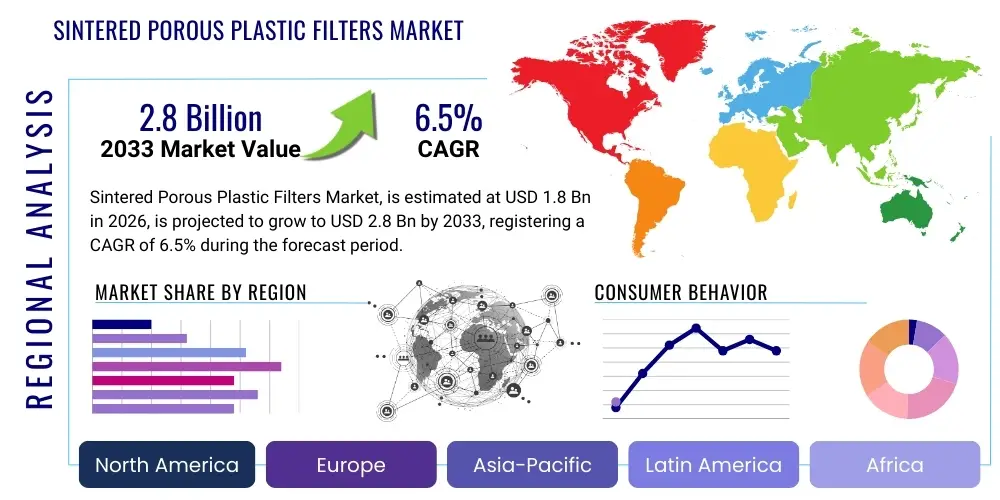

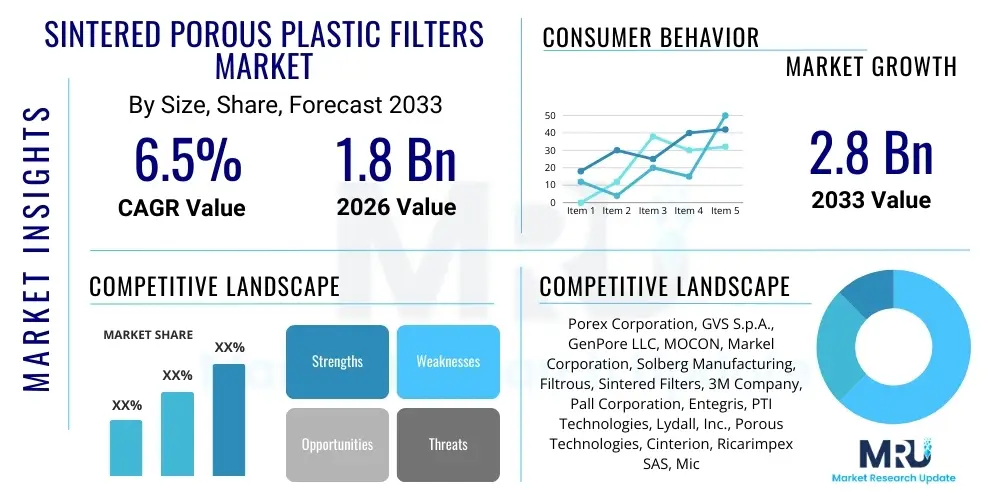

Sintered Porous Plastic Filters Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437322 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Sintered Porous Plastic Filters Market Size

The Sintered Porous Plastic Filters Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 1.8 Billion in 2026 and is projected to reach USD 2.8 Billion by the end of the forecast period in 2033.

Sintered Porous Plastic Filters Market introduction

The Sintered Porous Plastic Filters Market involves the manufacturing and distribution of filtration devices created by sintering fine plastic powders, typically High-Density Polyethylene (HDPE) or Ultra-High Molecular Weight Polyethylene (UHMW PE). This specialized process results in a self-supporting, rigid structure characterized by precise and interconnected pores, offering superior chemical resistance, thermal stability, and mechanical strength compared to traditional fibrous or metallic filters. These properties make them essential for high-purity separation tasks across numerous sensitive industries.

The primary applications of these advanced filters span fluid management, acoustic dampening, gas diffusion, and chromatography. Key sectors utilizing sintered porous plastic technology include healthcare (medical devices, blood filtration), environmental monitoring (water purification, air sampling), consumer goods (dispensing tips, writing instrument reservoirs), and specialized industrial processes (chemical processing, battery venting). The controlled pore size distribution, ranging from submicron to several hundred microns, allows for highly efficient particle retention and controlled flow rates, crucial for precision applications.

Key market drivers include the stringent regulatory requirements in the pharmaceutical and medical device industries demanding inert, sterile, and non-shedding filtration media. Furthermore, the increasing global focus on water purity and industrial air quality mandates the adoption of robust, corrosion-resistant filters. The inherent lightweight nature, low cost of manufacturing polymers relative to metals, and ease of customization (geometry and porosity) continue to position sintered porous plastics as a preferred solution for next-generation separation challenges worldwide.

Sintered Porous Plastic Filters Market Executive Summary

The global Sintered Porous Plastic Filters Market is experiencing robust expansion, fundamentally driven by the accelerated growth in the healthcare and life sciences sectors, particularly demanding high-purity point-of-use filtration and specialized medical components. Business trends indicate a strong move toward customization and miniaturization, enabling integration into portable diagnostic kits and small-scale analytical equipment. Manufacturers are heavily investing in advanced polymer science, specifically focusing on materials that offer enhanced chemical compatibility and resistance to high-pressure environments, broadening their application scope beyond traditional polymer limitations and competing more directly with specialized ceramics and metals.

Regionally, Asia Pacific (APAC) is emerging as the fastest-growing market, propelled by rapidly industrializing economies, significant government investment in water and wastewater infrastructure, and the expansion of domestic pharmaceutical manufacturing capabilities in countries like China and India. North America and Europe, while mature, maintain market leadership due to established stringent regulatory frameworks governing medical device purity and environmental emissions, fostering continuous demand for high-specification porous media. Strategic alliances between filter manufacturers and major medical device original equipment manufacturers (OEMs) are crucial for market penetration and accelerating product adoption in these high-value markets.

In terms of segment trends, filters based on High-Density Polyethylene (HDPE) currently dominate the market volume due to their cost-effectiveness and versatile performance characteristics, suitable for general industrial and consumer applications. However, the Polytetrafluoroethylene (PTFE) segment is projected to exhibit the highest growth rate, driven by its superior chemical inertness and suitability for extreme temperature and aggressive chemical environments required in advanced industrial filtration and critical battery venting applications. Furthermore, the rising demand for sterile venting and acoustic management components in electronics and automotive sectors underscores the diversification of filter functions beyond conventional liquid and gas separation.

AI Impact Analysis on Sintered Porous Plastic Filters Market

Common user questions regarding AI's impact on the Sintered Porous Plastic Filters Market often revolve around operational efficiency, product quality assurance, and the development of next-generation porous materials. Key concerns include how Artificial Intelligence (AI) and Machine Learning (ML) can optimize the complex sintering process, which requires precise control over temperature and pressure cycles to achieve desired pore morphology and distribution. Users seek clarity on whether AI can reduce manufacturing defects, predict performance degradation in real-time applications, and accelerate the discovery of new polymer compounds suitable for ultra-specific filtration tasks. The prevailing expectation is that AI will primarily revolutionize the manufacturing backend and predictive maintenance, transitioning the industry towards smart manufacturing.

The implementation of AI systems in the manufacturing of sintered porous plastic filters is primarily focused on enhancing process control and maintaining highly consistent pore structure, which is vital for filtration effectiveness. ML algorithms analyze multivariate data streams—including temperature gradients, raw material batch variances, and sintering pressure profiles—to predict and mitigate deviations that lead to inconsistent permeability or pore size. This proactive control significantly reduces scrap rates, minimizes the time required for quality checks, and ensures that the final product adheres perfectly to the tight specifications demanded by medical and semiconductor industries. Consequently, AI enables manufacturers to offer more reliable and repeatable products globally.

Beyond process optimization, AI is starting to play a strategic role in research and development, particularly in material informatics. ML models can sift through vast databases of polymer characteristics and simulation data to rapidly identify optimal material combinations and particle geometries for specific filtration challenges, such as viral filtration or highly selective gas separation. This acceleration of material discovery allows companies to quickly respond to emerging market needs, such as the requirements for sustainable, bio-based porous plastics, or filters designed for harsh, abrasive environments. Ultimately, AI transforms product customization from a labor-intensive iterative process into an efficient, data-driven endeavor, leading to a faster time-to-market for specialized filter solutions.

- AI optimizes sintering parameters for uniform porosity and minimal structural defects.

- Machine Learning models predict filter lifespan and schedule preventative maintenance in critical applications.

- AI-driven image analysis accelerates Quality Control (QC) by identifying subtle pore inconsistencies.

- Material informatics utilizes ML to accelerate the R&D of novel polymer compositions for specific chemical resistance.

- Predictive modeling minimizes raw material waste and energy consumption during high-volume production runs.

DRO & Impact Forces Of Sintered Porous Plastic Filters Market

The market dynamics for sintered porous plastic filters are governed by a complex interplay of strong drivers, necessary restraints, and significant opportunities, which collectively define the impact forces shaping its trajectory. The primary driver is the pervasive need for precise and chemically inert separation media across highly regulated industries, especially healthcare, where these filters are integral to drug delivery, sterile venting, and diagnostic devices. Coupled with this is the opportunity presented by regulatory mandates globally enforcing stricter standards for industrial emissions and clean water infrastructure, necessitating reliable, long-lasting filtration solutions that porous plastics inherently provide. However, growth is tempered by restraints such such as the material limitations regarding high-temperature tolerance and specific chemical incompatibility issues encountered in extremely harsh industrial processes, alongside the ongoing challenge of high initial investment required for advanced sintering equipment and quality assurance instrumentation.

Drivers exerting substantial positive pressure include the expanding adoption of specialized medical applications, such as disposable medical filters and chromatography columns, where the non-shedding, clean nature of sintered plastics is paramount. Furthermore, the proliferation of Internet of Things (IoT) devices and electric vehicles (EVs) drives demand for specialized venting filters that manage pressure equalization and mitigate condensation, leveraging the acoustic and hydrophobic properties of porous plastics. The shift towards sustainable manufacturing processes also offers an opportunity for utilizing bio-based and recycled polymers in porous filter production, appealing to environmentally conscious industries and bolstering market differentiation against traditional media. This sustained high-growth potential in niche, high-value applications overshadows the general commoditization risk associated with lower-end industrial filter manufacturing.

Restraints, primarily centered around technical performance ceilings and cost structures, necessitate strategic innovation. The inability of standard polyethylene or polypropylene filters to withstand temperatures exceeding 135°C limits their utility in certain industrial sterilization or high-heat processing environments, creating a technological barrier that drives innovation towards fluoropolymers like PTFE. Another significant constraint is the complexity of achieving absolute sub-micron filtration compared to membrane technologies, requiring continuous R&D investment to narrow the performance gap. The impact forces are thus heavily weighted towards technological advancement and regulatory compliance; companies that successfully overcome thermal and chemical stability restraints while maintaining cost competitiveness and providing certified solutions for critical applications are positioned for dominant market leadership throughout the forecast period.

- Drivers:

- Increasing application in disposable medical devices and diagnostics requiring high purity.

- Rising global demand for water purification and treatment systems.

- Technological advancements allowing for highly customized pore sizes and shapes.

- Growth in automotive and electronics sectors requiring venting and acoustic management components.

- Restraints:

- Limited thermal resistance compared to metallic or ceramic alternatives.

- High capital expenditure required for precise sintering and quality control infrastructure.

- Challenges in achieving ultra-fine (sub-0.1 micron) filtration requirements consistently.

- Price sensitivity and competition from traditional filter media in low-end industrial applications.

- Opportunities:

- Development of bio-based and sustainable porous polymer materials.

- Expansion into chromatography and separation science requiring highly inert materials.

- Miniaturization trends in portable devices driving demand for micro-sintered components.

- Integration of smart features (e.g., flow sensors) into porous plastic filter assemblies.

- Impact Forces:

- High Regulatory Compliance Pressure (especially medical and environmental).

- Moderate to High Need for Material Innovation (thermal/chemical stability).

- High Customer Demand for Customization and Precision Manufacturing.

Segmentation Analysis

The Sintered Porous Plastic Filters Market is broadly segmented based on material type, pore size, application, and end-use industry, reflecting the diverse technical requirements across different sectors. Material segmentation is crucial as it determines the chemical compatibility, temperature tolerance, and mechanical strength of the filter; the major polymers include Polyethylene (PE), Polypropylene (PP), Polytetrafluoroethylene (PTFE), and Polyvinylidene Fluoride (PVDF). Each material offers unique performance advantages, influencing its adoption in specific high-value or high-volume applications. The pore size segment classifies filters from coarse (over 100 microns) used in pre-filtration to fine (under 5 microns) used in critical sterilization and analytical processes, directly correlating with filtration efficiency and application type.

The application segmentation distinguishes between filtration (liquid/gas), diffusion, wicking/absorption, and venting, showcasing the multi-functional capability of sintered media beyond traditional separation. For instance, diffusion applications are critical in gas mixers and spargers, while wicking functions are pivotal in medical diagnostics and consumer product reservoirs. End-use industries represent the final layer of segmentation, with healthcare, chemicals, automotive, and electronics being the primary consumers, each imposing unique quality and regulatory burdens on filter specifications. The complexity of these segments highlights the highly specialized nature of the market, where standardized products coexist alongside bespoke, custom-engineered components.

- By Material Type:

- High-Density Polyethylene (HDPE)

- Ultra-High Molecular Weight Polyethylene (UHMW PE)

- Polypropylene (PP)

- Polytetrafluoroethylene (PTFE)

- Polyvinylidene Fluoride (PVDF)

- Others (e.g., Nylon, PEEK)

- By Pore Size:

- Coarse Filtration (>50 microns)

- Medium Filtration (5 to 50 microns)

- Fine Filtration (<5 microns)

- By Function/Application:

- Filtration and Separation (Liquid & Gas)

- Venting and Equalization (Pressure Relief)

- Diffusion and Sparging

- Wicking and Absorption

- Acoustic Management (Dampening)

- By End-Use Industry:

- Healthcare and Pharmaceuticals

- Chemical and Process Industry

- Automotive and Transportation

- Electronics and Consumer Goods

- Water and Wastewater Treatment

- Environmental Monitoring

Value Chain Analysis For Sintered Porous Plastic Filters Market

The value chain for Sintered Porous Plastic Filters begins upstream with the procurement of specialized, high-purity polymer powders, primarily HDPE, PTFE, and PP. Raw material suppliers must ensure highly consistent particle size distribution and chemical composition, as even minor variances significantly impact the final filter porosity and performance. This stage is crucial, as the quality of the polymer powder directly dictates the feasibility of the subsequent, highly technical sintering process. Key activities at the upstream level involve polymerization, grinding, and specialized blending of additives to enhance properties such as hydrophobicity or UV resistance, establishing the foundational quality of the porous media.

Midstream activities constitute the core manufacturing process, involving sophisticated techniques like cold isostatic pressing and high-temperature sintering. Manufacturers apply controlled heat and pressure to the powdered polymer inside molds, fusing the particles without complete melting, thereby creating the intricate, interconnected porous network. This stage demands specialized equipment, high energy consumption, and stringent environmental control to maintain product consistency. Following sintering, secondary processing includes shaping, cutting, bonding, and integrating the porous media into final filter housings or assemblies, often involving ultrasonic welding or specialized adhesive application, catering to precise OEM specifications.

The downstream segment focuses on distribution channels and end-user integration. Sintered filters are typically distributed through a mix of direct sales channels, particularly for large, highly customized OEM orders in the medical and automotive industries, and specialized industrial distributors for general market products. The role of indirect channels, often third-party distributors specializing in fluid handling or laboratory supplies, is crucial for accessing smaller end-users and maintenance markets. The effectiveness of the downstream process is highly dependent on technical support and application expertise, as end-users require assurance regarding compliance, material compatibility, and filtration efficiency for their specific process requirements.

Sintered Porous Plastic Filters Market Potential Customers

The primary customers for sintered porous plastic filters are large-scale Original Equipment Manufacturers (OEMs) within highly regulated sectors who integrate these components into their finished products. The healthcare industry represents the most critical segment, with customers including manufacturers of infusion pumps, dialysis machines, surgical instruments requiring sterile venting, and diagnostic kits (e.g., blood plasma separation filters). These buyers prioritize material inertness, sterilization compatibility (e.g., gamma radiation or autoclave), and guaranteed non-shedding characteristics, often demanding bespoke designs and long-term supply agreements for certified components.

Another major customer base resides in the chemical and process industries, particularly those requiring corrosion-resistant filtration for harsh acids, bases, or solvents. Companies involved in specialty chemical production, petrochemical refining, and semiconductor manufacturing utilize these filters for particle removal, solvent recovery, and gas sparging, where metallic filters would corrode rapidly. These buyers value the chemical resistance of materials like PTFE and PVDF and the mechanical integrity of the sintered structure under pressure, often purchasing large, custom-molded parts for integration into industrial filtration cartridges and vessels.

Furthermore, the automotive and consumer electronics sectors represent rapidly growing segments. Automotive manufacturers use sintered plastic filters for battery venting systems in electric vehicles to manage pressure and moisture, enhancing safety and longevity. Electronics companies utilize these components for acoustic dampening in microphones, pressure equalization in sensitive sensors, and micro-filtration in ink reservoirs for printing technologies. These customers seek compact, lightweight, and highly durable components that can be seamlessly integrated into miniaturized assemblies, driving demand for fine-pore, highly customized polymer structures.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.8 Billion |

| Market Forecast in 2033 | USD 2.8 Billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Porex Corporation, GVS S.p.A., GenPore LLC, MOCON, Markel Corporation, Solberg Manufacturing, Filtrous, Sintered Filters, 3M Company, Pall Corporation, Entegris, PTI Technologies, Lydall, Inc., Porous Technologies, Cinterion, Ricarimpex SAS, Micro-Filter GmbH, Seebach GmbH, Trinity Engineered Porous Products, Capillex, Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Sintered Porous Plastic Filters Market Key Technology Landscape

The technology landscape governing the Sintered Porous Plastic Filters Market is defined by continuous advancements in powder processing, sintering methodologies, and post-processing techniques aimed at achieving superior control over pore size distribution (PSD) and enhancing material properties. The foundational technology involves specialized polymer powder preparation, where the particle morphology must be meticulously controlled to ensure uniform packing and predictable porosity outcomes. Advanced milling and classification techniques are utilized to prepare high-ppurity spherical or near-spherical particles, which are essential for producing homogeneous filters with narrow pore size tolerances critical for analytical and medical applications. Innovations in this area include optimizing particle surface energy to promote better inter-particle adhesion during the fusion phase.

The core technology lies in the sintering process itself, moving beyond conventional atmospheric heating towards highly controlled processes such as vacuum sintering or hot isostatic pressing (HIP). These specialized methods allow manufacturers to exert extremely precise control over the polymer fusion, minimizing material degradation and volatile organic compound (VOC) generation, which is crucial for high-purity applications. Furthermore, the development of sophisticated molding technologies permits the creation of highly complex filter geometries, enabling the production of filters with integrated connections, varied thickness profiles, or multi-layered structures in a single manufacturing step, significantly reducing assembly costs and enhancing structural integrity of the final product.

A critical emerging area of technological focus involves functionalizing the porous plastic surfaces through chemical modification or specialized coating applications. For instance, techniques are being developed to apply highly selective chemistries onto the pore walls to enhance capture efficiency for specific targets (e.g., biological agents or heavy metals) or to permanently alter the surface tension, increasing hydrophilicity or hydrophobicity as required for fluid dynamics management. Additionally, the integration of 3D printing (Additive Manufacturing) is being explored, particularly for prototyping complex porous structures and creating custom, low-volume filter elements with previously impossible internal channel designs, although this technology still faces challenges regarding throughput and fine pore consistency for mass production.

Regional Highlights

North America holds a substantial share of the Sintered Porous Plastic Filters Market, primarily due to the presence of a robust, highly regulated healthcare and pharmaceutical industry, especially in the United States. The demand here is characterized by high-specification requirements for disposable medical devices, drug discovery processes, and advanced analytical instrumentation. Strict FDA regulations drive the necessity for certified, high-purity filtration media, favoring established players capable of extensive validation and compliance documentation. Furthermore, significant investment in the automotive sector, specifically in EV battery technology, contributes heavily to the regional demand for high-performance venting filters.

Europe represents another mature and high-value market, propelled by stringent environmental regulations concerning water quality and industrial emissions across the European Union. Countries like Germany and the UK exhibit strong demand in the chemical processing and industrial manufacturing sectors, prioritizing high chemical resistance and durability. The market growth in Europe is steady, focused heavily on sustainable materials and energy-efficient filtration solutions. Research initiatives funded by the EU often foster innovation in polymer technology, driving the adoption of specialized polymers like PVDF and PTFE for demanding industrial applications.

Asia Pacific (APAC) is projected to be the fastest-growing region during the forecast period. This rapid expansion is fueled by massive industrialization, increasing urbanization leading to heightened demand for clean water infrastructure, and the surging growth of the regional healthcare markets, particularly in China, Japan, and India. While price sensitivity remains a factor in certain segments, the massive scale of manufacturing in consumer electronics and automotive components in this region creates unparalleled volume demand for porous plastic components used in venting, acoustic dampening, and ink jet filtration systems. Local manufacturers are rapidly adopting advanced sintering technologies to meet rising domestic and export demands.

Latin America and the Middle East and Africa (MEA) currently account for smaller market shares but offer significant long-term growth potential. Latin America's growth is tied to investments in water treatment infrastructure and expansion of regional pharmaceutical manufacturing capabilities, requiring reliable filtration solutions. The MEA region is characterized by steady investment in petrochemical processing and specialized industrial applications, where the corrosion resistance and thermal stability of certain porous plastics are highly valued in desalination and oil & gas refining processes, though political and economic volatility can impact project timelines and market demand variability.

- North America: Dominates the high-value medical device and laboratory filtration segments, driven by stringent regulatory frameworks (FDA) and advanced R&D in materials science.

- Europe: Strong focus on environmental compliance and industrial process filtration, emphasizing sustainable polymers and high-durability components for chemical manufacturing.

- Asia Pacific (APAC): Highest growth trajectory, fueled by rapid expansion in manufacturing (electronics, automotive) and massive investments in public water infrastructure and regional healthcare services.

- Latin America: Emerging market driven by necessity for better water quality solutions and expanding local pharmaceutical production capacity.

- Middle East & Africa (MEA): Growth concentrated in specialized applications within the oil & gas and desalination sectors, valuing chemical resistance and robust mechanical properties.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Sintered Porous Plastic Filters Market.- Porex Corporation

- GVS S.p.A.

- GenPore LLC

- MOCON

- Markel Corporation

- Solberg Manufacturing

- Filtrous

- Sintered Filters

- 3M Company

- Pall Corporation (A Danaher Company)

- Entegris

- PTI Technologies

- Lydall, Inc. (Now part of Unifrax)

- Porous Technologies

- Cinterion

- Ricarimpex SAS

- Micro-Filter GmbH

- Seebach GmbH

- Trinity Engineered Porous Products

- Capillex, Inc.

Frequently Asked Questions

Analyze common user questions about the Sintered Porous Plastic Filters market and generate a concise list of summarized FAQs reflecting key topics and concerns.What advantages do sintered porous plastic filters offer over metallic or ceramic alternatives?

Sintered porous plastic filters offer superior advantages including exceptional chemical inertness (especially with PTFE and PVDF), significantly lower density and weight, enhanced structural versatility for complex geometries, and greater cost-effectiveness in high-volume, disposable applications, particularly in the medical and analytical fields.

Which polymer material dominates the Sintered Porous Plastic Filters Market?

High-Density Polyethylene (HDPE) currently dominates the market volume due to its excellent balance of mechanical strength, versatile pore size range, and cost-efficiency, making it suitable for a wide variety of industrial, consumer, and certain lower-risk medical applications.

How is the pore size of sintered plastic filters precisely controlled during manufacturing?

The pore size is precisely controlled by meticulously managing the particle size distribution of the polymer powder, the pressure applied during pre-forming, and the temperature profile and duration during the high-heat sintering cycle, ensuring predictable and repeatable interconnected pore geometry.

What role do sintered porous plastic filters play in the growing electric vehicle (EV) market?

In the EV market, these filters are crucial components in battery venting systems, where their hydrophobic properties and controlled porosity manage pressure equalization, prevent moisture ingress, and offer a degree of thermal insulation, thus enhancing battery safety and longevity.

What are the key restraint factors limiting the widespread adoption of porous plastic filters?

The primary restraint factors include the comparatively lower maximum operating temperatures (typically below 135°C for standard polymers) compared to metallic filters, which limits their use in high-heat sterilization or aggressive industrial processes, and the significant capital investment required for state-of-the-art sintering technology.

Are porous plastic filters suitable for sterile filtration in pharmaceutical applications?

Yes, specific grades, particularly those made from inert polymers like PTFE and UHMW PE, are widely used for sterile venting, gas filtration, and pre-filtration steps in pharmaceutical manufacturing due to their non-shedding characteristics and ability to withstand common sterilization methods such as gamma irradiation and ethylene oxide (EtO).

How does the use of AI benefit the manufacturing of sintered porous plastic components?

AI benefits manufacturing by optimizing the complex sintering process parameters in real-time, reducing material inconsistencies, predicting quality deviations, and minimizing energy consumption, thereby leading to higher product yield and more uniform pore size distribution critical for high-performance applications.

Which geographical region exhibits the fastest growth potential in this market?

Asia Pacific (APAC) is projected to demonstrate the fastest market growth, driven by rapid industrial expansion, escalating investment in domestic healthcare and pharmaceutical production, and significant government initiatives focused on improving regional water and wastewater management infrastructure.

Beyond filtration, what other primary functions do sintered porous plastics perform?

Beyond traditional filtration, sintered porous plastics excel in specialized functions including pressure equalization (venting), controlled gas mixing and delivery (diffusion/sparging), liquid transport (wicking), and noise reduction (acoustic dampening) in sensitive electronic and consumer products.

What is the typical range of pore sizes available in commercial sintered porous plastic filters?

Commercial sintered porous plastic filters are available with pore sizes ranging from sub-micron (e.g., 0.5 microns) up to several hundred microns (e.g., 250 microns or more), allowing engineers to precisely select the filtration efficiency and permeability required for their specific application.

How do manufacturers ensure the material purity required for medical device applications?

Manufacturers ensure purity through rigorous selection of medical-grade polymer powders, cleanroom processing environments, strict quality control procedures including leachables and extractables testing, and comprehensive validation protocols to guarantee compliance with ISO 13485 and FDA regulations.

What are the primary upstream challenges in the value chain for sintered porous plastic filters?

The primary upstream challenge is ensuring the consistent supply of high-purity polymer powders with highly specific and uniform particle size distribution, as variations in raw material quality directly and significantly compromise the structural integrity and filtration efficacy of the final sintered product.

Is the market experiencing a shift towards sustainable or bio-based polymer use?

Yes, there is a growing market opportunity and technological focus on developing and utilizing bio-based and sustainable polymers for sintered filter applications, driven by corporate sustainability goals and increasing consumer demand for environmentally responsible products, though scaling remains a technical hurdle.

How does the sintering process differ from conventional plastic molding techniques?

Unlike conventional molding (injection or compression) which involves full melting of the polymer, sintering involves heating the plastic powder just enough to fuse the particles at their points of contact without liquefaction, thereby creating the rigid, self-supporting structure with interconnected pores.

What specialized polymers are used for applications requiring extreme chemical resistance?

For extreme chemical resistance, especially when handling aggressive acids, bases, or specialized organic solvents, Polytetrafluoroethylene (PTFE) and Polyvinylidene Fluoride (PVDF) are the specialized polymers of choice, offering superior inertness and high thermal stability compared to polyethylene or polypropylene.

What is the significance of the "wicking" function in sintered porous plastics?

The wicking function leverages capillary action within the porous structure to draw and distribute fluids efficiently, a critical capability used extensively in medical diagnostic test strips, sample preparation cartridges, and controlled fluid delivery systems in consumer products like markers and dispensers.

How does the market address the demand for customized filter geometries?

The market addresses customization through advanced tooling and specialized molding techniques during the sintering process, allowing manufacturers to create bespoke shapes, integrated features (like threads or nozzles), and multi-layer structures in a single, cost-effective operation for high-volume OEM requirements.

What specific challenges does the semiconductor industry pose for filter manufacturers?

The semiconductor industry demands ultra-high purity filtration to prevent particle contamination in chemical delivery systems and cleanrooms. This requires filters with extremely low extractables, superior resistance to aggressive etchants, and certified non-shedding characteristics, pushing manufacturers to use specialty fluoropolymers and stringent quality control.

How do global water purification needs influence market growth?

Global water purification needs significantly drive market growth by increasing the demand for robust, cost-effective pre-filtration and sediment removal systems in municipal, industrial, and residential water treatment, where porous plastic filters offer long lifespan and resistance to bio-fouling and chemical treatments.

What defines the market segment based on "Fine Filtration" (<5 microns)?

The Fine Filtration segment (typically below 5 microns) is defined by applications requiring highly critical particle removal, such as sterile filtration in medical labs, final polishing in chemical production, or removing fine particulates from sensitive hydraulic fluids, necessitating high consistency and stringent quality assurance.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager