial trends centered on consolidation, standardization, and workflow integration. Key business trends include aggressive merger and acquisition activities, driven by established vendors seeking to expand their portfolio breadth—especially in high-growth segments like large-volume bioreactors and aseptic fluid transfer systems. There is a strong industry push towards developing universal standards for single-use components, aimed at improving supply chain resilience and ensuring compatibility between different vendor systems, a critical concern highlighted by recent global disruptions. Furthermore, CDMOs are heavily investing in fully single-use facilities, recognizing that this model offers faster time-to-market and lower capital expenditure compared to traditional fixed-asset stainless steel plants.

Regionally, North America maintains its dominance due to a mature biopharmaceutical ecosystem, extensive R&D spending, and the presence of major market players and early technology adopters. However, the Asia Pacific (APAC) region is projected to exhibit the highest growth rate, fueled by substantial government initiatives supporting domestic biotechnology sectors, increasing foreign direct investment in biomanufacturing facilities in China and India, and the rising demand for affordable biosimilars and vaccines. Europe remains a significant market, driven by favorable regulatory environments and a strong presence in vaccine production and specialty biologics manufacturing, with particular focus on implementing SUTs in continuous bioprocessing applications across countries like Germany and Ireland.

Segment trends reveal that the 'Bioreactors and Fermenters' category holds a commanding share, driven by their necessity in upstream processing of high-titer cell cultures. However, 'Single-Use Filtration Assemblies' and 'Aseptic Connectors' are experiencing accelerated growth, reflecting the intense focus on ensuring product quality and sterility during critical downstream and fluid management operations. In terms of end-users, CDMOs represent the fastest-growing segment, leveraging the flexibility of SUTs to manage diverse client pipelines efficiently. The long-term trend points toward fully integrated, standardized, and closed-system single-use workflows that minimize manual interventions, thereby reducing operational variability and maintaining strict regulatory compliance across global manufacturing sites.

AI Impact Analysis on Single-Use Technologies for the Biologic Market

User inquiries concerning AI's integration into the Single-Use Technologies market predominantly revolve around three critical themes: optimizing process yields, ensuring quality control using predictive analytics, and enhancing the resilience of the complex SUT supply chain. Users are keenly interested in how machine learning algorithms can analyze vast datasets generated by single-use sensors (e.g., pH, dissolved oxygen, temperature) to predict optimal operating parameters in real-time within disposable bioreactors, thus maximizing cell viability and protein yield. Concerns often focus on the validation of AI-driven control systems in heavily regulated GMP environments and the security of proprietary bioprocessing data handled by these smart systems. Users expect AI to mitigate risks associated with single-use components, such as early detection of potential leachables or film integrity failures, transforming reactive maintenance into proactive quality assurance protocols.

AI's primary influence is manifesting in enhancing the intelligence and efficiency of SUT workflows. By applying predictive modeling, AI analyzes historical batch data, sensor readings, and material lot quality information to fine-tune bioprocessing parameters far beyond human capability. This capability is crucial for maximizing the yield from expensive cell culture media and ensuring consistent product quality across multiple disposable batches. Furthermore, AI systems are being developed to automate and standardize complex downstream steps, such as chromatography and ultrafiltration, where single-use assemblies are frequently employed, leading to reduced processing time and minimizing material waste, a critical factor for disposable systems.

In the domain of supply chain and inventory management, AI algorithms are playing an increasingly vital role in forecasting demand for specific single-use components, addressing the industry's historical vulnerability to supply bottlenecks. Given the lengthy lead times for specialized films and resins, AI helps manufacturers and end-users maintain optimal safety stock levels, predict potential material shortages based on global logistics data, and optimize the geographic distribution of SUT production sites. This digital transformation, driven by AI, is fundamentally shifting SUTs from simple disposable tools to integrated, data-rich components of a highly optimized, automated biomanufacturing ecosystem.

- AI optimizes bioprocess parameters in disposable bioreactors for maximal yield.

- Predictive maintenance driven by ML algorithms detects potential single-use component failures (e.g., film breach, sensor drift) proactively.

- Enhanced quality control through real-time data analysis of critical process parameters (CPPs) in SUTs.

- AI-driven supply chain forecasting improves inventory management and mitigates risks associated with long lead times for specialized single-use materials.

- Automation of complex downstream purification steps using AI to manage single-use chromatography columns and filtration stacks.

DRO & Impact Forces Of Single-Use Technologies for the Biologic Market

The market for Single-Use Technologies is shaped by a confluence of powerful drivers related to operational efficiency and the biological complexity of modern therapeutics, counterbalanced by inherent limitations such as waste management and material compatibility risks. The primary drivers include the accelerated development timelines for novel biologics, such as cell and gene therapies which thrive in smaller, highly flexible single-use environments, and the economic benefit derived from eliminating CIP/SIP validations. Restraints primarily center on the environmental impact of increased plastic waste and the persistent, complex challenge of ensuring that leachables and extractables from plastic films do not compromise the drug product safety or efficacy, requiring rigorous regulatory scrutiny and vendor qualification. Opportunities are abundant, specifically in the integration of SUTs into continuous bioprocessing schemes and the expansion into emerging markets where rapid, low-CAPEX facility deployment is essential.

The core impact force driving market expansion is the global strategic shift toward flexible manufacturing platforms. Biopharmaceutical companies require the ability to rapidly scale production up or down, or to quickly switch between different products within the same facility (multi-product facilities). SUTs facilitate this flexibility, significantly lowering the barrier to entry for smaller biotech firms and enabling large pharma companies to adapt their global manufacturing network more dynamically. Furthermore, the stringent quality requirements for biologics necessitate closed and aseptic fluid paths, which SUTs inherently provide through pre-sterilized, sealed systems. This factor significantly reduces the operational risk associated with microbial contamination, a critical consideration for maintaining Good Manufacturing Practice (GMP) compliance.

Conversely, the impact of plastic waste generation remains a critical impedance. While vendors are exploring sustainable materials and recycling programs, the sheer volume of disposable plastic components presents a logistical and environmental burden that governments and end-users are increasingly scrutinizing. Addressing this restraint through advanced material science (e.g., bio-based or readily recyclable polymers) and enhanced waste management infrastructure represents a significant opportunity. The overarching impact forces thus create a landscape where technological innovation—particularly in materials and automation—is crucial for overcoming sustainability challenges and maintaining the exponential growth trajectory established by the efficiency benefits.

Segmentation Analysis

The Single-Use Technologies market is primarily segmented based on the type of product, the specific application in the bioprocessing workflow, and the end-user profile. Product segmentation is diverse, reflecting the various stages of biologic manufacturing, encompassing large-scale systems like single-use bioreactors and smaller, specialized components such as connectors and sensors. Application segmentation details whether the SUTs are used in upstream processing (cell culture), downstream processing (purification and filtration), or formulation and fill/finish operations, providing insights into where the highest capital investment and operational usage occur. Finally, end-user segmentation differentiates between pharmaceutical companies, Contract Development and Manufacturing Organizations (CDMOs), and academic research institutes, illustrating the commercial uptake across different business models.

Further granularity in segmentation often addresses the scale and complexity of the SUTs. For instance, bioreactors are segmented by volume (e.g., 50 L, 200 L, 1000 L and above), reflecting the trend towards increasing size capability for commercial manufacturing while maintaining single-use benefits. Downstream processing segments include various filtration technologies (tangential flow filtration, depth filtration) and chromatography systems, all integrated into disposable manifolds. This detailed segmentation helps suppliers tailor their offerings precisely to the needs of different manufacturing scales and therapeutic modalities, such as smaller volume requirements typical of cell and gene therapy production compared to the large-scale needs of monoclonal antibody production.

The dominance of specific segments is tied directly to current biomanufacturing bottlenecks. The high growth rate observed in components like single-use mixers and storage bags highlights the need for reliable, aseptic handling of large volumes of media and buffers throughout the process. Segmentation analysis confirms that while large pharmaceutical companies still constitute the largest revenue base, the fastest growth acceleration is being witnessed within the CDMO sector, which requires highly standardized and interoperable SUT components to service a wide array of clients and diverse therapeutic projects.

- By Product:

- Single-Use Bioreactors and Fermenters

- Single-Use Mixers

- Single-Use Storage Bags and Containers

- Single-Use Filtration Assemblies

- Tubing, Connectors, and Fittings (Aseptic and Standard)

- Single-Use Probes and Sensors

- Single-Use Chromatography Columns

- By Workflow:

- Upstream Processing (Cell Culture and Media Preparation)

- Downstream Processing (Purification and Filtration)

- Process Development and Clinical Trials

- Formulation and Fill/Finish

- By Application:

- Monoclonal Antibodies (mAbs) Production

- Vaccine Production

- Cell and Gene Therapy Manufacturing

- Recombinant Proteins

- By End-User:

- Pharmaceutical and Biotechnology Companies

- Contract Development and Manufacturing Organizations (CDMOs)

- Academic and Research Institutes

Value Chain Analysis For Single-Use Technologies for the Biologic Market

The value chain for Single-Use Technologies is complex, starting with specialized polymer and film material sourcing (upstream) and extending through rigorous manufacturing, sterilization, distribution, and final end-user utilization (downstream). The upstream segment is dominated by a few specialized chemical and material science companies that produce the high-grade, biocompatible resins and multilayer films essential for single-use bags and bioreactors. This stage is crucial, as the performance and regulatory compliance of the final SUT product are intrinsically linked to the quality and consistency of these raw materials, particularly regarding leachables and extractables profiles. Key manufacturers must manage intellectual property surrounding advanced film structures (e.g., low-density polyethylene layers, barrier films, contact layers) and ensure robust supply chain control over these foundational components, often sourced globally, which introduces logistical vulnerabilities.

The mid-stream segment involves the integration and assembly of these films, tubing, connectors, and sensors into certified, customized systems. Major SUT vendors perform precision welding, rigorous testing, and final sterilization (usually gamma irradiation) before packaging. This manufacturing phase requires significant investment in cleanroom facilities and sophisticated automation to ensure product sterility and consistency across high-volume production lines. The integration of proprietary sensors and advanced monitoring capabilities adds technological value at this stage. Following manufacturing, the distribution channel plays a vital role, often leveraging specialized logistics providers capable of handling temperature-sensitive or highly fragile sterile components, ensuring the integrity of the SUTs until they reach the biomanufacturing suite.

The downstream analysis focuses on the end-user adoption and post-use lifecycle management. Distribution channels often operate through a mix of direct sales forces, especially for large, customized bioreactor systems sold to major pharmaceutical clients, and indirect distribution networks (third-party distributors) for standardized components and consumables, which is prevalent in smaller biotech or academic settings. The post-use phase, encompassing waste handling and disposal, increasingly influences purchasing decisions. Customers favor vendors who offer comprehensive waste management solutions or designs incorporating sustainable materials, reflecting growing regulatory and corporate environmental responsibility pressures, completing the value cycle by integrating sustainability considerations back into the upstream material selection process.

Single-Use Technologies for the Biologic Market Potential Customers

The primary consumers and end-users of Single-Use Technologies in the biologic market are segmented based on their operational scope and manufacturing needs, with Pharmaceutical and Biotechnology Companies forming the bedrock of demand. These large entities use SUTs extensively across their internal clinical trial manufacturing, process development, and increasingly, commercial production for high-value biologics like mAbs and specialty drugs. Their primary motivation for adopting SUTs centers on risk mitigation (contamination avoidance), flexibility in facility utilization, and rapid deployment capabilities when launching new products or securing manufacturing capacity swiftly. They often demand highly customized, large-volume single-use solutions integrated with advanced monitoring and process control systems.

Contract Development and Manufacturing Organizations (CDMOs) represent the fastest-growing customer segment. CDMOs thrive on efficiency and flexibility, necessitating the capability to swiftly switch between manufacturing campaigns for different clients and diverse products (vaccines, proteins, cell therapies). SUTs are foundational to the CDMO business model, allowing them to minimize facility downtime between batches and avoid the extensive revalidation required with stainless steel systems. They are heavy users of standardized SUT consumables, aseptic connectors, and medium-scale bioreactors (200L to 1000L), valuing high interoperability between different suppliers to ensure supply chain robustness and meet client-specific technology preferences.

A third, rapidly expanding customer base includes research institutions, university core facilities, and smaller, emerging biotechnology startups focused specifically on Cell and Gene Therapies (CGT). CGT manufacturing typically involves small batch sizes, extremely high product value, and critical sterility requirements—attributes perfectly matched by single-use systems. These customers prioritize small, functionally closed SUTs (e.g., cell culture bags, specialized tubing sets) that minimize manual handling and integrate seamlessly into highly controlled laboratory environments. Their purchasing criteria often emphasize ease of use, compliance with specific regulatory requirements for ATMPs (Advanced Therapy Medicinal Products), and minimal initial capital investment compared to establishing traditional manufacturing infrastructure.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 14.5 Billion |

| Market Forecast in 2033 | USD 46.8 Billion |

| Growth Rate | 18.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Danaher Corporation (Cytiva), Sartorius AG, Merck KGaA, Thermo Fisher Scientific Inc., Pall Corporation (a subsidiary of Danaher), Lonza, Avantor, Corning Inc., Repligen Corporation, Saint-Gobain, Entegris, W. L. Gore & Associates, Meissner Filtration Products, Parker Hannifin Corporation, Eppendorf AG, GE Healthcare, Cole-Parmer, Infors AG, CESCO Bioengineering, Finesse Solutions. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Single-Use Technologies for the Biologic Market Key Technology Landscape

The technological evolution of Single-Use Technologies is primarily driven by three critical areas: advanced material science for contact layers, sophisticated sensor integration, and enhanced system automation for fluid transfer. Regarding materials, the industry is perpetually seeking films that offer superior mechanical strength, gas barrier properties, and, most importantly, minimal quantifiable leachables and extractables (E&L) under diverse processing conditions. Next-generation multi-layer films incorporate high-purity, medical-grade polyethylene derivatives and EVOH/nylon barrier layers to protect the sensitive drug product from external environmental factors and internal material degradation products. The standardization and regulatory qualification of these specialized film technologies are paramount, as they form the foundation for all single-use bags and bioreactor liners.

Integration of sophisticated monitoring and control elements represents another major technological leap. Traditional single-use systems relied on external, intrusive probes, but the modern landscape favors non-invasive or pre-calibrated integrated sensors. Technologies such as disposable optical sensors (for pH, dissolved oxygen), conductivity probes, and specialized temperature sensors are being welded directly into the fluid path during manufacturing. This allows for closed-system monitoring, enhancing process control and consistency while eliminating the risk of breaching sterility through sensor insertion. Furthermore, advancements in aseptic connection technology, such as sterile welding and quick-connect systems, are critical, enabling reliable, risk-free connections between different single-use components in a non-classified environment, thereby streamlining complex fluid management operations across the bioprocessing suite.

Finally, automation and system architecture are key to maximizing SUT benefits. The market is moving toward fully integrated, plug-and-play single-use manifolds and cassettes that are pre-designed for specific unit operations, such as TFF or chromatography. This technology simplifies setup and reduces the need for custom tubing assemblies. Furthermore, the development of robust, scalable single-use stirred-tank bioreactors, reaching volumes up to 2,000 liters, has been crucial for commercialization, requiring highly engineered mechanical support structures and specialized impellers designed to deliver efficient mixing and mass transfer while maintaining cell integrity. Digital twins and advanced process analytical technology (PAT) leveraging SUT sensor data are further optimizing these systems, marking the convergence of hardware, material science, and digital intelligence.

Regional Highlights

- North America (NA): Dominates the global SUT market, primarily due to the concentration of major biopharmaceutical companies, extensive government and private investment in biotechnology R&D, and the early adoption of single-use systems for both clinical and commercial manufacturing. The US leads in the development and production of novel cell and gene therapies, a segment heavily reliant on SUTs. Strong regulatory infrastructure (FDA) also fosters innovation and confidence in disposable systems.

- Europe: Represents a mature and rapidly expanding market, characterized by strong vaccine production capabilities and a focus on advanced bioprocessing technologies, including continuous manufacturing where SUTs are integral. Countries like Germany, Ireland, and Switzerland are key hubs, driven by large established pharmaceutical presences and regulatory bodies (EMA) that are proactive in supporting innovative manufacturing methods.

- Asia Pacific (APAC): Expected to register the highest Compound Annual Growth Rate (CAGR) globally. This growth is spurred by expanding domestic biotechnology industries in China and India, significant foreign direct investment (FDI) in new manufacturing capacities, and increasing focus on biosimilar production. The lower initial capital investment required for single-use facilities makes SUTs highly attractive for rapid capacity expansion across the region.

- Latin America (LATAM): A developing market characterized by increasing investment in local drug manufacturing capabilities, particularly in Brazil and Mexico. SUT adoption is accelerating as local players seek to modernize facilities and meet international quality standards without the prohibitive capital costs associated with new stainless steel facilities.

- Middle East and Africa (MEA): Currently the smallest market, but demonstrating steady growth, driven by regional strategic goals to enhance pharmaceutical self-sufficiency and reduce reliance on imported medicines. SUTs offer rapid deployment solutions for small-to-medium scale vaccine and therapeutic manufacturing projects supported by public health initiatives.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Single-Use Technologies for the Biologic Market.- Danaher Corporation (Cytiva)

- Sartorius AG

- Merck KGaA

- Thermo Fisher Scientific Inc.

- Pall Corporation (a subsidiary of Danaher)

- Lonza

- Avantor

- Corning Inc.

- Repligen Corporation

- Saint-Gobain

- Entegris

- W. L. Gore & Associates

- Meissner Filtration Products

- Parker Hannifin Corporation

- Eppendorf AG

- GE Healthcare

- Cole-Parmer

- Infors AG

- CESCO Bioengineering

- Finesse Solutions

Frequently Asked Questions

Analyze common user questions about the Single-Use Technologies for the Biologic market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the high adoption rate of Single-Use Technologies (SUTs) in biomanufacturing?

The primary driver is the significant reduction in operational complexity and cost associated with eliminating Cleaning-In-Place (CIP) and Sterilization-In-Place (SIP) procedures, leading to faster facility turnaround times, reduced capital expenditure, and mitigated risk of cross-contamination across batches.

How do Single-Use Technologies address the manufacturing challenges specific to Cell and Gene Therapies (CGT)?

SUTs are ideal for CGT due to their ability to support small-volume, high-value batch production in a functionally closed, highly sterile environment, minimizing the crucial risk of contamination and maximizing process flexibility required for personalized or autologous treatments.

What are the main concerns regarding the environmental impact and sustainability of disposable bioprocessing systems?

The main concern is the increased volume of plastic waste generated by SUTs. The industry is responding through the development of advanced recycling programs, the use of more sustainable materials (bio-based polymers), and the design of more compact, waste-efficient components to improve the environmental profile.

What are 'Leachables and Extractables' (E&L) in the context of SUTs, and why are they critical?

E&L refer to compounds that may migrate from the plastic materials of the SUTs into the drug product. They are critical because they could potentially alter the efficacy or safety profile of the biologic drug. Manufacturers must use highly purified, certified films and conduct rigorous testing to ensure minimal E&L profiles comply with regulatory standards.

Which geographic region is expected to demonstrate the fastest growth in the Single-Use Technologies market through 2033?

The Asia Pacific (APAC) region is projected to exhibit the highest growth rate, fueled by rapid establishment of new biomanufacturing facilities, expansion in biosimilar production, and strategic government investments supporting local biotechnology sectors in countries like China and India.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager