SIP Clients Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434170 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

SIP Clients Market Size

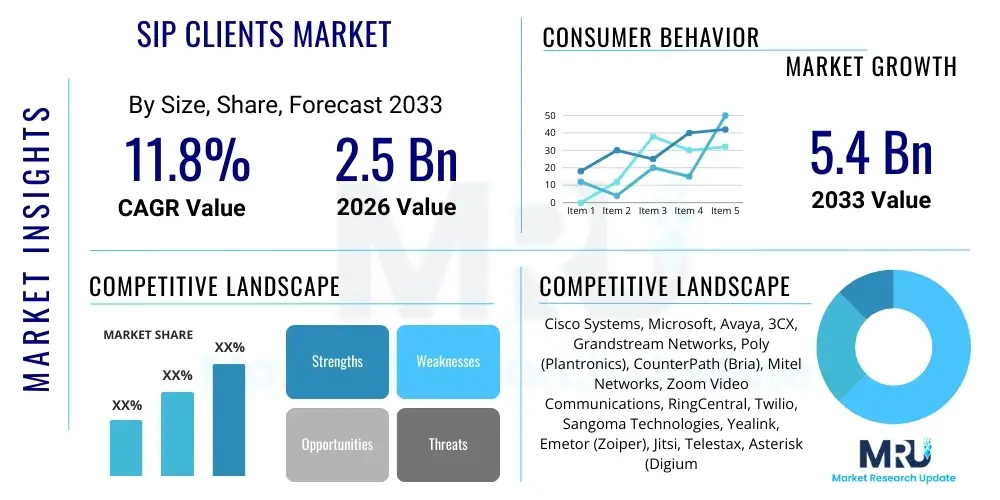

The SIP Clients Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 11.8% between 2026 and 2033. The market is estimated at USD 2.5 Billion in 2026 and is projected to reach USD 5.4 Billion by the end of the forecast period in 2033.

SIP Clients Market introduction

The Session Initiation Protocol (SIP) Clients Market encompasses software and hardware endpoints utilized to establish, manage, and terminate multimedia communication sessions, prominently including Voice over IP (VoIP), video conferencing, and instant messaging. These clients, ranging from softphones installed on desktop or mobile devices to dedicated IP phones and specialized conferencing equipment, function as the primary interface between the end-user and the underlying SIP-based communication infrastructure, such as Private Branch Exchanges (PBXs) and Unified Communications as a Service (UCaaS) platforms. The market's foundational technology, SIP, is an application layer control protocol designed for managing the signaling and controlling of multimedia communication sessions, enabling seamless interoperability across diverse vendor ecosystems and network architectures, fundamentally replacing traditional Public Switched Telephone Network (PSTN) technologies for business communications.

The necessity for flexible, scalable, and cost-efficient communication solutions across the enterprise landscape is the primary impetus fueling the expansion of this market. SIP clients offer significant benefits over legacy telephony, including reduced operational costs, enhanced geographic mobility, and the integration of advanced features like presence monitoring, rich media handling, and integration with Customer Relationship Management (CRM) systems. Major applications span across enterprise telephony, contact centers, remote work infrastructure, and specialized sectors requiring robust real-time communication, such as healthcare and finance. The widespread adoption of cloud-based communication services, particularly UCaaS and Contact Center as a Service (CCaaS), inherently mandates the deployment of modern SIP client solutions, as these protocols form the backbone of cloud telephony operations, ensuring high-quality and reliable service delivery globally.

Driving factors in the SIP Clients Market are deeply intertwined with the digital transformation initiatives of global organizations. The massive shift towards remote and hybrid work models has accelerated the demand for softphone applications that provide enterprise-grade communication capabilities regardless of location. Furthermore, the continuous improvement in broadband infrastructure, the standardization efforts led by organizations like the Internet Engineering Task Force (IETF), and the growing preference for converged network solutions that consolidate voice, data, and video onto a single IP network are providing substantial tailwinds. These factors collectively push enterprises to decommission outdated TDM systems in favor of future-proof, SIP-enabled communication ecosystems, focusing on user experience and comprehensive feature sets delivered through modern client interfaces.

SIP Clients Market Executive Summary

The SIP Clients Market is experiencing significant dynamic growth driven by the acceleration of unified communications adoption, the global proliferation of hybrid work environments, and the critical need for resilient, feature-rich cloud telephony solutions. Business trends indicate a marked shift from hardware-centric solutions (dedicated IP phones) towards software-defined softphones and mobile applications, optimizing resource allocation and enhancing user mobility. Key technological advancements center on integrating Artificial Intelligence for enhanced functionality, such as automated call transcription and intelligent routing within the client interface, pushing vendors towards offering highly integrated UC platforms rather than standalone client applications. Competitive strategies focus heavily on interoperability testing, security enhancements (especially regarding encryption and authentication protocols like TLS and SRTP), and API extensibility to facilitate deep integration with enterprise workflows, ensuring the sticky nature of their client solutions within the larger IT ecosystem.

Regionally, North America maintains the dominant market share due to its early adoption of advanced UCaaS technologies, high concentration of technology providers, and robust telecommunication infrastructure supporting high-quality VoIP services. However, the Asia Pacific (APAC) region is projected to exhibit the highest CAGR during the forecast period, fueled by rapid digitalization across emerging economies, expanding mobile workforce penetration, and substantial investments in cloud infrastructure development, particularly in countries like China, India, and Southeast Asian nations. European markets show stable growth, driven by stringent data privacy regulations requiring highly secure, localized communication solutions and the comprehensive rollout of all-IP networks replacing legacy copper infrastructure, necessitating widespread deployment of compliant SIP clients across vertical sectors.

In terms of segmentation, the Softphones segment is forecasted to command the highest growth rate, reflecting the preference for device-agnostic, flexible communication tools aligned with the "bring your own device" (BYOD) trend. By deployment, the Cloud-based segment is rapidly overshadowing on-premises installations, capitalizing on benefits such as lower upfront capital expenditure, simplified maintenance, and inherent scalability crucial for modern enterprise operations. Furthermore, the large enterprise segment currently holds the largest revenue share, demanding complex, multi-functional SIP clients integrated within extensive UC ecosystems, while the Small and Medium Enterprises (SMEs) segment represents a high-potential growth avenue due to the increasing affordability and accessibility of managed UCaaS solutions utilizing standardized SIP client interfaces.

AI Impact Analysis on SIP Clients Market

Analysis of common user questions regarding the influence of Artificial Intelligence on SIP Clients reveals three primary areas of concern and expectation: enhanced user productivity, improved security measures, and the future role of the traditional voice client interface. Users frequently inquire about how AI can transform standard softphone features, such as integrating real-time language translation during calls, providing intelligent summarization of meeting transcripts, and leveraging machine learning algorithms for superior noise reduction and voice clarity. Security remains a top concern, with expectations that AI will detect and prevent complex security threats, including deepfake voice impersonation and sophisticated phishing attempts targeting communication endpoints. Furthermore, enterprises are exploring whether AI-driven chatbots and virtual assistants, accessible via the SIP client, will eventually automate routine communication tasks, changing the fundamental interaction paradigm and potentially reducing the need for human agents for initial customer engagement.

The integration of AI technologies is fundamentally transforming the value proposition of SIP clients, shifting them from simple communication tools to intelligent productivity hubs. AI algorithms are increasingly embedded within client software to optimize network performance, predict potential quality-of-service degradation, and dynamically adjust codecs to maintain high fidelity audio and video even under challenging network conditions. This AI-driven optimization enhances the reliability and professionalism of remote communications, directly addressing enterprise requirements for seamless and uninterrupted collaboration. Vendors are leveraging these capabilities to differentiate their offerings, positioning their SIP clients as smart endpoints capable of contextual awareness and proactive assistance, moving beyond basic calling functionality.

Moreover, AI is playing a crucial role in post-communication analysis and compliance. Features such as automatic transcription, sentiment analysis, and keyword spotting, integrated directly into the SIP client's recording functionality, streamline regulatory compliance and enhance business intelligence gathering. For contact centers utilizing SIP clients, AI-powered routing and agent assist features drastically cut down average handling time (AHT) by providing real-time information and predictive guidance during live interactions. This integration ensures that the SIP client remains an indispensable component of the modern digital workplace, serving not just as a means to communicate, but as an integral platform for data capture, automation, and decision support, thereby justifying continued investment in updated client software and infrastructure.

- AI-powered noise cancellation and voice clarity enhancement drastically improve user experience, especially in remote environments.

- Intelligent call routing and automated attendant features embedded in the client improve efficiency and first-call resolution rates.

- Real-time transcription and summarization tools enhance meeting productivity and compliance documentation.

- Machine learning algorithms strengthen endpoint security by identifying anomalous usage patterns and detecting fraud attempts.

- Integration of AI-driven virtual assistants within the client interface enables automation of routine communication tasks.

DRO & Impact Forces Of SIP Clients Market

The SIP Clients Market is shaped by a confluence of driving factors, persistent restraints, and significant opportunities, which collectively determine its trajectory and impact forces. The primary drivers include the mandatory transition from legacy PSTN/TDM systems to all-IP infrastructure globally, the exponential growth in Unified Communications as a Service (UCaaS) penetration across enterprise segments, and the post-pandemic permanent adoption of remote and hybrid work models demanding location-agnostic communication tools. These forces necessitate immediate and comprehensive deployment of modern SIP client solutions. Restraints challenging the market include persistent interoperability issues between disparate SIP vendor products, increasing cybersecurity threats targeting VoIP endpoints requiring robust and costly encryption standards, and concerns over maintaining consistent Quality of Service (QoS) across varying internet bandwidths, particularly in mobile and remote settings. Opportunities lie in the expansion of high-definition video conferencing integration, the untapped potential in specialized verticals like healthcare (telemedicine) and education (e-learning), and the development of lightweight, containerized SIP clients optimized for next-generation 5G networks and edge computing architectures.

Driving factors are primarily governed by the cost-benefit analysis favoring IP communications. Enterprises realize substantial operational savings by consolidating networks and reducing maintenance complexities associated with traditional phone systems. The rich feature sets offered by modern SIP clients—including presence, instant messaging, screen sharing, and CRM integration—provide a tangible increase in workforce productivity and collaboration efficiency, making the upgrade a strategic business imperative rather than just an IT decision. Furthermore, industry trends such as the widespread availability of high-speed fiber optics and increasingly standardized SIP specifications (though not perfectly uniform) facilitate easier deployment and management of vast communication networks, fueling large-scale enterprise adoption across multinational corporations seeking global standardization.

The impact forces influencing vendors are intense competition and the rapid pace of technological obsolescence. Vendors must continually innovate, moving beyond mere adherence to SIP standards to offer proprietary, value-added features that integrate seamlessly with major operating systems and UC platforms (e.g., Microsoft Teams, Zoom). The requirement for robust security protocols (SRTP/TLS) and end-to-end encryption has become a table stakes expectation, forcing significant investment in client software development and regular security patching. The highest impact force remains the shift towards cloud deployment; cloud-native SIP clients that offer zero-touch provisioning, automatic updates, and subscription-based models are achieving superior market penetration compared to traditional perpetually licensed desktop softphones or physical IP phones, fundamentally reshaping how client software is procured and managed by IT departments globally.

Segmentation Analysis

The SIP Clients Market is comprehensively segmented based on Type (Hardware IP Phones, Softphones/Software Clients), Deployment Model (On-Premises, Cloud/Hosted), End-User (SMEs, Large Enterprises), and Industry Vertical (BFSI, IT & Telecom, Healthcare, Government & Public Sector, Retail & E-commerce, Others). This segmentation framework allows for targeted analysis of growth patterns and competitive dynamics. The Softphone segment is rapidly gaining dominance due to its flexibility, lower Total Cost of Ownership (TCO), and alignment with mobile and BYOD strategies. Simultaneously, the Cloud-based segment is expected to outpace the on-premises segment, reflecting the broader market migration toward UCaaS platforms that necessitate cloud-native client solutions for optimal performance and scalability, particularly favored by geographically dispersed organizations seeking centralized communication management.

- By Type

- Hardware IP Phones

- Softphones (Software Clients)

- Video/Conferencing Clients

- By Deployment Model

- On-Premises

- Cloud (Hosted)

- By End-User Size

- Small and Medium Enterprises (SMEs)

- Large Enterprises

- By Industry Vertical

- IT & Telecom

- Banking, Financial Services, and Insurance (BFSI)

- Healthcare and Pharmaceuticals

- Government and Public Sector

- Retail and E-commerce

- Media and Entertainment

- Others (Education, Manufacturing)

Value Chain Analysis For SIP Clients Market

The value chain of the SIP Clients Market begins with the upstream component and technology providers, including semiconductor manufacturers, chipset designers, operating system developers, and open-source SIP stack creators (e.g., PJSIP, Sofia-SIP). These foundational elements dictate the performance, security, and feature potential of the final client product. Moving downstream, the critical manufacturing and development stage involves specialized SIP client vendors—ranging from established telephony equipment providers to modern software-focused UCaaS players—who design, code, test, and brand the hardware (IP phones) or software (softphones) offerings. Significant value addition occurs here through proprietary firmware development, user interface design, and rigorous interoperability testing against various SIP PBXs and communication platforms to ensure broad market compatibility and compliance with international standards.

The distribution channel is multifaceted, relying heavily on both direct and indirect sales strategies. Direct channels typically target large enterprises through specialized sales teams, particularly for complex, custom UC deployments and high-volume hardware orders, allowing for closer control over client relationships and service delivery. Indirect distribution, however, dominates the mass market, utilizing a network of authorized Value-Added Resellers (VARs), Managed Service Providers (MSPs), and IT distributors. These partners often bundle the SIP client software or hardware with broader UCaaS subscriptions, installation, integration services, and ongoing technical support, effectively reaching the SME segment and specialized vertical markets. Cloud-based SIP client distribution increasingly relies on proprietary app stores and licensing portals managed directly by the UCaaS provider (e.g., RingCentral, Zoom Phone), minimizing the traditional reseller layer for pure software clients.

The final stage involves end-user deployment, integration, and post-sales support, which is critical for customer retention and market reputation. Integration services, particularly connecting SIP clients to enterprise databases (CRM, ERP), are vital for maximizing productivity gains. Support mechanisms include firmware updates, security patches, technical troubleshooting, and continuous feature enhancements, often delivered automatically through cloud infrastructure for softphones. The lifecycle management aspect is crucial, as the user experience—from initial provisioning (zero-touch) to daily use and integration fluidity—determines the stickiness of the client solution within the organizational workflow. The shift to subscription models reinforces the importance of continuous post-sale value delivery, transforming the client relationship from a transactional purchase to a long-term service engagement.

SIP Clients Market Potential Customers

The primary consumers and end-users of SIP client solutions span across nearly every sector of the global economy, driven by the universal need for reliable, unified, and cost-effective communication infrastructure. Large enterprises, including Fortune 500 companies, represent significant potential customers, demanding sophisticated, centralized communication platforms capable of managing thousands of endpoints across multiple geographic locations, requiring high-end IP phones and highly customizable softphones integrated deeply into their existing IT stack. Small and Medium Enterprises (SMEs) constitute another vast and rapidly growing customer base, primarily adopting cloud-hosted UCaaS solutions which inherently include the deployment of standardized, easy-to-manage SIP softphones and mobile apps, valued for their affordability and rapid deployment capabilities.

Sector-wise, the IT & Telecom industry is a foundational consumer, leveraging SIP clients for internal collaboration, software development coordination, and customer support. The Banking, Financial Services, and Insurance (BFSI) sector requires secure, high-compliance SIP clients for recording, auditing, and maintaining sensitive client communications, prioritizing solutions with robust encryption (SRTP) and reliable uptime. Healthcare providers are increasingly critical customers, utilizing SIP clients for telemedicine consultations, internal hospital communication, and connecting remote care teams, prioritizing mobility and integration with electronic health record (EHR) systems. Furthermore, contact centers across all industries are major consumers, relying on specialized SIP client software integrated with advanced call handling features and CRM interfaces to manage high-volume customer interactions efficiently and professionally.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 2.5 Billion |

| Market Forecast in 2033 | USD 5.4 Billion |

| Growth Rate | 11.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Cisco Systems, Microsoft, Avaya, 3CX, Grandstream Networks, Poly (Plantronics), CounterPath (Bria), Mitel Networks, Zoom Video Communications, RingCentral, Twilio, Sangoma Technologies, Yealink, Emetor (Zoiper), Jitsi, Telestax, Asterisk (Digium), Ekiga, Linphone, PJSIP, Unify (Atos), 8x8. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

SIP Clients Market Key Technology Landscape

The technology landscape for SIP clients is characterized by continuous evolution centered around enhancing security, improving media quality, and ensuring seamless integration into modern IT environments. Core technologies include the SIP protocol itself, which handles signaling, and associated protocols such as Real-time Transport Protocol (RTP) and its secure counterpart, Secure Real-time Transport Protocol (SRTP), crucial for encrypting media streams and ensuring privacy. Transport Layer Security (TLS) is widely adopted to secure the SIP signaling path, mitigating man-in-the-middle attacks. Codec technology, encompassing G.711, G.729, and Opus, dictates audio quality and bandwidth efficiency; the increasing adoption of wideband and super-wideband codecs (like Opus) is paramount for delivering high-definition voice and minimizing latency, crucial for enterprise communication standards.

The underlying infrastructure utilizes advanced network technologies, including Quality of Service (QoS) mechanisms (like DiffServ and RSVP) implemented at the network layer to prioritize VoIP traffic over less time-sensitive data, thus minimizing packet loss and jitter—the two primary detractors of SIP client performance. Modern SIP clients often incorporate WebRTC (Web Real-Time Communication) standards, enabling browser-based softphones that require no installation, increasing accessibility and cross-platform compatibility. Furthermore, the development of proprietary APIs and SDKs (Software Development Kits) allows third-party developers to embed SIP functionality directly into business applications (e.g., click-to-call functionality within a CRM), transforming static applications into dynamic communication tools.

Crucially, provisioning and management technologies are vital for scalability. Technologies such as TR-069 and proprietary Zero-Touch Provisioning (ZTP) mechanisms automate the configuration and deployment of thousands of SIP endpoints simultaneously, reducing administrative overhead and speeding up enterprise rollouts. Cloud environments leverage containerization technologies (like Docker) and microservices architectures to ensure that softphone applications are lightweight, scalable, and rapidly updateable across diverse operating systems (Windows, macOS, iOS, Android). This technological shift toward software-defined, highly secure, and efficiently managed endpoints underscores the maturity and complexity of the current SIP client market offerings, moving communication endpoints into the realm of integrated enterprise applications.

Regional Highlights

- North America: This region dominates the global SIP Clients Market revenue share, driven by the early and widespread adoption of UCaaS solutions and a highly mature telecommunication infrastructure. The presence of major market leaders (e.g., Cisco, Microsoft, Zoom) and high enterprise spending on digital transformation initiatives, particularly in the US and Canada, ensures continuous demand for high-feature, secure SIP softphones and integrated communication platforms. Strong regulatory support for cloud services further accelerates market momentum.

- Europe: The European market demonstrates steady growth, propelled by governmental mandates requiring the migration from traditional PSTN infrastructure to all-IP networks across major economies (Germany, UK, France). The emphasis in Europe is often placed on compliance, data privacy (GDPR), and highly localized solutions, driving demand for secure, certified SIP clients compatible with regional regulatory frameworks. Central and Eastern Europe present high growth potential as digitalization efforts catch up with Western European counterparts.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing region, fueled by rapid urbanization, massive investment in mobile infrastructure (including 5G rollout), and significant expansion of the SME sector in countries like India, China, and Japan. The burgeoning remote workforce and the increasing accessibility of affordable, scalable cloud communication services are driving large-scale adoption of mobile and desktop softphones, particularly in emerging markets focused on rapid digital infrastructure build-out.

- Latin America (LATAM): This region is characterized by high price sensitivity but growing acceptance of cloud telephony to bypass expensive legacy infrastructure. Brazil and Mexico are key markets, showing increasing demand for managed SIP services that offer reliable connectivity and basic to mid-range IP phones and softphones. Growth is steady, primarily concentrated in metropolitan areas with reliable internet access.

- Middle East and Africa (MEA): The MEA market shows promising, albeit fragmented, growth, driven by substantial public sector investments (e.g., smart city initiatives in the GCC states) and diversification away from oil economies, necessitating modern IT infrastructure. The reliance on mobile communication dictates a high demand for mobile SIP clients, although security and connectivity challenges remain significant hurdles in several sub-regions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the SIP Clients Market.- Cisco Systems Inc.

- Microsoft Corporation

- Avaya Inc.

- 3CX

- Grandstream Networks, Inc.

- Poly (Plantronics, Inc.)

- CounterPath Corporation (Bria)

- Mitel Networks Corporation

- Zoom Video Communications, Inc.

- RingCentral, Inc.

- Twilio Inc.

- Sangoma Technologies Corporation

- Yealink Network Technology Co., Ltd.

- Emetor (Zoiper)

- Jitsi (8x8)

- Telestax

- Asterisk (Digium)

- Ekiga

- Linphone (Belledonne Communications)

- PJSIP

- Unify (Atos SE)

- Dialpad

Frequently Asked Questions

Analyze common user questions about the SIP Clients market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between SIP softphones and hardware IP phones?

SIP softphones are software applications installed on personal computing devices (desktop, mobile), offering portability, lower deployment cost, and easier integration with desktop applications. Hardware IP phones are dedicated physical devices (desk phones) providing superior reliability, traditional ergonomics, and often higher voice quality due to dedicated chipsets, though they require specific physical installation and centralized power (PoE).

How does the shift to UCaaS impact the demand for SIP Clients?

The migration to Unified Communications as a Service (UCaaS) significantly boosts demand for SIP clients, particularly cloud-native softphones and mobile applications. UCaaS platforms utilize SIP as the foundational protocol for communication, making compliant client software essential for accessing services like voice, video, and presence management seamlessly from any location or device, thereby driving the software segment's growth.

What are the critical security considerations for deploying SIP Clients in an enterprise environment?

Critical security considerations include implementing Transport Layer Security (TLS) for securing SIP signaling and Secure Real-time Transport Protocol (SRTP) for encrypting media streams to prevent eavesdropping and hijacking. Enterprises must also ensure robust authentication methods, regularly patch client software vulnerabilities, and utilize Session Border Controllers (SBCs) to filter malicious traffic and protect the network perimeter from VoIP-specific attacks.

Which industry vertical is projected to show the highest adoption rate for advanced SIP Clients?

The Healthcare vertical is projected to exhibit a high adoption rate for advanced SIP clients, driven by the rapid expansion of telemedicine and remote patient monitoring services. These specialized applications require reliable, secure, and mobile-friendly SIP clients capable of handling high-definition video and integrating seamlessly with Electronic Health Records (EHR) systems for efficient, compliant virtual care delivery.

How is AI changing the functionality and competitive landscape of SIP Client vendors?

AI is transforming SIP client functionality by integrating features like intelligent noise suppression, real-time call transcription, and predictive routing within the application interface. This shift forces vendors to compete not just on basic connectivity but on enhancing user productivity and embedding advanced intelligence, making the SIP client an integrated component of an intelligent enterprise workflow system.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager