Single Use Video Endoscope Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432803 | Date : Dec, 2025 | Pages : 255 | Region : Global | Publisher : MRU

Single Use Video Endoscope Market Size

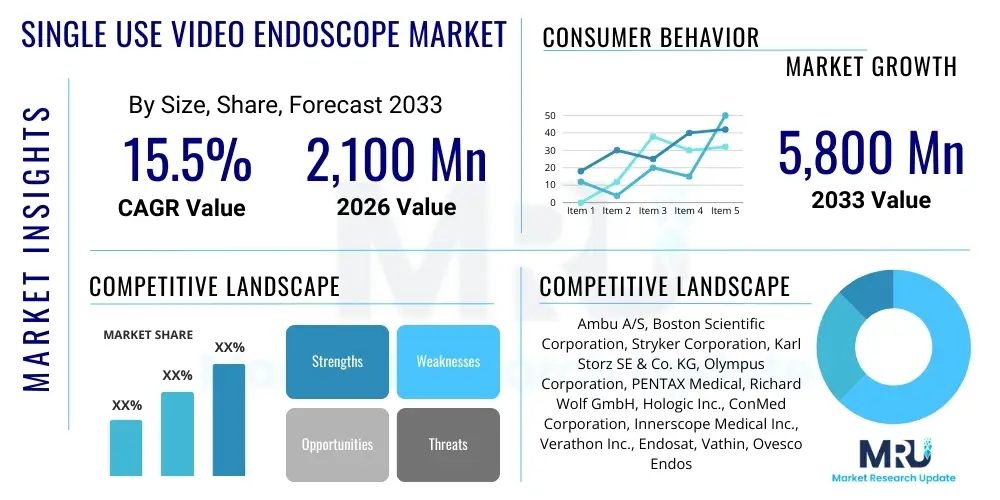

The Single Use Video Endoscope Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 15.5% between 2026 and 2033. The market is estimated at $2.1 Billion in 2026 and is projected to reach $5.8 Billion by the end of the forecast period in 2033.

Single Use Video Endoscope Market introduction

The Single Use Video Endoscope Market encompasses technologically advanced medical devices designed for diagnostic and therapeutic procedures, offering high-resolution imaging capabilities while fundamentally mitigating the significant risks associated with cross-contamination inherent in complex, multi-use reusable endoscopes. These devices, which integrate a miniaturized camera, sophisticated light source, and functional working channel within a flexible insertion tube, are engineered for disposal immediately after a single patient use. This paradigm shift in procedural instrumentation bypasses the critical vulnerabilities inherent in the reprocessing workflow, which includes rigorous manual cleaning, chemical high-level disinfection (HLD), or sterilization, steps that have frequently been proven incomplete, leading to documented outbreaks of Healthcare-Associated Infections (HAIs). The core innovation lies in achieving performance comparable to high-end reusable scopes but at a manufacturing cost structure suitable for disposability and mass adoption, thereby ensuring guaranteed sterility for every procedure and patient.

Major applications for single-use video endoscopes span critical areas of modern medicine, significantly impacting specialties such as pulmonology (disposable bronchoscopes for intubation and lavage in intensive care settings), urology (flexible ureteroscopes for complex stone management and diagnostics), and gastroenterology (gastroscopes and colonoscopes used primarily for screening and intervention). The fundamental appeal of these instruments stems from unparalleled patient safety, as the sterility of every device is guaranteed upon opening the packaging, providing clinicians and hospital risk management teams with utmost confidence in the infection control process. Beyond safety, adopting single-use technology contributes substantially to improved operational efficiency within clinical settings. Hospitals can eliminate the dedicated physical space, specialized labor, costly chemicals, and extensive downtime associated with reprocessing reusable fleets, allowing for faster procedural turnover, predictable scheduling, and avoidance of highly variable repair costs.

Market expansion is powerfully driven by escalating global regulatory scrutiny focused intensely on infection prevention and control, specifically targeting the documented failure points of reusable scope reprocessing protocols, exemplified by multiple regulatory alerts concerning duodenoscopes. The increasing global burden of chronic diseases, such as respiratory disorders, cancer, and urinary tract issues, concurrently raises the demand for precise, minimally invasive endoscopic diagnostics and interventions. Furthermore, sustained technological breakthroughs in micro-optics, advanced sensor miniaturization (CMOS technology), and sophisticated, automated, low-cost manufacturing processes are continually closing the performance gap between disposable and reusable scopes while simultaneously reducing the unit cost. These technological and regulatory tailwinds ensure that single-use video endoscopes are transitioning from being a niche, supplemental tool to becoming a standard instrument across multiple high-risk endoscopic specialties worldwide, accelerating the market's robust Compound Annual Growth Rate and redefining the standard of care.

Single Use Video Endoscope Market Executive Summary

The Single Use Video Endoscope Market is undergoing a transformational period characterized by a rapid commercial shift driven by regulatory mandates and a heightened clinical focus on patient safety, particularly mitigating infectious disease transmission. Key business trends underscore a strategic movement towards vertical integration among major medical device manufacturers, aiming to secure the supply chain for specialized components like micro-sensors and biocompatible polymers. The competitive landscape is intensely focused on intellectual property related to chip-on-the-tip visualization technology and advanced scope maneuverability, necessitating frequent mergers and acquisitions to capture smaller, innovative entities that possess proprietary disposable design expertise. Furthermore, manufacturers are increasingly offering flexible purchasing models, including subscription or cost-per-procedure arrangements, to help large institutions manage the financial transition from capital expenditure-heavy reusable fleets to operational expenditure-driven disposable inventory, thereby effectively addressing initial unit cost resistance among procurement departments.

Geographically, North America currently holds the largest revenue share, primarily attributable to early and aggressive adoption spurred by explicit safety recommendations from regulatory bodies such as the FDA concerning duodenoscope reprocessing protocols and the region's litigious environment regarding HAIs. High per capita healthcare spending and a well-established reimbursement structure that supports premium sterile solutions further solidify this dominance. Conversely, the Asia Pacific (APAC) region is projected to register the highest growth velocity during the forecast period. This rapid expansion is a direct consequence of significant public and private investment in modernizing healthcare infrastructure, an expanding middle class accessing advanced medical care, and the proactive implementation of sophisticated infection control guidelines, especially in populous nations like China and India where extremely high procedural volumes demand scalable, sterile solutions.

Segmentation analysis reveals pivotal trends in product evolution and end-user behavior. The digital imaging segment, utilizing advanced CMOS sensors, is rapidly dominating the market due to its superior image fidelity, resistance to reprocessing damage (as it is single-use), and suitability for mass production at lower costs. Application-wise, the bronchoscopy segment, critical for managing respiratory illnesses and diagnosing lung cancer in vulnerable patients, alongside the urology segment (flexible ureteroscopy for kidney stone management), are exhibiting exceptional growth rates, driven by the immediate need for sterile instrumentation in these high-stakes procedures and the historical difficulty in achieving effective high-level disinfection of these scopes. End-user adoption patterns confirm a strong shift in preference among Ambulatory Surgical Centers (ASCs) towards single-use instruments. ASCs value the guaranteed sterility, simplified logistics, and avoidance of complex reprocessing infrastructure, reinforcing the market’s underlying transition toward streamlined, disposable workflow solutions that optimize procedural efficiency outside traditional, large hospital environments.

AI Impact Analysis on Single Use Video Endoscope Market

Analysis of common user queries reveals significant interest in how Artificial Intelligence (AI) integration will enhance the utility and value proposition of single-use video endoscopes, transforming them into intelligent diagnostic tools. The primary questions center on whether AI can transform the already high-quality video captured by disposable scopes into automated diagnostic tools, and how the computational demands of advanced AI will be effectively met within the constraints of disposable or peripheral hardware. Users are highly concerned about standardization—if AI models trained on vast datasets from reusable scope procedures will be fully compatible and optimized for the unique optical characteristics and data formats generated by various disposable scope manufacturers. Expectations are high that AI will move beyond simple image enhancement to provide real-time, objective measurements of procedural quality, sophisticated decision support for clinicians, and enhanced real-time documentation capabilities, potentially mitigating diagnostic variability among different clinicians and greatly increasing the overall efficiency and effectiveness of every single-use device deployed in the field.

- AI-Assisted Lesion Detection: Utilizing deep learning algorithms running in the external processor to automatically identify, highlight, and characterize abnormalities (polyps, tumors, bleeding sources) in real-time on the single-use scope feed, providing instantaneous feedback and significantly reducing the potential for missed diagnosis during rapid procedures.

- Automated Procedural Quality Assessment: AI software analyzes critical metrics such as mucosal visualization adequacy, withdrawal speed during screening procedures (e.g., adenoma detection rate factors), and overall completeness of the examination, providing immediate, objective feedback to the physician and contributing to standardized best practice adherence.

- Enhanced Data Standardization and Collection: AI facilitates the systematic tagging, indexing, and structuring of high-definition video data captured by disposable scopes, automatically capturing crucial procedural milestones and creating massive, high-quality, standardized datasets essential for both clinical research and the continuous training of future diagnostic algorithms.

- Procedural Navigation Assistance: Integrating AI and computational vision to provide real-time anatomical mapping and guidance, assisting the clinician in navigating complex or tortuous anatomy, particularly critical in difficult intubations, flexible ureteroscopy, and deep airway branching structures, thereby reducing procedure time and complication rates.

- Resource Optimization and Predictive Planning: Integration of AI with hospital scheduling systems, utilizing historical procedural complexity data derived from single-use scope use, to accurately predict procedure length, required ancillary resources, and potential scheduling conflicts, leading to demonstrably improved operating room and procedural unit turnaround times and overall throughput.

- Integrated Workflow and Documentation: AI automatically generates concise, structured procedure reports based on visual evidence and clinical events captured during the endoscopy, simultaneously capturing key static images, minimizing the administrative burden on the clinician and ensuring comprehensive, auditable documentation for quality assurance and medico-legal compliance.

DRO & Impact Forces Of Single Use Video Endoscope Market

The market trajectory for single-use video endoscopes is defined by powerful forces demanding profound clinical transformation and stringent economic accountability within healthcare systems globally. The primary drivers are unequivocally centered on the uncompromising mandate for infection prevention and control, fueled by global regulatory bodies pushing for guaranteed sterility in invasive medical procedures, especially following numerous high-profile, devastating outbreaks linked to improperly sterilized complex devices. This intense regulatory pressure is synergized by the undeniable operational benefits single-use devices offer, specifically the complete elimination of labor-intensive, resource-draining, and error-prone reprocessing cycles, which directly translates into reduced staffing needs, minimized infrastructure costs associated with specialized HLD equipment, and greater certainty in procedure scheduling, maximizing facility efficiency. Furthermore, the inherent risk mitigation concerning costly patient safety litigation provides a substantial, non-clinical impetus for institutional adoption, readily justifying the premium price point of disposable solutions against the potentially catastrophic financial and reputational costs associated with an infectious disease outbreak.

However, the market’s expansive growth is significantly constrained by two main commercial factors that challenge widespread, rapid displacement of incumbent reusable technology. Firstly, the comparatively high unit cost of a single disposable scope relative to the perceived, immediate cost of reusing an existing, amortized capital investment remains a critical procurement barrier, particularly in price-sensitive emerging markets or heavily centralized public health systems bound by rigid annual budgeting cycles favoring capital expense over operational expenditure. Secondly, entrenched clinical inertia and a deep-seated preference among senior, influential practitioners for certain specialized reusable systems, where decades have been spent perfecting techniques with familiar, high-performance instruments, significantly slow down the adoption curve for new disposable alternatives. Opportunities, conversely, are vast and strategic, focusing on the expansion into highly specialized, high-acuity procedures (e.g., highly flexible cholangioscopy, intricate pediatric applications) where the risk of device damage or incomplete reprocessing is maximized, thereby making the absolute sterility assurance of a disposable device an invaluable clinical asset. Penetrating the rapidly expanding outpatient setting, such as Ambulatory Surgical Centers (ASCs), also represents a substantial growth vector due to their intrinsic operational preference for simplified, asset-light, and predictable procedural cost models.

The principal impact force reshaping this market is the intensified global regulatory environment, which has effectively shifted the responsibility and onus of proof regarding scope sterility from the end-user (hospital sterile processing department) back onto the device manufacturer, fundamentally driving innovation toward inherently safer disposable designs that require zero reprocessing. Concurrently, rapid technological advancement acts as a powerful enabling force. Continuous breakthroughs in micro-optics, micro-sensor manufacturing, and highly automated assembly processes are dramatically improving the clinical performance and simultaneously reducing the manufacturing cost of the disposable components, steadily eroding the image quality advantage and durability perception once held exclusively by high-end reusable endoscopes. As performance parity is achieved and the unit cost incrementally declines, the overwhelming combined advantages of guaranteed sterility, regulatory compliance, and streamlined operational simplification create an undeniable and irreversible market momentum, fundamentally altering the competitive dynamics between traditional capital equipment manufacturers and new disposable technology innovators, ensuring continued rapid market expansion.

Segmentation Analysis

The Single Use Video Endoscope Market exhibits complex segmentation patterns crucial for strategic analysis, primarily organized around procedural application, core technology utilized, and the specific end-user profile. The application-based segmentation (e.g., bronchoscopy, ureteroscopy, GI endoscopy) is of paramount importance as it directly correlates with procedural volume, the level of regulatory urgency (i.e., known reprocessing failures), and existing reusable device failure/repair rates, clearly highlighting where the economic and clinical rationale for disposability is strongest and most immediately required. For example, segments involving extremely narrow channels or high-risk internal anatomy, such such as flexible ureteroscopy, heavily prioritize disposability due to the documented difficulty of proper cleaning and the high incidence of damage to expensive reusable fiber scopes during procedural use and subsequent reprocessing cycles. The market’s technological breakdown, centered on the foundational shift from older fiber optic systems to modern, high-resolution digital imaging (CMOS/CCD), determines performance benchmarks, manufacturing scalability, and ultimate profitability, indicating the industry's primary investment priorities.

End-user segmentation is vital as it clearly differentiates market uptake based on institutional capability, risk tolerance, and underlying financial structure. Hospitals and large academic medical centers represent the primary revenue stream, driven by the need to manage extremely high procedural volumes, complex surgical interventions, and stringent infection control compliance requirements imposed by accreditation bodies. However, the fastest growth trajectory is observed within Ambulatory Surgical Centers (ASCs) and specialized outpatient diagnostic clinics. These facilities, operating under stricter cost-per-case economic models and typically lacking the extensive, dedicated physical infrastructure and specialized staffing required for complex high-level disinfection, find the operational simplicity, guaranteed sterility, and predictable costs of single-use scopes highly attractive. Understanding the varying procurement cycles, clinical needs, and regulatory demands across these distinct end-user segments is essential for effective product development and targeted market penetration strategies, as ASCs require faster integration and lower total resource commitment compared to sprawling hospital systems.

- By Application:

- Bronchoscopy: Driven by high risk of cross-contamination in the pulmonary system, increasing procedural volume in intensive care units, and high incidence of lung disease requiring visualization.

- Ureteroscopy (Flexible and Rigid): Exhibits the highest growth segment due to extremely high damage rates, specialized procedure difficulty, and the clinical challenges inherent in cleaning the narrow lumens of reusable flexible scopes used for complex kidney stone management and oncology.

- Gastrointestinal Endoscopy (Colonoscopy, Gastroscopy, Duodenoscopy): The largest volume segment, primarily driven by critical duodenoscope reprocessing failure alerts and mandated national preventative screening programs for colorectal cancer.

- Choledochoscopy: Specialized high-acuity procedures (bile duct visualization) where guaranteed sterility is absolutely critical for managing septic risk and ensuring optimal patient outcomes.

- Laryngoscopy and Rhinolaryngoscopy: Focused on rapid assessment, intubation guidance, and diagnostic flexibility in ENT and emergency room settings, prioritizing immediate readiness and infection control.

- Cystoscopy: Used for bladder and urethra examination, rapidly gaining traction in high-volume, cost-sensitive outpatient settings.

- Arthroscopy and Other Applications: Smaller specialized areas such as joint visualization requiring high levels of sterility assurance and minimizing the risk of prosthetic joint infections.

- By Technology:

- Digital Endoscopes (CMOS and CCD based): The overwhelmingly dominant and fastest-growing technological segment, offering superior, consistent image quality, reliability, and robust scalability essential for high-volume, low-cost mass production required for disposable units.

- Fiber Optic Endoscopes: Older, less sophisticated technology, now primarily used only in lower-cost, simpler scopes or rapidly being phased out, with digital alternatives steadily replacing them across most applications.

- By End-User:

- Hospitals and Surgical Centers: The core revenue-generating segment, driven by complex, multi-specialty cases and the management of high-volume diagnostic and therapeutic procedures.

- Ambulatory Surgical Centers (ASCs): The fastest-growing segment in terms of percentage growth, primarily due to their preference for low operational overhead, simplified logistics, and predictable cost-per-procedure models.

- Diagnostic Centers and Clinics: Utilizing single-use scopes for routine, low-complexity examinations where immediate availability and guaranteed sterility are primary concerns.

- By Specialty:

- Pulmonology: High demand driven by immunocompromised patients (e.g., oncology, transplant) and the necessity of sterile visualization for airway management.

- Urology: Demand driven by intricate procedures, minimizing damage costs, and avoiding infection risk in the urinary tract.

- Gastroenterology: Heavily impacted by severe regulatory oversight on the reprocessing of complex digestive tract scopes.

- Others (ENT, Orthopedics): Growing niche markets requiring absolute sterility assurance to prevent high-risk surgical site infections.

- By Region:

- North America, Europe, Asia Pacific (APAC), Latin America, Middle East & Africa (MEA).

Value Chain Analysis For Single Use Video Endoscope Market

The value chain for the single-use video endoscope market is characterized by a significant reliance on deep technological expertise concentrated in its initial upstream phases, demanding stringent management to ensure cost-efficiency and quality. This upstream segment is dominated by highly specialized component suppliers providing critical inputs, particularly miniature CMOS image sensors, requiring advanced proficiency in medical-grade wafer fabrication and specialized chip-on-the-tip packaging for placement at the distal end. Other essential inputs include flexible printed circuit boards (FPCBs), high-intensity micro-LED arrays for integrated illumination, and advanced, cost-effective, but highly durable polymers for the instrument shaft, working channels, and steering mechanism elements. Securing these proprietary and specialized micro-components is a major competitive differentiator, often leading to rapid vertical integration strategies by market leaders aiming to control quality and stabilize high-volume component pricing. The intense dependence on a small group of high-tech component manufacturers necessitates rigorous quality assurance protocols and robust, long-term supply agreements to mitigate the risk of supply chain bottlenecks and quality variance crucial for disposable, sterile products.

The mid-stream activity is centered on highly automated cleanroom assembly and rigorous final sterilization procedures. Unlike reusable scope manufacturing, where assembly focuses on durability and repairability, the process here is obsessively optimized for high-volume, low-cost assembly, minimizing manual intervention to ensure rapid scalability and manufacturing cost efficiency that justifies disposability. The integration of the delicate chip-on-the-tip technology requires precise, often robotic assembly processes conducted in geographically centralized manufacturing hubs to capitalize on skilled labor access and logistics efficiencies. Terminal sterilization, predominantly utilizing highly controlled Ethylene Oxide (EtO) or radiation methods, is a mandatory regulatory step that must be validated for every specific device type and batch, adding significant and complex logistical hurdles. This phase is critical as any failure in sterility assurance voids the primary value proposition of the product, mandating zero-tolerance quality systems.

Downstream distribution channels primarily rely on extensive, third-party medical device distributors (indirect sales) who possess the established warehousing infrastructure, complex inventory management systems, and specialized logistics capabilities necessary to handle sterile, high-volume medical consumables with expiration dating. Direct sales channels are strategically employed for key, high-volume hospital systems, allowing manufacturers to maintain direct control over pricing, conduct complex product demonstrations, and gather detailed, immediate clinical feedback essential for continuous iterative product improvement and regulatory compliance. Value capture is maximized at the point of sale by justifying a premium price based on guaranteed sterility, regulatory adherence, and the demonstrated total operational cost savings realized by the healthcare provider. Effective inventory management—both within the distribution network and at the hospital floor level—is crucial in this model, as institutions must hold sufficient sterile stock to cover unpredictable procedural demand while avoiding product expiry, transforming the logistics structure into a fast-moving, just-in-time supply operation fundamentally different from the slow-moving capital equipment model.

Single Use Video Endoscope Market Potential Customers

The core customer base for single-use video endoscopes consists of large institutional healthcare providers that manage exceptionally high procedural volumes and maintain a heightened sensitivity to regulatory compliance and patient safety risks, viewing infection control as a paramount operational concern. Large academic medical centers, sprawling integrated delivery networks (IDNs), and specialized surgical hospitals represent the most significant segment by sheer volume and aggregate revenue. These high-acuity facilities manage complex procedures on vulnerable patient populations, including those who are highly immunocompromised, where the risk of infection transmission is clinically and ethically unacceptable. Their crucial purchasing decisions are heavily influenced by the mandates of hospital infection control committees, proactive risk management departments, and the precise clinical demands of specialized procedural physicians. For these key customers, the guaranteed sterility and the subsequent ability to effectively reduce or eliminate intractable bottlenecks in their sterile processing departments often justify and secure approval for the marginal increase in the unit cost, framing single-use devices as essential risk mitigation and profound operational streamlining tools.

The fastest-growing and increasingly commercially influential customer segment is the burgeoning Ambulatory Surgical Center (ASC) market. ASCs specialize in outpatient, high-turnover procedures and operate under tight budgetary constraints, demanding operational models that maximize efficiency and minimize fixed overhead. These centers, by their nature, often lack the extensive, dedicated physical infrastructure and the specialized, highly trained staffing required for complex, multi-step high-level disinfection of reusable endoscopes. For an ASC, adopting single-use scopes entirely eliminates the associated high capital investment, ongoing maintenance costs, and significant liability attached to maintaining a compliant sterile processing department, offering a clean, predictable, and fully accounted-for cost-per-procedure model that aligns perfectly with their operational and financial strategy. This segment's demand is characterized by a strong preference for instruments that are universally user-friendly, consistently highly reliable, and immediately available for use without complex setup, making single-use devices exceptionally attractive for common, high-volume procedures like routine colonoscopy, flexible cystoscopy, and basic bronchoscopy diagnostics.

Beyond traditional acute care and outpatient settings, specialized medical practitioners and governmental agencies form important and rapidly emerging secondary customer groups. Specialty physicians, particularly Urologists utilizing flexible scopes for stone ablation, Pulmonologists managing intricate airways, and Gastroenterologists performing high-risk interventions, act as the primary clinical advocates whose detailed procedural preferences and safety concerns heavily dictate hospital procurement choices and product adoption rates. Furthermore, specific high-risk institutional users such as military health systems, disaster relief organizations, and remote field medical clinics are key potential customers for whom mobility, rapid deployment capability, and guaranteed, absolute sterility are non-negotiable operational requirements. These customers prioritize the logistical simplicity and self-contained nature of single-use devices, as they negate the burdensome logistical requirement to transport complex decontamination equipment or rely on external sterilization services, ensuring immediate, high-quality diagnostic and therapeutic capability even in challenging, low-resource environments globally, further diversifying the market reach.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $2,100 Million |

| Market Forecast in 2033 | $5,800 Million |

| Growth Rate | 15.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Ambu A/S, Boston Scientific Corporation, Stryker Corporation, Karl Storz SE & Co. KG, Olympus Corporation, PENTAX Medical, Richard Wolf GmbH, Hologic Inc., ConMed Corporation, Innerscope Medical Inc., Verathon Inc., Endosat, Vathin, Ovesco Endoscopy AG, SENS-END, Steris plc, Fujifilm Holdings Corporation, Hill-Rom Holdings (Baxter), Medical Devices Group (MDG), Asahi Intecc Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Single Use Video Endoscope Market Key Technology Landscape

The pivotal technological development underpinning the commercial viability and expansive growth of the single-use endoscope market is the dramatic and ongoing improvement in micro-miniaturization, principally centered around CMOS (Complementary Metal-Oxide-Semiconductor) sensor technology. Unlike older reusable scopes relying on fragile, light-attenuating fiber optic bundles to physically transmit images to an external camera system, modern single-use devices successfully employ the "chip-on-the-tip" architecture, where a high-definition CMOS sensor is meticulously integrated directly at the distal end of the instrument. This core innovation ensures consistently superior and pristine image quality across every procedure, completely eliminates the possibility of fiber optic damage, and prevents pixelation or degradation from chemical exposure and heat associated with reprocessing. Crucially, CMOS manufacturing processes are inherently scalable and highly cost-effective, meeting the high-volume, low-cost economic requirements absolutely essential for commercially viable disposable medical devices. Continuous research is heavily focused on aggressively increasing the image resolution, enhancing the light sensitivity of these micro-sensors under challenging internal body conditions, and simultaneously reducing their physical footprint and total power consumption, systematically closing the performance gap with specialized, costly capital equipment.

Beyond imaging technology, material science innovation forms a fundamental and critical layer of the single-use landscape's success. Manufacturers are heavily invested in developing advanced, proprietary polymer materials for the insertion tube, the external sheath, and the crucial internal working channels that must offer an optimal and balanced combination of flexibility, torque transmission (necessary for physician control), and lubricity for easy insertion, yet remain inexpensive enough for justifiable disposal. The internal mechanical structure, particularly the complex actuation and steering mechanisms (often leveraging simplified, cost-effective pull-wire technology), must be meticulously simplified and optimized for guaranteed single-use reliability, ensuring functionality is never compromised. Furthermore, the specialized development of fully integrated, high-efficiency LED illumination systems is key. These systems deliver sufficient, cold light intensity for clear, artifact-free visualization deep within the body cavity while strictly managing heat generation within the constraints of a micro-tip environment, ensuring clinical efficacy without requiring bulky, expensive external fiber-optic light source connections traditionally mandated by reusable scopes.

The evolving technological landscape also encompasses advanced data connectivity and robust processing capabilities crucial for maximizing the clinical utility of the disposable scope. While the scope itself is discarded, the associated display and processing unit (which remains a separate capital component) is becoming exponentially more sophisticated, incorporating powerful microprocessors designed to handle the massive volume of high-definition digital data generated by the chip-on-the-tip scope. This external processing hardware serves as the essential foundation for integrating future technologies like Artificial Intelligence (AI) for real-time image analysis, automated clinical documentation, and complex procedural guidance overlays. Furthermore, standardizing universal plug-and-play digital connectivity protocols is paramount to ensure seamless, compliant digital integration into hospital Picture Archiving and Communication Systems (PACS) and Electronic Health Records (EHRs), streamlining workflow and fulfilling rigorous regulatory requirements concerning data security and storage. Future technology trends will focus intensely on integrated micro-fluidics for superior irrigation and suction efficiency, and potentially incorporating micro-biosensors within the tip to gather real-time physiological data (e.g., pH, temperature) alongside visual information, profoundly expanding the diagnostic and therapeutic utility of the disposable endoscopy platform.

Regional Highlights

- North America: Dominates the global market in terms of revenue and technological adoption, primarily driven by highly rigorous regulatory enforcement from organizations like the FDA concerning complex reprocessing procedures and mandatory patient safety measures. The region benefits from substantial healthcare expenditure, robust reimbursement mechanisms that readily cover the cost of high-quality sterile disposable devices, and a high, proactive level of patient and public awareness regarding HAI risks. The region's active litigation environment related to documented HAI outbreaks further provides compelling financial incentive for institutions to accelerate the permanent transition to sterile disposable instruments, especially impacting core high-risk areas like duodenoscopy and flexible bronchoscopy procedures.

- Europe: Represents a substantial, mature, and steadily growing market characterized by predictable growth patterns, underpinned by strong public health system mandates for stringent infection control standards across major Western European nations. Adoption is actively supported by centralized governmental purchasing organizations that meticulously conduct rigorous Total Cost of Ownership (TCO) analyses, frequently concluding that the long-term operational savings realized from eliminating complex, error-prone reprocessing cycles significantly outweigh the initially higher unit cost of disposable scopes. Countries such as Germany, the UK, and France are proactively updating national clinical guidelines to formally incorporate and favor the superior safety profile of single-use devices, though the adoption velocity can be slightly moderated by varying national reimbursement timelines and historical clinical preference for established reusable technologies.

- Asia Pacific (APAC): Forecasted to be the fastest-growing market globally, characterized by an exceptionally high Compound Annual Growth Rate (CAGR). This rapid and expansive growth is fundamentally fueled by large-scale, sustained government and private sector investments in modernizing and expanding healthcare infrastructure, especially across rapidly emerging economies like China, India, and Southeast Asian nations. The region's immense and aging patient population requiring endoscopic screening and diagnostic procedures ensures exceptionally high and growing procedural volumes. Furthermore, the rapid dissemination and implementation of international best practices in infection control and the growing middle class demanding higher standards of medical safety are collectively propelling the definitive shift from legacy reusable fiber scopes to modern digital single-use video scopes, often efficiently bypassing the initial establishment of costly traditional reprocessing infrastructure entirely.

- Latin America (LATAM): Exhibits moderate yet critical growth potential, particularly within the affluent private healthcare sector. Market expansion faces constraints primarily related to lingering price sensitivity, variable public healthcare capital shortages, and non-uniform regulatory standards across the diverse countries within the region. However, private healthcare facilities in major economies like Brazil, Mexico, and Chile are increasingly prioritizing single-use technology to minimize clinical and liability risk and align their procedural standards with highly competitive international safety benchmarks, rapidly recognizing the compelling long-term economic benefits associated with improved patient throughput and significantly reduced infection-related liability exposure in their competitive private health landscape.

- Middle East and Africa (MEA): This region represents the smallest but most technologically selective market segment. Growth is heavily concentrated in the affluent Gulf Cooperation Council (GCC) countries (e.g., UAE, Saudi Arabia, Qatar) which maintain exceptionally high, Westernized standards for imported medical technology and possess substantial government resources allocated to ambitious healthcare modernization projects. Demand in this sub-region is typically for premium, cutting-edge, high-quality, and readily available sterile disposable devices suitable for sophisticated procedural needs, although widespread adoption remains highly segmented by the profound economic disparity across the broader African continent.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Single Use Video Endoscope Market.- Ambu A/S

- Boston Scientific Corporation

- Stryker Corporation

- Olympus Corporation

- PENTAX Medical (Hoya Corporation)

- Richard Wolf GmbH

- Karl Storz SE & Co. KG

- Hologic Inc.

- ConMed Corporation

- Verathon Inc.

- Innerscope Medical Inc.

- Vathin Medical Technology (Suzhou) Co., Ltd.

- Endosat

- Ovesco Endoscopy AG

- SENS-END

- Steris plc

- Fujifilm Holdings Corporation

- Hill-Rom Holdings (now part of Baxter International)

- Medical Devices Group (MDG)

- Asahi Intecc Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Single Use Video Endoscope market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the adoption of single-use video endoscopes globally?

The primary driver is the stringent global demand for enhanced patient safety and infection control, specifically the need to definitively eliminate the persistent risk of cross-contamination and subsequent Healthcare-Associated Infections (HAIs) linked to the inadequate cleaning and reprocessing of complex, multi-channel reusable endoscopes, particularly highlighted by duodenoscope outbreaks.

Are modern single-use endoscopes comparable in image quality and maneuverability to established reusable systems?

Yes, modern single-use endoscopes, leveraging advanced chip-on-the-tip CMOS technology, offer high-definition visualization (HD) that often rivals or exceeds the quality of reusable fiber-optic systems. Furthermore, recent design iterations have significantly improved scope flexibility and torque transmission, enhancing maneuverability to meet the complex requirements of procedures like flexible ureteroscopy and difficult bronchoscopies, ensuring consistent, undegraded performance.

How do single-use scopes affect the Total Cost of Ownership (TCO) for hospitals and Ambulatory Surgical Centers (ASCs)?

While the unit cost of a disposable scope is notably higher than the per-use amortized cost of a reusable instrument, the TCO model strongly favors disposables when factoring in eliminated expenses. These savings include substantial costs associated with dedicated reprocessing staff, expensive cleaning chemicals, frequent scope repairs and maintenance contracts, asset depreciation, procedural downtime due to scope unavailability, and the immense financial and legal liability associated with potential HAI outbreaks.

Which application segment is expected to show the most aggressive revenue growth rate and why?

The bronchoscopy and urology (flexible ureteroscopy) segments are projected to experience the most aggressive revenue growth. This acceleration is driven by the immediate clinical necessity for sterile instruments in high-risk patient populations (pulmonary/immunocompromised) and the consistently high rate of damage and cleaning challenges inherent to reusable scopes used in the narrow and complex anatomical pathways of the urinary tract.

What technological advancement is most critical for the continued growth and cost reduction of the single-use endoscopy market?

The critical technology is the progressive miniaturization and cost-effective mass production of high-resolution CMOS imaging sensors (chip-on-the-tip technology). This development allows manufacturers to achieve superior diagnostic image quality at a sufficiently low Bill of Materials (BOM) cost, ensuring that the devices are economically viable for single-use disposal while still meeting rigorous clinical performance standards.

How is the adoption of single-use technology influencing the structure of hospital sterile processing departments (SPD)?

The increasing adoption of single-use endoscopes is fundamentally shifting the operational focus of SPDs away from complex, time-consuming scope reprocessing toward managing simpler sterilization processes and logistics for other reusable instruments. This transition allows SPDs to reallocate specialized labor and resources, reducing workflow bottlenecks and minimizing the institutional dependence on highly skilled staff for scope HLD, thereby improving overall organizational efficiency.

What is the primary difference in the distribution model between reusable and single-use endoscopes?

Reusable endoscopes follow a capital equipment model requiring specialized sales and repair services. Single-use endoscopes utilize a high-volume consumable distribution model, relying heavily on sophisticated indirect logistics and inventory management systems to ensure hospitals maintain adequate sterile stock on demand, transforming the supply chain from a slow-moving asset management system into a fast-moving, just-in-time logistics operation.

Are regulatory bodies mandating the complete replacement of all reusable endoscopes with disposable models?

While a complete mandatory replacement is not yet universal, regulatory bodies, particularly in the US, have issued strong safety alerts and transitional recommendations, urging healthcare facilities to transition to disposable models for high-risk, difficult-to-reprocess scopes (like duodenoscopes). This pressure strongly encourages, rather than explicitly mandates, the systematic adoption of single-use devices as the preferred infection control standard for many procedural categories.

What is the role of large traditional endoscope manufacturers like Olympus and Karl Storz in the single-use market?

These traditional giants are defensively and strategically entering the single-use market through a combination of internal R&D, strategic partnerships, and acquisitions. They aim to protect their large installed base of reusable systems while responding to market shifts and regulatory pressure by offering hybrid solutions or fully disposable alternatives in high-risk categories to maintain their market leadership and relevance.

How is AI expected to integrate with the single-use endoscope workflow?

AI integration occurs primarily in the external processing unit or visualization monitor rather than the disposable scope tip itself. AI will provide real-time diagnostic assistance (lesion detection, boundary demarcation), automate procedural quality assessment, and enhance data aggregation for clinical documentation, maximizing the clinical value derived from the high-quality, single-use video stream.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager