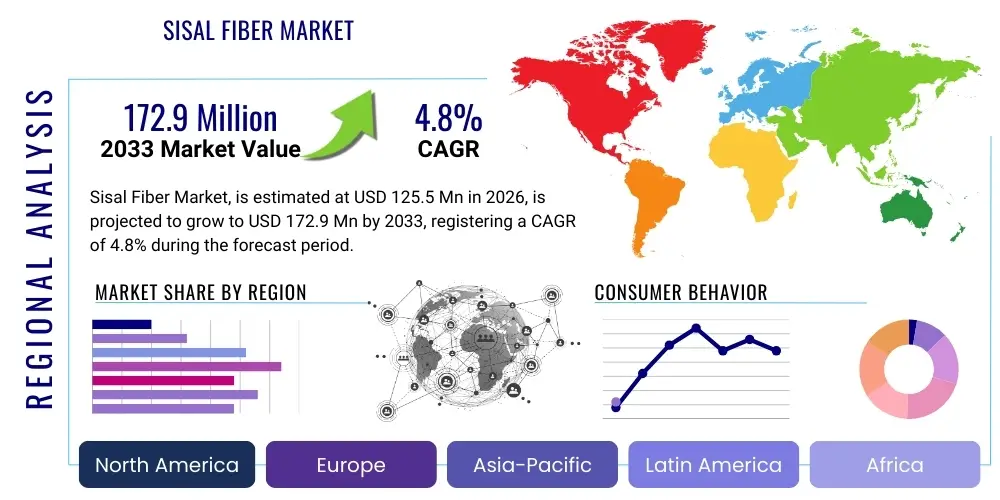

Sisal Fiber Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437875 | Date : Dec, 2025 | Pages : 255 | Region : Global | Publisher : MRU

Sisal Fiber Market Size

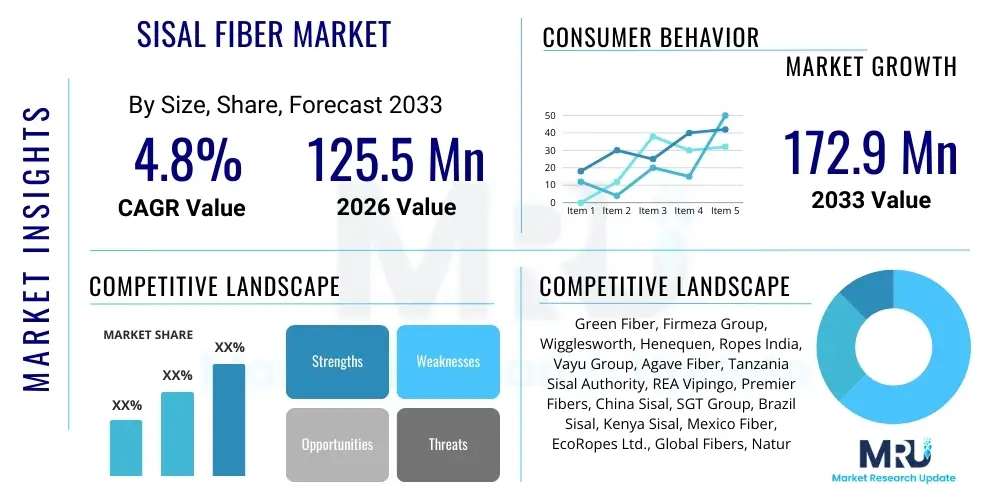

The Sisal Fiber Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at USD 125.5 Million in 2026 and is projected to reach USD 172.9 Million by the end of the forecast period in 2033.

Sisal Fiber Market introduction

The Sisal Fiber Market encompasses the global trade and utilization of natural fibers derived from the leaves of the Agave sisalana plant. Sisal fiber is renowned for its strength, durability, resistance to degradation by saltwater, and excellent capacity for absorbing sound and reducing heat. Historically dominant in agricultural applications like twine and rope, the market is undergoing a significant transformation due to increasing demand for sustainable and biodegradable materials across diverse industries, including construction, automotive manufacturing, and geotextiles. Sisal’s inherent sustainability profile, coupled with growing environmental regulations favoring natural materials over synthetic alternatives, positions it favorably for robust growth.

The primary applications of sisal fiber extend beyond traditional uses to include reinforcement materials in composites, specialized pulp for high-quality paper production, and raw material for durable carpets and matting. Its utilization in the automotive sector for interior plastic reinforcement is a key driving factor, offering manufacturers a lightweight and environmentally friendly alternative to glass fiber or carbon fiber composites. Furthermore, sisal is increasingly adopted in the civil engineering sector as a component in geotextiles for erosion control and soil stabilization, particularly in developing regions where sustainable infrastructure development is prioritized.

Driving factors in the sisal market include heightened consumer awareness regarding ecological footprints, governmental incentives promoting bio-based materials, and technological advancements enabling better processing and integration of sisal into complex industrial products. The fiber's natural attributes—high tensile strength, low density, and complete biodegradability—provide substantial benefits over petroleum-based competitors, ensuring its continued relevance in a circular economy framework. Market participants are focusing on improved cultivation techniques, standardized grading, and establishing stable supply chains to meet escalating global demand, especially from European and North American manufacturing hubs seeking certified sustainable input materials.

Sisal Fiber Market Executive Summary

The Sisal Fiber Market is characterized by a definitive shift towards high-value industrial applications, moving away from its traditional reliance on the volatile agricultural twine segment. Current business trends indicate significant investment in processing infrastructure, particularly decortication and refining technologies, aimed at producing standardized, high-grade fibers suitable for composites and pulp. Companies are strategically integrating backward into cultivation or forging strong partnerships with large sisal plantation holders in East Africa and Brazil to ensure stable supply and quality control. Mergers and acquisitions are common among downstream users seeking to secure access to proprietary fiber treatment techniques that enhance fire retardancy or moisture resistance, crucial for advanced automotive and construction applications.

Regionally, Asia Pacific (APAC) is emerging as the fastest-growing market, driven primarily by the rapid expansion of its automotive manufacturing and construction sectors, particularly in China and India, where sisal is valued as a low-cost, effective reinforcement material. However, Latin America, particularly Brazil, remains the dominant region in terms of production volume and export capacity, benefiting from favorable climates and established processing infrastructure. Europe and North America represent key consumers, focusing heavily on utilizing sisal in environmentally sensitive products, pushing demand for certified organic and fair-trade sisal sources. Regulatory frameworks supporting biodegradable packaging and materials in these developed regions further underpin consumption growth.

Segment trends reveal that the Pulp & Paper segment is experiencing robust expansion, leveraging sisal's long fibers for specialty papers, banknotes, and tea bags, where strength and durability are paramount. The Composites segment, encompassing automotive parts and building materials, is expected to register the highest CAGR, driven by innovation in natural fiber reinforced polymers (NFRPs). While the traditional Rope & Twine segment still holds a substantial market share, its growth rate is relatively modest compared to the industrial and niche applications, emphasizing the market's evolving structural dynamics towards technical and performance-oriented uses.

AI Impact Analysis on Sisal Fiber Market

User queries regarding AI's influence on the Sisal Fiber Market predominantly focus on optimizing agricultural yield, enhancing supply chain transparency, and improving quality control during fiber processing. Key themes revolve around the potential for AI-driven precision farming (monitoring soil health, predicting harvest timing, optimizing irrigation in sisal plantations) to mitigate climate change risks and increase yield predictability. Furthermore, users are keenly interested in how machine learning algorithms can be applied to sorting and grading sisal fibers post-decortication, standardizing quality parameters (e.g., length, fineness, strength) which are currently often reliant on manual inspection. Concerns also include the cost of adopting AI infrastructure and ensuring equitable benefits for smallholder sisal farmers, suggesting a need for accessible, scalable technological solutions that address supply chain fragmentation.

- AI-driven precision agriculture optimization for maximizing sisal leaf yield and resource management.

- Machine learning algorithms enhancing fiber grading, sorting, and quality standardization post-harvest.

- Predictive analytics improving supply chain resilience and demand forecasting for key consumer industries (e.g., automotive).

- Integration of AI in manufacturing processes to optimize composite formulation using sisal fiber parameters.

- Implementation of blockchain and AI for enhancing traceability and provenance of sustainable sisal products.

DRO & Impact Forces Of Sisal Fiber Market

The Sisal Fiber Market is influenced by a complex interplay of internal and external forces driving its growth trajectory. The primary driver is the accelerating global preference for sustainable, bio-degradable, and carbon-neutral materials, positioning sisal as a superior substitute for synthetic fibers derived from petroleum. This trend is strongly supported by increasingly stringent environmental regulations, particularly in major consuming markets like the EU, which mandates higher recycled or bio-based content in industrial products. However, the market faces significant restraints, chiefly stemming from the inherent price volatility of agricultural commodities, which makes long-term forecasting and fixed-price contracts challenging for large industrial buyers. Furthermore, competition from cheaper, high-volume synthetic alternatives like polypropylene and specialized natural fibers such as coir and jute limits market penetration in certain price-sensitive applications.

Opportunities for market expansion are substantial, particularly in high-growth, high-value segments. The development of advanced sisal-reinforced composites for the automotive lightweighting trend presents a major avenue for expansion, capitalizing on sisal's favorable strength-to-weight ratio. Additionally, the growing global focus on sustainable infrastructure and large-scale erosion control projects boosts demand for sisal-based geotextiles. The market's impact forces are dominated by regulatory shifts and technological innovation. Regulatory frameworks, such as the European Green Deal, amplify demand, while innovations in chemical treatment and decortication efficiency are crucial for overcoming quality inconsistencies and expanding the addressable market for industrial applications. The market structure, predominantly defined by fragmented production (many small farms) and concentrated consumption (few large industrial buyers), exerts a continuous impact on pricing dynamics and supply chain stability, requiring strategic coordination to mitigate risk and ensure consistent quality delivery.

Segmentation Analysis

The Sisal Fiber Market is comprehensively segmented based on product type, application, and end-user industry, reflecting the diverse utility of the fiber across various industrial and traditional sectors. Analysis of these segments is crucial for market participants seeking to identify high-growth niches and optimize production strategies. The differentiation across product types—from premium, long-fiber bales utilized in paper and composites to waste sisal repurposed for low-grade applications—highlights the need for precise grading and standardized specifications to serve sophisticated industrial users. Application segmentation demonstrates the critical transition of sisal from traditional agricultural usage into modern technical applications, particularly in advanced material manufacturing.

- Product Type:

- Bale Sisal (High-grade, long fiber)

- Tow Sisal (Medium-grade, shorter fiber)

- Waste Sisal (Low-grade, utilized for padding and cheap material)

- Application:

- Rope and Twine

- Pulp and Paper

- Composites (Automotive, Construction)

- Geotextiles and Matting

- Darts, Carpets, and Other Consumer Goods

- End-User Industry:

- Agriculture

- Industrial Manufacturing (Automotive, Aerospace)

- Construction and Infrastructure

- Packaging and Consumer Goods

Value Chain Analysis For Sisal Fiber Market

The Sisal Fiber Value Chain commences with the Upstream Analysis, which involves sisal cultivation, primarily conducted by smallholder farmers or large, centralized plantations, predominantly in Brazil, Tanzania, Kenya, and China. This stage is highly resource-intensive, requiring specialized farming practices and significant manual labor for harvesting the sisal leaves. The crucial upstream process is decortication, where the fibers are mechanically separated from the pulp. Efficiency and quality control at this early stage are paramount, as the resulting raw fiber quality dictates its suitability for high-end applications, driving the need for sophisticated decorticating machinery and immediate processing to prevent degradation.

The Midstream component focuses on fiber processing, encompassing grading, cleaning, drying, and baling. This stage often includes sophisticated chemical or mechanical treatments to enhance specific fiber properties, such such as softness, fire retardancy, or compatibility with polymer matrices for composites. Processing facilities, often located near cultivation centers, play a key role in stabilizing quality and standardizing output for the global market. Distribution channels involve both Direct and Indirect mechanisms. Direct channels often involve large industrial buyers (e.g., automotive manufacturers or specialized pulp mills) sourcing directly from major plantation groups or centralized exporters through long-term contracts. Indirect channels utilize global commodity traders, brokers, and local aggregators who handle smaller volumes from numerous sources, facilitating market access for small producers but potentially adding layers of cost and complexity.

The Downstream analysis involves the conversion of the processed sisal fibers into finished products. Key downstream industries include rope and twine manufacturing, specialty paper production (pulp mills), and increasingly, the production of natural fiber reinforced plastic components used in the construction and automotive industries. End-users determine the final demand characteristics, with sophisticated industrial end-users requiring stringent specifications and high certification standards (e.g., ISO certification, sustainability verification). The evolution of the downstream segment towards advanced composites is continually driving innovation back towards the upstream processing phase, demanding higher quality and consistency from raw fiber producers to meet global industrial standards.

Sisal Fiber Market Potential Customers

The Sisal Fiber Market caters to a diverse range of End-User/Buyers, broadly segmented by their application requirements and purchasing volume. Historically, agricultural wholesalers and cooperatives procuring twine for baling hay and other farming tasks constituted the largest volume buyers. However, the modern market's most lucrative potential customers reside within the Industrial Manufacturing sector, specifically automotive component suppliers and original equipment manufacturers (OEMs). These buyers seek high-performance, lightweight natural fibers for interior paneling, parcel shelves, and trim, prioritizing suppliers who can guarantee consistent supply, standardized fiber specifications, and necessary quality certifications, often requiring specialized, chemically treated sisal.

Another significant customer base includes specialty pulp and paper mills requiring long, strong fibers for durable products like currency paper, technical filters, and specialized packaging materials, emphasizing fiber length and cleanliness. The Construction and Infrastructure segment represents a burgeoning potential customer group, consuming sisal primarily in the form of geotextiles for large-scale soil stabilization, embankment reinforcement, and erosion control projects, where biodegradability is a key selling point. Furthermore, the residential and commercial furnishing sectors, including carpet and mat manufacturers, remain crucial customers demanding sisal for its durability, natural aesthetic, and hypoallergenic properties, requiring fibers processed for softness and dye affinity. These high-volume, performance-driven industrial buyers necessitate robust supply chain integration and predictable pricing structures.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 125.5 Million |

| Market Forecast in 2033 | USD 172.9 Million |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Green Fiber, Firmeza Group, Wigglesworth, Henequen, Ropes India, Vayu Group, Agave Fiber, Tanzania Sisal Authority, REA Vipingo, Premier Fibers, China Sisal, SGT Group, Brazil Sisal, Kenya Sisal, Mexico Fiber, EcoRopes Ltd., Global Fibers, Natural Fiber Co., Sisal AG, SisalTec. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Sisal Fiber Market Key Technology Landscape

The Sisal Fiber Market relies heavily on robust yet evolving technologies across the cultivation, processing, and application stages. Core technology centers around mechanization of the harvest and decortication process. Modern decorticator machines, moving beyond rudimentary manual systems, are designed to maximize fiber extraction efficiency while minimizing fiber damage and water usage, crucial for resource-efficient production. Furthermore, significant technological advancements have occurred in post-decortication processing, specifically in fiber cleaning, drying, and grading systems. Advanced pneumatic and optical sorting technologies are increasingly being deployed to ensure uniform fiber length and quality, meeting the precise specifications required by high-end industrial consumers like the automotive sector, thereby moving sisal from a purely commodity status to a technical input material.

Chemical modification and surface treatment represent another critical technological area. Researchers and processing companies utilize techniques such as mercerization, acetylation, and treatment with coupling agents (e.g., silanes) to enhance sisal's compatibility with hydrophobic polymer matrices, a necessity for creating effective natural fiber reinforced composites (NFRPs). These treatments improve fiber-matrix adhesion, reduce moisture absorption (a historical drawback of natural fibers), and enhance the overall mechanical performance of the final composite material. The development of greener, bio-based chemical modification agents is also a burgeoning trend, aligning with the core sustainability ethos of the sisal market itself.

In application technology, the integration of sisal into complex manufacturing systems, particularly injection molding and extrusion processes used in automotive and packaging production, is continuously being optimized. Key technologies here involve pre-treatment of sisal fibers into non-woven mats or pellets that can be easily fed into standard industrial machinery. Furthermore, digital technologies such as remote sensing and IoT devices are slowly being integrated into large plantations to monitor crop health, predict yield, and optimize resource allocation, leading to more stable supply chains. The drive towards fully automated, waste-reducing processing plants is defining the future technology landscape, aiming for consistent quality and lower operational costs across the value chain, particularly concerning water recycling and pulp utilization.

Regional Highlights

The global Sisal Fiber Market exhibits distinct regional dynamics driven by local production capacities, industrial demands, and varying regulatory environments concerning natural materials. Latin America, particularly Brazil, dominates the global supply landscape. Brazil leverages its extensive land area, favorable climate, and established infrastructure to be the largest producer and exporter of sisal fiber globally. Brazilian production tends to focus on high-volume, standardized fibers, serving both the traditional agricultural sector and increasingly, global commodity markets for industrial applications. The region’s low production cost profile makes it a highly competitive source, influencing global pricing benchmarks.

Asia Pacific (APAC) is characterized by high consumption growth and moderate local production (e.g., China). The market expansion in APAC is fueled by massive infrastructure projects and the burgeoning automotive industry in countries like India and China, which are rapidly adopting natural fibers for lightweighting and reducing environmental impact. While APAC imports significant quantities of high-grade sisal, domestic production often focuses on raw material for local crafts and lower-grade industrial uses. The region's increasing regulatory scrutiny on plastic usage, however, is expected to dramatically accelerate the industrial adoption of imported sisal over the forecast period, especially in specialty paper and packaging.

Europe and North America, while having negligible domestic production, are the primary drivers of demand for high-quality, sustainably certified sisal fiber. These regions house large industrial consumers, including major European automotive OEMs and specialty paper producers, who place a premium on transparency, ethical sourcing, and consistent fiber parameters. Demand here is strongly influenced by sophisticated consumer preferences for eco-friendly products and stringent regional policies like REACH, pushing manufacturers to actively substitute synthetic materials with verified natural alternatives like sisal, creating a high-value, quality-focused import market.

- Latin America (Brazil, Mexico): Dominates global production volume; strong focus on high-volume agricultural and industrial exports; competitive cost structure.

- Asia Pacific (China, India): Fastest-growing consumer market; significant demand from automotive and construction sectors; relying heavily on imports of high-grade industrial fibers.

- Europe (Germany, UK, France): Key consumer market for certified sustainable and specialized sisal fibers; strong regulatory push for natural composites and biodegradable packaging.

- Middle East and Africa (MEA) (Tanzania, Kenya): Major established production hubs; focus on enhancing processing technologies and achieving better price realization for premium exports.

- North America (USA, Canada): High-value industrial consumption, particularly in specialty paper and high-end geotextiles; demand driven by environmental compliance and sophisticated product design.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Sisal Fiber Market.- Green Fiber

- Firmeza Group

- Wigglesworth

- Henequen

- Ropes India

- Vayu Group

- Agave Fiber

- Tanzania Sisal Authority

- REA Vipingo

- Premier Fibers

- China Sisal

- SGT Group

- Brazil Sisal

- Kenya Sisal

- Mexico Fiber

- EcoRopes Ltd.

- Global Fibers

- Natural Fiber Co.

- Sisal AG

- SisalTec

Frequently Asked Questions

Analyze common user questions about the Sisal Fiber market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary industrial applications driving sisal fiber demand?

The primary industrial drivers are the automotive sector, utilizing sisal for lightweight composites and interior parts, and the construction industry, where it is used in specialty cement reinforcement and biodegradable geotextiles for erosion control.

How does the sustainability of sisal fiber compare to synthetic alternatives?

Sisal fiber is highly sustainable, being a natural, renewable, and fully biodegradable material with low embodied energy. It offers a significantly smaller carbon footprint compared to petroleum-based synthetic fibers like polypropylene or glass fiber.

Which regions dominate the global production and consumption of sisal?

Latin America, especially Brazil, dominates global production. Consumption is primarily concentrated in Europe and North America (for high-value industrial uses) and the Asia Pacific region (driven by rapid industrial growth).

What is the main challenge affecting the pricing and supply stability of sisal fiber?

The main challenge is the inherent price volatility characteristic of agricultural commodities, coupled with supply fragmentation due to production being highly dependent on climatic conditions and numerous smallholder farmers.

Is sisal fiber suitable for advanced composite manufacturing?

Yes, sisal fiber is highly suitable for advanced composites. Technological advancements in chemical treatments (e.g., mercerization) improve its adhesion and moisture resistance, making it effective for reinforcing polymers in automotive and lightweight structural applications.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager