Single Use Tubing Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432891 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Single Use Tubing Market Size

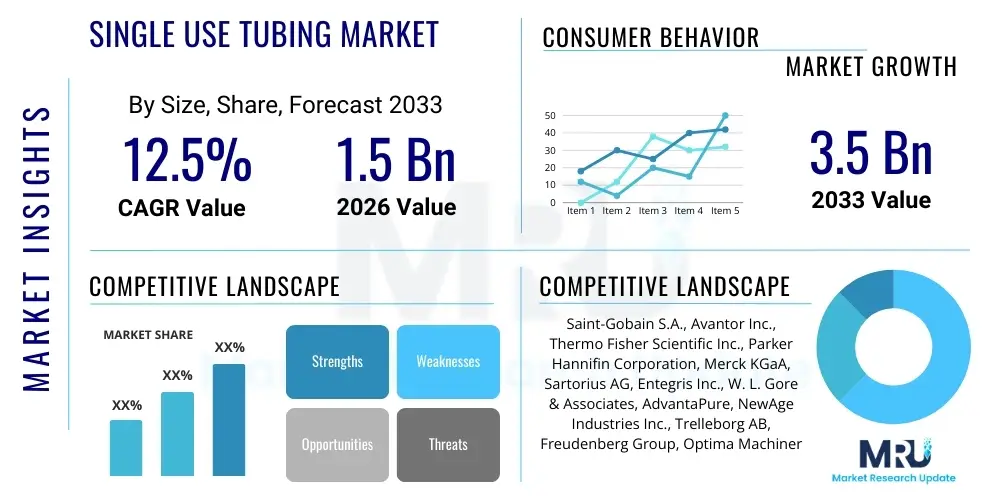

The Single Use Tubing Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 12.5% between 2026 and 2033. The market is estimated at USD 1.5 Billion in 2026 and is projected to reach USD 3.5 Billion by the end of the forecast period in 2033.

Single Use Tubing Market introduction

The Single Use Tubing Market encompasses specialized polymer components designed for temporary fluid transfer, storage, and processing within highly regulated environments, primarily biotechnology and pharmaceutical manufacturing. These flexible tubes, often fabricated from materials such as silicone, thermoplastic elastomers (TPE), and specialized PVC, form the crucial circulatory system in single-use bioprocessing systems, facilitating aseptic handling of critical liquids, including cell culture media, buffers, drug substance intermediates, and final drug products. The inherent design philosophy of single-use (or disposable) systems revolves around eliminating the need for complex, time-consuming, and resource-intensive cleaning validation processes, thereby accelerating batch turnaround times and significantly reducing the risk of cross-contamination between different manufacturing runs.

The increasing prevalence of personalized medicine, coupled with the rapid expansion of biologic drugs—such as monoclonal antibodies (mAbs), vaccines, and cell and gene therapies—serves as the primary catalyst for market expansion. Single-use tubing is integral to nearly every stage of the biomanufacturing workflow, from upstream operations (e.g., bioreactor feeding and sampling) to downstream purification (e.g., chromatography and tangential flow filtration systems) and final aseptic filling. Product descriptions emphasize compatibility with sterilization methods like gamma irradiation, material flexibility under various pressure conditions, and stringent control over leachables and extractables (L&E) profiles to ensure drug safety and integrity.

Major applications span media preparation, buffer management, sterile filtration, bulk product storage, and transfer lines connecting modular single-use components like bags, filters, and chromatography columns. Key driving factors include the substantial reduction in capital expenditure associated with stainless steel infrastructure, faster facility build-out, minimized utility consumption (especially water for injection), and the overall operational efficiencies gained in multi-product facilities. These benefits solidify the essential role of single-use tubing as a foundational element supporting the global shift towards flexible and adaptable biomanufacturing strategies, particularly within emerging markets and for smaller batch production typical of advanced therapies.

Single Use Tubing Market Executive Summary

The Single Use Tubing Market is experiencing robust growth driven by the ongoing paradigm shift in biopharmaceutical manufacturing towards disposable technologies. Business trends indicate a strong focus on supply chain resilience, particularly after global disruptions highlighted vulnerabilities in sourcing specialized polymeric materials. Leading market participants are heavily investing in vertical integration and geographical diversification of manufacturing sites to mitigate risks associated with raw material dependence and ensure consistent availability of high-quality, pre-sterilized tubing assemblies required for critical manufacturing steps. Furthermore, there is a distinct trend toward customization and optimization, with manufacturers offering tubing kits pre-assembled and validated for specific customer processes, simplifying logistics and reducing the risk of contamination during system setup.

Segment trends reveal that the Thermoplastic Elastomer (TPE) segment is exhibiting the fastest growth due to its superior weldability, making it highly suitable for aseptic connection in automated bioprocessing lines without relying on external connectors or sterile welding devices. Geographically, North America remains the dominant revenue contributor, largely due to the presence of a mature biopharmaceutical industry, stringent regulatory frameworks necessitating single-use sterility assurance, and extensive R&D activity in cell and gene therapies. However, the Asia Pacific (APAC) region is projected to register the highest Compound Annual Growth Rate, fueled by significant government investments in biomanufacturing capacity expansion in countries like China, India, and South Korea, coupled with the establishment of contract manufacturing organizations (CMOs) catering to global demand.

Overall, the market trajectory is characterized by technological maturity in material science, focusing on reducing L&E profiles and enhancing pressure stability, while simultaneously addressing sustainability concerns by exploring greener, disposable solutions. The shift towards continuous bioprocessing and modular manufacturing further necessitates high-performance, single-use fluid handling components, ensuring the market's sustained expansion throughout the forecast period. Strategic alliances between tubing suppliers and large bioprocessing equipment providers are becoming common, aiming to provide fully integrated and validated system solutions to end-users.

AI Impact Analysis on Single Use Tubing Market

Users frequently inquire about how Artificial Intelligence (AI) and machine learning (ML) can enhance the reliability and quality assurance of single-use components, particularly tubing. Key concerns revolve around predicting material performance under stress, optimizing supply chain logistics to prevent stockouts of critical consumables, and automating quality control (QC) checks for manufacturing defects. Users expect AI to minimize human error in assembly processes, validate sterilization efficacy, and accelerate the identification of optimal material formulations that minimize leachables and extractables (L&E). The central theme is leveraging predictive analytics to shift quality control from reactive testing to proactive, in-line process monitoring, thereby ensuring the sterility and integrity of the single-use fluid path across complex bioprocessing systems.

- AI-driven Predictive Maintenance: Utilizing sensor data embedded in automated single-use systems to predict tubing failure or degradation before catastrophic leaks occur, enhancing operational safety.

- Quality Control Automation: Employing computer vision systems and ML algorithms for rapid, non-destructive inspection of extruded tubing and assembled connections, significantly improving detection rates for pinholes, inclusion defects, and dimensional inconsistencies.

- Leachables and Extractables (L&E) Modeling: Using AI/ML to simulate chemical interactions between specific drug formulations and polymer types, accelerating material selection and reducing extensive, costly empirical testing.

- Supply Chain Optimization: Implementing predictive analytics to forecast demand fluctuations for specific tubing sizes and materials, optimizing inventory levels, and enhancing the resilience of the complex single-use supply network.

- Process Parameter Optimization: ML algorithms assisting biomanufacturers in defining optimal flow rates, pressures, and sterilization parameters compatible with various single-use tubing materials, maximizing throughput without compromising integrity.

- Customization and Design Acceleration: AI tools aiding in the rapid design and prototyping of custom tubing assemblies and manifolds based on specific bioreactor volumes and purification train requirements, shortening time-to-market for novel drug modalities.

DRO & Impact Forces Of Single Use Tubing Market

The Single Use Tubing Market dynamics are governed by a complex interplay of powerful growth drivers and significant regulatory restraints, balanced by emerging technological opportunities. The major driver is the accelerating development and commercialization of complex biopharmaceuticals, particularly cell and gene therapies, which inherently demand small-batch, highly flexible, and contamination-risk-free manufacturing platforms that only single-use systems can efficiently provide. The continuous pressure on biomanufacturers to reduce operational costs (OpEx) and facility footprint further fuels adoption, as disposable components eliminate the need for costly steam-in-place (SIP) and clean-in-place (CIP) utilities. The shift towards modular and portable bioprocessing units, enabling rapid deployment globally, represents a key factor compelling market expansion.

Conversely, the primary restraint is the stringent regulatory oversight concerning the safety of materials used in contact with drug products. Concerns regarding leachables and extractables (L&E) remain paramount; any perceived risk of material contaminants leaching into the drug substance can lead to extensive regulatory scrutiny, product recalls, or delayed approvals, necessitating exhaustive vendor qualification and testing. Furthermore, the reliance on petroleum-derived polymers creates challenges related to sustainability and waste disposal, which, although not currently market-limiting, poses a growing ethical and logistical restraint that necessitates future innovation in biodegradable or recyclable biopolymers. The vulnerability of the polymer supply chain, particularly for high-purity medical-grade materials, also represents a substantial operational constraint.

The major opportunity lies in the advancement of high-barrier, multi-layer tubing constructions that offer enhanced chemical resistance and reduced gas permeability, suitable for oxygen-sensitive or aggressive solvents required in advanced bioprocessing. Developing standardized, universally compatible aseptic connectors and automated welding technologies specific to next-generation tubing materials presents a lucrative avenue for market penetration. The increasing demand for flexible facilities in developing economies seeking localized vaccine production and biosimilar manufacturing offers a vast, untapped market opportunity for global suppliers capable of providing cost-effective and validated single-use solutions. These forces collectively dictate the investment landscape and strategic direction of material innovation and facility design within the biopharma sector.

Segmentation Analysis

The Single Use Tubing Market is broadly segmented based on Material, Application, and End-User, reflecting the diverse functional requirements across the biopharmaceutical production lifecycle. Material composition is crucial, as it dictates flexibility, chemical compatibility, pressure resistance, and L&E profiles. The most common materials include silicone, known for its flexibility and durability; thermoplastic elastomers (TPE), valued for their aseptic weldability; and specialized materials like PTFE and PVC used where specific chemical resistance or cost efficiency is required. Understanding this segmentation is vital for suppliers to tailor product offerings to specific process requirements, such as high shear environments or aggressive solvent exposure typical in certain downstream purification steps.

Application segmentation illustrates the versatility of single-use tubing, ranging from media and buffer preparation—high-volume, non-sterile transfers—to sterile filtration and aseptic filling—critical, low-volume, high-value operations. The largest application segment is consistently bioprocessing (upstream and downstream), where tubing forms the backbone of large-scale bioreactor feeding, harvesting, and purification systems. The end-user segment is dominated by Pharmaceutical and Biotechnology companies, which are the primary consumers of high-purity tubing for internal drug manufacturing. However, the Contract Manufacturing Organization (CMO) segment is growing rapidly, driven by the increasing outsourcing of biologics production, requiring CMOs to maintain large inventories of diverse, validated tubing assemblies.

Detailed analysis of these segments reveals that the shift toward high-throughput, closed systems is driving demand for advanced TPE and reinforced silicone tubing that can withstand higher pressures encountered in intensified continuous bioprocessing methods. Moreover, regulatory trends are increasingly favoring components that can demonstrate the lowest possible L&E characteristics, prompting manufacturers to invest in proprietary material formulations and advanced surface treatments, thereby differentiating products within highly competitive segments like sterile fluid transfer and final product filling lines.

- Material:

- Silicone

- Thermoplastic Elastomers (TPE)

- Polyvinyl Chloride (PVC)

- Polytetrafluoroethylene (PTFE)

- Others (e.g., C-Flex, PharMed)

- Application:

- Bioprocessing (Upstream and Downstream)

- Filtration and Purification

- Media and Buffer Preparation

- Drug Delivery and Sampling

- Aseptic Filling and Finishing

- End-User:

- Pharmaceutical and Biotechnology Companies

- Contract Manufacturing Organizations (CMOs)

- Academic and Research Institutes

- Clinical Trial Suppliers

Value Chain Analysis For Single Use Tubing Market

The value chain for the Single Use Tubing Market begins with the highly specialized upstream analysis involving raw material suppliers, primarily chemical companies providing high-purity, medical-grade polymers (silicones, TPE resins). This stage is critical because the quality and regulatory compliance (e.g., USP Class VI, ISO standards) of the final tubing product are intrinsically linked to the purity of the polymer feedstock. Key upstream activities include material compounding, extrusion, and specialized post-processing treatments to ensure optimal surface finish and reduced particulate contamination, demanding intensive quality control and traceability measures. Consolidation in this upstream segment grants significant bargaining power to major polymer suppliers, influencing cost structures throughout the value chain.

Midstream activities involve the primary manufacturing of the tubing, followed by complex assembly into pre-validated single-use systems or manifolds. Tubing manufacturers invest heavily in cleanroom facilities (ISO Class 7 or 8) for extrusion and assembly, often incorporating advanced welding and bonding technologies. Distribution channels are twofold: direct and indirect. Direct sales are common for large biopharma companies requiring customized, long-term supply agreements and technical support directly from the tubing manufacturer or a specialized system integrator. Indirect channels involve global scientific distributors and regional resellers who cater to smaller labs, CMOs, and academic institutions, providing broader market access and localized inventory management, often dealing with standard, off-the-shelf tubing lengths and connectors.

Downstream analysis focuses on the end-users—biopharmaceutical companies and CMOs—who integrate the tubing into their production workflows. The single-use tubing must interface seamlessly with other single-use components (bags, filters, sensors). Post-use, the final stage involves waste disposal, which currently presents a significant challenge due to the lack of specialized recycling infrastructure for irradiated plastic waste, requiring incineration or landfill. The entire value chain is heavily influenced by regulatory compliance requirements (FDA, EMA), emphasizing the necessity for robust documentation, change control, and supplier qualification at every stage, from polymer synthesis to final installation.

Single Use Tubing Market Potential Customers

The primary consumers and end-users of single-use tubing are organizations engaged in the discovery, development, and large-scale manufacturing of biopharmaceuticals and advanced therapies. These include global pharmaceutical giants that rely on single-use systems for flexible manufacturing lines dedicated to biologics, such as insulin, therapeutic proteins, and complex vaccines. Their need is driven by the necessity for swift changeover between batches and the need to mitigate the risk associated with high-value drug substance manufacturing. Tubing is a critical consumable, and procurement decisions are often influenced by pre-existing supplier relationships, validation data regarding L&E, and the manufacturer's capacity for global, reliable supply.

Contract Manufacturing Organizations (CMOs) and Contract Development and Manufacturing Organizations (CDMOs) represent the fastest-growing customer segment. As outsourcing becomes prevalent, CMOs require an extensive portfolio of single-use tubing assemblies that are highly adaptable to the diverse processes and scales of their multiple clients. CMOs prioritize suppliers who offer standardized, readily available components and comprehensive regulatory support documentation, enabling them to meet varying client specifications and accelerate technology transfer protocols. Their purchasing power and high volume consumption make them pivotal strategic targets for tubing manufacturers.

Furthermore, academic research institutes, university spin-offs, and small biotechnology startups focused on early-stage drug development or niche applications (like exosome research or small-scale cell culture) constitute a vital customer base. While their individual consumption volume is lower, their demand is characterized by a need for highly specialized, small-diameter tubing suitable for laboratory bench-scale experimentation and pilot runs. Clinical trial material producers also rely heavily on validated single-use tubing to maintain sterility and traceability for early-phase human trials, where regulatory scrutiny on material quality is exceptionally high, solidifying their role as indispensable buyers in the overall market ecosystem.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.5 Billion |

| Market Forecast in 2033 | USD 3.5 Billion |

| Growth Rate | 12.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Saint-Gobain S.A., Avantor Inc., Thermo Fisher Scientific Inc., Parker Hannifin Corporation, Merck KGaA, Sartorius AG, Entegris Inc., W. L. Gore & Associates, AdvantaPure, NewAge Industries Inc., Trelleborg AB, Freudenberg Group, Optima Machinery Corporation, Nordson Corporation, Raumedic AG, Teel Plastics, Dow Corning, Qosina Corp., PendoTECH, Colder Products Company (CPC). |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Single Use Tubing Market Key Technology Landscape

The technology landscape for the Single Use Tubing Market is defined by continuous innovation in material science and aseptic connection methods, aiming to enhance product reliability and regulatory compliance. Material technology primarily focuses on formulating medical-grade polymers with extremely low levels of L&E, moving towards proprietary, stabilized formulations of TPE and silicone that maintain physical integrity under harsh conditions (e.g., high flow rates, extreme pH, or freezing temperatures). A critical technological advancement is the development of co-extruded and multi-layer tubing, which combines the benefits of an inner layer (e.g., high chemical resistance) with an outer layer (e.g., flexibility or weldability), effectively creating superior fluid handling paths that traditional single-material tubing could not achieve.

Beyond the material itself, processing and assembly technologies are crucial. This includes highly automated extrusion techniques that ensure exceptional dimensional consistency and smooth bore surfaces to minimize fluid shear stress and particle generation. Furthermore, gamma sterilization compatibility is a non-negotiable technological requirement; materials must be engineered to resist degradation, discoloration, or embrittlement following high-dose irradiation. The integration of advanced cleanroom manufacturing and packaging under stringent quality standards (e.g., utilizing HEPA filtration and environmental monitoring systems) is standard practice, ensuring the sterility assurance level (SAL) meets biopharmaceutical demands.

Aseptic connection technology, though peripheral to the tubing itself, significantly impacts tubing adoption. Modern bioprocessing relies heavily on automated tubing welders and sealers, especially those compatible with TPE tubing, which allows for secure, sterile connections in non-sterile environments. Furthermore, integrating smart technologies, such as RFID or barcoding on single-use assemblies, enables superior traceability and inventory management throughout the manufacturing facility. This combination of superior material engineering, advanced manufacturing precision, and seamless integration with aseptic connection hardware defines the competitive technology landscape for specialized fluid handling components.

Regional Highlights

- North America (USA and Canada): North America maintains its leadership position in the Single Use Tubing Market, driven by the world's largest concentration of biotechnology companies, major pharmaceutical headquarters, and robust R&D investment, particularly in advanced modalities like gene and cell therapies. The stringent regulatory environment necessitates high-quality, validated single-use components, favoring major global suppliers. The US market dictates trends in material validation and system integration, characterized by early adoption of new technologies such as continuous bioprocessing and highly customized tubing manifold assemblies. The high cost structure is supported by premium pricing justified by comprehensive technical and regulatory support documentation provided by suppliers.

- Europe (Germany, UK, France): Europe represents the second-largest market, fueled by strong governmental support for biopharmaceutical innovation, especially in countries like Germany and Ireland which serve as major manufacturing hubs. Regulatory harmonization efforts across the EU facilitate the adoption of standardized single-use systems. The region shows a growing interest in sustainable biomanufacturing practices, prompting demand for tubing suppliers that can demonstrate environmentally responsible sourcing and disposal strategies, often favoring certified or partially recyclable polymers where feasible. Growth is robust in vaccine production and biosimilars manufacturing.

- Asia Pacific (APAC) (China, India, South Korea): The APAC region is poised for the fastest market growth, largely due to rapid capacity expansion led by China and India. Government initiatives supporting domestic drug manufacturing, combined with rising foreign direct investment in biopharma infrastructure, are driving mass adoption of single-use technologies to accelerate facility construction and reduce validation complexity. While cost sensitivity remains a factor, the increasing maturity of local CMOs and the regulatory push toward global quality standards are shifting demand towards high-ppurity, internationally certified tubing products, moving away from cheaper, unvalidated alternatives.

- Latin America (LATAM) and Middle East & Africa (MEA): These regions represent emerging markets characterized by foundational investment in local vaccine production and generic biologics manufacturing, often facilitated by technology transfer from developed nations. Market growth is slower but steady, highly dependent on regulatory approvals and national healthcare infrastructure development. Demand often focuses on standardized, cost-effective single-use tubing suitable for basic media transfer and large-volume buffer management. Local distributors play a crucial role in managing logistics and providing essential technical services in these geographically diverse and fragmented markets.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Single Use Tubing Market.- Saint-Gobain S.A.

- Avantor Inc.

- Thermo Fisher Scientific Inc.

- Parker Hannifin Corporation

- Merck KGaA

- Sartorius AG

- Entegris Inc.

- W. L. Gore & Associates

- AdvantaPure

- NewAge Industries Inc.

- Trelleborg AB

- Freudenberg Group

- Optima Machinery Corporation

- Nordson Corporation

- Raumedic AG

- Teel Plastics

- Dow Corning

- Qosina Corp.

- PendoTECH

- Colder Products Company (CPC)

Frequently Asked Questions

Analyze common user questions about the Single Use Tubing market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary regulatory concerns associated with single-use tubing materials?

The primary concern is the potential for leachables and extractables (L&E) that could contaminate the drug product, affecting efficacy or patient safety. Suppliers must rigorously test tubing to meet stringent standards such as USP Class VI and specific FDA guidelines for material compatibility and chemical inertness in bioprocessing applications.

How does the choice of tubing material impact its use in aseptic bioprocessing?

Material choice significantly impacts weldability and sealability. Thermoplastic elastomers (TPE) are highly favored because they can be aseptically welded and sealed using automated devices, creating a sterile fluid path without the need for traditional connectors, which is essential for maintaining closed system integrity in high-risk operations.

Which market segment is expected to show the fastest growth, and why?

The Thermoplastic Elastomer (TPE) segment is anticipated to exhibit the fastest growth. This is primarily due to its superior flexibility, low L&E profile, and crucial ability to be thermally welded, which supports the increasing industry shift toward continuous processing and highly flexible, closed, multi-use facilities.

What role does standardization play in the single-use tubing value chain?

Standardization, particularly for connectors, sizes, and validation protocols, is critical for streamlining supply chains, accelerating technology transfer between facilities (especially for CMOs), and reducing overall qualification costs for biopharma end-users, thereby enhancing overall operational efficiency and reducing time-to-market.

How are environmental sustainability pressures affecting the single-use tubing market?

Sustainability concerns are driving innovation towards exploring biodegradable or more easily recyclable polymer alternatives and materials with reduced carbon footprints. While disposability remains key to sterility, manufacturers are increasingly expected to develop take-back programs or materials that minimize the environmental impact of plastic waste generated by large-scale biomanufacturing.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager